Professional Documents

Culture Documents

Case 4064-89 MERGER PROCEDURE - 05

Uploaded by

oleg7962Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 4064-89 MERGER PROCEDURE - 05

Uploaded by

oleg7962Copyright:

Available Formats

C1.

Horizontal effects

Introduction

18. AGCO has two tractor plants in Europe: in Beauvais, France, and Marktoberdorf,

Germany. AGCO has also a manufacturing facility in Canoas, Brazil. AGCO’s tractor

brands in the EEA are Massey Ferguson and Fendt. Massey Ferguson is a globally well-

known old brand, positioned in the medium-price category. Fendt is a high-tech tractor

which is segmented in the high-end, high-price category. Fendt holds niche market

positions in most markets except in Germany, where it has a stronger market position as

a traditionally German-made tractor.

19. Valtra manufactures tractors for the European market in Suolahti, Finland. Valtra has

another production facility in Brazil. Valtra's strongest market has traditionally been

Finland. Valtra marketed its tractors until 2001 under the "Valmet" brand. The brand has

since been changed into "Valtra". Valtra tractors are positioned in the medium/lower

price category.

Market position

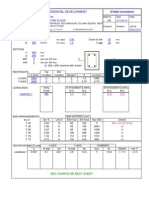

20. AGCO has estimated that the total EEA-wide market for standard tractors was 7,671

million Euros in 2002, corresponding to 149,754 units. The value of the market has been

decreasing slightly from 8,028 million Euros in 2000 (150,169 units). The investigation

shows that the European markets are expected to decrease further by some 5% within the

next few years. Growth in the market is expected mainly in the Eastern Europe.

21. On the EEA-wide level, the market leader is Case New Holland ("CNH") with [25-35]%

of the market in volume terms. John Deere is the next largest competitor with [10-20]%,

Same-Deutz-Fahr ("SDF") has [10-20]%. AGCO accounts for [10-20]% of the EEA-

wide market and Valtra [0-10]%. The combined market position would therefore be [15-

25]%, still behind CNH and slightly ahead of John Deere. Smaller producers such as

Landini and Renault have less than [0-10]% of the EEA-wide market each, but

significant market positions in certain national markets. Outside the Nordic region,

Valtra is only a minor player with market shares generally in the low single-digit

percentage range.

22. In individual Member States, the market positions vary. CNH is currently the market

leader in all other Member States apart from Finland. Following the transaction, CNH

retains its leading market position in most Member States. However, in Sweden, Norway

and Germany the new entity will become the largest supplier in terms of market share.

23. The transaction gives rise to horizontally affected markets in 10 EU Member States,

Norway and Iceland. On the following markets, the parties' combined market shares of

the new entity remain below [30-40]%: Italy [0-10]% (increment [<5]%), Portugal [5-

15]% (increment [<5]%), Spain [10-20]% (increment [<5]%), Austria [10-20]%

(increment [<5]%), France [15-25]% (increment [0-10]%), Belgium/Luxembourg [15-

25]% (increment [<5]%), the Netherlands [20-30]% (increment [0-10]%), UK [20-30]%

(increment [<5]%), Germany [20-30]% (increment [<5]%), Ireland [20-30]% (increment

[0-10]%), Denmark [25-35]% (increment [10-20]%) and Iceland [30-40]% (increment

[5-15]%).

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Case 4064-89 MERGER PROCEDURE - 10Document1 pageCase 4064-89 MERGER PROCEDURE - 10oleg7962No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Case 4064-89 MERGER PROCEDURE - 07Document1 pageCase 4064-89 MERGER PROCEDURE - 07oleg7962No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Case 4064-89 MERGER PROCEDURE - 08Document1 pageCase 4064-89 MERGER PROCEDURE - 08oleg7962No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Case 4064-89 MERGER PROCEDURE - 11Document1 pageCase 4064-89 MERGER PROCEDURE - 11oleg7962No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Case 4064-89 MERGER PROCEDURE - 09Document1 pageCase 4064-89 MERGER PROCEDURE - 09oleg7962No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Case 4064-89 MERGER PROCEDURE - 06Document1 pageCase 4064-89 MERGER PROCEDURE - 06oleg7962No ratings yet

- Case 4064-89 MERGER PROCEDURE - 04Document1 pageCase 4064-89 MERGER PROCEDURE - 04oleg7962No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Total Oil Too Tracktor - 14Document1 pageTotal Oil Too Tracktor - 14oleg7962No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Case 4064-89 MERGER PROCEDURE - 03Document1 pageCase 4064-89 MERGER PROCEDURE - 03oleg7962No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Case 4064-89 MERGER PROCEDURE - 02Document1 pageCase 4064-89 MERGER PROCEDURE - 02oleg7962No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Total Oil Too Tracktor - 15Document1 pageTotal Oil Too Tracktor - 15oleg7962No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Total Oil Too Tracktor - 13Document1 pageTotal Oil Too Tracktor - 13oleg7962No ratings yet

- Case 4064-89 MERGER PROCEDURE - 01 PDFDocument1 pageCase 4064-89 MERGER PROCEDURE - 01 PDFoleg7962No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Total Oil Too Tracktor - 13Document1 pageTotal Oil Too Tracktor - 13oleg7962No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Total Oil Too Tracktor - 12Document1 pageTotal Oil Too Tracktor - 12oleg7962No ratings yet

- Total Oil Too Tracktor - 02Document1 pageTotal Oil Too Tracktor - 02oleg7962No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Total Oil Too Tracktor - 09 PDFDocument1 pageTotal Oil Too Tracktor - 09 PDFoleg7962No ratings yet

- Total Oil Too Tracktor - 06Document1 pageTotal Oil Too Tracktor - 06oleg7962No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Total Oil Too Tracktor - 11Document1 pageTotal Oil Too Tracktor - 11oleg7962No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Total Oil Too Tracktor - 07Document1 pageTotal Oil Too Tracktor - 07oleg7962No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Total Oil Too Tracktor - 09 PDFDocument1 pageTotal Oil Too Tracktor - 09 PDFoleg7962No ratings yet

- Total Oil Too Tracktor - 04Document1 pageTotal Oil Too Tracktor - 04oleg7962No ratings yet

- Valtra Tracto T Ser - 10Document1 pageValtra Tracto T Ser - 10oleg7962No ratings yet

- Total Oil Too Tracktor - 03Document1 pageTotal Oil Too Tracktor - 03oleg7962No ratings yet

- Total Oil Too Tracktor - 01Document1 pageTotal Oil Too Tracktor - 01oleg7962No ratings yet

- Valtra Tracto T Ser - 11Document1 pageValtra Tracto T Ser - 11oleg7962No ratings yet

- Valtra Tracto T Ser - 09Document1 pageValtra Tracto T Ser - 09oleg7962No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Valtra Tracto T Ser - 08Document1 pageValtra Tracto T Ser - 08oleg7962No ratings yet

- Valtra Tracto T Ser - 05 PDFDocument1 pageValtra Tracto T Ser - 05 PDFoleg7962No ratings yet

- Sindarin-English Dictionary - 2nd EditionDocument192 pagesSindarin-English Dictionary - 2nd EditionNea Tan100% (1)

- Scuba Diving - Technical Terms MK IDocument107 pagesScuba Diving - Technical Terms MK IJoachim MikkelsenNo ratings yet

- KZPOWER Perkins Stamford Genset Range CatalogueDocument2 pagesKZPOWER Perkins Stamford Genset Range CatalogueWiratama TambunanNo ratings yet

- 100 Years of Hydrodynamic PDFDocument28 pages100 Years of Hydrodynamic PDFnikodjoleNo ratings yet

- Acer AIO Z1-752 System DisassemblyDocument10 pagesAcer AIO Z1-752 System DisassemblySERGIORABRNo ratings yet

- Group Collaborative Activity TaskonomyDocument2 pagesGroup Collaborative Activity TaskonomyTweeky SaureNo ratings yet

- Civil Engineering Topics V4Document409 pagesCivil Engineering Topics V4Ioannis MitsisNo ratings yet

- AnamnezaDocument3 pagesAnamnezaTeodora StevanovicNo ratings yet

- IFIS - Intraoperative Floppy Iris Syndrome Wa Wa 27-09-2008Document18 pagesIFIS - Intraoperative Floppy Iris Syndrome Wa Wa 27-09-2008JanuszNo ratings yet

- AC350 Specs UsDocument18 pagesAC350 Specs Uskloic1980100% (1)

- Assignment 7 - Cocktail RecipiesDocument20 pagesAssignment 7 - Cocktail RecipiesDebjyoti BanerjeeNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- M1-Safety StandardsDocument9 pagesM1-Safety StandardscarlNo ratings yet

- Fluid Solids Operations: High HighDocument20 pagesFluid Solids Operations: High HighPriscilaPrzNo ratings yet

- Texas Instruments FootprintsDocument7 pagesTexas Instruments FootprintsSteve SmithNo ratings yet

- Panasonic Refrigeraor NR-B472TZ - B412TZ v1.1Document24 pagesPanasonic Refrigeraor NR-B472TZ - B412TZ v1.1Anonymous 2iQ1B59No ratings yet

- TA308 616configurationDocument1 pageTA308 616configurationJesus AvilaNo ratings yet

- Mercedez-Benz: The Best or NothingDocument7 pagesMercedez-Benz: The Best or NothingEstefania RenzaNo ratings yet

- Asyb 2020 2Document295 pagesAsyb 2020 2KhangNo ratings yet

- The Ecological Effects of Eucalyptus PDFDocument97 pagesThe Ecological Effects of Eucalyptus PDFgejuinaNo ratings yet

- IMS Institute BelgradeDocument10 pagesIMS Institute BelgradeBoško JanjuševićNo ratings yet

- Fatigue Consideration in DesignDocument3 pagesFatigue Consideration in DesigngouthamNo ratings yet

- The Influence of School Architecture and Design On The Outdoor Play Experience Within The Primary SchoolDocument20 pagesThe Influence of School Architecture and Design On The Outdoor Play Experience Within The Primary SchoolAnca BalotaNo ratings yet

- Column c4 From 3rd FloorDocument1 pageColumn c4 From 3rd Floor1man1bookNo ratings yet

- 2014 An125hkl4Document69 pages2014 An125hkl4El Turco ChalabeNo ratings yet

- Menstrupedia Comic: The Friendly Guide To Periods For Girls (2014), by Aditi Gupta, Tuhin Paul, and Rajat MittalDocument4 pagesMenstrupedia Comic: The Friendly Guide To Periods For Girls (2014), by Aditi Gupta, Tuhin Paul, and Rajat MittalMy Home KaviNo ratings yet

- 2UEB000487 v1 Drive On GeneratorDocument19 pages2UEB000487 v1 Drive On GeneratorSherifNo ratings yet

- 520L0586 MMF044Document48 pages520L0586 MMF044vendas servicosNo ratings yet

- Data Sheet: W-Series WSI 6/LD 10-36V DC/ACDocument12 pagesData Sheet: W-Series WSI 6/LD 10-36V DC/ACLUIS FELIPE LIZCANO MARINNo ratings yet

- JCHT35K9 EngDocument5 pagesJCHT35K9 EngRodica PuscauNo ratings yet

- BLANCHARD-The Debate Over Laissez Faire, 1880-1914Document304 pagesBLANCHARD-The Debate Over Laissez Faire, 1880-1914fantasmaNo ratings yet

- ChatGPT Money Machine 2024 - The Ultimate Chatbot Cheat Sheet to Go From Clueless Noob to Prompt Prodigy Fast! Complete AI Beginner’s Course to Catch the GPT Gold Rush Before It Leaves You BehindFrom EverandChatGPT Money Machine 2024 - The Ultimate Chatbot Cheat Sheet to Go From Clueless Noob to Prompt Prodigy Fast! Complete AI Beginner’s Course to Catch the GPT Gold Rush Before It Leaves You BehindNo ratings yet

- The Fabric of Civilization: How Textiles Made the WorldFrom EverandThe Fabric of Civilization: How Textiles Made the WorldRating: 4.5 out of 5 stars4.5/5 (57)

- Sully: The Untold Story Behind the Miracle on the HudsonFrom EverandSully: The Untold Story Behind the Miracle on the HudsonRating: 4 out of 5 stars4/5 (103)

- Hero Found: The Greatest POW Escape of the Vietnam WarFrom EverandHero Found: The Greatest POW Escape of the Vietnam WarRating: 4 out of 5 stars4/5 (19)

- Learn Mandarin Chinese with Paul Noble for Beginners – Complete Course: Mandarin Chinese Made Easy with Your 1 million-best-selling Personal Language CoachFrom EverandLearn Mandarin Chinese with Paul Noble for Beginners – Complete Course: Mandarin Chinese Made Easy with Your 1 million-best-selling Personal Language CoachRating: 5 out of 5 stars5/5 (15)

- Lands of Lost Borders: A Journey on the Silk RoadFrom EverandLands of Lost Borders: A Journey on the Silk RoadRating: 3.5 out of 5 stars3.5/5 (53)

- Faster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestFrom EverandFaster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestRating: 4 out of 5 stars4/5 (28)