Professional Documents

Culture Documents

TABLE I: Alluvial Fund LP Returns (%) As of June 30, 2020: YTD 2019 2018 2017 Cumulative Annualized

Uploaded by

Andy HuffOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TABLE I: Alluvial Fund LP Returns (%) As of June 30, 2020: YTD 2019 2018 2017 Cumulative Annualized

Uploaded by

Andy HuffCopyright:

Available Formats

Dear Partners,

Alluvial Fund rose 14.8% in the second quarter, recouping most of the first quarter’s losses. As

I write in late July, the fund has reached approximately break-even for the year while small-cap

and micro-cap indexes remain down by double digit percentages, with “value” indexes faring

significantly worse. While break-even is certainly not an exciting result, I am happy to have

succeeded in preserving our capital amidst a thoroughly dispiriting environment for investors in

small companies and less liquid securities..

Most of our portfolio holdings are showing strong resilience in the face of the economic slowdown.

Those that have been stung by the pandemic have the operational flexibility and balance sheet

strength to manage through the downturn. Just as our often unlisted, often thinly-traded holdings

tend to outperform when fear and panic rule the day, they tend to lag when euphoria reigns. As

market indexes roared from March’s lows, many of the companies in our universe experienced only

a modest bounce, or none at all. I am reminded of the months and years following the financial

crisis of 2008, where investors only slowly regained the confidence needed to purchase lesser-

known securities despite the economic and market recovery taking place. Of course, brave souls

who were willing to buy these shares were amply rewarded in due time. I continue to seek out the

best of these opportunities for Alluvial Fund.

TABLE I: Alluvial Fund LP Returns (%) as of June 30, 2020

YTD 2019 2018 2017 Cumulative Annualized

Alluvial Fund LP NET -5.5 18.4 -9.0 29.6 32.0 8.3

Russell MicroCap TR -11.2 22.4 -13.1 13.2 6.9 1.9

Russell 2000 TR -13.0 25.7 -11.2 14.7 11.2 3.1

S&P 500 TR -3.1 31.5 -4.4 21.8 48.4 11.9

Partnership began operations 01/01/2017

In most of these letters, I highlight a few holdings that are new, or have reported substantial

business developments since my last communication. I thought partners would appreciate me

taking a more comprehensive approach in this letter and providing a run-down of all the fund’s

materially-sized positions. I believe each of these companies is dramatically under-valued either

Alluvial Capital Management, LLC Q2 2020 Letter to Limited Partners | p. 1

on its present-day assets and cash flows, or on a conservative estimate of the present value of all

growth and reinvestment opportunities.

Portfolio Review

P10 Holdings continues to be the fund’s largest position. I added to our position when shares

fell to $1.50 during March’s panic. With fears of economic catastrophe fading, P10 shares have

since soared to new highs. I believe P10 shares are currently worth between $3.50 and $4.00, and

potentially far more in future years depending on the company’s ability to acquire additional high-

margin, predictable fee streams from alternative investments managers. COVID-19 has not slowed

down P10’s ability to form relationships with new clients. In May, P10 subsidiary RCP Advisors won

a mandate from a Dutch pension group to invest $500 million over five years.

Intred SpA is (thus far) our most successful discovery from the Borsa Italiana’s AIM segment. Shares

have more than tripled since our initial purchases. This fiber-optic network operator continues

to sign up new clients for its ultra-high-speed network, and recently acquired a competitor. The

company is no longer an obvious value based on free cash flow yield, but Intred continues to enjoy

a strong set of investment opportunities,

both internal and external. What’s more, TABLE II: Top Ten Holdings (%)

Intred has created a negative working capital P10 Holdings Inc. 15.4

cycle where it gets paid in advance for its

services, effectively creating investment Intred S.p.A. 8.5

“float” and subsidizing its investment needs. Bredband2 i Skandinavien AB 8.0

I have become increasingly interested in firms

with sustainably negative working capital LICT Corporation 7.4

positions. More on the topic later in this Nuvera Communications 7.1

letter. Intred Shares remain attractive under

€10. Rand Worldwide Inc. 7.1

Crawford United Corp. 6.4

Bredband2 i Skandinavien continues to

Polaris Infrastructure Inc. 6.4

thrive as a low-cost provider of high-speed

internet in Sweden. Unlike Intred, Bredband2 MMA Capital Holdings Inc. 5.2

is largely non-asset-based, providing its

Butler National Corp. 4.6

services on networks owned by other parties.

Like Intred, Bredband2 generates substantial Total, Top Ten 76.1%

cash from advance payments by customers.

The magnitude of these payments allows Bredband2 to operate with negative invested capital and

fund all its capex needs from customer pre-payments. Astonishing. Bredband2 is a bargain below

SEK 2.00 per share, though I would be hesitant to sell our shares even at that level based on the

company’s long runway for growth and rare cash flow characteristics.

Following Bredband2 is LICT Corporation. LICT is in prime position in the telecom industry. LICT

has invested heavily over the years and now boasts a fiber-heavy, state-of-the-art network that

is well-positioned to deliver broadband to rural Americans for decades to come. The company

enjoys a substantial net cash position, enabling it to return virtually all its earnings to shareholders

via share repurchases. I wrote about LICT in a little more detail on OTC Adventures recently. Shares

Alluvial Capital Management, LLC Q2 2020 Letter to Limited Partners | p. 2

are conservatively worth $25,000, a figure that will only grow as the company companies to shrink

its share count.

Nuvera Communications has been a long-time stalwart for Alluvial Fund. The company will benefit

from increased need for quality consumer and business broadband connections in its Minnesota

and Iowa service territories. I am hard-pressed to find a better combination of robust free cash flow

generation, low risk operations and a healthy balance sheet. The company is not exactly exciting

or communicative (despite the name) and perhaps that is why Nuvera shares languish at 8.3x free

cash flow and 7.4x cash earnings (net income plus intangibles amortization). Nuvera has a history

of acquiring small Minnesota telecoms, and I expect the company to go on the hunt once again

as it pays down the low-cost debt it took on to purchase Scott-Rice Telephone in 2018. I believe

Nuvera should trade at a free cash flow yield of ~7-8%, which would value shares at $25-29. While

Nuvera does not have the highest long-term return potential in the Alluvial Fund portfolio, it offers

attractive upside potential with minimal risk.

Rand Worldwide has been a wonderful holding for Alluvial Fund, and I expect the best is yet to

come. Rand is a value-added software reseller of Autodesk products. Customers come to Rand

because they need assistance with training, software integration, and support. Autodesk software

is the gold standard in the engineering and design fields, and Autodesk is making every effort to

increase its sales by transitioning to a software-as-a-service model and beginning to crack down

on unauthorized users. Rand Worldwide is the beneficiary of these trends, and its revenues have

soared. Rand requires little investment and produces copious free cash flow, allowing the firm to

buy competitors and return capital. I would not sell Rand for less than $16 today, and I expect the

company’s value to grow quickly under the leadership of majority owner Peter Kamin.

Crawford United is one of our “stung” holdings. The company’s industrial subsidiaries were set to

have a record year until the pandemic came along and walloped the aerospace and construction

industries. This year’s results will not be impressive, but I continue to like the company’s long-

term strategy of acquiring small, good quality industrial firms in the Midwest. There are thousands

of potential acquisition targets. Acquiring these niche companies at low multiples of operating

income using responsible amounts of debt financing is a winning strategy that is both repeatable

and scalable. I continue to believe shares of Crawford are worth at least $25 today and potentially

far more in years to come.

Polaris Infrastructure has been a wild ride for shareholders, but the company’s core business

has never been stronger. The next 12 months will be an extraordinary time for Polaris. All of the

company’s Peruvian assets will come online, the company will very likely complete a hydro power

acquisition in Panama, and there is a strong chance the company will complete a refinancing of

its Nicaragua debt, lowering its cost and freeing up current cash flow. I expect the company to

continue making attractive purchases of renewable power resources in Latin America and South

America and sharing the resulting cash flow with shareholders. A 10% free cash flow yield would

be a fair price for Polaris, which would value shares well over $20 Canadian. Once the company’s

Nicaragua assets no longer account for the majority of the company’s value, I expect the free cash

flow yield to compress and for fair value to rise into the $30s.

Alluvial Capital Management, LLC Q2 2020 Letter to Limited Partners | p. 3

Next is MMA Capital Holdings, another long-time Alluvial holding. MMAC has been among

Alluvial’s most successful investments to date, though shareholders have little to show for the last

three years. Despite the market’s disinterest, the firm’s book value continues to grow at a healthy

pace. Earnings are growing proportionally as the solar construction lending business scales. MMA

was formerly a voracious repurchaser of its own shares but reduced its activity in favor of building

out its core business and preserving liquidity as credit markets came under stress earlier this year.

I am hopeful that with the worst of COVID-related fears behind us and shares still trading at a

25% discount to book value (excluding tax assets) the company will resume buying back shares. I

believe MMA should trade somewhere in the upper $30s, much closer to book value.

Butler National Corporation rounds out our meaningful holdings. Butler, an aerospace provider

with a casino company attached, would seem to be at the epicenter of industries most affected

by COVID-19. Indeed, Butler’s Kansas casino was closed for 66 days. However, the casino has

experienced good levels of traffic since reopening and is actually on track for a record July. The

much more important aerospace segment saw its profit slip to just under breakeven for the

quarter ended April 30, but backlog remains strong and the company is confident it will continue

experiencing healthy demand for its aircraft upgrades, modifications, and systems. Butler’s balance

sheet is as strong as ever with 15 cents in

net cash per share, casino lease excluded. I TABLE III: World Allocation (%)

struggle to see how Butler shares could be

United States 69.3

worth less than $1.00, though it may take

time for investors to regain their confidence Eurozone 11.9

in Butler’s continued profitability.

Sweden 8.0

Missing is Meritage Hospitality Group, Canada 6.7

which I sold in the second quarter after

United Kingdom 2.3

holding shares for years. Ultimately, I decided

I was no longer comfortable with the firm’s Australia 1.6

aggressive use of debt and its high operating Other 0.2

leverage given the extreme economic

uncertainty that prevailed. The risk that a Total 100%

long period of depressed revenue would

force Meritage to raise equity capital on deeply disadvantageous terms, or even force the firm into

bankruptcy, was unacceptably high. Additionally, other opportunities promised better upside with

substantially less risk. Fortunately for Meritage, a worst-case scenario has not come to pass, and

the company has dealt with its challenges effectively. Fortunately for us, the securities I purchased

with the proceeds from our Meritage shares (mainly P10 and Polaris) have performed very well.

On Negative Working Capital Cycles

As I mentioned when discussing Intred and Bredband2, I have become fascinated by business

models that feature a negative working capital cycle. Working capital may not be the flashiest

subject, but a company’s working capital characteristics will have a significant effect on its ability to

grow profitably and how it will manage the ups and downs of the business cycle.

Nearly all firms operate with positive working capital. Simply put, they receive cash some length of

Alluvial Capital Management, LLC Q2 2020 Letter to Limited Partners | p. 4

time after they record revenue. Their operating cash, inventory, and receivables, less payables, is a

positive figure. A positive working capital balance represents invested capital that must be funded

with debt or equity. As the company’s revenue grows, so do its working capital requirements and

the amount of capital required. Working capital needs act as a drag on returns on capital and on

the firm’s ability to produce profitable growth.

Rarely, a firm figures out how to reverse the normal pattern and collect significant cash before it

delivers its good or services. Most often, these are companies offering some kind of high-margin

intangible service that requires minimal physical inventory. For a firm that operates with negative

working capital, growth actually provides a capital subsidy as additional cash rolls in. Instead of

requiring incremental capital to support its working capital needs, the firm is free to use excess

cash to subsidize investment in fixed assets, perform acquisitions, or return capital to shareholders

without sacrificing growth opportunities.

Bredband2 i Skandinavien is a shining example. From 2015 to 2019, Bredband2 grew its revenues

from SEK 364 million to SEK 671 million, an increase of 84%. Over the same period, the company’s

non-cash net working capital went from negative SEK 65 million to negative SEK 119 million. That’s

a stunning figure. One would think an increase of 307 million in annual revenue would require

some increase in working capital, but not for Bredband2. Instead, the firm’s growth has freed up

over SEK 50 million in cash. The firm’s incredible cash generation is one reason Bredband2 has

been able to grow at a high-teens rate while distributing virtually all its earnings to shareholders.

Now, it must be said that the virtues of a negative working capital cycle only continue for as long

as a firm grows its revenue. If revenues fall, working capital consumes cash rather than providing

it. The long-term benefits of a negative working capital model only accrue to companies offering

products and services that will experience long-term growth in demand with minimal cyclicality.

Hmm, sounds a lot like broadband internet…

I am working to identify other small, little-known businesses that generate float through a negative

working capital cycle. One company I have found is a provider of custom, high-end travel packages

that gets paid by clients months in advance of their actual vacations. (Obviously, this business faces

short-term challenges from the pandemic.) If this company ends up in the Alluvial Fund portfolio, I

will be sure to provide a more complete description in my next letter.

Concluding Thoughts

Thank you for your confidence in Alluvial. I remain available any time for questions regarding our

strategy and portfolio, so please do not hesitate to contact me. As always, my entire investable

capital is committed to Alluvial Fund, and I spend each day looking for ways to make our collective

investment grow! I hope you and your families are happy and healthy despite the disruption we are

all experiencing. I look forward to writing to you again in October.

Regards,

Dave Waters, CFA

Alluvial Capital Management, LLC

Alluvial Capital Management, LLC Q2 2020 Letter to Limited Partners | p. 5

Disclosures

Investment in Alluvial Fund are subject to risk, including the risk of permanent loss. Alluvial Fund’s strategy may experience greater volatility and

drawdowns than market indexes. An investment in Alluvial Fund is not intended to be a complete investment program and is not intended for short-

term investment. Before investing, potential limited partners should carefully evaluate their financial situation and their ability to tolerate volatility.

Alluvial Capital Management, LLC believes the figures, calculations and statistics included in this letter to be correct but provides no warranty

against errors in calculation or transcription. Alluvial Capital Management, LLC is a Registered Investment Advisor. This communication does not

constitute a recommendation to buy, sell, or hold any investment securities.

Performance Notes

Net performance figures are for a typical limited partner under the standard fee arrangement. Returns for partners’ capital accounts may vary

depending on individual fee arrangements. Alluvial Fund, LP has a fiscal year end of December 31, 2019 and is subject to an annual audit by Cohen

& Company. Performance figures for year-to-date periods are calculated by NAV Consulting, Inc. Year-to-date figures are unaudited and are subject

to change. Gross performance figures are reported net of all partnership expenses. Net performance figures for Alluvial Fund, LP are reported net of

all partnership expenses, management fees, and performance incentive fees.

Contact

Alluvial welcomes inquiries from clients and potential clients. Please visit our website at alluvialcapital.com, or contact Dave Waters at info@

alluvialcapital.com or (412) 368-2321.

Alluvial Capital Management, LLC Q2 2020 Letter to Limited Partners | p. 6

You might also like

- Summary of Heather Brilliant & Elizabeth Collins's Why Moats MatterFrom EverandSummary of Heather Brilliant & Elizabeth Collins's Why Moats MatterNo ratings yet

- Letter To Limited Partners First Quarter 2021Document8 pagesLetter To Limited Partners First Quarter 2021l chanNo ratings yet

- Alluvial Capital Management Q2 2021 Letter To PartnersDocument8 pagesAlluvial Capital Management Q2 2021 Letter To Partnersl chanNo ratings yet

- May 15 10 Buy PDFDocument13 pagesMay 15 10 Buy PDFmerphixNo ratings yet

- Alluvial Capital Management Q4 2022 Letter To PartnersDocument9 pagesAlluvial Capital Management Q4 2022 Letter To PartnersChristopher CardonaNo ratings yet

- 2022 Q3 BAM LTR To ShareholdersDocument6 pages2022 Q3 BAM LTR To ShareholdersDan-S. ErmicioiNo ratings yet

- What We Don'T Own: Greenhaven Road CapitalDocument11 pagesWhat We Don'T Own: Greenhaven Road Capitall chanNo ratings yet

- 4-5 Maple FinanceDocument13 pages4-5 Maple FinanceasdNo ratings yet

- Top 5 PositionsDocument15 pagesTop 5 PositionsPradeep RaghunathanNo ratings yet

- Artko Capital 2019 Q2 LetterDocument7 pagesArtko Capital 2019 Q2 LetterSmitty WNo ratings yet

- Maran Partners Fund LP 2017 4Q LetterDocument10 pagesMaran Partners Fund LP 2017 4Q LetterTimmyNo ratings yet

- Q1 2018 - Investor LetterDocument4 pagesQ1 2018 - Investor Letterbillroberts981No ratings yet

- Artko Capital 2016 Q4 LetterDocument8 pagesArtko Capital 2016 Q4 LetterSmitty WNo ratings yet

- Kinnevik's Online Portfolio Poised for Emerging Market GrowthDocument118 pagesKinnevik's Online Portfolio Poised for Emerging Market GrowthDaniel ChngNo ratings yet

- Artko Capital LP Q2 2017 Letter Highlights Strong Returns and Focus on ROICDocument7 pagesArtko Capital LP Q2 2017 Letter Highlights Strong Returns and Focus on ROICSmitty WNo ratings yet

- Artko Capital 2018 Q2 LetterDocument9 pagesArtko Capital 2018 Q2 LetterSmitty WNo ratings yet

- Accounts Project ReportDocument30 pagesAccounts Project ReportkandysuchakNo ratings yet

- Steven Romick September 30, 2010Document13 pagesSteven Romick September 30, 2010eric695No ratings yet

- More IdeasDocument13 pagesMore IdeasRohaan KapurNo ratings yet

- Bruce Packard's Weekly Commentary on Spectra Systems and SomeroDocument8 pagesBruce Packard's Weekly Commentary on Spectra Systems and Somerobruce packardNo ratings yet

- Third Point Q4 Investor Letter FinalDocument12 pagesThird Point Q4 Investor Letter FinalZerohedge100% (3)

- Kinder Morgan Summary AnalysisDocument2 pagesKinder Morgan Summary Analysisenergyanalyst100% (2)

- Long Cast Advisors 3q18+letter+finalDocument7 pagesLong Cast Advisors 3q18+letter+finalkdwcapitalNo ratings yet

- Fitch Revises Outlook On Lippo Karawaci To Negative Due To Coronavirus Pandemic Af Rms at 'B-'Document10 pagesFitch Revises Outlook On Lippo Karawaci To Negative Due To Coronavirus Pandemic Af Rms at 'B-'Aryo DanudoroNo ratings yet

- Third Point Q3 2021 Investor Letter TPILDocument10 pagesThird Point Q3 2021 Investor Letter TPILZerohedge100% (2)

- Maran Partners Fund Q2 2020Document6 pagesMaran Partners Fund Q2 2020Paul AsselinNo ratings yet

- Artko Capital Q3 2019 Letter Highlights Strong Returns, Microcap Focus, Partnership GoalsDocument10 pagesArtko Capital Q3 2019 Letter Highlights Strong Returns, Microcap Focus, Partnership GoalsSmitty WNo ratings yet

- Third Point Q3 2013 TPOI LetterDocument5 pagesThird Point Q3 2013 TPOI LettermistervigilanteNo ratings yet

- 2022 Q2 BAM LTR To Shareholders FF BDocument8 pages2022 Q2 BAM LTR To Shareholders FF BDan-S. ErmicioiNo ratings yet

- VIC On Dolphin CapitalDocument6 pagesVIC On Dolphin Capitalredcorolla95573No ratings yet

- Quarterly Letter ReviewDocument4 pagesQuarterly Letter ReviewMatt EbrahimiNo ratings yet

- 2 PDFDocument5 pages2 PDFAnonymous Feglbx5No ratings yet

- RIDDocument8 pagesRIDrobpatel408No ratings yet

- Preqin Private Equity Spotlight December 2012Document20 pagesPreqin Private Equity Spotlight December 2012richard_dalaudNo ratings yet

- 1Q 2019 PresentationDocument8 pages1Q 2019 Presentationaugtour4977No ratings yet

- Kerr Is Dale Quarterly Letter 12-31-11Document3 pagesKerr Is Dale Quarterly Letter 12-31-11VALUEWALK LLCNo ratings yet

- Pitchbook 2020 Private Equity OutlookDocument15 pagesPitchbook 2020 Private Equity Outlookmichael zNo ratings yet

- Cedar Creek Partners Q1 2021 Results: Fund Returns 19.7Document7 pagesCedar Creek Partners Q1 2021 Results: Fund Returns 19.7Matt EbrahimiNo ratings yet

- Q1 2019 - Investor LetterDocument3 pagesQ1 2019 - Investor Letterbillroberts981No ratings yet

- Third Point May 2021Document10 pagesThird Point May 2021Owm Close CorporationNo ratings yet

- Greenspring Fund: Greenspring Fund Performance For The Periods Ended December 31, 2014Document6 pagesGreenspring Fund: Greenspring Fund Performance For The Periods Ended December 31, 2014Anonymous Feglbx5No ratings yet

- Investor LetterDocument3 pagesInvestor LetterRichard LiuNo ratings yet

- Artko Capital 2018 Q1 Letter PDFDocument9 pagesArtko Capital 2018 Q1 Letter PDFSmitty WNo ratings yet

- Q2 2017 - Investor LetterDocument6 pagesQ2 2017 - Investor Letterbillroberts981No ratings yet

- PGY MemoDocument74 pagesPGY MemoNesNosssNo ratings yet

- Funds Outperform Goals but Lag Benchmarks in 2019Document8 pagesFunds Outperform Goals but Lag Benchmarks in 2019Andy MaierNo ratings yet

- ForbesDocument24 pagesForbesapi-330066158No ratings yet

- Top Dividend ETFs 2012Document4 pagesTop Dividend ETFs 2012rlmohlaNo ratings yet

- Q2 2021results For Cedar Creek Partners CorrectedDocument8 pagesQ2 2021results For Cedar Creek Partners Correctedl chanNo ratings yet

- Artko Capital 2018 Q4 LetterDocument9 pagesArtko Capital 2018 Q4 LetterSmitty WNo ratings yet

- 2017 Q3 MC LetterDocument9 pages2017 Q3 MC LetterAnonymous Ht0MIJNo ratings yet

- Greenhaven Road Capital Q4 2018 Investor LetterDocument11 pagesGreenhaven Road Capital Q4 2018 Investor Letterl chanNo ratings yet

- Earn Higher Returns With A Low Risk Asset Class: Drip CapitalDocument2 pagesEarn Higher Returns With A Low Risk Asset Class: Drip CapitalMohammed Abrar AsifNo ratings yet

- Emp Capital Partners - 4Q12 Investor LetterDocument7 pagesEmp Capital Partners - 4Q12 Investor LetterLuis AhumadaNo ratings yet

- 1Q23 Robo ReportDocument14 pages1Q23 Robo ReportTaranga SenNo ratings yet

- To Longleaf Shareholders: Cumulative Returns at December 31, 2011Document6 pagesTo Longleaf Shareholders: Cumulative Returns at December 31, 2011VALUEWALK LLCNo ratings yet

- Five Questions For Dividend-Hungry InvestorsDocument5 pagesFive Questions For Dividend-Hungry InvestorsihopethisworksNo ratings yet

- The Right Time ToInvestDocument10 pagesThe Right Time ToInvestPrabu RagupathyNo ratings yet

- Greenlight UnlockedDocument7 pagesGreenlight UnlockedZerohedgeNo ratings yet

- The Broyhill Letter 2020.08 FINALDocument12 pagesThe Broyhill Letter 2020.08 FINALAndy HuffNo ratings yet

- Letter To Our Co Investors 2Q20Document26 pagesLetter To Our Co Investors 2Q20Andy HuffNo ratings yet

- Something of ValueDocument18 pagesSomething of ValueForkLogNo ratings yet

- General Updates: More Frequent and More SevereDocument14 pagesGeneral Updates: More Frequent and More SevereAndy HuffNo ratings yet

- Greenhaven Road Partners Fund (2020 Q2) Quarterly LetterDocument3 pagesGreenhaven Road Partners Fund (2020 Q2) Quarterly LetterAndy HuffNo ratings yet

- We Believe Lexinfintech Holdings Ltd. (Nasdaq: LX) Is A Leverage Time Bomb About To ExplodeDocument32 pagesWe Believe Lexinfintech Holdings Ltd. (Nasdaq: LX) Is A Leverage Time Bomb About To ExplodeAndy HuffNo ratings yet

- Fluidigm (FLDM) - The Stock That Will Spit To $35: BackgroundDocument10 pagesFluidigm (FLDM) - The Stock That Will Spit To $35: BackgroundAndy HuffNo ratings yet

- Rhizome Partners Q2 2020 Investor Letter FinalDocument12 pagesRhizome Partners Q2 2020 Investor Letter FinalAndy HuffNo ratings yet

- Northern Dynasty (NAK US) : MiningDocument23 pagesNorthern Dynasty (NAK US) : MiningAndy HuffNo ratings yet

- Spruce Point Activism Succeeds in Canada with Average 77% Share Price DeclinesDocument107 pagesSpruce Point Activism Succeeds in Canada with Average 77% Share Price DeclinesAndy HuffNo ratings yet

- Letter To Shareholders Excerpted From The 2020 Semiannual Financial Statement PDFDocument21 pagesLetter To Shareholders Excerpted From The 2020 Semiannual Financial Statement PDFAndy Huff100% (1)

- Letter To Shareholders Excerpted From The 2020 Semiannual Financial Statement PDFDocument21 pagesLetter To Shareholders Excerpted From The 2020 Semiannual Financial Statement PDFAndy Huff100% (1)

- 2Q20 Investor LetterDocument6 pages2Q20 Investor LetterAndy HuffNo ratings yet

- Letter To Shareholders Excerpted From The 2020 Semiannual Financial Statement PDFDocument21 pagesLetter To Shareholders Excerpted From The 2020 Semiannual Financial Statement PDFAndy Huff100% (1)

- Survivor & Thriver: Capital IQ, JDP EstimatesDocument4 pagesSurvivor & Thriver: Capital IQ, JDP EstimatesAndy HuffNo ratings yet

- Time Period Hayden (Net) S&P 500 MSCI World (ACWI)Document13 pagesTime Period Hayden (Net) S&P 500 MSCI World (ACWI)Andy HuffNo ratings yet

- Massif Capital 2nd Quarter Letter To InvestorsDocument6 pagesMassif Capital 2nd Quarter Letter To InvestorsAndy HuffNo ratings yet

- Epoch's Quarterly Capital Markets Outlook: William W. Priest, Cfa Lilian Quah, Cfa Kevin Hebner, PHDDocument23 pagesEpoch's Quarterly Capital Markets Outlook: William W. Priest, Cfa Lilian Quah, Cfa Kevin Hebner, PHDAndy HuffNo ratings yet

- Third Point Q2 2020 Investor Letter TPOIDocument13 pagesThird Point Q2 2020 Investor Letter TPOIZerohedge100% (1)

- 2020 08 10 Askeladden Capital Q2 2020 Letter UnkindDocument9 pages2020 08 10 Askeladden Capital Q2 2020 Letter UnkindAndy HuffNo ratings yet

- Lakewood Capital - 2020 Q2 Letter PDFDocument10 pagesLakewood Capital - 2020 Q2 Letter PDFcaleb wattsNo ratings yet

- Baron Asset Fund: June 30, 2020Document4 pagesBaron Asset Fund: June 30, 2020Andy HuffNo ratings yet

- Industry 4.0: Volume Lii July 2020Document8 pagesIndustry 4.0: Volume Lii July 2020Andy HuffNo ratings yet

- Small-Cap Value Fund: AS OF JUNE 30, 2020Document5 pagesSmall-Cap Value Fund: AS OF JUNE 30, 2020Andy HuffNo ratings yet

- 11018e PDFDocument1 page11018e PDFAndy HuffNo ratings yet

- 5f0b44cdc10751fbb7009cf3 - McLain Capital Q2 2020 Investor LetterDocument19 pages5f0b44cdc10751fbb7009cf3 - McLain Capital Q2 2020 Investor LetterAndy HuffNo ratings yet

- Q2 2020 Investor LetterDocument14 pagesQ2 2020 Investor LetterAndy HuffNo ratings yet

- RBC Global Insight - May-13Document13 pagesRBC Global Insight - May-13Andy HuffNo ratings yet

- Sentinel Boom: Ensuring An Effective Solution To Your Oil Spill Requirements!Document2 pagesSentinel Boom: Ensuring An Effective Solution To Your Oil Spill Requirements!Adrian GomezNo ratings yet

- A Disaster Recovery Plan PDFDocument12 pagesA Disaster Recovery Plan PDFtekebaNo ratings yet

- How To Make A Business Plan: Barbara MasciocchiDocument20 pagesHow To Make A Business Plan: Barbara MasciocchiFabianNo ratings yet

- Web Search - People's Public Trust CVACDocument23 pagesWeb Search - People's Public Trust CVACVincent J. CataldiNo ratings yet

- USTDA GPI Supports Fair ProcurementDocument2 pagesUSTDA GPI Supports Fair ProcurementMin HajNo ratings yet

- ECON F211 Principles of Economics: Module 3 (RSG)Document51 pagesECON F211 Principles of Economics: Module 3 (RSG)Hritik LalNo ratings yet

- Capstone Project 1: Product BacklogDocument11 pagesCapstone Project 1: Product BacklogHoàng Văn HiếuNo ratings yet

- Maulik Shah ResumeDocument1 pageMaulik Shah ResumeDeepak SantNo ratings yet

- ENGLISH - Radio Rebel Script - DubbingDocument14 pagesENGLISH - Radio Rebel Script - DubbingRegz Acupanda100% (1)

- Rimi Khanuja Vs S P Mehra Ors On 24 August 2022Document4 pagesRimi Khanuja Vs S P Mehra Ors On 24 August 2022Prakhar SinghNo ratings yet

- Chuo CityDocument8 pagesChuo CityEfra ReyNo ratings yet

- Carta de Porte Ferroviario: Modelos de Contratos InternacionalesDocument5 pagesCarta de Porte Ferroviario: Modelos de Contratos InternacionalesJonathan RccNo ratings yet

- The Girl in Room 105 Is The Eighth Novel and The Tenth Book Overall Written by The Indian Author Chetan BhagatDocument3 pagesThe Girl in Room 105 Is The Eighth Novel and The Tenth Book Overall Written by The Indian Author Chetan BhagatSiddharrth Prem100% (1)

- Understanding Diverse LearnersDocument13 pagesUnderstanding Diverse LearnersMerry Grace Aballe Abella100% (2)

- Multi Q!Document112 pagesMulti Q!collinmandersonNo ratings yet

- Notification No.54/2021 - Customs (N.T.) : Schedule-IDocument3 pagesNotification No.54/2021 - Customs (N.T.) : Schedule-Ianil nayakanahattiNo ratings yet

- 2022-09-01 The Harry Styles Photo BookDocument100 pages2022-09-01 The Harry Styles Photo BookSzilvia KovacsNo ratings yet

- Income Tax Appeals: Taxpayers Facilitation GuideDocument18 pagesIncome Tax Appeals: Taxpayers Facilitation GuideAqeel ZahidNo ratings yet

- Punjab National Bank Punjab National Bank Punjab National BankDocument1 pagePunjab National Bank Punjab National Bank Punjab National BankHarsh ChaudharyNo ratings yet

- Nike, Inc. and The Athletic Footwear Industry Strategy and Competition AnalysisDocument25 pagesNike, Inc. and The Athletic Footwear Industry Strategy and Competition AnalysisFernando Jorge Gomez Sulca100% (1)

- Tri-Cities Community Bank Case Study SolutionDocument2 pagesTri-Cities Community Bank Case Study SolutionJohn Marthin ReformaNo ratings yet

- CS PDFDocument26 pagesCS PDFcwmediaNo ratings yet

- IMICS Graduate Handbook 2014Document31 pagesIMICS Graduate Handbook 2014greenglassNo ratings yet

- SAP Certified FICO Consultant ResumeDocument12 pagesSAP Certified FICO Consultant Resumeஆக்ஞா கிருஷ்ணா ஷர்மாNo ratings yet

- I Twin Technology11 PDFDocument14 pagesI Twin Technology11 PDFChandhanNo ratings yet

- Security Valuations - Stocks EZDocument9 pagesSecurity Valuations - Stocks EZAakash RegmiNo ratings yet

- Court Clerk Cover Letter ExamplesDocument7 pagesCourt Clerk Cover Letter Examplesafazapfjl100% (2)

- Persuasive EssayDocument4 pagesPersuasive Essayapi-338650494100% (7)

- David Vs ArroyoDocument2 pagesDavid Vs ArroyoAjpadateNo ratings yet

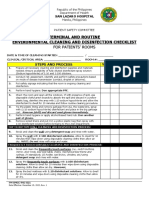

- Fm-Omcc-Psc-021 Terminal and Routine Environmental Cleaning and Disinfection Checklist.Document2 pagesFm-Omcc-Psc-021 Terminal and Routine Environmental Cleaning and Disinfection Checklist.Sheick MunkNo ratings yet

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionRating: 5 out of 5 stars5/5 (1)