Professional Documents

Culture Documents

Description: S&P BSE 100

Uploaded by

deepak sadanandanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Description: S&P BSE 100

Uploaded by

deepak sadanandanCopyright:

Available Formats

Equity

S&P BSE 100

Description

The index is designed to measure the performance of the 100 largest and most liquid Indian companies within the S&P

BSE LargeMidCap. The index calculated in Indian Rupees.

Index Attributes

The index consists of the 100 largest and most-liquid Indian companies within the S&P BSE LargeMidCap. The index is

float adjusted, with securities that are highly liquid. Designed to serve as both an investable index intended to reflect the

Indian economy, the S&P BSE 100 covers approximately two-thirds of the market cap of the listed universe at BSE Ltd.

Methodology Construction

• Universe. Constituents must be members of the S&P BSE LargeMidCap.

• Market Cap. Index constituents are selected based on free-float market cap.

• Liquidity. Eligible companies must have an annualized trading value of at least INR 10 billion (at least INR 8 billion for

current constituents) and no more than five non-trading days in the past six months.

• Constituent Selection. Eligible stocks are considered for index inclusion based on their final ranking. Rankings are

calculated assuming a combination of market cap and liquidity. The top 100-ranked stocks form the index subject to a

20% buffer on either side.

• Constituent Weighting. Index constituents are weighted based on their float-adjusted market capitalization.

Quick Facts

WEIGHTING METHOD Float-adjusted market cap weighted

REBALANCING FREQUENCY Semiannually in June and December

CALCULATION FREQUENCY Real time

CALCULATION CURRENCIES INR, USD

LAUNCH DATE January 3, 1989

FIRST VALUE DATE April 3, 1984

For more information, including the complete methodology document, please visit:

https://asiaindex.com/indices/equity/sp-bse-100

All information for an index prior to its Launch Date is back-tested, based on the methodology that was in effect on the Launch Date. Back-tested

performance, which is hypothetical and not actual performance, is subject to inherent limitations because it reflects application of an Index

methodology and selection of index constituents in hindsight. No theoretical approach can take into account all of the factors in the markets in general

and the impact of decisions that might have been made during the actual operation of an index. Actual returns may differ from, and be lower than,

back-tested returns.

www.asiaindex.co.in index_services@spbse.com AS OF MAY 29, 2020

Equity

S&P BSE 100

Historical Performance

* Data has been re-based at 100

S&P BSE 100 (TR) S&P BSE 500 (TR)

Performance

INDEX LEVEL RETURNS ANNUALIZED RETURNS

1 MO 3 MOS YTD 1 YR 3 YRS 5 YRS 10 YRS

TOTAL RETURNS

11,684.52 -2.46% -13.72% -20.29% -18.37% 0.56% 3.97% 7.87%

PRICE RETURNS

9,697.9 -2.55% -14.12% -20.74% -19.48% -0.78% 2.55% 6.34%

BENCHMARK* TOTAL RETURNS

14,923.33 -2.32% -14.74% -20.29% -18.88% -0.75% 3.76% 7.72%

BENCHMARK* PRICE RETURNS

12,414.85 -2.41% -15.13% -20.76% -20% -2.02% 2.41% 6.23%

* The index benchmark is the S&P BSE 500

www.asiaindex.co.in index_services@spbse.com AS OF MAY 29, 2020

Equity

S&P BSE 100

Calendar Year Performance

2019 2018 2017 2016 2015 2014 2013 2012 2011 2010

TOTAL RETURNS

10.92% 2.62% 33.27% 5.02% -1.95% 34.21% 7.56% 32.21% -24.75% 17.21%

PRICE RETURNS

9.63% 1.19% 31.52% 3.57% -3.25% 32.28% 5.87% 29.96% -25.73% 15.66%

BENCHMARK* TOTAL RETURNS

8.98% -1.81% 37.6% 5.15% 0.45% 38.93% 4.93% 33.41% -26.42% 17.89%

BENCHMARK* PRICE RETURNS

7.75% -3.08% 35.94% 3.78% -0.82% 36.96% 3.25% 31.2% -27.41% 16.35%

* The index benchmark is the S&P BSE 500

Risk

ANNUALIZED RISK ANNUALIZED RISK-ADJUSTED RETURNS

3 YRS 5 YRS 10 YRS 3 YRS 5 YRS 10 YRS

STD DEV

20.52% 18.18% 17.75% 0.03 0.22 0.44

BENCHMARK* STD DEV

21.09% 18.75% 18.05% -0.04 0.2 0.43

Risk is defined as standard deviation calculated based on total returns using monthly values.

* The index benchmark is the S&P BSE 500

Fundamentals

P/E [TRAILING] P/E [PROJECTED] P/B INDICATED DIV YIELD P/SALES P/CASH FLOW

19.12 19.66 2.3 1.36% 1.81 -19.88

As of May 29, 2020. Fundamentals are updated on approximately the fifth business day of each month.

Index Characteristics

NUMBER OF CONSTITUENTS 101

CONSTITUENT MARKET CAP [INR CRORE]

MEAN TOTAL MARKET CAP 89,566.72

LARGEST TOTAL MARKET CAP 927,920.68

SMALLEST TOTAL MARKET CAP 1,838.23

MEDIAN TOTAL MARKET CAP 42,564

WEIGHT LARGEST CONSTITUENT [%] 10.1

WEIGHT TOP 10 CONSTITUENTS [%] 53.3

www.asiaindex.co.in index_services@spbse.com AS OF MAY 29, 2020

Equity

S&P BSE 100

ESG Carbon Characteristics

CARBON TO VALUE INVESTED (METRIC TONS CO2e/$1M INVESTED)* 336.68

CARBON TO REVENUE (METRIC TONS CO2e/$1M REVENUES)* 1,004.25

WEIGHTED AVERAGE CARBON INTENSITY (METRIC TONS CO2e/$1M REVENUES)* 498.32

FOSSIL FUEL RESERVE EMISSIONS (METRIC TONS CO2/$1M INVESTED) 618.21

*Operational and first-tier supply chain greenhouse gas emissions.

For more information, please visit: www.spdji.com/esg-carbon-metrics.

Top 10 Constituents By Index Weight

CONSTITUENT SYMBOL SECTOR*

Reliance Industries Ltd 500325 NA

HDFC Bank Ltd 500180 NA

Housing Development Finance Corp 500010 NA

Infosys Ltd 500209 NA

ICICI Bank Ltd 532174 NA

Tata Consultancy Services Ltd 532540 NA

Hindustan Unilever Ltd 500696 NA

ITC Ltd 500875 NA

Kotak Mahindra Bank Ltd 500247 NA

Larsen & Toubro Ltd 500510 NA

*Based on GICS® sectors

Tickers

TICKER REUTERS

PRICE RETURNS BSE100 .BSE100

TOTAL RETURNS BSE100TR N/A

www.asiaindex.co.in index_services@spbse.com AS OF MAY 29, 2020

Equity

S&P BSE 100

Disclaimer

Source: Asia Index Private Limited.

The launch date of the S&P BSE 100 was January 3, 1989.The launch date of the S&P BSE 500 was August 9, 1999.

All information presented prior to the index launch date is back-tested. Back-tested performance is not actual performance, but is hypothetical. The

back-test calculations are based on the same methodology that was in effect when the index was officially launched. Past performance is not a

guarantee of future results. Please see the Performance Disclosure at http://www.asiaindex.co.in/regulatory-affairs-disclaimers/ for more information

regarding the inherent limitations associated with back-tested performance.

© Asia Index Private Limited 2020. All rights reserved. Redistribution, reproduction and/or photocopying in whole or in part are prohibited without

written permission. The S&P BSE Indices (the “Indices”) are published by Asia Index Private Limited (“AIPL”), which is a joint venture among affiliates of

S&P Dow Jones Indices LLC (“SPDJI”) and BSE Limited (“BSE”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s

Financial Services LLC (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). BSE® and SENSEX®

are registered trademarks of BSE. These trademarks have been licensed to AIPL. AIPL, BSE, S&P Dow Jones Indices LLC or their respective affiliates

(collectively “AIPL Companies”) make no representation or warranty, express or implied, as to the ability of any index to accurately represent the asset

class or market sector that it purports to represent and AIPL Companies shall have no liability for any errors, omissions, or interruptions of any index or

the data included therein. Past performance of an index is not an indication of future results. This document does not constitute an offer of any

services. All information provided by AIPL Companies is general in nature and not tailored to the needs of any person, entity or group of persons. It is not

possible to invest directly in an index. AIPL Companies may receive compensation in connection with licensing its indices to third parties. Exposure to

an asset class represented by an index is available through investable instruments offered by third parties that are based on that index. AIPL

Companies do not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that seeks to provide an investment

return based on the performance of any Index. AIPL and S&P Dow Jones Indices LLC are not an investment advisor, and the AIPL Companies make no

representation regarding the advisability of investing in any such investment fund or other investment vehicle. For more information on any of our

indices please visit www.spdji.com and www.asiaindex.co.in.

CONTACT US

www.asiaindex.co.in MUMBAI TOKYO MEXICO CITY

index_services@spbse.com +91-22-22725200 81 3 4550 8564 52 (55) 1037 5290

BEIJING SYDNEY LONDON

86.10.6569.2770 61 2 9255 9802 44 207 176 8888

HONG KONG NEW YORK DUBAI

852 2532 8000 1 212 438 7354 971 (0)4 371 7131

1 877 325 5415

You might also like

- The Art of Coaching - User GuideDocument18 pagesThe Art of Coaching - User Guidedeepak sadanandan100% (1)

- Hyundai D4FB Diesel Fuel System 2Document727 pagesHyundai D4FB Diesel Fuel System 2Alexey Koshelnik100% (1)

- Class 8 Imo 5 Years e Book l2 2017 (PDF - Io)Document7 pagesClass 8 Imo 5 Years e Book l2 2017 (PDF - Io)JaySharan50% (2)

- Magic HRC Scarf 1: by Assia BrillDocument6 pagesMagic HRC Scarf 1: by Assia BrillEmily HouNo ratings yet

- Manpower EstimationDocument28 pagesManpower EstimationRakesh Ranjan100% (2)

- The Seven Pillars of Servant LeadershipDocument3 pagesThe Seven Pillars of Servant Leadershipapi-337945795100% (3)

- Plant InvitroDocument219 pagesPlant InvitroMD Nassima100% (4)

- Service ManualDocument9 pagesService ManualgibonulNo ratings yet

- ISolutions Lifecycle Cost ToolDocument8 pagesISolutions Lifecycle Cost ToolpchakkrapaniNo ratings yet

- Reverse Circulation DrillingDocument6 pagesReverse Circulation DrillingHabib Ur Rahman100% (1)

- Previews 2502414 PreDocument9 pagesPreviews 2502414 PreAlex Andre RojasNo ratings yet

- Boiler I.B.R. CalculationDocument10 pagesBoiler I.B.R. CalculationGurinder Jit Singh100% (1)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Using The BJAC Properties Package With Aspen EDRDocument9 pagesUsing The BJAC Properties Package With Aspen EDRShitalbioNo ratings yet

- Fs SP Bse Capital GoodsDocument5 pagesFs SP Bse Capital GoodsyaarthNo ratings yet

- Fs SP Bse Low Volatility IndexDocument5 pagesFs SP Bse Low Volatility Indexd.a.m.ari.onjua.re.z5.98No ratings yet

- Fs SP Bse Momentum IndexDocument5 pagesFs SP Bse Momentum Indexpriya.sunderNo ratings yet

- Fs SP Bse Sensex 50Document5 pagesFs SP Bse Sensex 50Samriddh DhareshwarNo ratings yet

- Description: S&P/Asx All Technology IndexDocument6 pagesDescription: S&P/Asx All Technology IndexSuhasNo ratings yet

- Description: S&P Bse TeckDocument5 pagesDescription: S&P Bse TeckNeelkanth DaveNo ratings yet

- Description: S&P Bse Financials Ex-Banks 30 IndexDocument6 pagesDescription: S&P Bse Financials Ex-Banks 30 IndexKamal joshiNo ratings yet

- Fs SP 500 PDFDocument8 pagesFs SP 500 PDFAndrés EscobarNo ratings yet

- Description: S&P 500 Dividend and Free Cash Flow Yield IndexDocument6 pagesDescription: S&P 500 Dividend and Free Cash Flow Yield IndexKOMATSU SHOVELNo ratings yet

- Description: S&P Biotechnology Select Industry IndexDocument7 pagesDescription: S&P Biotechnology Select Industry IndexRandom LifeNo ratings yet

- Fs SP Asx 200 Utilities SectorDocument5 pagesFs SP Asx 200 Utilities SectorRaymond LauNo ratings yet

- Fs SP TSX Composite IndexDocument6 pagesFs SP TSX Composite Indexalt.sa-33bwuogNo ratings yet

- Description: S&P/BMV Mining & Agriculture IndexDocument5 pagesDescription: S&P/BMV Mining & Agriculture Indextmayur21No ratings yet

- Description: S&P Retail Select Industry IndexDocument7 pagesDescription: S&P Retail Select Industry IndexAndrew KimNo ratings yet

- Fs SP 500 PDFDocument9 pagesFs SP 500 PDFSajad AhmadNo ratings yet

- Fs SP 500 Industrials SectorDocument6 pagesFs SP 500 Industrials SectorLuella LukenNo ratings yet

- Description: S&P/BMV Commercial Services IndexDocument5 pagesDescription: S&P/BMV Commercial Services Indextmayur21No ratings yet

- Description: S&P 500 Dividend AristocratsDocument7 pagesDescription: S&P 500 Dividend AristocratsCalvin YeohNo ratings yet

- Fs SP Bse MidcapDocument7 pagesFs SP Bse MidcapRavishankarNo ratings yet

- S&P 500 FactsheetDocument8 pagesS&P 500 FactsheetSurre BankéNo ratings yet

- Fs SP 500 GrowthDocument7 pagesFs SP 500 GrowthDynand PLNNo ratings yet

- Fs SP 500 Financials SectorDocument7 pagesFs SP 500 Financials SectorJeffrey NguyenNo ratings yet

- Fs SP Bric 40 IndexDocument7 pagesFs SP Bric 40 IndexHARSH KATARE MA ECO KOL 2021-23No ratings yet

- Fs SP Smallcap 600 Equal Weighted IndexDocument5 pagesFs SP Smallcap 600 Equal Weighted Indexchintu2005No ratings yet

- Description: S&P/BMV Mexico-Brazil IndexDocument6 pagesDescription: S&P/BMV Mexico-Brazil Indextmayur21No ratings yet

- Description: S&P/BMV Retail & Distributors IndexDocument6 pagesDescription: S&P/BMV Retail & Distributors Indextmayur21No ratings yet

- Fs SP Pan Arab CompositeDocument6 pagesFs SP Pan Arab CompositeMarNo ratings yet

- Fs SP BMV Construction IndexDocument6 pagesFs SP BMV Construction Indextmayur21No ratings yet

- Fs SP Asx All Technology IndexDocument7 pagesFs SP Asx All Technology IndexTim RileyNo ratings yet

- Fs SP 500 Top 50Document5 pagesFs SP 500 Top 50Terence La100% (1)

- Fs SP Uk Investment Grade Corporate Bond IndexDocument4 pagesFs SP Uk Investment Grade Corporate Bond IndexAlokNo ratings yet

- Fs SP 500Document7 pagesFs SP 500sohbifayrouzNo ratings yet

- Fs SP Global 1200Document8 pagesFs SP Global 1200prathap.hcuNo ratings yet

- Fs SP 500 CadDocument7 pagesFs SP 500 Cadalt.sa-33bwuogNo ratings yet

- Fs SP 2Document13 pagesFs SP 2FuboNo ratings yet

- Description: S&P/BMV Total Mexico Esg Index (MXN)Document7 pagesDescription: S&P/BMV Total Mexico Esg Index (MXN)tmayur21No ratings yet

- Fs SP Asx 200Document7 pagesFs SP Asx 200Oliver LeeNo ratings yet

- Fs SP 500Document13 pagesFs SP 500alt.sa-33bwuogNo ratings yet

- Fs Dow Jones Us Completion Total Stock Market IndexDocument6 pagesFs Dow Jones Us Completion Total Stock Market IndexparaoaltoeavanteNo ratings yet

- Trade Chart Patterns Like The Pros025Document61 pagesTrade Chart Patterns Like The Pros025VERO NICANo ratings yet

- Fs Dow Jones Us Basic Materials IndexDocument5 pagesFs Dow Jones Us Basic Materials Indexsilva.mathew29No ratings yet

- Trade Chart Patterns Like The Pros026Document64 pagesTrade Chart Patterns Like The Pros026VERO NICANo ratings yet

- Fs SP TSX 60 IndexDocument7 pagesFs SP TSX 60 Indexjaya148kurupNo ratings yet

- Fs SP Epac Largemidcap UsdDocument7 pagesFs SP Epac Largemidcap UsdNguoi KoNo ratings yet

- Fs SP 500 Shariah IndexDocument8 pagesFs SP 500 Shariah IndexJimot DLangapaNo ratings yet

- Fs SP TSX Composite Index UsdDocument6 pagesFs SP TSX Composite Index Usdjaya148kurupNo ratings yet

- Fs SP Korea Corporate Bond IndexDocument5 pagesFs SP Korea Corporate Bond Indexj.dohNo ratings yet

- Fs SP Byma Cedear Index ArsDocument7 pagesFs SP Byma Cedear Index ArsmartinezivanlNo ratings yet

- Fs SP 500 Information Technology SectorDocument8 pagesFs SP 500 Information Technology SectorAbudNo ratings yet

- Fs SP 500 Vix Short Term Futures KRW TRDocument5 pagesFs SP 500 Vix Short Term Futures KRW TRflyingscotsmanxlNo ratings yet

- Fs SP Morocco Sovereign Bond IndexDocument4 pagesFs SP Morocco Sovereign Bond IndexMohamed ZahryNo ratings yet

- Fs Energy Select Sector IndexDocument7 pagesFs Energy Select Sector IndexdanieldebestNo ratings yet

- Description: S&P Gsci SGD TRDocument5 pagesDescription: S&P Gsci SGD TRCalvin YeohNo ratings yet

- Fs SP Us High Yield Corporate Bond Energy IndexDocument5 pagesFs SP Us High Yield Corporate Bond Energy IndexpabloNo ratings yet

- Fs Dow Jones Islamic Market World IndexDocument8 pagesFs Dow Jones Islamic Market World IndexOğuzhan ÖzçelebiNo ratings yet

- Fs Dow Jones Emerging Asean Titans 100 Index UsdDocument7 pagesFs Dow Jones Emerging Asean Titans 100 Index UsdAbudNo ratings yet

- Fs SP Us Treasury Principal Strips IndexDocument5 pagesFs SP Us Treasury Principal Strips IndexMbusoThabetheNo ratings yet

- Fs Dow Jones Us Semiconductors IndexDocument5 pagesFs Dow Jones Us Semiconductors IndexRakesh SNo ratings yet

- Description: S&P Cryptocurrency Largecap IndexDocument5 pagesDescription: S&P Cryptocurrency Largecap IndexAJ MagtotoNo ratings yet

- Create The Implementation Plan: Pick The First Value StreamDocument5 pagesCreate The Implementation Plan: Pick The First Value Streamdeepak sadanandanNo ratings yet

- Identify Value Streams and Arts: A Value Stream RefresherDocument10 pagesIdentify Value Streams and Arts: A Value Stream Refresherdeepak sadanandanNo ratings yet

- 5 Reasons To Use Classes of ServiceDocument1 page5 Reasons To Use Classes of Servicedeepak sadanandanNo ratings yet

- 7 Scaledagileframework Com Prepare For Art LaunchDocument7 pages7 Scaledagileframework Com Prepare For Art Launchdeepak sadanandanNo ratings yet

- Train Executives, Managers, and Leaders: Exhibit The Lean-Agile MindsetDocument3 pagesTrain Executives, Managers, and Leaders: Exhibit The Lean-Agile Mindsetdeepak sadanandanNo ratings yet

- 5 Reasons To Collect Your DataDocument1 page5 Reasons To Collect Your Datadeepak sadanandanNo ratings yet

- Train Lean-Agile Change Agents: The Need For A Powerful CoalitionDocument3 pagesTrain Lean-Agile Change Agents: The Need For A Powerful Coalitiondeepak sadanandanNo ratings yet

- Reaching The Tipping Point: The Need For ChangeDocument3 pagesReaching The Tipping Point: The Need For Changedeepak sadanandanNo ratings yet

- Create A Lean-Agile Center of Excellence: Team SizeDocument4 pagesCreate A Lean-Agile Center of Excellence: Team Sizedeepak sadanandanNo ratings yet

- Methodology SP Bse IndicesDocument57 pagesMethodology SP Bse Indicesdeepak sadanandanNo ratings yet

- Safe Implementation Roadmap Series, 12Document2 pagesSafe Implementation Roadmap Series, 12deepak sadanandanNo ratings yet

- WWW Leadstrat Com Leadership Strategy Resources The FacilitaDocument3 pagesWWW Leadstrat Com Leadership Strategy Resources The Facilitadeepak sadanandanNo ratings yet

- Voltagecontrol Com Blog What Are Facilitation Skills and WhyDocument23 pagesVoltagecontrol Com Blog What Are Facilitation Skills and Whydeepak sadanandanNo ratings yet

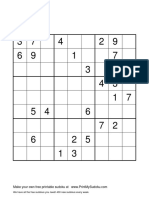

- Grid N°25160 Easy: We Have All The Free Sudokus You Need! 400 New Sudokus Every WeekDocument3 pagesGrid N°25160 Easy: We Have All The Free Sudokus You Need! 400 New Sudokus Every Weekdeepak sadanandanNo ratings yet

- Grid N°3868 Easy: We Have All The Free Sudokus You Need! 400 New Sudokus Every WeekDocument12 pagesGrid N°3868 Easy: We Have All The Free Sudokus You Need! 400 New Sudokus Every Weekclient_escopyNo ratings yet

- The New Science of Team Chemistry: Read 4 Pieces in This PackageDocument55 pagesThe New Science of Team Chemistry: Read 4 Pieces in This Packagedeepak sadanandanNo ratings yet

- The New Science of Team Chemistry: Read 4 Pieces in This PackageDocument55 pagesThe New Science of Team Chemistry: Read 4 Pieces in This Packagedeepak sadanandanNo ratings yet

- The New Science of Team Chemistry: Read 4 Pieces in This PackageDocument55 pagesThe New Science of Team Chemistry: Read 4 Pieces in This Packagedeepak sadanandanNo ratings yet

- How IoT Changed Our LifeDocument5 pagesHow IoT Changed Our LifeJawwad AhmadNo ratings yet

- Pharmacology Antibiotics: Fluoroquinolone - Chloramphenicol - TetracycllineDocument40 pagesPharmacology Antibiotics: Fluoroquinolone - Chloramphenicol - TetracycllinemluthfidunandNo ratings yet

- Standard Operating Procedure Carburetor Over Flow: Technical Support - ServiceDocument2 pagesStandard Operating Procedure Carburetor Over Flow: Technical Support - ServiceAnonymous nIcSGEw100% (1)

- Some Lower Bounds On The Reach of An Algebraic Variety: Chris La Valle Josué Tonelli-CuetoDocument9 pagesSome Lower Bounds On The Reach of An Algebraic Variety: Chris La Valle Josué Tonelli-CuetospanishramNo ratings yet

- Bot115 Picaxe Create: RevolutionDocument33 pagesBot115 Picaxe Create: Revolutionabiel fernandezNo ratings yet

- Lab4 F15 Si DiodeDocument15 pagesLab4 F15 Si DiodeJohn MarkNo ratings yet

- Journal of Experimental Biology and Agricultural Sciences: Anitha KC, Rajeshwari YB, Prasanna SB and Shilpa Shree JDocument5 pagesJournal of Experimental Biology and Agricultural Sciences: Anitha KC, Rajeshwari YB, Prasanna SB and Shilpa Shree Jkristel amadaNo ratings yet

- Spare Parts Quotation For Scba & Eebd - 2021.03.19Document14 pagesSpare Parts Quotation For Scba & Eebd - 2021.03.19byhf2jgqprNo ratings yet

- Ahmedabad BRTSDocument3 pagesAhmedabad BRTSVishal JainNo ratings yet

- 8-Unit, Low-Saturation Driver: Package Dimensions ApplicationsDocument4 pages8-Unit, Low-Saturation Driver: Package Dimensions ApplicationsTestronicpartsNo ratings yet

- Examination, June/July: ExplainDocument6 pagesExamination, June/July: ExplainSandesh KulalNo ratings yet

- Ant WorldDocument17 pagesAnt WorldGerardo TorresNo ratings yet

- RELI 280 NotesDocument7 pagesRELI 280 NotesFaith KentNo ratings yet

- Analisis Sensori Produk Stik Sukun (Artocarpus Altilis) Dengan Perlakuan Pendahuluan Blanching Dan Perendaman Dalam Larutan Kalsium KloridaDocument6 pagesAnalisis Sensori Produk Stik Sukun (Artocarpus Altilis) Dengan Perlakuan Pendahuluan Blanching Dan Perendaman Dalam Larutan Kalsium KloridaTommy ChandraNo ratings yet

- Project: Study On Building Construction Using Foam ConcreteDocument5 pagesProject: Study On Building Construction Using Foam ConcreteAzhagesanNo ratings yet

- Ma2 - Acca - Chapter 1Document24 pagesMa2 - Acca - Chapter 1leducNo ratings yet

- Staircase & Ramps Duration (DAYS) Appendix StaircaseDocument7 pagesStaircase & Ramps Duration (DAYS) Appendix StaircaseLai ChungyiNo ratings yet

- A Framework For Developing and Evaluating Utility Substation Cyber Security - Schneider ElectricDocument10 pagesA Framework For Developing and Evaluating Utility Substation Cyber Security - Schneider ElectricHugh cabNo ratings yet

- Nsejs Exam Solutions Paper 2019 PDFDocument27 pagesNsejs Exam Solutions Paper 2019 PDFMrinalini SinghNo ratings yet