Professional Documents

Culture Documents

Contemporary Issues in Accounting: H3: Standard Setting

Uploaded by

7th library0 ratings0% found this document useful (0 votes)

13 views2 pagesThe document discusses the advantages and disadvantages of rules-based and principles-based standards for financial reporting. Rules-based standards are more detailed and must be followed precisely, while principles-based standards provide broad guidelines and allow more professional judgment. Both approaches have tradeoffs between clarity and flexibility. Most countries are moving toward principles-based standards set within a conceptual framework in order to increase accuracy, comparability and faithfulness of financial reporting.

Original Description:

ثصقثصقثصقصثقصثقثصق

Original Title

paper CH3

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the advantages and disadvantages of rules-based and principles-based standards for financial reporting. Rules-based standards are more detailed and must be followed precisely, while principles-based standards provide broad guidelines and allow more professional judgment. Both approaches have tradeoffs between clarity and flexibility. Most countries are moving toward principles-based standards set within a conceptual framework in order to increase accuracy, comparability and faithfulness of financial reporting.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views2 pagesContemporary Issues in Accounting: H3: Standard Setting

Uploaded by

7th libraryThe document discusses the advantages and disadvantages of rules-based and principles-based standards for financial reporting. Rules-based standards are more detailed and must be followed precisely, while principles-based standards provide broad guidelines and allow more professional judgment. Both approaches have tradeoffs between clarity and flexibility. Most countries are moving toward principles-based standards set within a conceptual framework in order to increase accuracy, comparability and faithfulness of financial reporting.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Contemporary Issues in Accounting

H3: Standard Setting

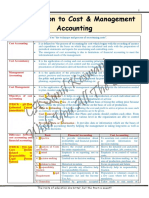

Disadvantage Advantage

1- Difficult to forecast accurately. 1- Facilities budgetary control.

2- Time consuming. 2- Leads to more accurate budgeting.

3- Do not prevent bugs. 3- Assists in performance measurement.

4- Demotivating if wrong. 4- Assists in target setting for staff.

5- Force people to change their methods. 5- Reducing costs.

6- The implementation of standard removes 6- Assists in price setting.

the creative element of the program.

7- Reduce productivity by forcing 7- Increasing productivity.

unnecessary actions.

8- Reducing unnecessary variety.

9- Ensuring interchangeability.

10- Ensuring safety.

11- Quality assurance.

12- Provide a generally accepted language for

financial statements that renders them

more comprehensible to the of accounting

information.

13- May be regarded to establish that the

collective wisdom and experience rather

than the viewpoint of individual

accountant may prevail in the matter.

14- Eliminate or reduce the effect of diverse

accounting policies and What are practices

and make the financial statement more

meaningful and comparable. In other

words, Accounting Standards promote

better understanding an of accounting

statement.

* The benefits of using standards, like:

1. Market Growth for new and emerging technologies.

2. Reduce development time and cost.

3. Reducing business risk and market risks.

4. Standards set the recognized level of quality.

5. Increase productivity and enhance efficiency.

6. Ultimately reduce cost for consumers.

7. Standards facilitate interchangeability of products and services designed for the same purpose.

8. Improving performance.

9. Encouraging innovation, standards help set the rules and establish the frameworks, making it

easier to innovate successfully.

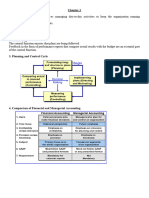

Most world countries have institutional framework that have organizational structure to provide the

process of standard setting through rule (must followed) or principles (to follow) based when preparing

financial statement. Eventually the general trend is to adopt principles based rather than the rule based

Standard Setting Rules-based standards (must follow) Principles-based standards (to follow)

Meaning are sets of detailed rules that must be are based on a conceptual framework that

followed when preparing financial provides a broad basis for accountants to follow.

statements. -The focus is on the economic substance of a

transaction, engaging the professional judgement

and expertise of those preparing financial

statements.

Advantage 1- Perspective (step scope) 1- Simpler

2- Clear Procedures. 2- Increase supply guidelines

3- Reduce conflict (positive) 3- Completed by the time

4- Management (more efficient internal 4- Decrease earning management

control) (reduce judgment). 5- Decrease auditors Procedures

5- More comparability (external users). 6- Flexible

6- More accuracy (less earning 7- Conceptual framework (standardize and

management). regulate accounting definitions,

7- More verifiability. assumptions, and methods)

8- Allowing professional judgement.

9- Increase improve faithfulness.

10- IFRSs are principles-based standards.

Disadvantage 1- Complex (more details) 1- Sometimes Not reflect economic

2- Lead to unfavourable reporting. substance.

3- Incomplete and obsolete standard by 2- Less(reduced) comparability.

the time they issued. 3- More conflict between economic

4- Increase auditors Procedures transaction and external auditors because

becouse Manipulated compliance what me should be.

with rules.

5- Leas faithfulness (disclosure)

6- Not applicable public purpose.

7- No general framework.

The accounting information is a ‘public good’ there are argues that it needs to be proceed under

regulation or not. Therefore, we have the following theories regarding the need of regulations.

1. Signalling Theory.

2. Public Interest Theory.

3. Capture Theory.

4. ‘Bushfire’ Theory.

You might also like

- Solution Manual For Auditing and Assurance Services 16th Edition by ArensDocument15 pagesSolution Manual For Auditing and Assurance Services 16th Edition by ArensMāhmõūd Āhmēd50% (2)

- Iia Whitepaper Integrated Risk Based Internal AuditingDocument8 pagesIia Whitepaper Integrated Risk Based Internal AuditingMaria Jeannie CurayNo ratings yet

- Arens Auditing16e SM 01Document14 pagesArens Auditing16e SM 01Ji RenNo ratings yet

- Guesstimates: by ICON-Consulting Club of IIM-BDocument9 pagesGuesstimates: by ICON-Consulting Club of IIM-BPratyush GoelNo ratings yet

- Chapter 1 - Introduction To Cost & Management AccountingDocument30 pagesChapter 1 - Introduction To Cost & Management AccountingJiajia MoxNo ratings yet

- 1 Overview of MADocument29 pages1 Overview of MALizette Allison BallesterosNo ratings yet

- Mas MergedDocument24 pagesMas MergedRengeline LucasNo ratings yet

- MAS A - Management AccountingDocument4 pagesMAS A - Management AccountingIvan ChiuNo ratings yet

- Cost Accounting (Chapter 1-3)Document5 pagesCost Accounting (Chapter 1-3)eunice0% (1)

- Financial Reporting (F7) : Conceptual FrameworkDocument3 pagesFinancial Reporting (F7) : Conceptual FrameworkAmbreen KureemunNo ratings yet

- Mas ReviewerDocument10 pagesMas ReviewerKathrine Nicole FernanNo ratings yet

- Lecture 01Document32 pagesLecture 01chiuchuiyingccyNo ratings yet

- Standards and The Conceptual Framework Underlying Financial AccountingDocument26 pagesStandards and The Conceptual Framework Underlying Financial AccountingLodovicus LasdiNo ratings yet

- Strategy in ActionDocument23 pagesStrategy in ActionNirushini ThurairajNo ratings yet

- Chapter 02 AnsDocument9 pagesChapter 02 AnsDave Manalo100% (1)

- Management Accounting Basic ConceptsDocument5 pagesManagement Accounting Basic ConceptsAlexandra Nicole IsaacNo ratings yet

- Overview of Cost AccountingDocument39 pagesOverview of Cost AccountingolafedNo ratings yet

- Caserones Overview Gte GralDocument17 pagesCaserones Overview Gte GralRodrigo PinedaNo ratings yet

- 901 1Document36 pages901 1M RNo ratings yet

- SCM Lesson 1Document5 pagesSCM Lesson 1Mainit, Shiela Mae, S.No ratings yet

- Accounting and Assurance Principles Notes - Sir PerlasDocument7 pagesAccounting and Assurance Principles Notes - Sir PerlasScarlet DragonNo ratings yet

- The Demand For Audit and Other Assurance Services: Review Questions 1-1Document13 pagesThe Demand For Audit and Other Assurance Services: Review Questions 1-1Kristel Nuyda LobasNo ratings yet

- Arch Ivo 20140723210300 PMDocument16 pagesArch Ivo 20140723210300 PMMarcela OrtizNo ratings yet

- Auditing Theory Cabrera 2010 Chap 2Document8 pagesAuditing Theory Cabrera 2010 Chap 2Squishy potatoNo ratings yet

- Accounting Concepts and Principles - Chapter 2Document12 pagesAccounting Concepts and Principles - Chapter 2Nicole DomingoNo ratings yet

- The Demand For Audit and Other Assurance Services: Review Questions 1-1Document13 pagesThe Demand For Audit and Other Assurance Services: Review Questions 1-1Audric AzfarNo ratings yet

- Financial Accounting and Reporting (FAR) - Part 2Document5 pagesFinancial Accounting and Reporting (FAR) - Part 2Malcolm HolmesNo ratings yet

- BMGT ReviwerDocument13 pagesBMGT ReviwerKrisselyn ReigneNo ratings yet

- LU292 - ExternalvsInternalAuditsDocument1 pageLU292 - ExternalvsInternalAuditsAna LemosNo ratings yet

- SM ch01Document13 pagesSM ch01tikaa13290No ratings yet

- Management AccountingDocument18 pagesManagement AccountingFiyadNo ratings yet

- Overview of The Financial Architecture in Oraclee Business Suite Release 12Document56 pagesOverview of The Financial Architecture in Oraclee Business Suite Release 12NgocTBNo ratings yet

- Conceptual and Regulatory FrameworkDocument8 pagesConceptual and Regulatory FrameworkJaylan A ElwailyNo ratings yet

- MAS.01 Overview of Cost and Managerial AccountingDocument34 pagesMAS.01 Overview of Cost and Managerial AccountingGeorgie SarmientoNo ratings yet

- Summary Theory - Costing PDFDocument66 pagesSummary Theory - Costing PDFartizutshiNo ratings yet

- Systems": General Ledger Systems ShouldDocument2 pagesSystems": General Ledger Systems ShouldKaren CaelNo ratings yet

- Objectives Role and Scope of Management AccountingDocument9 pagesObjectives Role and Scope of Management AccountingEarl EzekielNo ratings yet

- Concepts MgtAcctgWITHOUTDocument15 pagesConcepts MgtAcctgWITHOUTJAY AUBREY PINEDANo ratings yet

- Overview of The New Financial Architecture in Oracle E-Business Suite Release 12Document57 pagesOverview of The New Financial Architecture in Oracle E-Business Suite Release 12Hazem WaheebNo ratings yet

- CFAS Notes Unit1Document2 pagesCFAS Notes Unit1BabeEbab AndreiNo ratings yet

- Overview of The New Financial Architecture in Oracle E-Business Suite Release 12Document57 pagesOverview of The New Financial Architecture in Oracle E-Business Suite Release 12Mbade NDONGNo ratings yet

- CLASS NOTES Topic 8 Conceptual Framework of AccountingDocument11 pagesCLASS NOTES Topic 8 Conceptual Framework of AccountingKiasha WarnerNo ratings yet

- FR Practice Questions PDF-6Document16 pagesFR Practice Questions PDF-6tugaNo ratings yet

- Two Day Programme On Finance For Non Finance ExecutivesDocument6 pagesTwo Day Programme On Finance For Non Finance ExecutivessandystaysNo ratings yet

- PrologueDocument4 pagesPrologueVivek SuranaNo ratings yet

- Audit Solution - Chapter 1Document13 pagesAudit Solution - Chapter 1Hoài NamNo ratings yet

- Workbook Financial-Management MidtermDocument33 pagesWorkbook Financial-Management MidtermMariel HablaNo ratings yet

- BFC 5175 Management Accounting NotesDocument94 pagesBFC 5175 Management Accounting NotescyrusNo ratings yet

- ACCA - Chapter 1-4Document5 pagesACCA - Chapter 1-4Bianca Alexa SacabonNo ratings yet

- Conceptual FWDocument27 pagesConceptual FWStefhanyNo ratings yet

- Acca - Chapter 1-9 SummaryDocument5 pagesAcca - Chapter 1-9 SummaryBianca Alexa SacabonNo ratings yet

- Enterprise Resource Planning (ERP) Is Defined As An Integrated Computer Based PlanningDocument10 pagesEnterprise Resource Planning (ERP) Is Defined As An Integrated Computer Based PlanningSweta BastiaNo ratings yet

- Arens Auditing16e SM 01Document14 pagesArens Auditing16e SM 01Mohd KdNo ratings yet

- First Time Adoption-TraineeDocument42 pagesFirst Time Adoption-Traineedirenetwork9No ratings yet

- Elements of Financial StatementDocument33 pagesElements of Financial StatementKertik Singh100% (1)

- At 04 Auditing PlanningDocument8 pagesAt 04 Auditing PlanningJelyn RuazolNo ratings yet

- 10 Management Accounting Basic Management Functions and Concepts - CompressDocument6 pages10 Management Accounting Basic Management Functions and Concepts - Compressmarco.igmint5No ratings yet

- Solution Manual For Auditing and Assurance Services 17th by ArensDocument15 pagesSolution Manual For Auditing and Assurance Services 17th by ArensMarsha Johnson100% (30)

- Line AuthorityDocument3 pagesLine AuthorityGwyneth GloriaNo ratings yet

- Maximize Your Investment: 10 Key Strategies for Effective Packaged Software ImplementationsFrom EverandMaximize Your Investment: 10 Key Strategies for Effective Packaged Software ImplementationsNo ratings yet

- Syllabus - Advanced Corp Fin 2022-2023 SpringDocument3 pagesSyllabus - Advanced Corp Fin 2022-2023 SpringAssiat ZhassaganbergenNo ratings yet

- Payment Successful '470.82: Mobile Jiofiber Business Shop AppsDocument2 pagesPayment Successful '470.82: Mobile Jiofiber Business Shop AppsSisir MohantyNo ratings yet

- Bill AckmanDocument729 pagesBill AckmanTheMoneyMitraNo ratings yet

- 2021 Global Islamic Fintech Report 2021Document56 pages2021 Global Islamic Fintech Report 2021Slamet PrayitnoNo ratings yet

- Bos 59504Document48 pagesBos 59504swati dubeyNo ratings yet

- Questions and Answers On FriaDocument18 pagesQuestions and Answers On FriaJoseph John Santos Ronquillo100% (1)

- Hussen Nuri Adem Import and Export TradeDocument2 pagesHussen Nuri Adem Import and Export Tradehaymanot fuadNo ratings yet

- LU1 - Value-Added TaxDocument24 pagesLU1 - Value-Added Taxmandisanomzamo72No ratings yet

- 1575 1604 1590 1601 1583 1593 1608 1575 1604 1576 1602 1585 1577Document16 pages1575 1604 1590 1601 1583 1593 1608 1575 1604 1576 1602 1585 1577AlexandraNo ratings yet

- Consolated Balance Sheet: Advance Accounting-II (Chapter-3.4)Document8 pagesConsolated Balance Sheet: Advance Accounting-II (Chapter-3.4)Md Shah AlamNo ratings yet

- Michael Porter's Diamond ModelDocument5 pagesMichael Porter's Diamond ModelTiberiu FalibogaNo ratings yet

- Payslip - 2022 12 31Document1 pagePayslip - 2022 12 31mateivalentin94No ratings yet

- Gopal Vashistha 200992105067 - Asian Paints STPR PDFDocument101 pagesGopal Vashistha 200992105067 - Asian Paints STPR PDFSumitNo ratings yet

- Aluminium Profiles IselDocument22 pagesAluminium Profiles IselBorisNo ratings yet

- Industry Visit Report For DiplomaDocument19 pagesIndustry Visit Report For DiplomaChandu AnoopNo ratings yet

- Goods and Service Tax MCQs With AnswersDocument6 pagesGoods and Service Tax MCQs With Answersmonalisha mishraNo ratings yet

- A. Stockholders and Spouses: Management DiscountsDocument4 pagesA. Stockholders and Spouses: Management DiscountsJoan OraleNo ratings yet

- A Study On Mutual Funds in India PDFDocument6 pagesA Study On Mutual Funds in India PDFSahida ParveenNo ratings yet

- Theme 2 Technology and The Geo-Economy - FinalDocument57 pagesTheme 2 Technology and The Geo-Economy - Finalreginaamondi133No ratings yet

- Introduction To BankingDocument3 pagesIntroduction To BankingwubeNo ratings yet

- 5211 SUNWAY AnnualReport 2020-12-31 SunwayBerhadAnnualReport2020Part2 - 693819198Document169 pages5211 SUNWAY AnnualReport 2020-12-31 SunwayBerhadAnnualReport2020Part2 - 693819198Read Do WanNo ratings yet

- Bcog-172 eDocument495 pagesBcog-172 eYashita KansalNo ratings yet

- Chapter 15 Inventory SlidesDocument9 pagesChapter 15 Inventory SlidesKhairul Bashar Bhuiyan 1635167090No ratings yet

- UM20MB551-Corporate Finance: DR C Sivashanmugam Sivashanmugam@pes - EduDocument45 pagesUM20MB551-Corporate Finance: DR C Sivashanmugam Sivashanmugam@pes - EduRU ShenoyNo ratings yet

- Timesheet - 01 - 09 - 2021 To 05 - 09 - 2021Document1 pageTimesheet - 01 - 09 - 2021 To 05 - 09 - 2021dileep dudiNo ratings yet

- Bowles, S. (2012) - Three'sa Crowd My Dinner Party With Karl, Leon, and Maynard.Document31 pagesBowles, S. (2012) - Three'sa Crowd My Dinner Party With Karl, Leon, and Maynard.lcr89No ratings yet

- MAN IndiualDocument15 pagesMAN IndiualAvinash GajbhiyeNo ratings yet

- Econ 24 CH1 To CH3Document18 pagesEcon 24 CH1 To CH3Muyano, Mira Joy M.No ratings yet

- UK Land LawDocument12 pagesUK Land LawLuminita OlteanuNo ratings yet