Professional Documents

Culture Documents

RSI Turning Lower at Overbought Zone Could Mean Possible Consolidation After Sharp Rally in Nifty: Pritesh Mehta

Uploaded by

Artz TakOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RSI Turning Lower at Overbought Zone Could Mean Possible Consolidation After Sharp Rally in Nifty: Pritesh Mehta

Uploaded by

Artz TakCopyright:

Available Formats

7/26/2020 Moneycontrol.

com

Print This Pa

RSI turning lower at overbought zone could mean possible consolidation after sharp rally in Nifty: Pritesh

Mehta

Pritesh Mehta

Indian markets had all the ingredients to take the foot off the pedal in Friday's session. To begin with, global markets were in red,

in the opening trades sharp cut was seen in both the key indices back home. However, index heavyweight Reliance Industries had

another idea, it stood against the tide by rallying over 4 percent, thereby restricting the damage on the benchmark Nifty.

Eventually, the index closed lower by just 21 points. Friday's trade could well be described as an act of defiance. Despite gloomy

cues, the index did well to recover from the low of 11,090 placed near three-digit Gann number of 111(00). Till Nifty sustains above

confluence of Gann numbers placed around 11,000 mark, the positive bias will prevail in the market. Currently, the index is in a

sweet spot, where we are witnessing gradual upside move every other day, and even retracement/corrective moves are short-

lived.

At around 11,000 after having defied the negative cues of early 2020, Nifty must surely sound like music to investors' ears. The

index has indeed surpassed a rather slippery wall of worries, thanks to the strength in select biggies. However, Nifty Midcap and

Nifty 500 index is lacking the momentum shown by benchmark Nifty. Ratio chart of Nifty 500/Nifty50 is marking series of lower

tops and lower highs last week of June 2020, implying underperformance of broader markets. Similarly, ratio of Midcap/Nifty50

shows a break of rising trendline (from the low of April 2020). So, broader participation is missing at current juncture.

Even the advance/decline ratio of Nifty components was heavily tilted in favour of bears, despite a recovery from day's low in

Friday's session. With Nifty 500 index, around 77 percent of components are trading above its 20-DMA as on Thursday, the trend

has been sliding lower since the week of June 2020, it implies that short-term breakouts are not sustaining in the current

environment and select outperformers are pushing the markets higher. Going ahead, Nifty's multiple peaks near 11,250 with

momentum indicators like RSI turning lower at overbought zone could mean possible price consolidation after the sharp rally.

Though the headline index for the week was up by 2.7 percent, it does not really echo the street sentiment. Financials & BankNifty

had a catch-up move this week post months of underperformance. However, daily price ratio chart of Nifty Private Bank index

versus BankNifty clearly shows that it is hovering beneath the hurdle zone. Even, ratio of BankNifty/Nifty in last two weeks has

broken below support of its 50-DMA. The same is expected to act as a hurdle going ahead.

With support base shifting higher as index gradually keeps moving higher, the downside is expected to be restricted till 11,000

mark. During a period where the index is creating whipsaws, and broader participation is dwindling, the current rally would gain

credence only on a convincing move above 11,300.

IT Index has been a major mover in this month so far, up by around 16 percent. However, the internals of the Nifty IT index clearly

indicates that there are a clear set of underperformers and outperformers and TCS fits the bill of an underperformer. Ratio chart of

TCS/Nifty IT index has seen a sharp decline from March 2020, it implies that it has underperformed Nifty IT index. Break below

rising trendline and a move below 3-year mean indicates further underperformance of TCS against the Nifty IT index. Meanwhile,

within the index, the focus should be on outperformers like HCL Technologies, Tech Mahindra and Infosys, wherein steady gains

are expected.

The author is Lead Technical Analyst - Institutional Equities at YES Securities.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the

website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment

decisions.

"Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd

which publishes Moneycontrol."

https://www.moneycontrol.com/news/printpage/5599841/ 1/1

You might also like

- T I M E S: Nifty Respects The Support Level of 10625Document20 pagesT I M E S: Nifty Respects The Support Level of 10625Niteesh JainNo ratings yet

- GSEC BOND-A Turnaround May Be Around The Corner, Market Stats Show - The Economic TimesDocument1 pageGSEC BOND-A Turnaround May Be Around The Corner, Market Stats Show - The Economic TimessudhakarrrrrrNo ratings yet

- Sectoral Index Report Banking 07042020 202004070809432449396 PDFDocument4 pagesSectoral Index Report Banking 07042020 202004070809432449396 PDFflying400No ratings yet

- D Street FinalDocument3 pagesD Street FinalAkash AgarwalNo ratings yet

- MoneytimesDocument19 pagesMoneytimesArijitNathNo ratings yet

- WEEKLY Market Outlook JUL 26 - JUL 30 2021Document4 pagesWEEKLY Market Outlook JUL 26 - JUL 30 2021Milan VaishnavNo ratings yet

- Monthly Technical Outlook: A Chart Book On Benchmark, Sectors, Global Market and Inter Market AnalysisDocument15 pagesMonthly Technical Outlook: A Chart Book On Benchmark, Sectors, Global Market and Inter Market AnalysisOkilaNo ratings yet

- Day Trading Guide - Day Trading Guide For Monday - The Economic TimesDocument3 pagesDay Trading Guide - Day Trading Guide For Monday - The Economic TimesAnupNo ratings yet

- Caution against sharing access to our websiteDocument23 pagesCaution against sharing access to our websiteramshere2003165No ratings yet

- T I M E S: Market Yearns For Fresh TriggersDocument22 pagesT I M E S: Market Yearns For Fresh TriggersDhawan SandeepNo ratings yet

- Weekly Snippets - Karvy 12 Mar 2016Document7 pagesWeekly Snippets - Karvy 12 Mar 2016AdityaKumarNo ratings yet

- Money Times MagazineDocument18 pagesMoney Times MagazineAkshay Dujodwala0% (1)

- Monthly Derivatives Selling Pressure May Continue Till Nifty Doesn't Surpass 5840Document10 pagesMonthly Derivatives Selling Pressure May Continue Till Nifty Doesn't Surpass 5840Ramesh KrishnamoorthyNo ratings yet

- 20000, But Who's Got Richer?Document3 pages20000, But Who's Got Richer?Rohit_DhannawatNo ratings yet

- Sector Technical Watch: A Periodical Technical Report On Banking & IT SectorsDocument6 pagesSector Technical Watch: A Periodical Technical Report On Banking & IT SectorsGauriGanNo ratings yet

- Weekly View: Consolidation in Nifty Likely To Continue in Result SeasonDocument14 pagesWeekly View: Consolidation in Nifty Likely To Continue in Result SeasonFaisal KorothNo ratings yet

- Coronavirus Impact: Continue with SIP investments; focus on stocks with strong earningsDocument14 pagesCoronavirus Impact: Continue with SIP investments; focus on stocks with strong earningsfaizahamed111No ratings yet

- NewsDocument7 pagesNewsJignesh Jagjivanbhai PatelNo ratings yet

- Bullish tone set to scale Nifty towards lifetime highsDocument9 pagesBullish tone set to scale Nifty towards lifetime highsM DanishNo ratings yet

- Mentum Stocks: Sector Technical WatchDocument5 pagesMentum Stocks: Sector Technical WatchGauriGanNo ratings yet

- Iip ArticlesDocument12 pagesIip ArticlesManoj AwasthiNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchDinesh ChoudharyNo ratings yet

- Stock Surge Has Lingering Worry - A Steady Drop in Trading Volumes - The Economic TimesDocument2 pagesStock Surge Has Lingering Worry - A Steady Drop in Trading Volumes - The Economic TimessudhakarrrrrrNo ratings yet

- Morts Musings Sep 28 - Oct 01 2020 PDFDocument5 pagesMorts Musings Sep 28 - Oct 01 2020 PDFanandsemails6968No ratings yet

- FII's & DII's: Impact On Indian Stock MarketDocument31 pagesFII's & DII's: Impact On Indian Stock Marketpranav2411No ratings yet

- Weekly MONDAY Strategy LowRiskinDownside NoRiskonUpsideDocument3 pagesWeekly MONDAY Strategy LowRiskinDownside NoRiskonUpsideraghavendra.eNo ratings yet

- T I M E S: Markets To Struggle at Higher LevelsDocument23 pagesT I M E S: Markets To Struggle at Higher LevelsMAJNU BhaiNo ratings yet

- Weekly View:: Nifty Move Above 7800 To Lead To Short CoveringDocument17 pagesWeekly View:: Nifty Move Above 7800 To Lead To Short CoveringArnav SharmaNo ratings yet

- Globe Capital (Daily Reports) 25 May 2023Document13 pagesGlobe Capital (Daily Reports) 25 May 2023Adnan JavedNo ratings yet

- 421026fad Analysis Making Use of Open Passion, Rollover As Well As FiiDocument3 pages421026fad Analysis Making Use of Open Passion, Rollover As Well As FiimurciavchfNo ratings yet

- Money Time May 13 PDFDocument18 pagesMoney Time May 13 PDFravi dNo ratings yet

- REITs, InvITs Get More Attractive Should You Invest Now - A Performance Check of Listed REITs, InvITs - The Financial ExpressDocument14 pagesREITs, InvITs Get More Attractive Should You Invest Now - A Performance Check of Listed REITs, InvITs - The Financial ExpressMohamed Rajiv AshaNo ratings yet

- T I M E S: Markets Turn VolatileDocument18 pagesT I M E S: Markets Turn Volatileswapnilsalunkhe2000No ratings yet

- T I M E S: Follow-Up Buying Support Needed at Higher LevelsDocument19 pagesT I M E S: Follow-Up Buying Support Needed at Higher LevelsSudarsan PNo ratings yet

- Money Times Tower Talk - 26th Nov'18Document20 pagesMoney Times Tower Talk - 26th Nov'18DeepakGarudNo ratings yet

- Mentum Stocks: Sector Technical WatchDocument5 pagesMentum Stocks: Sector Technical WatchGauriGanNo ratings yet

- Daily Technical Report - 29 March 2022 - 28-03-2022 - 23Document4 pagesDaily Technical Report - 29 March 2022 - 28-03-2022 - 23MkNo ratings yet

- WealthRays Special Report - Impact of Fed Stimulus On Indian MarketsDocument3 pagesWealthRays Special Report - Impact of Fed Stimulus On Indian MarketsSteven BartonNo ratings yet

- Banking & IT Sector WatchDocument6 pagesBanking & IT Sector WatchGauriGanNo ratings yet

- Best Advisory Services in Indore and Intraday Trading Tips by CapitalHeight.Document4 pagesBest Advisory Services in Indore and Intraday Trading Tips by CapitalHeight.Damini CapitalNo ratings yet

- Trend Follower - 2nd IssueDocument6 pagesTrend Follower - 2nd IssuecrystalNo ratings yet

- Importance of The Fiis: Wikipedia States About FiiDocument3 pagesImportance of The Fiis: Wikipedia States About FiiSusil SinghNo ratings yet

- Subject-Financial Market Operations & Financial Statement AnalysisDocument5 pagesSubject-Financial Market Operations & Financial Statement AnalysisSaurabh AgarwalNo ratings yet

- Sensex Reclaims Mount 28k, RBI Rate Cut Hope Fuels Rally: HDFC HDFC Bank L&TDocument3 pagesSensex Reclaims Mount 28k, RBI Rate Cut Hope Fuels Rally: HDFC HDFC Bank L&TDynamic LevelsNo ratings yet

- 282136fii & Dii Trading Task in Cash, Futures As Well As Options, MF Sebi & Fii Sebi Daily Trends Supplies DataDocument3 pages282136fii & Dii Trading Task in Cash, Futures As Well As Options, MF Sebi & Fii Sebi Daily Trends Supplies DataaedelycuoyNo ratings yet

- DailyTechnical-Report - 27 July 2023 - 26-07-2023 - 21Document5 pagesDailyTechnical-Report - 27 July 2023 - 26-07-2023 - 21lachhireddy20No ratings yet

- MT 26th JuneDocument22 pagesMT 26th JuneSatya PrasadNo ratings yet

- Monthly Derivatives SustainabilityDocument14 pagesMonthly Derivatives Sustainabilitychoni singhNo ratings yet

- Nifty Weightage Understanding Its Significance in The Indian Stock MarketDocument23 pagesNifty Weightage Understanding Its Significance in The Indian Stock Marketmahedihasan141997No ratings yet

- Capstocks (Daily Reports) 29 Feb 2024Document13 pagesCapstocks (Daily Reports) 29 Feb 2024LaxmiNarasimhaa KrishnapurAnanthNo ratings yet

- India Market Outlook 2024Document18 pagesIndia Market Outlook 2024arpit2mutha2No ratings yet

- Nifty Technical & Derivatives ReportDocument5 pagesNifty Technical & Derivatives ReportRajasekhar Reddy AnekalluNo ratings yet

- Weekly market outlook and recommendations from ICICI SecuritiesDocument14 pagesWeekly market outlook and recommendations from ICICI SecuritiesRaya DuraiNo ratings yet

- Sernet Retail Research-Daily 13-02-2024Document13 pagesSernet Retail Research-Daily 13-02-2024Mayank ShahNo ratings yet

- Crystal Ball Gazing: Key Insights from 2013 Technical ResearchDocument28 pagesCrystal Ball Gazing: Key Insights from 2013 Technical Researchsunil0547No ratings yet

- Daily Technical Report - 02 May 2022 - 02-05-2022 - 08Document5 pagesDaily Technical Report - 02 May 2022 - 02-05-2022 - 08vikalp123123No ratings yet

- Market Outlook Diwali Picks - Nov 2018Document24 pagesMarket Outlook Diwali Picks - Nov 2018Kishor KrNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail Researcharun_algoNo ratings yet

- The Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataFrom EverandThe Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataRating: 2 out of 5 stars2/5 (1)

- REIT Investing for Beginners: Mastering Wealth in Real Estate Without Direct Property Ownership + Overcoming Inflation with Reliable 9% DividendsFrom EverandREIT Investing for Beginners: Mastering Wealth in Real Estate Without Direct Property Ownership + Overcoming Inflation with Reliable 9% DividendsNo ratings yet

- GAIL Q1 NPDocument1 pageGAIL Q1 NPArtz TakNo ratings yet

- Tata Steel Reports Consolidated Q1 Loss at Rs 4,648 Crore Management Says Worst Is Behind ItDocument1 pageTata Steel Reports Consolidated Q1 Loss at Rs 4,648 Crore Management Says Worst Is Behind ItArtz TakNo ratings yet

- Shriram Transport Q1 net falls 50Document2 pagesShriram Transport Q1 net falls 50Artz TakNo ratings yet

- BPCL Reports Q1 Profit of Rs 2,076 CroreDocument1 pageBPCL Reports Q1 Profit of Rs 2,076 CroreArtz TakNo ratings yet

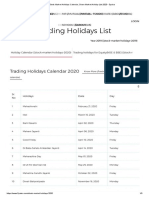

- Stock Market Holidays Calendar, Share Market Holiday List 2020 - 5paisaDocument3 pagesStock Market Holidays Calendar, Share Market Holiday List 2020 - 5paisaArtz TakNo ratings yet

- NSE overview: India's leading stock exchangeDocument12 pagesNSE overview: India's leading stock exchangeArtz TakNo ratings yet

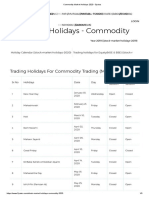

- Commodity Market Holidays 2020 - 5paisaDocument3 pagesCommodity Market Holidays 2020 - 5paisaArtz TakNo ratings yet

- Research Paper For National Stock Exchange: Gopikrishna Suvanam & Amit TrivediDocument28 pagesResearch Paper For National Stock Exchange: Gopikrishna Suvanam & Amit TrivediArtz TakNo ratings yet

- NSE - BSE Holidays, List of NSE - BSE Holidays 2020 - 5paisaDocument4 pagesNSE - BSE Holidays, List of NSE - BSE Holidays 2020 - 5paisaArtz TakNo ratings yet

- Technical View - Nifty Forms 'Bearish Belt Hold' Pattern Traders Can Go ShortDocument8 pagesTechnical View - Nifty Forms 'Bearish Belt Hold' Pattern Traders Can Go ShortArtz TakNo ratings yet

- Nifty 50: Index MethodologyDocument16 pagesNifty 50: Index MethodologyObhiejitNo ratings yet

- Circular: National Stock Exchange of India LimitedDocument8 pagesCircular: National Stock Exchange of India LimitedArtz TakNo ratings yet

- MoFPI Secretar Letter To Chief Secretary - 26th March 20Document2 pagesMoFPI Secretar Letter To Chief Secretary - 26th March 20Artz TakNo ratings yet

- Project Report of Financial ManagementDocument13 pagesProject Report of Financial ManagementAhmad RazaNo ratings yet

- Acct Statement - XX6268 - 13062023Document11 pagesAcct Statement - XX6268 - 13062023Rishi AgarwalNo ratings yet

- JURNAL Anggrenita Aulia (1810412620008) - RevisiDocument11 pagesJURNAL Anggrenita Aulia (1810412620008) - Revisipengetikan normansyahNo ratings yet

- Flipkart Operation ProcessDocument11 pagesFlipkart Operation ProcessMd ToufikuzzamanNo ratings yet

- Acc 6 CH 01Document46 pagesAcc 6 CH 01Md. Rubel HasanNo ratings yet

- DAY 03 06 Oct 2022Document26 pagesDAY 03 06 Oct 2022Venu GopalNo ratings yet

- Tenke Mining Corp Annual Report Highlights Exploration SuccessDocument33 pagesTenke Mining Corp Annual Report Highlights Exploration Successdely susantoNo ratings yet

- Case Study: Pakistan A Story of Technology, Entrepreneurs and Global NetworksDocument3 pagesCase Study: Pakistan A Story of Technology, Entrepreneurs and Global NetworksTayyaba Mahr100% (1)

- 3475665-Guguianu - 1 2Document9 pages3475665-Guguianu - 1 2ElenaNo ratings yet

- Anita Mills CaseDocument6 pagesAnita Mills CaseKushal ThakkarNo ratings yet

- Budgetary Control AssignmentDocument6 pagesBudgetary Control AssignmentBhavvyam BhatnagarNo ratings yet

- Annex B - Negotiated Offer To Purchase FormDocument1 pageAnnex B - Negotiated Offer To Purchase FormcandiceNo ratings yet

- Final Product CostDocument2 pagesFinal Product CostAlokKumarNo ratings yet

- YPFB TransporteDocument3 pagesYPFB TransporteCarlos RodriguezNo ratings yet

- Lecture03 SlidesDocument50 pagesLecture03 Slidesaditya jainNo ratings yet

- Week 2 Chapter 3Document6 pagesWeek 2 Chapter 3Chipp chipNo ratings yet

- Part IV Civil ProcedureDocument3 pagesPart IV Civil Procedurexeileen08No ratings yet

- V Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetDocument3 pagesV Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetV_Krishna_AnaparthiNo ratings yet

- Trading Questions AnsweredDocument22 pagesTrading Questions AnsweredShagudi Gutti100% (1)

- Best Performing Cities 2021Document75 pagesBest Performing Cities 2021Adam ForgieNo ratings yet

- A1946758328 12348 2 2021 Finm551ca1Document8 pagesA1946758328 12348 2 2021 Finm551ca1MithunNo ratings yet

- Economics PYQ SSCDocument48 pagesEconomics PYQ SSCNitin Vishwakarma100% (1)

- ACI International Concrete PrecastDocument104 pagesACI International Concrete PrecastDaniel Saborío RomanoNo ratings yet

- The Key Success Factors of Availability Payment Scheme Implementation in The Palapa Ring Western Package PPP ProjectDocument9 pagesThe Key Success Factors of Availability Payment Scheme Implementation in The Palapa Ring Western Package PPP ProjectDimas PermanaNo ratings yet

- FINAL Q4 22 Shareholder LetterDocument16 pagesFINAL Q4 22 Shareholder LetterJulia JohnsonNo ratings yet

- FIN081 - P2 - Q2 - Receivable Management - AnswersDocument7 pagesFIN081 - P2 - Q2 - Receivable Management - AnswersShane QuintoNo ratings yet

- Motilal Oswal Zomato IPO NoteDocument10 pagesMotilal Oswal Zomato IPO NoteKrishna GoyalNo ratings yet

- Jasper and Anneka Rehnquist Case Study SolutionDocument5 pagesJasper and Anneka Rehnquist Case Study SolutionChintu WatwaniNo ratings yet

- 2 1 4 PDFDocument4 pages2 1 4 PDFankusha SharmaNo ratings yet

- RA No. 10667Document16 pagesRA No. 10667Sab Amantillo BorromeoNo ratings yet