Professional Documents

Culture Documents

Question 3

Question 3

Uploaded by

Faraz Ali0 ratings0% found this document useful (0 votes)

3 views2 pagesPSD solver

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPSD solver

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesQuestion 3

Question 3

Uploaded by

Faraz AliPSD solver

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

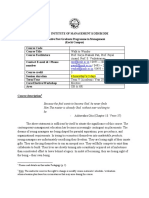

Question: 20 marks

UTOPIA BANK HAS BEEN APPROACHED BY TWO CUSTOMERS FOR A SHORT TERM LOAN OF $ 3,000 MILLION

THE FOLLOWING SUMMARISED FINANCIAL INFORMATION IS AVAILABLE FRON THE LATEST FINANCIAL ST

ALPHA CORP BETA CORP

$ MILLIONS $ MILLIONS THE BANK INTENDS TO ACCEPT ON OF T

NET SALES 72,800 65,000 REQUIRED ; WHICH CUSTOMER’S LOAN

GROSS PROFIT MARGIN 24,020 19,500 WHAT ADDITIONAL INFORMATION MAY

INTEREST EXPENSE 1,200 700 ASSUME THAT THE YEAR END ACCOUNT

INCOME TAX 6,500 5,000

PROFIT AFTER TAX 7,000 4,500

INVENTORIES 9,000 3,500

DEBTORS 4,000 2,200

CASH 900 1,200

CURRENT LIABILITIES 16,680 7,200

LONG TERM LIABILITIES 19,000 11,000

SHARE HOLDERS’ EQUITY 21,000 22,000

Debt to Equity ration 0.4498714653 0.88353414

AN OF $ 3,000 MILLION.

LATEST FINANCIAL STATEMENTS.

DS TO ACCEPT ON OF THE TWO LOAN REQUESTS.

CH CUSTOMER’S LOAN REQUEST SHOULD BE ACCEPTED ? WHY ?

AL INFORMATION MAY BE USEFUL IN MAKING A DECISION ?

HE YEAR END ACCOUNT BALANCES ARE REPRESENTATIVE OF THE WHOLE YEAR.

You might also like

- Quiz #4 Ans KeyDocument7 pagesQuiz #4 Ans KeyMarriz Bustaliño Tan57% (7)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Pa-Note Nalang Pag May Babaguhin Kayong SagotDocument26 pagesPa-Note Nalang Pag May Babaguhin Kayong SagotErika Mae LegaspiNo ratings yet

- Franchise AccountingDocument4 pagesFranchise AccountingJeric IsraelNo ratings yet

- Franchise AccountingDocument16 pagesFranchise AccountingJi YuNo ratings yet

- AssignmentDocument26 pagesAssignmentGio BurburanNo ratings yet

- Part 1. Multiple ChoicesDocument8 pagesPart 1. Multiple ChoicesQuỳnh VânNo ratings yet

- Coc Project Level Three: Project One Koket Company Post Closing Trial Balance SEPTEMBER 20,2018Document4 pagesCoc Project Level Three: Project One Koket Company Post Closing Trial Balance SEPTEMBER 20,2018Aye Tube100% (5)

- Accounting CatDocument3 pagesAccounting Catalanorules001No ratings yet

- IA 3 AssignmentDocument2 pagesIA 3 AssignmentToni Rose Hernandez LualhatiNo ratings yet

- Current Liabilities and Warranties p2Document4 pagesCurrent Liabilities and Warranties p2James AngklaNo ratings yet

- Accounting Aptitude TestDocument5 pagesAccounting Aptitude TestCarmel AlgabreNo ratings yet

- Final Tax On Passive Income2Document7 pagesFinal Tax On Passive Income2Ivy Rica AyapanaNo ratings yet

- Name: - Date: - Grade Level & SectionDocument11 pagesName: - Date: - Grade Level & SectionCynthia Santos100% (1)

- Loans and Receivables Handout1Document3 pagesLoans and Receivables Handout1hwoNo ratings yet

- Midterm Examination in ProfElec1Document11 pagesMidterm Examination in ProfElec1Bryan FelicianoNo ratings yet

- 6937 - Statement of Cash FlowsDocument2 pages6937 - Statement of Cash FlowsAljur SalamedaNo ratings yet

- Answer Key Fa RemDocument4 pagesAnswer Key Fa RemMac b IBANEZNo ratings yet

- Omar Muhktar Abusama Nov 19Document34 pagesOmar Muhktar Abusama Nov 19Garpt Kudasai100% (1)

- Midterm QADocument2 pagesMidterm QAvicky manimtimNo ratings yet

- Acc 109 P3 Quiz No 2Document2 pagesAcc 109 P3 Quiz No 2Wilmz SalacsacanNo ratings yet

- AMF 2202 Test 2 2022-2023 - 221111 - 085401Document3 pagesAMF 2202 Test 2 2022-2023 - 221111 - 085401mugenyi DixonNo ratings yet

- Special JournalDocument38 pagesSpecial JournalSally Ubando Delos Reyes100% (1)

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- Problem 4Document6 pagesProblem 4Peachy Rose TorenaNo ratings yet

- Problem 7 - 22Document3 pagesProblem 7 - 22Jao FloresNo ratings yet

- Corporate Accounting - IiDocument26 pagesCorporate Accounting - Iishankar1287No ratings yet

- 03 Cash and Cash Equivalents (Student)Document27 pages03 Cash and Cash Equivalents (Student)Christina Dulay50% (2)

- Intermediate Accounting QuizDocument5 pagesIntermediate Accounting Quizchingchong100% (1)

- AP1: Cash and AccrualsDocument3 pagesAP1: Cash and AccrualsJelwin Enchong BautistaNo ratings yet

- Adjusting Entries Discussion and Solution5Document23 pagesAdjusting Entries Discussion and Solution5Garp BarrocaNo ratings yet

- Karthik Single EntryDocument4 pagesKarthik Single EntryAMIN BUHARI ABDUL KHADERNo ratings yet

- Statement of Cash Flows - Homework - Finacc5Document1 pageStatement of Cash Flows - Homework - Finacc5CRISZA MAE BERINo ratings yet

- Accounting From Incomplete RecordsDocument8 pagesAccounting From Incomplete RecordsVisha JainNo ratings yet

- Acc10007 P1Document8 pagesAcc10007 P1Vuong Bao KhanhNo ratings yet

- Aac M 2 Cash Flow Prob Answer 1 5Document11 pagesAac M 2 Cash Flow Prob Answer 1 5Micah Danielle S. TORMON0% (1)

- BAM 031 Income Taxation 2nd Periodical Exam With AKDocument8 pagesBAM 031 Income Taxation 2nd Periodical Exam With AKbrmo.amatorio.uiNo ratings yet

- Chap 11 Debt Restructure Fin Acct 2 - Barter Summary TeamDocument5 pagesChap 11 Debt Restructure Fin Acct 2 - Barter Summary TeamRon EsperanzaNo ratings yet

- Fin 018 Problem SolvingDocument7 pagesFin 018 Problem SolvingVincenzo CassanoNo ratings yet

- Pilot TestDocument6 pagesPilot TestNguyễn Thị Ngọc AnhNo ratings yet

- P1 QuestionsDocument31 pagesP1 QuestionsWillen Christia M. MadulidNo ratings yet

- Statement of Cash Flow SolutionDocument14 pagesStatement of Cash Flow Solutionnguyenkyphong18No ratings yet

- Franchise Accounting PDF FreeDocument5 pagesFranchise Accounting PDF Freedes arellanoNo ratings yet

- ANSSSKODocument7 pagesANSSSKOIsabelle CandelariaNo ratings yet

- Revision Paper Semester Examination 2023 JulyDocument4 pagesRevision Paper Semester Examination 2023 JulydinishiappuhamyNo ratings yet

- Franchise AccountingDocument5 pagesFranchise Accountingnephtalie92% (12)

- Q.1. Write Short Notes On The Following (A) Business Entity Concept (B) Subsidiary Books (C) Errors of Principles (D) Promissory Notes (E) ProvisionsDocument4 pagesQ.1. Write Short Notes On The Following (A) Business Entity Concept (B) Subsidiary Books (C) Errors of Principles (D) Promissory Notes (E) ProvisionsLekha DhagatNo ratings yet

- Accounts ReceivableDocument2 pagesAccounts ReceivableMike MikeNo ratings yet

- ACC 123 Quiz 1Document16 pagesACC 123 Quiz 1hwo50% (2)

- Receivables QuizDocument2 pagesReceivables Quizhoneyjoy salapantanNo ratings yet

- Name: - Score: - Course & Section: - DateDocument5 pagesName: - Score: - Course & Section: - DateRendyel PagariganNo ratings yet

- Internal Controls in MicrofinanceDocument10 pagesInternal Controls in Microfinancemugenyi DixonNo ratings yet

- Accountancy - EM - Unit Test - 1Document4 pagesAccountancy - EM - Unit Test - 1Amar AmbethNo ratings yet

- Statement of Cash FlowDocument2 pagesStatement of Cash FlowHaidee Flavier Sabido100% (1)

- Accounting MockDocument6 pagesAccounting MockGSNo ratings yet

- Final Tax On Passive Income For NuDocument6 pagesFinal Tax On Passive Income For NuLynn TaneoNo ratings yet

- Private Wealth: Wealth Management In PracticeFrom EverandPrivate Wealth: Wealth Management In PracticeRating: 3 out of 5 stars3/5 (1)

- EPGP 07 BPP Hand Book FinalDocument12 pagesEPGP 07 BPP Hand Book Finalanishjoseph007No ratings yet

- 1.introduction 1 5Document70 pages1.introduction 1 5anishjoseph007No ratings yet

- Walk To Wonder - Course Outline - EPGP (Kochi)Document9 pagesWalk To Wonder - Course Outline - EPGP (Kochi)anishjoseph007No ratings yet

- Project Progress Report Infants Territory: PurposeDocument2 pagesProject Progress Report Infants Territory: Purposeanishjoseph007No ratings yet

- Class Exercise - LD and Force MajeureDocument5 pagesClass Exercise - LD and Force Majeureanishjoseph007No ratings yet

- Financial Inclusion: Role of Microfinance in IndiaDocument12 pagesFinancial Inclusion: Role of Microfinance in Indiaanishjoseph007No ratings yet

- Financial Accounting - Review: HUL Q4 Misses Estimates, Profit Dips 1% To Rs 1,519 Crore, Volume Shrinks 7%Document10 pagesFinancial Accounting - Review: HUL Q4 Misses Estimates, Profit Dips 1% To Rs 1,519 Crore, Volume Shrinks 7%anishjoseph007No ratings yet

- A. Introduction-4Document5 pagesA. Introduction-4anishjoseph007No ratings yet

- Answer Script - ISDocument21 pagesAnswer Script - ISanishjoseph007No ratings yet

- 03 Sports and GamesDocument14 pages03 Sports and Gamesanishjoseph007No ratings yet

- Indian Institute of Management KozhikodeDocument3 pagesIndian Institute of Management Kozhikodeanishjoseph007No ratings yet

- Prodigy Returns: Reimagined Recharged Re Magined RechargedDocument9 pagesProdigy Returns: Reimagined Recharged Re Magined Rechargedanishjoseph007No ratings yet

- Asset Cash A/R Inventory Machinerypatent Legal Fees Equity Ret Earnings Jan-02 Jan-15 Jun-15 Jun-24 1 2 3 4 5 6 7 1 2 3 4 5 Legal FeesDocument1 pageAsset Cash A/R Inventory Machinerypatent Legal Fees Equity Ret Earnings Jan-02 Jan-15 Jun-15 Jun-24 1 2 3 4 5 6 7 1 2 3 4 5 Legal Feesanishjoseph007No ratings yet

- Long Ago, We Were Rich, We Built Wonders Like The Taj Mahal (An Everlasting Beauty)Document13 pagesLong Ago, We Were Rich, We Built Wonders Like The Taj Mahal (An Everlasting Beauty)anishjoseph007No ratings yet

- Vehicle For Everyone Hamaara Bajaj Naya Avatar .: The New Star From A Great FamilyDocument15 pagesVehicle For Everyone Hamaara Bajaj Naya Avatar .: The New Star From A Great Familyanishjoseph007No ratings yet

- Buland Bharat Ki Buland Tasveer - Hamara BajajDocument14 pagesBuland Bharat Ki Buland Tasveer - Hamara Bajajanishjoseph007No ratings yet

- Chetak 2.0: Submitted By: Group 7Document19 pagesChetak 2.0: Submitted By: Group 7anishjoseph007No ratings yet