Professional Documents

Culture Documents

Varun Project

Varun Project

Uploaded by

Vishwa NOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Varun Project

Varun Project

Uploaded by

Vishwa NCopyright:

Available Formats

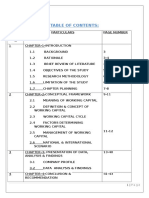

WORKING CAPITAL MANAGEMENT

PART- 1

EXECUTIVE SUMMARY

KRUPANIDHI DEGREE COLLEGE Page | 1

WORKING CAPITAL MANAGEMENT

EXECUTIVE SUMMARY

A project on working capital management has been a very good experience. Every

manufacturing company faces the problem of working capital management in their day to day

process. An organization’s cost reduces and the profits increased only if it is able to manage its

working capital efficiently. At the same time, the company can provide customer satisfaction and

hence can improve their overall productivity and profitability.

This project is sincere effort to study and analyze the working capital management

of EXIDE INDUSTRIES, HOSUR. The project focused on making a financial overview of the

company by conducting a working capital analysis of EXIDE INDUSTRIES for the years 2011-12

to 2015-16

All organization has to carry working capital in one form or the other. The efficient

management of working capital is important from the point of view of both liquidity and

profitability. Poor management of working capital means that funds are unnecessary tied up in idle

assets. Hence reducing liquidity and reducing the ability to invest in productive assets such as plant

and machinery, affects the profitability.

The working capital management refers to management of working capital or to be

more precise the management of current assets. A firm’s working capital consist of its investments in

currents assets which include short term assets such as cash and cash balances, inventories

receivables and marketable securities. So the working capital management refers to the management

of the level of all those individual current assets. The need for working capital management arises

from two considerations. First, existence of working capital is imperative in any firm. The fixed

assets, which usually require a large chunk of total funds, can be used at an optimum level of only if

supported by sufficient working capital and second the working capital involves investment of funds

of the firms. If the working capital level is not properly maintained and managed, then it may result

in unnecessary blocking of scarce resources of the firm. The insufficient working capital on the other

hand, will put various hindrances in smooth working of the firm. Therefore, the working capital

management needs attention of all the financial managers.

KRUPANIDHI DEGREE COLLEGE Page | 2

WORKING CAPITAL MANAGEMENT

PART- 2

RESEARCH METHODOLOGY

KRUPANIDHI DEGREE COLLEGE Page | 3

WORKING CAPITAL MANAGEMENT

RESEARCH METHODOLOGY

The methodology I have adopted while collecting the information and interpretation

and interpreting in a significant way. The main sources from which I have collected information are:

i. Place of study: EXIDE INDUSTRIES, HOSUR.

ii. Time span of study. 4 weeks

iii. Method of study: discussion with concerned persons in the finance persons in the finance

and other concerned departments.

iv. Subject of financial management: Ascertain various ratios and its comparison with

yesteryears.

TITLE OF THE STUDY

Project Report on “A study on Working Capital Management with reference to

EXIDE INDUSTRIES”, HOSUR.

STAMETMENT OF THE PROBLEM:

Working capital is the lifeblood and nerve system of a business. Just as circulation of

blood is essential in the human body for maintaining life; working capital is very essential to

maintain the smooth running of business. No business can successfully run without an adequate

amount of working capital. Working capital is very significant aspect in the management of finance

of any organization. Scrutiny of the levels of working capital can straightforwardly identify the

liquidity and profitably position of the firm.

OBJECTIVES OF THE STUDY:

1. To understand the policies and procedure followed by the EXIDE INDUSTRIES, HOSUR

concerning the working capital management with particular reference to cash flow statement

and ratio analysis.

2. To study the currents assets and current liabilities of the company

KRUPANIDHI DEGREE COLLEGE Page | 4

WORKING CAPITAL MANAGEMENT

3. To study the accounts receivable and payables , inventory, and cash system in, EXIDE

INDUSTRIES, HOSUR

4. To offer suggestion for improving the working capital management in the Company.

SCOPE OF STUDY:

The working capital management includes administration of both current assets and

current liabilities, as the time for the dissertation is restricted and the subject is very crucial, the

study is confined to only the management of current assets in EXIDE INDUSTRIES, HOSUR.

RESEARCH DESIGN:

The study relates to working capital management in EXIDE INDUSTRIES,

HOSUR. According to Claire Selltiz and others “a research design is the arrangement of conditions

for collection and analysis of data in a manner that aims to combine relevance to the research

purpose with economy in procedure”. The research design is the concepted structure within which

research is conducted.

Thus research is an organized inquiry designed and carried out to provide

information to solve the problem. Research is the process is the process of scientific investigation of

a certain problems; Research is the process of systematically obtaining accurate answers and

interpreting information

SOURCES OF DATA COLLECTION

There are two sources of data for investigation.

1) Primary source: Primary data are those, which are collected for the first time, and they are

original in nature. Primary data has been collected through personal interviews with

concerned Officers of the company like finance department, finance manager and as well

staff.

KRUPANIDHI DEGREE COLLEGE Page | 5

WORKING CAPITAL MANAGEMENT

2) Secondary sources: They include a company’s profit and loss account, balance sheet, sales

figures, sales reports, inventory records, registers, document etc. A proper analysis of these

records will reveal the degree of efficiency of the business.

LIMITATIONS OF THE STUDY

1) The information is considered is confidential and not available for study.

2) Definition and concepts used by different authorities are different.

3) Time available for the study is limited.

4) The study conducted in Exide industries Hosur alone only and not the other plant of Exide

industries Hosur.

KRUPANIDHI DEGREE COLLEGE Page | 6

WORKING CAPITAL MANAGEMENT

PART- 3

INDUSTRY PROFILE

COMPANY PROFILE

KRUPANIDHI DEGREE COLLEGE Page | 7

WORKING CAPITAL MANAGEMENT

INDUSTRY PROFILE

MANUGACTURING INDUSTRY OVERVIEW

Manufacturing industry refers to those industries which involve in the

manufacturing and processing of items and indulge in either creation of new commodities or in value

addition. The manufacturing industry accounts for a significant share of the industrial sector in

developed countries. The final products can either serves as a finished good for sale to customers or

as intermediate goods used in the production process.

EVOLUTION OF MANUFACTURING INDUSTRY

Manufacturing industries came into being with the occurrence of technological and

socio-economic transformations in the Western countries in the 18th-19th century. This was widely

known as industrial revolution. It began in Britain and replaced the labor intensive textile production

with mechanization and use of fuels.

Working of manufacturing industry:

Manufacturing industries are the chief wealth producing sectors of an economy.

These industries use various technologies and methods widely known as manufacturing process

management. Manufacturing industries are broadly categorized into engineering industries,

construction industries, electronics industries, chemical industries, energy industries, textile

industries, food and beverage industries, metalworking industries, plastic industries, transport and

telecommunication industries.

Manufacturing industries are important for an economy as they employ a huge share

of the labor force and produce materials required by sectors of strategic importance such as national

infrastructure and defense. However, not all manufacturing industries are beneficial to the nation as

some of them generate negative externalities with huge social costs. The cost of letting such

industries flourish may even exceed the benefits generated by them.

KRUPANIDHI DEGREE COLLEGE Page | 8

WORKING CAPITAL MANAGEMENT

ANALYSIS OF MANUFACTURING INDUSTRY

It suggests that the manufacturing industry has served as the pivotal factor in the

economic development of a country. The same applies for the United States Of America, whose

economy has been growing rapidly owing to the successful manufacturing industry. Manufacturing

industry analysis also indicates that the manufacturing industry provides employment to many

thereby contributing to the gross domestic product and per capita income of the country.

Approximately 75% of the engineers as well as the scientists get employed in the manufacturing

industry as recorded by a manufacturing industry analysis. The Census bureau categorizes a

particular manufactured product depending on the primary goods produced by the manufacturing

industry.

Statistical data showing the impact of the manufacturing industry on economy:

In the year 1992, the expenditure incurred on the research and development by the

manufacturing establishments was USD$91.2 billion in the United States of America. Out of

this Non Governmental manufacturing establishments registered 79.4% of USD$91.2 billion

18% of GDP or gross domestic product in the year 1993 was due to revenues generated by

the manufacturing industry, established according to reports of manufacturing industry

analysis.

46.4 was the result obtained in order to find out the number of workers employed in every

establishment. This figure was registered in the year 1992.

15% of shipments in the manufacturing segment were due to the material industry.

Capital stock has registered a steady rise for all the sectors of the manufacturing industry

since 1982.

Employment opportunity in the manufacturing industry has declined comparatively.

Manufacturing industry analysis also suggests that in some countries like China,

technological knowhow has to be developed. Despite the fact that China is ranked fourth in

the manufacturing productivity, due to technological lacunae, it is not being able to compete

in the world market. Also needed are professionals well versed in the technological

knowhow.

KRUPANIDHI DEGREE COLLEGE Page | 9

WORKING CAPITAL MANAGEMENT

BATTERY MANUFACTURING INDUSTRY PROFILE

The Indian storage batteries market is approximately estimated at US$ 500

million with the automotive batteries segment 60 to 70 percent of the overall market value. In

terms of volumes, the overall consumption of the automotive batteries could be around 6.3

million units with the 40 QE segment comprising around 1.2 to 1.3 million units per annum,

Various batteries (clockwise from bottom left): two 9-volt, two AA, one D, a handheld ham

radio battery, a cordless phone battery, a camcorder battery, one C, and three AAA.

A battery is one or more electrochemical cells, which store chemical energy and

make it available as electric current. There are many types of electrochemical cells, including

galvanic J' cells, electrolytic cells, fuel cells, flow cells, and voltaic cells. Strictly, an electrical

"battery" is two or more cells connected together, but often a single cell is called a battery. A

battery's characteristics may vary due to many factors including internal chemistry, current

drain, and temperature.

There are two types of batteries, primary (disposable) and secondary

(rechargeable), both of which convert chemical energy to electrical energy. Primary batteries can

only be used once because they use up their chemicals in an irreversible reaction. Secondary

batteries can be recharged because the chemical reactions they use are reversible; they are

recharged by running a charging current through the battery, but in the opposite direction of the

discharge current. Secondary, also called rechargeable batteries can be charged and discharged

many times before wearing out. After weaning out some of the batteries can be recycled.

ABOUT BATTERY

A battery is perhaps the only gift of science where electric is stored by means of

elector chemical potentials guided by electro comical reaction. Chemical reaction initiated by

electricity. Which take place with the means of electron exchange between the reactions, as and

when required the stored energy can be counted back to electro chemical reaction. In certain

cases the electrical chemical reactions guiding the energy transformation is not reversible. Such

batteries are called ordinary cells. Where the electro chemical reaction guiding energy

transformation is reversible hence they can be reused through only after outing a required

amount of electric energy once it gets exhausted. These batteries are called secondary batteries.

KRUPANIDHI DEGREE COLLEGE Page | 10

WORKING CAPITAL MANAGEMENT

BATTERY HISTORY

A battery, which is actually an electric cell, is a device that produces electricity

from a chemical reaction. Strictly speaking, a battery consists of two or more cells connected in

series or parallel, but the term is generally used for a single cell. A cell consists of a negative

electrode; an electrolyte, which conducts ions; a separator, also an ion conductor; and a positive

electrode.

TIMELINE OF BATTERY HISTORY

1748 - Benjamin Franklin first coined the term "battery" to describe an array of charged

glass plates.

1780 to 1786 - Luigi Galvani demonstrated what we now understand to be the electrical

basis of nerve impulses and provided the cornerstone of research for later inventors like

Volta.

1800 - Alessandro Volta invented the voltaic pile and discovered the first practical

method of generating electricity. Constructed of alternating discs of zinc and copper with

pieces of cardboard soaled in between the metals, the voltaic pile produced electrical

current. The metallic conducting;- arc was used to carry the electricity over a greater

distance. Alessandro Volta's voltaic pile was the first "wet cell battery" that produced a

reliable, steady current of electricity.

1836 - Englishman, John F. Daniel invented the Daniel Cell that used two electrolytes:

copper sulfate and zinc sulfate. The Daniel Cell was somewhat safer and less corrosive

then the Volta cell.

1839 - William Robert Grove developed the first fuel cell, which produced electrical by

combining hydrogen and oxygen.

1839 to 1842 - Inventors created improvements to batteries that used liquid electrodes to

produce electricity. Bunsen (1842) and Grove (1839) invented the most successful.

1859 - French inventor, Gaston Planet developed the first practical storage lead-acid

battery that could be recharged (secondary battery). This type of battery is primarily used

in cars today.

KRUPANIDHI DEGREE COLLEGE Page | 11

WORKING CAPITAL MANAGEMENT

1866 - French engineer, Georges Leclanche patented the carbon-zinc wet cell battery

called the Leclanche cell. According to The History of Batteries: "George Leclanche's

original cell was assembled in a porous pot. The positive electrode consisted of crushed

manganese dioxide with a little carbon mixed in. The negative pole was a zinc rod. The

cathode was packed into the pot, and a carbon rod was inserted to act as a currency

collector. The anode or zinc rod and the pot were then immersed in an ammonium

chloride solution. The liquid acted as the electrolyte, readily seeping through the porous

cup and making contact with the cathode material. The liquid acted as the electrolyte,

readily seeping through the porous cup and making contact with the cathode material."

1868 - Twenty thousand of Georges Leclanche's cells were now being used with

telegraph equipment.

1881 - J.A. Thiebaut patented the first battery with both the negative electrode and

porous pot placed in a zinc cup.

1881 - Carl Gassner invented the first commercially successful dry cell battery (zinc

carbon cell).

1899 - Wald mar Jenner invented the first nickel-cadmium rechargeable battery.

1901 - Thomas Alva Edison invented the alkaline storage battery. Thomas Edison's alkaline

cell had iron as the anode material (-) and nickelic oxide as the cathode material (+).

1949 - Lew Urry developed the small alkaline battery in 1949. The inventor was working for

the Eveready Battery Co. at their research laboratory in Parma, Ohio. Alkaline batteries last

five to eight times as long as zinc-carbon cells, their predecessors.

1954 - Gerald Pearson, Calvin Fuller and Daryl Chapin invented the first solar battery. A

solar battery converts the sun's energy to electricity. In 1954, Gerald Pearson, Calvin Fuller

and Daryl Chapin invented the first solar battery. The inventors created an array of several

strips of silicon (each about the size of a razorblade), placed them in sunlight, captured the

free electrons and turned them into electrical current. Bell Laboratories in New York

announced the prototype manufacture of a new solar battery. Bell had funded the research.

The first public service trial of the Bell Solar Battery began with a telephone carrier system

(Americus, Georgia) on October 4 1955.

1964 - Duracell was incorporated.

KRUPANIDHI DEGREE COLLEGE Page | 12

WORKING CAPITAL MANAGEMENT

COMPANY PROFILE

INTRODUCTION

Incorporated in January 1947.

EXIDE is Asia’s largest exporter of batteries.

A veteran with 52 years of experience.

It has seven manufacturing units in India and five units apart from India.

It has corporate alumni of chloride group PLC, UK.

It provides 4.2 million SLI automotive batteries and 3 million industrial batteries with 300Ah

capacity.

Collaborated with shin- Kobe electric machinery ltd (part of Hitachi group), Japan and

Furukawa batteries, Japan.

It is a leader of South Africa traction batteries with 25% market shares.

EXIDE captured international market and got costumers like Hyundai, Mitsubishi, TATA,

Toyota, Hero, Honda, FIAT etc.

The company has subsidiaries in UK, Singapore and Srilanka.

It’s export span to eighteen countries across five continents in growing list of overseas

costumers.

The types of batteries manufactured by EXIDE are:

Automotive Batteries

Industrial Batteries

Submarine batteries

The two main manufacturing units of EXIDE which are present in all its manufacturing

plants are:

Automotive

VRLA (industrial)

It has products which has capacity ranging from 2.5Ah to 10,000Ah and more.

EXIDE also acquired the industrial/ manufacturing units of standard batteries ltd located at

Taloja & kanchurmarg (Maharashtra), Guindy (Tamil Nadu), and plant at Ahmednagar

(Maharashtra) from Cosepa Fiscal industries ltd as a going concern.

The manufacturing plants of EXIDE in India are:

KRUPANIDHI DEGREE COLLEGE Page | 13

WORKING CAPITAL MANAGEMENT

Shamnagar (West Bengal)

Chinchwad (Pune)

Haldia (West Bengal)

Hosur (Tamil Nadu)

Taloja (Maharashtra)

Ahmednagar (Maharashtra)

Bawal (Haryana)

The company’s Submarine batteries is mainly manufactured in the Pune manufacturing plant

It is the first company to design battery powered electrical boat and maintenance free

batteries, traction batteries for wheel chairs and flat plate batteries for automated guided

vehicles.

EXIDE today is a Rs 3606 crores power storage company.

HISTORY:

1916- Chloride Electric Storage Co. (CESCO) UK sets up trading operations in India as an

import house.

1946- First factory set up in Shamnagar, West Bengal.

KRUPANIDHI DEGREE COLLEGE Page | 14

WORKING CAPITAL MANAGEMENT

1947- Incorporated as Associated Battery Makers (Eastern) Limited on 31 January 1947

under the Companies Act.

1947- Incorporated Chloride International Limited (previously Exide Products Limited)

1969- Second factory at Chinchwad, Pune

1972- The name of the Company was changed to Chloride India Limited

1976- R&D Centre established at Calcutta

1981- Third factory at Haldia, West Bengal

1988- The name of the Company was changed to Chloride Industries Limited

1994- Technical collaboration with Shin Kobe Electric Machinery Co. Ltd. of Japan, a

subsidiary of the Hitachi Group.

1995- Chloride Industries Limited renamed Exide Industries Limited

1997- Fourth factory at Hosur, Tamil Nadu

1998- Acquisition of industrial/ manufacturing units of Standard Batteries Ltd located at

Taloja & Kanjurmarg (Maharashtra), Guindy (Tamil Nadu) and plant at Ahmednagar

(Maharashtra) from Cosepa Fiscal Industries Limited as a going concern.

1999- Acquired 51% Shareholding in Caldyne Automatics Ltd

2000- Acquisition of 100% stake in Chloride Batteries S E Asia Pvt Ltd., Singapore and 49%

stake in Associated Battery Manufacturers (Ceylon) Limited, Sri Lanka.

2003- Commissioned plant at Bawal, Haryana

2003- New joint venture in UK, ESPEX, with 51% holding.

2004- Associated Battery Manufacturers (Ceylon) Limited, Sri Lanka became a subsidiary

consequent to acquiring further 12.50% Equity holding.

2005- Investment in 50% shareholding of ING VYSYA Life Insurance Company Limited

2007- Caldyne Automatics Ltd becomes 100% subsidiary consequent to acquiring the

balance 49% shareholding.

2007- Investment with 26% shareholding in CEIL Motive Power Pty Ltd. A Joint Venture in

Australia.

2007- Acquired 100% stake in Tandon Metals Ltd.

2008- Acquired 51% stake in Lead Age Alloys India Ltd.

2009- Divestment of shareholding in CEIL Motive Power Pty Ltd.

2012- Acquisition of Inverter manufacturing facility at Roorkee, Uttarakhand

2012- Technical Collaboration with East Penn Manufacturing Co., USA

KRUPANIDHI DEGREE COLLEGE Page | 15

WORKING CAPITAL MANAGEMENT

2012- Acquisition of second Inverter manufacturing facility at Haridwar, Uttarakhand.

2012- Acquisition of balance 49% shares in ESPEX Batteries Limited, UK.

2013- Acquisition of remaining 26% shares of ING VYSYA Life Insurance Company adding

a total of 100% stake.

2014- ING VYSYA renamed as “EXIDE LIFE INSURANCE COMPANY LTD.

PRESENT STATUS

Largest manufacturers and exporter of batteries in Asia.

Developed vast range of batteries through research and developments and has number of

patents to its name

Manufacturing specific batteries for specific applications that tough the daily lives of

millions of people and costumers of India

Thus justifies the slogan “India moves on EXIDE”

WHY EXIDE INDIA?

1) CLAIM LEADERSHIP

EXIDE is a dominant player in the industrial battery segment. The company exports

batteries which have captured niches in south East Asian and European markets.

KRUPANIDHI DEGREE COLLEGE Page | 16

WORKING CAPITAL MANAGEMENT

2) GLOBAL QUALITY

Developed and produced accordingly to international standards and ISO9001, 14001

and ISO/ TS- 16949.

Longer warranty time.

Lower total cost of ownership.

3) MANUFACTURING STRENGTH

The only company with multi locational manufacturing units spread across country

and equipped with words largest and most advanced machineries.

4) OFFER WIDE RANGE OF BATTERIES

Products range cowering capacities from 2.5Ah to10,000Ah and more. Using the

latest technological input, we manufacture industrial batteries for the power, telecom,

infrastructure projects computer industries as well as the railways, mining and defense

sectors.

5) SOLUTION PROVIDER

EXIDE offers complete solution regarding equipment selection, battery sizing,

optimum room layout, installation, operation and maintenance. We offer lead acid batteries

from 2.5Ah to10,000Ah which no other companies in India offer wide range of capacity.

KRUPANIDHI DEGREE COLLEGE Page | 17

WORKING CAPITAL MANAGEMENT

6) EXPERIENCE

Over 52 years accumulated experience of research and development, manufacturing

field operations

7) R&D CENTER

Our R&D center, set up in 1976, is counted among the premier battery research

facilities in the world and is recognized by the department of scientific and industrial.

Research under ministry of science and technology, government of India.

8) SAFETY CONSCIOUS

Underwriters laboratories Inc. USA certifications for the products and available on

request.

KRUPANIDHI DEGREE COLLEGE Page | 18

WORKING CAPITAL MANAGEMENT

MANUFACTURING PLANTS OF EXIDE

MANUFACTURING STATE ESTABLISHED YEAR

PLANTS

Shamnagar West Bengal 1946

Chinchwad Pune 1969

Haldia West Bengal 1981

Hosur Tamil Nadu 1997

Taloja Maharashtra 1998

Ahmednagar Maharashtra 1998

Bawal Haryana 2003

EXECUTIVE COMMITTEE

Mr. G. Chatterjee

Mr. A. K. Mukherjee

Mr. Nadeem Kazim

Mr. Subir Chakraborty

Mr. Arun Mittal

Mr. Jitendra Kumar

Mr. Achim Luelsdorf

Mr. Arnab Saha

BOARD OF DIRECTORS

Mr. R. G. Kapadia, Chairman & Independent Director

Mr. R. B. Raheja ,Vice-Chairman & Non-Executive Director

Mr. P. K. Kataky, Managing Director & Chief Executive Officer (till April 30, 2016)

KRUPANIDHI DEGREE COLLEGE Page | 19

WORKING CAPITAL MANAGEMENT

Mr. G. Chatterjee, Managing Director & Chief Executive Officer (w.e.f May 01, 2016)

Mr. A. K. Mukherjee, Director- Finance & Chief Financial Officer

Mr. Nadeem Kazim, Director-HR & Personnel

Mr. Subir Chakraborty, Director-Automotive

Mr. Arun Mittal, Director-Industrial (w.e.f May 01, 2016)

Mr. Vijay Aggarwal, Independent Director

Ms. Mona N. Desai, Independent Director

Mr. Sudhir Chand, Independent Director

Mr. Bharat D. Shah, Independent Director

Mr. Nawshir H. Mirza, Independent Director

FACTORY PROFILE

Fourth factory

Established in 20th may, 1996

Manufacturing and operation started on June 1997

KRUPANIDHI DEGREE COLLEGE Page | 20

WORKING CAPITAL MANAGEMENT

It manufactures two type of batteries

Automotive batteries

Industrial batteries (VRLA)

Floor space: 50,000 sq.

Industrial plant

VRLA plant inauguration- April 1997

VRLA commercial production- June 1997

ISO 9001 certification- October 1998

UL certification- December 2000

Automotive plant

Auto project commenced- October 1997

Auto plant inauguration- July 1998

Auto new plant project started- February 2000

New plant inauguration- December 2000

NATURE OF BUSINESS CARRIED

Exide HOSUR plant is the fourth factory for Exide industry with a turnover of 6900

crores in the year 2015-16. It is found in 1997.It has total land area of 74.5 of which 42% is green

zone. HOSUR Exide plant is the more productive unit. It has been the two productive plants like

Auto and VRLA type batteries.

Auto plant batteries are used for car, truck, and tractor.

VRLA plant batteries are used for railways, ship.

Exide uses latest world class manufacturing technology to produce batteries for the

above applications. Its factories have all the modern equipment necessary to manufacture world class

products. It also sources its components from the best battery component in the world. The various

batteries are

Automotive Batteries

Industrial Batteries

Submarine Batteries

KRUPANIDHI DEGREE COLLEGE Page | 21

WORKING CAPITAL MANAGEMENT

EXIDE HOSUR- DREAM

To become a formidable global enterprise through manufacturing excellence.

FOCUS OF EXIDE- HOSUR

Quality

Productivity

Cost

Delivery

Safety and cleaner environment

Highly motivated team

Fast response (before and after sales)

Long lasting term costumer relationship

VISION

Providing credible value addition to customers, employees and shareholders while

simultaneously being recognized by society as a responsible corporate citizen. In addition, achieving

operational excellence while addressing and taking steps towards environmental protection.

MISSION

Strive to carefully balance the interest of all stakeholders; to fulfill aspirations of the

employees and to passionately pursue excellence without deviating from our core values.

CORE VALUES

Customer Orientation

Personal Integrity and Commitment

KRUPANIDHI DEGREE COLLEGE Page | 22

WORKING CAPITAL MANAGEMENT

Teamwork and Mutual Support

Employee Development and Involvement

Striving for Excellence

Management by Processes and Facts

Responsible Corporate Citizenship

OBJECTIVES AND GOALS OF THE COMPANY

To modernize , upgrade and improve facilities or higher production and productivity

To achieve better Quality in Products.

To Strengthen the Marketing Organization to effectively Compete in National and

international markets.

To get ISO certifications

To maintain and developed highly motivated human Resources to achieve Professional

competence and ensure career development of its work force.

To maintain Market Shares in Industry.

AWARDS/ CERTIFICATES AND RECOGNITION

Exide wins CFO of the year award in automotive and auto-ancillary category from CNBC-

TV18

CII Productivity Award -1ST Prize in category “A” for Significant Improvement in

Productivity

Company’s Plant at Hosur, Tamilnadu is an ISO-9001, ISO / TS-6949 and ISO-14001

certified by TUV-NORD of Germany.

Delivery and quality certificate from Toyota in 2002

Developing and improving quality of batteries by reducing lead time of suppliers from TVS

in 2002

100 PPM quality commitment award from APC 2003

100 PPM award from Hyundai in 2003

KRUPANIDHI DEGREE COLLEGE Page | 23

WORKING CAPITAL MANAGEMENT

100 PPM award from OEM customer American Power Corporation –January 2003

Quality award from OEM customer Toyota - April 2003 & April 2004

Safety award from Government of Tamilnadu - April’03

100 PPM award from OEM customer Hyundai - June’03

Zero PPM Award from OEM customer Toyota – April’04

Zero PPM award from Toyota in 2004

Green award from OEM customer Toyota - April’04

Best Quality supplier award from OEM customer Toyota – April’05

Zero PPM award from OEM customer Toyota- April’05

Quality Delivery Award from OEM customer Toyota - April’05

First Prize in Best Garden Competition (Industrial Category) awarded by Mysore

Horticulture Society – 2005

Leadership and Excellence Award in Safety , Health & Environment by CII –2006

Indian Manufacturing Excellence – “Gold” Award –for Automotive Ancillary Category from

Frost & Sullivan in 2006

CII-EXIM Bank Award for Strong Commitment to Excel by CII in 2006

Best quality award from Toyota in 2007

Teri corporate environmental award in 2007(second best)

CII business excellence award in 2007

"Exide, Haldia factory gets TPM award for Category A, 2008, from Japan Institute of Plant

Maintenance"

CII Quality Award – Certificate of Appreciation for Commendable effort in the area of Total

Quality at the CII(ER) Quality Award 2008-09

At the CII (Eastern Region) awards ceremony in Kolkata for 08-09 Exide won

Zero PPM & best Kaizen trophy from M/s Toyota in 2009

Good IR award from ministry of labor, Tamilnadu in 2009

KRUPANIDHI DEGREE COLLEGE Page | 24

WORKING CAPITAL MANAGEMENT

Best support award from m/s Hyundai and m/s Renault Nissan in 2010

Safety award from chief inspector of factories, Tamilnadu in 2010

JIIPM TPM award in 2010 (category A)

Quality circle award from M/s Toyota in 2011-12

Par- excellence & excellence award from CCQC & NCQC in 2012-13

1st prize in quality Kaizen competition from M/s JCB & M/s M&M in 2013

Winner of EFY award in the category SMF batteries in 2005-13

Central Excise award “top tax payer” in 2013-14

Green tech environment award in 2014

Quality improvement award from Hyundai in 2004

CII-ITC Award 2016 for Commendable Achievement in SCM Sustainability

Golden Peacock Award for Excellence in Corporate Governance 2016

Manufacturing Today Award 2016

Greentech Safety Award 2016

Golden Peacock National Quality Award 2016

NCQC Excellence Awards - 2015-16

RCQC Excellence Awards - 2015-16

Frost & Sullivan Sustainability 4.0 Awards - 2016

PRODUCTION DEPARTMENT PRINCIPLE

“TO ACHIEVE ZERO DEFECTS”

In production area they are using many process to produce a battery, some process

are grid casting, small parts casting, assembling the parts, acid filling, heat sealing, pole bearing, air

leakage testing & charging and testing.

KRUPANIDHI DEGREE COLLEGE Page | 25

WORKING CAPITAL MANAGEMENT

WORK FLOW MODEL

KRUPANIDHI DEGREE COLLEGE Page | 26

WORKING CAPITAL MANAGEMENT

BRIEF OUTLINE OF THE PROCESS OF MANUFACTURE OF VALUE

REGULATED LEAD ACID BATTERIES AND AUTOMOTIVE BATTERIES.

The basic raw material for manufacturing a lead acid battery & automotive battery (a

captive rechargeable source of energy) is lead. The essential steps for manufacture are as follows.

1) Alloy Blending

2) Grid costing & Ageing

3) Oxide Manufacturing

4) Paste Mixing, Pasting and Curing

5) Drying

6) Plate parting and Lug Brushing (Plate Cleaning or Plate Finishing)

7) Assembly

8) Charging

9) Final Assembly

QUALITY POLICY OF THE COMPANY

KRUPANIDHI DEGREE COLLEGE Page | 27

WORKING CAPITAL MANAGEMENT

The aim of the company is to always provide satisfaction to customers.

The company will develop design, produce and market products and services that cater

continuously to the needs and expectation of customer and succeed in gaining/retaining a

competitive edge.

A quality system meeting international standards will be implemented and maintained.

Procedures and processes shall be standardized and effective control systems instituted to

eliminate variability due to non-conformance.

The standards and system shall be continually reviews and up graded audits and management

reviews shall be carried out.

Human resources will be developed through planned and structured training and

development Programmes to be conducted on a reader basis.

T P M POLICY

ENVIRONMENT POLICY

It is the policy of the company to:

1. Minimize the adverse impact of our activities, products and service by implementing an

environmental management system.

2. Prevent pollution through waste minimization at source, recovery / treatment of emission

and releases conservation of energy, recycling & optimum use of resources.

3. Continuously improve our environmental performance through setting and reviewing and

associate objectives and targets and periodic evaluation.

4. Comply with applicable legal requirements and other requirements related to our

environmental aspects.

5. Communicated all interested practice and all people working for or on behalf of our

organization.

KRUPANIDHI DEGREE COLLEGE Page | 28

WORKING CAPITAL MANAGEMENT

PRODUCT PROFILE

For cars, Jeeps and commercial vehicles,

1. Automotive batteries

Passenger cars, two wheelers to tractors,

2. Heavy duty batteries For trucks and tractors

3. Light weight batteries For wireless transmission batteries

4. Transaction batteries For material handling equipment

5. Train lighting cells For railway coaches

For telecommunications, telephone,

6. Stationary batteries

Emergency lighting

For defense Requirements Company

Manufacturers, two or three submarine

7. Submarine batteries

batteries a year, for new generation

Submarine to the Indian navy

AREA OF OPERATION

Exide industrial limited manufacturing and distributing the batteries in globally, It

has National and regional customers where the activities takes place according to the order given by

customers that to the legal right. The distribution net work is as follows

COMPETITORS INFORMATION

The company faces competition on two fronts. It faces competition from new player

in the organized sector who is focusing on advertising and publicity for promoting their brands. The

company also faces competition from low cost products from the unorganized sector. There are

many firms or agencies dealing with batteries. They produces, markets the product. EXIDE

industries ltd facing a huge competition from companies like:

AUTOMATIVE BATTERIES INDUSTRIAL BATTERIES

KRUPANIDHI DEGREE COLLEGE Page | 29

WORKING CAPITAL MANAGEMENT

PANASONIC AMRAJA

AMARON HBL

WIPRO STAR

MICROTEX NED ENERGY SYSTEM

AMCO-YUASA KIRL OSKAR

PRESTOLITE PANASONIC

OKAYA BB-CHINA

VARTA ROCKET-KOREA

BRANDS OF EXIDE

CHLORIDE

INDEX

DYNEX

Standard Furukawa(sf sonic)

JUPITER

CONREX

CHAMPION

LITTLE CHAMP

BOSS

MAJOR CUSTOMERS

KRUPANIDHI DEGREE COLLEGE Page | 30

WORKING CAPITAL MANAGEMENT

AUTOMATIVE BATTERIES INDUSTRIAL BATTERIES

HYUNDAI MOTOROLA

HMT LTD. ERICSSON

MARUTI EMERSON

TATA SIEMENS

TOYOTA DUBAS

BAJAJ AUTO BHEL

FIAT BSNL

HERO VSNL

HONDA BEL

PIAGGO NTPC

ESCORTS GAIL

MAHINDRA ABB

ASHOK LEYLAND GODREJ

GENERAL MOTORS KPCL

SWARAJ MAZADA INDIAL RAILWAYS

MITSUBISHI MOTORS LUCENT TECHNOLOGY

JOHN DERE TVS ELECTRONICS

EICHER

MNC’S

KRUPANIDHI DEGREE COLLEGE Page | 31

WORKING CAPITAL MANAGEMENT

ORGANIZATIONAL STRUCTURE

EXECUTIVE CHAIRMAN

M D & CEO

DIRECTOR (INDUSTRIAL)

CHIEF OPERATING MANAGER

PRODUCTION PRODUCTION PERSONNEL ACCOUNTS MATERIAL CUSTOMER SUPPORT

AUTOMOTIVE INDUSTRIAL SERVICE

HEAD HEAD PRODUCTION HEAD PERSONNEL HEAD HEAD HEAD CUSTOMER

PRODUCTION INDUSTRIAL ACCOUNTS MATERIAL SUPPORT SERVICE

AUTOMOTIVE

MANAGER MANAGER ASSISTANT ASSISTANT ASSISTANT ASSISTANT

MANAGER MANAGER MANAGER MANAGER

ASSISTANT ASSISTANT

MANAGER MANAGER

KRUPANIDHI DEGREE COLLEGE Page | 32

WORKING CAPITAL MANAGEMENT

INFRASTRECTURAL FACILITIES

The Exide has eight manufacturing plants producing world class products. Exide

factories are located strategically around the country to provide logistic support for its production of

over five million batteries per annum.

Each of these factories is equipped with state of the art equipment sourced from the

best battery making machinery manufacturers in the world. Exide, due to its strong roots with the

erstwhile chloride group has access to the best manufacturing practices in the field of lead Acid

Batteries.

A technology tie up with Shin Kobe the makers of world class Hitachi VRLA

batteries has given Exide the technological edge in maintenance free catteries. Other strategic

technology agreement with Furukawa, Japan and Oldham, U, K. has given Exide competitive edge

in proving the most reliable solutions for packaged power.

Environmental policy

Safety measures facilities

Medical facilities

Effluents training

Transportation facilities

Canteen facilities

FUTURE GROWTH AND PROSPECTUS

To further expand the business to other regions of Karnataka, Tamil Nadu and Andhra

Pradesh.

To set up a sophisticated research and development so that the company may have its

own new styles and designs of products that suits the modern fast moving life style.

Objectives and Goals of Company

To modernize , upgrade and improve facilities or higher production and productivity

KRUPANIDHI DEGREE COLLEGE Page | 33

WORKING CAPITAL MANAGEMENT

To achieve better Quality in Products.

To Strengthen the Marketing Organization to effectively Compete in National and

international markets.

To get ISO certifications

To maintain and developed highly motivated human Resources to achieve Professional

competence and ensure career development of its work force.

To maintain Market Shares in Industry.

CSR ACTIVITIES OF EXIDE

eradicating hunger, poverty and malnutrition, (promoting health care including preventive

health care) and sanitation including contribution to the Swach Bharat Kosh set-up by the

Central Government for the promotion of sanitation and making available safe drinking water

promoting education, including special education and employment enhancing vocation

skills especially among children, women, elderly, and the differently abled and livelihood

enhancement projects

promoting gender equality, empowering women, setting up homes and hostels for women

and orphans; setting up old age homes, day care centers and such other facilities for senior

citizens and measures for reducing inequalities faced by socially and economically backward

groups

enduring environmental sustainability, ecological balance, protection of flora and fauna,

animal, welfare, agro-forestry, conservation of natural resources and maintaining quality of

soil, air and water including contribution to the Clean Ganga Fund setup by the Central

Government for rejuvenation of river Ganga.

protection of national heritage, art and culture including restoration of buildings and sites of

historical importance and works of art; setting up public libraries; promotion and

development of traditional arts and handicrafts

Measures for the benefit of armed forces veterans, war widows and their dependants.

Training to promote rural sport, nationally recognized sports, Paralympics sports and

Olympic sports

KRUPANIDHI DEGREE COLLEGE Page | 34

WORKING CAPITAL MANAGEMENT

Contribution to the Prime Minister’ National Relief Fund or any other fund set up by the

Central Government for socio - economic development and relief and welfare of the

Scheduled Castes, the Scheduled Tribes, other backward classes, minorities and women

Contribution or funds provided to technology incubators located within academic

institutions which are approved by the Central Government

Rural development projects

Any other projects or activities as may be approved by the Central Government pursuant to

section 135 of the Companies Act, 2013, from time to time

SWOT ANALYSIS

S-Strengths:

EXIDE is a super brand

It has wide distribution network

Appropriate infrastructure for condition of training

Partnership with various technical & management institution for providing a continuous

supply of fresh graduate

Streamlined system of recruitment

Providing the necessary welfare facilities for the employees in the comfort zone &

increasing the retention level of the employees

IR/LR relation very conductive for the smooth functioning of the unit

W-Weakness:

Difficult to change to an alternative line production with the existing machinery

High employee turnover

KRUPANIDHI DEGREE COLLEGE Page | 35

WORKING CAPITAL MANAGEMENT

Lack of clarity and transparency in upward/down ward communication.

Evaluation of effectiveness of training programmers being imparted.

No clear job description for various levels resulting in dual reporting relationships.

Performance appraisal system: its approach, effectiveness acceptability.

Effectiveness of organization health study.

O-Opportunities:

Opportunity to expand globally

To have in-house online dilution plant for sulphuric acid. This will not only reduce the cost

of acid procurement but also will help us to consume the recovered acidic water from plate

washing thereby achieving reduction in effluent generation.

To convert the accumulated calcium sulphate solid sludge to useful products in construction

industry with the help of IISc Bangalore.

Further reduction in tank formation by increasing the jar formation of VRLA batteries.

To start using rain water in process after necessary treatment. At present we are this only for

the green belt development. Storage caexidity of rain water reservoir is 30000KL.

To extend green belt in additional to hectares.

T-Threats:

Fast changing consumer’s tastes & preferences

Liberalization policy of the government of India

Fast changing market conditions

High costs price in view of overheads

Importing components at the low cost from china

Increasing competition (Nationality & Globally)

Unfavourable duty structure

Slow growth rate in profits expected.

KRUPANIDHI DEGREE COLLEGE Page | 36

WORKING CAPITAL MANAGEMENT

PART- 4

WORKING CAPITAL

MANAGEMENT

KRUPANIDHI DEGREE COLLEGE Page | 37

WORKING CAPITAL MANAGEMENT

CONCEPT OF WORKING CAPITAL

Working capital may be regarded as the lifeblood of a business. Working capital is

major important to internal and external analysis because of its close relationship with the current

day to day operations of the business.

Working capital defined as the excess of current assets over current liabilities and

provisions. It is concerned with the problems that arise in attempting to manage the current assets,

the current liabilities and the interrelationship that exist between them.

Working capital represents the total of all current assets, where the current liabilities

and provisions exceeds assets the difference is referred to has a negative working capital. This

situation does not generally exit in a business firms because this is generally a situation of crisis.

At the beginning of the business venture cash is provided by owners and lenders. A

part of this cash is invested in tools, machinery, furniture, equipment, building and other forms of

fixed assets which are not be sold during the normal course of business. The remaining cash is used

as a working capital to meet the current requirement of the business enterprise such as purchase of

services, raw materials or merchandise.

NATURE OF WORKING CAPITAL

Working capital management is concerned with the problems that arise in

attempting to manage the current assets, current liabilities and provisions.

CURRENT ASSETS

The term current assets refers to those assets which in the ordinary course of

business can be turned into cash within one year without undergoing a depreciation in the value and

without disrupting the operating of the firm.

CURRENT ASSETS INCLUDE:

Cash and bank balance

Investments

KRUPANIDHI DEGREE COLLEGE Page | 38

WORKING CAPITAL MANAGEMENT

Fixed deposits with bank

Pre paid expenses

Advance in payment for tax

Stock in process including semi finished goods.

CURRENT LIABILITIES

The term current liabilities are those liabilities which are intended at their inception

to be paid in the ordinary course of business or within one year out of the current assets or earnings

of the concern.

CURRENT LIABILITIES INCLUDE:

Unsecured loans

Provision for taxation

Sales tax dividends

Liabilities fox expenses

Provision fund dues.

NEED FOR WORKING CAPITAL:

The basic objective of the financial management is to maximize shareholder wealth.

This is possible only when company earns sufficient profit. The amount of such profit largely

depends upon the magnitude of the sales. However sales do not convert into cash instantaneously.

There is always time gap between the sales of goods and the receipt of cash. Working capital is

required for this period in order to sustain the sales activity. In case adequate working capital is not

available for this period, the company will not be in a position to sustain the sales since it may not be

in a position to purchase raw materials, pay wages and other expenses required for manufacturing

the goods to be sold.

KRUPANIDHI DEGREE COLLEGE Page | 39

WORKING CAPITAL MANAGEMENT

The goal of working capital management is to manage the firm’s current assets and

current liabilities in such way that a satisfactory level of working capital is maintained.

TYPES OF WORKING CAPITAL

WORKING CAPITAL

NET WORKING PERMANENT BALANCE SHEET NEGATIVE

CAPITAL WORKING CAPITAL WORKING CAPITAL WORKING CAPITAL

GROSS WORKING TEMPORARY CASH WORKING

CAPITAL WORKING CAPITAL CAPITAL

1. NET WORKING CAPITAL:

Net working capital is the difference between current assets and current liabilities.

The concept of net working capital enables a firm to determine how much amount is left for

operational requirements.

2. GROSS WORKING CAPITAL:

Gross working capital is the amount of funds invested in the various components of

current assets.

ADVANTAGES OF GROSS WORKING CAPITAL:

Financial managers are profoundly concerned with current assets;

It enables a firm to realize the greatest return on investments;

It helps in fixation of various areas of financial responsibilities.

KRUPANIDHI DEGREE COLLEGE Page | 40

WORKING CAPITAL MANAGEMENT

3. PERMANENT WORKING CAPITAL:

Permanent working capital is the minimum amount of current assets which is

needed to conduct a business even during the dullest season of the year. This amount varies from

year to year, depending upon the growth of a company and the stage of the business cycle which it

operates. It is the amount of fund required to produce the goods and services which are necessary to

satisfy demand at a particular point. It represents the current assets which are required on a

continuing basis over the entire year.

CHARACTERISTICS OF PERMANENT WORKING CAPITAL:

It is classified on the basis of the time factor;

Its size increases with the growth of business operation.

4. TEMPORARY OR VARIABLE WORKING CAPITAL:

It represents the additional assets which are required at different times during the

operating year-additional inventory, extra cash etc., seasonal working capital is the additional

amount of current assets particularly cash, receivables and inventory which are required during the

more active business season of year.

5. BALANCE SHEET WORKING CAPITAL:

Balance sheet working capital is one which is calculated from the items appearing in

the balance sheet. Gross working capital, which is represented by the excess of current assets, and

net working capital, which represented by the excess of current assets over current liabilities, are

examples of the balance sheet working capital.

6. CASH WORKING CAPITAL

Cash working capital is one which is calculated from the items appearing in the

profit and loss account. It shows the real flow of money or value at a particular time and is

considered to be the most realistic approach in working capital management. It is the basis of the

KRUPANIDHI DEGREE COLLEGE Page | 41

WORKING CAPITAL MANAGEMENT

operation cycle concept which has assumed a great importance in financial management in recent

years. The reason is that the cash working capital indicates the adequacy of the cash flow, which is

an essential pre-requisite of a business.

7. NEGATIVE WORKING CAPITAL:

Negative working capital emerges when current liabilities exceed current assets.

Such a situation is not absolutely theoretical, and occurs when a firm is nearing s crises of some

magnitude.

FACTORS DETERMINING WORKING CAPITAL:

Nature of industry

Cash requirements

Nature of business

Manufacturing time

Volume of sales

Inventory turnover

Receivable turnover

Value of current assets

Variations in sales

Credit control

Cash reserves

Changes in technology

Firm’s policies

Attitude of risk

KRUPANIDHI DEGREE COLLEGE Page | 42

WORKING CAPITAL MANAGEMENT

i. NATURE OF INDUSTRY:

The composition of assets is a function of the size of a business and the industry to

which it belongs. Small companies have smaller proportions of cash, receivables and

inventory than large companies.

ii. CASH REQUIREMRNTS:

Cash is one of the current assets which is essential for successful operations of the

production cycle. Cash should be adequate and properly utilized. It would be very expansive

to hold expensive cash. A minimum level of cash is always required to keep the operations

going. Adequate cash is also required to maintain good credit relation.

iii. NATURE OF BUSINESS:

The nature of business is an important determinant of the level of the working

capital. Working capital requirements depends upon the general nature or type of business

iv. MANUFACTURING TIME:

The level of working capital depends upon the time requirements to manufacture

good manufacturing. If the time is longer, the size of working capital is great. Moreover, the

amount of working capital depends upon inventory turnover and the unit cost of the goods

that are sold.

v. VOLUME OF SALES:

This is the most important factor affecting the size and components of working

capital. A firm maintains current assets because they are needed to support the operational

activate which result in sales. The volume of sales and size of the working capital are directly

related to each other. As the volume of sales increases, there is an increase in the investment

of working capital-in the cost of operations, in inventories and receivables.

vi. RECEIVABLE TURNOVER:

It is necessary to have an effective control of receivables. A prompt collection of

receivables and good facilities for setting payables result into low working capital

requirements.

KRUPANIDHI DEGREE COLLEGE Page | 43

WORKING CAPITAL MANAGEMENT

vii. VALUE OF CURRENT ASSETS:

A decrease in the real value of current assets as compared to their book value

reduces the size of working capital. If the real value of currents increases, there is an increase

in working capital.

viii. VARIATIONS IN SALEA:

A seasonal business requires the maximum amount of working capital for a

relatively short period of time.

ix. CREDIT CONTROL:

Credit control include such factors as the volume of credit sales, the collection policy

etc. With a sound credit control policy, it is possible for a firm to improve its cash inflow.

x. CASH RESERVES:

It would be necessary for a firm to maintain some cash reserves to enable it to meet

contingent disbursements. This would provide a buffer against abrupt shortage in cash flows.

xi. CHANGES IN TECHONOLOGY:

Technological developments related to the production process have a sharp impact

on the need for working capital.

xii. FIRM’S POLICES:

These affect the levels of permanent and variable working capital. Changes in credit

policy, production policy etc, are bound to affect the size of the working capital.

xiii. ATTITUDE OF RISK:

The greater the amount of working capital, the lower is the risk of liquidity.

KRUPANIDHI DEGREE COLLEGE Page | 44

WORKING CAPITAL MANAGEMENT

METHODS OF ESTIMATING WORKING CAPITAL:

CONVENTIONAL METHOD:

According to conventional method, cash inflows and outflows are matched with

each other. Greater emphasis is laid on liquidity and greater importance is attached to current

ratio, liquidity ratio etc. which pertain to the liquidity of a business.

OPERATING CYCLE METHOD:

In order to understand what gives to difference in the amount of timing of cash flows

.we should first know the length of time which is required to convert into resources,

resources into final product, the final product into receivables back into cash.

THERE ARE FOUR MAIN COMPONENTS IN THE OPERATING CYCLE:

The cycle starts with free capital in the form of cash and credit, followed by investment in

materials, manpower and the services;

Production phase;

Storage of the finished products terminating at the time finished product is sold;

Cash or accounts receivable collection period, which results in, and ends at the point of

Disinvestment of the free capital originally committed.

New free capital then becomes available for productive Re-investment. When new

liquid capital becomes available for recommitment to productive activity, a new operating cycle

begins.

This method is more dynamic and refers to working capital in a realistic way.

Different components of working capital are directed scientifically in order that the fullest utilization

of plant and machinery may be made. This method helps in increasing the profitability of a business.

This enables a company to maintain its liquidity and preserve that liquidity through profitability.

KRUPANIDHI DEGREE COLLEGE Page | 45

WORKING CAPITAL MANAGEMENT

ADQUACY OF WORKING CAPITAL:

It protects a business from the adverse effect of shrinkage in the values of current assets.

It is possible to pay all the current obligations promptly and to take advantage of cash discounts.

It enables a company to extend favorable credit terms to customers.

There may be operating losses or decreased retained earnings.

Current funds may be invested in non current assets

There may be an unwise dividend policy

INADEQUACY OF WORKING CAPITAL:

A company may not be able to take advantage of cash discount facilities.

It is not possible to utilize production facilities fully for the want of working capital.

A company will not be able to pay its dividends because of the non-availability of funds.

A company may not be able to take advantage of profitable business opportunities.

Its low liquidity may lead to low profitability in the same way as low profitability results in

low liquidity.

The credit worthiness of the company is likely to be jeopardized because of the lack of

liquidity.

A company may have borrowed funds at exorbitant rates of interest.

DANGERS OF EXCESSIVE WORKING CAPITAL:

A company may keep very big inventories and tie up its funds necessarily.

A company may be tempted to overtrade and lose heavily.

There may be a imbalance between liquidity and profitability.

A company may enjoy high liquidity and, at the same time, suffer from low profitability.

KRUPANIDHI DEGREE COLLEGE Page | 46

WORKING CAPITAL MANAGEMENT

SOURCES OF WORKING CAPITAL:

SOURCES OF WORKING

CAPITAL

LOANS FROM FUNDS THROUGH

FLOTING OF ISSUE OF ACCEPTING

FINANCIAL INTERNAL

DEBENTURES SHARES PUBLIC DEPOSITS

INSTUTIONS FINANCING

LOANS FROM FINANCIAL INSTITUTIONS:

The option is normally ruled out, because financial institutions do not provide

finance for working capital requirements. Further, this facility is not available to all

companies. For small companies this option is not practical.

FLOATING OF DEBENTURE:

The probability of a successful floatation of debentures seems to be rather meager.

In the India capital market, floating of debenture has still to gain popularity. Debenture issues

of companies in private sector not associated with certain reputed and well-known groups

generally fail to attract investors to invest their funds in companies. In this context, the mode

of raising funds by issuing convertible debentures/bonds is also considered, which may

attract a number of investors.

ACCEPTING PUBLIC DEPOSITS:

The next alternative is public deposits. The issue of tapping public deposits is

directly related to the image of the company seeking to invite public deposits. But the

problem of low profitability in many industries is very common.

ISSUE OF SHARES:

KRUPANIDHI DEGREE COLLEGE Page | 47

WORKING CAPITAL MANAGEMENT

With a view to financing additional working capital needs, issue of additional shares

could be one way to raise the equity base. Indian companies find themselves in a bad shape

in this context too. Low profit margins as well as lack of knowledge about the company

make the success of a capital issue very dim.

RAISING FUNDS BY INTERNAL FINANCING:

Raising equity by operational profits poses problems for many companies, because

prices of their end- products are controlled and do not permit companies to earn profits

sufficient to pay reasonable dividend and retain profits to cover margin money requirements

to finance additional working assets. Still, a largely feasible solution lies in increasing

profitability through cost reduction measures managing the cash operating cycle,

rationalizing inventory stocks and so on.

FORMAT OF WORKING CAPITAL IN EXIDE INDUSTRIES LTD:

Format of working capital means the study of elements of current assets and current

liabilities. The main elements of current assets and current liabilities in Exide Industries ltd are:

CURRENT ASSETS:

Inventories

Sundry debtors

Cash and bank balance

Loans and advances

CURRENT LIABILITIES:

Liabilities

Provisions

Tools of Financial Analysis:

KRUPANIDHI DEGREE COLLEGE Page | 48

WORKING CAPITAL MANAGEMENT

Following are the important methods/tools employed for studying and analyzing

financial statements of EXIDE INDUSTREIES, HOSUR are:

1) Ratio Analysis.

2) Statement of changes in working capital.

1) Ratio Analysis:

The ratio analysis is the one of the most powerful tools of financial analysis. It is the

process of establishing and interpreting various ratios (quantities relationship between figures and

groups of figures). It is with the help of ratios that the financial statement can be analyzed more

clearly and decision made from such analysis.

Meaning of ratio:

A ratio is a sample arithmetical expression of the relationship of one number to

another. It may are defined as the indicated quotient of two mathematical expressions. According to

accountant’s Handbook by Wixon, Kell and Bedford, a ratio “is an expression of a quantitative

relationship between two numbers”. In simple language ratios is one number into another and can be

worked out by dividing one number into the other. A financial ratio is the relationship between two

accounting figures expressed mathematically.

Ratios provide clues to the financial position of a concern. These are the pointers or

indicators of financial strength, soundness, positions or weakness of enterprises. One can draw

conclusion about the exact financial positions of a concern with the help of ratios.

Use and significance of ratio analysis:

The ratio analysis is one of the most powerful tools of financial analysis. It is used as

a device to analyzed and interprets the financial health of enterprise. The use of ratios is not confined

to financial managers only. There are several parties interested in the ratio analysis for knowing the

financial position of a firm for different purpose. The suppliers of goods on credit, banks, financial

institution, investors, shareholders and management all make use of ratio analysis one can measure

the financial condition of a firm and can point out whether the condition is strong, good,

questionable or poor.

1. Managerial use of ratio analysis:

KRUPANIDHI DEGREE COLLEGE Page | 49

WORKING CAPITAL MANAGEMENT

Helps in decision-making:

Financial statement is prepared primarily for decision-making. But the information

provided in financial statement is not an end in itself and meaningful conclusion cannot be

drawn from these statements alone. Ratio analysis helps in making decision from the

information provided in these financial statements.

Helps in financial forecasting and planning

Ratio analysis is of much help in financial forecasting and planning. Planning

is looking ahead and the ratio calculated for a number of year’s work as a guide for future.

Helps in communicating:

The financial strength and weakness of a firm are communicated in a more

easy and understandable manner by the use of ratio. The information contained in the

financial statement is conveyed in a meaningful manner to the one for whom it is meant.

Thus ratios help in communication and enhance the value of the financial statement.

Helps in co-ordination:

Raito’s even help in co-ordination, which is of utmost importance in effective

business management. Better communication of efficiency and weakness of an enterprises

result in better coordination of the enterprises.

Helps in control:

Ratio analysis even helps in making effective control of the business. Standard ratio

can be based upon Performa financial statement and variance and division, if any, can be

found by comparing the actual with the standards so as to take a corrective action at the right

time.

2. Utility to shareholders:

An investor in a company will like to assess the financial position of the concern

where he is going to invest. Every investor’s first interest will be the security of his investment

and then a return in the form of dividend or interest. Long-term solvency ratios will help an

investor in assessing financial position of the concern. Profitability ratios, on the other hand will

KRUPANIDHI DEGREE COLLEGE Page | 50

WORKING CAPITAL MANAGEMENT

be useful to determine profitability positions. Ratio analysis helps an investor in making up his

mind whether present financial position of the concern warrants further investment or not.

3. Utility to creditors:

The creditors or suppliers extend short-term credit to the concern. They are

interested to know whether financial position of the concern warrants their payments at a

specified time or not. Current and acid test ratios will give an idea about the current financial

position of the concern.

4. Utility to government:

Government is interested to know the overall strength of the industry. Various

financial statement published by industrial units are used to calculate ratios for determine short

term, long term and overall financial position of the concern. Profitability index can also be

prepared with the help of ratios.

Types of ratios:

Several ratios, calculated from the accounting data, can be grouped into various

classes according to financial activity or function to be evaluated. People interested in financial

analysis are short and long term creditors, owner and management. Long-term creditors, on the other

hand, are more interested in the long-term solvency and profitability of the firm. Similarly, owners

concentrate on the firm’s profitability and financial positions. Management is interest in evaluating

every aspect of the firm’s performance. The ratios are listed as follows:

Current ratio

Quick ratio

Working capital turnover ratio

Current asset turnover ratio

Net profit ratio

Inventory turnover ratio

Inventory to current asset ratio

KRUPANIDHI DEGREE COLLEGE Page | 51

WORKING CAPITAL MANAGEMENT

Current asset to share holders fund ratio

Net working capital to current liability ratio

Inventory to working capital ratio

Fixed asset turnover ratio

Equity ratio

Fixed asset ratio

Return on share holders fund

Return on capital employed

Working capital turnover ratio

KRUPANIDHI DEGREE COLLEGE Page | 52

WORKING CAPITAL MANAGEMENT

PART- 5

DATA ANALYSIS &

INTERPRETATION

KRUPANIDHI DEGREE COLLEGE Page | 53

WORKING CAPITAL MANAGEMENT

1. CURRENT RATIO:

The current ratio is a liquidity ratio that measures a company's ability to pay short-

term and long-term obligations. To gauge this ability, the current ratio considers the

current total assets of a company (both liquid and illiquid) relative to that company's

current total liabilities.

FORMULA:

CURRENT AS S ETS

CURRENT RATIO=

CURRENT LIABILITIES

TABLE-1

YEAR CURRENT ASSETS CURRENT LIABILITIES CURRENT

(RS in crores) (RS in crores) RATIO

2011-12 2430.16 1074.91 2.26

2012-13 3390.17 1820.28 1.86

2013-14 3529.44 1683.40 2.10

2014-15 3720.39 1719.09 2.16

2015-16 4177.26 2028.35 2.06

KRUPANIDHI DEGREE COLLEGE Page | 54

WORKING CAPITAL MANAGEMENT

GRAPH-1:

CURRENT RATIO

5

4.5

4

3.5

3

CURRENT RATIO

2.5

2

1.5

1

0.5

0

2011-12 2012-13 2013-14 2014-15 2015-16

ANALYSIS:

The current ratio in the year 2011-12 is 2.26, in the year 2012-13 is 1.86, in the year

2013-14 is 2.10, in the year 2014-15 is 2.16 and in the year 2015-16 is 2.06.

INTERPRETATION:

From the analysis done in the previous step, it is interpreted that the current ratio has

decreased in 2012-13 compared to 2011-12, again increased in the year 2013-14, again

increased in 2014-15 and again decreased in the year 2015-16.

KRUPANIDHI DEGREE COLLEGE Page | 55

WORKING CAPITAL MANAGEMENT

2. QUICK / LIQUID RATIO:

The quick ratio is a measure of how well a company can meet its short-term financial

liabilities, also known as the acid-test ratio. It is used to supplement the information given by

the current ratio.

FORMULA:

QUICK (¿)LIQUID ASSETS

QUICK RATIO=

CURRENT LIABILITIES

TABLE-2:

YEAR LIQUID ASSETS CURRENT LIABILITIES QUICK

(RS in crores) (RS in crores) ASSETS

2011-12 488.84 1074.91 0.45

2012-13 812.32 1820.28 0.44

2013-14 945.24 1683.40 0.56

2014-15 897.62 1719.09 0.52

2015-16 1016.15 2028.35 0.50

GRAPH-2:

KRUPANIDHI DEGREE COLLEGE Page | 56

WORKING CAPITAL MANAGEMENT

0.6

QUICK ASSETS

0.5

0.4

0.3

quick assets

0.2

0.1

0

2011-12 2012-13 2013-14 2014-15 2015-16

ANALYSIS:

The quick ratio in the year2011-12 is 0.45, in the year2012-13 is 0.44, in the year

2013-14 is 0.56, in the year 2014-15 is 0.52 and in the year 2015-16 is 0.50.

INTERPRETATION:

From the analysis done In the previous step, it is interpreted that the quick ratio has

decreased in the year 2012-13 compare to year 2011-12, again increased in the year 2013-14,

again decreased in the year 2014-15 and again decreased in the year 2015-16.

3. WORKING CAPITAL TURN OVER RATIO:

KRUPANIDHI DEGREE COLLEGE Page | 57

WORKING CAPITAL MANAGEMENT

The working capital turnover ratio is also referred to as net sales to working capital.

It indicates a company's effectiveness in using its working capital. The working capital

turnover ratio is calculated as follows: net annual sales divided by the average amount

of working capital during the same 12 month period.

FORMULA:

NET SALES

WORKING CAPITALTURNOVER RATIO=

NET WORKING CAPITAL

TABLE-3:

YEAR NET SALES NET WORKING WORKING

(RS in crores) CAPITAL CAPITAL

(RS in crores) TURNOVER

RATIO

2011-12 5318.67 1355.21 3.92

2012-13 6365.89 1569.89 4.05

2013-14 8308.85 1846.04 4.50

2014-15 9534.95 2001.30 4.76

2015-16 9479.44 2148.91 4.41

GRAPH-3:

KRUPANIDHI DEGREE COLLEGE Page | 58

WORKING CAPITAL MANAGEMENT

WORKING CAPITAL TURN OVER RATIO

5

4.5

3.5

3 WORKING CAPITAL TURN

OVER RATIO

2.5

1.5

0.5

0

2011-12 2012-13 2013-14 2014-15 2015-16

ANALYSIS:

In the year 2011-12 working capital turnover ratio is 3.92, in the year 2012-13 is

4.05, in the year 2013-14 is 4.50, in the year 2014-15 is 4.76 and in the year 2015-16 is 4.41.

INTERPRETATION:

From the analysis done In the previous step, it is interpreted that the working capital

turnover ratio has increased in the year 2012-13 compare to year 2011-12, again increased in

the year 2013-14, again increased in the year 2014-15 and again decreased in the year 2015-

16.

KRUPANIDHI DEGREE COLLEGE Page | 59

WORKING CAPITAL MANAGEMENT

4. CURRENT ASSET TURNOVER RATIO:

The asset turnover ratio is an efficiency ratio that measures a company's ability to

generate sales from its assets by comparing net sales with average total assets. In other

words, this ratio shows how efficiently a company can use its assets to generate sales.

FORMULA:

NET SALES

CURRENT ASSET TURNOVER RATIO=

CURRENT ASSETS

TABLE-4

YEAR NET SALES CURRENT CURRENT

(RS in crores) ASSETS ASSETS

(RS in crores) TURNOVER

RATIO

2011-12 5318.67 2430.16 2.19

2012-13 6365.89 3390.17 1.88

2013-14 8308.85 3529.44 2.35

2014-15 9534.95 3720.39 2.56

2015-16 9479.44 4177.26 2.27

GRAPH-4:

KRUPANIDHI DEGREE COLLEGE Page | 60

WORKING CAPITAL MANAGEMENT

CURRENT ASSET TURNOVER RATIO

3

2.5

2

CURRENT ASSET

1.5 TURNOVER RATIO

0.5

0

2011-12 2012-13 2013-14 2014-15 2015-16

ANALYSIS:

In the year 2011-12 current asset turnover ratio is 2.19, in the year 2012-13 is 1.88,

in the year 2013-14 is 2.35, in the year 2014-15 is 2.56 and in the year 2015-16 is 2.27.

INTERPRETATION:

From the analysis done in the previous step, it is interpreted that the current asset

turnover ratio has decreased in the year 2012-13 compare to year 2011-12, again increased in

the year 2013-14, again increased in the year 2014-15 and again decreased in the year 2015-

16.

5. STOCK TURNOVER RATIO/ INVENTORY TURNOVER RATIO:

KRUPANIDHI DEGREE COLLEGE Page | 61

WORKING CAPITAL MANAGEMENT

The inventory turnover ratio is an efficiency ratio that shows how effectively

inventory is managed by comparing cost of goods sold with average inventory for a period.

This measures how many times average inventory is "turned" or sold during a period.

FORMULA:

COST OF GOODS SOLD(NET SALES )

STOCK TURNOVER RATIO=

AVERAGE STOCK (INVENTORY )

TABLE-5

YEAR NET SALES AVERAGE STOCK STOCK TURN

(RS in crores) (RS in crores) OVER RATIO

2011-12 5318.67 1160.71 4.58

2012-13 6365.89 1407.39 4.52

2013-14 8308.85 1302.86 6.38

2014-15 9534.95 1646.36 5.79

2015-16 9479.44 1245.88 7.61

GRAPH-5

KRUPANIDHI DEGREE COLLEGE Page | 62

WORKING CAPITAL MANAGEMENT

STOCK TURN OVER RATIO

8

5

STOCK TURN OVER RATIO

4

0

2011-12 2012-13 2013-14 2014-15 2015-16

ANALYSIS:

In the year 2011-12 stock turnover ratio is 4.58, in the year 2012-13 is 4.52, in the year 2013-

14 is 6.38, in the year 2014-15 is 5.79 and in the year 2015-16 is 7.61.

INTERPRETATION:

From the analysis done in the previous step, it is interpreted that the stock turnover ratio has

decreased in the year 2012-13 compare to year 2011-12, again increased in the year 2013-14,

again decreased in the year 2014-15 and again increased in the year 2015-16.

6. NET PROFIT RATIO:

KRUPANIDHI DEGREE COLLEGE Page | 63

WORKING CAPITAL MANAGEMENT

The net profit percentage is the ratio of after-tax profits to net sales. It reveals the

remaining profit after all costs of production, administration, and financing have been

deducted from sales, and income taxes recognized.

FORMULA: