Professional Documents

Culture Documents

Prelims Intermedaite Acctg

Uploaded by

John Evan Raymund BesidCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prelims Intermedaite Acctg

Uploaded by

John Evan Raymund BesidCopyright:

Available Formats

TANAUAN INSTITUTE, INC.

COLLEGE DEPARTMENT

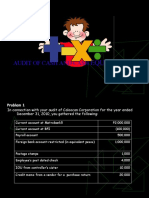

PRELIMINARY EXAMINATION - INTERMEDIATE ACCOUNTING 2

DIRECTION: SOLVE EACH NUMBER AND CHOOSE YOUR ANSWER FROM THOSE GIVEN

IN THE BOX.

A. In connection with your audit of the financial statements of

Onor Company for the year ended December 31, 2016, you gathered

the following information:

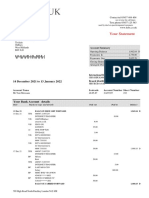

I. The company maintains its current account with Tsunami Bank.

The bank statement on December 31, 2016, showed the balance of

P638 340.

Your audit of the company’s account with Tsunami Bank

disclosed the following:

A check for P22 500, received from a customer whose account

is current had been deposited and then returned by the bank

on December 28, 2016. No entry was made for the return of

this check. The customer replaced the check on January 15,

2017.

A check for P5 720 was cleared by the bank as P7 520. The

bank made the correction on January 2, 2017.

A check for P3 500 representing payment of an employee

advance was received and deposited on December 27, 2016,

but was not recorded until January 3, 2017.

Postdated checks totaling P67 300, were included in the

deposits in transit. These represent collections of current

accounts receivable from customers. The checks were

actually deposited on January 5, 2017.

Various debit memos for drafts purchased for payment of

importation of equipment totaling P230 000 were not yet

recorded. These purchases were previously set up as

accounts payable. Said equipment arrived in December 2016.

Interest earned on the bank balance for the 4th quarter of

2016, amounting to P1 950 was not recorded.

Bank service charges totaling P1 260 were not recorded.

Deposit in transit and outstanding checks at December 31,

2016, totaled P136 250 and P276 380, respectively.

II. Various expenses from the company’s imprest petty cash fund

dated December 2016, totaled P16 250, while those dated January

2017, amounted to P5 903. Another disbursement from the fund

dated December 2016 was a cash advance to an employee amounting

to P3 500. A replenishment of the petty cash fund was made on

January 8, 2017.

III. The company’s trial balance on December 31, 2016, includes

the following accounts:

Cash in bank - Tsunami Bank P 748 320

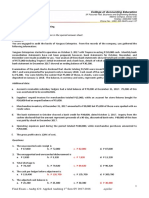

TANAUAN INSTITUTE, INC.

COLLEGE DEPARTMENT

PRELIMINARY EXAMINATION - INTERMEDIATE ACCOUNTING 2

Cash in bank - Earthquake Bank (restricted

account for plant expansion, expected to be

disbursed in 2017) 700 000

Petty cash fund 30 000

Time deposit, placed Dec. 20, 2016, and

due March 20, 2017 1 000

000

Money market placement - Prudential Bank 4 000 000

1. What is the adjusted petty cash fund balance on December 31,

2016?

2. The petty cash shortage on December 31, 2016, is

3. What is the adjusted Cash in Bank - Tsunami Bank balance in

December 31, 2016?

4. The entry to adjust the Cash in Bank - Tsunami Bank account

should include a debit to

5. The December 31, 2016, statement of financial position should

show cash and cash equivalents at

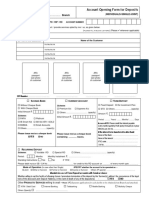

B. On January 1, Tanya Co. establishes a petty cash account and

designates Orly Reyes as petty cash custodian. The original

amount included in the petty cash fund is P10 000. The following

disbursements are made from the fund:

Office supplies P 3 460

Postage 2 240

Entertainment 840

The balance in the petty cash box is P3 200.

1. The person responsible, at all times, for the amount of the

petty cash fund is the

2. The following are appropriate procedures for controlling the

petty cash fund, except

3. The entry to replenish the fund is

4. The objective of establishing a petty cash fund is to

5. What is the effect of not replenishing the petty cash at year-

end and not making the appropriate adjusting entry

C. The cash of Velasco Company shows the following activities:

DATE DEBIT CREDIT

BALANCE

Nov 30 Balance P115 000

TANAUAN INSTITUTE, INC.

COLLEGE DEPARTMENT

PRELIMINARY EXAMINATION - INTERMEDIATE ACCOUNTING 2

Dec 2 November bank charges P 50 114 950

4 November bank credit for notes

receivable collected P10 000 P10 000 124

950

15 NSF Check 1 300 123 650

20 Loan proceeds 48 500 172

150

21 December bank charges 60 172 090

31 Cash receipts book 707 300 879 390

31 Cash disbursements book 408 000 471 390

CASH BOOKS

RECEIPTS PAYMENT

DATE OR NO. AMOUNT CHECK NO. AMOUNT

Dec 1 110-120 P 11 000 801 P 2 000

2 121-136 21 300 802 3 000

3 137-150 20 000 803 1 000

4 151-165 56 000 804 3 000

5 166-190 39 000 805 12 000

8 191-210 66 000 806 19 000

9 211-232 88 000 807 26

000

10 233-250 77 000 808 30 000

11 251-275 21 000 809 61 000

12 276-300 30 000 810 7 000

15 301-309 55 000 811 8 000

16 310-350 8 000 812 16 000

17 351-390 19 000 813 20 000

18 391-420 9 000 814 22 000

19 421-480 17 000 816 36 000

22 481-500 21 000 817 11 000

23 501-525 32 000 818 50 000

23 - - 819 7 000

23 - - 820 4 000

26 526-555 74 000 821 3 000

28 556-611 5 000 822 12 000

28 - - 823 13 000

29 612-630 38 000 824 29 000

29 - - 825 2 000

29 - - 826 11 000

TOTALS P 707 300 P 408 000

BANK STATEMENT

DATE CHECK NO. CHARGES CREDITS

Dec. 1 792 P 2 500 P 8 500

2 802 3 000 11 000

3 - - 21 300

4 804 3 000 20 000

5 EC 81 000 81 000

8 805 12 000 95 000

9 CM 16 - 12 000

TANAUAN INSTITUTE, INC.

COLLEGE DEPARTMENT

PRELIMINARY EXAMINATION - INTERMEDIATE ACCOUNTING 2

10 799 7 050 154 000

11 DM 57 1 300 77 000

12 808 30 000 21 000

15 803 1 000 -

16 809 61 000 85 000

17 DM 61 60 8 000

18 813 20 000 19 000

19 CM 20 - 48 500

22 815 6 000 -

23 816 36 000 47 000

23 811 8 000 -

23 801 2 000 -

26 814 22 000 32 000

28 818 50 000 74 000

28 DM 112 120 -

29 821 3 000 5 000

29 CM 36 - 12 000

29 820 4 000 -

TOTAL P 353 030 P 831 300

Additional information:

a. DMs 61 and 112 are for service charges.

b. EC is error corrected.

c. DM 57 is for an NSF Check.

d. CM 20 is for loan proceeds, net of P150 interest charges for

90 days.

e. CM 16 is for the correction of an erroneous November bank

charge.

f. CM 36 is for customer’s notes collected by bank in December.

g. Bank balance on December 31 is P592 270.

1. The total outstanding checks at November 30 should be

2. The total outstanding checks at December 31 should be

3. The deposit in transit at November 30 should be

4. The deposit in transit at December 31 should be

5. The adjusted book balance at November 30 should be

6. The adjusted bank receipts for the month of December should be

7. The adjusted book disbursements for the month of Dec. should

be

8. The adjusted bank balance at December 31 should be

767 800 477 270 9 550 124 950

Petty Cash

10 250 38 000 432 710 0 Custodian

To monitor variations in

5 442 960 153 000 different types of

expenditures, the petty

cash custodian files cash

8 500 415 480 vouchers by category of

Facilitate payment of small, expenditure after

miscellaneous items replenishing the fund.

Cash will be overstated

Office Supplies Expense 3 460

and expenses understated

Postage Expense 2 240

Entertainment Expense 840

Cash over and short 260 Accounts Receivable for 89 800

Cash 6 800

You might also like

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- CPAR AP - Audit of CashDocument9 pagesCPAR AP - Audit of CashJohn Carlo CruzNo ratings yet

- Audit of CashDocument4 pagesAudit of CashAivan De LeonNo ratings yet

- IAP ProblemsDocument6 pagesIAP ProblemsBianca LizardoNo ratings yet

- Bank Recon Seatwork PDFDocument2 pagesBank Recon Seatwork PDFhfjhdjhfjdeh100% (1)

- Bank Recon SeatworkDocument2 pagesBank Recon SeatworkhfjhdjhfjdehNo ratings yet

- Cash ProblemsDocument5 pagesCash ProblemsAnna AldaveNo ratings yet

- Date Debit CreditDocument7 pagesDate Debit CreditVincent SampianoNo ratings yet

- Auditing Problems v.1 - 2018Document18 pagesAuditing Problems v.1 - 2018Christine Ballesteros Villamayor33% (3)

- Auditing Problems2Document31 pagesAuditing Problems2Kimberly Milante100% (1)

- PROBLEM 1: (CPAR Final Preboards October 2015 - Auditing Problems)Document5 pagesPROBLEM 1: (CPAR Final Preboards October 2015 - Auditing Problems)Jessie J.No ratings yet

- Final ExaminationDocument16 pagesFinal ExaminationLorry Fe A. SargentoNo ratings yet

- BR PracticeDocument3 pagesBR PracticeRocelyn OrdoñezNo ratings yet

- DocxDocument25 pagesDocxPhilip Castro67% (3)

- MTDrill 2Document17 pagesMTDrill 2Cedric Legaspi TagalaNo ratings yet

- Nissan FinalDocument4 pagesNissan FinalPrince Jayanmar BerbaNo ratings yet

- Auditing Problems: Problem No. 1 - Audit of Property, Plant, and Equipment (Ppe)Document19 pagesAuditing Problems: Problem No. 1 - Audit of Property, Plant, and Equipment (Ppe)Marco Louis Duval UyNo ratings yet

- Auditing ProblemsDocument17 pagesAuditing ProblemsKathleenCusipagNo ratings yet

- Problem 1 - Dallas CorporationDocument6 pagesProblem 1 - Dallas CorporationKatherine Cabading InocandoNo ratings yet

- Financial Accounting - Exercises Proof of Cash: Date Debit Credit BalanceDocument2 pagesFinancial Accounting - Exercises Proof of Cash: Date Debit Credit BalanceStephany Joy M. MendezNo ratings yet

- October 5 Review PDFDocument5 pagesOctober 5 Review PDFLeah Mae NolascoNo ratings yet

- Auditing-23 A 1Document5 pagesAuditing-23 A 1Johnfree VallinasNo ratings yet

- Prelim Exam ManuscriptDocument10 pagesPrelim Exam ManuscriptJulie Mae Caling MalitNo ratings yet

- Proof of Cash - DiscussionDocument4 pagesProof of Cash - DiscussionJoyce Anne GarduqueNo ratings yet

- 123123Document3 pages123123xjammerNo ratings yet

- Debits and Credits - Bad DebtDocument25 pagesDebits and Credits - Bad DebtRevilyn Grace Bangayan100% (1)

- Auditing Problems v1 2018 CompressDocument36 pagesAuditing Problems v1 2018 CompressMr. CopernicusNo ratings yet

- Pak Enings HTDocument15 pagesPak Enings HTVincent SampianoNo ratings yet

- This Study Resource WasDocument3 pagesThis Study Resource WasKyree VladeNo ratings yet

- Proof of Cash Simulated ProblemDocument3 pagesProof of Cash Simulated ProblemephraimNo ratings yet

- Auditing Practice Problem 6Document2 pagesAuditing Practice Problem 6Jessa Gay Cartagena TorresNo ratings yet

- 6072-P1-B2 Lembar Kerja Buku BesarDocument9 pages6072-P1-B2 Lembar Kerja Buku BesarSmk Muhammadiyah BanjarmasinNo ratings yet

- Audit of Cash and Cash: EquivalentDocument14 pagesAudit of Cash and Cash: EquivalentJoseph SalidoNo ratings yet

- Samsona, Melanie 2018-1383Document9 pagesSamsona, Melanie 2018-1383Melanie SamsonaNo ratings yet

- Audprob QuizzersDocument12 pagesAudprob QuizzersDenezzy Manongas RicafrenteNo ratings yet

- Bank Reconciliation ProblemsDocument2 pagesBank Reconciliation ProblemsCris Jung80% (5)

- Quiz 1 - Without AnswersDocument6 pagesQuiz 1 - Without AnswersannyeongchinguNo ratings yet

- LESSON 3.2 - Bank ReconciliationDocument4 pagesLESSON 3.2 - Bank ReconciliationIshi MaxineNo ratings yet

- Self-Test Audit of CashDocument8 pagesSelf-Test Audit of CashShane TorrieNo ratings yet

- Audit of CashDocument4 pagesAudit of CashRegi IceNo ratings yet

- Problems For Proof of Cash and Bank ReconDocument2 pagesProblems For Proof of Cash and Bank ReconTine Vasiana DuermeNo ratings yet

- Assignment 2 ACFAR 1231 Bank ReconciliationDocument3 pagesAssignment 2 ACFAR 1231 Bank ReconciliationkakaoNo ratings yet

- Bank Recon and POC ProblemsDocument3 pagesBank Recon and POC ProblemsJanine IgdalinoNo ratings yet

- Quiz 3Document6 pagesQuiz 3Carl Joseph FuerzasNo ratings yet

- Ga Problem SolvingDocument9 pagesGa Problem SolvinggarciarhodjeannemarthaNo ratings yet

- Audit Prob Cash AnsDocument7 pagesAudit Prob Cash AnsNoreen BinagNo ratings yet

- Illustrative Examples - Bank Recon & PCFDocument3 pagesIllustrative Examples - Bank Recon & PCFjames patrick LaysonNo ratings yet

- Actrivity 1Document4 pagesActrivity 1Glydell MapayeNo ratings yet

- p1 Review With AnsDocument7 pagesp1 Review With AnsJiezelEstebeNo ratings yet

- Kunci Jawab BUKU BESARDocument13 pagesKunci Jawab BUKU BESARKhotibul ImamNo ratings yet

- Diagnostic QuizDocument3 pagesDiagnostic QuizXENA LOPEZNo ratings yet

- Final Exam 12 PDF FreeDocument17 pagesFinal Exam 12 PDF FreeEmey CalbayNo ratings yet

- This Study Resource Was Shared Via: Problem 3 Bank Statement Date Check # Charges CreditsDocument2 pagesThis Study Resource Was Shared Via: Problem 3 Bank Statement Date Check # Charges CreditsAngieNo ratings yet

- 1) Presented Below Is The Bank Statement of Gold Bank For The Month of March. Gold Bank Quezon City Supra GrocersDocument6 pages1) Presented Below Is The Bank Statement of Gold Bank For The Month of March. Gold Bank Quezon City Supra Grocersclarizel100% (1)

- Solution: (18,025 + 3,125 - 2,875 + 125) 18,400: Use The Following Information For The Next Three QuestionsDocument21 pagesSolution: (18,025 + 3,125 - 2,875 + 125) 18,400: Use The Following Information For The Next Three QuestionsJovel Paycana100% (5)

- Quiz Audit of CashDocument3 pagesQuiz Audit of CashwesNo ratings yet

- Audit of Cash and Cash EquivalentsDocument3 pagesAudit of Cash and Cash Equivalentssky wayNo ratings yet

- Lembar Kerja Lap Keu - Tahap 1Document4 pagesLembar Kerja Lap Keu - Tahap 1Safana AuraNo ratings yet

- MC DE - EEC Form 4A AEUR Commercial DEsDocument4 pagesMC DE - EEC Form 4A AEUR Commercial DEsJohn Evan Raymund BesidNo ratings yet

- PFF029 JointAffidavitOfTwoDisinterestedPersons V01Document1 pagePFF029 JointAffidavitOfTwoDisinterestedPersons V01Jerica AlondraNo ratings yet

- Marubeni Group Compliance ManualDocument32 pagesMarubeni Group Compliance ManualJohn Evan Raymund BesidNo ratings yet

- TM Application Form 101016 PDFDocument1 pageTM Application Form 101016 PDFRoseve BatomalaqueNo ratings yet

- Guidelines DO16Document77 pagesGuidelines DO16Marlo ChicaNo ratings yet

- Invitation Letter 74th ANCDocument1 pageInvitation Letter 74th ANCRene ValentosNo ratings yet

- OSH Standards 2017Document422 pagesOSH Standards 2017Kap LackNo ratings yet

- Do 174Document20 pagesDo 174ANo ratings yet

- A Market For Energy Efficiency in IndiaDocument25 pagesA Market For Energy Efficiency in IndiaJohn Evan Raymund BesidNo ratings yet

- Republic of The Philippines Regional Trial Court National Capital Judicial Region Branch 9 Quezon CityDocument4 pagesRepublic of The Philippines Regional Trial Court National Capital Judicial Region Branch 9 Quezon CityJohn Evan Raymund BesidNo ratings yet

- Quiz in Corporate GovernanceDocument3 pagesQuiz in Corporate GovernanceJohn Evan Raymund Besid100% (1)

- Financial Instruments Accounting For Asset Management PDFDocument39 pagesFinancial Instruments Accounting For Asset Management PDFNikitaNo ratings yet

- FBT Dealings in Property QuizDocument1 pageFBT Dealings in Property QuizJohn Evan Raymund BesidNo ratings yet

- Introduction To OSHA: Bureau of Workers' Compensation PA Training For Health & Safety (Paths)Document54 pagesIntroduction To OSHA: Bureau of Workers' Compensation PA Training For Health & Safety (Paths)John Evan Raymund BesidNo ratings yet

- Special Proceeding Reviewer (Regalado)Document36 pagesSpecial Proceeding Reviewer (Regalado)Faith Laperal91% (11)

- MC DE - EEC Form 4C AEUR Transport DEsDocument3 pagesMC DE - EEC Form 4C AEUR Transport DEsJohn Evan Raymund BesidNo ratings yet

- BIR Ruling 9-2003 PDFDocument0 pagesBIR Ruling 9-2003 PDFSean GalvezNo ratings yet

- MC DE - EEC Form 4A AEUR Commercial DEsDocument4 pagesMC DE - EEC Form 4A AEUR Commercial DEsJohn Evan Raymund BesidNo ratings yet

- Data Sharing Agreement Template PDFDocument7 pagesData Sharing Agreement Template PDFJohn Evan Raymund BesidNo ratings yet

- Amended Decision: SEP 2D14Document44 pagesAmended Decision: SEP 2D14John Evan Raymund BesidNo ratings yet

- Court of Tax Appeals: Republic of The Philippines Quezon CityDocument30 pagesCourt of Tax Appeals: Republic of The Philippines Quezon CityJohn Evan Raymund BesidNo ratings yet

- MC DE - EEC Form 4B AEUR Industrial DEsDocument6 pagesMC DE - EEC Form 4B AEUR Industrial DEsJohn Evan Raymund BesidNo ratings yet

- FINALS - Exam FormatDocument1 pageFINALS - Exam FormatJohn Evan Raymund BesidNo ratings yet

- MC DE - EEC Form 4D AEUR Other DEsDocument5 pagesMC DE - EEC Form 4D AEUR Other DEsJohn Evan Raymund BesidNo ratings yet

- INTELLECTUAL PROPERTY LAW Dinglasan WendelDocument6 pagesINTELLECTUAL PROPERTY LAW Dinglasan WendelJohn Evan Raymund BesidNo ratings yet

- Basic Non Disclosure AgreementDocument2 pagesBasic Non Disclosure AgreementBPO BusinessNo ratings yet

- En BancDocument35 pagesEn BancJohn Evan Raymund BesidNo ratings yet

- Oath of MembersDocument1 pageOath of MembersJohn Evan Raymund BesidNo ratings yet

- INTELLECTUAL PROPERTY LAW Dinglasan WendelDocument6 pagesINTELLECTUAL PROPERTY LAW Dinglasan WendelJohn Evan Raymund BesidNo ratings yet

- Second Division - PdiDocument15 pagesSecond Division - PdiJohn Evan Raymund BesidNo ratings yet

- Fedai - Quiz RemittanceDocument37 pagesFedai - Quiz RemittanceKIRAN REDDY100% (1)

- Black BookDocument104 pagesBlack BookSoni PalNo ratings yet

- OOMI Reference Case Study 2.0Document36 pagesOOMI Reference Case Study 2.0クマー ヴィーンNo ratings yet

- Sy Bbaca Project1Document13 pagesSy Bbaca Project1SARANG MORENo ratings yet

- Bob ChargesDocument59 pagesBob ChargeskotilakshminarayanaNo ratings yet

- Taxguru Consultancy & Online Publication LLPDocument24 pagesTaxguru Consultancy & Online Publication LLPPiyush SharmaNo ratings yet

- Savings BrochureDocument23 pagesSavings BrochureFarha TexeiraNo ratings yet

- Project Report - PNBDocument81 pagesProject Report - PNBabirwadhwa6027100% (1)

- Auditing Concept Problems Cash and Cash EquivalentDocument7 pagesAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenNo ratings yet

- Risky Ques On BANKINGDocument64 pagesRisky Ques On BANKINGabhishek3012No ratings yet

- TCL Digital Exams Instructions - Bangalore Centre (Music-Rp)Document4 pagesTCL Digital Exams Instructions - Bangalore Centre (Music-Rp)Joel E. DaveNo ratings yet

- Saroj Intern ReportDocument47 pagesSaroj Intern ReportAwshib BhandariNo ratings yet

- Project in C Banking Management SystemDocument24 pagesProject in C Banking Management SystemSwati MishraNo ratings yet

- #3315 December 2022Document4 pages#3315 December 2022annie janeNo ratings yet

- Premium Banking Programme of Kotak Mahindra BankDocument22 pagesPremium Banking Programme of Kotak Mahindra BankpritpalNo ratings yet

- Saving 5920Document5 pagesSaving 5920PhemmyDonOdumosu100% (2)

- 1 Kauffman Vs PNB (42 Phil 182, 29 September 1921)Document5 pages1 Kauffman Vs PNB (42 Phil 182, 29 September 1921)Lira HabanaNo ratings yet

- June 2022Document3 pagesJune 2022Missa Rose100% (1)

- Sem 4 ProjectDocument51 pagesSem 4 ProjectRavinder KaurNo ratings yet

- Chapter 1Document45 pagesChapter 1Clarisse Joyce Nava AbregosoNo ratings yet

- List PDFDocument4 pagesList PDFAlex RodriguezNo ratings yet

- 2022 01 13 - StatementDocument8 pages2022 01 13 - StatementToni MirosanuNo ratings yet

- Private Banking 101Document13 pagesPrivate Banking 101Jahe El100% (47)

- Bank Reconciliation Statement (BRS)Document15 pagesBank Reconciliation Statement (BRS)TheerthuNo ratings yet

- Bank Form IbDocument4 pagesBank Form IbRocky singhNo ratings yet

- Comparative Study of The Public Sector Amp Private Sector BankDocument54 pagesComparative Study of The Public Sector Amp Private Sector Banklaxmi sambreNo ratings yet

- 29th July 2022Document2 pages29th July 2022Morena hartnettNo ratings yet

- Axis Bank PrintDocument41 pagesAxis Bank PrintRudrasish BeheraNo ratings yet

- We AccessDocument8 pagesWe AccessGilbert MendozaNo ratings yet

- Retail Banking - IcicibankDocument69 pagesRetail Banking - IcicibankKaataRanjithkumarNo ratings yet