Professional Documents

Culture Documents

Corporation PDF

Uploaded by

Jorufel PapasinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporation PDF

Uploaded by

Jorufel PapasinCopyright:

Available Formats

lOMoARcPSD|5437160

Corporation - ....

Accounting (Far Eastern University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

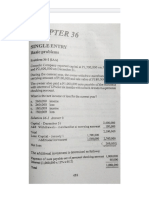

PROBLEM 2. ACCOUNTING FOR SHARE CAPITAL

Far East Corporation, a newly registered corporation had the following transactions during the year:

a) On January 2, Philippine SEC authorized the entity to issue 500,000 shares with par value of ten peso per

share.

b) The entity received subscription to 150,000 shares at par.

c) The entity collected 30% on the above subscription.

d) Received full payment for 90,000 shares originally subscribed.

e) The entity then issued the share certificates for 90,000 shares which were fully paid.

f) Received a cash subscription for 6,000 shares at par.

Memorandum Entry Method – IF THE PROBLEM IS SILENT, USE MEMO METHOD

a) The corporation was authorized to issue 500,000 shares with P10 par value.

b) Subscription Receivable 1,500,000

Subscribed Share Capital 1,500,000

(150,000 x P10)

c) Cash (1,500,000 x 30%) 450,000 initially paid

Subscription Receivable 450,000

d) Cash 630,000 eto pa yung babayaran niya kasi 270,000

Subscription Receivable 630,000 (30% na yung nabayaran out of 900,000)

e) Subscribed Share Capital 900,000

d) 90,000 shares + 60,000 shares = 150,000

Share Capital 900,000 x P10 x P10

f) Cash (6,000 x P10) 60,000 P900,000 + P600,000 = 1,500,000

Share Capital 60,000 x 30% x 30%

270,000 + 180,000 = 450,000

Journal Entry Method

a) Unissued Share Capital P5,000,000

Authorized Share Capital P5,000,000

(500,000 X P10)

b) Subscription Receivable 1,500,000

Subscription Share Capital 1,500,000

c) Cash 450,000

Subscription Receivable 450,000

d) Cash 630,000

Subscription Receivable 630,000

e) Subscribed Share Capital 900,000

UNISSUED SHARE CAPITAL 900,000

f) Cash 60,000

UNISSUED SHARE CAPITAL 60,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 3. ISSUANCE OF SHARE CAPITAL FOR CASH

1. With Par Value

Avalanche Corporation sold 20,000 ordinary shares of P100 par value for P130 per share.

Cash (20,000 x P130) 2,600,000

Ordinary Shares 2,000,000

Share Premium 600,000

2. Without Par Value

Vague Company sold 40,000 ordinary shares with stated value of P80 for P120 each.

Cash (40,000 x P120) 4,800,000

Ordinary Shares 3,200,000

Share Premium 1,600,000

3. No Par, No Stated Value - walang share premium

Cash 4,800,000

Ordinary Shares 4,800,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 4. ISSUANCE OF SHARES FOR NONCASH CONSIDERATION – hindi pera, but, land and

bldg. pinambayad.

a. Algeria Corp. issued 15,000 ordinary shares of P100 par value in exchange of for land and building with

total fair value of P2,000,000 of which 25% is attributable to the land.

2,000,000

x 25%

500,000 – Land

Land 500,000

Bldg 1,500,000

Ordinary Shares 1,500,000

Share Premium 500,000

b. Nortek Corporation exchanged 25,000 shares of its P100 par value share for a land. A few months ago, the

land was appraised by an independent appraiser at P4,000,000. Nortek is currently trading at the Philippine

Stock Exchange (PSE) at P140 per share.

Land (25,000 x P140) 3,500,000

Ordinary Shares (25,000 X P100) 2,500,000

Share Premium 1,000,000

c. Atty. Pao received 1,000 ordinary shares of P100 par value from Secador Cop. after rendering legal

services in getting the corporation organized. The fair value of such services is reliably determined to be

P125,000.

Professional Fee/Organization Cost 125,000

Ordinary Shares (1,000 x P100) 100,000

Share Premium 25,000

d. Dientes Corp. issued 5,000 shares of its P100 par ordinary share to Atty. Harvey as compensation for 1,200

hours of legal services performed. Atty. Harvey usually bills P500 per hour for legal services. On this date of

issuance, the share was selling at a public trading at P140 per share.

Professional Fee 700,000

Ordinary Shares 500,000

Share Premium 200,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 5A. INCORPORATON OF A PROPRIETORSHIP

The December 31, 2013 condensed statement of financial position of Django Services, an individual

proprietorship, follows:

Current Assets P 150,000

Equipment (net) 140,000

P 290,000

Liabilities P 90,000

Djangco, Capital 200,000

P 290,000

Fair Values at December 31, 2013 are as follows:

Current Assets P 170,000 If given yung FMV, ‘yun yung

Equipment 200,000 gagamitin

Liabilities 90,000

On January 2, 2014, Djangco Services was incorporated with 5,500, P10 par value, ordinary shares issued.

To convert into corporation type:

Current Assets P 170,000

Equipment 200,000

Liability P 90,000

Share Capital 55,000

Share Premium 225,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

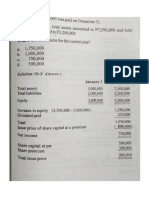

PROBLEM 5B. ISSUANCE OF TWO CLASSES OF SHARES

2 FMV given

Hologram Corporation issued 20,000 shares of its P10 par value ordinary shares and 40,000 shares of its P10

par value preference share for a total amount of P1,800,000. At this date, Hologram’s ordinary shares was

selling P20 per share and the preference share was selling for P30 per share.

OS (20,000 x P20) 400,000 4/16 x P1,800,000 = 450,000

PS (40,000 x P30) 1,200,000 12/16 x P1,800,000 = 1,350,000

P 1,600,000 P 1,800,000

Cash 1,800,000

Ordinary Shares (20,000 x P10) 200,000

SP-OS (450,000 – 200,000) 250,000

Preference Shares (40,000 x P10) 400,000

SP-PS (1,350,000 – 400,000) 950,000

1 FMV given (OS only)

Ordinary Shares (20,000 x P30) 600,000

Preference Shares (40,000 x P30) 1,200,000

P1,800,000

Cash 1,800,000

Ordinary Shares (20,000 x P10) 200,000

SP-OS (20,000 x P30 – 200,000) 400,000

Preference Shares (40,000 x P10) 400,000

SP-PS (40,000 x P30 – 400,000) 800,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 6. ORGANIZATION COST – organizing a corporation

Harlem Corporation issued 50,000 ordinary shares with par value of P100 for P150 per share. Costs incurred

related to the issuance which were paid cash are as follows:

Org Cost Cost of drafting articles of incorporation and by laws P25,000

Org Cost Other legal costs 5,000 45,000

Org Cost Incorporation fees 15,000

Share Issuance Cost of printing share certificate 10,000

Share Issuance Other share issuance cost (cost of stock and 25,000 35,000

transfer book, seal of corporation, underwriting

fees and legal fees related to share issuance)

REMEMBER:

issued – fully paid = CASH

received subscription = Subscription Receivable

Subscribed Share Capital

a) Issuance of shares

Cash (50,000 x P150) 7,500,000

Ordinary Shares (50,000 x P100) 5,000,000

Share Premium 2,500,000

b) Incurrence of organization cost

Organization 45,000

Organization Cost – treated as Outright EXPENSE

Cash 45,000

SP-OS 35,000

Cash 35,000

c) IF Share Issuance = 35,000

IF SP-OS = 25,000

1) Cash 5,025,000

Ordinary Shares 5,000,000

SP-OS 25,000

25,000 lang yung SP-OS mo, so need

2) Organization Cost 45,000 mong i-record sa RE yung remaining

Cash 45,000

SP-OS 25,000

Retained Earnings 10,000 RE = OTHER TERM = Accumulated P/L

Cash 35,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

d) IF Ordinary Shares ONLY

IF Par ONLY

NO Share Premium

1) Cash (50,000 x P100) 5,000,000

Ordinary Shares 5,000,000

2) Organization Cost 45,000

Cash 45,000

Retained Earnings 35,000

Cash 35,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 7. COMPUTATION OF LEGAL CAPITAL

w/ Par Value No Par Value, w/ Stated Value

Ordinary Share Ordinary Share

Preference Share Preference Share

Share Capital Share Capital

Subscribed – OS Share Premium – OS

Subscribed – PS Share Premium – PS

Subscribed – Share Capital Subscribed – OS

Subscribed – PS

Subscribed – Share Capital

CASE A – with Par Value

The shareholder’s equity of Lovely Company revealed the ff. information on December 31, 2012:

Preference share (P100 par), P2,500,000; share premium in excess of par-preference, P750,000; Ordinary

share (P10 par), P5,000,000; share premium in excess of par-ordinary, P2,800,000; Subscribed ordinary

share, P65,000; Accumulated P/L, P2,000,000; and Subscription receivable-ordinary, P350,000.

Preference Share 2,500,000

Ordinary Share 5,000,000

Subscribed Ordinary Share 65,000

P 7,565,000

CASE B – No Par, with Stated Value

The shareholder’s equity of Aranque Inc. revealed the ff. information on December 31, 2012:

Preference share (P80 stated value), P1,200,000; share premium in excess of stated value-preference,

P900,000; Ordinary share (P15 stated value), P3,000,000; share premium in excess of stated value-ordinary,

P2,800,000; Subscribed ordinary share, P80,000; Accumulated profits and losses, P1,950,000; and

Subscription receivable-ordinary, P200,000.

Preference Share 1,200,000

SP-PS 900,000

Ordinary share 3,000,000

SP-OS 2,800,000

Subscribed Ordinary Share 80,000

7,980,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 8. DELINQUENT SUBSCRIPTION AND HIGHES BIDDER

- Sa Subscription Contract nakalagay to what extent babayaran (eg. 1 year). If hindi nakabayad, ide-

declare niya yung share sa delinquent; iooffer yung share sa auction (bidding)

Macchiato Corp. had the following transactions with one of its subscribers during the year:

a) On January 2, Olive subscribes for 25,000 shares at par P50 to be paid within 60 days from the date

of subscription.

b) On February 28, Olive pays P750,000 of her subscription to the corporation.

c) On March 5, the corporation called Olive’s subscription balance but she defaulted. Consequently, the

subscription was declared to be delinquent. NO ENTRY if declared delinquent.

d) Macchiato paid P38,000 for expenses incurred in connection with the auction of the delinquent

shares. The offer price was P560,000 which includes the balance still due on the subscription, interest and

costs of the sale.

e) Three bidders offered to pay the offer price in exchange for the following shares: Rey 4,000 shares;

Paul 5,500 shares; and Joven 6,000 shares. Accordingly, the auction was awarded to the highest bidder. The

corporation then received cash representing the offer price on March 15. Offer price is still 560,000

f) Macchiato issued the shares to the subscribers on March 18.

A. Journalize

Jan 2 Subscribed Receivable (25,000 x P50) 1,250,000

Subscribed Share Capital 1,250,000

Feb 28 Cash 750,000

Subscription Receivable 750,000

Mar 5 No Entry

d) Receivable from Highest Bidder/Due from Highest Bidder 38,000

Cash 38,000

e) Cash 560,000

Subscription Receivable (1,250,000 – 750,000) 500,000

Receivable from Highest Bidder 38,000

Interest Income 22,000

f) Subscribed Share Capital 1,250,000

Share Capital 1,250,000

B. Who was the highest bidder?

Rey

C. How many shares were actually issued to (a) Olive and to the (b) highest bidder?

Olive 21,000 share

Rey 4,000

25,000 – Olive originally subscribes

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 9. TREASURY SHARES

- nire-acquire yung sarili mong share of stocks

- CONTRA-EQUITY ACCOUNT

- DEBIT

On August 10, Cultura Corporation reacquired 8,000 shares of its P100 par value ordinary shares at P134. The

share was originally issued at P110. The shares were resold on November 21 at P145.

Provide the entries required to record the reacquisition and the subsequent resale of the share using

the:

1) Par Value method of accounting for treasury share. (NO. Kasi hindi na ito ginagamit.)

2) Cost Method of accounting for treasury share. (COST NOT PAR; sa OS lang kasi yung credit up to

the extent of Par Value)

August 10 Treasury share (8,000 x P134) 1,072,000

Cash 1,072,000

Nov 21 Cash (8,000 x P145) 1,160,000

Treasury share 1,072,000

SP-TS 88,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 10. TREASURY SHARES – COST METHOD

Medley Inc. had the ff. information during the year:

a) Medley issued 10,000 ordinary shares (P100 par) for P120 per share.

b) Medley reacquired 3,000 ordinary shares at P150 per share.

c) The corporation then reissued 1,000 of the treasury shares for P170 per share.

d) Finally, the remaining treasury shares were issued at P100 per share.

a) Cash (10,000 x P120) 1,200,000

Ordinary Share 1,000,000

SP-OS 200,000

b) Treasury Share (3,000 x P150) 450,000

Cash 450,000

c) Cash (1,000 x P170) 170,000

Treasury Share (1,000 x P150) 150,000

SP-TS 20,000

d) Cash (2,000 x P100) 200,000

3,000 – reacquire

SP-TS 20,000

-1,000 – reissued

RE 80,000

2000

Treasury Share (2,000 x P150) 300,000

If no SP-TS, ilagay lahat sa RE

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 11. TREASURY SHARE PRESENTATION

Bucks Corp. have the ff. information as of December 31, 2012:

Ordinary share capital, 60,000 shares, P100 par; Share premium, P60,000; Retained Earnings, 2,000,000; and

Treasury shares, 5,000 at cost of P140 each.

Present the shareholder’s equity portion to be shown on the entity’s statement of fin’l position.

Shareholders’ Equity

CONTRIBUTED CAPITAL (including Legal Capital)

Ordinary Shares (60,000 x P100) 6,000,000

Share Premium 60,000

Retained Earnings 2,000,000

Treasury Shares (5,000 x P140) (700,000)

7,360,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 12. DONATED CAPITAL

- ginagamit lang kapag ang nag-donate ay shareholder

- OTHER INCOME : not a shareholder ang nag-donate

Cash Non-Cash

Cash Land

Donated Capital Donated Capital

Pashmina Inc. is a corporation incorporated in the Philippines, during the year, certain shareholder donated to

the entity an aggregate of 10,000 ordinary shares with par value of P100. Subsequently, the 10,000 donated

shares were sold for P130 per share.

1. Prepare the journal entries to record:

a. The receipt of the donated shares

The company received 10,000 ordinary shares with par value of P100 from its shareholders.

(Memo entry : Statement only)

b. The subsequent sale of the donated shares

Cash (10,000 x P130) 1,300,000

SP-Donated Capital (treated as EXCESS lang) 1,300,000

2. How would the donated capital be accounted for in the shareholder’s equity of Pashmina?

Shareholders’ Equity

CONTRIBUTED CAPITAL (including Legal Capital)

Ordinary Shares (10,000 x P100)

Share Premium

Retained Earnings

Treasury Shares (5,000 x P140)

Donated Capital

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 13. CONTRIBUTED CAPITAL

Nathaniel Corporation is authorized to issue 100,000 ordinary shares, P17 par value. At the beginning of 2012,

18,000 ordinary shares were issued and outstanding. These shares had been issued at P24. During 2012, the

company entered into the ff. transactions:

Jan 16 – Issued 1,300 ordinary shares at P25 per share. issued = fully paid

Mar 21 – Exchanged 12,000 ordinary shares for a building. The ordinary shares were selling at P27 per share.

May 7 – Reacquired 500 ordinary shares at P26 per share to be held in treasury.

Jul 1 – Accepted subscriptions to 1,000 ordinary shares at P28 per share. The contract called for 10% down

payment with the balance due on December 1.

Sep 20 – Sold 500 treasury shares at P29 per share.

Dec 1 – Collected the balance due on July 1 subscriptions and issued the shares.

COMPOSITION OF CONTRIBUTED CAPITAL

Share Capital

OS

PS

Share Premium

Treasury Shares (deducted from RE)

Subscribed Share Capital

Subscription Receivable

w/in 1 year beyond 1 year

do not present in the Contri Cap. - present at Subscription Receivable

CURRENT ASSET - deducted in Contributed Capital

Jan 16 Cash (1,300 x P25) 32,500

Ordinary Shares (1,300 x P17) 22,100

SP-OS 10,400

Mar 21 Building (12,000 x P27) 324,000

Ordinary Shares (12,000 x P17) 204,000

SP-OS 120,000

May 7 Treasury Shares (500 x P26) 13,000

Cash 13,000

Jul 1 Cash (1,000 x 10%) 2,800 1,000 x P28 = 28,000

Subscription Receivable 25,200

X 10% SR = 25,200

Subscribed OS (1,000 x P17) 17,000

Cash 2,800

SP-OS 11,000

Sep 20 Cash (500 x P29) 14,500

Treasury Shares (500 x P26) 13,000

SP-TS 1,500

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

Dec 1 Cash 25,200

Subscription Receivable 25,200

Subscribed OS 17,000

OS 17,000

Ordinary Shares SP-OS SP-TS

306,000 126,000 1,500

(18,000 x P17) (7 x 18,000)

22,100 10,400

204,000 120,000

17,000 11,000

549,100 267,400

IP = 24

PV = 17

SP = 7 x 18,000 = 126,000

CONTRIBUTED CAPITAL

w/ PAR Ordinary Shares P 549,000

w/out PAR SP-OS 267,400

SP-TS 1,500

818,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 14. RETIREMENT OF TREASURY SHARES

a) The corporation holds as treasury, 30,000 ordinary shares with P10 par value per share, at cost amounting

P250,000. The shares were subsequently retired.

If you retire TS, you also retire OS kasi yung TS is

part din naman ng OS

TS – normal is DEBIT OS – normal is CREDIT

- to remove is CREDIT - to remove is DEBIT

Ordinary Shares (30,000 x P10) 300,000

Treasury Share 250,000

SP-TS retirement 50,000

b) West Corporation has the ff. information: Retirement at a loss

Ordinary share capital, 200,000 shares, P10 par, P2,000,000; Share premium – original issuance,

P400,000; Share premium – Treasury, P80,000; Retained earnings P500,000; Treasury shares, 20,000

shares, at cost P350,000.

Kapag may SP-Orig Issuance, tanggalin

OS

SP-OS if kulang pa then proceed to

SP-TS if kulang pa rin then RE na

RE

(amount to be retired)

Ordinary Share (20,000 x P10) 200,000

SP-OS (20,000 x P400,000) 40,000

200,000 (total share issued) or;

SP-TS 80,000

RE (minus lahat then iminus to) 30,000 OS 2,000,000

Treasury Share 350,000 SP 400,000

2,400,000

/ 200,000

12

10

2 2 x 20,000 = 40,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 15. SHARE PREMIUM

Hello Corporation was organized on January 1, 2013, with an authorization of 1,000,000 ordinary shares with a

par value of P5 per share.

During 2013, the corporation had the ff. equity transactions:

Jan 4 – Issued 200,000 shares @ P5 per share. (same as Par Value)

Apr 8 – Issued 100,000 shares @ P7 per share.

Jun 9 – Issued 30,000 shares @ P10 per share.

Jul 29 – Purchased 50,000 shares @ P4 per share. (Treasury share kasi may subsequent issuance sa

Dec 31)

Dec 31 – Sold 50,000 shares held in treasury @ P8 per share.

What should be the total Share Premium as of Dec. 31, 2012?

Jan 4 P5 – P5 = 0 -----

Apr 8 (100,000 x P2) 200,000

Jun 9 (30,000 x P5) 150,000

Minus the current per

Jul 9 P4-P5 = Null -----

share from the original

Dec 31 (50,000 x P4) 200,000

per share

550,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 16. COMPREHENSIVE

The ff. transactions relate to the stockholders’ equity transactions of Monique Corporation for its first year of

existence.

Jan 7 Articles of incorporation are filed with the Philippine SEC. SEC authorized the issuance

of 10,000 shares of P50 par value preferred stock and 200,000 shares of P10 par value

common stock.

Jan 28 40,000 shares of common stock are issued for P14 per share.

Feb 3 80,000 shares of common stock are issued in exchange for land and buildings that have

an appraised value of P250,000 and P1,000,000, respectively. The stock traded at P15

per share on that date on the over-the-counter market. (clearly determinable kasi may

date)

Feb 24 2,000 shares of common stock are issued to Specter and Ross, Attorneys-at-Law, in

payment for legal services rendered in connection with incorporation. The company

charged the amount to organization costs. The market value of the stock was P16 per

share.

Sep 12 Received subscriptions for 10,000 shares of preferred stock at P53 per share. A 40%

down payment accompanied the subscriptions.

Oct 1 Reacquired 5,000 ordinary shares for a total cost of 80,000.

Nov 5 Reissued 3,000 ordinary shares at P18 per share.

Dec 10 Shareholders holding an aggregate of 5,000 shares donated their shares to Monique.

The company was able to reissue them at P12 per share.

Dec 31 Profit and loss summary to be closed to retained earnings amounted to P300,000

(credit).

1. Prepare the journal entries.

Jan 7 The company was authorized to issue 10,000 preferred stock, P50 par value and

200,000 common stock, P10 par value.

Jan 28 Cash (40,000 x P14) 560,000

Common Stock (40,000 x P10) 400,000

SP-CS 160,000

Feb 3 Land 240,000

Building 960,000

Common Stock (80,000 x P10) 800,000

SP-CS 400,000

80,000 x P15 = 1,200,000

Land 250,000 250/1,250 x 1,200,000 = 240,000

Bldg 1,000,000 1,000/1,250 x 1,200,000 = 960,000

1,250,000 1,200,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

Feb 24 Organization Cost (2,000 x P16) 32,000

Common Stock (2,000 x P10) 20,000

SP-CS 12,000

Sep 12 Cash 212,000

Subscription Receivable 318,000

Subscribed Preferred Stock (10,000 x P50) 500,000

SP-PS 30,000

10,000 x P53 = 530,000

x 40% SR = 318,000

Cash 212,000

Oct 1 Treasury Share (5,000 x P16) 80,000

Cash 80,000

Nov 5 Cash (3,000 x P18) 54,000

Treasury Share (3,000 x P16) 48,000

SP-TS 6,000

Dec 10 Cash (5,000 x P12) 60,000

SP-Donated Capital 60,000

(part of contri cap)

Dec 31 P/L Summary / Inc. and Exp. Summary 300,000 Result: Net Income

Retained Earnings 300,000 because of RE

Common Stock SP-CS SP-Preferred Stock

400,000 160,000 30,000

800,000 400,000

20,000 12,000

1,220,000 572,000

Treasury Shares SP-TS SP-DC

80,000 48,000 6,000 60,000

32,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

Retained Earnings

300,000

2. How much is the contributed capital?

P2,388,000

CONTRIBUTED CAPITAL

3. How much is the share premium as of December 31?

P668,000

4. How much is the total shareholder’s equity as of December 31?

P2,656,000

5. How much is the legal capital?

P1,720,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 17. COMPREHENSIVE

Casio Corp. registered with SEC and was authorized to issue 120,000 ordinary shares at P15 par value per

share. During the first year of operations, 40,000 shares were sold at P28 per share. 600 shares were issued

in payment of a current operating debt of P18,600. In the first year, the net income was P142,000.

During the year, dividends of P36,000 were paid to shareholders. At the end of the year, total liabilities were

P82,000. Use the given data to compute the ff. items at the end of the first year.

1. Total liabilities and shareholders’ equity

82,000 + 1,244,600 = 11,326,600

2. Shareholders’ equity

40,000 x 28 + 18600 = 1,244,600

3. Contributed capital

1,138,600

4. Issued share capital

609,000

5. Outstanding share capital (par)

609,000

6. Unissued share capital (number of shares)

79,400 shares

7. Share premium

529,600

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 18. BOOK VALUE PER SHARE

The shareholder equity of Dancing Queen Co. in the statement of financial position on December 31, 2014 is

as follows:

Share capital, P10 par, 100,000 shares P1,000,000

Share premium 500,000

Retained earnings 250,000

Treasury shares, 10,000 shares, cost – 50,000 50,000

Total Shareholder’s Equity / No. of shares outstanding = Book value

Share capital 1,000,000

Share premium 500,000

RE 250,000 100,000 – issued share

Treasury shares (50,000) -10,000 – TS (issued)

1,700,000 - SHE 90,000 – outstanding share

/ 90,000 - outstanding shares

Book Value = P18.89

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

PROBLEM 19. DIVIDENDS

For a company to declare Dividends, it must have Retained Earnings

RE- cinclose and income/expense ng corporation

Result: Income – RE (credit balance)

Loss – RE (debit balance); no longer called RE; DEFICIT instead

Unappropriated – all amounts are free for dividend declaration

Appropriation / Appropriated – setting aside portion of your income for a purpose

not free for dividend declaration / cannot declare as dividends

REASON:

1. Voluntary – the company itself, and the Board of Directors, set aside RE not to declare as dividends.

Expansion

2. Contractual

Loan agreement – they have contract na you cannot declare dividend unless you pay us

3. Legal

Treasury shares (deducted from RE)

EXAMPLE:

RE – P300,000 declare voluntary expansion, P100,000

RE 100,000

RE-appropriated 100,000

SHE (Shareholder’s Equity)

Contributed Capital

RE – unappropriated 200,000 – only amount that a company can declare dividend

RE – appropriated 100,000

300,000

TYPES OF DIVIDENDS

1. Cash - Cash Dividend Payable

2. Property (inventory - Property Dividend Payable

3. Share Dividends (Bonus issue) – Share/Stock Dividend Distributable with Share Capital & Share Premium (credit)

4. Scrip Dividend - Notes Payable with Interest Expense (debit)

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

DATES

1. Date of Declaration – date when BOD approved the payment of dividend

- LIABILITY arises

- may entry ka na kaagad

Example: Approves 200,000 dividends on 3/1/18

RE 200,000

Cash Dividend Payable 200,000 - depende kung anong klaseng dividend

2. Date of Record – lahat ng shareholder mo na makakareceive ng dividend until 4/1/18

- summarize who will receive dividend

- NO ENTRY

3. Date of Payment – paying all the liability on 5/1/18

Cash Dividend Payable 200,000 type of dividend ; current liability

Cash 200,000 kung ano yung given na word

Can be declared as

Peso value or

P5/share = 5,000

Percentage

10% x Par value

P100 - Par Value

x 10% - Percent

P10 / share dividend

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

Journalize each transaction below independently:

1. During the May 31, 2014, the Board of Directors of Cashew Corporation declared a dividend of P5 per

share, payable September 20, 2014, to shareholders of record July 31, 2014. The entity has 10,000 shares

issued and outstanding with par value of P100. Give the journal entries on (a) May 31, (b) July 31, and (c)

September 30.

a. May 31 RE 50,000

Cash Dividend Payable 50,000

b. Jul 31 No entry

c. Sept 30 Cash Dividend Payable 50,000

Cash 50,000

2. During the May 31, 2014, the Board of Directors of Cool Corporation declared a dividend of 10% dividend,

payable September 20, 2014, to shareholders of record July 31, 2014. The entity has 10,000 shares issued

(outstanding) and outstanding with par value of P100. Give the journal entries on (a) May 31, (b) July 31, and

(c) September 30.

P100 - Par Value

x 10% - Percent

10 - Dividend per share

x 10,000 Outstanding

P100,000

a. May 31 RE 100,000

Cash Dividend Payable 100,000

b. July 31 No entry

c. Sept 30 Cash Dividend Payable 100,000

Cash 100,000

3. Libra Co.’s board of directors decided to declare a dividend on June 30, 2014 to be distributed on August 1,

2014. The company will give inventories worth P1,500,000 to its shareholders of record July 10, 2014. Give the

journal entries on (a) June 30, (b) July 10, (c) August 1

a. Jun 30 RE 1,500,000

Property Dividend Payable 1,500,000

b. July 10 No entry

c. Aug 1 Property Dividend Payable 1,500,000

Inventories 1,500,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

4. Twins Corporation declared on July 1, 2014 dividends to its stockholders of record as of September 1, 2014.

However, due to shortage of cash, the corporation issued scrip dividends at the time of declaration amounting

to P100,000 (RE) with 12% interest payable on December 31, 2014. Give the journal entries on (a) July 1, (b)

September 1, and (c) December 31.

a. Jul 1 RE 100,000

Notes Payable 100,000

b. Sept 1 No entry

July 1 – Dec 31 (6 mos)

c. Dec 31 Notes Payable 100,000

Interest Expense 6,000

100,000 x 12% x 6/12 = 6,000

Cash 106,000

5. Consider the ff. information:

If Bonus Issue – find first the percentage if large

find the no. of shares outstanding

Bonus Issue – need to know the percentage na dineclare

20% more - LARGE - use PAR VALUE only

less than 20% - SMALL - use FMV

Share capital, P10 par, 100,000 shares authorized, 50,000 shares issued P500,000

Share premium 200,000

Retained earnings 300,000

The BOD declared a “bonus issue” on March 1, 2014 to be distributed on April 1, 2014. Fair value of

shares is P14 per share.

Prepare the entries on March 1, 2014 and April 1, 2014 assuming the company declared (a) 20% issue

and (b) 10% issue.

A. 20% @ PAR VALUE

50,000 - share issued (outstanding)

x 20%

10,000 - company will give new shares of 10,000 as dividends

a) RE (10,000 x P10) 100,000

Share/Stock Dividend Distributable 100,000

b) No Entry

c) Share/Stock Dividend Distributable 100,000

Share Capital 100,000

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

lOMoARcPSD|5437160

B. 10% @ FMV

50,000 - share issued

x 10%

5,000

a) RE (5,000 x P14) 70,000

Share/Stock Dividend Distributable 70,000

b) No Entry

c) Share/Stock Dividend Distributable 70,000

Share Capital (5,000 x P10) 50,000

Share Premium 20,000

Note: OS, PS, Share Capital = PAR VALUE

6. The company holds 15,000 shares in treasury costing P7.00 each with market value of P12 per share. The

BOD declared such treasury shares as dividend on February 14, 2014 to be issued on May 1, 2014. Prepare

the journal entries to record the foregoing transactions.

If treasury share and dineclare, ALWAYS COST METHOD

a) RE (15,000 x P7) 105,000

Stock/Share Dividend Distributable 105,000

b) No entry

c) Stock/Share Dividend Distributable 105,000

Share Capital 105,000

SHARE SPLIT

- kapag hindi na siya marketable, para mas mapababa yung value

- NO ENTRY ; Memo entry only

- NO EFFECT AT SHE

2-for-1 if may share of stock ka, yung isa mo gagawing dalawa.

dumarami lang yung par value

REVERSED – NO ENTRY

The comp. declare a 2-for-1 share split, the total number of share now is 2.

1-for-2 yung dalawa mo, magiging isa

tumataas yung par value

Downloaded by Jorufel Papasin (jorufel03@gmail.com)

You might also like

- Due Diligence Checklist For An ASSET PurchaseDocument2 pagesDue Diligence Checklist For An ASSET PurchaseDerek Noble50% (2)

- Sol To Exer 5-2 - 5-3 - 5-4 - 5-5 - 5-6 - 5-7 - 5-8 - 5-9 N Problem SolvingDocument32 pagesSol To Exer 5-2 - 5-3 - 5-4 - 5-5 - 5-6 - 5-7 - 5-8 - 5-9 N Problem Solvingzeroonezero80% (5)

- Chapter-7 Pracrice Exercise (Seatwork) Marato, Jedediah SamuelDocument3 pagesChapter-7 Pracrice Exercise (Seatwork) Marato, Jedediah SamuelJedediah Samuel Marato0% (1)

- Acco 20073 - Cost Accounting & Control: ApplicationsDocument23 pagesAcco 20073 - Cost Accounting & Control: ApplicationsMaria Kathreena Andrea AdevaNo ratings yet

- 01 AFAR L01 Partnership Formation & Operations PDFDocument7 pages01 AFAR L01 Partnership Formation & Operations PDFMikaela Salvador100% (1)

- Cost-Acctg-Page49-53Document5 pagesCost-Acctg-Page49-53Chen Hao50% (2)

- Answer KeyDocument5 pagesAnswer KeyYhancie Mae TorresNo ratings yet

- Cost of Land and Buildings Purchased by Esculent CoDocument7 pagesCost of Land and Buildings Purchased by Esculent Coprey kunNo ratings yet

- 6 Inventory PDFDocument10 pages6 Inventory PDFJorufel PapasinNo ratings yet

- 2019 Real Estate Accounting Reporting WhitepaperDocument24 pages2019 Real Estate Accounting Reporting Whitepaperrose querubinNo ratings yet

- Duyao - Yvonne - Antonette - M2ModuleAssignment-Data FilesDocument14 pagesDuyao - Yvonne - Antonette - M2ModuleAssignment-Data FilesYvonne DuyaoNo ratings yet

- Retirement of Share Capital and Treasury SharesDocument5 pagesRetirement of Share Capital and Treasury SharesAnnGabrielleUretaNo ratings yet

- Vdocuments - MX - Answers Chapter 3 Vol 2 RvsedDocument13 pagesVdocuments - MX - Answers Chapter 3 Vol 2 RvsedmirayNo ratings yet

- ms1 q3Document5 pagesms1 q3KrisshiaLynnSanchezNo ratings yet

- 555Document3 pages555Carlo ParasNo ratings yet

- Activity 10Document2 pagesActivity 10Randelle James FiestaNo ratings yet

- PAS 33-Earnings Per Share PAS 33-Earnings Per ShareDocument27 pagesPAS 33-Earnings Per Share PAS 33-Earnings Per ShareHazel PachecoNo ratings yet

- Pre FinactDocument6 pagesPre FinactMenardNo ratings yet

- Dividends Calculations for Preference and Ordinary SharesDocument9 pagesDividends Calculations for Preference and Ordinary SharesPenelope PalconNo ratings yet

- SHE Problems For Class Activity With AnswerDocument3 pagesSHE Problems For Class Activity With AnswerYou're WelcomeNo ratings yet

- Shareholders' Equity: Question 45-1Document18 pagesShareholders' Equity: Question 45-1debate ddNo ratings yet

- MS 1806 Inventory ModelDocument5 pagesMS 1806 Inventory ModelMariane MananganNo ratings yet

- Cost Accounting and Control Activity 2-Finals (Manufacturing Overhead: Actual and Applied)Document7 pagesCost Accounting and Control Activity 2-Finals (Manufacturing Overhead: Actual and Applied)Saarah KylueNo ratings yet

- Sample Journal EntriesDocument2 pagesSample Journal EntriesDoc Mark Emit100% (2)

- Effect of Loss of Objects of ObligationDocument3 pagesEffect of Loss of Objects of ObligationGabrielle MNo ratings yet

- 2.1D Diy-Exercises (Answer Key)Document28 pages2.1D Diy-Exercises (Answer Key)Chinito Reel CasicasNo ratings yet

- Partnership Dissolution AccountingDocument17 pagesPartnership Dissolution AccountingMaybelle Espenido0% (2)

- The and First: Following CostsDocument20 pagesThe and First: Following CostsVince Christian Padernal100% (1)

- University of Cebu Accounting 2 Prelim ExamDocument3 pagesUniversity of Cebu Accounting 2 Prelim ExamJM Singco Canoy100% (1)

- Kiara Company Provided The Following DataDocument1 pageKiara Company Provided The Following Datadagohoy kennethNo ratings yet

- P2 01Document10 pagesP2 01Herald GangcuangcoNo ratings yet

- Employee Benefits Part 2 pROBLEM 3-8Document2 pagesEmployee Benefits Part 2 pROBLEM 3-8Christian QuidipNo ratings yet

- Retained Earnings: Appropriation and Quasi-ReorganizationDocument25 pagesRetained Earnings: Appropriation and Quasi-ReorganizationtruthNo ratings yet

- Cost AccountingDocument6 pagesCost AccountingValierry VelascoNo ratings yet

- ParCor Chapter 3 - Hernandez - BSA 1-1 PDFDocument11 pagesParCor Chapter 3 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- Business Analytics - CrisEjanda11042019Document15 pagesBusiness Analytics - CrisEjanda11042019jayvee vitugNo ratings yet

- InventoryDocument4 pagesInventoryChris LutzNo ratings yet

- Inventories Problems 4-1. (Hamster Company) Include ExcludeDocument9 pagesInventories Problems 4-1. (Hamster Company) Include ExcludealeachonNo ratings yet

- Saint Louis CollegeDocument55 pagesSaint Louis CollegeKonrad Lorenz Madriaga UychocoNo ratings yet

- Parco RSPDocument5 pagesParco RSPElli Francis Tomenio0% (2)

- 642389Document6 pages642389mohitgaba19No ratings yet

- Case StudyDocument4 pagesCase StudyAnne Navarro100% (1)

- Exercises On InventoriesDocument19 pagesExercises On InventoriesJoel Christian Mascariña0% (1)

- Morilla, Rogelyn A. Bsa-1 Finacct E07 AnswersDocument5 pagesMorilla, Rogelyn A. Bsa-1 Finacct E07 AnswersGorge Rog Almaden Morilla100% (1)

- Business Law QuestionsDocument5 pagesBusiness Law QuestionschelissamaerojasNo ratings yet

- CORPORATIONEXERCISES28PROBLEMS29ONORGANIZATION21FEB21Document5 pagesCORPORATIONEXERCISES28PROBLEMS29ONORGANIZATION21FEB21Jasmine Acta0% (1)

- IA 1 Valix 2020 Ver. Problem 28Document6 pagesIA 1 Valix 2020 Ver. Problem 28Ariean Joy DequiñaNo ratings yet

- (Solved) 1. Mr. Lolong, Supervisory Employee, Received The Following Income... - Course HeroDocument11 pages(Solved) 1. Mr. Lolong, Supervisory Employee, Received The Following Income... - Course HeroBisag AsaNo ratings yet

- Cost - Concepts and ClassificationsDocument23 pagesCost - Concepts and ClassificationsYehetNo ratings yet

- Lump Sum LiquidationDocument10 pagesLump Sum LiquidationCharice Anne VillamarinNo ratings yet

- Earnings Per ShareDocument2 pagesEarnings Per Sharehae1234No ratings yet

- CH2 QuizkeyDocument5 pagesCH2 QuizkeyiamacrusaderNo ratings yet

- ParCor Chapter 5 - Hernandez - BSA 1-1 PDFDocument5 pagesParCor Chapter 5 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- INTACC DQsDocument9 pagesINTACC DQsMa. Alessandra BautistaNo ratings yet

- This Study Resource Was: Assessment Task 3Document5 pagesThis Study Resource Was: Assessment Task 3maria evangelistaNo ratings yet

- Pledge - Mortgage - Chattel MortgageDocument23 pagesPledge - Mortgage - Chattel MortgageJohn Kayle BorjaNo ratings yet

- ACCOUNTING FOR SHARE CAPITAL AND ORGANIZATION COSTSDocument27 pagesACCOUNTING FOR SHARE CAPITAL AND ORGANIZATION COSTSKrisha SaltaNo ratings yet

- CFASDocument4 pagesCFASAlyssa Janette SantosNo ratings yet

- Solution - Hand Out - Problems 2 3 and 4 - CFAS 2022Document12 pagesSolution - Hand Out - Problems 2 3 and 4 - CFAS 2022Anne Clarisse ConsuntoNo ratings yet

- Sw01 Shareholders Equity Key PDF FreeDocument5 pagesSw01 Shareholders Equity Key PDF FreePola PolzNo ratings yet

- Solution To Hand Out Problems - 5 - 6 - 7 and 8Document18 pagesSolution To Hand Out Problems - 5 - 6 - 7 and 8Anne Clarisse ConsuntoNo ratings yet

- Q1Document18 pagesQ1Hilario, Jana Rizzette C.No ratings yet

- ch10 ProblemsDocument8 pagesch10 ProblemsVon Edrian PaguioNo ratings yet

- Accounting For Income Tax-BasicDocument10 pagesAccounting For Income Tax-BasicJorufel PapasinNo ratings yet

- 9.3 Debt InvestmentsDocument7 pages9.3 Debt InvestmentsJorufel PapasinNo ratings yet

- 9.1 Equity Investments at Fair Value PDFDocument4 pages9.1 Equity Investments at Fair Value PDFJorufel PapasinNo ratings yet

- 9.3 Debt InvestmentsDocument7 pages9.3 Debt InvestmentsJorufel PapasinNo ratings yet

- 9.2 Investment in AssociateDocument6 pages9.2 Investment in AssociateJorufel PapasinNo ratings yet

- Inventory Estimation Techniques and Financial Accounting TheoriesDocument3 pagesInventory Estimation Techniques and Financial Accounting TheoriesJorufel PapasinNo ratings yet

- Cost Formulas, LCNRV, and Purchase CommitmentsDocument6 pagesCost Formulas, LCNRV, and Purchase CommitmentsJorufel PapasinNo ratings yet

- Hand-Out No. 5: Loan Receivable Financial Accounting and Reporting HAND-OUT NO. 5: Loan ReceivableDocument4 pagesHand-Out No. 5: Loan Receivable Financial Accounting and Reporting HAND-OUT NO. 5: Loan ReceivableJorufel PapasinNo ratings yet

- Bonds Payable PRACDocument6 pagesBonds Payable PRACJorufel PapasinNo ratings yet

- Cash Basis Basic ProblemDocument9 pagesCash Basis Basic ProblemJorufel PapasinNo ratings yet

- Dilluted Earnings Per ShareDocument7 pagesDilluted Earnings Per ShareJorufel PapasinNo ratings yet

- Accrued LiabilitiesDocument8 pagesAccrued LiabilitiesJorufel PapasinNo ratings yet

- Change in Accounting PolicyDocument5 pagesChange in Accounting PolicyJorufel PapasinNo ratings yet

- Single Entry PracDocument7 pagesSingle Entry PracJorufel PapasinNo ratings yet

- Imgtopdf Generated 1902201424029Document3 pagesImgtopdf Generated 1902201424029Jorufel PapasinNo ratings yet

- Imgtopdf Generated 1902201448002Document3 pagesImgtopdf Generated 1902201448002Jorufel PapasinNo ratings yet

- 1 - Basics of AccountingDocument48 pages1 - Basics of AccountingakshaykhaireNo ratings yet

- Solutions to End-of-Chapter ProblemsDocument12 pagesSolutions to End-of-Chapter ProblemsHadia ZafarNo ratings yet

- Accounting exam questions on corporate accounts and costingDocument3 pagesAccounting exam questions on corporate accounts and costingd.cNo ratings yet

- 17C - Jollibee Foods Corporation Press Release For 2ndQ 2021 FinalDocument7 pages17C - Jollibee Foods Corporation Press Release For 2ndQ 2021 FinalElla HermonioNo ratings yet

- Deutsche UFG Capital Management - ENGDocument28 pagesDeutsche UFG Capital Management - ENGAnton DenisovNo ratings yet

- Case Study Accounting Policy, Changes in Accounting Estimate, and ErrorsDocument2 pagesCase Study Accounting Policy, Changes in Accounting Estimate, and ErrorsHAO HUYNH MINH GIANo ratings yet

- Chapter - 5 Final Accounts: Learning Objectives After Learning This Chapter, You Will Be Able ToDocument41 pagesChapter - 5 Final Accounts: Learning Objectives After Learning This Chapter, You Will Be Able ToPranav SreeNo ratings yet

- Chap 11 - Equity Analysis and ValuationDocument26 pagesChap 11 - Equity Analysis and ValuationWindyee TanNo ratings yet

- Ac2102 RaDocument9 pagesAc2102 RaNors PataytayNo ratings yet

- Auditing & CostingDocument32 pagesAuditing & CostingAkki GalaNo ratings yet

- NPV and Other Investment RulesDocument23 pagesNPV and Other Investment RulesRajeevNo ratings yet

- Banking Laws and Jurisprudence ReviewerDocument82 pagesBanking Laws and Jurisprudence ReviewerAngel E. PortuguezNo ratings yet

- Mutual FundsDocument14 pagesMutual FundsSiddharthNo ratings yet

- ch10 - Divisional Performance DevelopmentDocument15 pagesch10 - Divisional Performance DevelopmentF RNo ratings yet

- WK - 7 - Relative Valuation PDFDocument33 pagesWK - 7 - Relative Valuation PDFreginazhaNo ratings yet

- Mutual Fund Child Plan AnalysisDocument3 pagesMutual Fund Child Plan AnalysisChintan DesaiNo ratings yet

- CHAPTER VI - Long-Term FinancingDocument55 pagesCHAPTER VI - Long-Term FinancingMan TKNo ratings yet

- Chapter 15 - Pas 16 PpeDocument36 pagesChapter 15 - Pas 16 PpeMarriel Fate CullanoNo ratings yet

- Read With Companies (Declaration and Payment of Dividend) Rules, 2014Document27 pagesRead With Companies (Declaration and Payment of Dividend) Rules, 2014nsk2231No ratings yet

- 2001 - DK Denis - Twenty-Five Years of Corporate Governance Research and CountingDocument22 pages2001 - DK Denis - Twenty-Five Years of Corporate Governance Research and Countingahmed sharkasNo ratings yet

- Taxsynth Page 25Document2 pagesTaxsynth Page 25Anne Marieline BuenaventuraNo ratings yet

- At December 31 2010 Westport Manufacturing Co Owned The FollowingDocument1 pageAt December 31 2010 Westport Manufacturing Co Owned The Followingtrilocksp SinghNo ratings yet

- Top 35 Equity Trading & Dealer Interview Questions With AnswersDocument7 pagesTop 35 Equity Trading & Dealer Interview Questions With Answersabhishek jainNo ratings yet

- AST MIDTERM Merged HandoutsDocument13 pagesAST MIDTERM Merged HandoutsUlyssa GeraldeNo ratings yet

- EPS significance and computationsDocument3 pagesEPS significance and computationsAccounterist ShinangNo ratings yet

- Quiz 1Document2 pagesQuiz 1Jao FloresNo ratings yet

- Proposed 51% Asset Purchase Structure for $823,140Document1 pageProposed 51% Asset Purchase Structure for $823,140SebiNo ratings yet

- Supply Chain ManagementDocument15 pagesSupply Chain Managementgabriel jimenezNo ratings yet