Professional Documents

Culture Documents

CIR Vs Metro Star

Uploaded by

Johnde MartinezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIR Vs Metro Star

Uploaded by

Johnde MartinezCopyright:

Available Formats

G.R. No. 185371. December 8, 2010.

* PETITION for review on certiorari of the decision and resolution

COMMISSIONER OF INTERNAL REVENUE, petitioner, vs. of the Court of Tax Appeals.

METRO STAR SUPERAMA, INC., respondent. The facts are stated in the opinion of the Court.

Office of the Solicitor General for petitioner.

Taxation; Court of Tax Appeals; Appeals; Court will not lightly set Baterina, Baterina, Casals, Lozada & Tiblani for

aside the conclusions reached by the Court of Tax Appeals (CTA) which

respondent.

by the very nature of its functions has accordingly developed an exclusive

expertise on the resolution unless there has been an abuse or improvident

MENDOZA, J.:

exercise of authority.—The general rule is that the Court will not lightly

set aside the conclusions reached by the CTA which, by the very nature of This petition for review on certiorari under Rule 45 of the

its functions, has accordingly developed an exclusive expertise on the Rules of Court filed by the petitioner Commissioner of Internal

resolution unless there has been an abuse or improvident exercise of Revenue (CIR) seeks to reverse and set aside the 1] September 16,

authority. In Barcelon, Roxas Securities, Inc. (now known as UBP 2008 Decision of the Court of Tax Appeals En Banc (CTA-En

1

Securities, Inc.) v. Commissioner of Internal Revenue, the Court wrote: Banc), in C.T.A. EB No. 306 and 2] its November 18, 2008

Jurisprudence has consistently shown that this Court accords the findings Resolution denying petitioner’s motion for reconsideration.

2

of fact by the CTA with the highest respect. In Sea-Land Service Inc. v. The CTA-En Banc affirmed in toto the decision of its Second

Court of Appeals [G.R. No. 122605, 30 April 2001, 357 SCRA 441, 445-

Division (CTA-Second Division) in CTA Case No. 7169 reversing

446], this Court recognizes that the Court of Tax Appeals, which by the

very nature of its function is dedicated exclusively to the consideration of the February 8, 2005 Decision of the CIR which assessed

tax problems, has necessarily developed an expertise on the subject, and its respondent Metro Star Superama, Inc. (Metro Star) of deficiency

conclusions will not be overturned unless there has been an abuse or value-added tax and withholding tax for the taxable year 1999.

improvident exercise of authority. Such findings can only be disturbed on _______________

appeal if they are not supported by substantial evidence or there is a

showing of gross error or abuse on the part of the Tax Court. In the 1 Rollo, pp. 32-75. Penned by Associate Justice Caesar A. Casanova, with

absence of any clear and convincing proof to the contrary, this Court must Associate Justices Erlinda P. Uy, Olga Palanca-Enriquez, concurring and Associate

presume that the CTA rendered a decision which is valid in every respect. Justices Ernesto D. Acosta and Lovell R. Bautista, dissenting.

_______________ 2 Id., at pp. 88-96.

636

* SECOND DIVISION.

636 SUPREME COURT REPORTS ANNOTATED

634

Commissioner of Internal Revenue vs. Metro Star Superama Inc

634 SUPREME COURT REPORTS ANNOTATEDBased on a Joint Stipulation of Facts and Issues of the parties, 3

the CTA Second Division summarized the factual and procedural

Commissioner of Internal Revenue vs. Metro Star Superama antecedents

Inc. of the case, the pertinent portions of which read:

Same; Assessment; If the taxpayer denies ever having received an “Petitioner is a domestic corporation duly organized and existing by

assessment from the Bureau of Internal Revenue (BIR), it is incumbent virtue of the laws of the Republic of the Philippines, x x x.

upon the latter to prove by competent evidence that such notice was indeed On January 26, 2001, the Regional Director of Revenue Region No.

received by the addressee.—Jurisprudence is replete with cases holding 10, Legazpi City, issued Letter of Authority No. 00006561 for Revenue

that if the taxpayer denies ever having received an assessment from the Officer Daisy G. Justiniana to examine petitioner’s books of accounts and

BIR, it is incumbent upon the latter to prove by competent evidence that other accounting records for income tax and other internal revenue taxes

such notice was indeed received by the addressee. The onus probandi was for the taxable year 1999. Said Letter of Authority was revalidated on

shifted to respondent to prove by contrary evidence that the Petitioner August 10, 2001 by Regional Director Leonardo Sacamos.

received the assessment in the due course of mail. The Supreme Court has For petitioner’s failure to comply with several requests for the

consistently held that while a mailed letter is deemed received by the presentation of records and Subpoena Duces Tecum, [the] OIC of BIR

addressee in the course of mail, this is merely a disputable presumption Legal Division issued an Indorsement dated September 26, 2001 informing

subject to controversion and a direct denial thereof shifts the burden to the Revenue District Officer of Revenue Region No. 67, Legazpi City to

party favored by the presumption to prove that the mailed letter was indeed proceed with the investigation based on the best evidence obtainable

received by the addressee (Republic vs. Court of Appeals, 149 SCRA 351). preparatory to the issuance of assessment notice.

Same; Same; Section 228 of the Tax Code clearly requires that the On November 8, 2001, Revenue District Officer Socorro O. Ramos-

taxpayer must be informed that he is liable for deficiency taxes through the Lafuente issued a Preliminary 15-day Letter, which petitioner received on

sending of a Preliminary Assessment Notice (PAN).—Section 228 of the November 9, 2001. The said letter stated that a post audit review was held

Tax Code clearly requires that the taxpayer must first be informed that he and it was ascertained that there was deficiency value-added and

is liable for deficiency taxes through the sending of a PAN. He must be withholding taxes due from petitioner in the amount of P 292,874.16.

informed of the facts and the law upon which the assessment is made. The On April 11, 2002, petitioner received a Formal Letter of Demand

law imposes a substantive, not merely a formal, requirement. To proceed dated April 3, 2002 from Revenue District No. 67, Legazpi City, assessing

heedlessly with tax collection without first establishing a valid assessment petitioner the amount of Two Hundred Ninety Two Thousand Eight

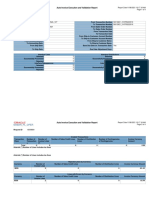

is evidently violative of the cardinal principle in administrative Hundred Seventy Four Pesos and Sixteen Centavos (P292,874.16.) for

investigations — that taxpayers should be able to present their case and deficiency value-added and withholding taxes for the taxable year 1999,

adduce supporting evidence. computed as follows:

Same; Same; The sending of a Preliminary Assessment Notice ASSESSMENT NOTICE NO. 067-99-003-579-072

(PAN) to taxpayer to inform him of the assessment made is but part of the

due process requirement in the issuance of a deficiency tax assessment, the

absence of which senders nugatory any assessment made by the tax VALUE ADDED TAX

authorities.—It is clear that the sending of a PAN to taxpayer to inform Gross Sales P1,697,718.9

him of the assessment made is but part of the “due process requirement in

the issuance of a deficiency tax assessment,” the absence of which renders Output Tax P 154,338.0

nugatory any assessment made by the tax authorities. The use of the word

“shall” in subsection 3.1.2 describes the mandatory nature of the service of Less: Input Tax ____________

a PAN. The persuasiveness of the right to due process reaches both VAT Payable P 154,338.0

substantial and procedural rights and the failure of the CIR to strictly

comply with the requirements laid down by law and its own rules is a Add: 25% Surcharge P 38,584.54

_______________

denial of Metro Star’s right to due process. Thus, for its failure to send the

PAN stating the facts and the law on which the assessment was made as

3 Id., at pp. 308-311.

required by Section 228 of R.A. No. 8424, the assessment made by the

CIR is void.635 637

VOL. 637, DECEMBER 8, 2010 VOL. 637, DECEMBER 8, 2010

Commissioner of Internal Revenue vs. Metro Star Superama Inc. Commissioner of Internal Revenue vs. Metro Star Superama Inc

Same; Same; While taxes are the lifeblood of the government, the

power to tax has its limits in spite of all its plenitude.—It is an elementary 20% Interest 79,746.49

rule enshrined in the 1987 Constitution that no person shall be deprived of Compromise Penalty

property without due process of law. In balancing the scales between the

power of the State to tax and its inherent right to prosecute perceived Late Payment P16,000.00

transgressors of the law on one side, and the constitutional rights of a

Failure to File VAT returns 2,400.00 18,400.00 136,731.01

citizen to due process of law and the equal protection of the laws on the

other, the scales must tilt in favor of the individual, for a citizen’s right is TOTAL P 291

amply protected by the Bill of Rights under the Constitution. Thus, while

“taxes are the lifeblood of the government,” the power to tax has its limits,

in spite of all its plenitude. WITHHOLDING TAX

Compensation 2

4 Id., at pp. 97-110.

Expanded

639

Total Tax Due P112,876.83

Less: Tax Withheld VOL. 637, DECEMBER 8, 2010

Deficiency Withholding Tax P Commissioner of Internal Revenue vs. Metro Star Superama Inc

Add: 20% Interest p.a. 576.51 4. Whether or not the assessment is based on the best

Compromise Penalty 200.00 evidence obtainable pursuant to Section 6(b) of the

National Internal Revenue Code.

TOTAL P

The CTA-Second Division found merit in the petition of

Metro Star and, on March 21, 2007, rendered a decision, the

*Expanded Withholding Tax P1,949,334.25 x 5% decretal portion of which reads:

Film Rental 10,000.25 x 10% “WHEREFORE, premises considered, the Petition for Review is

hereby GRANTED. Accordingly, the assailed Decision dated February 8,

Audit Fee 193,261.20 x 5% 2005 is hereby REVERSED and SET ASIDE and respondent is

Rental Expense 41,272.73 x 1% ORDERED TO DESIST from collecting the subject taxes against

petitioner.”

Security Service 156,142.01 x 1% ____

Service Contractor P The CTA-Second Division opined that “[w]hile there [is] a

disputable presumption that a mailed letter [is] deemed received

Total by the addressee in the ordinary course of mail, a direct denial of

the receipt of mail shifts the burden upon the party favored by the

presumption to prove that the mailed letter was indeed received by

SUMMARIES OF the addressee.” It also found that there was no clear showing that

5

DEFICIENCIES Metro Star actually received the alleged PAN, dated January 16,

VALUE ADDED TAX P 2002. It, accordingly, ruled that the Formal Letter of Demand

dated April 3, 2002, as well as the Warrant of Distraint and/or

WITHHOLDING TAX Levy dated May 12, 2003 were void, as Metro Star was denied due

TOTAL process.

P 292,874.16 6

The CIR sought reconsideration of the decision of the CTA-

7

Second Division, but the motion was denied in the latter’s July 24,

Subsequently, Revenue District Office No. 67 sent a copy of the Final

Notice of Seizure dated May 12, 2003, which petitioner received on May 2007 Resolution. 8

15, 2003, giving the latter last opportunity to settle its deficiency tax Aggrieved, the CIR filed a petition for review with the CTA- 9

liabilities within ten (10) [days] from receipt thereof, otherwise respondent En Banc, but the petition was dismissed after a determination that

BIR shall be constrained to serve and execute the Warrants of Distraint no new matters were raised. The CTA-En Banc disposed:

and/or Levy and Garnishment to enforce collection. _______________

On February 6, 2004, petitioner received from Revenue District

Office No. 67 a Warrant of Distraint and/or Levy No. 67-0029-23 dated 5 Id., at p. 85, citing Republic v. Court of Appeals, 233 Phil. 359, 364; 149

May 12, 2003 demanding payment of deficiency value-added tax and SCRA 351, 354 (1987).

withholding tax payment in the amount of P292,874.16.638 6 Id., at p. 86.

7 Id., at pp. 111-119.

8 Id., at pp. 120-122.

638 SUPREME COURT REPORTS ANNOTATED 9 Id., at pp. 123-138.

Commissioner of Internal Revenue vs. Metro Star Superama Inc. 640

On July 30, 2004, petitioner filed with the Office of respondent

Commissioner a Motion for Reconsideration pursuant to Section 3.1.5 of 640 SUPREME COURT REPORTS ANNOTATED

Revenue Regulations No. 12-99. Commissioner of Internal Revenue vs. Metro Star Superama Inc

On February 8, 2005, respondent Commissioner, through its “WHEREFORE, the instant Petition for Review is hereby DENIED

authorized representative, Revenue Regional Director of Revenue Region DUE COURSE and DISMISSED for lack of merit. Accordingly, the

10, Legaspi City, issued a Decision denying petitioner’s Motion for March 21, 2007 Decision and July 27, 2007 Resolution of the CTA Second

Reconsideration. Petitioner, through counsel received said Decision on Division in CTA Case No. 7169 entitled, “Metro Star Superama, Inc.,

February 18, 2005. petitioner vs. Commissioner of Internal Revenue, respondent” are hereby

x x x.” AFFIRMED in toto.

SO ORDERED.”

Denying that it received a Preliminary Assessment

Notice (PAN) and claiming that it was not accorded due process, The motion for reconsideration filed by the CIR was likewise

10

Metro Star filed a petition for review with the CTA. The parties

4

denied by the CTA-En Banc in its November 18, 2008

then stipulated on the following issues to be decided by the tax Resolution. 11

court: The CIR, insisting that Metro Star received the PAN, dated

1. Whether the respondent complied with the due process January 16, 2002, and that due process was served nonetheless

requirement as provided under the National Internal because the latter received the Final Assessment Notice (FAN),

Revenue Code and Revenue Regulations No. 12-99 with comes now before this Court with the sole issue of whether or not

regard to the issuance of a deficiency tax assessment; Metro Star was denied due process.

1.1 Whether petitioner is liable for the respective The general rule is that the Court will not lightly set aside the

amounts of P291,069.09 and P1,805.07 as conclusions reached by the CTA which, by the very nature of its

deficiency VAT and withholding tax for the year functions, has accordingly developed an exclusive expertise on the

1999; resolution unless there has been an abuse or improvident exercise

1.2. Whether the assessment has become final and of authority. In Barcelon, Roxas Securities, Inc. (now known as

12

executory and demandable for failure of petitioner UBP Securities, Inc.) v. Commissioner of Internal Revenue, the 13

to protest the same within 30 days from its receipt Court wrote:

thereof on April 11, 2002, pursuant to Section 228 “Jurisprudence has consistently shown that this Court accords the

of the National Internal Revenue Code; findings of fact by the CTA with the highest respect. In Sea-Land Service

2. Whether the deficiency assessments issued by the Inc. v. Court of Appeals [G.R. No. 122605, 30 April 2001, 357 SCRA 441,

respondent are void for failure to state the law and/or facts 445-446], this Court recognizes that the Court of Tax Appeals, which by

upon which they are based. the very nature of its function is dedicated exclusively to the consideration

of tax problems, has necessarily developed an expertise on the subject, and

2.2 Whether petitioner was informed of the law and

its conclusions will not be overturned unless there has been an abuse or

facts on which the assessment is made in improvident exercise of authority. Such findings can only be disturbed on

compliance with Section 228 of the National appeal if they are not supported by substantial evidence or there is a

Internal Revenue Code; showing of gross error or abuse on the part of the Tax Court. In the

3. Whether or not petitioner, as owner/operator of a absence of any clear and convincing proof

movie/cinema house, is subject to VAT on sales of _______________

services under Section 108(A) of the National Internal

10 Id., at pp. 139-152.

Revenue Code; 11 Id., at pp. 88-96.

_______________ 12 Toshiba Information Equipment (Phils), Inc. v. Commissioner of Internal Revenue , G.R.

No. 157594, March 9, 2010, 614 SCRA 526.

13 G.R. No. 150764, August 7, 2006, 498 SCRA 126, 135-136.

641

VOL. 637, DECEMBER 8, 2010

VOL. 637, DECEMBER 8, 2010 Commissioner of Internal Revenue vs. Metro Star Superama Inc

Commissioner of Internal Revenue vs. Metro Star Superama Inc.however,

cases:

that a preassessment notice shall not be required in the following

to the contrary, this Court must presume that the CTA rendered a decision (a) When the finding for any deficiency tax is the result of

which is valid in every respect.” mathematical error in the computation of the tax as appearing on the face

of the return; or

On the matter of service of a tax assessment, a further perusal (b) When a discrepancy has been determined between the tax

of our ruling in Barcelon is instructive, viz.: withheld and the amount actually remitted by the withholding agent; or

“Jurisprudence is replete with cases holding that if the taxpayer (c) When a taxpayer who opted to claim a refund or tax credit of

denies ever having received an assessment from the BIR, it is excess creditable withholding tax for a taxable period was determined to

incumbent upon the latter to prove by competent evidence that such have carried over and automatically applied the same amount claimed

notice was indeed received by the addressee. The onus probandi was against the estimated tax liabilities for the taxable quarter or quarters of the

shifted to respondent to prove by contrary evidence that the Petitioner succeeding taxable year; or

received the assessment in the due course of mail. The Supreme Court (d) When the excise tax due on exciseable articles has not been

has consistently held that while a mailed letter is deemed received by the paid; or

addressee in the course of mail, this is merely a disputable presumption (e) When the article locally purchased or imported by an exempt

subject to controversion and a direct denial thereof shifts the burden to the person, such as, but not limited to, vehicles, capital equipment,

party favored by the presumption to prove that the mailed letter was indeed machineries and spare parts, has been sold, traded or transferred to non-

received by the addressee (Republic vs. Court of Appeals, 149 SCRA 351). exempt persons.

Thus as held by the Supreme Court in Gonzalo P. Nava vs. Commissioner The taxpayers shall be informed in writing of the law and the

of Internal Revenue, 13 SCRA 104, January 30, 1965: facts on which the assessment is made; otherwise, the assessment shall

“The facts to be proved to raise this presumption are (a) be void.

that the letter was properly addressed with postage prepaid, Within a period to be prescribed by implementing rules and

and (b) that it was mailed. Once these facts are proved, the regulations, the taxpayer shall be required to respond to said notice. If the

presumption is that the letter was received by the addressee as taxpayer fails to respond, the Commissioner or his duly authorized

soon as it could have been transmitted to him in the ordinary representative shall issue an assessment based on his findings.

course of the mail. But if one of the said facts fails to appear, the Such assessment may be protested administratively by filing a request

presumption does not lie. (VI, Moran, Comments on the Rules of for reconsideration or reinvestigation within thirty (30) days from receipt

Court, 1963 ed, 56-57 citing Enriquez vs. Sunlife Assurance of of the assessment in such form and manner as may be prescribed by

Canada, 41 Phil. 269).” implementing rules and regulations. Within sixty (60) days from filing of

x x x. What is essential to prove the fact of mailing is the registry the protest, all relevant supporting documents shall have been submitted;

receipt issued by the Bureau of Posts or the Registry return card otherwise, the assessment shall become final.

which would have been signed by the Petitioner or its authorized If the protest is denied in whole or in part, or is not acted upon within

representative. And if said documents cannot be located, Respondent one hundred eighty (180) days from submission of documents, the

at the very least, should have submitted to the Court a certification taxpayer adversely affected by the decision or inaction may appeal to the

issued by the Bureau of Posts and any other pertinent document which Court of Tax Appeals within thirty (30) days from receipt of the said

is executed with the intervention of the Bureau of Posts. This Court decision, or from the lapse of one hundred eighty (180)-day period;

does not put much credence to the self serving documentations made by otherwise, the decision shall become final, executory and demandable.”

the BIR personnel especially if they are unsupported by substantial (Emphasis supplied).

evidence establishing the fact of mailing. Thus:

“While we have held that an assessment is made when sent 644

within the prescribed period, even if received by the taxpayer

after its

644 SUPREME COURT REPORTS ANNOTATED

642 Commissioner of Internal Revenue vs. Metro Star Superama Inc

Indeed, Section 228 of the Tax Code clearly requires that the

642 SUPREME COURT REPORTS ANNOTATED taxpayer must first be informed that he is liable for deficiency

Commissioner of Internal Revenue vs. Metro Star Superama Inc.taxes through the sending of a PAN. He must be informed of the

expiration (Coll. of Int. Rev. vs. Bautista, L-12250 and L-12259, facts and the law upon which the assessment is made. The law

May 27, 1959), this ruling makes it the more imperative that the imposes a substantive, not merely a formal, requirement. To

release, mailing or sending of the notice be clearly and proceed heedlessly with tax collection without first establishing a

satisfactorily proved. Mere notations made without the taxpayer’s valid assessment is evidently violative of the cardinal principle in

intervention, notice or control, without adequate supporting administrative investigations—that taxpayers should be able to

evidence cannot suffice; otherwise, the taxpayer would be at the

present their case and adduce supporting evidence. 14

mercy of the revenue offices, without adequate protection or

defense.” (Nava vs. CIR, 13 SCRA 104, January 30, 1965). This is confirmed under the provisions R.R. No. 12-99 of the

x x x. BIR which pertinently provide:

The failure of the respondent to prove receipt of the assessment by the “SECTION 3. Due Process Requirement in the Issuance of

Petitioner leads to the conclusion that no assessment was issued. a Deficiency Tax Assessment.—

Consequently, the government’s right to issue an assessment for the said 3.1 Mode of procedures in the issuance of a deficiency tax

period has already prescribed. (Industrial Textile Manufacturing Co. of the assessment:

Phils., Inc. vs. CIR, CTA Case 4885, August 22, 1996).” (Emphases 3.1.1 Notice for informal conference.—The Revenue Officer

supplied.)

who audited the taxpayer's records shall, among others, state in his

The Court agrees with the CTA that the CIR failed to report whether or not the taxpayer agrees with his findings that the

discharge its duty and present any evidence to show that Metro taxpayer is liable for deficiency tax or taxes. If the taxpayer is not

Star indeed received the PAN dated January 16, 2002. It could amenable, based on the said Officer’s submitted report of

have simply presented the registry receipt or the certification from investigation, the taxpayer shall be informed, in writing, by the

the postmaster that it mailed the PAN, but failed. Neither did it Revenue District Office or by the Special Investigation Division,

offer any explanation on why it failed to comply with the as the case may be (in the case Revenue Regional Offices) or by

requirement of service of the PAN. It merely accepted the letter of the Chief of Division concerned (in the case of the BIR National

Metro Star’s chairman dated April 29, 2002, that stated that he had Office) of the discrepancy or discrepancies in the taxpayer’s

received the FAN dated April 3, 2002, but not the PAN; that he payment of his internal revenue taxes, for the purpose of “Informal

was willing to pay the tax as computed by the CIR; and that he just Conference,” in order to afford the taxpayer with an opportunity to

wanted to clarify some matters with the hope of lessening its tax present his side of the case. If the taxpayer fails to respond within

liability. fifteen (15) days from date of receipt of the notice for informal

This now leads to the question: Is the failure to strictly comply conference, he shall be considered in default, in which case, the

with notice requirements prescribed under Section 228 of the Revenue District Officer or the Chief of the Special Investigation

National Internal Revenue Code of 1997 and Revenue Regulations Division of the Revenue Regional Office, or the Chief of Division

(R.R.) No. 12-99 tantamount to a denial of due process? in the National Office, as the case may be, shall endorse the case

Specifically, are the requirements of due process satisfied if only with the least possible delay to the Assessment Division of the

the FAN stating the computation of tax liabilities and a demand to Revenue Regional Office or to the Commissioner or his duly

pay within the prescribed period was sent to the taxpayer? authorized representative, as the case may be, for appropriate

The answer to these questions require an examination of review and issuance of a deficiency tax assessment, if warranted.

Section 228 of the Tax Code which reads: 3.1.2 Preliminary Assessment Notice (PAN).—If after

“SEC. 228. Protesting of Assessment.—When the Commissioner review and evaluation by the Assessment Division or by the

or his duly authorized representative finds that proper taxes should be Commissioner or his duly

assessed, he shall first notify the taxpayer of his findings: provided, _______________

643

14 Ang Tibay v. Court of Industrial Relations, 69 Phil. 635 (1940). No. 12-85 which sought to interpret Section 229 of the old tax law.

645

RA No. 8424 has already amended the provision of Section 229 on

protesting an assessment. The old requirement of

merely notifying the taxpayer of the CIR’s findings was changed

VOL. 637, DECEMBER 8, 2010 in 1998 to informing the taxpayer of not

Commissioner of Internal Revenue vs. Metro Star Superama Inc._______________

authorized representative, as the case may be, it is determined that

there exists sufficient basis to assess the taxpayer for any 15 Tupas v. Court of Appeals, G.R. No. 89571, February 6, 1991, 193 SCRA

597, 600.

deficiency tax or taxes, the said Office shall issue to the taxpayer, 16 G.R. No. 167560, September 17, 2008, 461 SCRA 565.

at least by registered mail, a Preliminary Assessment Notice

(PAN) for the proposed assessment, showing in detail, the facts 647

and the law, rules and regulations, or jurisprudence on which the VOL. 637, DECEMBER 8, 2010

proposed assessment is based (see illustration in ANNEX A

hereof). If the taxpayer fails to respond within fifteen (15) days Commissioner of Internal Revenue vs. Metro Star Superama Inc

from date of receipt of the PAN, he shall be considered in default, only the law, but also of the facts on which an assessment would

in which case, a formal letter of demand and assessment notice be made. Otherwise, the assessment itself would be invalid. The 17

shall be caused to be issued by the said Office, calling for payment regulation then, on the other hand, simply provided that a notice

of the taxpayer’s deficiency tax liability, inclusive of the be sent to the respondent in the form prescribed, and that no

applicable penalties. consequence would ensue for failure to comply with that form.

3.1.3 Exceptions to Prior Notice of the Assessment.—The The Court need not belabor to discuss the matter of Metro

notice for informal conference and the preliminary assessment Star’s failure to file its protest, for it is well-settled that a void

notice shall not be required in any of the following cases, in which assessment bears no fruit. 18

case, issuance of the formal assessment notice for the payment of It is an elementary rule enshrined in the 1987 Constitution that

the taxpayer’s deficiency tax liability shall be sufficient: no person shall be deprived of property without due process of

(i) When the finding for any deficiency tax is the result of law. In balancing the scales between the power of the State to tax

19

mathematical error in the computation of the tax and its inherent right to prosecute perceived transgressors of the

appearing on the face of the tax return filed by the law on one side, and the constitutional rights of a citizen to due

taxpayer; or process of law and the equal protection of the laws on the other,

(ii) When a discrepancy has been determined between the the scales must tilt in favor of the individual, for a citizen’s right is

tax withheld and the amount actually remitted by the amply protected by the Bill of Rights under the Constitution. Thus,

withholding agent; or while “taxes are the lifeblood of the government,” the power to tax

(iii) When a taxpayer who opted to claim a refund or tax has its limits, in spite of all its plenitude. Hence in Commissioner

credit of excess creditable withholding tax for a taxable of Internal Revenue v. Algue, Inc., it was said—

20

period was determined to have carried over and “Taxes are the lifeblood of the government and so should be collected

without unnecessary hindrance. On the other hand, such collection should

automatically applied the same amount claimed against be made in accordance with law as any arbitrariness will negate the very

the estimated tax liabilities for the taxable quarter or reason for government itself. It is therefore necessary to reconcile the

quarters of the succeeding taxable year; or apparently conflicting interests of the authorities and the taxpayers so that

(iv) When the excise tax due on excisable articles has not the real purpose of taxation, which is the promotion of the common good,

been paid; or may be achieved.

(v) When an article locally purchased or imported by an xxx xxx xxx

exempt person, such as, but not limited to, vehicles, It is said that taxes are what we pay for civilized society. Without

capital equipment, machineries and spare parts, has been taxes, the government would be paralyzed for the lack of the motive power

to activate and operate it. Hence, despite the natural reluctance to surrender

sold, traded or transferred to non-exempt persons. part of

3.1.4 Formal Letter of Demand and Assessment Notice.— _______________

The formal letter of demand and assessment notice shall be issued

by the Commissioner or his duly authorized representative. The 17 Commissioner of Internal Revenue v. Azucena T. Reyes, G.R. No. 159694 & G.R. No.

163581 January 27, 2006, 382 SCRA 480.

letter of demand calling for payment of the taxpayer’s deficiency 18 Id.

tax or taxes shall state the facts, the law, rules and regulations, or 19 Section 1, Article III, 1987 Constitution.

20 241 Phil. 829; 158 SCRA 9 (1988).

jurisprudence on which the assessment is based,

646 648

646 SUPREME COURT REPORTS ANNOTATED 648 SUPREME COURT REPORTS ANNOTATED

Commissioner of Internal Revenue vs. Metro Star Superama Inc. Commissioner of Internal Revenue vs. Metro Star Superama Inc

otherwise, the formal letter of demand and assessment notice shall one’s hard-earned income to taxing authorities, every person who is able to

be void (see illustration in ANNEX B hereof). must contribute his share in the running of the government. The

The same shall be sent to the taxpayer only by registered mail government for its part is expected to respond in the form of tangible and

or by personal delivery. intangible benefits intended to improve the lives of the people and enhance

If sent by personal delivery, the taxpayer or his duly their moral and material values. This symbiotic relationship is the rationale

of taxation and should dispel the erroneous notion that it is an arbitrary

authorized representative shall acknowledge receipt thereof in the

method of exaction by those in the seat of power.

duplicate copy of the letter of demand, showing the following: (a) But even as we concede the inevitability and indispensability of

His name; (b) signature; (c) designation and authority to act for taxation, it is a requirement in all democratic regimes that it be

and in behalf of the taxpayer, if acknowledged received by a exercised reasonably and in accordance with the prescribed

person other than the taxpayer himself; and (d) date of receipt procedure. If it is not, then the taxpayer has a right to complain and the

thereof. courts will then come to his succor. For all the awesome power of the tax

x x x.” collector, he may still be stopped in his tracks if the taxpayer can

demonstrate x x x that the law has not been observed.” (Emphasis 21

From the provision quoted above, it is clear that the sending supplied).

of a PAN to taxpayer to inform him of the assessment made is but

WHEREFORE, the petition is DENIED.

part of the “due process requirement in the issuance of a

SO ORDERED.

deficiency tax assessment,” the absence of which renders nugatory

Carpio (Chairperson), Nachura, Peralta and Abad,

any assessment made by the tax authorities. The use of the word

JJ., concur.

“shall” in subsection 3.1.2 describes the mandatory nature of the

service of a PAN. The persuasiveness of the right to due process Petition denied.

reaches both substantial and procedural rights and the failure of

the CIR to strictly comply with the requirements laid down by law Note.—A post-reporting notice and pre-assessment notice do

and its own rules is a denial of Metro Star’s right to due not bear the gravity of a formal assessment notice. (Commissioner

process. Thus, for its failure to send the PAN stating the facts and

15

on Internal Revenue vs. Menguito, 565 SCRA 461 [2008]

the law on which the assessment was made as required by Section ——o0o——

228 of R.A. No. 8424, the assessment made by the CIR is void.

The case of CIR v. Menguito cited by the CIR in support of

16

its argument that only the non-service of the FAN is fatal to the

validity of an assessment, cannot apply to this case because the

issue therein was the non-compliance with the provisions of R. R.

You might also like

- 2020 2021 Purples Notes TaxationDocument310 pages2020 2021 Purples Notes TaxationMichael James Madrid MalinginNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- CIR vs. Enron tax assessment rulingDocument2 pagesCIR vs. Enron tax assessment rulingAldrin TangNo ratings yet

- Viernes V NLRC Digest YNGAYODocument1 pageViernes V NLRC Digest YNGAYOJohnde MartinezNo ratings yet

- Commissioner of Internal Revenue vs. Citytrust Banking CorporationDocument7 pagesCommissioner of Internal Revenue vs. Citytrust Banking CorporationjafernandNo ratings yet

- CIR Must Provide Legal and Factual Bases for Tax AssessmentDocument7 pagesCIR Must Provide Legal and Factual Bases for Tax Assessmentjan panerioNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument4 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisJAGO TRADINGNo ratings yet

- CRM Services India Private Limited: Earnings DeductionsDocument1 pageCRM Services India Private Limited: Earnings DeductionsInnama SayedNo ratings yet

- Tax II Course Outline 2Document15 pagesTax II Course Outline 2Queenie Querubin100% (1)

- Cir Vs Metro Super Rama DigestDocument2 pagesCir Vs Metro Super Rama DigestKobe BryantNo ratings yet

- COMMISSIONER OF INTERNAL REVENUE Vs METRO STAR SUPERAMADocument1 pageCOMMISSIONER OF INTERNAL REVENUE Vs METRO STAR SUPERAMACharles Roger RayaNo ratings yet

- TaxRev - CIR v. Metro Star SuperamaDocument17 pagesTaxRev - CIR v. Metro Star SuperamaLudica OjaNo ratings yet

- Wise Ltd. GBP statement June-July 2022Document1 pageWise Ltd. GBP statement June-July 2022A VNo ratings yet

- Philips Semiconductors Phils. Inc. vs. Eloisa FadriquelaDocument4 pagesPhilips Semiconductors Phils. Inc. vs. Eloisa FadriquelaJohnde MartinezNo ratings yet

- CTA upholds taxpayer's right to due process in tax assessment caseDocument4 pagesCTA upholds taxpayer's right to due process in tax assessment caseBelle MaturanNo ratings yet

- CIR Vs Metro StarDocument6 pagesCIR Vs Metro StarKenmar NoganNo ratings yet

- CIR Vs Metro Star SuperamaDocument18 pagesCIR Vs Metro Star SuperamaPia Christine BungubungNo ratings yet

- Commissioner of Internal Revenue vs. Metro Star Superama Inc., 637 SCRA 633, December 08, 2010Document17 pagesCommissioner of Internal Revenue vs. Metro Star Superama Inc., 637 SCRA 633, December 08, 2010Maria Ana LemonNo ratings yet

- Commissioner of Internal Revenue, Petitioner, vs. Enron Subic Power Corporation, Respondent.Document9 pagesCommissioner of Internal Revenue, Petitioner, vs. Enron Subic Power Corporation, Respondent.Mariel ManingasNo ratings yet

- Due Process UpheldDocument33 pagesDue Process UpheldsalpanditaNo ratings yet

- Lascona Land Vs CirDocument15 pagesLascona Land Vs Circode4saleNo ratings yet

- Court upholds tax assessments against Surigao Micro Credit CorpDocument24 pagesCourt upholds tax assessments against Surigao Micro Credit CorpJerik ElesioNo ratings yet

- Cir v. PetronDocument32 pagesCir v. PetronRap VillarinNo ratings yet

- Court of Tax Appeal: Chairperson, andDocument19 pagesCourt of Tax Appeal: Chairperson, andJason MergalNo ratings yet

- Cta 2D CV 08222 D 2013may31 AssDocument20 pagesCta 2D CV 08222 D 2013may31 AssOliver TanNo ratings yet

- Philippine Supreme Court Rules on Tax Assessment CaseDocument9 pagesPhilippine Supreme Court Rules on Tax Assessment Casedivine venturaNo ratings yet

- CIR Vs Hantex, CTA Division, February 7, 2007Document14 pagesCIR Vs Hantex, CTA Division, February 7, 2007trina tsaiNo ratings yet

- 02 CIR Vs Metro StarDocument12 pages02 CIR Vs Metro StarEMNo ratings yet

- Court of Tax Appeals: Republic The Philippines Quezon CityDocument49 pagesCourt of Tax Appeals: Republic The Philippines Quezon CityFirenze PHNo ratings yet

- Special Second Division: DecisionDocument22 pagesSpecial Second Division: DecisionMarcy BaklushNo ratings yet

- 01-City of Manila v. Grecia-Cuerdo GR No 175723Document6 pages01-City of Manila v. Grecia-Cuerdo GR No 175723ryanmeinNo ratings yet

- Commissioner of Internal Revenue vs. T. Shuttle Services, Inc.Document6 pagesCommissioner of Internal Revenue vs. T. Shuttle Services, Inc.Carla DomingoNo ratings yet

- Cir V Pascor Realty & Dev'T Corp Et. Al. GR No. 128315, June 29, 1999Document8 pagesCir V Pascor Realty & Dev'T Corp Et. Al. GR No. 128315, June 29, 1999Cristy Yaun-CabagnotNo ratings yet

- 10 - CIR v. Yusen Logistics Center, Inc.Document3 pages10 - CIR v. Yusen Logistics Center, Inc.Carlota VillaromanNo ratings yet

- PART I GENERAL PRINCIPLES OF TAXATION CasesDocument46 pagesPART I GENERAL PRINCIPLES OF TAXATION CasesNis SaNo ratings yet

- Coon of Tax Appeals: Second DivisionDocument12 pagesCoon of Tax Appeals: Second DivisionGeorge HabaconNo ratings yet

- CIR V Eron Subic PowerDocument5 pagesCIR V Eron Subic PowerYoo Si JinNo ratings yet

- Cta Eb CV 01067 M 2015apr10 Ref PDFDocument7 pagesCta Eb CV 01067 M 2015apr10 Ref PDFKathrine Chin LuNo ratings yet

- Swedish Match Philippines, Inc. vs. Treasurer of The City of ManilaDocument6 pagesSwedish Match Philippines, Inc. vs. Treasurer of The City of ManilaRenz Aimeriza AlonzoNo ratings yet

- CIR vs. Eron Subic Power CorporationDocument5 pagesCIR vs. Eron Subic Power CorporationJohn FerarenNo ratings yet

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument23 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityClaire SantosNo ratings yet

- Special Second Division: Coon of Tax AppealsDocument15 pagesSpecial Second Division: Coon of Tax AppealsAko Si Paula MonghitNo ratings yet

- Cta Eb CV 00514 D 2010mar29 RefDocument19 pagesCta Eb CV 00514 D 2010mar29 RefAlfonso LeeNo ratings yet

- CIR vs Enron Subic Power - Assessment Notice RequirementsDocument4 pagesCIR vs Enron Subic Power - Assessment Notice RequirementsWinnie Ann Daquil Lomosad-MisagalNo ratings yet

- 6.12 Bloat and Ogle Vs CIR - CTADocument6 pages6.12 Bloat and Ogle Vs CIR - CTAMeg VillaricaNo ratings yet

- CIR Vs Enron Subic Power G.R. No. 166387Document6 pagesCIR Vs Enron Subic Power G.R. No. 166387Ahmad Israfil PiliNo ratings yet

- Cir VS SonyDocument31 pagesCir VS Sonyic corNo ratings yet

- Cir Vs Metro Star SuperamaDocument2 pagesCir Vs Metro Star SuperamaDonna TreceñeNo ratings yet

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument33 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityCJNo ratings yet

- 277-Oceanic Wireless Network, Inc. v. CIR G.R. No. 148380 December 9, 2005Document6 pages277-Oceanic Wireless Network, Inc. v. CIR G.R. No. 148380 December 9, 2005Jopan SJNo ratings yet

- 1 CIR vs. Fitness by Design, Inc., GR No. 215957 Dated November 9, 2016Document32 pages1 CIR vs. Fitness by Design, Inc., GR No. 215957 Dated November 9, 2016Alfred GarciaNo ratings yet

- COMMISSIONER OF INTERNAL REVENUE Vs METRO STAR SUPERAMA, INC.Document8 pagesCOMMISSIONER OF INTERNAL REVENUE Vs METRO STAR SUPERAMA, INC.Francise Mae Montilla MordenoNo ratings yet

- Commissioner of Internal Revenue, Petitioner, vs. Team (Philippines) Operations Corporation (Formerly Mirant (Phils) Operations Corporation), RespondentDocument13 pagesCommissioner of Internal Revenue, Petitioner, vs. Team (Philippines) Operations Corporation (Formerly Mirant (Phils) Operations Corporation), RespondentChristineNo ratings yet

- 7 - Edison Bataan Cogeneration Corporation vs. CIRDocument17 pages7 - Edison Bataan Cogeneration Corporation vs. CIRMae Angieline Tibon SalvaNo ratings yet

- Republic of The Philippines of Tax Quezon: Court Appeals CityDocument15 pagesRepublic of The Philippines of Tax Quezon: Court Appeals CityElvin LouieNo ratings yet

- Allied Banking Corporation Vs CirDocument13 pagesAllied Banking Corporation Vs CirAnonymous VtsflLix1No ratings yet

- Allied Banking Corp - V - CIRDocument9 pagesAllied Banking Corp - V - CIRKatherine AlombroNo ratings yet

- 1.) Cir V Bpi 521 Scra 373Document9 pages1.) Cir V Bpi 521 Scra 373Charles BusilNo ratings yet

- CIR v. Enron Subic Power CorporationDocument2 pagesCIR v. Enron Subic Power CorporationGain DeeNo ratings yet

- Republic of The Philippines Quezon City: Court of Tax AppealsDocument19 pagesRepublic of The Philippines Quezon City: Court of Tax AppealsAnonymous 1AgYRerl8No ratings yet

- Oceanic Wireless Network, Inc. vs. Commissioner of Internal Revenue, 477 SCRA 205, December 09, 2005Document13 pagesOceanic Wireless Network, Inc. vs. Commissioner of Internal Revenue, 477 SCRA 205, December 09, 2005j0d3No ratings yet

- 139 Lascona Land Co. - vs. CIRDocument12 pages139 Lascona Land Co. - vs. CIRKriszan ManiponNo ratings yet

- G.R. No. 134062Document12 pagesG.R. No. 134062Klein CarloNo ratings yet

- Cta 2D CV 06156 D 2005jun17 AssDocument29 pagesCta 2D CV 06156 D 2005jun17 AssRewsEnNo ratings yet

- En Banc G.R. No. 166387 January 19, 2009 Commissioner OF Internal REVENUE, Petitioners, Enron Subic Powercorporation, Respondents. Resolution Corona, J.Document4 pagesEn Banc G.R. No. 166387 January 19, 2009 Commissioner OF Internal REVENUE, Petitioners, Enron Subic Powercorporation, Respondents. Resolution Corona, J.Eunice NavarroNo ratings yet

- CTA Reviews St. Luke's Appeals of BIR Tax AssessmentsDocument100 pagesCTA Reviews St. Luke's Appeals of BIR Tax AssessmentsBryan MorteraNo ratings yet

- Nakpil Vs ValdezDocument12 pagesNakpil Vs ValdezJohnde MartinezNo ratings yet

- Domingo Vs AquinoDocument6 pagesDomingo Vs AquinoJohnde MartinezNo ratings yet

- 770 Supreme Court Reports Annotated: Quirante vs. Intermediate Appellate CourtDocument5 pages770 Supreme Court Reports Annotated: Quirante vs. Intermediate Appellate CourtJohnde MartinezNo ratings yet

- PP Vs SandiganbayanDocument15 pagesPP Vs SandiganbayanJohnde MartinezNo ratings yet

- 510 Supreme Court Reports Annotated: Masmud vs. National Labor Relations Commission (First Division)Document8 pages510 Supreme Court Reports Annotated: Masmud vs. National Labor Relations Commission (First Division)Johnde MartinezNo ratings yet

- Santos Vs ArrojadaDocument7 pagesSantos Vs ArrojadaJohnde MartinezNo ratings yet

- Dalisay Vs MauricioDocument8 pagesDalisay Vs MauricioJohnde MartinezNo ratings yet

- PNB Vs Uy Teng PiaoDocument4 pagesPNB Vs Uy Teng PiaoJohnde MartinezNo ratings yet

- 548 Supreme Court Reports Annotated: Perez vs. de La TorreDocument5 pages548 Supreme Court Reports Annotated: Perez vs. de La TorreAngelie FloresNo ratings yet

- Floran Vs EdizaDocument6 pagesFloran Vs EdizaJohnde MartinezNo ratings yet

- De Guzman Vs de DiosDocument4 pagesDe Guzman Vs de DiosJohnde MartinezNo ratings yet

- Nestle Vs SanchezDocument4 pagesNestle Vs SanchezJohnde MartinezNo ratings yet

- Aquino Vs CasabarDocument10 pagesAquino Vs CasabarJohnde MartinezNo ratings yet

- Buenavista Vs DeloriaDocument13 pagesBuenavista Vs DeloriaJohnde MartinezNo ratings yet

- PLDT Vs NLRC FULLDocument10 pagesPLDT Vs NLRC FULLJohnde MartinezNo ratings yet

- Saa Vs IBPDocument4 pagesSaa Vs IBPJohnde MartinezNo ratings yet

- Maceda Vs VasquezDocument4 pagesMaceda Vs VasquezJohnde MartinezNo ratings yet

- Paz Vs Northern TobaccoDocument4 pagesPaz Vs Northern TobaccoJohnde MartinezNo ratings yet

- Quiz 5 - Crim 2Document4 pagesQuiz 5 - Crim 2Johnde MartinezNo ratings yet

- Hornilla Vs SalunatDocument5 pagesHornilla Vs SalunatJohnde MartinezNo ratings yet

- Facts: GMA v. Pabriga, G.R. No. 176419, November 27, 2013Document3 pagesFacts: GMA v. Pabriga, G.R. No. 176419, November 27, 2013Johnde MartinezNo ratings yet

- Manila Electric V RemoquilloDocument6 pagesManila Electric V RemoquilloJohnde MartinezNo ratings yet

- Teague vs Fernandez tort caseDocument2 pagesTeague vs Fernandez tort caseJohnde MartinezNo ratings yet

- People Vs Pirame DigestDocument1 pagePeople Vs Pirame DigestJohnde MartinezNo ratings yet

- LRTA and Train Operator Not Liable for Passenger's DeathDocument4 pagesLRTA and Train Operator Not Liable for Passenger's DeathJohnde MartinezNo ratings yet

- Amaro Vs SumanguitDocument1 pageAmaro Vs SumanguitJohnde MartinezNo ratings yet

- Bill of RightsDocument2 pagesBill of RightsDavide LeeNo ratings yet

- PNCC vs. NLRC Okyo Fatima JeanDocument1 pagePNCC vs. NLRC Okyo Fatima JeanJohnde MartinezNo ratings yet

- TAX Report WireframeDocument13 pagesTAX Report WireframeHare KrishnaNo ratings yet

- IAS 12 Income Taxes Standard ExplainedDocument40 pagesIAS 12 Income Taxes Standard ExplainedfurqanNo ratings yet

- CPACE Terminal Kernel Specification - V1.0 20180712Document78 pagesCPACE Terminal Kernel Specification - V1.0 20180712Talha UrgancıNo ratings yet

- Swiftcom Screen Report Deut BniDocument1 pageSwiftcom Screen Report Deut BniBagus AndriansyahNo ratings yet

- UNIT 1 - Basic ConceptsDocument6 pagesUNIT 1 - Basic ConceptsTUSHARNo ratings yet

- Mxbar - PL - Oper: Auto Invoice Execution and Validation ReportDocument4 pagesMxbar - PL - Oper: Auto Invoice Execution and Validation ReportAntonio Arroyo SolanoNo ratings yet

- Finals Reviewer Tax 1Document10 pagesFinals Reviewer Tax 1xtinxtin5432No ratings yet

- GST Scope Post Release DocumentDocument22 pagesGST Scope Post Release DocumentRajesh KumarNo ratings yet

- Flipkart InvoiceDocument1 pageFlipkart InvoiceApplication PurposeNo ratings yet

- Factory Ledger and General LedgerDocument5 pagesFactory Ledger and General Ledgerapi-224920675No ratings yet

- ACC 430 Chapter 10Document20 pagesACC 430 Chapter 10vikkiNo ratings yet

- Major League Baseball Teams Have Imposed What Is Commonly CalledDocument1 pageMajor League Baseball Teams Have Imposed What Is Commonly Calledtrilocksp SinghNo ratings yet

- Kharghar Property Listings with Contact DetailsDocument2 pagesKharghar Property Listings with Contact DetailsanjuNo ratings yet

- AirAsia Travel Itinerary and Invoice for Booking ZS82QXDocument2 pagesAirAsia Travel Itinerary and Invoice for Booking ZS82QX邱子桐No ratings yet

- July292016 FINAL 4thedition KratzkeNOcover Lulu PDFDocument602 pagesJuly292016 FINAL 4thedition KratzkeNOcover Lulu PDFJohn Clifford EranaNo ratings yet

- 33 Various AssessmentsDocument9 pages33 Various AssessmentsVijay Patel InumulaNo ratings yet

- Nairawise Mass MRKT Tier3: First City Monument Bank LimitedDocument3 pagesNairawise Mass MRKT Tier3: First City Monument Bank LimitedJoshua Akorewaye ArigbedeNo ratings yet

- 01 03 Accretion Dilution AfterDocument3 pages01 03 Accretion Dilution AfterДоминик КоббNo ratings yet

- Atm and Role of Atm in BankingDocument9 pagesAtm and Role of Atm in BankingDrAbhishek SarafNo ratings yet

- Jo Valles - SPBUSDocument250 pagesJo Valles - SPBUSSheena MiñosaNo ratings yet

- Delivery Challan: GST NO.: 29ADOPS6311H1Z5Document5 pagesDelivery Challan: GST NO.: 29ADOPS6311H1Z5Ajay KumarNo ratings yet

- Rajasthan Housing Board, Circle - Iii, JaipurDocument1 pageRajasthan Housing Board, Circle - Iii, JaipuranilNo ratings yet

- Cash and Imprest PolicyDocument3 pagesCash and Imprest Policyaadishduggad100% (1)

- Cocktail Reception For Nan HayworthDocument2 pagesCocktail Reception For Nan HayworthSunlight FoundationNo ratings yet

- In El Carburetor California Population 1 001 There Is Not MuchDocument1 pageIn El Carburetor California Population 1 001 There Is Not Muchtrilocksp SinghNo ratings yet