Professional Documents

Culture Documents

Quiz On Depreciation

Uploaded by

Nouman MujahidOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz On Depreciation

Uploaded by

Nouman MujahidCopyright:

Available Formats

Quiz

1. Miss Zaira purchased a machine which will cost $2,97000 when purchased this year. It is

further expected to have a salvage value of $5340 at the end of its five year depreciable

life. Calculate complete depreciation schedules giving the depreciation charge, D(n), and

end-of-year book value, B(n), for straight-line (SL), sum of the years digits (SOYD) and

Reducing balance method.

2. Mr. Hamza Gillani wants to meet increased sales, a large dairy is planning to purchase 27

new Vans. Each van will cost $19,750. Compute the depreciation schedule for each truck,

using the Reducing balance method method, if the recovery period is 7 years.

3. Saba Textiles, Inc. purchased Ginning machinery for $759,348 four years ago. Due to a

change in the method of Ginning the machine was recently sold for $97,547. Determine

the Reducing balance method deprecation schedule for the machinery for the four years

of ownership. Assume a five year property class. What is the recaptured depreciation or

loss on the sale of the machinery?

4. Abbas Industries recently purchased a new Machine for $478,296. It is expected to last

14 years and has an estimated salvage value of $4,397. Determine the depreciation charge

on the crusher for the third year of its life and the book value at the end of 8 years, using

Reducing balance method depreciation

5. In the production of beverage, a final filtration is accomplished, which is composed of the

three stages. Miss Noma has purchased a property for filtering the beverages for

$978,41653 which has a salvage value of 784,295 that contains an estimated 90,758 tons.

Compute the depreciation charges for the first three years, if a production (or extraction)

of 7,954 tons, 19,813 tons, and 54,179 tons are planned for years 1, 2, and 3,

respectively., find the depreciation for respective years

6. On March 20, 2012, Shazib Chaudhary Systems acquired two new assets. Asset A was

research equipment costing $39,7583 and having a 5-year recovery period. Asset B was

duplicating equipment having an installed cost of $37,954,725 and a 7-year recovery

period. Using the MACRS depreciation percentages

You might also like

- Depreciation and Carrying AmountDocument12 pagesDepreciation and Carrying AmountNouman MujahidNo ratings yet

- Assets Liabilities and Owners EquityDocument9 pagesAssets Liabilities and Owners EquityNouman MujahidNo ratings yet

- When Market Risk Plus Own Company Debt Risk Adds It Becomes Beta LeveredDocument5 pagesWhen Market Risk Plus Own Company Debt Risk Adds It Becomes Beta LeveredNouman MujahidNo ratings yet

- Notes On Inventory ValuationDocument7 pagesNotes On Inventory ValuationNouman Mujahid100% (2)

- Assignment On DepreciationDocument4 pagesAssignment On DepreciationNouman MujahidNo ratings yet

- Merger: Acquiring CompanyDocument3 pagesMerger: Acquiring CompanyNouman MujahidNo ratings yet

- Quiz of DividendDocument1 pageQuiz of DividendNouman Mujahid0% (1)

- Notes On Working Capital ManagementDocument11 pagesNotes On Working Capital ManagementNouman MujahidNo ratings yet

- Breakeven Analysis: EBIT $0Document5 pagesBreakeven Analysis: EBIT $0Nouman MujahidNo ratings yet

- Ebit EBIT Q P-FC-VC Q: Find EBIT Price Quantity Sales - Fixed Cost - VC Per Unit Quantity TVCDocument6 pagesEbit EBIT Q P-FC-VC Q: Find EBIT Price Quantity Sales - Fixed Cost - VC Per Unit Quantity TVCNouman MujahidNo ratings yet

- Averageinvestment Under Proposed /actual Plan (Total Variable Cost) / (Turnover of Accounts Receivable)Document1 pageAverageinvestment Under Proposed /actual Plan (Total Variable Cost) / (Turnover of Accounts Receivable)Nouman MujahidNo ratings yet

- Ebit EBIT Q P-FC-VC Q: Find EBIT Price Quantity Sales - Fixed Cost - VC Per Unit Quantity TVCDocument6 pagesEbit EBIT Q P-FC-VC Q: Find EBIT Price Quantity Sales - Fixed Cost - VC Per Unit Quantity TVCNouman MujahidNo ratings yet

- Q13Document1 pageQ13Nouman MujahidNo ratings yet

- Dividends: Factors Affecting Dividend PolicyDocument7 pagesDividends: Factors Affecting Dividend PolicyNouman MujahidNo ratings yet

- What Is Behavioral FinanceDocument4 pagesWhat Is Behavioral FinanceNouman MujahidNo ratings yet

- Ebit EBIT Q P-FC-VC Q: Find EBIT Price Quantity Sales - Fixed Cost - VC Per Unit Quantity TVCDocument6 pagesEbit EBIT Q P-FC-VC Q: Find EBIT Price Quantity Sales - Fixed Cost - VC Per Unit Quantity TVCNouman MujahidNo ratings yet

- Personality Traits Impact Risk Taking Behavior of Pakistani Youth InvestorsDocument14 pagesPersonality Traits Impact Risk Taking Behavior of Pakistani Youth InvestorsNouman MujahidNo ratings yet

- When Market Risk Plus Own Company Debt Risk Adds It Becomes Beta LeveredDocument5 pagesWhen Market Risk Plus Own Company Debt Risk Adds It Becomes Beta LeveredNouman MujahidNo ratings yet

- How To Calculate The Beta of A Private CompanyDocument3 pagesHow To Calculate The Beta of A Private CompanyDuaa TahirNo ratings yet

- Accounts Payable ManagementDocument3 pagesAccounts Payable ManagementNouman MujahidNo ratings yet

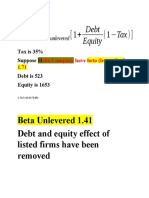

- Beta Levered and UnleveredDocument3 pagesBeta Levered and UnleveredNouman MujahidNo ratings yet

- CH 17Document39 pagesCH 17Nouman MujahidNo ratings yet

- Chapter# 7Document43 pagesChapter# 7Nouman MujahidNo ratings yet

- Required Units in Sq Yard for Medical StoreDocument29 pagesRequired Units in Sq Yard for Medical StoreNouman MujahidNo ratings yet

- Beta Levered and UnleveredDocument3 pagesBeta Levered and UnleveredNouman MujahidNo ratings yet

- Finance Interview Questions: Carey CompassDocument2 pagesFinance Interview Questions: Carey CompassNouman MujahidNo ratings yet

- Initial Cash FlowDocument3 pagesInitial Cash FlowNouman Mujahid50% (2)

- How To Write Effective Introduction of An ArticleDocument14 pagesHow To Write Effective Introduction of An ArticleNouman MujahidNo ratings yet

- W W W W W: Writing StrategiesDocument59 pagesW W W W W: Writing StrategiesHenao LuciaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)