Professional Documents

Culture Documents

Exercises II - Adjusting Transactions

Uploaded by

Jowjie TVCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercises II - Adjusting Transactions

Uploaded by

Jowjie TVCopyright:

Available Formats

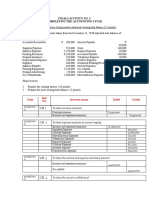

Exercises:

Prepare the adjusting entry for Christine Gamba Company under each of the following transactions for the year ending

December 31, 2017.

1. Paid P24,000 for a 1-year insurance fire policy to commence on Sept. 1. The amount of premium was debited to

Insurance Expense.

2. Purchased P 6,400 of supplies on account. At year’s end, P 5,000 worth of supplies was used during the

operation.

3. The entity purchased a delivery van worth P 500,000 and a market value of P 480,000. The delivery van was used

for the operation of the business. The estimated depreciation on the vehicle for the year was P 128,000.

Adjusting Entries:

Dec. 31 Prepaid Insurance 16,000

Insurance Expense 16,000

Supplies Expense 5,000

Supplies 5,000

Depreciation Expense - Del. Van 128,000

Accumulated Depreciation - Del. Van 128,000

Exercises:

a. The balance in the ledger account Office Supplies amounted to P 32,000. A count of the Office Supplies on Dec.

331, 2017 totaled P 12,800.

b. On Oct. 1, Gloria Diaz Company paid P 10,800 for 6-months’ rent. Prepare the adjusting entry on Dec. 31, 2017.

c. The entity acquired Office Equipment costing P352,800 on May 1, 2017. The equipment is expected to last 5

years after which it will be worthless. Compute for the depreciation expense as of Dec. 31, 2017.

d. Gloria Diaz received P 22,800 on Nov. 1 from a customer for service to be rendered during the months of

November to February. On December 31, 2 months’ worth of service is already done.

Answers:

Office Supplies Expense 19,200

Office Supplies 19,200

Rent Expense 5,400

Prepaid Rent 5,400

Depreciation Expense - Office Equip. 47,040

Accumulated Depreciation - Off. Equip. 47,040

Unearned Revenue 11,400

Revenue 11,400

Exercises:

a. Borrowed P 100,000 by issuing a 1-year note with 7% annual interest to BPI on Oct. 1, 2017.

b. Salary is paid on Saturdays. The weekly payroll is P 25,200. December 31 falls on Thursday. The company has a

six-day pay per week. The company has only one employee.

c. On December 31, Lipa Motors completed repairs on one of the trucks at a cost of P 8,000; the amount is not yet

recorded on Dec. 31, and by agreement it will be paid during Jan. 2018.

d. Received P 90,000 note in a certificate of deposit that paid 4% annual interest. The certificate was received by

the entity on May 1 and carried a 1-year term before maturity.

Answers:

Interest Expense 1,750

Interest Payable 1,750

Salaries Expense 16,800

Salaries Payable 16,800

Accounts Receivable 8,000

Revenues 8,000

Interest Receivable 2,400

Interest Income 2,400

Exercises:

a. Three-days’ salaries are unpaid as at December 31. Salaries are P75,000 for a five-day work week.

b. In December 31, a real property tax assessment for P16,000 on land owned during 2017 was received from the

BIR. The taxes, which are unpaid and unrecorded, are already due but the company intends to pay them on

January 15, 2018.

c. The P900,000 note payable was issued on October 31, 2017. It will be repaid in 12 months together with an

interest at an annual rate of 24%.

d. The entity has P2,000,000 sales and P4,500,000 sales on account for the year. It is estimated that 5% of the

credit sales are uncollectible at year-end.

Answers:

Salaries Expense 45,000

Salaries Payable 45,000

Taxes Expense 16,000

Taxes Payable 16,000

Interest Expense 36,000

Revenues 36,000

Uncollectible Accounts Expense 225,000

Allowance for Uncollectible Accounts 225,000

You might also like

- Adjusting Entries Exercises - EditedDocument4 pagesAdjusting Entries Exercises - EditedCINDY LIAN CABILLON100% (2)

- ASPL3 Activity 3-6 DoneDocument7 pagesASPL3 Activity 3-6 DoneConcepcion Family33% (3)

- Worksheet 1 PrelimDocument8 pagesWorksheet 1 PrelimGetteric obafial90% (20)

- WORKSHEETDocument36 pagesWORKSHEETNe Il100% (3)

- Worksheet SampleDocument6 pagesWorksheet SampleLycksele Rodulfa86% (7)

- Basic Accounting With Basic Corporate Accounting (ACCT 101)Document24 pagesBasic Accounting With Basic Corporate Accounting (ACCT 101)Harvy TorreburgerNo ratings yet

- ACTIVITY NO1and2Document5 pagesACTIVITY NO1and2Patricia Nicole Barrios100% (1)

- Noel Hungria, Adjusting EntriesDocument1 pageNoel Hungria, Adjusting EntriesFeiya Liu100% (2)

- Mads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEDocument3 pagesMads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEJowe Ringor Casignia100% (1)

- Adjusting Entry DrillDocument1 pageAdjusting Entry DrillJezeil Dimas50% (4)

- Laurent e Answer KeyDocument4 pagesLaurent e Answer KeyZee Santisas86% (7)

- General Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Document7 pagesGeneral Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Montibon El100% (1)

- T-Accounts, Evelyn Tria, Systems ConsultantDocument3 pagesT-Accounts, Evelyn Tria, Systems ConsultantFeiya Liu81% (21)

- Cleaners WorksheetDocument1 pageCleaners WorksheetCracklings Gacuma100% (3)

- Abm Q4Document3 pagesAbm Q4Brandon Choi100% (1)

- Activity 7 Adjusting Entries and Accounting PolicyDocument6 pagesActivity 7 Adjusting Entries and Accounting PolicyBlesh Macusi67% (3)

- MODULE-5 Ac 5 inDocument14 pagesMODULE-5 Ac 5 inBlesh Macusi75% (4)

- Adjusting EntriesDocument16 pagesAdjusting EntriesClarice Guintibano50% (6)

- Noel Hungria, Adjusting EntriesDocument1 pageNoel Hungria, Adjusting EntriesFeiya Liu100% (4)

- Travel Agency RubisomethingDocument12 pagesTravel Agency RubisomethingItsRenz YTNo ratings yet

- Initial InvestmentDocument18 pagesInitial InvestmentLyca Mae Cubangbang100% (3)

- SF Comprehensive Quiz 1Document10 pagesSF Comprehensive Quiz 1Francis Raagas40% (5)

- Work Sheet Moises Dondoyano Information SystemDocument1 pageWork Sheet Moises Dondoyano Information SystemRJ DAVE DURUHA100% (5)

- Account Transactions: Winnie VillanuevaDocument14 pagesAccount Transactions: Winnie VillanuevaPaula Bautista100% (7)

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Document3 pagesNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- Acc and BMDocument8 pagesAcc and BMShawn Mendez100% (1)

- Ebin Belderol TB and WorksheetDocument11 pagesEbin Belderol TB and WorksheetMarielle Ebin100% (3)

- Account Transactions: Kareen LeonDocument13 pagesAccount Transactions: Kareen LeonPaula BautistaNo ratings yet

- Closing Entries (Step 7) & Post Closing Trial Balance (Step 8)Document1 pageClosing Entries (Step 7) & Post Closing Trial Balance (Step 8)Eunice Villacacan33% (3)

- Accounting HomeworkDocument6 pagesAccounting HomeworkGavin Ramos100% (2)

- Saet Work AnsDocument5 pagesSaet Work AnsSeanLejeeBajan89% (27)

- Adjusting Entries Christine Gamba CargoDocument5 pagesAdjusting Entries Christine Gamba Cargoelma wagwag100% (2)

- Assignment1 M1 Transaction AnalysisDocument2 pagesAssignment1 M1 Transaction AnalysisAngel DIMACULANGANNo ratings yet

- Adjusting Entries 11-23Document2 pagesAdjusting Entries 11-23Allen CarlNo ratings yet

- Of The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesDocument5 pagesOf The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesLoriNo ratings yet

- Adjusting Entries ActivitiesDocument2 pagesAdjusting Entries ActivitiesJessa Mae Banse Limosnero100% (1)

- PROBLEMDocument3 pagesPROBLEMVine Vine D (Viney23rd)0% (6)

- FAR-Questionnaire 1Document71 pagesFAR-Questionnaire 1Jilian Kate Alpapara Bustamante40% (5)

- Feliciano CommunicationsDocument1 pageFeliciano Communicationscarlo serrano50% (8)

- AdjustingDocument39 pagesAdjustingRica mae camon100% (1)

- C3 - Problem 17 - Correcting A Trial BalanceDocument2 pagesC3 - Problem 17 - Correcting A Trial BalanceLorence John Imperial0% (1)

- Chapter 3Document14 pagesChapter 3Anjelika ViescaNo ratings yet

- FS Mariano Lerin FinalDocument15 pagesFS Mariano Lerin FinalMaria Beatriz Aban Munda75% (4)

- Lugo Z. Accounting Cycle Adjusting Entries, Financial Statements, Closing Entries, Reversing EntriesDocument78 pagesLugo Z. Accounting Cycle Adjusting Entries, Financial Statements, Closing Entries, Reversing EntriesCar Mela50% (2)

- Chapter 8-Problem 1Document3 pagesChapter 8-Problem 1kakao100% (1)

- Accounting 1 ReviewDocument13 pagesAccounting 1 ReviewAlyssa Lumbao100% (1)

- Ulidsonlen 5Document11 pagesUlidsonlen 5api-239547380100% (5)

- Adjusting EntriesDocument16 pagesAdjusting EntriesLuigi Santiago69% (26)

- Buenaventura Problem 11 15Document12 pagesBuenaventura Problem 11 15Anonn67% (3)

- Acctg1 - PDF Instruction ManualDocument114 pagesAcctg1 - PDF Instruction Manualdonaldpelaez67% (33)

- Finals Graded Exercises 005 OmarDocument26 pagesFinals Graded Exercises 005 OmarGarpt KudasaiNo ratings yet

- Accounting ProblemsDocument3 pagesAccounting ProblemsKeitheia Quidlat67% (3)

- 4.3.2.5 Elaborate - Determining AdjustmentsDocument4 pages4.3.2.5 Elaborate - Determining AdjustmentsMa Fe Tabasa0% (1)

- Comprehensive Problem 2 Corrected 1Document2 pagesComprehensive Problem 2 Corrected 1Ellaine joy Daria100% (3)

- Orca Share Media1605010109407 6731900321930361605Document37 pagesOrca Share Media1605010109407 6731900321930361605MARY JUSTINE PAQUIBOTNo ratings yet

- Paid Amount Due To Sanny Co. For The Purchase of Dec. 29, 2019 Less Discounts. Issued Check No. 83Document3 pagesPaid Amount Due To Sanny Co. For The Purchase of Dec. 29, 2019 Less Discounts. Issued Check No. 83Catherine Acutim100% (1)

- Cleaners WorksheetDocument1 pageCleaners WorksheetSeijuro Akashi100% (1)

- FSDocument44 pagesFSMaria Beatriz Aban Munda100% (2)

- Homework On Current Liabilities PDFDocument3 pagesHomework On Current Liabilities PDFJenneth RegalaNo ratings yet

- Acc ActivityDocument6 pagesAcc ActivityJoyce Eguia100% (1)

- PackagingDocument6 pagesPackagingJowjie TVNo ratings yet

- Purchase Decision Making Process in OrganizationDocument6 pagesPurchase Decision Making Process in OrganizationJowjie TVNo ratings yet

- Market Segmentation and TargetingDocument6 pagesMarket Segmentation and TargetingJowjie TVNo ratings yet

- Lesson 9. The Product I. Lesson ObjectivesDocument9 pagesLesson 9. The Product I. Lesson ObjectivesJowjie TVNo ratings yet

- Bases For Market SegmentationDocument7 pagesBases For Market SegmentationJowjie TVNo ratings yet

- 5 - Consumer Behavior Part 3 - Week 6Document7 pages5 - Consumer Behavior Part 3 - Week 6Jowjie TVNo ratings yet

- Consumer Behavior Part 2 - Week 4Document6 pagesConsumer Behavior Part 2 - Week 4Jowjie TVNo ratings yet

- Task Sheet - FileDocument1 pageTask Sheet - FileJowjie TVNo ratings yet

- An Overview of Marketing - Week 1Document7 pagesAn Overview of Marketing - Week 1Jowjie TVNo ratings yet

- Consumer Behavior - Week 3Document6 pagesConsumer Behavior - Week 3Jowjie TVNo ratings yet

- Task Sheet - BookDocument1 pageTask Sheet - BookJowjie TVNo ratings yet

- TASK SHEET - Edit Course SectionDocument1 pageTASK SHEET - Edit Course SectionJowjie TVNo ratings yet

- Revisiting Economics As A Social ScienceDocument6 pagesRevisiting Economics As A Social ScienceJowjie TVNo ratings yet

- Task Sheet - AssignmentDocument1 pageTask Sheet - AssignmentJowjie TVNo ratings yet

- Task Sheet - BackupDocument1 pageTask Sheet - BackupJowjie TVNo ratings yet

- Household Income and ExpenditureDocument7 pagesHousehold Income and ExpenditureJowjie TVNo ratings yet

- Rules and Regulations To Follow: Ict-Ed Institute of Science and Technology Inc. 1Document6 pagesRules and Regulations To Follow: Ict-Ed Institute of Science and Technology Inc. 1Jowjie TVNo ratings yet

- Competency-Based Training (CBT) : Ict-Ed Institute of Science and Technology Inc. 1Document16 pagesCompetency-Based Training (CBT) : Ict-Ed Institute of Science and Technology Inc. 1Jowjie TVNo ratings yet

- Roles of CBT Trainer and TraineesDocument4 pagesRoles of CBT Trainer and TraineesJowjie TVNo ratings yet

- Training Arrangements: Ict-Ed Institute of Science and Technology Inc. 1Document9 pagesTraining Arrangements: Ict-Ed Institute of Science and Technology Inc. 1Jowjie TVNo ratings yet

- Monitoring Tools: Ict-Ed Institute of Science and Technology Inc. 1Document9 pagesMonitoring Tools: Ict-Ed Institute of Science and Technology Inc. 1Jowjie TVNo ratings yet

- Evaluation System: Ict-Ed Institute of Science and Technology Inc. 1Document2 pagesEvaluation System: Ict-Ed Institute of Science and Technology Inc. 1Jowjie TVNo ratings yet

- Revisiting Economics As A Social ScienceDocument6 pagesRevisiting Economics As A Social ScienceJowjie TVNo ratings yet

- Applied Economics - Demand and SupplyDocument11 pagesApplied Economics - Demand and SupplyJowjie TV100% (1)

- Basic Economic Problems and The Philippine Socioeconomic Development in The 21st CenturyDocument6 pagesBasic Economic Problems and The Philippine Socioeconomic Development in The 21st CenturyJowjie TVNo ratings yet

- Revisiting Economics As A Social Science PART 2Document5 pagesRevisiting Economics As A Social Science PART 2Jowjie TVNo ratings yet

- TASK SHEET - Develop Chart of AccountsDocument2 pagesTASK SHEET - Develop Chart of AccountsJowjie TVNo ratings yet

- Case Study FormatDocument10 pagesCase Study FormatJowjie TVNo ratings yet

- Revisiting Economics As A Social ScienceDocument6 pagesRevisiting Economics As A Social ScienceJowjie TVNo ratings yet

- Study Guide: Facilitate Elearning Sessions Online Training (40 Hours) Prepared byDocument9 pagesStudy Guide: Facilitate Elearning Sessions Online Training (40 Hours) Prepared byPaulAcademics100% (2)

- Course Syllabus MGTP 31206 31207Document12 pagesCourse Syllabus MGTP 31206 31207NamitBhasinNo ratings yet

- Infographic Humanistic PsychologyDocument2 pagesInfographic Humanistic Psychologyvivain.honnalli.officialNo ratings yet

- Case Analysis: Beth OwensDocument8 pagesCase Analysis: Beth OwensPhillip CookNo ratings yet

- Northbrook CollegeDocument10 pagesNorthbrook CollegeDaniyal AsifNo ratings yet

- Culturally Safe Classroom Context PDFDocument2 pagesCulturally Safe Classroom Context PDFdcleveland1706No ratings yet

- Section-A: Terrace Ramp To Basement BalconiesDocument4 pagesSection-A: Terrace Ramp To Basement BalconiesRitikaNo ratings yet

- Z0109MN Z9M TriacDocument6 pagesZ0109MN Z9M TriaciammiaNo ratings yet

- Group Interative Art TherapyDocument225 pagesGroup Interative Art TherapyRibeiro CatarinaNo ratings yet

- Financial Markets & Institutions: Lecture Notes #3Document90 pagesFinancial Markets & Institutions: Lecture Notes #3Joan MaduNo ratings yet

- Eye Essentials Cataract Assessment Classification and ManagementDocument245 pagesEye Essentials Cataract Assessment Classification and ManagementKyros1972No ratings yet

- Crude TBP Country United Arab Emirates Distillation: MurbanDocument2 pagesCrude TBP Country United Arab Emirates Distillation: MurbanHaris ShahidNo ratings yet

- Esc200 12Document1 pageEsc200 12Anzad AzeezNo ratings yet

- Gambaran Professional Quality of Life Proqol GuruDocument7 pagesGambaran Professional Quality of Life Proqol Gurufebrian rahmatNo ratings yet

- Pentacon Six-02Document28 pagesPentacon Six-02Melissa Moreira TYNo ratings yet

- 4 - Mixing Equipments Used in Flocculation and CoagulationDocument27 pages4 - Mixing Equipments Used in Flocculation and Coagulationhadeer osmanNo ratings yet

- Project Report On MKT Segmentation of Lux SoapDocument25 pagesProject Report On MKT Segmentation of Lux Soapsonu sahNo ratings yet

- Amino AcidsDocument17 pagesAmino AcidsSiddharth Rohilla100% (2)

- Mcdes 1Document7 pagesMcdes 1JerdNo ratings yet

- 36 Petroland PD Serie DKDocument7 pages36 Petroland PD Serie DKBayu RahmansyahNo ratings yet

- Ryder Quotation 2012.7.25Document21 pagesRyder Quotation 2012.7.25DarrenNo ratings yet

- Chemsheets AS 006 (Electron Arrangement)Document27 pagesChemsheets AS 006 (Electron Arrangement)moiz427No ratings yet

- Physio Essay #4Document2 pagesPhysio Essay #4Maria Margarita Chon100% (1)

- Drug Abuse - A Threat To Society, Essay SampleDocument3 pagesDrug Abuse - A Threat To Society, Essay SampleAnonymous o9FXBtQ6H50% (2)

- Responsibility Accounting Practice ProblemDocument4 pagesResponsibility Accounting Practice ProblemBeomiNo ratings yet

- Osma Osmadrain BG Pim Od107 Feb 2017pdfDocument58 pagesOsma Osmadrain BG Pim Od107 Feb 2017pdfDeepakkumarNo ratings yet

- Traditional Christmas FoodDocument15 pagesTraditional Christmas FoodAlex DumitracheNo ratings yet

- Ethical Consideration in Leadership and ManagementDocument6 pagesEthical Consideration in Leadership and ManagementGlizzle Macaraeg67% (3)

- Inversor Abb 3 8kwDocument2 pagesInversor Abb 3 8kwapi-290643326No ratings yet

- Perkalink 900Document2 pagesPerkalink 900casual12100% (1)

- Prestress 3.0Document10 pagesPrestress 3.0Jonel CorbiNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet