89% found this document useful (18 votes)

85K views29 pagesChapter 1-5

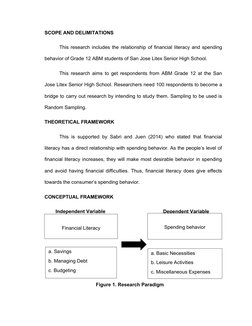

This chapter introduces the background, statement of the problem, significance, scope and limitations, theoretical framework, conceptual framework, and definition of terms for the study. Specifically:

1) The background discusses financial literacy, spending behavior, and factors that influence them.

2) The statement of the problem identifies the relationship between financial literacy and spending behavior as the focus of the study.

3) The significance explains how the study can benefit students, teachers, administrators, parents, and future researchers.

4) The scope and limitations indicate the study will examine this relationship for Grade 12 ABM students in one particular school.

Uploaded by

Diana ViñasCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

89% found this document useful (18 votes)

85K views29 pagesChapter 1-5

This chapter introduces the background, statement of the problem, significance, scope and limitations, theoretical framework, conceptual framework, and definition of terms for the study. Specifically:

1) The background discusses financial literacy, spending behavior, and factors that influence them.

2) The statement of the problem identifies the relationship between financial literacy and spending behavior as the focus of the study.

3) The significance explains how the study can benefit students, teachers, administrators, parents, and future researchers.

4) The scope and limitations indicate the study will examine this relationship for Grade 12 ABM students in one particular school.

Uploaded by

Diana ViñasCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

- Chapter 1: The Problem and Its Background

- Chapter 2: Review of Related Literature and Studies

- Chapter 3: Research Methodology

- Chapter 4: Presentation, Analysis, and Interpretation of Data

- Chapter 5: Summary of Findings, Conclusions and Recommendations