Professional Documents

Culture Documents

FORM TP 2020027: Test Code J Anu Ary

Uploaded by

queen CassieOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FORM TP 2020027: Test Code J Anu Ary

Uploaded by

queen CassieCopyright:

Available Formats

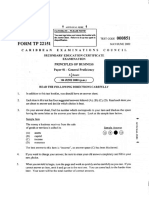

TEST CODE 01239010

FORM TP 2020027 J ANU ARY 2020

CARIBB E A N E XAMINATI O NS C OU NCIL

CARIBBEANSECONDARY E DUCATION CERTIFICATE®

EXAMINAI

T ON

PRINCIPLES OF ACCOUNT S

Pape r 01 - General Proficiency

1ho11r30 mi11t1tes

(08 JANUARY 2020 (p.m.))

READ THE FOLLOWING INSTRUCTIONS CAREFULLY.

1. This test consists of 60 items. You will have 1 hour and 30 minutes to answer them.

2. In addition to this test booklet, you should have an answer sheet.

3. Each item in this test has four suggested answe1s lettered ( A), ( B), ( C), (D). Read each item

you are about to answer and decide which choice is best.

4. On your answet" sheet, find the number which corresponds to your item and shade the space

having the same letter as the answer you have chosen. Look at the sample item below.

fuillml e Item

Prime cost is calculated by adding direct

factory expenses tp the S!m:i.ple Answer

( A) cost of goods sold

(B) cost of materials used

(C) sale of finished goods

(D) sale of non-current assets

The best answer to this item is "cost of materials used", so (B) has been shaded.

5. If yqu want to change your answer, erase it completely before you fill in your new choice.

6. When you are told to begin, turn the page and work as quickly and as carefully as you can.

If you cannot answer an item, go on to the next one. You may return to that item later.

7. You may use a silent, non-programmable calculator to answer items.

DO NOT TURN TIDS PAGE UNTIL YOU ARE TOLD TO DO SO.

Copyright <Cl 2019Caribbean Examinations Council

All rights reserved.

012390 l O/J/ CSEC 2020

-2-

1. Which of the following financial statements 5. The following information refers to the

shows the value of n business' assets? assets and liabilities of Mr J ones.

(A) Balance sheet $

(B) Trading account Cash at bank 800

(C) Cash flow statement Inventory 400

(D) Profit and loss account Payables 600

Receivables 125

Bank overdraft 250

2. The MAIN internal users of accounting Cash in hand 500

information are

From the information above, Mr Jones'

(A) managers capital amount is

(B) competitors

(C) local communities (A) $405

(D) government agencies (B) $450

(C) $850

(D) $975

3. Which of the following features are

benefits of using accounting software?

6. Pru-tnerships arc formed for the purpose of

I. Integrated analysis of information

II. Almost immediate updating of I. combining c11pital from diffelent

records persons

Ill. Progl11· mmable t o recognize II. benefiting from different skills and

irregular entries specializations

III. sharing ideas, experience and

(A) I and II only responsibilities

(B) I and III only

(C) II and III only (A) I and 11 only

(D) l, II and III (B) I and III only

(C) II and Ill only

(D) I, II and III

4. Which of the following lists of activities

shows the correct order of the stages in the

accounting cycle, before final accounts? 7. Which of the followfog is usually used to

complete a gcneialjournal entry?

(A) Posting to ledger,journalizing, trial

balance (A) Narration

(B) Posting to ledger, trial balance, (B) Description of assets

journalizing (C) Description of liabilities

(C) Journ111izing, postmg to ledger, tri11l (D) Name of book to which entry must

balance be posted

(D) Joumaltzing, trial balance, posting

to ledger

GO ON TO THE NEXT PAGE

01239010/J/CSEC2020

-3-

Item 8 refers to the following balances at Item 12 refers to the following balances

the end of a financial per:iod. taken from t.he books of Sherida's Ltd on

30 April 2019.

$

Motor vehicles 2 000 BALANCES

Payables 3 000 Rent owing $ 200

Receivables 2 000 Cash $3 500

Capital 11 000 Payables $1 200

Building 10 000 Prepaid insurance $ 300

Bank overdraft $ 400

s. What is the T,OTAL amount for the assets?

12. What is the current ratio of Sherida's Ltd?

(A) $12 000

(B) $13 000

(A) 1: l

( C) $14 000

(B) 1.5: I

(D) $15 000

(C) 2.1 : l

(D) 3.1 : l

9. Ram Singh purchased goods valued at $500

on credit. He paid off his bill within the grace 13. Which of the following entries should be

period and so received a 10% cElSh discount. used to post sales returns?

How much did he pay for the goods?

(A) Debit sales returns account

(A) $ 50 Credit the receivable account

(B)

·

$450 ,

(B) Debit sales returns account

(C) $490 Credit sales account

(D) $550

( C) Debit sales account

Credit sales returns account

(D) Debit the receivable account

10. Which of the following items are examples

Credit sales rc;t1.1rns account

of current liabilities?

I. Mortgages 14. Which of the following persons monitor a

II. Accounts payable company's financial statements, to discovet·

III. Accrued wages a desirable rate of return on capital?

(A) I and II only Investors

(A)

(B) I and m only

(B) Suppliers

(C ) II and lH only Customers

( C)

(D) I, II and III

(D) Employees

11. Which of the following entries in a three

column cash book are contra enhies?

(A) Debit cnsh, Credit bank

(B) Debit cash, Credit cash

( C) Credit cash, Credit bank

(D) Debit bank, Credit bank

GO ON TO THE NEXT PAGE

01239010/J/CSEC 2020

-4-

Item 15 iefers to the following info1mation 17. K. Khan, a debtor of A and B Enterprises,

from the books of a company. settles his debt of $120 loss discount, by

cheque. How should tho double entry

$ be recorded in the books of A and B

Enterprises?

Cash sales IO 000

Credit sales 45 000

40 000 (A) Debit K. Khan $117

Inventory on hand

Debit discount received $ 3

Drawings 8 000 Credit bank $120

Cash purchases 12 000

Credit purchases 20 200 (B) Debit K. Khan $117

Debit discount allowed $ 3

15. From the information above, what is the Credit bank $120

conect closing total for the sales account?

(C) Debit bank $117

Debit discount allowed $ 3

(A) $47000

C1 edit K. Khan $120

(B) $49 000

(C) $55 000

(D) $59 000 (D) Debit bank $117

Credit discount received $ 3

Credit K. Khan $120

16. Which of the following entries would

NOT appear in a cash book? 18. Mr A. Jones paid $250 in cash for Lepairs to

machinery. This transaction was entered in

( A) Payment for goods $100 the cash book and posted to the ledger. The

(B) Goods sold on cred�t $100 double entry involved would be

( C) Goods sold for cheque $100

(D) Goods bought for cash $100 (A ) Debit cash account

Credit repairs account

(B) Debit cash account

Credit machinery account

(C) Debit repairs account

Credit cash account

(D) Debit A. Jones account

Credit cash account

GO ON TO THE NEXT PAGE

01239010/J/CSEC 2020

-5 -

19. In orderto avoid writing numerous cheques 21. A businessman bought a new computerfor

for small amounts, a firm may set up a $6 000. He paid $4 000 in cash and traded

in his old computer. What is the entry to

(A) bnnk draft record this transaction?

(B) petty cash fund

(C) general journal Debit Credit

(D) bank standing order

(A) Debit old computer $2 000

Debit cash $4 000

Credit new computer $6 000

ll!<!!l2Q refers to the following information

(B) Debit new computer $4 000

from the sales book ofR. Lewis.

Debit cash $2 000

Credit old computer $6 000

2019 $

(C) Debit old computer $6 000

Debit cash $4 000

'·1) 2Jan H. Rick

Credit new computer $2 ODO

30@$1.50 45

(D) Debit new computer $6 000

Credit old computer $2 000

Less 33 t% Credit cash $4 000

Trade discount li

�

22. When a proprietor withdraws cash or other

assets fiom a business, what effect does it

2 0. How would R. Lewis record t h i s have on drawings or capital?

information in his ledger?

(A) Capital is increased.

Debit H. Rick's account $45 (B) Capital is decreased.

(A)

Credit sales account $45 (C) Drawings are decreased.

./ (D) Neither drawings nor capital is

7J

l! (B) Debit H. Rick's account ,'j;30 affected.

Credit sales day book $30

(C) Debit H. Rick's account $45

Credit sales account $30

(D) Debit H. Rick's account $30

Credit sales account $30

GO ON TO THE NEXT PAGE

01239010/J/CSEC 2020

- 6-

Items 23-25 refer to the following Statement of Financial Position (B alance Sheet).

$ $ $ $

Leasehold premises 10 000 Capital at start 24 000

Furniture, fittings and equipment 4 500 Less loss for year 2 200

14 500 21 800

Less drawings 1 800

Inventory 2 500 20 000

Receivables 3 700

B ank current ale 2 100 Creditors 2 100

Cash in hand 500 Accrued expenses 1200

8 800 3 300

23 300 23 300

23. What is the total value of the fixed assets?

(A) $11 200

(B) $14 500

(C ) $20 000

(D) $23 300

24. The closing capital is

(A) $20 000

(B) $20 700

(C) $21 800

(D) $22 800

25. The working capital i s

(A) $2 GOO

(B) $5 500

(C) $6 200

(D) $6 800

26. In calculating the gross profit pcrcentnge, gross profit should be divided by

(A) cost of goods sold

(B) net purchases

(C) net profit

(D) net sales

GO ON TO THE NEXT PAGE

01239010/J/CSEC 2020

.7.

Item 27 refers to the following information.

De bit Insurance Ale C1·edit

2017 $ 2017 $

2 January Balance b/d 700 31 December Profit & Loss A/c 8 100

15 January Bank 31 December Balance c/d 600

8 700

27. What is the amount of insurance prepaid at the end of the year?

(A) $ 600

(B) $ 700

(C) $8 000

(D) $8 100

28. Which of the following :financinl documents shows the net earnings of a business?

(A) Income Statement

(B) Appropriation Account

(C) Statement of Financial Position

(D) Receipts and Payments Account

Item 29 refers to the following table.

Amount of Accounts

Period of Debt Provision for Bnd Debts

Receivable

Over 3 years $6 000 3% of accounts receivable

Over2 years $4 000 2% of accounts receivable

Over 1 year $8 000 I% of accounts i eceivable

29. What is the TOTAL provi�ion for doubtful debts?

(A ) $180

(B) ?

$ 40

(C) $400

(D) $500

GO ON TO THE NEXT PAGE

01239010/J/CSEC 2020

30. An asset purchased for $1 ODO is depreciated Item 33 refers to the following information.

at the rate of 1D% per annum using the

reducing balance method. What is the book On 1 January 2019, $10 ODO was paid

value of the asset at the beginning of the towards an advertising campaign. Of this

third year? amount, $7 000 was used by 31 December

2019.

(A) $ SOD

( B) $ 81D 33. What was the amount of advertisingprepaid

(C) $ 9DD at year's end?

(D) $1 190

(A ) $ 3 000

(B) $ 7 000

31. An increase in the provision for doubtful (C) $ 1D DOO

debts wilt be (D) $17 000

(A) added to sales in the trading account

(B) subtracted from sales in the trading 34. A standing order of $25 for insurance

account appears in the debit column of the bank

(C) included as revenue in the profit statement. This amount does not appear

and loss account in the cash book. How is this item treated

(D) included as an expense in tho profit in order to update the cash book?

and Joss account

(A) Credit the bank account with $25.

(B) Debit the bank account with $25.

Item 32 refers to the following tnble which (C) Add $25 to the bank statement

shows the summarized position of Foster balance.

and Scott Limited at 6 March 2019. (D) Subtract $25 from the bank

statement balance.

$

Current liabilities 60 ODO

Item 35 refers to the following information

Current assets lDO ODO

p1 ovided by a business.

Non-current assets 200 ODO

Non-current liabilities 150 ODO

$

Total unpresented cheques 120

32. What was the capital of Foster and Scott Lodgement not entered

Limited at 6 March 20187 on bank statement 150

Balance per cash book 560

(A) $ 40 ODO

(B) $ 9D 000 35. What is the balance per bank statement?

(C) $150 DOD

(D) $190 000 (A) $120

(B) $150

(C) $340

(D) $530

GO ON TO THE NEXT PAGE

01239010/J/CSEC 2020

0 f .!ltl.. �hi c)c. -15 0 0

1"" Pv... r ck..,

. . - I ?ioo

�·,,Ir o� �oodl c:.,,a,..\ob/-<2. - 3/ 00

fO< S.. a..U.. ./ { ? ) 9

- c.lo�ifl.� !.-I-cu< - - -

Co!>� o.e .JO&IS. s.dc/ -_!J-o o_

'

-

Item 36 refers to the following information. 38. MrGreen andMrsBlack agreed to establish

a partnership, Green and Black Co. and

$ each of them deposited $5 000 into a bank

Inventoryat1January2019 l 500 account. How should this be iecorded in

Purchasesduringthcmonth 1 200 the books of the pa1tnership?

Cost of goods sold 1 400

(A) Credit cash $10 000

Debit capital $10 000

36. What is theinventory attbe end ofJanuary?

(B) DebitGreen andBlack.Co.$1O000

(A) $ 300 Cl'edit bank $10 000 each

(B) $ 500

$ 700 (C) Debit partnership bank account

(C)

$10 000

(D) $1 300

Credit partners' current accounts

$5 000 each

37. MrsAllen invested $20 000 andMrsBrown

and Mr Cable invested $5 000 each into (D) Debit partnership bank account

the same business. The loss sustained $10 000

during the year was$1000. The pnrtnership Credit partners' capital accounts

agreement is silent on the item of losses, $5 000 each

although profits are to be split in the Latia

2:2:1 in favour of Allen, Brown and Cable

respectively. How much of the loss must 39. A trader had an opening capital of$3 900.

be borne by Mr Cable? If his drawings were $900 and his closing

capital was$4 860, what was the net profit?

(A) $140

$200 (A) $ 900

(B)

(C) $300 (B) $ 960

(C) $1 860

(D) $400

(D) $3 000

GO ON TO THE NEXT PAGE

01239010/J/CSEC 2020

- 10 -

40. Rose contributed $7 000 in cash and a motor vehicle worth $3 000 to a partnership. Rose's

contribution to the partnership would be recorded in the journal a s

Debit Credit

$ $

(A) Cash 10 000

Rose's capital 10 000

(B) Rose's capital 7 000

Cash 7 000

(C) Cash 7 000

Motor vehicle 3 000

Rose's capital 10 000

(D) Rose's capital 10 000

Molo1 vehicle 3 000

Cash 7 000

41. In a cooperative society, 1he daily affairs are 44. According to the Partnership Act, if there

administered by is no Deed of Partnership, the amount of

profitto be received by EACHpartncrwould

(A) nil membets be

(B) a majority of shareholders

(C) the chaim1an of the board only ( A) divided equally

(D) pe1sons elected or appointed to do (B) calculated at 5% of net profit

so ( C) calculated nt5% on capital invested

(D) divided in proportion to capital

invested

42. The owner of a business paid a pe1sonal

medical bill from the bank account of the

business. The amount was debited to the 45. Which of the following items on a State

miscellaneous expenses account. Which ment of Financial Position would differ

of the following concepts wa& violated? MOST in presentation when comparing

the books of a company and the books of

(A) Matching a sole trader?

(B) Prudence

(C) Consistency ( A) Non-cunent assets

(D) Business entity (B) Current liabilities

(C) Current assets

(D) Capital

43. A photocopying machine valued at $5 000

is depreciated at 10% using the straight line

method. What is its book value after TWO 46. The reward of profit received by a

years? shareholder in a limited company is called

(A) $4 000 (A) interest

(B) $4 050 (B) drawings

(C) $4 500 (C) dividends

(D) $4 980 (D) commission

GO ON TO THE NEXT PAGE

01239010/J/CSEC 2020

- 11 -

47. How does an increase in bad debts affect a 51. The purpose of an appropriation account is

sole trader's financial statements? to

(A) Decreases the gross profit (A) show howthenet profit is distTibuted

(B) Increases the gross profit in a partnership or co-operative

(C) Decreases the net profit (B) change capital expenditure as

(D) Increases the net profit agreed upon in the Articles of

Association

(C) enter all capital and revenue

48. Which of the following accounts are expendih1re as stipulated in the

nominal? Partnership Act

(D) make appropriate changes related

(A) Wages and Rent to net profit as agreed upon in the

(B) Machinery and Plant Articles of Association

(C) Payables and Fixtures

(D) Inventory and Receivables

52. If revenue expenditure is overstated, which

of the following items will be affected?

49. Which of the following terms BEST

dcscdbes the final accounts of a non-profit (A) Sales

organization? (B) Surplus

(C) Inventory

I. Income Statement (D) Working capitnl

II. Receipts and Payments Account

ill. Statement ofFinancial Position J

53. When writing up the books ofa partnership,

(A) I and II only which account must EACH partner have?

(B) I and ill only

(C) II and ID only (A) Bank

(D) I, II and III (B) Current

(C) Savings

(D) Fixed deposit

50. An example of a capital expenditure ls

money spent for

(A) paying rent

(B) paying wages

: (C) purchasing goods

(D) purchasing a new building

GO ON TO THE NEXT PAGE

01239010/J/CSEC 2020

- 12 -

Item 54 refers to the following information.

J. Baynes Manufacturing Account for the Period Ended 31 December 2017

$ $

Inventory of raw materials 1 January 2017 800

Purchases of raw materials during year 4 500 Balance cnnied forward 6 800

5 300

Less closing inventory ofrnw

materials 31 December 2017 I 400

3 900

Productive wages 1 300

Fuel and power 900

Lubricants 100

Rent and rates 400

Insurance 200

6 800 6 800

54. What is the cost ofthe raw materials consumed?

(A) $ 800

(B) $1 200

(C) $3 900

(D) $4 500

ltem 55 refers to the following table which shows balances of the asset accounts of the Bayroe

Club as at 30 June 2019.

Assets $

Premises 5400

Equipment 1 825

Furniture 960

Bank and cash 1 640

Inventory and refreshments 72

55. The amount of the club's accumulated fund was

(A) $1 640

(B) $4 497

(C) $8 185

(D) $9 897

GO ON TO THE NEXT PAGE

0123901 O/J/CSEC 2020

- 13 -

56. Salaries paid to the administrative staff in Item 59 refers to the following list of

a factory would be classified as which of balances.

the following types of cost?

$

(A) Manufacturin g Work in progress 1 January 1 600

(B) Indirect Work in progress 31 December 1 700

(C) Direct Cost of materials used 3 000

(D) Prime Indirect expenses 3 200

Factory wages s 000

57. When a company declares a dividend of

15o/o the dividend warrant of a sharcholder 59. Using the list of balances above, what is

ownin � isoo one-dollal' ordinary shares is the cost of goods produced?

'

(A) $ 8 000

(A)-. $ 100

8 700

$ 225 (B) $

�) (C) $ 11 100

(G) - - $1 500

(D) $ 11 200

(D) ..

-J ��.....

$1 515

' 60. P. Amos is employed by a construction

58. Prime cost is $79 110, office expenses

$3 000 and factory overheads $4 720. How company at a rate of $7 per hour. During

ID}!Ch is the cost of production? a week, he worked his basic week of

40 hours. The income tax due on his pay

is $20, and he is also liable to pay national

.(i) . $ 4 720

insurance contributions of 5% of his gross

. \GQ) ".-. �71390 pay. What is his net pay?

(C) � - �83 830

•:' 7'(D) :_ $86 830

.

-

-·

,

.

(A) $246

t'.. . .. . .:'1 ""; (B) $260

'"..f I

. . (C) $266

-.

, ·.,, .. I

(D) $280

.·

'

·... .. � :. ..

-.

. . \

END OFTEST

IF YOU FINISH BEFORE T IME IS CALLED, CHECK YOUR WORK ON TIDS TEST.

.

01239010/J/CSEC 2020

You might also like

- Cape Communication Studies: Practical Exercises for Paper 02 EssaysFrom EverandCape Communication Studies: Practical Exercises for Paper 02 EssaysNo ratings yet

- CSEC POA June 2012 P1 PDFDocument12 pagesCSEC POA June 2012 P1 PDFjunior subhanNo ratings yet

- CSEC Principles of Accounts June 2015 Paper 1Document14 pagesCSEC Principles of Accounts June 2015 Paper 1Aria PersaudNo ratings yet

- CSEC POA June 2014 P1 PDFDocument12 pagesCSEC POA June 2014 P1 PDFjunior subhanNo ratings yet

- June 2015 p1 (With Answers)Document14 pagesJune 2015 p1 (With Answers)Ashleigh JacksonNo ratings yet

- CSEC POB June 2015 P1Document9 pagesCSEC POB June 2015 P1Tia GreenNo ratings yet

- June 2016 p1 (With Answers)Document12 pagesJune 2016 p1 (With Answers)Ashleigh JacksonNo ratings yet

- Caribbean Examinations Council: Caribbea) / Education Examination Principles ofDocument12 pagesCaribbean Examinations Council: Caribbea) / Education Examination Principles ofbrook leslieNo ratings yet

- CSEC POB June 2014 P1 PDFDocument9 pagesCSEC POB June 2014 P1 PDFschool yourschool50% (2)

- Caribbean Examinations Council: Caribbean Secondary Education Certificate ExaminationDocument32 pagesCaribbean Examinations Council: Caribbean Secondary Education Certificate ExaminationUnkown Wetlord100% (3)

- CSEC POB June 2012 P1 PDFDocument9 pagesCSEC POB June 2012 P1 PDFschool yourschoolNo ratings yet

- FORM TP 2020030: Caribbean ExaminationsDocument8 pagesFORM TP 2020030: Caribbean Examinationsjanaii50% (2)

- CSEC POB June 2002 P1 PDFDocument9 pagesCSEC POB June 2002 P1 PDFschool yourschool0% (2)

- CSEC Economics June 2009 P1Document12 pagesCSEC Economics June 2009 P1Sachin Bahadoorsingh100% (1)

- Pob Multiple Choice-1Document21 pagesPob Multiple Choice-1Nadine Davidson71% (17)

- CSEC POA January 2018 P032 PDFDocument10 pagesCSEC POA January 2018 P032 PDFTyreece BurnetteNo ratings yet

- CXC Csec Poa January 2017 p2Document28 pagesCXC Csec Poa January 2017 p2shady-angel100% (1)

- Economics - Paper 02Document7 pagesEconomics - Paper 02lalNo ratings yet

- Csec Poa January 2018 p2Document21 pagesCsec Poa January 2018 p2Joshua Melville100% (2)

- Caribbean Examinations Council: Caribbean Secondary Education Certificate ExaminationDocument20 pagesCaribbean Examinations Council: Caribbean Secondary Education Certificate ExaminationJohn taylorNo ratings yet

- CSEC Principles of Accounts January 2020 Paper 2 JkvejfDocument24 pagesCSEC Principles of Accounts January 2020 Paper 2 JkvejfKimi Manzano100% (1)

- Paper 02 POB January2021Document20 pagesPaper 02 POB January2021Grace65% (20)

- Csec-Poa-Formulae and DefinitionsDocument11 pagesCsec-Poa-Formulae and DefinitionsAiden100% (3)

- CSEC Office Administration January 2016 P02Document20 pagesCSEC Office Administration January 2016 P02Anonymous AwpYve100% (1)

- Csec Pob January 2019 p2Document20 pagesCsec Pob January 2019 p2Kabir Singh100% (1)

- Principle of Account January 2019Document28 pagesPrinciple of Account January 2019Ãryfa Hamid100% (1)

- Poa P2 2011 CXC CsecDocument8 pagesPoa P2 2011 CXC CsecMellison Molino60% (5)

- CSEC Economics June 2008 P1Document11 pagesCSEC Economics June 2008 P1Sachin BahadoorsinghNo ratings yet

- Poa Multiple Choice Questions 1-5Document16 pagesPoa Multiple Choice Questions 1-5nurul00078% (9)

- POB Past Q & ADocument31 pagesPOB Past Q & AAshley Morgan80% (10)

- Summary of POB TopicsDocument23 pagesSummary of POB TopicsRosemary Reynolds88% (16)

- POA 2023-CSEC ReviewDocument105 pagesPOA 2023-CSEC ReviewVarsha Ghanash100% (3)

- Csec Poa Paper2 Jan2015Document21 pagesCsec Poa Paper2 Jan2015Rochelle Spaulding100% (1)

- CSEC Economics June 2015 P1Document9 pagesCSEC Economics June 2015 P1Sachin Bahadoorsingh100% (1)

- CSEC Economics June 2011 P1Document10 pagesCSEC Economics June 2011 P1Sachin BahadoorsinghNo ratings yet

- Csec Poa Handout 1Document28 pagesCsec Poa Handout 1Taariq Abdul-Majeed100% (2)

- Csec Poa Handout 3Document32 pagesCsec Poa Handout 3Taariq Abdul-MajeedNo ratings yet

- Caribbean Examinations Council: Caribbean Secondary Education Certificate Examination 07 JANUARY 2021 (A.m.)Document32 pagesCaribbean Examinations Council: Caribbean Secondary Education Certificate Examination 07 JANUARY 2021 (A.m.)Tavia LordNo ratings yet

- CSEC Economics June 2012 P2Document5 pagesCSEC Economics June 2012 P2Sachin BahadoorsinghNo ratings yet

- POB Revision Text With MCQDocument310 pagesPOB Revision Text With MCQUnknown100% (3)

- CSEC Principles of Accounts Revision Course - Basic AccountingDocument9 pagesCSEC Principles of Accounts Revision Course - Basic AccountingVedang Kevlani100% (2)

- Pob NotesDocument21 pagesPob NotesOneeka Plutoqueenbee Adams91% (11)

- Csec Pob Paper 1 July 2021Document11 pagesCsec Pob Paper 1 July 2021yuvita prasad55% (11)

- CSEC Principles of Accounts MCQ Answer KeyDocument25 pagesCSEC Principles of Accounts MCQ Answer KeyDark PlaceNo ratings yet

- CSEC POB June 2019 P1Document10 pagesCSEC POB June 2019 P1Jermaine Strachan76% (17)

- Agape Learning Hub - Online Education ResourcesDocument12 pagesAgape Learning Hub - Online Education Resources5 Jai Roshan Gooloo100% (1)

- Poa 2010 P2Document10 pagesPoa 2010 P2Jam Bab100% (2)

- Preview Principles of Accounts For Caribbean Examinations TextbooksDocument18 pagesPreview Principles of Accounts For Caribbean Examinations TextbooksOkari Banton50% (4)

- CSEC Economics June 2007 P1Document10 pagesCSEC Economics June 2007 P1Sachin BahadoorsinghNo ratings yet

- POB P1s UpdatedDocument189 pagesPOB P1s Updatedpearl barkerNo ratings yet

- Csec CXC Pob Past Papers June 2016 Paper 02 PDFDocument18 pagesCsec CXC Pob Past Papers June 2016 Paper 02 PDFjohnny james100% (1)

- CSEC Economics June 2017 P1Document9 pagesCSEC Economics June 2017 P1Rafena MustaphaNo ratings yet

- CXC CSEC POA January 2017 P032 PDFDocument8 pagesCXC CSEC POA January 2017 P032 PDFNatalie50% (4)

- CSEC Information Technology January 2017 P2Document22 pagesCSEC Information Technology January 2017 P2Jhanett RobinsonNo ratings yet

- CSEC POA Jan 2022 P1Document13 pagesCSEC POA Jan 2022 P1gsvpjdq9wmNo ratings yet

- CAPE Accounting MCQDocument10 pagesCAPE Accounting MCQBradlee Singh100% (1)

- CAPE Accounting 2016 U1 P1Document10 pagesCAPE Accounting 2016 U1 P1DinaNo ratings yet

- Accts U1Document9 pagesAccts U1Avriella BlakeNo ratings yet

- Poa 2017 PDFDocument78 pagesPoa 2017 PDFAlyssa BrownNo ratings yet

- CAPE Accounting 2015 U1 P1Document9 pagesCAPE Accounting 2015 U1 P1LiciaFloydNo ratings yet

- Optimize for Virgie Litton accounting problem documentDocument14 pagesOptimize for Virgie Litton accounting problem documentPaul Gabriel FernandezNo ratings yet

- Ifs - PPTX PresentationDocument23 pagesIfs - PPTX PresentationMunira VohraNo ratings yet

- FS AnalysisDocument46 pagesFS AnalysisjaxxNo ratings yet

- BS Accountancy Batch 2018: Instructor: John Rey G. LobatonDocument78 pagesBS Accountancy Batch 2018: Instructor: John Rey G. Lobatonkacie domingoNo ratings yet

- Accounting 202 Chapter 15 TestansquestiDocument4 pagesAccounting 202 Chapter 15 TestansquestiSandra ReidNo ratings yet

- Audit 2 (T) - Topic2A SasaDocument27 pagesAudit 2 (T) - Topic2A SasaEleonora VinessaNo ratings yet

- PDF 6Document349 pagesPDF 6Aexisse OrchessaNo ratings yet

- Acb3 10Document37 pagesAcb3 10gizachew alekaNo ratings yet

- Comparative Ratio Analysis of Three Listed QSR Companies-2Document20 pagesComparative Ratio Analysis of Three Listed QSR Companies-2harshita khadayteNo ratings yet

- trắc nghiệm part 2Document39 pagestrắc nghiệm part 2HankhnilNo ratings yet

- Answer: Q 5,655 UnitsDocument6 pagesAnswer: Q 5,655 UnitsDavidNo ratings yet

- Model Exam 1Document25 pagesModel Exam 1rahelsewunet0r37203510No ratings yet

- Instruction. Encircle The Letter That Corresponds To Your Answer. Do Not Use Pencils. Avoid ErasuresDocument6 pagesInstruction. Encircle The Letter That Corresponds To Your Answer. Do Not Use Pencils. Avoid ErasuresstillwinmsNo ratings yet

- Part 2 SU6 SU15rev2 PDFDocument115 pagesPart 2 SU6 SU15rev2 PDFdeguNo ratings yet

- FAR Accounts-Receivables Drills-Quizzers FinalDocument35 pagesFAR Accounts-Receivables Drills-Quizzers FinalJuniah MyreNo ratings yet

- Lecture Slides - Chapter 3 4Document82 pagesLecture Slides - Chapter 3 4Bùi Phan Ý Nhi100% (1)

- Short-Term Finance and Planning: © 2003 The Mcgraw-Hill Companies, Inc. All Rights ReservedDocument59 pagesShort-Term Finance and Planning: © 2003 The Mcgraw-Hill Companies, Inc. All Rights ReservedKARISHMAATNo ratings yet

- Cherry Company accounts receivable adjustmentsDocument6 pagesCherry Company accounts receivable adjustmentsEdemson NavalesNo ratings yet

- 1st Long Exam (Summer 2022) WITHOUT ANSWERDocument10 pages1st Long Exam (Summer 2022) WITHOUT ANSWERDaphnie Kitch CatotalNo ratings yet

- Solution:: Notes ReceivableDocument11 pagesSolution:: Notes ReceivableAnonymous 46mMVoNo ratings yet

- Gecl 3.0 AutofillDocument63 pagesGecl 3.0 Autofillshyam krishnaNo ratings yet

- A Exam SampleDocument20 pagesA Exam Sampledanchinh100% (1)

- The Transactions Completed by Revere Courier Company During December 2014Document1 pageThe Transactions Completed by Revere Courier Company During December 2014Bube KachevskaNo ratings yet

- Far 6660Document2 pagesFar 6660Glessy Anne Marie FernandezNo ratings yet

- 1 Use The Numbers Given To Complete The Cash BudgetDocument1 page1 Use The Numbers Given To Complete The Cash BudgetAmit PandeyNo ratings yet

- FRSA - Unit 5 - Financial Statement InterpretationDocument93 pagesFRSA - Unit 5 - Financial Statement InterpretationPardeep MawliaNo ratings yet

- MTP May21 ADocument11 pagesMTP May21 Aomkar sawantNo ratings yet

- Financial Analysis of Aditya Birla GroupDocument70 pagesFinancial Analysis of Aditya Birla GroupSaloni Aman SanghviNo ratings yet

- Auto Invoice InterfaceDocument16 pagesAuto Invoice Interfacedeba11sarangi100% (1)

- Capital ManagementDocument61 pagesCapital Managementra2002ma2002931No ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Full Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperFrom EverandFull Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperRating: 5 out of 5 stars5/5 (3)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)