Professional Documents

Culture Documents

Transport Corp - ACMIIL

Transport Corp - ACMIIL

Uploaded by

vejendla_vinod351Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transport Corp - ACMIIL

Transport Corp - ACMIIL

Uploaded by

vejendla_vinod351Copyright:

Available Formats

ISO 9001:2008 Certified Company

COMPANY REPORT

B U Y

10 Jan, 2011

Transport Corporation of India Ltd

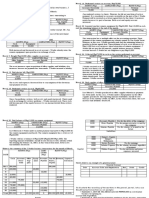

Key Data (`) We initiate coverage on Transport Corporation of India (TCI) with a “BUY”

CMP 111 recommendation with target price of ` 135. We are valuing the stock at 13.5x FY12E

Target Price 135 EPS of ` 10. An increasing contribution from high margin businesses like express

delivery solutions (XPS) and supply chain solutions (SCS), improving volumes from

Key Data the automobile industry with continual and sustainable margin expansion, we believe

Bloomberg Code TRPC IN TCI will register a growth of 17.9% and 29.5% CAGR in topline and bottomline,

Reuters Code TCIL.BO respectively, during FY10-FY12E.

BSE Code 532349

Investment Rationale

NSE Code TCI

Face Value (`) 2

●● Largest integrated logistics service provider

Market Cap. (` mn) 8,050 TCI is the largest integrated player, having 15% market share of the organized

52 Week High (`) 165 logistics industry. Over the years, TCI has built a strong infrastructure network.

52 Week Low (`) 77 It has a branch network of over 1,200 company-owned offices. It operates

Avg. Daily Volume (6m) 40,223 approximately 7,000 trucks on a daily basis, of which 1,200 are owned trucks

and 1,000 attached trucks and trailers. Apart from transportation, the company

Shareholding Pattern

has one of the largest warehousing space of about 8.5 mn sq ft. It also has a fleet

Promoters 68.7

of six ships with a total capacity of 16000 DWT.

Mutual Funds / Bank/ FI 0.0

Foreign Institutional Investors 6.6

●● Timely freight revision

Bodies Corporate/Individuals/ 24.7 TCI operates 65-70% of the business on contractual basis with a fuel cost escalation

others clause, where the fuel price hike is passed on immediately to the customers. The

Total 100.0 balance portion that is exposed to spot freight rates is further transferred with a

(` mn) FY10 FY11E FY12E lag effect of 1.5 – 2 months. Therefore, owing to timely freight revision, TCI’s

Revenue 14,506.6 17,211.5 20,157.5 exposure to fuel price hikes is minimal.

(` Mn.) ●● Major beneficiary of introduction of GST

EBITDA 1,100.0 1,325.3 1,612.6

Road transportation is a costlier mode of transportation when compared to rail,

(` Mn.)

seaways or pipelines. Introduction of GST will eliminate multiple taxes presently

PAT (` Mn.) 434.5 580.5 728.3

charged while carrying goods by road, thereby reducing the overall transportation

E B I T D A 7.6 7.7 8.0

Margin (%)

cost, making road freight rates more viable. Since GST is expected to standardize

PAT Margin 3.2 3.4 3.6

rates across the nation, considerable consolidation is expected in the warehousing

(%) segment, as companies would be able to manage bigger warehouses at few strategic

EPS (`) 6.0 8.0 10.0 locations. TCI being a largest integrated logistics service provider, we believe the

company to be a major beneficiary

●● Expansion to trigger growth

TCI is on course to invest ~ ` 1,600 million in FY11E of which it has already

invested ~ ` 460 million in H1FY11. The planned capital expenditure (capex)

would be utilized for acquisition of trucks and containers (~ ` 655 million), ship

(~ ` 500 million), warehouses (~ ` 250 million) and upgrading IT infrastructure

(~ ` 195 million).

Valuation

At the current price of ` 111, the stock is trading at 13.9x its FY11E EPS of ` 8 and

11.1x its FY12E EPS of ` 10. We value the core standalone business at 13.5x FY12E

Analyst EPS to arrive at our target price of ` 135. Considering the recent price correction,

Rajni Ghildiyal we recommend a “BUY” rating on the stock.

research@acm.co.in

Tel: (022) 2858 3401

Transport Corporation of India Ltd ACMIIL 1

ISO 9001:2008 Certified Company

COMPANY REPORT

Industry Overview

Fragmented market structure

Structure of the road freight transport industry in India is highly fragmented.

The industry broadly consists of players who provide the transportation services,

intermediaries (transport contractors / booking agents) who offer haulage services,

brokers supplying equipment, drivers for commission and the consignors constituting

the ultimate demand for the services.

Road transport operators provide point-to-point transportation. These operators are

classified into small fleet operators (SFOs), medium fleet operators (MFOs) and large

fleet operators (LFOs). Over the years, LFOs have witnessed a gradual increase in the

pie of vehicle ownership, while SFOs have been steadily losing share. Further, during

the slowdown, several SFOs exited the industry, owing to hardening interest rates and

reduced freight availability. It was quite difficult for SFOs to bear the capital costs of

their assets. Unlike SFOs, LFOs have their presence in other logistics businesses like

warehousing, supply chain solutions, cold chains etc. LFOs generally have a multi-

regional network or a pan-India network, supported by adequate infrastructure. TCI

is a LFO with pan-India presence operating over 7,000 trucks per day.

Truck ownership pattern

Truck Ownership 1978-79 1993-94 2002-03 2008-09E

Operators own up to 5 trucks (SFOs) 98% 85% 77% 74%

Operators own 6 to 20 trucks (MFOs) 2% 13% 17% 15%

Operators own more than 20 trucks (LFOs) 0% 2% 6% 11%

Source: Crisil Research

Indian national companies are quite skeptical to outsource their logistics operations

owing to safety and security concerns. The complex tax structure prevailing in

India also induces corporates to invest in small warehouses all over the country,

thus handling their logistics operations themselves. Therefore, 46% of the logistics

operations in India are handled by the Corporates themselves through their in-house

logistics department. Unorganized players dominate the balance 54% outsourced

arena. TCI the largest road transport player has ~15% share in the organized logistics

industry i.e. ~8% share in the total outsourced logistics. Undersized market share of

the industry leader demonstrates the extremely fragmented nature of the industry.

Logistics spending structure in the industry

44%

54%

46%

10%

In-house logistics Outsourced Organised Unorganised

Source: Company

Transport Corporation of India Ltd ACMIIL 2

ISO 9001:2008 Certified Company

COMPANY REPORT

Trend in road freight rates

Road freight rates are primarily determined on the basis of demand-supply scenario

prevalent at any time in the country. This in turn is driven by economic activity,

existing truck capacities on road and cost factors like diesel prices, which is the prime

input cost for truck operators. Substitutes and industry structure also play a key role

in determining freight rates, in addition to regulations. Road transport attracts the

highest freight rates followed by rail, pipelines and waterways.

Trend in diesel price v/s road freight rates

42 175

174.5

40 174

38 173.5

173

36 172.5

`

172

34 171.5

32 171

170.5

30 170

June 09

July 09

Aug 09

Sep 09

Oct 09

Nov 09

Dec 09

Jan 10

Feb 10

Mar 10

Apr 10

May 10

June 10

July 10

Aug 10

Sep 10

Gap between fuel cost and RFI Time taken to pass on the hike

Diesel Price (LHS) Indian Road Freight Index (RHS)

Source: IOCL, Company, ACMIIL Research

Fuel costs typically constitutes more than 50% of the total operating costs of the

transport operator. Hence, any increase in diesel prices may affect their operating

margins. Typically, transport operators pass on the hike in fuel cost to their customers

with a lag effect of ~1.5 – 2 months. However, transport operators are able to pass on

the increase in cost in the form of higher freight rates only in a scenario of good freight

availability. Therefore, most of the LFOs in the industry have contractual agreements

with clients that cushion them from severe fluctuations in freight availability. Almost

all contractual arrangements have an escalation clause, clearly stating that for any

increase in fuel price, the freight rate shall automatically increase to the same extent

or for fuel hikes at X %, freight shall increase automatically at Y %, with effect from

the date of the fuel hike.

However, it should be noted that the costs of delay and uncertainty in transportation,

increases the effective cost to the users significantly. Thus, there exists tremendous

potential for reduction in indirect costs associated with inefficiencies caused by

infrastructure and regulations.

Infrastructure and Regulations

India has the third largest road network in the world stretching 3.32 million kilometer

in length. As per World Bank, national highways aggregating a length of close to

70,748 km, constitutes a mere 2 % of the road network but carries about 40 % of

the total road traffic in India. On the other hand, state roads and major district roads

carry another 40 % of traffic and account for 18 % of the road length. This inevitably

leads to traffic jams.

Transport Corporation of India Ltd ACMIIL 3

ISO 9001:2008 Certified Company

COMPANY REPORT

Classification of India’s road network

2%

4%

80%

14%

Rural Roads NationalHighways State Highways Major DistrictRoads

Source: NHAI, ACMIIL Research

To add to this the Indian taxation system is quite complex. In order to avoid multiple

taxation, companies typically have warehousing operations in every state. This

results in large number of small warehouses across the country that lack in the latest

warehousing processes and technologies. Lack of adequate infrastructure and complex

taxation and regulations are major obstacles for logistics players in India. Roads

occupy a crucial position in the growth and development of the transportation industry.

Hence, Government has undertaken several projects to expand the road network

nationwide for providing connectivity and mobility in both the rural and urban areas.

Details of NHAI projects as on November 30, 2010

NHDP Component Total Length Completed 4 lane Under Balance

implementation Lengthfor award

GQ Phase I 5,846 5,809 37 0

Port Connectivity Phase I 380 291 83 6

Other NHs Phase I 1,383 926 437 20

NS-EW Phase II 7,144 5,385 1,332 427

NHDP Phase-III 12,109 1,922 5,207 4,980

NHDP Phase- IV 20,000 0 0 20,000

NHDP Phase-V 6,500 407 1,893 4,200

NHDP Phase-VI 1,000 0 0 1,000

NHDP Phase-VII 700 0 41 659

Total 55,062 14,740 9,030 31,292

Source: NHAI

Despite the limitations, we visualize a strong potential in this sector. Several initiatives

and projects are underway to boost development of roads while the complex Central

Sales Tax is to be phased out in coming years to welcome GST. The emergence of India

as a manufacturing hub, growth of the organized retail industry, increased domestic

consumption, and the global best practices of multinationals are all expected to boost

the logistics industry. The key initiatives that could further trigger the growth of the

industry includes, spurring growth in third party logistics (3PL), introduction of GST

and upcoming multi-modal logistics parks. Increasing IT penetration will further improve

the efficiency of the players by enabling smooth movement of goods by online tracking,

better cargo management and record maintenance of huge cargo handled on daily basis.

Transport Corporation of India Ltd ACMIIL 4

ISO 9001:2008 Certified Company

COMPANY REPORT

Industry Analysis using Porters five force model

Entry Barriers: Low

Low capital requirement, easy credit availability,

low skills / qualification required and ease in

obtaining license

Bargaining power of suppliers Threat of new entrants

Suppliers:Medium Competition:High Buyers: High

Big consignors have high bargaining power owing

Dominance by few large equipment suppliers, Highly fragmented market with lack of to presence of large number of small operators.

Government controls diesel prices differentiation in services However, LFOs experience less pressure as

compared to SFOs / MFOs as they provide value

added services

Threat of substitutes Bargaining power of buyers

Substitutes: Medium

Threat from railways is high whereas from other

mode of transport is low. Considering that road

transport players enjoy higher accessibility /

flexibility over other modes of transport, overall

threat remains medium

Source: ACMIIL Research

Company Background

Transport Corporation of India is India’s leading integrated supply chain and logistics

solutions provider. With expertise developed over five decades and customer centric

approach, TCI is equipped with an extensive set up of 1200 branch offices, a large

workforce of 6,500 employees, huge fleet of customized vehicles and managed

warehouse space of 8.5 million sq ft. Leveraging on its extensive infrastructure, strong

foundation and skilled manpower TCI offers seamless multi-modal logistics solutions.

TCI formerly started its operations in Calcutta with single truck in 1958 and since then,

the company has expanded its footprints as India’s leading integrated supply chain

solutions provider with a global presence. TCI has been continuously introducing

new and innovative services from multi-modal transportation (road, rail, air, sea)

to express delivery solutions, from freight forwarding and customs clearances to

warehouse management services. TCI is well equipped to take on new challenges

with a host of value added services and has plans to further strengthen its presence in

India and Asia. The company has plans to invest in state of the art, large scale multi

user multi product warehouses, ships, trucks, trailers and technology to establish

itself as a complete supply chain solutions provider.

Business Model

Transport Corporation of India(TCI)

TCI Freight TCI XPS TCI Supply Chain TCI Seaways TCI Global Others

FTL/FCL, LTL & Express company A Single-window Completes the service

Leading player in

over-dimensional engaged in door solutions enablerfrom offering of the Group Wind power

Coastal Shipping,

cargo servicesthrough to door courier Conceptualization with connectivity & generation andTrading

NVOCC & Projectcargo

Road, Rail & Sea and cargo to Implementation services across the world

Source: Company

Transport Corporation of India Ltd ACMIIL 5

ISO 9001:2008 Certified Company

COMPANY REPORT

Exhibit 8: Segmental contribution to revenue and profitability in FY10

Revenue PBIT Contribution

4% 1%

2% 3% 4%

9%

32%

17%

TCI Freight

TCI XPS

50%

TCI SupplyChain 18%

TCI Seaways

TCI Global

Others

26%

34%

Source: Company

Freight Division

TCI is one of India’s premier organized freight services provider with pan India

presence. They operate around 7,000 trucks and trailers, to provide freight movement

services on a daily basis. The freight division handles FTL (Full Truck Load), LTL (Less

Than Truck Load), FCL (Full Container Load), and ODC (Over Dimensional Cargo).

TCI’s network of 1,200 company owned offices makes them closer to the source of

raw material and customers across the country. TCI also has tactical partnership with

Container Corporation of India to provide integrated rail – road container haulage.

The company has become quite watchful in this business, owing to existence of large

number of unorganized players shrinking the profitability margins. TCI is looking at

creating value addition where margins could be better. Thus, the growth rate in this

segment is expected to be moderate. This is the major division contributing ~50% to

the topline in FY10. We expect the revenue from this segment to grow at 9.5% CAGR

during FY10-12E, while revenue contribution to come down to ~43% in FY12E, owing

to increased focus towards other high margin businesses.

XPS Division

This division provides express door-to-door service for time sensitive and high value

documents and parcels. The company operates through its own fleet of 300 dedicated

XPS trucks and delivers to 13,000 locations in India & more than 200 countries

overseas. This division has four sub-segments viz. TCI XPS Surface, TCI XPS Air,

TCI XPS Courier and TCI XPS priority services, classified according to client needs.

This is the second major division contributing ~26% to the topline in FY10. We expect

the revenue from this segment to grow at 20% CAGR during FY10-12E.

Supply Chain Solution (SCS) Division

TCI’s SCS division provides inbound / outbound logistics and supply chain solutions

right from conceptualization to implementation. This division operates with a

customized fleet of 800 owned trucks. Auto sector currently contributes to 75%

of total SCS revenue. TCI also provides transport solutions for perishable cargo in

pharma, foods & chemicals by reefer vehicles. Going forward, the company is also

targeting some non-auto segment clients from retail, FMCG and telecom sectors to

reduce the dependency on auto sector from current level of 75% to 50% in coming

years. The uniqueness of the TCI-SCS is their domain knowledge, assets (vehicles,

modern warehouses) coupled with footprint of group companies in freight, express

cargo and courier, shipping, freight forwarding & custom clearance.

Revenue contribution from this segment has scaled up to ~17% in FY10 from ~8% in

FY06 and we expect it to further stretch to ~23% in FY12E. We expect the revenue

from this segment to grow at ~37% CAGR during FY10-12E.

Transport Corporation of India Ltd ACMIIL 6

ISO 9001:2008 Certified Company

COMPANY REPORT

Seaways Division

This division provides coastal shipping services for transporting container and bulk

cargo along the eastern coast of India. TCI has also formed 50-50 JV called “Ann

Sofie Scan ApS” with Scan Trans – world’s sixth largest seaways company to focus

on Europe. The company owns and operates 5 domestic ships with capacity of 2500

– 4500 DWT (deadweight- tonne); including project ships equipped with own cranes

and 1 international ship with Ann Sofie Scan ApS. The revenue from this segment

has been quite subdued, owing to lack of new fleet addition and 1 ship per quarter

being sent for dry-docking from past few quarters.

Global Division

The Global business division of TCI provides complete logistics & SCS across

boundaries. TCI Global has set up offices in Brazil, China, Germany, Indonesia,

Hong Kong, Malaysia, Mauritius, Netherlands, Singapore and Thailand. However,

operations have started only at 5 wholly owned subsidiaries in Asia / South East

Asia (Singapore, Hong Kong, Indonesia, Thailand and China). Businesses at other

locations are expected to be operational shortly. It is planning to expand its horizon of

services to other Asian countries and selected centers in Europe as well. TCI Global

offers freight forwarding, customs clearance activities, transportation, warehousing

and courier services. This segment is expected to breakeven by end of FY12E.

Others

Other businesses include wind power generation, where the company has a cumulative

capacity of 11.5 MW. The company is also engaged in fuel trading business, mainly

constituting one fuel station, which contributed about 1% to the topline in FY10 and

had PBIT margin ~1.5%. In FY07, the company sold eight of the then nine outlets.

Going forward, no major growth is expected in this division.

De-merger of Real Estate and Warehousing division

TCI recently de-merged its real estate & warehousing division into TCI Developers

Ltd (TDL) to have greater efficiency and synergy in operations. De-merged entity TDL

has plans to develop every individual property on the basis of its size, location and

feasibility as a residential and/or commercial project. Other projects would include

state-of-the-art multi modal logistics parks, truck terminals, free-trade warehousing

zones etc. Post de-merger, every Shareholder of TCI received 1 equity share of `

10/- each in TDL for every 20 equity shares of ` 2/- each held in TCI. The company

is planning to list TDL on stock exchanges in the near term.

SWOT ANALYSIS

Positive Negative

Strengths Weakness

●● Largest integrated road transport player providing value added services ●● Presence in largely unorganised and fragmented

●● Strong relationship with clients market

Internal Factors ●● IT penetration ●● Dependence on spot market for truck availability

●● Large scale of operation (1,200 company owned branch offices and 1,200 owned

trucks)

●● Focus on high margin SCS and XPS business

Opportunities Threats

●● Introduction of GST ●● Increasing fuel cost / de-regulation of diesel prices

External Factors ●● Improvement in sea freight rates along with planned expansion ●● Increase in toll rates

●● Lower bargaining power with big consignors

●● Railways getting more aggressive

Source: ACMIIL research

Transport Corporation of India Ltd ACMIIL 7

ISO 9001:2008 Certified Company

COMPANY REPORT

Investment Rationale

Largest integrated logistics service provider

TCI is the largest integrated player, having a 15% market share of the organized logistics

industry. Over the years, TCI has built a strong infrastructure network. It has a branch

network of over 1,200 company-owned offices. It operates approximately 7,000 trucks

on a daily basis, of which 1,200 are owned trucks and 1,000 attached trucks and trailers.

Apart from transportation, the company has one of the largest warehousing space of

about 8.5 mn sq ft. It also has a fleet of six ships with a total capacity of 16000 DWT.

Industry Dynamics and Segment Snapshot

TCI Freight TCI XPS TCI Supply Chain TCI Seaways TCI Global

Industry Scenario Mature, Fragmented, Growth, niche, high Nascent, knowledge Growth, high entry Mature, medium entry

Low bar riers to entry barriers, cost b a s e d , v e r y h i g h barriers, low cost barriers, Single window

entry, low cost efficiency barriers, single window across boundaries

Industry Growth 5-10% 15-20% 20-30% 10-15% 10-15%

TCI Guidance on Revenue Growth (FY11E) 10-15% 20-25% 25-40% 20-25% -

YoY growth achieved in H1FY11 13.7% 26.1% 76.6% 9.3% 169.5%

Estimated Revenue CAGR during FY11-12E 9.5% 20.0% 37.3% 10.0% 134.5%

% Of Total Revenues (FY 10) 49.9% 26.5% 17.0% 4.3% 0.6%

% Of Total Revenues (FY 12E) 43.1% 27.5% 23.1% 3.8% 2.3%

Trend in TCI EBIDTA Margins 4-5% 10-12% 9-12% 20+% -

TCI PBIT Margins (FY10) 3.9% 7.8% 6.6% 13.1% -

Source: Company, ACMIIL Research

TCI has altered its business model from core low margin trucking service provider

to high margin SCS and express delivery business. The SCS division is expected

to grow rapidly above the industry growth rate owing to increase in outsourcing by

companies looking at re-aligning their supply chains. TCI also provides dedicated

multi modal services through its XPS division. These two segments are expected to

provide higher growth, going forward.

Segmental revenue and profitability in Fy10

8,000 20

7,000 15

10

6,000

5

5,000 0

` Million

(%)

4,000 -5

3,000 -10

-15

2,000

-20

1,000 -25

0 -30

Global

TCI XPS

Seaways

Others

Freight

TCI Supply

TCI

TCI

Chain

TCI

Revenue PBIT Margin

Source: Company, ACMIIL Research

Transport Corporation of India Ltd ACMIIL 8

ISO 9001:2008 Certified Company

COMPANY REPORT

Quarterly trend in revenue & margin contribution from SCS & XPS divisions

1,400 10%

1,200

8%

1,000

Revenue (` Million)

6%

800

PBIT Margin

600 4%

400

2%

200

0 0%

Q1FY10 Q2FY10 Q3FY10 Q4FY10 Q1FY11 Q2FY11

Supply Chain XPS Supply Chain XPS

Source: Company

Timely freight revision

TCI operates 65-70% of the business on contractual basis with a fuel cost escalation

clause, where the fuel price hike is passed on immediately to the customers. The

balance portion that is exposed to spot freight rates is further transferred with a lag

effect of 1.5 – 2 months. Therefore, owing to timely freight revision, TCI’s exposure

to fuel price hikes is minimal. However, hike in the fuel / freight rates are usually

passed on only when there is freight availability. Therefore, during recession it was

apparent that TCI had to absorb certain small fuel / freight hikes in order to ensure

volumes. As a result, freight expenses as percentage to sales had augmented by 165

bps YoY in FY10. However, going forward, we believe this hike would be gradually

passed on to the customers in coming quarters.

Trend in freight expenses

12,000 83.1 83.3 85

82.0 82.2 82.0

10,000

80

8,000

75

` Million

71.5 71.6

6,000 70.4

69.4

70

4,000 66.0

2,000 66.1 66.2 65

61.8 65.9

64.5

0 60

FY07 FY08 FY09 FY10 H1FY11

Freight Expenses % to total operating cost % to total expenditure X % to sales

Source: Company, ACMIIL Research

We believe passing on of any further hike in the fuel price would not be a major

concern at this point of time when volumes have picked up at the global and national

level. Revival in freight volumes comforts us with higher possibility of fuel price

hike to be passed on to the customers.

Major beneficiary of introduction of GST

The introduction of Goods and Services Tax (GST) will abolish centre as well as

state level taxes such as sales tax, octroi tax etc and a single tax will be charged when

a good is up for sale. GST would help to bring in more transparency in the system,

as it will solve the problem of cascading taxes that are levied across the goods. The

introduction of GST is a significant step towards the betterment of the industry.

Transport Corporation of India Ltd ACMIIL 9

ISO 9001:2008 Certified Company

COMPANY REPORT

Major benefits

●● Manufacturers would be entitled to input tax credit of all inputs and capital goods

purchased from within the State as well as inter-State, from a registered dealer for

setting off the output tax liability on the sale of their finished products. Similarly,

distributors would also be able to pass on the duty burden to their customers.

This would ensure that there is no cascading effect of taxes and would result in

a reduction in the cost of doing business

●● Road transportation is a costlier mode of transportation when compared to rail,

seaways or pipelines. Introduction of GST will eliminate multiple taxes presently

charged while carrying goods by road, thereby reducing the overall transportation

cost, making road freight rates more viable

●● Since GST is expected to standardize rates across the nation, considerable

consolidation is expected in the warehousing segment, as companies would be

able to manage bigger warehouses at few strategic locations

●● TCI being a largest integrated logistics service provider, we believe the company

to be a major beneficiary

We believe that industrial productivity and earnings will improve, more investments

will happen and GDP will get a boost. Introduction of GST will encourage foreign

companies to enter the Indian market as they will not have to deal with different

types of taxes to be paid and at the same time it will consolidate the Indian logistics

sector. In the absence of definite information on what would be the combined rate

of CGST and SGST it is difficult to estimate the impact of GST at this point of time.

However, the belief that trade and industry will benefit from implementation of GST

is widely accepted.

Expansion to trigger growth

TCI is on course to invest ~ ` 1,600 million in FY11E of which it has already invested

~ ` 460 million in H1FY11. The planned capital expenditure (capex) would be utilized

for acquisition of trucks and containers (~ ` 655 million), ship (~ ` 500 million),

warehouses (~ ` 250 million) and upgrading IT infrastructure (~ ` 195 million). Of the

planned capex, the management is uncertain about acquisition of the ship in FY11E

itself. Therefore, we have assumed a capex of `1,100 million for FY11E and the

ship to be acquired in FY12E. We believe, shipping division to register better growth

only after further capacity addition. The investment in trucks, containers, warehouses

and IT infrastructure are incorporated in our estimates of 17.9% and 29.5% CAGR

growth in topline and bottomline, respectively, during FY10-FY12E.

Transport Corporation of India Ltd ACMIIL 10

ISO 9001:2008 Certified Company

COMPANY REPORT

Financials

TCI registered net sales of `14,506.6 million in FY10, growth of 11.8% YoY. EBITDA

margins improved 45 bps YoY to 7.6% during the same period. The company recorded

net profit of `434.5 million in FY10 against `283.4 million in FY09, growth of

53.3% YoY.

Continual and sustainable improvement in profitability margins and return

ratios

Considering the ongoing bend towards the high margin businesses, TCI has been able

to register notable improvement in profitability margins over the years and we believe

the same trend to continue going forward in FY11E and FY12E as well.

Trend in profitability margins

9

7.7 8.0

8 7.6

7.1

7 6.4

6

5

%

4 3.3 3.5

3.0

3 2.4 2.2

2

1

0

FY08 FY09 FY10 FY11E FY12E

EBITDA Margins PAT Margins

Source: Company, ACMIIL Research

The company has also registered improvement in the return ratios that indicates

efficiency in profitability of company’s capital investments.

Trend in return ratios

18

16.4

16 15.2

14.0 15.7

14 13.3

14.6

11.5 13.5

12

%

10 10.8

9.9

8

6

FY08 FY09 FY10 FY11E FY12E

RONW ROCE

Source: Company, ACMIIL Research

Transport Corporation of India Ltd ACMIIL 11

ISO 9001:2008 Certified Company

COMPANY REPORT

Income Statement ` Million

FY08 FY09 FY10 FY11E FY12E

Net Sales 11,985.2 12,979.5 14,506.6 17,211.5 20,157.5

Total Expenditure 11,221.1 12,054.3 13,406.6 15,886.2 18,544.9

EBIDTA 764.1 925.2 1,100.0 1,325.3 1,612.6

Other Income 43.8 64.7 39.6 43.5 43.5

Depreciation 207.9 259.8 267.6 301.9 359.2

EBIT 600.1 730.1 871.9 1,066.9 1,296.9

Interest 168.3 240.7 195.6 223.6 242.3

PBT 431.8 489.5 676.3 843.3 1,054.6

Taxation 147.1 166.0 212.6 262.8 326.3

PAT 284.7 323.4 463.7 580.5 728.3

Less: Extraordinary item 0.0 40.0 29.3 0.0 0.0

Net Profit 284.7 283.4 434.5 580.5 728.3

Source: Company, ACMIIL Research

Balance Sheet ` Million

FY08 FY09 FY10 FY11E FY12E

Sources of funds

Equity Share Capital 145.0 145.0 145.1 145.2 145.3

Reserves & Surplus 2,484.9 2,714.5 3,085.1 3,588.5 4,240.5

Shareholders Funds 2,629.9 2,859.6 3,230.1 3,733.6 4,385.8

Loan Funds 2,290.3 2,329.0 2,716.3 2,980.7 3,230.7

Deferred Tax Liability 282.8 283.0 292.2 330.5 368.6

Total Liability 5,203.1 5,471.6 6,238.7 7,044.8 7,985.1

Application of Funds

Gross Block 3,901.3 4,132.3 4,417.8 4,847.8 5,497.8

Less: Accumulated Depreciation 1,055.6 1,268.8 1,474.3 1,776.3 2,135.4

Net Block 2,845.7 2,863.5 2,943.5 3,071.6 3,362.4

Capital WIP 30.2 119.3 149.4 234.5 261.0

Investments 158.5 185.7 357.1 387.1 417.1

Translation Difference 0.0 10.3 -2.3 0.0 0.0

Net Current Assets 2,168.6 2,292.9 2,791.0 3,351.6 3,944.6

Total Asset 5,203.1 5,471.6 6,238.7 7,044.8 7,985.1

Source: Company, ACMIIL Research

Cash flow Statement ` Million

FY08 FY09 FY10 FY11E FY12E

Op Bal Cash & Cash equivalents 154.0 123.5 106.7 205.1 248.7

Profit after Tax 284.7 283.4 434.5 580.5 728.3

Operating profit before working capital changes 583.5 889.8 1,031.7 988.9 1,399.8

Add: Changes In working Capital -421.7 -309.9 -469.9 -413.0 -594.1

Cash generated from operations 161.8 579.9 561.8 575.9 805.7

Cash Flow from Investing activities -585.2 -369.5 -615.5 -545.1 -706.6

Cash from Financing Activities 393.0 -227.3 152.1 12.7 -39.4

Net Cash Inflow / Outflow -30.5 -16.8 98.4 43.6 59.7

Closing Cash/ Cash Equivalent 123.5 106.7 205.1 248.7 308.4

Source: Company, ACMIIL Research

Transport Corporation of India Ltd ACMIIL 12

ISO 9001:2008 Certified Company

COMPANY REPORT

Ratios

FY08 FY09 FY10 FY11E FY12E

EPS (`) 3.9 3.9 6.0 8.0 10.0

Diluted EPS (`) 3.9 3.9 6.0 8.0 10.0

Market Cap (` million) 8,048.1 8,048.1 8,050.6 8,057.6 8,065.6

Debt (` million) 2,290.3 2,329.0 2,716.3 2,980.7 3,230.7

Cash (` million) 123.5 106.7 205.1 248.7 308.4

Enterprise Value (` million) 10,214.9 10,270.4 10,561.9 10,789.6 10,987.9

Book Value per share (`) 36.3 39.4 44.5 51.4 60.4

Price to Book Value (x) 3.1 2.8 2.5 2.2 1.8

EV/Sales (x) 0.9 0.8 0.7 0.6 0.5

EV/EBIDTA (x) 13.4 11.1 9.6 8.1 6.8

Market Cap to sales (x) 0.7 0.6 0.6 0.5 0.4

Operating Margin (%) 6.4 7.1 7.6 7.7 8.0

Net Profit Margin (%) 2.4 2.2 3.2 3.4 3.6

RONW (%) 10.8 9.9 13.5 15.5 16.6

ROCE (%) 11.5 13.3 14.0 15.1 16.2

Debt/ Equity (x) 0.9 0.8 0.8 0.8 0.7

Current Ratio 8.1 7.3 6.4 8.5 8.7

Fixed Assets Turnover Ratio 4.2 4.5 4.9 5.6 6.0

Source: Company, ACMIIL Research

Peer Comparison

Dupont Analysis – FY10 TCI Gati Blue Dart Express

Operating Efficiency - Net Profit Margin 3.2 1.0 6.7

Asset Use Efficiency - Asset Turnover Ratio 2.3 1.1 1.6

Financial Leverage - Equity Multiplier 1.9 3.0 1.3

ROE (%) 14.4 3.4 13.5

Source: Company, ACMIIL Research

FY10 TCI Gati Blue Dart Express

EPS 6.0 1.1 25.6

Current Market Price 111 64 1061

PE multiple 18.5 60.6 41.5

Source: Company, ACMIIL Research

Transport Corporation of India Ltd ACMIIL 13

ISO 9001:2008 Certified Company

COMPANY REPORT

Valuation and Recommendation

The revision in road freight rates and subsequent passing on of the same by the

company to its customers will boost the topline and bottomline. With increasing

contribution from high margin businesses like XPS and supply chain, improving

volumes from the automobile industry and continual and sustainable margin

expansion, we believe TCI will register a growth of 17.9% and 29.5% CAGR in

topline and bottomline, respectively, during FY10-FY12E.

At the current price of ` 111, the stock is trading at 13.9x its FY11E EPS of ` 8 and

11.1x its FY12E EPS of ` 10. We value the core standalone business at 13.5x FY12E

EPS to arrive at our target price of ` 135. Considering the recent price correction,

we recommend a “BUY” rating on the stock.

PE Band

150

130

Share Price (`)

110

90

70

50

Dec-09

Jan-10

Feb-10

Mar-10

Apr-10

May-10

Jun-10

Jul-10

Aug-10

Sep-10

Oct-10

Nov-10

Dec-10

TCI 18x 15x 12x 9x

Source: Company, ACMIIL Research

Stock price movement vis-a-vis Index movement

180

20,000

150

120 15,000

90

`

10,000

60

5,000

30

0 0

Apr-09 Aug-09 Dec-09 May-10 Sep-10

TCI Sensex

Source: Company, ACMIIL Research

Transport Corporation of India Ltd ACMIIL 14

ISO 9001:2008 Certified Company

COMPANY REPORT

Notes:

Institutional Sales:

Ravindra Nath, Tel: +91 22 2858 3400

Kirti Bagri, Tel: +91 22 2858 3731

K.Subramanyam, Tel: +91 22 2858 3739

Email: instsales@acm.co.in

Institutional Dealing:

Email: instdealing@acm.co.in

Disclaimer:

This report is based on information that we consider reliable, but we do not represent that it is accurate or complete and it should not be relied upon such. ACMIIL or

any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information

contained in the report. ACMIIL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report.

To enhance transparency we have incorporated a Disclosure of Interest Statement in this document. This should however not be treated as endorsement of the views

expressed in the report

Disclosure of Interest Transport Corporation of India Ltd

1. Analyst ownership of the stock NO

2. Broking Relationship with the company covered NO

3. Investment Banking relationship with the company covered NO

4. Discretionary Portfolio Management Services NO

This document has been prepared by the Research Desk of Asit C Mehta Investment Interrmediates Ltd. and is meant for use of the recipient only and is not for

circulation. This document is not to be reported or copied or made available to others. It should not be considered as an offer to sell or a solicitation to buy any security.

The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We

may from time to time have positions in and buy and sell securities referred to herein.

SEBI Regn No: BSE INB 010607233 (Cash); INF 010607233 (F&O), NSE INB 230607239 (Cash); INF 230607239 (F&O)

Transport Corporation of India Ltd ACMIIL 15

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Wolf of Wall Street - A SummaryDocument3 pagesThe Wolf of Wall Street - A SummaryAkshatNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Galion Term Sheet Serie ADocument8 pagesGalion Term Sheet Serie AogrjkvdjNo ratings yet

- Murabaha Case StudiesDocument2 pagesMurabaha Case StudiesOwais Ahmed86% (7)

- Educational Software K-12 Business PlanDocument32 pagesEducational Software K-12 Business PlanPawan KumaarNo ratings yet

- Multiple Choice Questions of TYBBI Auditing (Sem 5)Document15 pagesMultiple Choice Questions of TYBBI Auditing (Sem 5)jai shree krishnaNo ratings yet

- Goya EDA MemoDocument6 pagesGoya EDA MemoNew Jersey Policy PerspectiveNo ratings yet

- Malhotra CommitteeDocument2 pagesMalhotra CommitteeajucoolestNo ratings yet

- ItsTime EbookDocument365 pagesItsTime EbookPelatihan Terus100% (2)

- IPSAS in Your Pocket - January 2021Document61 pagesIPSAS in Your Pocket - January 2021Megha AgarwalNo ratings yet

- Corporation Finals 1 TheoriesDocument9 pagesCorporation Finals 1 TheoriesEphreen Grace MartyNo ratings yet

- Dhatarwal Construction Company Private LimitedDocument3 pagesDhatarwal Construction Company Private LimitedVipasha SanghaviNo ratings yet

- AdmissionDocument3 pagesAdmissionaashishNo ratings yet

- Range Division: KHS Engineering TechnologiesDocument2 pagesRange Division: KHS Engineering TechnologiesVenu GopalNo ratings yet

- Sadhguru GK Residency Automated - BrochureDocument3 pagesSadhguru GK Residency Automated - BrochureNive DitaNo ratings yet

- Law On Sales Outline 2013Document51 pagesLaw On Sales Outline 2013Ange Buenaventura SalazarNo ratings yet

- MintDocument15 pagesMintSahil GuptaNo ratings yet

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationDocument20 pagesCambridge International Examinations Cambridge International General Certificate of Secondary EducationAung Zaw HtweNo ratings yet

- 2015 Psy PDFDocument606 pages2015 Psy PDFMichael RootNo ratings yet

- Concepts & Conventions in AccountingDocument5 pagesConcepts & Conventions in Accountingpratz dhakateNo ratings yet

- Trends in Portfolio Management Services of Axis Bank, Icici and HDFC BankDocument18 pagesTrends in Portfolio Management Services of Axis Bank, Icici and HDFC BankPratik GuravNo ratings yet

- What Is A Land PatentDocument107 pagesWhat Is A Land PatentDelbert BlairNo ratings yet

- 10000005545Document49 pages10000005545Chapter 11 DocketsNo ratings yet

- Fabm Nites PrintDocument3 pagesFabm Nites Printwiz wizNo ratings yet

- Financial Statements For Decision Making: Powerpoint Presentation by Phil Johnson ©2015 John Wiley & Sons Australia LTDDocument30 pagesFinancial Statements For Decision Making: Powerpoint Presentation by Phil Johnson ©2015 John Wiley & Sons Australia LTDShiTheng Love UNo ratings yet

- 1 Bank LendingDocument56 pages1 Bank Lendingparthasarathi_inNo ratings yet

- Assignment 1 Class 11 Accountancy (2021-22)Document2 pagesAssignment 1 Class 11 Accountancy (2021-22)Binode SarkarNo ratings yet

- El Hogar v. ParedesDocument9 pagesEl Hogar v. ParedesEzra Dan BelarminoNo ratings yet

- DocMorris-AG 17082023Document12 pagesDocMorris-AG 17082023StevenNo ratings yet

- Understanding Vietnam - A Look Beyond The Facts and PDFDocument24 pagesUnderstanding Vietnam - A Look Beyond The Facts and PDFDawood GacayanNo ratings yet

- Measuring Trend MomentumDocument3 pagesMeasuring Trend Momentumpderby1100% (1)