Professional Documents

Culture Documents

AE 1 Take-Home No. 3

AE 1 Take-Home No. 3

Uploaded by

John Alfred CastinoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AE 1 Take-Home No. 3

AE 1 Take-Home No. 3

Uploaded by

John Alfred CastinoCopyright:

Available Formats

ECQ Take-home Assignment 3

Acctg 2: Accounting for Partnership and Corporation

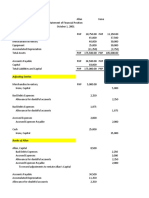

Problem 1: Lump-sum Liqudation

Escareal, Acosta and Lopez are liquidating their business. They share profits and losses in a 2:3:1 ratio,

respectively, and currently have capital balances of ₱300,000, ₱210,000 and ₱390,000 respectively. In

addition, the partnership has ₱150,000 in cash, ₱250,000 in accounts payable, and ₱1,000,000 in non-

cash assets. Escareal and Lopez are personally solvent, but Acosta is not. Assuming that the noncash

assets are sold for ₱460,000. Prepare a statement of partnership liquidation and the liquidation journal

entries.

Problem 2: Installment Liquidation

Partners Lim, Pe and Sy share profits and losses in the ratio of 5:3:2. The partners decided to liquidate

the partnership. Their statement of financial position prior to liquidation is:

Assets Liabilities and Capital

Cash 400,000 Liabilities 600,000

Other Assets 2,100,000 Lim, Loan 80,000

Lim, Capital 400,000

Pe, Capital 720,000

Sy, Capital 700,000

Total 2,500,000 Total 2,500,000

The partnership is to be liquidated by installment. The first sale of non-cash assets costing ₱1,200,000

realized by ₱900,000. Liquidation expenses paid amounted to ₱20,000.

Prepare a statement of partnership liquidation, schedule of safe payments and liquidation journal

entries.

You might also like

- Partcorp. LiquidDocument8 pagesPartcorp. LiquidMark Dave Yu100% (1)

- Chapter 3 Case Part 2Document3 pagesChapter 3 Case Part 2graceNo ratings yet

- AE 112 Finals Summative AssessmentDocument12 pagesAE 112 Finals Summative AssessmentmercyvienhoNo ratings yet

- Liquidation Problem Partnership and Corporation AccountingDocument3 pagesLiquidation Problem Partnership and Corporation AccountingChichoNo ratings yet

- Acct Project Question 4Document15 pagesAcct Project Question 4graceNo ratings yet

- CORPORATIONEXERCISES28PROBLEMS29ONORGANIZATION21FEB21Document9 pagesCORPORATIONEXERCISES28PROBLEMS29ONORGANIZATION21FEB21Jasmine ActaNo ratings yet

- LSPU - PARCOR Final ExamDocument3 pagesLSPU - PARCOR Final ExamRosejane EM100% (1)

- PARCORDocument1 pagePARCORRhea Royce Cabuhat43% (7)

- Chapter 11 SampleDocument6 pagesChapter 11 SamplePattraniteNo ratings yet

- Parco RSPDocument5 pagesParco RSPElli Francis Tomenio0% (2)

- DocumentDocument5 pagesDocumentJannelle SalacNo ratings yet

- Chap 3 and 4 - ParcorDocument4 pagesChap 3 and 4 - ParcorAnne Gwynneth RadaNo ratings yet

- Proof of Cash SolutionsDocument4 pagesProof of Cash SolutionsyowatdafrickNo ratings yet

- Chapter 3 ProblemshhhDocument15 pagesChapter 3 Problemshhhahmed arfanNo ratings yet

- Activity Partnership DissolutionDocument2 pagesActivity Partnership DissolutionKaren Joy Jacinto ElloNo ratings yet

- Partnership Liquidation 1Document17 pagesPartnership Liquidation 1Shoyo HinataNo ratings yet

- Chapter08 Inventory Cost Other Basis Student Copy LectureDocument9 pagesChapter08 Inventory Cost Other Basis Student Copy LectureAngelo Christian B. OreñadaNo ratings yet

- PracticeDocument2 pagesPracticesppNo ratings yet

- Long QuizDocument5 pagesLong QuizMitch Tokong MinglanaNo ratings yet

- Corp. Retained EarningsDocument9 pagesCorp. Retained EarningshsjhsNo ratings yet

- ParCor Chapter 5 - Hernandez - BSA 1-1 PDFDocument5 pagesParCor Chapter 5 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- AssignmentDocument9 pagesAssignmentBaekhunnie ByunNo ratings yet

- TOPIC EconDocument44 pagesTOPIC EconChristy HabelNo ratings yet

- Acct NG SolutionsDocument1 pageAcct NG SolutionsGelyn Cruz100% (1)

- Romela Company (Gross Method)Document2 pagesRomela Company (Gross Method)AnonnNo ratings yet

- Name: Course & Yr: Schedule: Score: - : Subscribed and Paid-Up Shares Amou NTDocument3 pagesName: Course & Yr: Schedule: Score: - : Subscribed and Paid-Up Shares Amou NTYricaNo ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyxNo ratings yet

- Allan and Irene Answer KeyDocument9 pagesAllan and Irene Answer KeyApril NaidaNo ratings yet

- Chapter 2 Problem 9 in Win Ballada ParcorDocument4 pagesChapter 2 Problem 9 in Win Ballada ParcorKatrina PetracheNo ratings yet

- Orca Share Media1579219923157Document10 pagesOrca Share Media1579219923157leejongsuk44% (9)

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyx0% (1)

- Partnership Dissolution Changes in OwnershipDocument30 pagesPartnership Dissolution Changes in OwnershipKeith Joshua GabiasonNo ratings yet

- Present Value of Principal (8,000,000 X 0.6756) 5,404,800 Jan-01 Present Value of Semi Annual Interest (400,000 X 8.11) 3,244,000 Purchase Price 8,648,800 Jul-01Document2 pagesPresent Value of Principal (8,000,000 X 0.6756) 5,404,800 Jan-01 Present Value of Semi Annual Interest (400,000 X 8.11) 3,244,000 Purchase Price 8,648,800 Jul-01AnonnNo ratings yet

- PreweekSol (Advacc)Document91 pagesPreweekSol (Advacc)Rommel Cruz100% (2)

- Intangible Assets PPT More ProblemsDocument19 pagesIntangible Assets PPT More ProblemsSheila Grace BajaNo ratings yet

- Requirement: A New Set of Books Will Be Opened by The Partnership Roces' Books Sales' BooksDocument7 pagesRequirement: A New Set of Books Will Be Opened by The Partnership Roces' Books Sales' BooksJunzen Ralph YapNo ratings yet

- Chapter 5 Installment LiquidationDocument25 pagesChapter 5 Installment LiquidationApple Jane Galisa Secula0% (2)

- Ppe Borrowing Cost July 12 SummerDocument12 pagesPpe Borrowing Cost July 12 SummerJelyn RuazolNo ratings yet

- MiyawwDocument9 pagesMiyawwjessa mae zerdaNo ratings yet

- Chapter 7 Angel Ann E. Orola Bsba HR1 1Document90 pagesChapter 7 Angel Ann E. Orola Bsba HR1 1Gwen Stefani DaugdaugNo ratings yet

- Problem #9 Two Sole Proprietorship Form A PartnershipDocument3 pagesProblem #9 Two Sole Proprietorship Form A PartnershipNiño Rey LopezNo ratings yet

- Partnership Liquidation Exercises p.135Document6 pagesPartnership Liquidation Exercises p.135Kaye GomezNo ratings yet

- Chapter 02Document25 pagesChapter 02Mendoza KlariseNo ratings yet

- Acfar1130 - Chapter 12 ProblemsDocument2 pagesAcfar1130 - Chapter 12 ProblemsMae BarsNo ratings yet

- Requirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20ADocument4 pagesRequirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20AGvm Joy MagalingNo ratings yet

- Activity 3Document7 pagesActivity 3Rishaan Dominic100% (1)

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseMarjorieNo ratings yet

- CHAPTER 3 - Partnership Dissolution - Changes in OwnershipDocument16 pagesCHAPTER 3 - Partnership Dissolution - Changes in OwnershipRominna Dela RuedaNo ratings yet

- ParCor Chapter 4 - Hernandez - BSA 1-1 PDFDocument7 pagesParCor Chapter 4 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- CHAPTER 16 - DIVIDENDS - Problem 3 - Computations - Page 597-599Document9 pagesCHAPTER 16 - DIVIDENDS - Problem 3 - Computations - Page 597-599Penelope PalconNo ratings yet

- UntitledDocument4 pagesUntitledShevina Maghari shsnohsNo ratings yet

- CHAPTER 2 - Partnership OperationsDocument10 pagesCHAPTER 2 - Partnership OperationsRominna Dela RuedaNo ratings yet

- MC 5 Dissolution P2Document3 pagesMC 5 Dissolution P2Jenny BernardinoNo ratings yet

- Multiple Choice Answers and Solutions: Aquino Locsin David HizonDocument26 pagesMultiple Choice Answers and Solutions: Aquino Locsin David HizonclaudettegasendoNo ratings yet

- CONFRAS LiquidationDocument2 pagesCONFRAS LiquidationMaybelyn DagamiNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationMaria LopezNo ratings yet

- Mock Up Soal Uas Akl II Dan Adv II 2018Document4 pagesMock Up Soal Uas Akl II Dan Adv II 2018nadea06_20679973No ratings yet

- Problem 1-8Document11 pagesProblem 1-8JPIA-UE Caloocan '19-20 AcademicsNo ratings yet

- MOCK UP SOAL UAS AKL II Dan ADV II 2018Document5 pagesMOCK UP SOAL UAS AKL II Dan ADV II 2018Nathalie Christnindita DecidNo ratings yet

- LIQUIDATIONDocument3 pagesLIQUIDATIONesparagozanichole01No ratings yet

- AE 22 Answer Key To Seatwork July 23Document2 pagesAE 22 Answer Key To Seatwork July 23John Alfred CastinoNo ratings yet

- AE 22 Assignment 3Document1 pageAE 22 Assignment 3John Alfred CastinoNo ratings yet

- Final Exams PArCOr 2020Document4 pagesFinal Exams PArCOr 2020John Alfred CastinoNo ratings yet

- Midterm Exam Parcor 2020Document1 pageMidterm Exam Parcor 2020John Alfred CastinoNo ratings yet

- Accounting 2 PrelimsDocument3 pagesAccounting 2 PrelimsJohn Alfred Castino100% (1)

- Notes On Partnership LiquidationDocument3 pagesNotes On Partnership LiquidationJohn Alfred CastinoNo ratings yet

- Mixed Income QuestionDocument1 pageMixed Income QuestionJohn Alfred CastinoNo ratings yet

- Acctg 1 Problems - JMCDocument1 pageAcctg 1 Problems - JMCJohn Alfred CastinoNo ratings yet