Professional Documents

Culture Documents

Intraday Trading Techniques, Formula & Tricks - 100% Profitable

Uploaded by

harishvasanth198267%(6)67% found this document useful (6 votes)

24K views9 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

67%(6)67% found this document useful (6 votes)

24K views9 pagesIntraday Trading Techniques, Formula & Tricks - 100% Profitable

Uploaded by

harishvasanth1982Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 9

Secret Formula of Intraday

Trading Techniques

Prashant Raut January 11, 2017

Learn Intraday Trading Formula Of Break

Out :

If Close is Above the previous Candle High.

It calls as a Closing Basis Break Out.

This Break Out is Useful for BUY.

If Close is Below the previous candle Low

It calls as a Closing Basis Break Out.

This Break Out is Useful for Sell Short.

Follow this Technical Intraday Rules :

1. Useful for Nifty & Bank nifty ( Read More about –

What is Nifty )

2. Accuracy more than 75 % to 80 % in Intraday (Day

Trading)

3. Input 5 min chart (Need min to min chart)

4. Focus on day first candle High and Low (DFC)

5. Chance to earn every month minimum of 20,000 Rs.

(Fix Income In Intraday Trading)

You Also Like: Best Trading Strategies

Intraday Trading Break Out Formula :

Sell Trade Success Techniques

1. When the day first candle (DFC) gives closing below

the low, the trader should punch the sell trade. The

trader should focus on the close & close below low.

The trader can get closing on any no of candle i.e 3,

4 or 5 candle. The next candle to closing candle will

be a qualified candle to go for sell-side.

2. Day first candle high and low difference will be first

target for the trader to book profit.

3. DFC high be where you should put stop loss

4. you need to look for the second target at 3:25 pm

Buy Trade Success Intraday Techniques

1. When the day first candle (DFC) gives closing above

the high, a trader should punch the buy trade. The

trader should focus on the close & close above High.

The trader can get closing on any no of candle i.e 3,

4 or 5 candles. The next candle to closing candle will

be a qualified candle to go for buy-side.

2. Day first candle high and low difference will be first

target for the trader to book profit.

3. DFC low be where you should put stop loss

4. You need to look for the second target at 3:25 pm

Gap Up or Down Open – Good News Or Bad News?

1. Previous Day High Above Open = Out Side Gap Up

2. Previous Day Low Below Open = Out Side Gap Down

INTRADAY BREAKOUT FORMULA WITHOUT GAP-UP

OPEN:

INTERPRETATION:

If the market open at price higher then previous day high

it’s said to be Out Side Gap Up Open. If the DFC candle

(9:15 Am) with the gap up open price gives closing above

high, go for a buy trade. Here the close above high is on

4 candles. 5 candle is a qualified candle to punch buy

trade.

BREAKOUT FORMULA WITHOUT GAP – DOWN OPEN:

INTERPRETATION:

If the DFC candle (9:15 AM) opens below previous day

low, it is said to be Candle with Gap down open price. If

The Candle with Gap down price gives closing below the

low, go for a sell trade. Here the close below low is on 2

candles. 3 candle is a qualified candle to punch sell trade.

More Latest Chart Banknifty :

The Secret Formula for Day Trading

Intraday trading is not as simple as it is made out to be.

Before you get into the act of intraday trading, you need

to learn the secret formula for intraday trading. Let us

look at this formula that can help you to become a

successful intraday trader.

Trading Rules to become a successful intraday trader:

Intraday trading is about focusing on and protecting

your capital. Do not trade with big profits in your

mind, instead of that focus on how much risk you are

willing to take per trade. Once you learned about

protecting your capital from depleting beyond a

point, profits from day trading will automatically

follow.

Don’t trade during the volatile market. Always trade

with the trend. Intraday trading gives the best result

when the momentum and direction of the market are

predictable.

Never forget to keep stop loss. It is one of the keys

to achieve success in day trading. Without a stop

loss, you may end up holding positions with the

unmanageable market to market loss.

Whatever trade setup you use for day trading, as an

intraday trader you must know about right entry and

exit point. You have to take three key decisions

about when to buy, when to sell and when to sit

tight.

Don’t panic when you are doing intraday trading,

that leads you to take wrong and hasty decisions in

the market.

Never try to recover your losses by overtrading. It is

the golden rule for intraday trading. Overtrading will

lead you to lose money in both ways.

Keep a record of your daily trade. It will help you to

find your mistakes and really useful for you to

become a better trader.

Whatever Intraday Formula you use for Intraday

trading, first do backtest with past data and also in

the live market. Once you are ready with backtesting,

as per your risk management strategy you can use

your intraday trading formula.

There is no golden key to become a successful

trader, only practice makes you a good intraday

trader. Practice, Discipline and Risk management is

the key formula for successful intraday trader.

Lastly, We at Trading Fuel don’t use simple intraday

techniques because they are good. We use them

because they work.

Our trading methods are based on simple rules which

anyone can easily adopt. They help us to act in time with

perfect information and give best results. Our trading

methods are tested and confirm that are accurate and

profitable.

We impart training to investors and traders using our

trading methods that can help you to become an

independent profitable trader.

You might also like

- Intraday Trading Rules PDFDocument10 pagesIntraday Trading Rules PDFsathish bethri100% (2)

- Intraday Trading Strategies For Expanding WealthDocument15 pagesIntraday Trading Strategies For Expanding WealthPam G.100% (2)

- Secret Formula of Intraday Trading Techniques & StrategiesDocument7 pagesSecret Formula of Intraday Trading Techniques & Strategiesswetha reddy40% (5)

- Intraday Trading Strategies Using Technical AnalysisDocument71 pagesIntraday Trading Strategies Using Technical AnalysisTejas Pegado92% (12)

- 25 Day Trading Strategies for Nifty and Bank NiftyDocument170 pages25 Day Trading Strategies for Nifty and Bank Niftyjemehax13894% (50)

- Learn 15 Day Trading Patterns and Strategies in a Single WebinarDocument11 pagesLearn 15 Day Trading Patterns and Strategies in a Single WebinarVinod100% (3)

- 9 Profitable Intraday Trading Strategies (That You Can Use Right Now)Document35 pages9 Profitable Intraday Trading Strategies (That You Can Use Right Now)M Default Name100% (1)

- Uni Directional Trade Strategies PDFDocument19 pagesUni Directional Trade Strategies PDFm Kumar100% (2)

- Price Action & RM-PS Spider PDFDocument28 pagesPrice Action & RM-PS Spider PDFGenrl Use100% (1)

- GV K's Chartink Technical Analysis Strategies and ScreenersDocument8 pagesGV K's Chartink Technical Analysis Strategies and Screenerssri sri100% (2)

- 11.BTST Trading StrategyDocument15 pages11.BTST Trading Strategyrocimo100% (1)

- 15 Strategies For Intra DayDocument4 pages15 Strategies For Intra DayNaruto Shippuden100% (1)

- Option Buying FinalDocument59 pagesOption Buying Finalhardik Patel100% (2)

- Banknifty IntradayDocument117 pagesBanknifty IntradayUmesh ThakkarNo ratings yet

- Technical Analysis, Moving Averages & Risk ManagementDocument29 pagesTechnical Analysis, Moving Averages & Risk Managementkmurali100% (1)

- Intraday TradingDocument13 pagesIntraday TradingUtpal Saha100% (2)

- Trade AchieversDocument17 pagesTrade AchieversR. Boopathi R. Boopathi89% (18)

- Intraday Trading Strategies 23 2 2018Document13 pagesIntraday Trading Strategies 23 2 2018santanu_1310100% (1)

- CRUDEOIL INTRADAY STRATEGY - Swapnaja SharmaDocument268 pagesCRUDEOIL INTRADAY STRATEGY - Swapnaja Sharmaআম্লান দত্তNo ratings yet

- Intraday TradingDocument10 pagesIntraday TradingAnonymous 4kd02a100% (1)

- UntitledDocument19 pagesUntitledDeepak Raj100% (1)

- Ashwani Gujral Trading StrategiesDocument4 pagesAshwani Gujral Trading Strategiesskotte80% (5)

- Intraday Trading StrategiesDocument6 pagesIntraday Trading Strategiesmdjauhar63% (16)

- Pivot Call EbookDocument103 pagesPivot Call Ebooksree100% (1)

- CPR by Kgs Newsletter Issue 04Document5 pagesCPR by Kgs Newsletter Issue 04murariNo ratings yet

- Banknifty DoctorDocument9 pagesBanknifty DoctorMeghali BorleNo ratings yet

- Nifty Intra Day TradingDocument20 pagesNifty Intra Day Tradingvarun vasurendranNo ratings yet

- NIFTY - Options Open Interest AnalysisDocument22 pagesNIFTY - Options Open Interest AnalysisSamir MatkarNo ratings yet

- Before 10 Am Sell SureshotDocument9 pagesBefore 10 Am Sell SureshotSujit Soni50% (2)

- Data Trading Nifty StrategyDocument35 pagesData Trading Nifty StrategySharma compNo ratings yet

- Mindfluential EbookDocument95 pagesMindfluential EbookAkhil Kotian100% (4)

- GTF Traders ChecklistDocument6 pagesGTF Traders ChecklistSagar JoshiNo ratings yet

- Pathik StrategiesDocument6 pagesPathik StrategiesMayuresh DeshpandeNo ratings yet

- Nsemcxarena StrategyDocument22 pagesNsemcxarena Strategyदेवेंद्र विश्राम परबNo ratings yet

- Banknifty StrategyDocument3 pagesBanknifty Strategyjavaindian0% (1)

- Bank Nifty Stratergy PDFDocument11 pagesBank Nifty Stratergy PDFRuhul IslamNo ratings yet

- CPR & OrbDocument21 pagesCPR & OrbHimanshu Singh Rajput100% (2)

- Intraday Trading Stock SelectionDocument29 pagesIntraday Trading Stock SelectionManikanta SVS100% (1)

- Webinar PDFDocument14 pagesWebinar PDFAjiThomas44% (9)

- Option Buying SetupDocument17 pagesOption Buying Setuprahul100% (1)

- Nifty and Bank Nifty Trading Program - Learn Intraday and Option Trading Strategies Over 6 DaysDocument93 pagesNifty and Bank Nifty Trading Program - Learn Intraday and Option Trading Strategies Over 6 DaysMak N100% (4)

- SEASONAL STOCKS in India For ProfitingDocument1 pageSEASONAL STOCKS in India For Profitingamveryhot0950% (2)

- Rajan Sir OptionsDocument19 pagesRajan Sir Optionsshanmugam0% (1)

- eLearnMarkets OptionsBuying HindiDocument17 pageseLearnMarkets OptionsBuying Hindisrinivas20% (1)

- Ashish BookDocument79 pagesAshish BookDhanush Kumar100% (1)

- Nifty Options ProfitDocument29 pagesNifty Options Profitsajinct50% (2)

- OI - Understanding Option Chain ExcelDocument4 pagesOI - Understanding Option Chain Excelsripeksha123No ratings yet

- Trading Stocks Intraday PDFDocument10 pagesTrading Stocks Intraday PDFSwathy Rai0% (1)

- SG SETUP FOR INTRADAY TRADINGDocument3 pagesSG SETUP FOR INTRADAY TRADINGMinakshi bahalNo ratings yet

- NIFTY Options Trading StrategiesDocument9 pagesNIFTY Options Trading Strategiessantosh kumari100% (5)

- Day Trading With Pivot PointsDocument108 pagesDay Trading With Pivot PointsSadanand Mahato100% (2)

- Tutorial SantuBabaTricksDocument64 pagesTutorial SantuBabaTricksArvsrv100% (14)

- Oi Pulse Manual FileDocument221 pagesOi Pulse Manual Filelakshmipathihsr64246100% (1)

- Moneypati Options OI Sheet Link Password PDFDocument10 pagesMoneypati Options OI Sheet Link Password PDFSHOEBNo ratings yet

- NiftyBank Intraday Option Buying Single Successull StrategyDocument30 pagesNiftyBank Intraday Option Buying Single Successull Strategyajayvg50% (2)

- Intraday Trading TechniquesDocument40 pagesIntraday Trading Techniquesdebu_debu75% (4)

- Intraday 890 PDFDocument3 pagesIntraday 890 PDFharishvasanth1982100% (1)

- How To Make Money in Intraday Trading - A Master Class by One of India - S Most Famous TradersDocument279 pagesHow To Make Money in Intraday Trading - A Master Class by One of India - S Most Famous TradersAnuj Saxena87% (99)

- Sony RX100 VII Advanced ManualDocument108 pagesSony RX100 VII Advanced Manualharishvasanth1982No ratings yet

- How To Make Money in Intraday Trading - A Master Class by One of India - S Most Famous TradersDocument279 pagesHow To Make Money in Intraday Trading - A Master Class by One of India - S Most Famous TradersAnuj Saxena87% (99)

- Market Pulse June 2020 PDFDocument121 pagesMarket Pulse June 2020 PDFharishvasanth1982No ratings yet

- Shiva Ultimate OutlawDocument55 pagesShiva Ultimate Outlawరహ్మానుద్దీన్ షేక్100% (5)

- EPS-50 High-speed Paper Straw Machine-Eureka Offer(LJ不锈钢)Document4 pagesEPS-50 High-speed Paper Straw Machine-Eureka Offer(LJ不锈钢)harishvasanth1982No ratings yet

- Downloaded FromDocument1 pageDownloaded Fromharishvasanth1982No ratings yet

- English FinalDocument3 pagesEnglish Finalharishvasanth1982No ratings yet

- SHS Research Paper - Final 3Document57 pagesSHS Research Paper - Final 3Jaycee MeerandaNo ratings yet

- Supply Chain Management in Big BazaarDocument25 pagesSupply Chain Management in Big Bazaarabhijit05582% (11)

- Request For Quotation 11316: Please Submit Your Response ToDocument10 pagesRequest For Quotation 11316: Please Submit Your Response ToNaser FarhatNo ratings yet

- Nepal Health Service Act 2053 BSDocument72 pagesNepal Health Service Act 2053 BSDinesh YadavNo ratings yet

- Agile Development: © Lpu:: Cap437: Software Engineering Practices: Ashwani Kumar TewariDocument28 pagesAgile Development: © Lpu:: Cap437: Software Engineering Practices: Ashwani Kumar TewariAnanth KallamNo ratings yet

- Analysis of Competitiveness of The Agribusiness Sector Companies Using Porter'S Five ForcesDocument11 pagesAnalysis of Competitiveness of The Agribusiness Sector Companies Using Porter'S Five ForceseryNo ratings yet

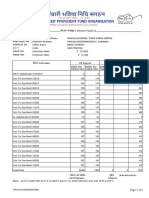

- Member Passbook DetailsDocument2 pagesMember Passbook DetailsNaveen SinghNo ratings yet

- Group assignment on financial analysis of projects A, B, C and DDocument62 pagesGroup assignment on financial analysis of projects A, B, C and DSameer AsifNo ratings yet

- SSRN Id4207171Document39 pagesSSRN Id4207171Nhat LinhNo ratings yet

- Whirlpool 4 in 1 Convertible Cooling 1.5 Ton 3 Star Split Inverter AC - WhiteDocument2 pagesWhirlpool 4 in 1 Convertible Cooling 1.5 Ton 3 Star Split Inverter AC - WhiteAquib ezazNo ratings yet

- Tata Tea - FADocument27 pagesTata Tea - FASagar BsNo ratings yet

- MSc Sales & Marketing Statement of PurposeDocument1 pageMSc Sales & Marketing Statement of PurposeDaud LawrenceNo ratings yet

- Interbrand Breakthrough Brands 2020 ReportDocument44 pagesInterbrand Breakthrough Brands 2020 ReportThu Hà NguyễnNo ratings yet

- Marketing Plan Guidelines:: Bus314 Marketing Management (Ncy)Document2 pagesMarketing Plan Guidelines:: Bus314 Marketing Management (Ncy)Murgi kun :3No ratings yet

- Quiz Manajemen Pengadaan - Nisrina Zalfa Farida - 21B505041003Document5 pagesQuiz Manajemen Pengadaan - Nisrina Zalfa Farida - 21B505041003Kuro DitNo ratings yet

- Problem 9-21 (Pp. 420-421) : 1. Should The Owner Feel Frustrated With The Variance Reports? ExplainDocument3 pagesProblem 9-21 (Pp. 420-421) : 1. Should The Owner Feel Frustrated With The Variance Reports? ExplainCj SernaNo ratings yet

- Durado RRLDocument3 pagesDurado RRLJohneen DungqueNo ratings yet

- SCM Furniture 027Document14 pagesSCM Furniture 027Mohaiminul IslamNo ratings yet

- The Digital Marketing Blueprint 2023Document23 pagesThe Digital Marketing Blueprint 2023Loura FitnessNo ratings yet

- K WaterDocument113 pagesK WaterAmri Rifki FauziNo ratings yet

- Bni Organization ChartDocument1 pageBni Organization ChartVickyRahadianNo ratings yet

- Building Contruction Workers Regulation of Employment and Working Conditions Act 1996Document14 pagesBuilding Contruction Workers Regulation of Employment and Working Conditions Act 1996omarmhusainNo ratings yet

- Jurnal Penelitian Dosen Fikom (UNDA) Vol.10 No.2, November 2019, ISSNDocument8 pagesJurnal Penelitian Dosen Fikom (UNDA) Vol.10 No.2, November 2019, ISSNkiki rifkiNo ratings yet

- PAS 141:2010 Specification For The Processing For Reuse of Waste and Used Electrical and Electronic Equipment (WEEE and UEEE)Document20 pagesPAS 141:2010 Specification For The Processing For Reuse of Waste and Used Electrical and Electronic Equipment (WEEE and UEEE)Ivan TtofimchukNo ratings yet

- Use Investing in People Financial Impact of Human Resources Initiatives by Cascio and BoudreauDocument3 pagesUse Investing in People Financial Impact of Human Resources Initiatives by Cascio and BoudreauDoreen0% (1)

- Romania Pestel Analysis Comprehensive Country OutlookDocument6 pagesRomania Pestel Analysis Comprehensive Country OutlookAtharva UppalwarNo ratings yet

- Aaaa Whipshaw PDFDocument121 pagesAaaa Whipshaw PDFMaphosa Nhlapo100% (3)

- Deloitte - ChinaCast EducationDocument75 pagesDeloitte - ChinaCast EducationcorruptioncurrentsNo ratings yet

- Designing The Perfect Procurement Operating Model: OperationsDocument9 pagesDesigning The Perfect Procurement Operating Model: Operationspulsar77No ratings yet

- TCPL Integrated Annual Report - FY2020-21Document288 pagesTCPL Integrated Annual Report - FY2020-21Mark LucasNo ratings yet