Professional Documents

Culture Documents

This Study Resource Was: Ak - Ic - Mock Exam Set A

Uploaded by

ArvinALOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

This Study Resource Was: Ak - Ic - Mock Exam Set A

Uploaded by

ArvinALCopyright:

Available Formats

AK_IC - MOCK EXAM SET A

1. Mr. Kho’s participating whole life insurance policy includes a waiver of premium for disability benefit.

During the period when premium payments are being waived under this provision, the cash value of

this policy will

a. increase and Mr. Kho will continue to receive policy dividends

b. decrease but Mr. Kho will continue to receive policy dividends

c. remain the same and Mr. Kho will continue to receive policy dividends

d. stop increasing for the term of the rider

2. An applicant wants to get a participating policy which will have the maximum cash available for

emergencies. Which of the following should he select?

a. loan value c. accumulated dividend

m

er as

b. extended term insurance d. paid-up addition

co

3. A whole life policy provides

eH w

o.

a. the highest level of savings for the insured within a specified term of years

b.

c. rs e

protection for life of the policyholder with premiums payable for a limited term of years

low cost protection only for a limited term of years with no savings

ou urc

d. protection with premiums payable for life and a low level of savings as an alternative

to continued protection in old age

o

4. A prospect tells you that he wants the highest coverage possible for the least annual cash outlay.

aC s

Would you offer him

vi y re

a. a whole life policy? c. a term policy?

b. an endowment policy? d. a 20-pay life policy?

5. A company can restrict its liability if death occurs as a result of an aviation accident. The aviation

ed d

exclusion clause usually applies to which of the following?

ar stu

a. anybody in an aircraft flight

b. only for pilots

c. anybody aboard an aircraft in flight who has duties aboard the aircraft

sh is

d. anybody in the aviation industry who works around or in the aircraft

Th

6. A Family Income Rider is specifically designed to

a. pay twice the face amount of the policy in the event of death

b. provide a monthly income from the date of death of the insured to some future date

specified in the contract

c. provide an income for the adjustment period immediately following death

d. provide a retirement income for the insured and his spouse

7. A prospect tells you that he wants to be insured for life but he does not want to pay premiums after

he retires at age 65. Would you offer him

a. a whole life policy? c. a 20-pay life policy?

b. an endowment policy? d. a life paid-up at age 65 policy?

Agency Training and Development Department Page 1

https://www.coursehero.com/file/44844580/356355495-ANSWER-KEY-IC-MOCK-EXAM-SET-A-pdfpdf/ ANSWER KEY_IC_MOCK A_V2

8. A prospect tells you that he wants to be insured at age 65 but he does not want to pay more than

the minimum possible level of premiums. Would you offer him

a. a whole life policy? c. a term policy?

b. an endowment policy? d. a life paid-up at age 65 policy?

9. A prospect tells you that he wants to be insured for life at the least annual cost until he dies. What

would you offer him?

a. a whole life policy c. a term policy

b. an endowment policy d. a 20-pay life policy

10. Limited payment life policies are called such because these policies

a. limit the conditions under which the policies are payable

m

b. shorten the period when benefits may be paid

er as

c. limit the period during which premiums are payable

co

d. limit the number of beneficiaries thereby minimizing problems of paying too many people

eH w

11. All of the following are correct statements except:

o.

a. rs e

premiums for whole life insurance are less than for endowment policies

ou urc

b. the cash value of a 20-year endowment policy are greater than those of a whole life policy

c. whole life insurance and endowment insurance serve different purpose

d. there is a higher risk element for the insurance company involved in connection with

o

endowment policies than with whole life policies

aC s

12. At the end of 25 years, which statement is true for a 25-Pay Life and is not true for a 25-Year

vi y re

endowment?

a. No further premiums are paid c. The sum insured is paid

b. The contract is terminated d. The insurance remains in force

ed d

ar stu

13. All of the following policies can be used to afford retirement income except:

a. endowment age 60 c. limited payment life

b. whole life d. term to age 65

sh is

14. A term policy provides

Th

a. the highest level of savings for the insured within a specified term of years

b. protection for the life of the policyholder with premiums payable for a limited term of years

c. low cost protection only for a limited term of years with no savings

d. protection with premiums payable for life and a low level of savings as an alternative to

continued protection in old age

15. Applicants for life insurance with moderate physical impairments are called sub-standard risks and

a. therefore cannot obtain life insurance in any company

b. may be insured at increased rates to compensate for the extra hazard

c. are issued policies without any non-forfeiture option

d. are required to pay premiums on an annual basis

Agency Training and Development Department Page 2

https://www.coursehero.com/file/44844580/356355495-ANSWER-KEY-IC-MOCK-EXAM-SET-A-pdfpdf/ ANSWER KEY_IC_MOCK A_V2

16. A policy requiring the payment of premiums through life, or until the cash value equals its face value

at age 100 is called

a. an income endowment policy c. an unlimited payment life

b. a limited pay life policy d. an ordinary life policy

17. A prospect tells you that he has a loan with a financial institution and he would like an insurance

company to pay it off if he dies, but, he is hard-up and he wants this coverage at the lowest possible

cost. Would you offer him

a. a whole life policy? c. a 20-pay life policy?

b. a term policy? d. a life paid-up at age 65 policy?

18. Which of the following statements is incorrect?

m

er as

a. The cash value of a whole life policy builds up at a slower rate than for a 20 year

co

endowment

eH w

b. The cash value of an endowment builds up faster than that of a limited pay life policy of the

same duration

o.

c. Because of its very short duration the cash value of a yearly renewable term policy

rs e

grows very fast

ou urc

d. The cash value in a permanent policy is guaranteed by the Company

19. In a child insurance policy, the Parent Waiver Clause is?

o

a. Double Indemnity Rider

aC s

b. Guaranteed Insurability

vi y re

c. Child Insanity Rider

d. Total Disability Waiver of Premium Rider

20. A person’s human economic value is defined as the

ed d

ar stu

a. total value of his physical assets

b. the amount of capital required to replace family income needs

c. total value of assets and any future earnings derived therefrom

d. total value of the individual’s tax contribution to the national economy

sh is

21. In order for life insurance premiums to be waived under a typical waiver of premium for disability

Th

clause, the disability of the insured person must be total and the disability must

a. be expected to continue until death

b. have continued for a specified period, such as six months

c. have been caused by illness of a chronic nature, not accident

d. have been caused by accident not by illness

22. Insurance provides protection against economic loss by enabling the policyowner to

a. transfer responsibility for the loss to others

b. take speculative risk to compensate for the loss

c. reduce the possibility of the occurrence of the event causing the loss

d. share the loss with others exposed to a similar risk

Agency Training and Development Department Page 3

https://www.coursehero.com/file/44844580/356355495-ANSWER-KEY-IC-MOCK-EXAM-SET-A-pdfpdf/ ANSWER KEY_IC_MOCK A_V2

23. Life insurance guarantees cash benefits for all of the following except

a. clean-up fund

b. family dependency period income

c. educational fund

d. mortgage

24. Participating life insurance policies are policies which

a. allow variation in the wording of certain provisions

b. provide for the distribution of dividends to the policyowner

c. develop profit which must be paid to stockholders

d. permit beneficiaries to exercise certain ownership rights during the lifetime of the insured

m

25. Non-productive agents in a company affect

er as

co

a. profit allowance c. mortality

eH w

b. risk sharing d. expense control

o.

26. All of the following are sources of underwriting information except:

rs e

ou urc

a. medical examination report

b. agent’s confidential report

c. government tax records

applicant’s personal appearance

o

d.

aC s

27. Under an endowment policy, if the person whose life is insured survives to the end of the period

vi y re

stated in the policy, the

a. policy will terminate without value

b. face amount will be paid

ed d

c. policy will automatically be converted to paid-up whole life policy

ar stu

d. the extended term insurance option will go into effect

28. When the death benefit of a policy is restricted in amount during the early years of the policy, this

restriction is known as

sh is

a. rate adjustment c. lien

Th

b. an increasing death benefit d. a subtractive clause

29. In theory, endowment insurance is a combination of

a. level term and pure endowment

b. increasing term and whole life insurance

c. level term and whole life

d. increasing term and decreasing whole life

Agency Training and Development Department Page 4

https://www.coursehero.com/file/44844580/356355495-ANSWER-KEY-IC-MOCK-EXAM-SET-A-pdfpdf/ ANSWER KEY_IC_MOCK A_V2

30. Some insurance companies charge females a lower premium rate than males. Which of the

following reasons justifies that practice?

a. women are less likely to lapse their policies

b. generally women have less hazardous jobs

c. women have longer life expectancy than men

d. generally women buy the higher premium policies

31. The premium for a participating life insurance policy is

a. the same as a non-participating policy

b. greater at younger ages

c. lower than a non-participating policy

d. higher than a non-participating policy

m

er as

32. The information on a life insurance application relating to an applicant’s birthday, occupation, and

co

avocation is used by the company primarily for the purpose of:

eH w

a. appraising the risk

o.

b. assigning the risk

c. rs e

determining the insurable interest

ou urc

d. determining a suitable plan of insurance

33. Which of the following statements is NOT correct?

o

a. When an agent meets a prospect for the first time, he has to sell confidence in himself

aC s

b. When an agent makes a sales presentation, he has to sell confidence in the product

vi y re

c. The primary job of an agent is to get people happily involved with the ownership of his policy

d. The primary job of an agent is to squeeze as much money as possible out of making

a new sale

ed d

34. The level premium system means the

ar stu

a. face amount of insurance premium remains the same each year

b. policy reserves increase by the same amount each year

c. premiums remain the same each year

sh is

d. mortality rate remains the same each year

Th

35. All of the following term policies can be sold as a basic policy contract except

a. yearly renewable term c. ten year term

b. six-month interim term d. decreasing term

36. A life insurance agent is permitted to

a. approve an application for insurance

b. waive any of the requirements of the Company

c. guarantee dividends on participating policies

d. prepare routine proposals for life insurance coverage

Agency Training and Development Department Page 5

https://www.coursehero.com/file/44844580/356355495-ANSWER-KEY-IC-MOCK-EXAM-SET-A-pdfpdf/ ANSWER KEY_IC_MOCK A_V2

37. Life insurance companies practice risk selection primarily to

a. guard against anti-selection

b. establish dividend rates on participating policies

c. determine policy reserve amount

d. gather and test mortality statistics

38. An Individual, at age 35, purchases a policy under which he will in 20 years receive the face amount

of the policy himself if he is still alive at that date. This policy is obviously a

a. 20 Yr. Endowment c. 20 Yr. Term

b. 20 Pay Life d. None of the above

39. In determining the number of people dying or living at a particular age within a given period, we use

m

er as

the principle of:

co

a. probability c. mortality table

eH w

b. insurable interest d. risk sharing

o.

rs e

40. Which of the following statements about Disability Waiver of Premium Rider is incorrect?

ou urc

a. There is a waiting period

b. The disability must occur before a stated age

c. The insured has to die while disabled

o

d. It has to be attached to a life insurance policy

aC s

vi y re

41. A housewife without gainful employment applies for a P 500,000 life coverage. Which of the

following should the agent do?

a. be grateful

b. examine the adequacy of the husband’s insurance coverage

ed d

c. suggest she double the amount

ar stu

d. tell her she has no need for it

42. The total life coverage of a permanent basic policy can be greatly increased through the use of

sh is

a. an interim term rider

b. an accidental death benefit rider

Th

c. a supplemental term rider

d. a cancer rider

43. If premiums are being waived under a waiver of premium benefit and the insured dies, the proceeds

will be

a. reduced paid-up face amount

b. face amount less unpaid premiums

c. cash surrender value

d. face amount

Agency Training and Development Department Page 6

https://www.coursehero.com/file/44844580/356355495-ANSWER-KEY-IC-MOCK-EXAM-SET-A-pdfpdf/ ANSWER KEY_IC_MOCK A_V2

44. The full face amount is received by the insured himself

a. when he becomes 65 years of age in the case of a whole life policy

b. on the date of maturity in the case of endowment policy

c. only if he lives to 100 years of age in the case of an endowment

d. when he becomes 65 years of age in the case of limited pay life

45. A parent taking a life insurance policy on his minor child wishing to provide that the policy will

continue in force in the event of his own death, would apply for

a. term insurance

b. total and permanent disability clause

c. family income provision

d. payor insurance benefit

m

er as

46. If a policyholder changes his occupation without notifying the company, might it affect the benefits

co

under his policy?

eH w

a. No, benefits and premiums may only be changed at the renewal date of the policy

o.

b. Yes, unless the policy specified otherwise, if he engaged in a more hazardous occupation,

rs e

his benefits may be prorated

ou urc

c. No, benefits agreed upon at the inception of the policy may not be changed

d. None of the above

o

47. The fundamental advantage of the use of insurance as a means of meeting economic losses is that

through insurance these losses are

aC s

vi y re

a. spread over a large number of people

b. deferred for a specified period of time

c. reduced for the group as a whole through the multiplier effect

d. met as they arise through savings accumulated on an assessment basis

ed d

ar stu

48. For the waiver of premium to be effective

a. disability must be total

b. disability must be permanent

sh is

c. both a & b

d. either a or b

Th

49. Because the renewal of a term life insurance policy presents an increased possibility of anti-

selection, it is customary for the insurance company to

a. require some evidence of insurability each time the policy is renewed

b. charge higher premium rates for term policies that are renewable than for those that

are not renewable

c. restrict the policyowner’s right to change the beneficiary on a renewable term policy

d. define insurable interest more strictly for term policies than for other policies

Agency Training and Development Department Page 7

https://www.coursehero.com/file/44844580/356355495-ANSWER-KEY-IC-MOCK-EXAM-SET-A-pdfpdf/ ANSWER KEY_IC_MOCK A_V2

50. A businessman has arranged for a development loan which will be available one year from now.

Because he is unable to wait until then he has arranged an interim loan with his bank. The only

problem is that the bank wants the loan secured against the risk of his death. What is the most

economic arrangement that you can recommend?

a. extended term c. interim term

b. decreasing term d. yearly renewable term

51. A Pure Endowment policy

a. pays proceeds to the insured only if he lives to the end of a specified period

b. pays proceeds to the insured if he lives to the end of endowment period, or pays the face

amount to the named beneficiary if the insured dies before the end of the endowment period

c. is actually a combination of endowment insurance and term insurance

m

d. none of the above

er as

co

52. Substandard premium rates are charged for

eH w

a. applicants who are better than average risks

o.

b. policies that carry a lower than usual interest rate

c. rs e

applicants who carry a higher health or occupational risk

ou urc

d. applicants who desire low premiums

53. An insurance company which is owned and controlled by the policyowners who also share in the

o

earnings of the insurance company in the form of dividends is known as

aC s

a. stock company c. domestic company

vi y re

b. foreign company d. mutual company

54. “Critical years” in the programming of life insurance means:

ed d

a. retirement years

ar stu

b. years between the time the youngest is 15 years old and the mother is 62 years old

c. years immediately following the death of the insured

d. period during which the children are small and cannot provide for themselves

sh is

55. The consideration required by the life insurance company to make the insurance coverage effective

is the

Th

a. beneficiary’s continuing insurable interest in the life of the insured

b. payment of the initial premium

c. applicant’s promise to act in good faith

d. payment of each renewal premium before the end of the applicable period

56. In most life insurance applications the largest amount of information requested is data which

a. describes the desired benefits and mode of payment

b. identifies the applicant

c. describes the type of insurance applied for

d. relates to the insurability of the applicant

Agency Training and Development Department Page 8

https://www.coursehero.com/file/44844580/356355495-ANSWER-KEY-IC-MOCK-EXAM-SET-A-pdfpdf/ ANSWER KEY_IC_MOCK A_V2

57. In a Life Insurance Company, risk appraisal is necessary to

a. project dividend rates for participating policies

b. prevent any anti-selection

c. collate mortality statistics

d. calculate the mortality rate for a given policy

58. A limited pay life policy provides

a. protection for the life of the policyholder with premiums payable for a limited term of

years

b. low cost protection only for a limited term of years with no savings

c. the highest level of savings for the insured within a specified term of years

d. protection with premiums payable for life and a low level of savings as an alternative to

m

continued protection in old age.

er as

co

59. In life insurance, the term “sub-standard rates” is generally used to refer to

eH w

a. premiums charged for policies with low amounts

o.

b. premiums charged to persons who are considered to be higher-than-average risk

categories rs e

ou urc

c. mortality rates that are lower than the rates suggested by the regulatory authorities

d. mortality rates that are lower than those expected by the company according to its mortality

table

o

60. Life insurance companies make use of the laws of probability in order to

aC s

vi y re

a. estimate future death rates among members of a given group

b. predict when an individual insured will die

c. develop statistics of past deaths among the general population

d. determine the experienced death rate among insured persons

ed d

ar stu

-end of Set A-

sh is

Th

Agency Training and Development Department Page 9

https://www.coursehero.com/file/44844580/356355495-ANSWER-KEY-IC-MOCK-EXAM-SET-A-pdfpdf/ ANSWER KEY_IC_MOCK A_V2

Powered by TCPDF (www.tcpdf.org)

You might also like

- Answer Key - Ic - Mock Exam - Set A PDFDocument9 pagesAnswer Key - Ic - Mock Exam - Set A PDFZyzy Lepiten80% (46)

- MOCK EXAM: Insurance Commission: Module 1 - Principles of Life InsuranceDocument25 pagesMOCK EXAM: Insurance Commission: Module 1 - Principles of Life InsuranceTGiF TravelNo ratings yet

- IC Mock Exam As of June-10 Answer KeyDocument25 pagesIC Mock Exam As of June-10 Answer KeyTGiF TravelNo ratings yet

- Answer Key - Life - Mock Exam 1Document8 pagesAnswer Key - Life - Mock Exam 1Alex MacasaetNo ratings yet

- Orca Share Media1560502291818 PDFDocument17 pagesOrca Share Media1560502291818 PDFamor macayanNo ratings yet

- Trad Ic Mock Exam Answer KeyDocument15 pagesTrad Ic Mock Exam Answer KeyGener ApolinarioNo ratings yet

- L M NotesDocument8 pagesL M NotesBABYLEN BAHALANo ratings yet

- Trad Ic Mock ExamDocument15 pagesTrad Ic Mock ExamArvin AltamiaNo ratings yet

- IIAP Mock 1 Answer KeyDocument6 pagesIIAP Mock 1 Answer KeyTGiF Travel0% (1)

- Answer Key - Ic - Mock Exam - Set B PDFDocument8 pagesAnswer Key - Ic - Mock Exam - Set B PDFZyzy Lepiten75% (28)

- Insurance Licensure Exam Review: Traditional Life InsuranceDocument29 pagesInsurance Licensure Exam Review: Traditional Life InsuranceSheena Fatima100% (3)

- IC EXAM REVIEWER (Updated) With Answer XDDocument5 pagesIC EXAM REVIEWER (Updated) With Answer XDJason Bagadiong100% (1)

- Ak Iiap Mock-Exam-1Document8 pagesAk Iiap Mock-Exam-1joseph s. butawanNo ratings yet

- IC Trad Exam Reviewer 1Document5 pagesIC Trad Exam Reviewer 1scribd KokoNo ratings yet

- Answer Key for IC Mock Exam Set BDocument9 pagesAnswer Key for IC Mock Exam Set BrandomNo ratings yet

- Life Insurance Mcqs QuestionnaireDocument6 pagesLife Insurance Mcqs QuestionnaireTrev ANo ratings yet

- Ol Ic Reviewer 2021Document8 pagesOl Ic Reviewer 2021Paulo MoralesNo ratings yet

- Insurance Commission Reviewer Set ADocument9 pagesInsurance Commission Reviewer Set AMelissa CaagNo ratings yet

- ACE Traditional IC Online Mock Exam - 08182021Document8 pagesACE Traditional IC Online Mock Exam - 08182021Ana FelicianoNo ratings yet

- Online+trad.+ic+mock+exam 09262023Document9 pagesOnline+trad.+ic+mock+exam 09262023Sonny CandidoNo ratings yet

- Traditional+ic+mock+exam Version+2 10022023Document11 pagesTraditional+ic+mock+exam Version+2 10022023Sonny CandidoNo ratings yet

- IC Exam Review 2Document4 pagesIC Exam Review 2Jason BagadiongNo ratings yet

- INSURANCE EXAM REVIEWDocument6 pagesINSURANCE EXAM REVIEWJon EsberNo ratings yet

- Stqqnngc4oibqioc Tfkvnbcrnffbhp1n-Online+Trad.+Ic+Mock+Exam 08262021Document8 pagesStqqnngc4oibqioc Tfkvnbcrnffbhp1n-Online+Trad.+Ic+Mock+Exam 08262021Sonny CandidoNo ratings yet

- TRADITIONAL LIFE MOCK EXAM - 03102015 v.1 PDFDocument8 pagesTRADITIONAL LIFE MOCK EXAM - 03102015 v.1 PDFRegine Allaine ReyesNo ratings yet

- RADITIONAL LIFE MOCK EXAMvgvhDocument8 pagesRADITIONAL LIFE MOCK EXAMvgvhjan christopher VerginomNo ratings yet

- PRUREVIEWDocument8 pagesPRUREVIEWnicelim64No ratings yet

- Traditional Life Licensing Mock Exam (Set D) : Instructions: Please Encircle The Correct AnswerDocument8 pagesTraditional Life Licensing Mock Exam (Set D) : Instructions: Please Encircle The Correct AnswerKenneth QuiranteNo ratings yet

- Life Ic Reviewer 2017Document9 pagesLife Ic Reviewer 2017SHENNA ALLAM0% (1)

- Traditional Life Mock Exam 03102015 v.1Document8 pagesTraditional Life Mock Exam 03102015 v.1francis50% (2)

- TRADITIONAL LIFE MOCK EXAM - 03102015 v.1 PDFDocument8 pagesTRADITIONAL LIFE MOCK EXAM - 03102015 v.1 PDFfrancisNo ratings yet

- Traditional Life Licensing Mock Exam (Set D) : Instructions: Please Encircle The Correct AnswerDocument8 pagesTraditional Life Licensing Mock Exam (Set D) : Instructions: Please Encircle The Correct AnswerKenneth QuiranteNo ratings yet

- Rai Ic - Trad (9426)Document30 pagesRai Ic - Trad (9426)jeffrey resos100% (1)

- Insurance Commission ReviewerDocument29 pagesInsurance Commission Reviewerabi horohoroNo ratings yet

- STD-Insurance Commission TRAD REVIEWER Rev1 PDFDocument24 pagesSTD-Insurance Commission TRAD REVIEWER Rev1 PDFJomar Carabot100% (1)

- Manu LifeDocument19 pagesManu LifeHarold MillaresNo ratings yet

- Traditional Life Mock Exam ADocument15 pagesTraditional Life Mock Exam ABryan MorteraNo ratings yet

- Iiap Reviewer NewDocument18 pagesIiap Reviewer Newcindy100% (3)

- Traditional IC Mock Exam - 02042020 PDFDocument37 pagesTraditional IC Mock Exam - 02042020 PDFMikaella SarmientoNo ratings yet

- Answer Key - Ic - Mock Exam - Set C PDFDocument10 pagesAnswer Key - Ic - Mock Exam - Set C PDFZyzy Lepiten84% (25)

- Ak - Ic - Mock Exam Set CDocument11 pagesAk - Ic - Mock Exam Set CJerrymae D. CadutdutNo ratings yet

- Insurance Commission TRAD Reviewer SPECIAL With AnswersDocument8 pagesInsurance Commission TRAD Reviewer SPECIAL With AnswersLOLITA P. FERNANDEZNo ratings yet

- Insurance Commission Traditional Life Reviewer QuizDocument41 pagesInsurance Commission Traditional Life Reviewer QuizSHENNA ALLAM100% (1)

- Traditional IC Mock ExamDocument37 pagesTraditional IC Mock ExamNald FigueroaNo ratings yet

- Traditional Life Mock Exam 1Document12 pagesTraditional Life Mock Exam 1Jen NyNo ratings yet

- Traditional ADocument13 pagesTraditional AFarm KONo ratings yet

- TRADITIONAL LIFE MOCK EXAM Full ExamDocument10 pagesTRADITIONAL LIFE MOCK EXAM Full ExamJaquelyn ClataNo ratings yet

- 123 Questions Insurance Class ReviewDocument25 pages123 Questions Insurance Class ReviewJoelyca Sescon100% (2)

- INSURANCE COMMISSION TRADITIONAL LIFE MOCK EXAMDocument9 pagesINSURANCE COMMISSION TRADITIONAL LIFE MOCK EXAMCris Rivera75% (4)

- Insurance Commission Traditional Life Mock Exam 1Document8 pagesInsurance Commission Traditional Life Mock Exam 1Charish DanaoNo ratings yet

- IIAP Mock Exam Reviewer Answer Key - LifeDocument13 pagesIIAP Mock Exam Reviewer Answer Key - LifeJanine Semper100% (1)

- Mock Exam Traditional Life Exam Reviewer 1Document19 pagesMock Exam Traditional Life Exam Reviewer 1MatetNo ratings yet

- Trad Reviewer John Aldrin PDFDocument26 pagesTrad Reviewer John Aldrin PDFDrin Garrote Toribio100% (3)

- Insurance Commission Traditional Life ReviewerDocument42 pagesInsurance Commission Traditional Life Reviewerkristine de jesus100% (1)

- IC Exam Reviewer For TRADDocument8 pagesIC Exam Reviewer For TRADjohninopatinNo ratings yet

- Insurance ReviewerDocument8 pagesInsurance ReviewerRae Krystylynne CodillaNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Graduate Enrollment FormDocument1 pageGraduate Enrollment FormArvinALNo ratings yet

- 'YJ, Nee'!!j: - M L - A - , - , RDocument3 pages'YJ, Nee'!!j: - M L - A - , - , RArvinALNo ratings yet

- Std-Ic Vul Simulated Exam (Questionnaire) - FinalDocument10 pagesStd-Ic Vul Simulated Exam (Questionnaire) - FinalRey Bautista69% (13)

- Variable Examination Review Session (Verse) Mock ExamDocument12 pagesVariable Examination Review Session (Verse) Mock ExamArvinALNo ratings yet

- Plan A Bs Ee Schedule - Third Year Sy:2020-2021 Time Monday Section ScheduleDocument9 pagesPlan A Bs Ee Schedule - Third Year Sy:2020-2021 Time Monday Section ScheduleArvinALNo ratings yet

- Licenseby AlDocument1 pageLicenseby AlArvinALNo ratings yet

- Answer Key - Ic - Mock Exam - Set C PDFDocument10 pagesAnswer Key - Ic - Mock Exam - Set C PDFZyzy Lepiten84% (25)

- How Does VUL Work: in This Module, You Will Discover How Variable Unit-Linked (VUL) WorksDocument43 pagesHow Does VUL Work: in This Module, You Will Discover How Variable Unit-Linked (VUL) WorksYhunice Garcia CarbajalNo ratings yet

- Answer Key - Ic - Mock Exam - Set B PDFDocument8 pagesAnswer Key - Ic - Mock Exam - Set B PDFZyzy Lepiten75% (28)

- Sketch Slope Fields PDFDocument2 pagesSketch Slope Fields PDFArvinALNo ratings yet

- VUL Mock Exam 1 - June 6, 2011 Version 1Document11 pagesVUL Mock Exam 1 - June 6, 2011 Version 1Anonymous iOYkz0w73% (44)

- Directional SlopeDocument2 pagesDirectional SlopeArvinALNo ratings yet

- MATH2412-Graphs Polar EquationsDocument11 pagesMATH2412-Graphs Polar EquationsGonKilNo ratings yet

- Isoclines For y 2x yDocument3 pagesIsoclines For y 2x yArvinALNo ratings yet

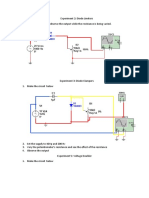

- Experiment 2: Diode Limiters Tested with Different LoadsDocument4 pagesExperiment 2: Diode Limiters Tested with Different LoadsArvinALNo ratings yet

- Semiconductor PhysicsDocument5 pagesSemiconductor PhysicsArvinALNo ratings yet

- Lahat NG Problem Solving... (Ito Na Yun)Document5 pagesLahat NG Problem Solving... (Ito Na Yun)Erald PeriaNo ratings yet

- Experiment Multisim ProceduresDocument2 pagesExperiment Multisim ProceduresArvinALNo ratings yet

- Diode - Applications and Power SupplyDocument5 pagesDiode - Applications and Power SupplyArvinALNo ratings yet

- Electronic Devices Experiment 4Document13 pagesElectronic Devices Experiment 4ArvinALNo ratings yet

- UB Letterhead Colored (Revised Aja)Document1 pageUB Letterhead Colored (Revised Aja)ArvinALNo ratings yet

- Diode Operation, Biasing, ModelDocument4 pagesDiode Operation, Biasing, ModelArvinALNo ratings yet

- Diode Operation, Biasing, ModelDocument4 pagesDiode Operation, Biasing, ModelArvinALNo ratings yet

- Computer Engineering Department: in Partial Fulfillment For The Course Fundamentals of Electronic CircuitsDocument3 pagesComputer Engineering Department: in Partial Fulfillment For The Course Fundamentals of Electronic CircuitsArvinALNo ratings yet

- College of Engineering Computer Engineering DepartmentDocument1 pageCollege of Engineering Computer Engineering DepartmentArvinALNo ratings yet

- Diode - Applications and Power SupplyDocument6 pagesDiode - Applications and Power SupplyArvinALNo ratings yet

- College of Engineering Computer Engineering DepartmentDocument1 pageCollege of Engineering Computer Engineering DepartmentArvinALNo ratings yet

- Coe: Seatwork in Fundamentals EEDocument3 pagesCoe: Seatwork in Fundamentals EEArvinALNo ratings yet

- Insurance policy dispute over property transfer locationDocument6 pagesInsurance policy dispute over property transfer locationDis CatNo ratings yet

- Reliance Life Insurance Super Endowment Plan benefitsDocument13 pagesReliance Life Insurance Super Endowment Plan benefitsmiteshtakeNo ratings yet

- Insurance IntermediariesDocument9 pagesInsurance IntermediariesarmailgmNo ratings yet

- C - S4FTR - 1909 SAP Certified Application Associate Treasury With SAP S/4HANADocument63 pagesC - S4FTR - 1909 SAP Certified Application Associate Treasury With SAP S/4HANASanja KostićNo ratings yet

- Class Notes - Financial Institutions and ManagementDocument83 pagesClass Notes - Financial Institutions and ManagementRutwik PatilNo ratings yet

- Living Benefits: Your Plan Also Comes With The Following BenefitsDocument20 pagesLiving Benefits: Your Plan Also Comes With The Following BenefitsJULIUS TIBERIONo ratings yet

- Praxis 2011Document72 pagesPraxis 2011zhuhainie0% (1)

- 1 PDFDocument7 pages1 PDFRonit RayNo ratings yet

- 1990-2013 Examinations: Beneficiary: Effects: Irrevocable Beneficiary (2005)Document27 pages1990-2013 Examinations: Beneficiary: Effects: Irrevocable Beneficiary (2005)JubsNo ratings yet

- Gold Trading, Inc. Adjusted Trial Baalnce 31-Dec-20Document2 pagesGold Trading, Inc. Adjusted Trial Baalnce 31-Dec-20ME Valleser0% (1)

- International Student Insurance Coverage Certification Form 0 0Document1 pageInternational Student Insurance Coverage Certification Form 0 0Chew BachaNo ratings yet

- Adamjee Internship Report by Aftab AliDocument11 pagesAdamjee Internship Report by Aftab AliAftab AliNo ratings yet

- Constantino vs. Asia Life Insurance Co. non-payment premiums rule during warDocument2 pagesConstantino vs. Asia Life Insurance Co. non-payment premiums rule during warAnne Ausente BerjaNo ratings yet

- Pacific Banking Corp vs. CADocument10 pagesPacific Banking Corp vs. CAjieNo ratings yet

- Medical Expenses Claim FormDocument4 pagesMedical Expenses Claim FormCHEMA KREMANo ratings yet

- GCC Healthcare Sector Poised for Strong GrowthDocument59 pagesGCC Healthcare Sector Poised for Strong GrowthToni Rose RotulaNo ratings yet

- CACS1Document152 pagesCACS1rajkumarvpost6508No ratings yet

- Financial Accounting: Theory & Practice Provisions & ContingenciesDocument85 pagesFinancial Accounting: Theory & Practice Provisions & ContingenciesAngeilyn Roda50% (2)

- Exploring Rural Market For Private Life Insurence Players in IndiaDocument18 pagesExploring Rural Market For Private Life Insurence Players in IndiaLakshmish GopalNo ratings yet

- frmStaticPage - 2022-11-04T172525.484Document2 pagesfrmStaticPage - 2022-11-04T172525.484krishna11143No ratings yet

- Sum Assured 1 (Lac) : 2389 (Qly) 4705 (Hly) 9265 (Yly)Document1 pageSum Assured 1 (Lac) : 2389 (Qly) 4705 (Hly) 9265 (Yly)rvsamy80No ratings yet

- Updated Reminders in The Assessment of TheDocument7 pagesUpdated Reminders in The Assessment of Therian.lee.b.tiangcoNo ratings yet

- Ensure Motor InsuranceDocument7 pagesEnsure Motor InsuranceGodwin UdoakanNo ratings yet

- Chapter 17 Itemized DeductionsDocument7 pagesChapter 17 Itemized DeductionsLiana Monica LopezNo ratings yet

- PolicySchedule 422363675Document2 pagesPolicySchedule 422363675Anand SinghNo ratings yet

- Hiscox Interim Statement 2019Document18 pagesHiscox Interim Statement 2019saxobobNo ratings yet

- Aetna Life Ins V Haworth 300 US 227 - Switch in Time CaseDocument525 pagesAetna Life Ins V Haworth 300 US 227 - Switch in Time CasegoldilucksNo ratings yet

- Institute of Management Studies Davv Indore Mba (Financial Administration) Ii ND Semester - Fa 303C Insurance and Bank ManagementDocument2 pagesInstitute of Management Studies Davv Indore Mba (Financial Administration) Ii ND Semester - Fa 303C Insurance and Bank ManagementjaiNo ratings yet

- Exchange Fall 2 0 2 1: International College of Liberal Arts Yamanashi Gakuin UniversityDocument40 pagesExchange Fall 2 0 2 1: International College of Liberal Arts Yamanashi Gakuin UniversitySaw JetherNo ratings yet

- Vehicle Insurance Claim Form - 15102019Document4 pagesVehicle Insurance Claim Form - 15102019DILIP KNo ratings yet