Professional Documents

Culture Documents

Letters of Credit Defined & Explained

Uploaded by

Genevieve BermudoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Letters of Credit Defined & Explained

Uploaded by

Genevieve BermudoCopyright:

Available Formats

LETTERS OF CREDIT

ARTICLE 567.

Letters of credit are those issued by one merchant to another or for the purpose of attending to a

commercial transaction.

ARTICLE 568.

The essential comditions of letters of credit shall be:

1. To be issued in favor of a definite person and not to order.

2. To be limited to a fixed and specified amount, or to one or more undetermined amounts,

but within a maximum limits of which has to be stated exactly.

LETTER OF CREDIT DEFINED.

- Is a letter from a merchant or bank or banker in one place, addressed to another, in another place

or country, requesting the addressee to pay money or deliver goods to a third party named therein,

the writer of the letter undertaking to provide him the money for the goods or to repay him.

- It is a letter requesting one person to make advances to a third person on the credit of the writer

who assumes responsibility for payment of the debt therefor to the addressee.

PARTIES TO A LETTER OF CREDIT.

1. The buyer or importer;

2. The seller, also referred to as beneficiary

3. The opening bank which is usually the buyer’s bank which actually issues the letter of credit;

4. The notifying bank which is the corresponding bank of the opening bank through which it

advises the beneficiary of the letter of credit;

5. Negotiating bank which is usually any bank in the city of the beneficiary. The services of the

notifying bank must always be utilized if the letter of credit is to be advised to the beneficiary

through cable;

6. The paying bank which buys or discounts that drafts contemplated by the letter of credit, if such

draft is to be drawn on the opening bank or on another designated bank not in the city of

beneficiary.

7. The confirming bank which, upon the request of the beneficiary, confirms the letter of credit

issued by the opening bank.

KINDS OF LETTERS OF CREDIT.

1. Commercial Letter of Credit – involve the payment of money under a contract of sale. Such

credits become payable upon the presentation by the seller-beneficiary of documents that show he

has taken affirmative steps to comply with the sales agreement. (Transfield Philippines vs Luzon

Hydro Corp.)

2. Standby Letter of Credit – the credit is payable upon certification of a party's nonperformance

of the agreement. The documents that accompany the beneficiary's draft tend to show that the

applicant has not performed. (Transfield Philippines vs Luzon Hydro Corp.)

BASIC PRINCIPLES OF LETTERS OF CREDIT.

1. Strict Compliance Rule - It is a settled rule in commercial transactions involving letters of credit

that the documents tendered must strictly conform to the terms of the letter of credit. The tender

of documents by the beneficiary (seller) must include all documents required by the letter. A

correspondent bank which departs from what has been stipulated under the letter of credit, as

when it accepts a faulty tender, acts on its own risks and it may not thereafter be able to recover

from the buyer or the issuing bank (FBTC vs CA)

2. Independence Principle – assures the seller or the beneficiary of prompt payment independent

of any breach of the main contract and precludes the issuing bank from determining whether the

main contract is actually accomplished or not. Under this principle, banks assume no liability or

responsibility for the form, sufficiency, accuracy, genuineness, falsification or legal effect of any

documents, or for the general and/or particular conditions stipulated in the documents or

superimposed thereon, nor do they assume any liability or responsibility for the description,

quantity, weight, quality, condition, packing, delivery, value or existence of the goods

represented by any documents, or for the good faith or acts and/or omissions, solvency,

performance or standing of the consignor, the carriers, or the insurers of the goods, or any other

person whomsoever.

The independent nature of the letter of credit may be:

(a) independence in toto where the credit is independent from the justification aspect and is a

separate obligation from the underlying agreement like for instance a typical standby; or

(b) independence may be only as to the justification aspect like in a commercial letter of credit

or repayment standby, which is identical with the same obligations under the underlying

agreement. In both cases the payment may be enjoined if in the light of the purpose of the credit

the payment of the credit would constitute fraudulent abuse of the credit. (Transfield Philippines

vs Luzon Hydro Corp.)

3. Fraud Exception Rule – It provides that the untruthfulness of a certificate accompanying a

demand for payment under a standby letter of credit may qualify as fraud sufficient to support an

injunction against payment. (Transfield Philippines vs Luzon Hydro Corp.)

You might also like

- Essential Guide to Letters of CreditDocument11 pagesEssential Guide to Letters of CreditOna DlanorNo ratings yet

- Week 2 G. Contract of Commodatum Essentially GratuitousDocument15 pagesWeek 2 G. Contract of Commodatum Essentially GratuitousDANICA FLORESNo ratings yet

- Republic Act No. 8799 The Securities Regulation CodeDocument29 pagesRepublic Act No. 8799 The Securities Regulation CodeAstrid Gopo BrissonNo ratings yet

- Banks Liable for Negligence in Client DepositsDocument2 pagesBanks Liable for Negligence in Client DepositsLuke VerdaderoNo ratings yet

- Republic Act No. 3591 Philippine Deposit Insurance CorporationDocument42 pagesRepublic Act No. 3591 Philippine Deposit Insurance CorporationJomer FernandezNo ratings yet

- Philippine Deposit Insurance Corporation (PDIC) policies on insured depositsDocument5 pagesPhilippine Deposit Insurance Corporation (PDIC) policies on insured depositsAngelo Raphael B. DelmundoNo ratings yet

- Insurance Contract Definitions QuizDocument6 pagesInsurance Contract Definitions Quizmelaniem_1No ratings yet

- Difference Commodatum v. MutuumDocument3 pagesDifference Commodatum v. MutuumAnjung Manuel CasibangNo ratings yet

- Equity Vs Right of RedemptionDocument1 pageEquity Vs Right of RedemptionAlex Rabanes100% (2)

- Financial Rehabilitation and Insolvency Act of 2010Document18 pagesFinancial Rehabilitation and Insolvency Act of 2010jimmy100% (2)

- Corpo Lecture NotesDocument40 pagesCorpo Lecture Notesgilberthufana446877100% (1)

- Saludo vs. PNBDocument8 pagesSaludo vs. PNBGLORILYN MONTEJONo ratings yet

- LAW ON SALES, AGENCY, AND CREDITDocument5 pagesLAW ON SALES, AGENCY, AND CREDITPaw VerdilloNo ratings yet

- Republic Act No. 10607Document85 pagesRepublic Act No. 10607Anny YanongNo ratings yet

- RFBT.09 - Lecture Notes (Truth in Lending Act)Document3 pagesRFBT.09 - Lecture Notes (Truth in Lending Act)Monica GarciaNo ratings yet

- Guaranty Basics in 40 CharactersDocument29 pagesGuaranty Basics in 40 CharactersMing100% (1)

- Donor's Tax and Foreign Tax Credit (Presentation Slides)Document5 pagesDonor's Tax and Foreign Tax Credit (Presentation Slides)Kez100% (1)

- 5 Sales ReadyDocument27 pages5 Sales ReadyBrian DuelaNo ratings yet

- Notes 23 - Commodatum CodalDocument5 pagesNotes 23 - Commodatum CodalChristine Daine BaccayNo ratings yet

- Section 2 Loss of The Thing DueDocument3 pagesSection 2 Loss of The Thing DueGwen CaldonaNo ratings yet

- Banking - Bar QuestionsDocument11 pagesBanking - Bar QuestionsGenelle Mae MadrigalNo ratings yet

- REPUBLIC ACT 3765 "Truth in Lending Act" PurposeDocument1 pageREPUBLIC ACT 3765 "Truth in Lending Act" PurposeKarl Luzung100% (2)

- Exceptions To The Secrecy of Bank DepositsDocument1 pageExceptions To The Secrecy of Bank DepositsIlanieMalinisNo ratings yet

- Pledge, Mortgage, AntichresisDocument9 pagesPledge, Mortgage, AntichresisAnonymous N9dx4ATEghNo ratings yet

- Contract of Sale vs Option: Key DifferencesDocument2 pagesContract of Sale vs Option: Key DifferencesThameenah Arah100% (1)

- Section 73. Books To Be Kept Stock Transfer AgentDocument5 pagesSection 73. Books To Be Kept Stock Transfer AgentIan Joshua Romasanta100% (1)

- Contract of SaleDocument5 pagesContract of SaleMae Richelle D. DacaraNo ratings yet

- Simple Loan or MutuumDocument54 pagesSimple Loan or MutuumNoreenesse SantosNo ratings yet

- Nego NotesDocument10 pagesNego NotesChristian Paul Pinote100% (1)

- Corporation Law Case Digests Philippines Merger and ConsolidationDocument7 pagesCorporation Law Case Digests Philippines Merger and ConsolidationAlpha BetaNo ratings yet

- Cash and Marketable SecuritiesDocument30 pagesCash and Marketable Securitiesmac777phNo ratings yet

- 2 - Secrecy of Bank DepositsDocument14 pages2 - Secrecy of Bank Depositsrandyblanza2014No ratings yet

- Act No. 2031 February 03, 1911 The Negotiable Instruments Law ACT NO. 2031 February 03, 1911 The Negotiable Instruments LawDocument18 pagesAct No. 2031 February 03, 1911 The Negotiable Instruments Law ACT NO. 2031 February 03, 1911 The Negotiable Instruments Lawi syNo ratings yet

- The Laws On Partnership General ProvisionsPart1Document24 pagesThe Laws On Partnership General ProvisionsPart1Angelita Dela cruzNo ratings yet

- NEGOTIABLE INSTRUMENTS REVIEWERDocument7 pagesNEGOTIABLE INSTRUMENTS REVIEWERRem SerranoNo ratings yet

- Two main types of loanDocument9 pagesTwo main types of loanErika Angela GalceranNo ratings yet

- Financial Rehabilitation Act SummaryDocument25 pagesFinancial Rehabilitation Act SummaryNaiza Mae R. Binayao100% (2)

- Banking Memory AidDocument7 pagesBanking Memory Aidangelica arnaizNo ratings yet

- Secrecy of Bank DepositsDocument4 pagesSecrecy of Bank DepositsRoseanneNo ratings yet

- King Vs PeopleDocument1 pageKing Vs Peoplejobelle barcellanoNo ratings yet

- Close Corporation Requirements and ManagementDocument13 pagesClose Corporation Requirements and Managementgilberthufana446877100% (2)

- Part 3 Credit TransactionsDocument8 pagesPart 3 Credit TransactionsClint AbenojaNo ratings yet

- Sec. 52. What Constitutes A Holder in Due Course. - A Holder in Due Course Is A Holder Who Has Taken The InstrumentDocument8 pagesSec. 52. What Constitutes A Holder in Due Course. - A Holder in Due Course Is A Holder Who Has Taken The InstrumentKriselle Joy ManaloNo ratings yet

- Law Art 1511 - 1525Document14 pagesLaw Art 1511 - 1525zcel delos ReyesNo ratings yet

- Manila Banking V TeodoroDocument2 pagesManila Banking V Teodoroluiz ManieboNo ratings yet

- PledgeDocument2 pagesPledgeKellNo ratings yet

- Bar Questions in Negotiable InstrumentDocument13 pagesBar Questions in Negotiable InstrumentAlyza Montilla BurdeosNo ratings yet

- New Central Bank ActDocument17 pagesNew Central Bank ActKamil Ubungen Delos ReyesNo ratings yet

- PPT - Truth in Lending ActDocument23 pagesPPT - Truth in Lending ActGigiRuizTicar100% (1)

- Nil TFDocument3 pagesNil TFlachimolala. kookieee97No ratings yet

- Vii. Board of Directors and Trustees: A. Doctrine of Centralized ManagementDocument13 pagesVii. Board of Directors and Trustees: A. Doctrine of Centralized ManagementIts meh SushiNo ratings yet

- Republic Act 7653 "The New Central Bank Act"Document9 pagesRepublic Act 7653 "The New Central Bank Act"angeNo ratings yet

- Prohibitions on Manipulation and Insider TradingDocument9 pagesProhibitions on Manipulation and Insider TradingJaylordPataotaoNo ratings yet

- Articles 1962-2009Document6 pagesArticles 1962-2009MarkNo ratings yet

- Multiple choice questions on negotiable instruments, contracts, corporations and partnershipsDocument11 pagesMultiple choice questions on negotiable instruments, contracts, corporations and partnershipsJinx Cyrus RodilloNo ratings yet

- BANKING LAWS: KEY ROLES OF THE BANGKO SENTRAL NG PILIPINASDocument17 pagesBANKING LAWS: KEY ROLES OF THE BANGKO SENTRAL NG PILIPINASJanice F. Cabalag-De VillaNo ratings yet

- Nature and Effects of Contract of GuarantyDocument3 pagesNature and Effects of Contract of GuarantyNikki Andrade100% (2)

- Nature and Extent of GuarantyDocument5 pagesNature and Extent of GuarantyNikka GloriaNo ratings yet

- Bank Secrecy LawDocument20 pagesBank Secrecy LawLyra Escosio100% (2)

- Lecture Notes SpeccomDocument7 pagesLecture Notes Speccomjolly faith pariñasNo ratings yet

- UNDHR BookletDocument72 pagesUNDHR BookletAbhishek NawkarNo ratings yet

- Chapter 1 Cases TortsDocument1 pageChapter 1 Cases TortsGenevieve BermudoNo ratings yet

- Chapter 4 Cases TortsDocument2 pagesChapter 4 Cases TortsGenevieve BermudoNo ratings yet

- Notes On VAWC Part 1Document3 pagesNotes On VAWC Part 1Genevieve BermudoNo ratings yet

- TITLE 4 - LOPEZ REALTY Vs FONTECHADocument15 pagesTITLE 4 - LOPEZ REALTY Vs FONTECHAGenevieve BermudoNo ratings yet

- Cases - ElectionDocument39 pagesCases - ElectionSimon ZgdNo ratings yet

- Errol Johnson v. JamaicaDocument16 pagesErrol Johnson v. JamaicaGenevieve BermudoNo ratings yet

- Human Rights Chapter SummaryDocument28 pagesHuman Rights Chapter Summaryflippchick100% (15)

- Catholic Commissionr For Justice and Peace in Zimbabwe VDocument31 pagesCatholic Commissionr For Justice and Peace in Zimbabwe VGenevieve BermudoNo ratings yet

- Spouses Ong vs. Philippine Commercial BankDocument29 pagesSpouses Ong vs. Philippine Commercial BankGenevieve BermudoNo ratings yet

- Admin CasesDocument33 pagesAdmin CasesSimon ZgdNo ratings yet

- Gen Prov Cases in CredtransDocument12 pagesGen Prov Cases in CredtransGenevieve BermudoNo ratings yet

- Gardner Vs Court of AppealsDocument12 pagesGardner Vs Court of AppealsGenevieve BermudoNo ratings yet

- Gardner Vs Court of AppealsDocument12 pagesGardner Vs Court of AppealsGenevieve BermudoNo ratings yet

- Cases in Mutuum CredtransDocument12 pagesCases in Mutuum CredtransGenevieve BermudoNo ratings yet

- Gen Prov Cases in CredtransDocument12 pagesGen Prov Cases in CredtransGenevieve BermudoNo ratings yet

- Super Final Legaspi Towers VS MuerDocument22 pagesSuper Final Legaspi Towers VS MuerGenevieve BermudoNo ratings yet

- ROBERN DEVELOPMENT CORPORATION Vs PELADocument14 pagesROBERN DEVELOPMENT CORPORATION Vs PELAGenevieve BermudoNo ratings yet

- Simny Guy, Geraldine Guy, Gladys Yao, and The Heirs of The Late Grace G. Cheu vs. Gilbert GuysDocument13 pagesSimny Guy, Geraldine Guy, Gladys Yao, and The Heirs of The Late Grace G. Cheu vs. Gilbert GuysGenevieve BermudoNo ratings yet

- Legaspi Towers 300 Vs MUERDocument4 pagesLegaspi Towers 300 Vs MUERGenevieve BermudoNo ratings yet

- Ong Vs PCIBDocument3 pagesOng Vs PCIBGenevieve BermudoNo ratings yet

- Legaspi Tower Vs MuerDocument6 pagesLegaspi Tower Vs MuerGenevieve BermudoNo ratings yet

- Legaspi Tower Vs MuerDocument6 pagesLegaspi Tower Vs MuerGenevieve BermudoNo ratings yet

- Grace Christian High School VS CaDocument11 pagesGrace Christian High School VS CaGenevieve BermudoNo ratings yet

- CHUNG KA BIO Vs IAC ScriptDocument5 pagesCHUNG KA BIO Vs IAC ScriptGenevieve BermudoNo ratings yet

- Script Robern Corp VS PelaDocument4 pagesScript Robern Corp VS PelaGenevieve BermudoNo ratings yet

- Specpro Cases 9-15Document13 pagesSpecpro Cases 9-15Genevieve BermudoNo ratings yet

- Grace National High School Board Seat CaseDocument2 pagesGrace National High School Board Seat CaseGenevieve BermudoNo ratings yet

- Grace Christian High School VS CaDocument11 pagesGrace Christian High School VS CaGenevieve BermudoNo ratings yet

- Spouses Ong vs. Philippine Commercial BankDocument29 pagesSpouses Ong vs. Philippine Commercial BankGenevieve BermudoNo ratings yet

- DEME Offshore Brochure_2022Document16 pagesDEME Offshore Brochure_2022amin32No ratings yet

- IJPC 13 4 Hormone Replacement TherapyDocument92 pagesIJPC 13 4 Hormone Replacement TherapyMatiasNo ratings yet

- Cognitive Load Theory (John Sweller) : Information ProcessingDocument2 pagesCognitive Load Theory (John Sweller) : Information ProcessingNik ZazlealizaNo ratings yet

- CN Assignment 1 COE-540Document5 pagesCN Assignment 1 COE-540Ghazanfar LatifNo ratings yet

- A Very Rare Type of NeuralgiaDocument2 pagesA Very Rare Type of NeuralgiarosaNo ratings yet

- Recipe of Medical AirDocument13 pagesRecipe of Medical AirMd. Rokib ChowdhuryNo ratings yet

- XFARDocument14 pagesXFARRIZA SAMPAGANo ratings yet

- K&J Quotation For Geotechnical - OLEODocument4 pagesK&J Quotation For Geotechnical - OLEORamakrishnaNo ratings yet

- Role of Various Avonoids: Hypotheses On Novel Approach To Treat DiabetesDocument6 pagesRole of Various Avonoids: Hypotheses On Novel Approach To Treat DiabetesYuliet SusantoNo ratings yet

- African in The Modern WorldDocument18 pagesAfrican in The Modern WorldSally AnkomaahNo ratings yet

- Define steradian, radian, density, and luminanceDocument16 pagesDefine steradian, radian, density, and luminancesunshaniNo ratings yet

- Dispersion of Carbon Nanotubes in Water and Non-Aqueous SolventsDocument41 pagesDispersion of Carbon Nanotubes in Water and Non-Aqueous SolventsSantiago OrtizNo ratings yet

- Perlis V. Composer's Voices From Ives To Ellington PDFDocument506 pagesPerlis V. Composer's Voices From Ives To Ellington PDFOleksii Ternovii100% (1)

- MJP Rate Schedule for Water Supply Pipeline ProjectDocument6 pagesMJP Rate Schedule for Water Supply Pipeline ProjectJalal TamboliNo ratings yet

- ES Model Question Paper With Solution KeyDocument10 pagesES Model Question Paper With Solution Keyvidhya_bineeshNo ratings yet

- INTELLISPEC SERIE V-Páginas-31-46Document16 pagesINTELLISPEC SERIE V-Páginas-31-46Antonio Valencia VillejoNo ratings yet

- X-Plane Installer LogDocument3 pagesX-Plane Installer LogMarsala NistoNo ratings yet

- T e 2552674 Percy Polls Peculiar Plants Fiction Year 5 Reading Comprehension - Ver - 5Document20 pagesT e 2552674 Percy Polls Peculiar Plants Fiction Year 5 Reading Comprehension - Ver - 5mariam osamaNo ratings yet

- Falling Weight Deflectometer (FWD) Projects in IndiaDocument13 pagesFalling Weight Deflectometer (FWD) Projects in IndiaKaran Dave100% (1)

- Course Outline TP WindowsDocument6 pagesCourse Outline TP WindowsAnonymous PcPkRpAKD5No ratings yet

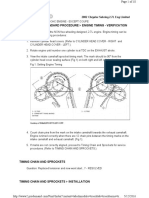

- 02+sebring+2.7+timing+chainDocument10 pages02+sebring+2.7+timing+chainMaushil Salman MarkNo ratings yet

- Bartending and Catering: Agenda: Basics of Bartending Bar Tools and EquipmentDocument146 pagesBartending and Catering: Agenda: Basics of Bartending Bar Tools and EquipmentMars Mar100% (1)

- English Assignment Team:: Devia Annisa E. E44190045 2. TB. Aditia Rizki E44190027 3. Tedi Irfan Jelata E44190028Document3 pagesEnglish Assignment Team:: Devia Annisa E. E44190045 2. TB. Aditia Rizki E44190027 3. Tedi Irfan Jelata E4419002856TB. Aditia RizkiNo ratings yet

- Calculating Maintenance and ReliabilityDocument7 pagesCalculating Maintenance and ReliabilityArdian P Noviatmoko100% (1)

- Chapin - Advanced Tech For Modern Drummer - SAMPLEDocument5 pagesChapin - Advanced Tech For Modern Drummer - SAMPLEhokoNo ratings yet

- CPA Review Module on Accounting Standards and RegulationDocument13 pagesCPA Review Module on Accounting Standards and RegulationLuiNo ratings yet

- MSDS Slideway Oil Iso VG 68 - 031115Document6 pagesMSDS Slideway Oil Iso VG 68 - 031115Rini SiskayantiNo ratings yet

- 3M NLP White PaperDocument12 pages3M NLP White PaperJayampathi SamarasingheNo ratings yet

- MathWorks Interview ProcessDocument2 pagesMathWorks Interview ProcessPawan Singh100% (1)

- Vol 14, No 4 RHADocument20 pagesVol 14, No 4 RHAKawchhar AhammedNo ratings yet