Professional Documents

Culture Documents

Illustration 9-10: Allocation of Costs, Using Relative Standalone Sales Value

Illustration 9-10: Allocation of Costs, Using Relative Standalone Sales Value

Uploaded by

Iqramul IslamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration 9-10: Allocation of Costs, Using Relative Standalone Sales Value

Illustration 9-10: Allocation of Costs, Using Relative Standalone Sales Value

Uploaded by

Iqramul IslamCopyright:

Available Formats

8Minerals and mineral products, such as coal or iron ore, may also be measured at net realizable value

in accordance with well-established industry practices. In the mining industry, when minerals have

been extracted, there is often an assured sale under a forward contract, government guarantee, or in

an active market. Because there is negligible risk of failure to sell, measurement at net realizable

value is justified. In these contexts, and similar to the accounting for agricultural assets, minerals

and mineral products are recorded at net realizable value at the point of extraction, with a gain

recorded in the period of extraction. In subsequent periods, changes in value of minerals and

mineral products inventory are recognized in profit or loss in the period of the change.

3 LEARNING OBJECTIVE

Explain when companies use the

relative standalone sales value

method to value inventories.

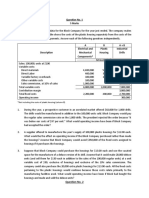

ILLUSTRATION 9-10

Allocation of Costs,

Using Relative

Standalone Sales Value

Number Sales Total Relative Cost Cost

of Price Sales Sales Total Allocated per

Lots Lots per Lot Price Price Cost to Lots Lot

A 100 $10,000 $1,000,000 100/250 $1,000,000 $ 400,000 $4,000

B 100 6,000 600,000 60/250 1,000,000 240,000 2,400

C 200 4,500 900,000 90/250 1,000,000 360,000 1,800

$2,500,000 $1,000,000

ILLUSTRATION 9-11

Determination of Gross

Profi t, Using Relative

Standalone Sales Value

Number of Cost per Cost of

Lots Lots Sold Lot Lots Sold Sales Gross Profit

A 77 $4,000 $308,000 $ 770,000 $ 462,000

B 80 2,400 192,000 480,000 288,000

C 100 1,800 180,000 450,000 270,000

$680,000 $1,700,000 $1,020,000

408 Chapter 9 Inventories: Additional Valuation Issues

The ending inventory is therefore $320,000 ($1,000,000 2 $680,000).

Woodland also can compute this inventory amount another way. The ratio of cost to

selling price for all the lots is $1 million divided by $2,500,000, or 40 percent. Accordingly,

if the total sales price of lots sold is, say $1,700,000, then the cost of the lots sold is

40 percent of $1,700,000, or $680,000. The inventory of lots on hand is then $1 million less

$680,000, or $320,000.

The petroleum industry widely uses the relative standalone sales value method to

value (at cost) the many products and by-products obtained from a barrel of crude oil.

You might also like

- Commodity Market Trading and Investment: A Practitioners Guide to the MarketsFrom EverandCommodity Market Trading and Investment: A Practitioners Guide to the MarketsNo ratings yet

- Chap 7 - Flexible Budget, Direct Cost Variance and Management Control - Students NoteDocument13 pagesChap 7 - Flexible Budget, Direct Cost Variance and Management Control - Students NoteZulIzzamreeZolkepliNo ratings yet

- Case 16 3 Bill French Case Analysis KoDocument5 pagesCase 16 3 Bill French Case Analysis KoPankit Kedia100% (1)

- Financial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide RiskFrom EverandFinancial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide RiskNo ratings yet

- Solution Manual For Microeconomics 5th Edition by David BesankoDocument26 pagesSolution Manual For Microeconomics 5th Edition by David BesankomohsinwazirNo ratings yet

- Actg 10 - MAS Midterm ExamDocument24 pagesActg 10 - MAS Midterm Examjoemel091190100% (1)

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Illustration 9-10: Allocation of Costs, Using Relative Standalone Sales ValueDocument1 pageIllustration 9-10: Allocation of Costs, Using Relative Standalone Sales ValueIqramul IslamNo ratings yet

- CH - 09 - Inventories Additional Valuation IssuesDocument37 pagesCH - 09 - Inventories Additional Valuation IssuesJoseph Gaspard100% (1)

- Assignment No. 2: Course: Advanced Microeconomics Code: 805 Semester: Spring, 2020 Level: M.Sc. EconomicsDocument14 pagesAssignment No. 2: Course: Advanced Microeconomics Code: 805 Semester: Spring, 2020 Level: M.Sc. EconomicsAmmara RukhsarNo ratings yet

- Intermediate Financial Accounting - I-1-1Document9 pagesIntermediate Financial Accounting - I-1-1natinaelbahiru74No ratings yet

- Kieso 13 TH Ed Powerpoint Slides Ch09Document59 pagesKieso 13 TH Ed Powerpoint Slides Ch09Evan BermanNo ratings yet

- Vix Cos R: 106 Cost AccountingDocument15 pagesVix Cos R: 106 Cost AccountingaprilNo ratings yet

- Solutions To QuestionsDocument12 pagesSolutions To QuestionsFariz Amri RNo ratings yet

- Activity Inventory Cost Flow and LCNRVDocument3 pagesActivity Inventory Cost Flow and LCNRVGinalyn BisongaNo ratings yet

- SESSION 6 Cost-Volume-Profit AnalysisDocument21 pagesSESSION 6 Cost-Volume-Profit Analysisnikhil srivastavaNo ratings yet

- Lecture 5 - Bond Portfolio Management - IRRM - Immunization and ALMDocument31 pagesLecture 5 - Bond Portfolio Management - IRRM - Immunization and ALMNguyễn Việt LêNo ratings yet

- CVP TTQDocument4 pagesCVP TTQChristopher LoisulieNo ratings yet

- Price Elasticity of Demand (PED) : The Responsiveness of Quantity Demanded To ChangesDocument5 pagesPrice Elasticity of Demand (PED) : The Responsiveness of Quantity Demanded To Changes7472 VITHALAPARANo ratings yet

- Ped Elasticity ActivitiesDocument5 pagesPed Elasticity ActivitiesSonia HajiyaniNo ratings yet

- Chapter 3.1 - Sales VariancesDocument37 pagesChapter 3.1 - Sales VariancesRazan QueenNo ratings yet

- 18-Joint Products and Byproducts PDFDocument17 pages18-Joint Products and Byproducts PDFSyed Ahsan Hussain XaidiNo ratings yet

- ElasticityDocument14 pagesElasticitysidlbsimNo ratings yet

- MBA 504 Ch8 SolutionsDocument11 pagesMBA 504 Ch8 SolutionspheeyonaNo ratings yet

- Financial Decision MakingDocument4 pagesFinancial Decision MakingTaha JavaidNo ratings yet

- Principle of Accounting 2 - Unit 3Document12 pagesPrinciple of Accounting 2 - Unit 3Alene Amsalu100% (1)

- 4 Cvpbe PROB EXDocument5 pages4 Cvpbe PROB EXjulia4razoNo ratings yet

- Caselets For Location of Warehouses in A Logistics NetworkDocument6 pagesCaselets For Location of Warehouses in A Logistics NetworkShravan VijayaraghavanNo ratings yet

- Intermediate Accounting: Prepared by University of California, Santa BarbaraDocument69 pagesIntermediate Accounting: Prepared by University of California, Santa BarbaraHenry BarlowNo ratings yet

- Exam135 08Document3 pagesExam135 08Rabah ElmasriNo ratings yet

- Chapter - One Cost-Volume-Profit AnalysisDocument13 pagesChapter - One Cost-Volume-Profit Analysisliyneh mebrahituNo ratings yet

- Institute of Certified General Accountants of Bangladesh (ICGAB) Performance Management (P13) LC-3: CVP AnalysisDocument5 pagesInstitute of Certified General Accountants of Bangladesh (ICGAB) Performance Management (P13) LC-3: CVP AnalysisMozid RahmanNo ratings yet

- RCA Solutions Mod5Document5 pagesRCA Solutions Mod5Danica Austria DimalibotNo ratings yet

- Eco CH 5Document6 pagesEco CH 5hajra khanNo ratings yet

- Mathematics of Investment (Establishing Retail Prices)Document33 pagesMathematics of Investment (Establishing Retail Prices)Calyx OxfordNo ratings yet

- Ped ElasticityDocument5 pagesPed ElasticityArsath malik ArsathNo ratings yet

- Transfer PricingDocument11 pagesTransfer Pricingarun_batraNo ratings yet

- Sales MixDocument7 pagesSales Mixasela_perera291No ratings yet

- Index Numbers UpdatedDocument14 pagesIndex Numbers UpdatedMartin KobimboNo ratings yet

- CH 09Document79 pagesCH 09Chang Chan ChongNo ratings yet

- ch08 InventoryDocument8 pagesch08 InventoryJayca Jade MoranoNo ratings yet

- Notes: Limitations of CVP Analysis For Planning and Decision Making Cost Volume Profit Analysis PDFDocument13 pagesNotes: Limitations of CVP Analysis For Planning and Decision Making Cost Volume Profit Analysis PDFNur Shaik MohdNo ratings yet

- Managerial Economics Questions: Perfect CompetitionDocument4 pagesManagerial Economics Questions: Perfect CompetitionTrang Ngô100% (1)

- Marginal and Absorption CostingDocument10 pagesMarginal and Absorption CostingSandip GhoshNo ratings yet

- 1 - Clean - Edits - Stock Management (1336) 1Document12 pages1 - Clean - Edits - Stock Management (1336) 1ZED360 ON DEMANDNo ratings yet

- ECO2001 Problemset5 SolDocument5 pagesECO2001 Problemset5 Sol정서윤No ratings yet

- Project Proposal 2Document9 pagesProject Proposal 2katinuke8No ratings yet

- ch09 Invenories AddtlDocument12 pagesch09 Invenories AddtlSalverika TorecampoNo ratings yet

- Accounting 14 Assignment To HahahaDocument14 pagesAccounting 14 Assignment To HahahaRampotz Ü EchizenNo ratings yet

- Solution Manual For Microeconomics 19th Edition by McconnellDocument14 pagesSolution Manual For Microeconomics 19th Edition by Mcconnelllouisdienek3100% (26)

- Strategic Management and AccountingDocument10 pagesStrategic Management and AccountingHassaan HunaidNo ratings yet

- Cost-Volume-Profit (CVP) Analysis: MODULE 7 - Applied EconomicsDocument5 pagesCost-Volume-Profit (CVP) Analysis: MODULE 7 - Applied EconomicsAstxilNo ratings yet

- 26 Economies and Diseconomies of ScaleDocument5 pages26 Economies and Diseconomies of ScaleAvikshita JoarderNo ratings yet

- Capital Structure Management in Practice: Answers To QuestionsDocument20 pagesCapital Structure Management in Practice: Answers To QuestionsJenifer GaliciaNo ratings yet

- Hansen AISE IM Ch11Document73 pagesHansen AISE IM Ch11Nanik NiandariNo ratings yet

- Genmath Q2 Week4Document36 pagesGenmath Q2 Week4ShennieNo ratings yet

- Boston Creamery, IncDocument10 pagesBoston Creamery, IncAto SumartoNo ratings yet

- Kse-100 Index: Investment Portfolio ManagementDocument48 pagesKse-100 Index: Investment Portfolio Managementchemeleo zapsNo ratings yet

- Modern Derivatives Pricing and Credit Exposure Analysis: Theory and Practice of CSA and XVA Pricing, Exposure Simulation and BacktestingFrom EverandModern Derivatives Pricing and Credit Exposure Analysis: Theory and Practice of CSA and XVA Pricing, Exposure Simulation and BacktestingNo ratings yet

- Debenham: Apple ComputerDocument1 pageDebenham: Apple ComputerIqramul IslamNo ratings yet

- Evaluation of Gross Profi T Method: Illustration 9-16Document1 pageEvaluation of Gross Profi T Method: Illustration 9-16Iqramul IslamNo ratings yet

- Cost 1 Gross Profit 5 Selling Price: C 1 .25C 5 SPDocument1 pageCost 1 Gross Profit 5 Selling Price: C 1 .25C 5 SPIqramul IslamNo ratings yet

- Computation of Gross Profi T Percentage: Inventories: Additional Valuation IssuesDocument1 pageComputation of Gross Profi T Percentage: Inventories: Additional Valuation IssuesIqramul IslamNo ratings yet

- CoolDocument2 pagesCoolIqramul IslamNo ratings yet