Professional Documents

Culture Documents

GST Rate Revision Effective From 1 October 2019

Uploaded by

mrbhala31240 ratings0% found this document useful (0 votes)

15 views2 pagesUpdated GST rate for Indian GST system

Original Title

New Gst Tax Rate

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentUpdated GST rate for Indian GST system

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views2 pagesGST Rate Revision Effective From 1 October 2019

Uploaded by

mrbhala3124Updated GST rate for Indian GST system

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

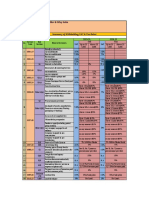

GST Rate Revision effective from 1 October 2019

Item Current New Rate

Rate

Plates and cups made of flowers, leaves and bark 5% Nil

Caffeinated Beverages 18% 28%+12% cess

Supplies of Railways wagons & coaches (without refund of 5% 12%

accumulated ITC)

Outdoor Catering (without ITC) 18% 5%

Diamond Job work 5% 1.50%

Other Job work 18% 12%

Hotels (Room Tariff of Rs.7501 or above) 28% 18%

Hotels (Room Tariff from Rs 1,001 to Rs 7,500) 18% 12%

Woven/ Non-woven Polyethylene Packaging bags 18% 12%

Marine fuel 18% 5%

Almond Milk 18%

Slide fasteners 18% 12%

Wet grinders (consisting of stone as a grinder) 12% 5%

Dried Tamarind 5% Nil

Semi-precious stones- cut & polished 3% 0.25%

Specified goods for petroleum operation under HELP* Applicable 5%

Rate

*Hydrocarbon Exploration Licensing Policy

Item Current New Rate

Rate

Cess on Petrol Motor Vehicles (Capacity of 10-13 passengers) 15% 1%

Cess on Diesel Motor Vehicles (Capacity of 10-13 passengers) 15% 3%

GST Exemption available for:

Supplies to FIFA- specified persons for the Under-17 Women’s Football World

Cup in India

Supply to the Food and Agriculture Organisation (FAO) for specified projects in

India

Imports of certain defence goods not made indigenously (up to 2024)

Supply of silver/platinum by specified agencies (Diamond India Ltd) for export

Import of Silver or Platinum by specified agencies (Diamond India Ltd)

You might also like

- Presented by CA Piyali Parashari 15/6/2017Document7 pagesPresented by CA Piyali Parashari 15/6/2017Pawan SisodiaNo ratings yet

- Tariff Item Description Present GST Rate Proposed by CouncilDocument3 pagesTariff Item Description Present GST Rate Proposed by CouncilkkodgeNo ratings yet

- I. Pre-GTS Tax Incidence Vis-À-Vis GST Rate For Goods: S. No. Description of Goods Pre-GST Tax Incidence GST RateDocument5 pagesI. Pre-GTS Tax Incidence Vis-À-Vis GST Rate For Goods: S. No. Description of Goods Pre-GST Tax Incidence GST RateVipinNo ratings yet

- 1 CGSTratesDocument489 pages1 CGSTratesSatya swaroop ReddyNo ratings yet

- Notes Regards TaxDocument7 pagesNotes Regards TaxlakshminathNo ratings yet

- 37 GST Council MeetingDocument5 pages37 GST Council MeetingChinmay BhatNo ratings yet

- 28th Council Changed GST RatesDocument7 pages28th Council Changed GST RatesRizwan AnsariNo ratings yet

- GST Rates & HSN Codes - GST Tax Rate & SAC Codes in India For 2019Document22 pagesGST Rates & HSN Codes - GST Tax Rate & SAC Codes in India For 2019ManojNo ratings yet

- 47th GST Council Meeting Press ReleaseDocument13 pages47th GST Council Meeting Press ReleaseRoyal MarathaNo ratings yet

- GST Rates 3174103aDocument6 pagesGST Rates 3174103aMahesh RamNo ratings yet

- Non GST Goods: Petroleum Planning & Analysis CellDocument1 pageNon GST Goods: Petroleum Planning & Analysis CellIyengar PrasadNo ratings yet

- Do You Know GST - NOV 21Document19 pagesDo You Know GST - NOV 21CA Ranjan MehtaNo ratings yet

- Trade in PakistanDocument22 pagesTrade in PakistanANJUM KHANNo ratings yet

- GST___Expenses_List__1_Document2 pagesGST___Expenses_List__1_akcabhay9No ratings yet

- GST Rates 2017, GST Rate in India (Item Wise GST Rate List in PDFDocument18 pagesGST Rates 2017, GST Rate in India (Item Wise GST Rate List in PDFSubhrajyoti SarkarNo ratings yet

- MMB PresentationDocument15 pagesMMB PresentationPranai MehtaNo ratings yet

- Eco7 Launching A New Motor Oil SpreadsheetDocument12 pagesEco7 Launching A New Motor Oil SpreadsheetHarsh Vivek0% (3)

- Eco 7 XL Final VersionDocument12 pagesEco 7 XL Final VersionAbhijan Carter BiswasNo ratings yet

- GST Tax Rates and GST Slabs in India 2017Document4 pagesGST Tax Rates and GST Slabs in India 2017seeralan_1986100% (1)

- Vat Rates on Fuel by StationDocument4 pagesVat Rates on Fuel by StationomkargokhaleNo ratings yet

- TheUpticks Round1 ExcelDocument66 pagesTheUpticks Round1 ExcelDewashish RaiNo ratings yet

- Welcome To Business Sensitization: Union Officer Bearers DR'sDocument32 pagesWelcome To Business Sensitization: Union Officer Bearers DR'sSandeep KumarNo ratings yet

- Indirect TaxDocument17 pagesIndirect Taxakprasanth1205No ratings yet

- H123 Report Card AnalysisSub-Title Key Operating Metrics and Financial RatiosDocument30 pagesH123 Report Card AnalysisSub-Title Key Operating Metrics and Financial RatiosNikhilKapoor29No ratings yet

- WithholdingRatesCards 2022-2023Document17 pagesWithholdingRatesCards 2022-2023ausafhaider5345No ratings yet

- Ice Cream Industry SnapshotDocument5 pagesIce Cream Industry SnapshotGibin KollamparambilNo ratings yet

- 47th Meeting of the GST Council Recommends Changes to Rates and ExemptionsDocument8 pages47th Meeting of the GST Council Recommends Changes to Rates and ExemptionsNavaneethan NatarajanNo ratings yet

- GST Rates Item ListDocument7 pagesGST Rates Item Listshaikh IjazNo ratings yet

- GST NoteDocument13 pagesGST NoteSubin chhatriaNo ratings yet

- Pib1755925 1631899685Document6 pagesPib1755925 1631899685Dost BhawanaNo ratings yet

- Revenue and profitability CAGR analysis and 10-year projectionsDocument11 pagesRevenue and profitability CAGR analysis and 10-year projectionsbkpatel83No ratings yet

- Offline - Primary/ Secondary Packaging 161 15%-20%Document2 pagesOffline - Primary/ Secondary Packaging 161 15%-20%PriyankaNo ratings yet

- Press Release 45 GSTC 210917 212016Document8 pagesPress Release 45 GSTC 210917 212016RepublicNo ratings yet

- Burundi Intra-Africa trade and tariff profile September 2018Document3 pagesBurundi Intra-Africa trade and tariff profile September 2018ntibalain18No ratings yet

- Important AnalysisDocument32 pagesImportant AnalysisSandeep KumarNo ratings yet

- Mini-Budget Sector Impact FY22Document23 pagesMini-Budget Sector Impact FY22Arsalan LobaniyaNo ratings yet

- BGMG & Associates: Chartered AccountantsDocument23 pagesBGMG & Associates: Chartered AccountantsAjit GuptaNo ratings yet

- Mathoru PaganDocument3 pagesMathoru Pagankumar45caNo ratings yet

- Financial Model Excel FileDocument67 pagesFinancial Model Excel FileSaumitr Mishra0% (1)

- MICECO - Final ReportDocument5 pagesMICECO - Final ReportNikhil WadhwaniNo ratings yet

- ASEAN - India Free Trade Agreement (AIFTADocument2 pagesASEAN - India Free Trade Agreement (AIFTAJohan Dewa SiraitNo ratings yet

- AIFTADocument2 pagesAIFTAEdwin WruhantoroNo ratings yet

- GST & Taxtiles Industry1Document10 pagesGST & Taxtiles Industry1CA Chetan patelNo ratings yet

- What Is GSTDocument4 pagesWhat Is GSTbalachandran.balaoct1982No ratings yet

- Group 3 TCIL 1008Document10 pagesGroup 3 TCIL 1008ManoNo ratings yet

- Apples Standards 2023Document21 pagesApples Standards 2023CharlotteNo ratings yet

- Product SelectionDocument3 pagesProduct SelectionArhiya ParkNo ratings yet

- Bangladesh Economic OverviewDocument7 pagesBangladesh Economic OverviewHasan Imam FaisalNo ratings yet

- Session 5 - India - Policy Crop Ethanol - Siddharth Amin DR Amin Controllers - Original.1550055423Document12 pagesSession 5 - India - Policy Crop Ethanol - Siddharth Amin DR Amin Controllers - Original.1550055423iljanNo ratings yet

- DSP Natural Resources and New Energy FundDocument15 pagesDSP Natural Resources and New Energy FundArmstrong CapitalNo ratings yet

- Market Potential StudyDocument12 pagesMarket Potential StudyRajkumar KVMNo ratings yet

- Currency Fluctuation Mitigation Plan for 80% of £14.16M SpendDocument1 pageCurrency Fluctuation Mitigation Plan for 80% of £14.16M SpendLiew Chee KiongNo ratings yet

- Sr. No Nature of Expense Rate of Tax Whether Registered Supplier Will Levy Tax Reverse Charge (If Supply Is Unregistered) Whether Eligible For Input CreditDocument5 pagesSr. No Nature of Expense Rate of Tax Whether Registered Supplier Will Levy Tax Reverse Charge (If Supply Is Unregistered) Whether Eligible For Input CreditAnonymous PJwazlNo ratings yet

- Petroleum Planning & Analysis CellDocument1 pagePetroleum Planning & Analysis CellhimanshuextraNo ratings yet

- Withholding VAT & Tax Rates Summary for FY 2019-20 and 2018-19Document3 pagesWithholding VAT & Tax Rates Summary for FY 2019-20 and 2018-19Tanvir TanmoyNo ratings yet

- A New Generation of Hydroconversion and Hydrodesulphurization CatalystDocument30 pagesA New Generation of Hydroconversion and Hydrodesulphurization CatalystTomasz OleckiNo ratings yet

- Bobot KPIDocument15 pagesBobot KPIulfa97575No ratings yet

- Old Scrap GST Rate Latest 2022 - Google SearchDocument1 pageOld Scrap GST Rate Latest 2022 - Google Searchrinku LALNo ratings yet

- Kirby Market SegmentationDocument1 pageKirby Market Segmentationsuk1234No ratings yet

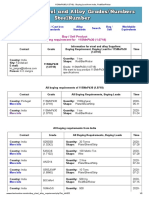

- 11SMnPb30 (1.0718) - Rod - Bar - RebarDocument2 pages11SMnPb30 (1.0718) - Rod - Bar - Rebarmrbhala3124No ratings yet

- Tedx Content GuidelinesDocument1 pageTedx Content Guidelinesmrbhala3124No ratings yet

- Seachem Flourish Excel (250 ML) - UsageDocument1 pageSeachem Flourish Excel (250 ML) - Usagemrbhala3124No ratings yet

- Material Specification Sheet Saarstahl - C45: 1.0503 BS: Afnor: Sae: Material Group: Chemical Composition: ApplicationDocument2 pagesMaterial Specification Sheet Saarstahl - C45: 1.0503 BS: Afnor: Sae: Material Group: Chemical Composition: Applicationshankarjb100% (1)

- Talentz Mania2Document1 pageTalentz Mania2mrbhala3124No ratings yet

- SMC Needle ValvesDocument104 pagesSMC Needle Valvesmrbhala3124100% (1)

- DIY - Excel - Dosing (CO2 Replacement) - Way CheaperDocument5 pagesDIY - Excel - Dosing (CO2 Replacement) - Way Cheapermrbhala3124No ratings yet

- Fighting Green Water Algae - Simple Cheap MethodDocument6 pagesFighting Green Water Algae - Simple Cheap Methodmrbhala3124No ratings yet

- ROFformsDocument14 pagesROFformsMohsin MohdNo ratings yet

- Designing With Leds: Review: Intellitube LED T8 Lamp Works With/without BallastDocument5 pagesDesigning With Leds: Review: Intellitube LED T8 Lamp Works With/without Ballastmrbhala3124No ratings yet

- New Product DevelopmentDocument9 pagesNew Product Developmentmrbhala3124No ratings yet

- Aquarium Filtration CapacityDocument4 pagesAquarium Filtration Capacitymrbhala3124No ratings yet

- 8 Easy Aquarium Plants - AquariadiseDocument11 pages8 Easy Aquarium Plants - Aquariadisemrbhala3124No ratings yet

- Remember 47 processes and 207 T&Ts mnemonicsDocument3 pagesRemember 47 processes and 207 T&Ts mnemonicsmrbhala3124No ratings yet

- Share Your PMP Success StoryDocument32 pagesShare Your PMP Success Storymrbhala3124No ratings yet

- PMP Pmbok5 Based TT MnemonicsDocument3 pagesPMP Pmbok5 Based TT Mnemonicsmrbhala3124No ratings yet

- Personality TestDocument11 pagesPersonality Testmrbhala3124No ratings yet

- Personality TestDocument11 pagesPersonality Testmrbhala3124No ratings yet

- BP500-F-50-M Sheet1-12Document12 pagesBP500-F-50-M Sheet1-12mrbhala3124No ratings yet