Professional Documents

Culture Documents

UNIT 8 Entity Conversions and Combinations - Question Bank (2020)

Uploaded by

simson0 ratings0% found this document useful (0 votes)

6 views7 pagesUNIT 8 Entity Conversions and Combinations - Question Bank (2020)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentUNIT 8 Entity Conversions and Combinations - Question Bank (2020)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views7 pagesUNIT 8 Entity Conversions and Combinations - Question Bank (2020)

Uploaded by

simsonUNIT 8 Entity Conversions and Combinations - Question Bank (2020)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

QUESTION BANK- 2017

BUSINESS CONVERSIONS AND

COMBINATIONS

Exercises and Probloms in Financial Accounting

£20-1

trading as sole proprietors for some time,

n of whom bave been

Peter and Paul, both of wh oe ety wit bo a

Maren To marge their business enterprises as from 1 July 20X6. The

parinerehip to bo known ac P Squared.

‘They agree that the assets and liailtias of each sole proprietorship shall be taken over

by the partnership at the values shown in the lists below, but subject to the folowing

adjustments:

1. The fair value of the accounts receivable of Peter's and Paut's business enterprises

amount to RIG 560 and R14 400 respeativaly.

2. Peter's motor vehicles are fo be taken over at R12 000 and Paul's at R22 000,

3. Peter and Paul are to bring in or withdraw sufficient cash to incvease or decrease

their capital accounts as shown in the partnership accounting records to R280 000

and! F120 000 respectively.

Polar Paul

a R

i Assets

Land and buteéngs. 120.000 40 090

Furniture and figs 20.000 +6 000

Motor vahictos| 16000 28 000

trventory 40.000 20.009

Accounts receivable +18 400 16.009

Cash at bank 63 600 4.009

258.000 720,000

Liabities prrere

Accounts payable 22.000 20.000

You are required to:

Prepare the opening journal ontties in the accounting records of the partnership on

1 ly 20x66.

352

Questions, Exercises and Problems in Financial Aecounting

You are required 10:

1) Prepare the realisation account, the bank account, tho partners! capital accounts (i

aera far), 28 wel a he accounts for Aioy (ry) Lid and Shares in Aley (Pry) Ud.

) Prepare the jour entves inthe accounting records of Bey (PV) Ltd to record the

ewes acquired and the settlement to Park and Station.

P20-2

“tabu, Meinijes and Chwor erin partnership tracing a8 Going Up, They shave profits and

osses in the ratio of 3:2:1

Cchver has ciscussed his intention 10 aie with Jabu and Mints, and October

SoxG is sot as bis retirement date. Jabu and Meinties ave not able to conkows Of their

ram and therefore approach Taba to form a close corporation to be Krewe at Going

Up Tao CC. The formation of Going Up Two OG is to fake place immeciately alter the

issolution of Going Up.

‘The rat statement of financial position of Going UP at St October 20%8, before the

ratirernant of Cluver, is as follows:

GOING UP

STATEMENT OF FINANCIAL POSITION AT 31 OCTOBER 20%6

ASSETS

Non-current assets

Land and bulktings at cost

Vehicles at carnying amount

Equipment at carrying amount

Investment - sharos in Gon UG

Current assets

Inventory

‘Accounts receabie

EQUITY AND LIABILITIES

Capital

Cagitel accounts 300 000

“Jabu 150.000

eines 100.000

Cwer 50.000

Current accounis 41470

abe 13000)

Meintjes @ 500)

Chuver 6970.

356

- Chapter 20 s and Conversions,

EQUITY AND LIABILITIES

Non-current liabilities

Mortgage loan

Current liabilities

Accounts payable

Bank overcratt

‘The accountants of Going Up met with Jabu, Meintjies and Cluver to discuss the terms

‘and conditions of Cluver's ratirement. They produced the fofowing report based on the

discussions:

Tick & Bash

Chartered Accountants

PO Box 105

Wits 2050

25 October 20X6

The Partners

Going Up

Killarney Towers

Deer Sits,

‘We recommend the following plan forthe retiement of your Mir Chavers

+The land and buildings are to be revalued at R160 000,

+ Cluver sto take over one ofthe three vehicles at its eas yiag am

ther two vehicles are valued ata total of RAB 000,

‘The equipment is valued at R52 000.

The shares in Don Lid should be sol,

‘The fair vale of goodwill has been determined to be R120 000,

The inventory has « net reaisabl value of R38 360,

‘The expected cash flow fom accounts receivable is R65 531

‘There are no errors in the accounts payable subsidiary ledger and the total agrees

with the balance inthe wecounts payable control account in the general ledger,

of R15 000. The

Yours faithfully

Tick & Bash

Partners: !Tick & U Bash

: eee ~ 357

‘Questions, Exercises and Problems in Financial Accounting vs

“The shares in Don Lid wore sold and a cheque for the net proceeds of R27 620 was

rectived rom the stackbroker on St October 20X6. This cash, together with an increase

in the bank overdraft, is to bo used to seit the amount owing to Clwver, Entrias have not

been procescod to record the sale, and, as the financial statements have already been

prepared, the partners wish for any further profits or losses to be transferred directly 10

their capital accounts.

(On 1 November 20X85, Going Up Two CC is formed, The association agreament has the

following terms and concitions.

Association agreement of Going Up Two CC:

4. The accounting ecards af Going Up Two CC are to be the samo as those used by

the Going Up partnership.

2, Each member is to have a third interest in the close corporation.

3, The membership contribution of Jabu, Meintjes and Tsaba is R100 each,

‘Teaba is to introduce a vehicle valued at R25 000, inventory valued at R12 600, cash

of F125 000 andl accounts payable valued at RB 000. The excess over his member’

contribution ig to be treated as a long-term member's loan.

6. ‘The balances on the capital accounts of Jabs and Mointjies in the Going Up

parinership (after providing for their membership contribution) are to be treated as

Jong-term members’ loans of Going Up Two OC.

6. ‘The balances on the current accounts of Jabu and Meinijies in the Going Up

partnership are to bo treated as short-term members" loans of Going Up Two CC.

You are required to:

a) Prepare the revaluation account end the partners’ capital accounts {in columnar

form) in the ledger of the Going Up partnership, taking into account all the

recommendations of the plan relating to Cluver's retirement.

) Prepare tho journal entries to effect the conversion of the partnership to the close

corporation,

6) Prepare the statement of financial position of Going Up Two CC at 1 November

20K6.

P20-3

Chester was trading as a sole trader known as Backs, while Francois was trading as

solo tader called Forwards. Chester and Francois decided to combine their businesses

with effect fram 1 October 20X5 by forming a close corporation, Amatioko CC.

“The trial balances of the two businesses at 30 September 20X5 were as follows:

358

vs

solo

esc

sellin

‘ereises and Problems in Financial Accounting

Questions,

4. Allof the assets and fabilties of Forwards were taken over at their carrying amounts,

except for the folowing assets which were rovalved before the combination and

taken over at the revalued amounts:

R

Land and buildings 187 500

lvantory +87 500

5, The purchase consideration of R435 500 for Forwards was settlad by alocating a

member's contribution to Francois in the new clase corporation ecual to the amount

of the purchase consideration.

You are required to:

Show al the entes in the journal of Forwards and Amaboko GC to record the formation

Of the close corporation

P20-4

Double Take Cis invowedin the fastfood industry. An exact of tho tal balanes ofthe

lose corporation at 31 December 20X1 is shown below.

DOUBLE TAKE cc

(EXTRACT FROM) TRIAL BALANCE AT 31 DECEMBER 20x1

or cr

Acoumviated deprecation on equipment 0.000

Bank 15000

Members! contibutions 203.000

Unetawn prott 210.000

Members" loans 115000

On 1 January 20X2 al the assots and liabilities, excluding the bank account, of Double

Take CC were taken over by Van Damme (Ply) Ltd. The purchase consideration of

F600 000 was seltled by the issue of ordinary shares and a payment of 100 000 in

cash,

‘The shares vere used to settle the balances on the members’ contributions account,

the realisation surplus account and the undavn profit account. The members’ ‘oan

accounts were sottlod in cash

Yan Damme (Pty) Ltd considered the land and buikings 10 be worth an additional

R30 000 anc! R2 000 of the accounts receivable to be recoverable. All other assets

were agreed to be fairly valved.

‘The comparative statements of financial position of Van Damme (Pty) Ltd at 31 December

20K1 (the day before the takeover) and at 1 January 20X2 (the day after the takeover)

are as follows:

360

ian

Chapler 20 Entity Combinations and Conversions.

VAN DAMME (PTY) LTD

{EXTRACT FROM) STATEMENT OF FINANCIAL POSITION AT

1 Jan 202. 81 Dec 20x1

ASSETS

Non-currant assets

Land and butings 2 450.000 2 000 000

Equiament — cost 480 000 409 009

~ accumsiatad depreciation 2 (200 000)

Goodwit 2 i

Current assots

Inventory 120.000 100.000

Accounts recente 105.000 80 000

‘Alowance for doubt debts (10 000) (6.000)

Bank 160.000 260.000

EQUITY AND LIABILITIES

‘Share capital and reserves

(rcinary share capital 2 200.000 + 700.000

Retainod earings 2 7

‘Current labilties

Accounts payable #80000 420.000

Roceiver of Revenue 60.009 60.000

‘Shareholders for divider! 470.000 170.000

You are required to:

8) Propare the realisation account, bank account and the account for the shares in Van

Damme (Pty) Lid in the accounting records of Double Take CC at the date of the

takeover,

') Prepare the journal entries in the accounting records of Van Damme (Ply) Ltd to

record the acquisition.

P20-5

Jacko and Myles have been trading togethor in partnership for some time, sharing profits

‘and losses in the ratio of 4:1. They are approached by Saki to sell the business, He

intends to form a close corporation to be known as Busy Bee CC,

The trial balance of the partnership at 30 September 20%3 is presented below:

- - 361

You might also like

- AAM3781 AAM3781 Lesson 6 Transportation PDFDocument61 pagesAAM3781 AAM3781 Lesson 6 Transportation PDFsimsonNo ratings yet

- Cost Volume Profit Analysis: F. M. KapepisoDocument19 pagesCost Volume Profit Analysis: F. M. KapepisosimsonNo ratings yet

- Relevant Costs (Part 2) : F. M. KapepisoDocument21 pagesRelevant Costs (Part 2) : F. M. KapepisosimsonNo ratings yet

- AAM3781 AAM3781 Course Outline 2017Document3 pagesAAM3781 AAM3781 Course Outline 2017simsonNo ratings yet

- AAM3781-Test 1 06 March 2017 1 Hour 15 Minutes: 40 Marks Examiner: FM KapepisoDocument2 pagesAAM3781-Test 1 06 March 2017 1 Hour 15 Minutes: 40 Marks Examiner: FM KapepisosimsonNo ratings yet

- Linear Programming: Graphical Method: F. M. KapepisoDocument27 pagesLinear Programming: Graphical Method: F. M. KapepisosimsonNo ratings yet

- Relevant Cost Part 1 of 2Document25 pagesRelevant Cost Part 1 of 2simsonNo ratings yet

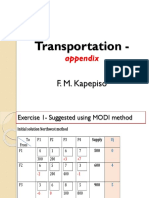

- Transportation method-APPENDIXDocument7 pagesTransportation method-APPENDIXsimsonNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)