Professional Documents

Culture Documents

Griffin Form 6 2014, 2015, 2016, 2017

Uploaded by

Mike Schmoronoff0 ratings0% found this document useful (0 votes)

156 views11 pagesGriffin Form 6 2014, 2015, 2016, 2017

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGriffin Form 6 2014, 2015, 2016, 2017

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

156 views11 pagesGriffin Form 6 2014, 2015, 2016, 2017

Uploaded by

Mike SchmoronoffGriffin Form 6 2014, 2015, 2016, 2017

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 11

Hillsborough Tax Collector hopeful April

Griffin regulariy late filing property taxes

By

on

July 7, 2020

Hillsborough County Tax Collector candidate April Griffin might be looking at some erticism as

she takes on 2 competitive race to replace incumbent Doug Belden,

Filsborough County tax documents, fled with the office she seeks to lead, show Grifin was

delinquent in paying property taxes on a home she and her husband own on West Hency Ave. in

Tampa every year since 2010 and in 2008,

In each year, the Tax Collector's office fled a tax certificate auction, which are interest-bearing,

liens meant to expedite the tax recuperation process.

“Internet auctions not only increase the speed and efficiency ofthe taxcertificate sale, but ensure

the prompt and accurate collection of delinquent tax revenue needed to fund vital county

services." areording to the Millehoroweh County Tax Callactors website,

Each ofthe payments wore paid approximately one year late, though all were eventually settled.

Asked about the late payments, Griffin described an issue with the bank's eserow process, which

‘many homeowners use to pay property taxes and insurance. The issue went unnoticed for yeas,

Griffin's husband, rian, explained, because the tax receipt and notice would come at about the

same time, giving the appearance the taxes were current. As soon ashe found out, he corrected

the error and the property taxes are now current

‘The couple did not have similar troubies with thelr other property, which is also In Tampa,

Stil, Because ofthe job Giffin is seeking, the issue is likely to become a campaign talking point.

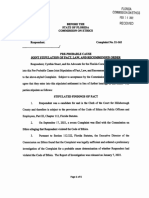

In another error, Giffin improperly filled out a financial disclosure in 2017. She listed three

Habiltes — the home on West Henry Ave, another on East 113th Ave. in Tampa and credit cards.

‘The disclosure does include the amount of ability — $160,000 for the Henry home, $200,000 for

the 113th Ave, home and $20,000 in credit card debt.

‘The disclosures do not, however, include who money Is owed, a requirement on financlal

disclosures.

Griffin sald the error was an oversight and she plans to file an amended disclosure containing

lender information,

FULL AND PUBLIC DISCLOSURE. 2017

TORGPRCE USE ONT

DI2G14

oot est Kennedy Bis PROGESSED

‘COMMISSION ONETHICS

cag a ‘COUNTY JUL 08 Tot

es See | RECEIVED

School District OF Hillsborough County

schoo! Board Member

GHCKIFTHSISATLNGAVAGHOOAE Ol

PART A-NET WORTH

Please enter he value of your net worth 3s of December 3, 2017 ore more curent date. Note: Net worth not cal

culated by subtacng your reported lanes rom your pated asses, 20 please se the Intuctons on page 2)

My net woth as of December 31 20.17 wan $ 440,000.00

PARTE ASSETS

‘a kh eae pee ony, clecan mae. is, nd moots tne, 9 ie; Pou ‘rowan ard

‘ne apa ate mynd poo an peace face mrt abv}, 78,000.00

ASSETS NOMDUALLY VALUED AT OVER 5,00:

‘DESCRAT OF ASSET Gece decerton equa senertone p4) tue or Asser

Home 308 Wes Henry Ave, Tpa Fl '300,00.00,

Home = 6306 East 113th Ave. Tpa Fl 380,00.00

Ca 10,000.00

PART C~ LIABILITIES:

LuxaiuTes mw #xc885 OF 4000 (Eo arco on pe

Hiome 304 West Ifeney Ave, Tpa Fl 160,000.00

[Home -6306 East 113th Ave. Tpa FL [300,000-00

Credit Canis [20700000

TRIES =Ee Tae TET

oy spn nau ane hi eccnd 000 ge a ang ancy san an, Cretan aap

Sere Birman aces wesc Pn mao soca rea as

eet ip oy 21 to ne tm nat staan nt tenet

(phe cl uc your et ya toga a at DS

Pras? SOURCES OF NCONE (te nsvtons on ag 5

| swe or souncs of cone presen S100) 2ooness or pounce o= no 120

TFRusband's Income JP Morgan Chase [4200 West Cypress Ave Tpa FL 760,000.00

School Distt of Wlisborough County |901 East Kennedy Blvd, Tpa FL 2,000.00

‘HESORONTY SOURCES OF NEDHE claro, le fone una Uy pa aon wan np

| caseaeearaeeasae ses aigiesnsessestepeaeeertneneereriaraaieenaeleietemmmmiimmmmmet

TART = INTERESTS IN SPECIFIED BUSINESSES [erection om P=]

Behe our, |Change Manegement Solutions

BEES ny 6306 East 11h Ave. Tp FL

a

amreni [CEO

‘rencar n me poses | Yes

Sines nenest [Owner

ARTF TRAINING

squire to complet annual sthis ting pursuant to secon 112.3142, FS.

I CERTIFY THAT | HAVE COMPLETED THE REQUIRED TRAINING.

OATH Sonever = Hh |

|i pono secs appear ths swap stim and tected vblome is AY covet

ageing fee pst on ca er atan ~

Foe

Yard Sone

races pus som bvnnd wie’ Cha 75a suroyhgood dang wha Pls Su Pate is You Pe

seen aty coon

a ______pepre r Fom in acortsce win At. So. 8, Feri Corson

‘Scio ETE Pa SRG, and VaR frm Woon my esos notes sable ear re a

"ANY OF PARTS A THROUGH E ARE CONTINUED ON A SEPARA

L102 SIeIOYIO TUISIG JooYDS 40} SuIuIed| SOIWIA

‘asinoo eu) paya|duioo sey

UMS [dy

syenp Ayy129 01 St STELL,

ANAWSASIHOV 10 SLVOISLLHS9

FORM 6 FULL AND PUBLIC DISCLOSURE 2016

ese pmeoropevor te, OF FINANCIAL INTERESTS FOR OFFICE USE ONLY:

Daal mr en 212414

crit api FLORIOA

TENS ORES ‘COMMON ONETHICS

201 East Kennedy Bs aon

ay a cao RECENED

rampe, FL 3s02 llsborough

AE OF ASE

school Distt of Hisborough County

EOF GFTCE OF POSTON HED OR SOUST PROCESSED

School Board Member

CHECK IF THSISAFLNG BvAGANDGATE Cl

PART A= NET WORTH

Prease enter the value of your net wort as of December 31, 2016 ora more curt dato. [Note: Not worth isnot cl:

cated by subtracting your reported labiltes fom your roparted assets, so please see the instuctions on page 3]

‘My net worth as of December 31 20 16 _was $ 440,000.00

PART B ASSETS

7EeECoH ponte pone tas ay be eford i Aen sum # her agree vai excnce $1.00, ne cep noes ayo the

{slough or menmart pupares. ray cas of Sp, gus en Pumice Hers of Dees Pavsahal ecard

‘nos ting, oer hou foe and ence or pasa emit one ot mae

“he somone ve omy house gros and penal oes feserbed stove) 6 75,000.00 ae

ASSETS INIVOUALLY VALUED AT OVER $1,900:

[DESCRIPTION OF ASSET lpeeife desertion ried oe tuto p4) VALUE OF ASSET

ome - 304 West Henry Avene, Tampa, FL $300,000.00

ome ~ 6908 East 118th Avenua, Tampa, FL 360,000.00

70,0000

Gar

PART C= LIABILITIES

LUMBLITIES IW EXCESS OF $100 (80 instetons on pope 4

Toma = 504 West Henry Avenue, Tampa, FL 560,000.00

Homa - 6906 East 113th Avenue, Tampa, FL $300,000.00

[Great Cards [$20,000.00

PART D~ INCOME

Icey each stare suc en aout ep ic stead 0g yoo hid candace fname Oraech camp

‘Soret yu 20s esol ce tx nurs a Ws, sede assert Menara oy Sol esry bros Manes eee

tet te ny fy 206 drat nee en ane 2, se, a tacts,

(yar chce ts ox ateh o cpy your 2016 neu You ie crs ema of PO}

PRISARY SOURCES OF NCOHEE (Soe ntuctons on Fae SE

ater nae sPugen Ga [ OAR Aen Trp. emamneo |

‘School Distt of Hilsborough County ‘801 East Kennedy Blvd, Tampa, FL. $42,000.00 4

ee,

ousittSShoy | MOPSGARSSSE | PES, |S

I {

‘PART E-~ INTERESTS IN SPECIFIED BUSINESSES [esrucions on page

BBR ener

PRP BUSINESS

Baar

Site reREST

PART F- TRAINING

For afcers required to complete annua ethics traning pureuant io section 112.3142, FS.

ICERTIFY THAT | HAVE COMPLETED THE REQUIRED TRAINING.

a

OATH eounvor Hit orough

Le paso whe nameeppeats ttbe Sno ae ans steed ete mone LTR cay

apg of om, co pare an ab fiat

ln sy ate inomaon eee th oem

wa Stay bells

Persona Kram XD) Gr Produced dentietin

Tra cotou pubic somunit lrnsc! uns hepa 4750 homey good slang wi te Flea Bat popaed Wome Yu, he oF

‘hems compute ne obowing atone

ropa th CE Form i sosatance wiht Sc. 9, Fila Conti,

‘$2 TSR, Fra SIGS ae he Tu Toefl Upon my ears oweage me eit, he daconre hee 9

Date

Sones

{o sgn the form under ont

Preparation ofthis form bya CPA or attorney docs not rey ie fer ofthe responsibi

TFANY OF FARTS A THROUGH E ARE CONTINUED ON A SEPARATE SHEET, PLEASE CHECK HERE LP

FORM 6 FULL AND PUBLIC DISCLOSURE 2015

Ps See oe OF FINANCIAL INTERESTS FOR OFFICE USE ONLY:

TASTE PAST WE SLE TIE 4

Geiffin, April D. Alan 9

eae conus

[Tampa FL 33602 - Hillsborough meee

= = cual RECEIVED

ssh! Distrito Fileorwgh County

Soe ooo RTO PROCESSED

cheeks TS eArEGavAcMBNTE Ol

PARTA~NEF WORTH

Please enter the value of your et worth a5 of Decomber 31,2015 ora more cunt data. [Not Net wort snot cal

tadated by sdsracng your reported lites from your eporisd assets, 6 plesse see the istucons on page 3]

My net worth as of exh 20.15 __was $ #00mo0

PART = ASSETS

Tsu ond pas ss my eptee aarp am ayaa cae $1.00, Te tea aes 2

{towns # ft he mesma paper jay clans tarp pte, rsone So. ats Pacha ease! 2

‘Srsot: tug enroute pone whter bed oe

‘ne age acy Pause gn ond arn ac (ee tei 79000

ASSETS MDIDUALLY VALUED Ar OvERS4.000¢

‘DESCRIPTION Or ASSET eect dserpon i eqrd 40 neers auue oF Asse

oe 38 Wet Aes Te FL soy00000,

one 26 a1 ree Tepe PL sm0n00

Te a 18 Ave, TF smomn08

1 Remorntiy incre sbi Fac, leseeeaaeaedead Bese

PART D= INCOME,

‘Sorel toa as esol nome tex mur neg at Ws saan dsc, Pean eae oy taal ea eae

saci yay 2015 rnc een rs ca et

Wyeast aren enon py you S05 sa or ed vtcmopae eat of Par

‘Pua SOURCES OF COME (Se ietucsos on poe Se

NaN OF INCOME EACEEDNG SIO 20S OF SOURCE OF NEOME 4

Hosbrdleome-JP Morgan Chase 200 W, Cypress Ave. Temps FL sien r0.00

Schoo! sve of Hilsboough Couniy 901: Kenly vd Tanga FL seis77.00

| secovonay sounces oF mCoM fis acta Gers, of buinenns wre by png pha ns on a

PART E-~ INTERESTS IN SPECIFIED BUSINESSES [lasrctions on po 6

ienesr boats

PARTE -TRAINING

For afters requred to complete annual etic traning pursuant fo secon 1125142, FS.

)_I CERTIFY THAT | HAVE COMPLETED THE REQUIRED TRAINING.

OATH Shimer ne" Hy tls borough

i ence we ane gear ate rope aenes an tat er ett ZOISE ayo

Deon oS pn on no sean

A “Cee ter,

1s ert pub econo eis une’ Chapt 172 sary m apo Sanding wih be PtaaBa wopered iso fr You, he

se mustcompe eon strent

‘icin Ta, FOE Ss, ap wazeo othe om pot tacos krone on oat oO Pn Pos

Sra ‘ae

aration ofthis form by a CPA or attorney docs not rive the fer ofthe responsibilty to sign the form under cath

IFANY OF PARTS A THROUGH E ARE CONTINUED ON A SEFARATE SHEET, PLEASE CHECK HERE. C]

FORM 6 FULL AND PUBLIC DISCLOSURE 2014

Peep sroaeyoeaceg_] OF FINANCIAL INTERESTS FOR OFFICE USE ON

ar eee FT TT BIFAG

eo fogs

sberugh County Pub Sone CCONNISSION ON ETHICS

for enemy Ba = = 62 1205,

ramps FL 39602.3602 RECEIVED

oreo Ns OT PROCESSED

PARTA~NETWORTH

Piease enter the value of your net worth as of December 31,2014, (Note: Net worth isnot calculated by

subtracting your reported liabilities from your reported assets, s0 pease see the intrucions on page 3]

My net worth as of December 31, 2014 was § 196,000.00

PARTE ASSETS

‘sow thn ernie pul acy ett eas gat mma es ee Nee eee

rst carer oer smolts angeses pares wn her ae aes

st pesos res so $7500.00

[DESCRDTION OF ASSET pce deseo equ 46st 9.4) Wiuue oF ASSET

Home 304 West Henry Averus, Tama, FL $260,000.00

Home 6208 East 113th Averue, Yampa, FL $60,000.00

cae $10,000.00

Cocina on separate sost

PART C~ LIABILITIES

Home 308 West Hen Averue, Tampa, FL 780,000.00

Home 6808 East 13h Avenue, Targa, FL. $330,000.00

Crest Cae $20,000.00,

PART D— INCOME

camel ay yu 204 feel nae go sce ad tes OR 2) 8m

stoning cone sa sen tee men woe Heh ey ano Sa Soe

cette acapy at my 214 aco x and, ale satan,

yuck bond ator apy oyu Shes or ee oso eed Pat}

ANE oF SOURCE OF COME EXCEEDING 00, 2008688 oF sounce oF oOME etd

Husband's Income - JP Morgan Chao 4200 West Cypress Averwe, Tampa, FL $126,000.00,

‘School Distt of ilsbrough County 001 East Kennedy OWvs, Tampa, FL $43,877.00,

‘SECONDARY SOURCES OF INCOME ap tora un, of tubezte ney rafting ene Fawr nan

ust eNTTY MOF MuemeSe HEME | creole ASTM OF SOUREE

ART E~ INTERESTS IN SPECIFIED BUSINESSES [Instrocions on pee 6)

PART E- TRAINING

For oftoers tequred to complete annual es taring pursuant o action 112.3142, FS.

@_ICERTIFY THAT I HAVE COMPLETED THE REQUIRED TRAINING,

OATH eounvor ™* Lallsbooren

1.2. perwon whoee name appears ot the Sworn [or ames) and subscrtzed betore me os _[B*Y aay of

Sse ae

cuore Magy EMILY D.BRIogs

EMIL) siren eos,

i { Sa rownatycin_X

a

ome te lowing start

Pepres he CE Fom Sin acto wiht Se. 8 Feria Centon,

$i TESTA Fea Sa TRS HAST en oy ec aa aes il es es Sey

See a ee eens Dae

Preparation ofthis form by 2 CPA o attorney doesnot reve the flr ofthe responsibility fo sig the frm underoath

IFANY OF PARTS A THROUGH EARE CONTINUED ON A SEPARATE SHEET, PLEASE CHECK HERE

April. Grifin Full and Public Disclosure

Schoo! Board Member of Financial Interests

Hillsborough County Public Schools Form 6 - 2014

801 E. Kennedy Blvd

Tampa, FL 33602-3502

Part B~ Assets

SAVING son sow85,000.00

401K... : rnn$15,000,00

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hillsborough County Finance Report - Final 2020xDocument33 pagesHillsborough County Finance Report - Final 2020xABC Action News100% (1)

- Moore, Benjamin Personnel FileDocument214 pagesMoore, Benjamin Personnel FileMike SchmoronoffNo ratings yet

- 18-402657 - Snively/Hillsborough County Sheriff's ReportDocument8 pages18-402657 - Snively/Hillsborough County Sheriff's ReportMike SchmoronoffNo ratings yet

- Plant City Homeowner or RentDocument1 pagePlant City Homeowner or RentMike SchmoronoffNo ratings yet

- 8th Grade 2022 Sex EdDocument260 pages8th Grade 2022 Sex EdMike SchmoronoffNo ratings yet

- 9th Grade 2022 Sex EdDocument242 pages9th Grade 2022 Sex EdMike SchmoronoffNo ratings yet

- HCTA Bills For InsuranceDocument24 pagesHCTA Bills For InsuranceMike Schmoronoff100% (1)

- 7th Grade 2022 Sex EdDocument174 pages7th Grade 2022 Sex EdMike SchmoronoffNo ratings yet

- Maintenance Org ChartDocument9 pagesMaintenance Org ChartMike SchmoronoffNo ratings yet

- Temple Terrace Homeowner or RentDocument1 pageTemple Terrace Homeowner or RentMike SchmoronoffNo ratings yet

- Temple Terrace Apt or CommercialDocument1 pageTemple Terrace Apt or CommercialMike SchmoronoffNo ratings yet

- Unincorporated Hills Homeowner or RentDocument1 pageUnincorporated Hills Homeowner or RentMike SchmoronoffNo ratings yet

- Allen Masonry Correspondence - Unofficial RecordsDocument15 pagesAllen Masonry Correspondence - Unofficial RecordsMike SchmoronoffNo ratings yet

- Ben Moore Employment AppDocument4 pagesBen Moore Employment AppMike SchmoronoffNo ratings yet

- General Manager Maintenance Job DescriptionDocument4 pagesGeneral Manager Maintenance Job DescriptionMike SchmoronoffNo ratings yet

- State of Florida Commission On EthicsDocument5 pagesState of Florida Commission On EthicsMike SchmoronoffNo ratings yet

- Tampa Police Dept ContractDocument7 pagesTampa Police Dept ContractMike SchmoronoffNo ratings yet

- Board Electoral Boundary Redistricting 12-8-2021Document24 pagesBoard Electoral Boundary Redistricting 12-8-2021Mike SchmoronoffNo ratings yet

- Employees Salary Over 90K DetailDocument172 pagesEmployees Salary Over 90K DetailMike SchmoronoffNo ratings yet

- OPS School SecurityDocument73 pagesOPS School SecurityMike SchmoronoffNo ratings yet

- Powerpoint CombinedDocument61 pagesPowerpoint CombinedMike SchmoronoffNo ratings yet

- Security Officer Obed GerenaDocument29 pagesSecurity Officer Obed GerenaMike SchmoronoffNo ratings yet

- Response To September 23, 2021 Letter - HillsboroughDocument13 pagesResponse To September 23, 2021 Letter - HillsboroughMike SchmoronoffNo ratings yet

- 3 Districts 3 Different StoriesDocument26 pages3 Districts 3 Different StoriesMike SchmoronoffNo ratings yet

- Covid Rules Hillsborough 2021Document5 pagesCovid Rules Hillsborough 2021Mike SchmoronoffNo ratings yet

- Employees Salary Over 90KDocument2 pagesEmployees Salary Over 90KMike SchmoronoffNo ratings yet

- 19.20 ESE Hillsborough Parent SurveyDocument10 pages19.20 ESE Hillsborough Parent SurveyMike SchmoronoffNo ratings yet

- Attorney PaymentsDocument89 pagesAttorney PaymentsMike SchmoronoffNo ratings yet

- Documents Related To April Griffin, Campaign, and StrochaksDocument8 pagesDocuments Related To April Griffin, Campaign, and StrochaksMike SchmoronoffNo ratings yet