Professional Documents

Culture Documents

MODIBBO ADAMA UNIVERSITY FINANCIAL ACCOUNTING TEST

Uploaded by

Babatunde BambiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MODIBBO ADAMA UNIVERSITY FINANCIAL ACCOUNTING TEST

Uploaded by

Babatunde BambiCopyright:

Available Formats

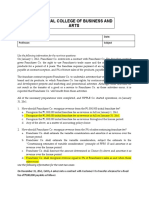

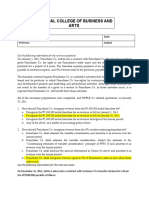

MODIBBO ADAMA UNIVERSITY OF TECHNOLOGY, YOLA

SCHOOL OF TECHNOLOGY AND SCIENCE EDUCATION

DEPARTMENT OF VOCATIONAL EDUCATION

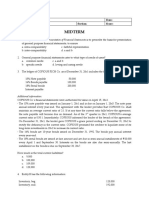

2018/2019 BSD 206 FINANCIAL ACCOUNTING TEST

INSTRUCTION: Answer Any Two TIME: 1 Hour

1. John and Jude are in partnership, sharing profits & losses in the ratio 6:4 respectively with

John & Jude contributing N180, 000 and N120, 000 as capital. They are entitled to 8%

interest on capital and charge 5% as interest on drawing. John and Jude both withdrew

N20, 000 while John is entitled to N 5,000 commission and Jude N15,000 monthly salary.

Thus, you are required to calculate their share of profit, given that the Net Profit for the

year was N100, 000, and also show all the necessary entries in;

a. Partners’ Appropriation Account,

b. Partners’ Capital Account and

c. Partners’ Current Account. (10 marks)

2. Ali and Adamu entered into a Joint venture on 1 st January, 2017 for the sale of Kitchen

tools. Profits and losses were agreed to be shared in the ratio 3:7. Ali bought goods for

N55,000 and incurred N7,500 as loading expenses; N6,000 as rent; N10,500 as sundry

expenses and N2,000 as market rates. Adamu also bought goods for N65,000 while

incurring N10,000 for advert; N14,000 as general expenses and sold the goods for

N200,000. He is entitled to 10% commission out of his own sale while Ali sold his goods

for N 60,000. You are required to prepare

a. Joint venture account in the books of each venture and

b. Joint venture memorandum account for the period. (10 marks)

3. Hassan conducts his business in two departments. The following balances were extracted

from their records as at 31st December 2014.

Dept. A Dept. B

Opening Stock 50,000 40,000

Purchases 236,000 164,000

Sales 400,000 320,000

Rent 28,000

Admin expenses 42,000

Salesman salaries 88,000

Insurance 21,000

Discount Allowed 8,000

Delivery Van expenses 56,000

Additional Information:

a) The closing stock of each department is 20% higher than the opening stock

b) All expenses relating to sales should be apportioned based on Sales

c) All expenses relating to building should be shared based on floor size of 3:4

d) Others are to be apportioned equally.

You are required to prepare Hassan’s departmental, trading, profit & loss account as at

31/12/2014. (10 marks)

You might also like

- Bcom 2 Sem Financial Accounting 2 20101139 Nov 2020Document5 pagesBcom 2 Sem Financial Accounting 2 20101139 Nov 2020Akhil AbrahamNo ratings yet

- 106 1648004706 PDFDocument15 pages106 1648004706 PDFMohd AmanullahNo ratings yet

- CU-2021 B. Com. (Honours) Financial Accounting-II Part-II Paper-C-22A QPDocument5 pagesCU-2021 B. Com. (Honours) Financial Accounting-II Part-II Paper-C-22A QPiamloser74No ratings yet

- JAM For Quiz MasterDocument10 pagesJAM For Quiz MasterJulie VelasquezNo ratings yet

- 207B 3rd Preboard ActivityDocument12 pages207B 3rd Preboard ActivityJERROLD EIRVIN PAYOPAYNo ratings yet

- MIDTERM EXAM FDocument14 pagesMIDTERM EXAM FJoyce LunaNo ratings yet

- Sol Installment SalesDocument16 pagesSol Installment SalesMaria Beatrice100% (1)

- Exam 2Document19 pagesExam 2SHE50% (2)

- Intermediate Accounting 3 Final Exam ReviewDocument19 pagesIntermediate Accounting 3 Final Exam ReviewMay Ramos100% (2)

- May 2017Document15 pagesMay 2017Cayden FavaNo ratings yet

- ACC201 Group Assignment covers inventory, depreciation, and bad debtsDocument3 pagesACC201 Group Assignment covers inventory, depreciation, and bad debtsPhan Phúc NguyênNo ratings yet

- Accounting Review: Key Financial ConceptsDocument23 pagesAccounting Review: Key Financial Conceptsjoyce KimNo ratings yet

- Institute of Business Management Final Assessment - Spring 2020Document6 pagesInstitute of Business Management Final Assessment - Spring 2020Shaheer KhurramNo ratings yet

- BA 99.1 Rodriguez LE 1 SamplexDocument6 pagesBA 99.1 Rodriguez LE 1 SamplexYsabella Beatriz SamsonNo ratings yet

- Final Revision Part 2 Language (2st)Document21 pagesFinal Revision Part 2 Language (2st)Magdy KamelNo ratings yet

- 11 Accountancy First Term Set BDocument6 pages11 Accountancy First Term Set Bmcsworkshop777No ratings yet

- Sample IA QuestionDocument3 pagesSample IA QuestionElisa Ferrer RamosNo ratings yet

- 11 Accountancy First Term Set ADocument6 pages11 Accountancy First Term Set Amcsworkshop777No ratings yet

- AFAR Qualifying ExamDocument7 pagesAFAR Qualifying ExamJeser JavierNo ratings yet

- MAS Final Preboard QuestionsDocument12 pagesMAS Final Preboard QuestionsVillanueva, Mariella De VeraNo ratings yet

- CBCS BCOM HONS Sem-3 COMMERCEDocument5 pagesCBCS BCOM HONS Sem-3 COMMERCEbittughNo ratings yet

- Assignment No. 5 Hoba Franchising Joint ArrangementsDocument4 pagesAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoNo ratings yet

- Financial AccountingDocument19 pagesFinancial AccountingObed AsamoahNo ratings yet

- Buss. Combi PrelimDocument8 pagesBuss. Combi PrelimPhia TeoNo ratings yet

- 207A Midterm ExaminationDocument5 pages207A Midterm ExaminationAldyn Jade Guabna100% (1)

- The ending balance of the "allowance for markup" account before combining the financial statements is 500,000.This is given directly in the information provided from the home office recordsDocument8 pagesThe ending balance of the "allowance for markup" account before combining the financial statements is 500,000.This is given directly in the information provided from the home office recordsAngelica CerioNo ratings yet

- Buss. Combi PrelimDocument8 pagesBuss. Combi PrelimPhia TeoNo ratings yet

- Sem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201Document5 pagesSem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201ruPAM DeyNo ratings yet

- BBA 8338 Financial Statement Analysis Assignment SolutionsDocument11 pagesBBA 8338 Financial Statement Analysis Assignment Solutionsmonir mahmudNo ratings yet

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- A. Technical MalversationDocument8 pagesA. Technical MalversationDinosaur Korean100% (1)

- AccountingDocument5 pagesAccountingOwen Hambulo Sr.No ratings yet

- Cash Flow Statement AnalysisDocument22 pagesCash Flow Statement AnalysisJoyce LunaNo ratings yet

- October2022 B Com WithCredits RegularunderCBCSPatternF Y B Com 956AA1A3Document3 pagesOctober2022 B Com WithCredits RegularunderCBCSPatternF Y B Com 956AA1A3All timeNo ratings yet

- Financial Management 2 Quiz Cash Flow and Financial PlanningDocument7 pagesFinancial Management 2 Quiz Cash Flow and Financial PlanningLeane MarcoletaNo ratings yet

- FINALS QUIZ Fin3Document11 pagesFINALS QUIZ Fin3Angela MartiresNo ratings yet

- FINALS QUIZ Fin3Document11 pagesFINALS QUIZ Fin3Erika Larinay100% (1)

- AUDITING-Adjusting Entries-Correction of ErrorsDocument10 pagesAUDITING-Adjusting Entries-Correction of ErrorsJamhel MarquezNo ratings yet

- Midterm Exam AST With AnswersDocument15 pagesMidterm Exam AST With AnswersJames CantorneNo ratings yet

- Midterm Exam AST With AnswersDocument15 pagesMidterm Exam AST With AnswersJames CantorneNo ratings yet

- 93 - Final PB MASDocument12 pages93 - Final PB MASEliny CruzNo ratings yet

- ASSET 2019 Mock Boards - AFARDocument8 pagesASSET 2019 Mock Boards - AFARKenneth Christian Wilbur0% (1)

- Group Assignment On Fundamentals of Accounting IDocument6 pagesGroup Assignment On Fundamentals of Accounting IKaleab ShimelsNo ratings yet

- AccountingDocument6 pagesAccountingBlue HourNo ratings yet

- Seatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWDocument5 pagesSeatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWChristine Joy LanabanNo ratings yet

- Basic Accounting and PartnershipDocument11 pagesBasic Accounting and PartnershipMichelle Chandria Bernardo-FordNo ratings yet

- Home Office and Branch AccountingDocument5 pagesHome Office and Branch AccountingMaryjoy Sarzadilla JuanataNo ratings yet

- 1 Partnership-YTDocument7 pages1 Partnership-YTSherwin DueNo ratings yet

- MODULE 3 - Installment SalesDocument8 pagesMODULE 3 - Installment SalesEdison Salgado Castigador50% (2)

- Special TransactionsDocument5 pagesSpecial TransactionsJehannahBarat100% (1)

- Jaya College of Arts and Science Department of ManagDocument4 pagesJaya College of Arts and Science Department of ManagMythili KarthikeyanNo ratings yet

- Thrift Corp. Prepaid Expenses QuizDocument9 pagesThrift Corp. Prepaid Expenses QuizKristine VertucioNo ratings yet

- FYJC Book Keeping and Accuntancy Topic Final AccountDocument4 pagesFYJC Book Keeping and Accuntancy Topic Final AccountRavichandraNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Afar QuizDocument18 pagesAfar QuizCpa Cheap review materialsNo ratings yet

- SOLIDATED-FINANCIAL-STATEMENTS-INTERCOMPANY-TRANSACTIONSDocument2 pagesSOLIDATED-FINANCIAL-STATEMENTS-INTERCOMPANY-TRANSACTIONSDarlyn DalidaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- BSD 206 - Manufacturing AccountDocument6 pagesBSD 206 - Manufacturing AccountBabatunde BambiNo ratings yet

- Partnership Accounting RecordsDocument16 pagesPartnership Accounting RecordsBabatunde BambiNo ratings yet

- Modibbo Adama University of Technology, YolaDocument3 pagesModibbo Adama University of Technology, YolaBabatunde BambiNo ratings yet

- Modibbo Adama University of Technology, YolaDocument3 pagesModibbo Adama University of Technology, YolaBabatunde BambiNo ratings yet

- Modibbo Adama University of Technology, YolaDocument3 pagesModibbo Adama University of Technology, YolaBabatunde BambiNo ratings yet

- Modibbo Adama University of Technology, YolaDocument3 pagesModibbo Adama University of Technology, YolaBabatunde BambiNo ratings yet

- Modibbo Adama University of Technology, YolaDocument3 pagesModibbo Adama University of Technology, YolaBabatunde BambiNo ratings yet

- Modibbo Adama University of Technology, YolaDocument3 pagesModibbo Adama University of Technology, YolaBabatunde BambiNo ratings yet

- Material On Entrepreneurship & Venture MGTDocument15 pagesMaterial On Entrepreneurship & Venture MGTBabatunde BambiNo ratings yet

- Modibbo Adama University of Technology, YolaDocument3 pagesModibbo Adama University of Technology, YolaBabatunde BambiNo ratings yet

- Modibbo Adama University of Technology, YolaDocument3 pagesModibbo Adama University of Technology, YolaBabatunde BambiNo ratings yet

- Strategic Planning Can Enhance Nigerian University QualityDocument12 pagesStrategic Planning Can Enhance Nigerian University QualityBabatunde BambiNo ratings yet

- Strategic Planning Can Enhance Nigerian University QualityDocument12 pagesStrategic Planning Can Enhance Nigerian University QualityBabatunde BambiNo ratings yet

- Behavioral BiasesDocument56 pagesBehavioral BiasesRajesh Chowdary Chintamaneni100% (1)

- Pre-Joining Documents ChecklistDocument6 pagesPre-Joining Documents ChecklistHeyder HeyderovNo ratings yet

- Cost ConceptsDocument24 pagesCost ConceptsAshish MathewNo ratings yet

- Economics XII ISC Sample PaperDocument3 pagesEconomics XII ISC Sample PaperAkshay Pandey100% (2)

- Canadian Income Taxation Solution ManuelDocument853 pagesCanadian Income Taxation Solution Manuelsam85% (13)

- York Capital's Letter To InvestorsDocument7 pagesYork Capital's Letter To InvestorsDealBook100% (12)

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro LimitedRishabh PareekNo ratings yet

- Develop Understanding of TaxationDocument19 pagesDevelop Understanding of TaxationHenok Eosi83% (6)

- Ch11 Corporations - Organization, Share Transactions, Dividends, and Retained EarningsDocument101 pagesCh11 Corporations - Organization, Share Transactions, Dividends, and Retained EarningsAhlan Jufri AbdullahNo ratings yet

- 75 - Industrial All RiskDocument28 pages75 - Industrial All RiskAMIT GUPTANo ratings yet

- Statutory Benefits For Workers in Industry AutosavedDocument11 pagesStatutory Benefits For Workers in Industry AutosavedErika100% (1)

- REVENUE MEMORANDUM CIRCULAR NO. 3-2013 Issued On January 9, 2013 ClarifiesDocument1 pageREVENUE MEMORANDUM CIRCULAR NO. 3-2013 Issued On January 9, 2013 ClarifiesmonarequillasNo ratings yet

- Completing The Accounting Cycle: Assignment Classification TableDocument107 pagesCompleting The Accounting Cycle: Assignment Classification Table김재민No ratings yet

- ChemoMetec annual report highlights global growth and customer focusDocument24 pagesChemoMetec annual report highlights global growth and customer focusDavidNo ratings yet

- B2B - Group 3 - Case 3 AnalysisDocument4 pagesB2B - Group 3 - Case 3 AnalysisSumedh KakdeNo ratings yet

- PM Philip Morris International CAGNY 2017Document59 pagesPM Philip Morris International CAGNY 2017Ala BasterNo ratings yet

- Quiz On RizalDocument14 pagesQuiz On RizalYorinNo ratings yet

- Entrepreneurship Grade12Document212 pagesEntrepreneurship Grade12Carmela Malabed0% (1)

- 4133104Document1 page4133104Ann BenjaminNo ratings yet

- Financial Statements Analysis - Ratio AnalysisDocument44 pagesFinancial Statements Analysis - Ratio AnalysisDipanjan SenguptaNo ratings yet

- Solutions To Self-Study QuestionsDocument47 pagesSolutions To Self-Study QuestionsChristina ZhangNo ratings yet

- Stop Order PlacementDocument19 pagesStop Order PlacementCeesdJ100% (1)

- Company Analysis - Applied Valuation by Rajat JhinganDocument13 pagesCompany Analysis - Applied Valuation by Rajat Jhinganrajat_marsNo ratings yet

- Mendez Vs People 726 SCRA 203 2014Document2 pagesMendez Vs People 726 SCRA 203 2014Anonymous MikI28PkJcNo ratings yet

- Individual Dividend Growth Portfolios OutperformDocument1 pageIndividual Dividend Growth Portfolios OutperformrickescherNo ratings yet

- Why Start A Chili Farming BusinessDocument21 pagesWhy Start A Chili Farming BusinessLalthanmawia Hrahsel100% (1)

- MR D.I.Y.: OutperformDocument9 pagesMR D.I.Y.: OutperformZhi_Ming_Cheah_8136No ratings yet

- Karnataka Financial Code SummaryDocument286 pagesKarnataka Financial Code SummaryMadhu YbNo ratings yet

- Disney stock valuation approachesDocument5 pagesDisney stock valuation approachesSiti Nabilah100% (1)

- Accounting policies and bank reconciliationDocument5 pagesAccounting policies and bank reconciliationHorace IvanNo ratings yet