Professional Documents

Culture Documents

Product Features: Term Loan (Unsecured) Facility in The Form of Personal Loans by Poonawala Finance

Uploaded by

BALA G0 ratings0% found this document useful (0 votes)

33 views2 pagesLOANS FOR CAs

Original Title

PoonawalaFinance CA LOAN

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLOANS FOR CAs

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views2 pagesProduct Features: Term Loan (Unsecured) Facility in The Form of Personal Loans by Poonawala Finance

Uploaded by

BALA GLOANS FOR CAs

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Committee for Members in Practice (CMP)

The Institute of Chartered Accountants of India

14th July, 2020

The Committee for Members in Practice (CMP) of the Institute of Chartered

Accountants of India (ICAI) has arranged the Term Loan Facility for the Members of

ICAI.

The web link to submit the loan application and the contact details in the event of

escalation:

1) Web Link to submit loan application:

· For professional loan to individuals in whole time practice -

https://www.poonawallafinance.com/professional-loan-application/

· For personal loan to individuals in whole-time employment -

https://www.poonawallafinance.com/personal-loan-application/

2) Customer care number - 8822 200 200

3) For Escalation - Contact person and contact numbers:

MOBILE

NAME NUMBER EMAIL ID

ESCALATION MATRIX – LEVEL 1:

Ashutosh Sharma 8669984720 ashutosh.sharma@poonawallafinance.com

Atul Bichave 8669971433 atul.bichave@poonawallafinance.com

Shashishekhar

Hiremath 9130033608 shashishekhar.hiremath@poonawallafinance.com

ESCALATION MATRIX – LEVEL 2:

Sujit Thite 8669926668 sujit.thite@poonawallafinance.com

Manoj Gujaran 8669977242 manoj.gujaran@poonawallafinance.com

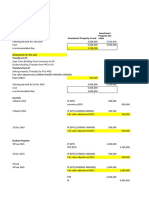

Product Features

Term Loan (unsecured) facility in the form of Personal loans By

Poonawala Finance

Particulars Individuals in whole time Individuals in whole time practice

employment

Products Term Loan (unsecured) Term Loan (unsecured) facility in

Offered facility in the form of the form of Loan to professionals

Personal loans – Be it higher - At Poonawalla Finance, we

education, home renovations, understand your need to reach the

medical emergency, dream next level in your professional

wedding or exotic family practice and we are by your side in

vacations - we will strive to enabling the growth you aspire and

make it happen for you, with a for business expansion including

Committee for Members in Practice (CMP)

The Institute of Chartered Accountants of India

sense of understanding and the takeover of existing high cost loans

commitment to offer customised with clean track.

solutions.

Product a) Minimum loan amount INR 2 a) Minimum loan amount INR 2

Features lakh and max INR 30 lakh. lakh.

b) Rate of Interest – 9.99 % p.a. b) Maximum loan amount upto INR

upto 36 months and 10.99 % 10 lakh for a member having less

p.a. above 36 months than 5 years of experience and

(reducing balance method). INR 30 lakh for a member having

c) Processing fee – NIL for loan equal to or more than 5 years of

upto 36 months and 1 % + experience.

applicable taxes for loan c) Rate of Interest – 9.99 % p.a.

above 36 months. upto 36 months and 10.99 %

d) Collateral Free Loan. p.a. above 36 months (reducing

e) Zero prepayment charges. balance method).

f) Minimum loan tenure of 12 d) Processing fee – NIL for loan upto

months and maximum loan 36 months and 1 % + applicable

tenure of upto 60 months. taxes for loan above 36 months.

g) Quick approval within 24 e) Minimum loan tenure of 12

hours, easy and hassle free months and maximum loan

process with minimum tenure of upto 60 months.

documentation. f) Quick approval within 24 hours,

h) Collateral free loan, ZERO easy and hassle free process with

prepayment charges, no minimum documentation.

hidden charges, no g) Collateral free loan, ZERO

guarantee and no security. prepayment charges, no hidden

i) Takeover of high cost existing charges, no guarantee and no

loans. security.

j) Loan application process will h) Takeover of high cost existing

be completely 100% online loans.

without any need to visit i) Loan application process will be

branch – any CA can apply completely 100 % online without

from anywhere, anytime. any need to visit branch – any

CA can apply from anywhere,

anytime.

Eligibility

Criteria

a) Age Minimum 22 years (subject to 1 Minimum 22 years (subject to 1

year experience in employment) year experience in practice) and

and maximum upto 60 years maximum upto 60 years.

b) Income Minimum net salary of INR Minimum annual gross receipt of

20,000/- INR 3 lakh subject to minimum 1-

year vintage in COP/ 1-year

experience in employment however

please note this facility will not be

for fresher CA.

c) Stability 1 year with 2 months’ stability 2 years

with current employer. Minimum 1-year experience in

employment for those members, who

were in employment and later on

intend to start their own practice.

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- ICAI - Term Loan ProcessDocument2 pagesICAI - Term Loan ProcessRahul KediaNo ratings yet

- Capacity Building Initiatives of The Committee For Members in Practice (CMP), ICAIDocument33 pagesCapacity Building Initiatives of The Committee For Members in Practice (CMP), ICAIVeerNo ratings yet

- AIKBEA & KBOO Cir 9-2022Document4 pagesAIKBEA & KBOO Cir 9-2022Nihar RanjanNo ratings yet

- Auto Loan Parameters at HDFC BankDocument5 pagesAuto Loan Parameters at HDFC BankVasudev KashyapNo ratings yet

- Policy Update_Verified Income May'21Document3 pagesPolicy Update_Verified Income May'21debprosaddalalNo ratings yet

- Bank Promotion Exam Recollected Questions Part 4Document11 pagesBank Promotion Exam Recollected Questions Part 4RADHA KRISHNANNo ratings yet

- SIDBI Loans for MSMEsDocument12 pagesSIDBI Loans for MSMEsbalaji shanmugamNo ratings yet

- RBC CP ASSOCIATES STUDY MATERIAL IMPORTANT QUESTIONS FOR EXAMDocument15 pagesRBC CP ASSOCIATES STUDY MATERIAL IMPORTANT QUESTIONS FOR EXAMkhudalNo ratings yet

- IDBI Bank Home LoanDocument11 pagesIDBI Bank Home Loansahil7827No ratings yet

- IOB Promotion Class on Retail Schemes Highlights Housing, Education LoansDocument36 pagesIOB Promotion Class on Retail Schemes Highlights Housing, Education LoansHari RamNo ratings yet

- Financial Inclusion of Street Vendors Promotion of Micro EnterprisesDocument10 pagesFinancial Inclusion of Street Vendors Promotion of Micro EnterprisesNaman AgrawalNo ratings yet

- OU 24 Ppts GRAMEENK COMPETITDocument1 pageOU 24 Ppts GRAMEENK COMPETITapi-3774915No ratings yet

- Icici Home LoansDocument43 pagesIcici Home Loanskashyappawan007No ratings yet

- Bank ComparisionDocument66 pagesBank ComparisionEkansh DanielNo ratings yet

- N S Toor Recalled Question - 2015 PDFDocument27 pagesN S Toor Recalled Question - 2015 PDFPraveen PathakNo ratings yet

- PNB Personal Loan Scheme-Pnb Sahyog Covid 19Document17 pagesPNB Personal Loan Scheme-Pnb Sahyog Covid 19Nishesh KumarNo ratings yet

- Maha Bank Gold Loan Scheme DetailsDocument2 pagesMaha Bank Gold Loan Scheme DetailsRohith RaoNo ratings yet

- Chapter3 Bank OperationsDocument16 pagesChapter3 Bank OperationsRiya AgarwalNo ratings yet

- Highest Safety, Rates ReaffirmedDocument5 pagesHighest Safety, Rates ReaffirmedNavya ShreeNo ratings yet

- Detailed Tender Notice for 373 Villages Gangapur Water Supply SchemeDocument11 pagesDetailed Tender Notice for 373 Villages Gangapur Water Supply SchemeMalay NiravNo ratings yet

- Quick Success Series - P Segment Loan Products (February 28, 2013)Document16 pagesQuick Success Series - P Segment Loan Products (February 28, 2013)Raghu NayakNo ratings yet

- QUIZ 4, Prepared by Baroda Academy, AHMEDABAD - Print - QuizizzDocument27 pagesQUIZ 4, Prepared by Baroda Academy, AHMEDABAD - Print - QuizizzShilpa JhaNo ratings yet

- Goa Tribal Employment Generation Programmegtegp Scheme - EDC GOADocument1 pageGoa Tribal Employment Generation Programmegtegp Scheme - EDC GOAEDCGOANo ratings yet

- Dudu SACCO Savings Products and Credit FeaturesDocument7 pagesDudu SACCO Savings Products and Credit FeaturesmbesyaNo ratings yet

- Corporation Bank Home Loan DetailsDocument4 pagesCorporation Bank Home Loan DetailsKeerthana PadmakumarNo ratings yet

- The Preferred Partner in Prosperity: One Stop Solution For All Banking NeedsDocument37 pagesThe Preferred Partner in Prosperity: One Stop Solution For All Banking NeedsvelankanniamNo ratings yet

- Sagar & AnandDocument9 pagesSagar & AnandAnand ChavanNo ratings yet

- Government Sponsored SchemesDocument5 pagesGovernment Sponsored SchemesClassicaverNo ratings yet

- JD-NRI-RMDocument3 pagesJD-NRI-RMswarangiprabhu01No ratings yet

- Banking Operartions Isa-2 (Group-1)Document12 pagesBanking Operartions Isa-2 (Group-1)Analize PintoNo ratings yet

- One Pager For Channel & Sales - Jun'22Document4 pagesOne Pager For Channel & Sales - Jun'22Gaurav SinghNo ratings yet

- HDFC Ltd. Home Loan FeaturesDocument8 pagesHDFC Ltd. Home Loan FeaturesVishv SharmaNo ratings yet

- Capital Budgeting Techniques for Evaluating Investment ProjectsDocument7 pagesCapital Budgeting Techniques for Evaluating Investment ProjectsSaswat MishraNo ratings yet

- Full 500 QuestionsDocument64 pagesFull 500 QuestionsarunNo ratings yet

- Complete guide to housing loan applicationDocument5 pagesComplete guide to housing loan applicationamiteshnegiNo ratings yet

- WINGS 2016 - SBLC MasulipatnamDocument184 pagesWINGS 2016 - SBLC Masulipatnamkirabhijit100% (2)

- Brief-River View SouthDocument1 pageBrief-River View SouthAL-HUSSAIN PROPERTIESNo ratings yet

- Chenoa Fund Training #5 - Final Docs ServicingDocument36 pagesChenoa Fund Training #5 - Final Docs ServicingchenoaNo ratings yet

- Government Loan Schemes for Small Scale Businesses ExplainedDocument5 pagesGovernment Loan Schemes for Small Scale Businesses ExplainedKunal HarinkhedeNo ratings yet

- Government Startup Loans in India: Schemes and ProvidersDocument10 pagesGovernment Startup Loans in India: Schemes and ProvidersSriniketh SridharNo ratings yet

- Omni - PQ-200 - 99-2023 - Consultancy Services To Obtain Govt. Licenses For Majesto LTD., 8 Nov 2023Document1 pageOmni - PQ-200 - 99-2023 - Consultancy Services To Obtain Govt. Licenses For Majesto LTD., 8 Nov 2023Rashedul IslamNo ratings yet

- DHFL Sanction LetterDocument6 pagesDHFL Sanction LetterRamesh Kulkarni75% (4)

- MITC terms for business loanDocument6 pagesMITC terms for business loansandeep Kumar Dubey100% (1)

- Sbi ProjectDocument7 pagesSbi ProjectSumeet KambleNo ratings yet

- ED Bank E FundingDocument8 pagesED Bank E FundingNAVYASHREE B 1NC21BA050No ratings yet

- SIDBI & CLCS Scheme SummaryDocument16 pagesSIDBI & CLCS Scheme SummaryKiran KesariNo ratings yet

- Home Improvement Loans GuideDocument6 pagesHome Improvement Loans Guideshailabanumh256No ratings yet

- Msme Product-Baroda Academy KolkataDocument28 pagesMsme Product-Baroda Academy KolkataSAMBITPRIYADARSHI100% (1)

- Sidbi BVB302Document17 pagesSidbi BVB302679shrishti SinghNo ratings yet

- Enhanced Business Loan PropositionDocument6 pagesEnhanced Business Loan PropositionAwadhesh Kumar KureelNo ratings yet

- Applicable Schedule of Charges and Penal Interest For Farmer Funding (B2C) Businesses of Bharat Enterprises (W.e.f 1st April 2023)Document4 pagesApplicable Schedule of Charges and Penal Interest For Farmer Funding (B2C) Businesses of Bharat Enterprises (W.e.f 1st April 2023)Raj kumarNo ratings yet

- Cgtmse (Credit Guarantee Fund Trust For Micro & Small Enterprises)Document16 pagesCgtmse (Credit Guarantee Fund Trust For Micro & Small Enterprises)Abinash MandilwarNo ratings yet

- Nformation Technology in Health ServicesDocument18 pagesNformation Technology in Health ServicesAkhil VsNo ratings yet

- Role of Commercial BanksDocument10 pagesRole of Commercial BanksKAAVIYAPRIYA K (RA1953001011009)No ratings yet

- Commercial Banking-Hdfc Housing FinanceDocument24 pagesCommercial Banking-Hdfc Housing FinancePankul KohliNo ratings yet

- House LoanDocument4 pagesHouse LoanRamana GNo ratings yet

- Submitted To Submitted To DR - Liaqat Ali Amardeep Singh 18421078Document38 pagesSubmitted To Submitted To DR - Liaqat Ali Amardeep Singh 18421078Surbhi AroraNo ratings yet

- Contractual-Employees-FAQSDocument2 pagesContractual-Employees-FAQSHumza AltafNo ratings yet

- JD PB RMDocument3 pagesJD PB RMVinayrajNo ratings yet

- THESISDocument62 pagesTHESISBetelhem EjigsemahuNo ratings yet

- Government Accounting ManualDocument9 pagesGovernment Accounting ManualGabriel PonceNo ratings yet

- Snake LTD - Class WorkingsDocument2 pagesSnake LTD - Class Workingsmusa morinNo ratings yet

- Summer Project On Chocolate Industry in Lotte India Corporation Ltd1Document51 pagesSummer Project On Chocolate Industry in Lotte India Corporation Ltd1jyotibhadra67% (3)

- Presentation On Internship Program Done at The Enq: Subhankar BhattacharjeeDocument28 pagesPresentation On Internship Program Done at The Enq: Subhankar BhattacharjeeSubhankar BhattacharjeeNo ratings yet

- Friedrich Ulrich Maximilian Johann Count of LuxburgDocument4 pagesFriedrich Ulrich Maximilian Johann Count of LuxburgjohnpoluxNo ratings yet

- Major Benefits For IndiaDocument3 pagesMajor Benefits For IndiaamitNo ratings yet

- 2019 Inditex Anual Report PDFDocument472 pages2019 Inditex Anual Report PDFShivangi RajouriyaNo ratings yet

- Assign. Acct 101Document16 pagesAssign. Acct 101Carlos Vicente E. Torralba100% (1)

- Module 1 Engineering EconomicsDocument34 pagesModule 1 Engineering EconomicsSINGIAN, Alcein D.No ratings yet

- ACCT 434 Midterm Exam (Updated)Document4 pagesACCT 434 Midterm Exam (Updated)DeVryHelpNo ratings yet

- Charles SchawabDocument3 pagesCharles SchawabAmar VermaNo ratings yet

- Skill Development Is Key To Economic Growth - Role of Higher Education in IndiaDocument34 pagesSkill Development Is Key To Economic Growth - Role of Higher Education in IndiaAmit Singh100% (1)

- GRC PWC IntegritydrivenperformanceDocument52 pagesGRC PWC IntegritydrivenperformanceDeepak YakkundiNo ratings yet

- British Steel Interactive Stock Range GuideDocument86 pagesBritish Steel Interactive Stock Range GuideLee Hing WahNo ratings yet

- Presentation On Risk Based Auditing For NGOsDocument26 pagesPresentation On Risk Based Auditing For NGOsimranmughalmaniNo ratings yet

- (Terms and Conditions of Contract For Position of General Manager) Hanoi 22 January, 2021Document4 pages(Terms and Conditions of Contract For Position of General Manager) Hanoi 22 January, 2021Angel Beluso DumotNo ratings yet

- 3 AlibabaDocument24 pages3 AlibabaADAM LOW0% (1)

- COSACC Assignment 2Document3 pagesCOSACC Assignment 2Kenneth Jim HipolitoNo ratings yet

- Module 13 Cost Accounting ManufacturingDocument23 pagesModule 13 Cost Accounting Manufacturingnomvulapetunia460No ratings yet

- DLL ENTREP Week 9Document6 pagesDLL ENTREP Week 9KATHERINE JOY ZARANo ratings yet

- Accounting For Managers: Module - 1Document31 pagesAccounting For Managers: Module - 1Madhu RakshaNo ratings yet

- Balance of PaymentsDocument39 pagesBalance of PaymentsMarta Amarillo GarridoNo ratings yet

- Account Statement: Parikshit YadavDocument19 pagesAccount Statement: Parikshit YadavParikshit YadavNo ratings yet

- Case Study 1 - Strategic HR Integration at The Walt Disney CompanyDocument2 pagesCase Study 1 - Strategic HR Integration at The Walt Disney CompanyTrần Thanh HuyềnNo ratings yet

- Risk Assessment Process For Ayala Land Inc. v22Document11 pagesRisk Assessment Process For Ayala Land Inc. v22Nelzen GarayNo ratings yet

- Budget Memo 2015 PDFDocument2 pagesBudget Memo 2015 PDFDominic HuniNo ratings yet

- Investigation of Factors Affecting Termination of Construction Contracts in Gaza StripDocument122 pagesInvestigation of Factors Affecting Termination of Construction Contracts in Gaza Stripsuranjan deyNo ratings yet

- Company Profile 032019 (Autosaved)Document29 pagesCompany Profile 032019 (Autosaved)ePeople ManpowerNo ratings yet

- Ch4 - Designing Distribution Networks and Applications To Omni-Channel Retailing (Student)Document45 pagesCh4 - Designing Distribution Networks and Applications To Omni-Channel Retailing (Student)Wenhui TuNo ratings yet