Professional Documents

Culture Documents

House Bill 5636 - Package 1

Uploaded by

Denise MarambaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

House Bill 5636 - Package 1

Uploaded by

Denise MarambaCopyright:

Available Formats

Tax Reform Package 1

(House Bill 5636)

15 June 2017

TRAIN

Tax Reform for Acceleration and Inclusion

House Bill No. 5636

An Act Amending Sections 5, 6, 22, 24, 25, 31, 32, 33, 34, 79, 84, 86, 99,

106, 107, 108, 109, 116, 148, 149, 155, 171, 232, 237, 254, 264 and 288;

Creating new Sections 148-A, 150-A, 237-A, 264-A, 264-B and 265-A;

and Repealing Sections 35 and 62, all under the National Internal

Revenue Code of 1997, as amended

► Certified as urgent by President Rodrigo R. Duterte on

May 29, 2017

► Approved on the third and final reading by the House of

Representatives on May 31, 2017

Page 2 1 January 2014 Presentation title

Income tax rates for individual citizens and

resident aliens

► Current National Internal Revenue Code of 1997, as amended

Not over 10,000 5%

Over 10,000 But not over 500 + 10% of

30,000 excess over

10,000

2,500 + 15% of

Over 30,000 But not over

excess over

70,000

30,000

Over 70,000 But not over 8,500 + 20% of

140,000 excess over

70,000

Over 140,000 But not over 22,500 + 25% of

250,000 excess over

140,000

Page 3 14 June 2017 Tax Reform Package (House Bill 5636)

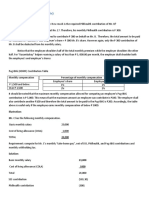

Income tax rates for individual citizens and

resident aliens

► HB 5636

Effective January 1, 2018, 2019 and 2020: Effective January 1, 2021 onwards:

Not 250,000 0% Not 250,000 0%

over over

Over 250,000 But not over 20% of excess over 250,000 Over 250,000 But not over 15% of excess over 250,000

400,000 400,000

Over 400,000 But not over 30,000 + 25% of excess over Over 400,000 But not over 22,500 + 20% of excess over

800,000 400,000 800,000 400,000

Over 800,000 But not over 130,000 + 30% of excess Over 800,000 But not over 102,500 + 25% of excess

2,000,000 over 800,000 2,000,000 over 800,000

Over 2,000,000 But not over 490,000 + 32% of excess Over 2,000,000 But not over 402,500 + 30% of excess

5,000,000 over 2,000,000 5,000,000 over 2,000,000

Over 5,000,000 1,450,000 + 35% of excess Over 5,000,000 1,302,500 + 35% of excess

over 5,000,000

over 5,000,000

► After 2022, the taxable income levels and base in the above schedule shall be adjusted once every three (3) years

after considering the effect of the same of the three-year cumulative CPI inflation rate rounded off to the nearest

thousandth.

Page 4 14 June 2017 Tax Reform Package (House Bill 5636)

Personal Income Tax Provisions Removed

► Minimum Wage Earners

► Definitions of Statutory Minimum Wage and Statutory Minimum

Wage Earner and the related provision on income tax exemption of

Minimum Wage Earners are removed

► Personal and Additional Exemptions

► Sections 35 on Personal and Additional Exemptions for Individual

Taxpayer and Section 79(D) on the related exemption certificate is

repealed

► 79(F) on the Rule on claiming exemptions for husband and wife is

also repealed

► Premium Payments on Health and/Hospitalization

► Deduction of P2,400.00 per family is removed

Page 5 14 June 2017 Tax Reform Package (House Bill 5636)

Personal Income Tax Provisions Revised

► Fringe Benefits Tax

► FBT shall be 30% from 32%

► The fringe benefit shall form part of the recipient employee’s gross

income beginning 2022 and thereafter, subject to regular income

tax

► 13th Month Pay and Other Benefits Excluded from Gross

Income

► Increased from P82,000.00 to P100,000.00

► Those who are allowed Deductions from Gross Income

► Included are self-employed and/or professionals whose gross

sales or gross receipts exceed the VAT threshold in Section 109

(P3,000,000).

Page 7 14 June 2017 Tax Reform Package (House Bill 5636)

Self-Employed Professionals

► HB 5636 added Section 24(A)(2)(B), (C) and (D) whereby:

► Self-employed and/or Professionals whose gross sales or gross

receipts do not exceed the VAT threshold in Section 109

(P3,000,000) will be subject to 8% income tax on gross sales or

gross revenues in excess of P250,000 in lieu of percentage tax.

► Self-employed and/or Professionals whose gross sales or gross

receipts exceed the VAT threshold in Section 109 (P3,000,000)

shall be taxed in the same manner as corporations as to the

applicable tax rate, minimum income tax and allowable

deductions, as provided in Sections 27(A), 27(E) and 34 of the Tax

Code.

Page 8 14 June 2017 Tax Reform Package (House Bill 5636)

Estate Tax

► Present NIRC - graduated schedule of rates:

If the net estate is:

Over But Not Over The Tax Shall Plus Of the Excess

Be Over

P 200,000 Exempt

P 200,000 500,000 0 5% P 200,000

500,000 2,000,000 P15,000 8% 500,000

2,000,000 5,000,000 135,000 11% 2,000,000

5,000,000 10,000,000 456,000 15% 5,000,000

10,000,000 And Over 1,215,000 20% 10,000,000

► HB 5636 - estate tax shall be 6% of the value of the net

estate.

Page 9 14 June 2017 Tax Reform Package (House Bill 5636)

Donor’s Tax

► Present NIRC - graduated schedule of rates:

If the net gift is:

Over But Not Over The Tax Shall be Plus Of the Excess Over

P 100,000 Exempt

P 100,000 200,000 0 2% P100,000

200,000 500,000 2,000 4% 200,000

500,000 1,000,000 14,000 6% 500,000

1,000,000 3,000,000 44,000 8% 1,000,000

3,000,000 5,000,000 204,000 10% 3,000,000

5,000,000 10,000,000 404,000 12% 5,000,000

10,000,000 1,004,000 15% 10,000,000

► Exception - gift to a stranger taxed at 30% of the net gift

Page 10 14 June 2017 Tax Reform Package (House Bill 5636)

Donor’s Tax

► HB 5636:

► Donor’s tax - 6% to be computed on the basis of the total gifts in

excess of P100,000 exempt gift made during the calendar year.

► The provision in Section 99(B) on a 30% donor’s tax on donations

to a stranger is removed.

Page 11 14 June 2017 Tax Reform Package (House Bill 5636)

VALUE-ADDED TAX (VAT)

Page 12 1 January 2014 Presentation title

VAT Zero-Rated Sales of Goods

► Sale of gold to the Bangko Sentral ng Pilipinas (BSP)

► Removed under the category: Export Sales

► Listed as a separate VAT zero-rated sale of goods [as Section

106(2)(c)];

► Section 106(A)(2)(a)(6) on VAT zero-rated export sale

now reads:

“Sale of goods, supplies, equipment and fuel to persons engaged in

international shipping or international air transport operations;

provided, that the goods, supplies, equipment and fuel shall be

used for international shipping or air transport operations.”

Page 13 14 June 2017 Tax Reform Package (House Bill 5636)

VAT Zero-Rated Sales of Goods

► A paragraph is added under VAT Zero-rated Export Sales to provide that:

► The following items shall be subject to the 12% VAT and no longer be

considered export sales subject to zero-percent (0%) VAT rate upon the

establishment and implementation of an enhanced VAT refund system

which gives the taxpayer the actual refund or denial of his application

within ninety (90) days from filing of the VAT refund application:

► Sale of raw materials or packaging materials to a nonresident buyer for

delivery to a resident local export-oriented enterprise to be used in

manufacturing, processing, packing or repacking in the Philippines of the

said buyer’s goods and paid for in acceptable foreign currency and

accounted for in accordance with BSP rules and regulations;

► Sale of raw materials or packaging materials to export-oriented enterprise

whose export sales exceed seventy percent (70%) of total annual

production;

► Those considered export sales under Executive Order No. 226, otherwise

known as the "Omnibus Investment Code of 1987", and other special laws;”

Page 14 14 June 2017 Tax Reform Package (House Bill 5636)

VAT Zero-Rated Sales of Goods

► B. Foreign-currency denominated sales:

► Removed from list of VAT zero-rated transactions

► C. Section 106(2)(a)(c) is revised to read as follows:

► “Sales to persons or entities whose exemption under special laws

or international agreements to which the Philippines is a signatory.”

► The phrase “effectively subjects such sales to zero rate” is

removed.

Page 15 14 June 2017 Tax Reform Package (House Bill 5636)

VAT on Sale of Services

Definition of “sale or exchange of services”

► The phrase “sale or exchange of services” shall include

sales of electricity by generation companies, transmission,

and distribution companies, including electric

cooperatives.

Page 16 14 June 2017 Tax Reform Package (House Bill 5636)

VAT Zero-rated Sales of Services

Revisions

The provision below is revised to read as follows:

SEC. 108. Value-added Tax on Sale of Services and Use or Lease of

Properties. –

(B) Transactions Subject to Zero Percent (0%) Rate - The following services performed in

the Philippines by VAT- registered persons shall be subject to zero percent (0%) rate. xxx

(4) Services rendered to persons engaged in international shipping or international air

transport operations, including leases of property for use thereof provided, that these

services shall be exclusively for international shipping or air transport operations.

Xxx xxx xxx

(6) Transport of passengers and cargo by domestic air or sea vessels from the

Philippines to a foreign country; and xxx”

Page 17 14 June 2017 Tax Reform Package (House Bill 5636)

VAT Zero-rated Sales of Services

Revisions

The provision below is revised to read as follows:

SEC. 108. Value-added Tax on Sale of Services and Use or Lease of

Properties. –

(B) Transactions Subject to Zero Percent (0%) Rate - The following services performed in

the Philippines by VAT- registered persons shall be subject to zero percent (0%) rate. xxx

(5) Services performed by subcontractors and/or contractors in processing,

converting, of manufacturing goods for an enterprise whose export sales

exceed seventy percent (70%) of total annual production.

Xxx xxx xxx

“Provided, that item (B)(5) hereof shall be subject to the twelve percent (12%)

value-added tax and no longer be subject to zero-percent (0%) VAT rate upon

the establishment and implementation of an enhanced VAT refund system

which gives the taxpayer the actual refund or denial of his application within

ninety (90) days from the filing of the VAT refund application.”

Page 18 14 June 2017 Tax Reform Package (House Bill 5636)

VAT- Exempt Transactions

Removed Provision

Item Q below is removed from the list of VAT-Exempt

Transactions:

► Lease of a residential unit with a monthly rental not exceeding Ten

thousand pesos (P10,000) (supposed to be Php12,800.00 under

RR 16-2011).

Page 19 14 June 2017 Tax Reform Package (House Bill 5636)

VAT- Exempt Transactions

The following VAT-exempt transaction is revised to read as

follows:

► “(D) Importation of professional instruments and implements, tools of trade,

occupation or employment, wearing apparel, domestic animals, and

personal household effects belonging to persons coming to settle in the

Philippines or Filipinos or their families and descendants who are now

residents or citizens of other countries, such parties hereinafter referred to

as overseas Filipinos, in quantities and of the class suitable to the

profession, rank or position of the persons importing said items, for their

own use and not for barter or sale, accompanying such persons, or arriving

within reasonable time: Provided, that the Bureau of Customs may, upon

the production of satisfactory evidence that such persons are actually

coming to settle in the Philippines and that the goods are brought from

their former place of abode; Provided, further, that vehicles, vessels,

aircrafts, machineries and other similar goods for use in manufacture, shall

not fall within this classification and shall therefore be subject to duties,

taxes and other charges.”

Page 20 14 June 2017 Tax Reform Package (House Bill 5636)

VAT- Exempt Transactions

Revisions

► The provision below is revised as follows:

► Section 109 of Present NIRC:

► (P) Sale of real properties not primarily held for sale to customers or held for lease

in the ordinary course of trade or business, or real property utilized for low-cost and

socialized housing as defined by Republic Act No. 7279, otherwise known as the

Urban Development and Housing Act of 1992, and other related laws, residential

lot valued at One million five hundred thousand pesos (P1,500,000) and below,

house and lot, and other residential dwellings valued at Two million five hundred

thousand pesos (P2,500,000) and below: Provided, That not later than January 31,

2009 and every three (3) years thereafter, the amounts herein stated shall be

adjusted to their present values using the Consumer Price Index, as published by

the National Statistics Office (NSO);

► HB 5636:

► “(P)Sale of real properties not primarily held for sale to customers or held for lease

in the ordinary course of trade or business, or real property utilized for socialized

housing as defined by Republic Act No. 7279, otherwise known as the Urban

Development and Housing Act of 1992, and other related laws.”

Page 21 14 June 2017 Tax Reform Package (House Bill 5636)

VAT- Exempt Transactions

Revisions

► The provision below is revised to read as follows:

► Section 109 of Present NIRC:

► (U) Importation of fuel, goods and supplies by persons engaged in

international shipping or air transport operations;

► HB 5636

► “(T) Importation of fuel, goods and supplies by persons engaged in

international shipping or air transport operations; Provided, that the

fuel, goods, and supplies, shall be used for international shipping

or air transport operations.”

Page 22 14 June 2017 Tax Reform Package (House Bill 5636)

VAT- Exempt Transactions

Revisions

► The provision below is revised as follows:

► Section 109 of Present NIRC

► (W) Sale or lease of goods or properties or the performance of services other

than the transactions mentioned in the preceding paragraphs, the gross annual

sales and/or receipts do not exceed the amount of One million five hundred

thousand pesos (P1,500,000): Provided, That not later than January 31, 2009

and every three (3) years thereafter, the amount herein stated shall be adjusted

to its present value using the Consumer Price Index, as published by the

National Statistics Office (NSO);”

► HB 5636

► “(W) Sale or lease of goods or properties or the performance of services other

than the transactions mentioned in the preceding paragraphs, the gross annual

sales and/or receipts do not exceed the amount of Three million pesos

(P3,000,000): Provided, That not later than January 31, 2021 and every three

(3) years thereafter, the amount herein stated shall be adjusted to its present

value using the Consumer Price Index, as published by the Philippine Statistics

Authority (PSA).”

Page 23 14 June 2017 Tax Reform Package (House Bill 5636)

VAT- Exempt Transactions

Added Provisions

► The provision below is added to the list of VAT exempt

transactions :

► Section 109(V):

“Sale or lease of goods and services to senior citizens and persons with disabilities, as

provided under Republic Act Nos. 9994 (Expanded Senior Citizens Act of 2010) and

10754 (An Act Expanding the Benefits and Privileges of Persons with Disability).”

► The following is added as a last paragraph under Section 109:

► “Provided, that the sale of real property utilized for socialized housing under Item

(P) hereof shall no longer be an exempt transaction upon the establishment of a

housing voucher system which shall benefit buyers of socialized housing.”

Page 24 14 June 2017 Tax Reform Package (House Bill 5636)

Tax on Persons Exempt from VAT

Section 116 is revised as follows:

► Present NIRC

► "SECTION 116. Tax on Persons Exempt from Value-added Tax (VAT). — Any

person whose sales or receipts are exempt under Section 109 (V) of this Code from

the payment of value-added tax and who is not a VAT-registered person shall pay a

tax equivalent to three percent (3%) of his gross quarterly sales or receipts:

Provided, That cooperatives shall be exempt from the three percent (3%) gross

receipts tax herein imposed.”

► HB 5636

► "SECTION 116. Tax on Persons Exempt from Value-added Tax (VAT). — Any

person whose sales or receipts are exempt under Section 109 (W) of this Code

from the payment of value-added tax and who is not a VAT-registered person shall

pay a tax equivalent to three percent (3%) of his gross quarterly sales or receipts:

Provided, That self-employed and/or professionals whose gross sales or gross

receipts do not exceed the VAT threshold and cooperatives shall be exempt from

the three percent (3%) gross receipts tax herein imposed.”

Page 25 14 June 2017 Tax Reform Package (House Bill 5636)

Excise Tax

Page 26 1 January 2014 Presentation title

Excise Tax

Rates for Manufactured Oils and Other Fuels

► Lubricating oils and greases

► Increased to P7 from P4.50 (to P9.00 in 1/1/19 and to P10 in 1/1/20);

► Processed gas, per liter of volume capacity

► Increased to P3 from P0.05 (to P 5 in 1/1/19 and to P6 in 1/1/20);

► Denatured alcohol to be used for motive power, per liter of volume capacity

► Increased to P3 from P0.05 (to P5 in 1/1/19 and to P6 in 1/1/20);

► Leaded premium gasoline, per liter of volume capacity

► increased to P7 from P 5.35 (to P9 in 1/1/19 and to P10 in 1/1/20);

► Unleaded premium gasoline, per liter of volume capacity

► increased to P7 from P4.35 (to P9 in 1/1/19 and to P10 in 1/1/20);

Page 27 14 June 2017 Tax Reform Package (House Bill 5636)

Excise Tax

► Aviation turbo jet fuel

► Increased to P7 from P3.67 (to P9 in 1/1/19 and to P10 in 1/1/20);

► For kerosene

► Increased to P3 from P0 (to P5 in 1/1/19 and to P6 in 1/1/20);

► For diesel fuel oil, and on similar fuel oils having more or less the same generating

power

► Increased to P3 from P0 (to P5 in 1/1/19 and to P6 in 1/1/20);

► For liquefied petroleum gas

► Increased to P3 from P0 (to P5 in 1/1/19 and to P6 in 1/1/20),;

► For bunker fuel oil, and on similar fuel oils having more or less the same generating

power

► Increased to P3 from P0 (to P5 in 1/1/19 and to P6 in 1/1/20);

► For the period covering 2018 to 2020, the scheduled increase in the excise tax on fuel as imposed in

this section shall be suspended should the Dubai crude oil price reach eighty dollars (USD 80) per

barrel or more;

► Provided, that, should the said oil price per barrel fall below eighty dollars (USD 80), the scheduled

increase in excise tax shall be implemented: Provided, finally, that any suspension of the increase in

excise tax shall not result in any reduction of the excise tax being imposed at the time of the

suspension.

Page 28 14 June 2017 Tax Reform Package (House Bill 5636)

Mandatory Marking of Petroleum Products

Page 29 1 January 2014 Presentation title

Mandatory Marking of all Petroleum Products

Section 148-A (A) – (B)

► All petroleum products (refined oil and other fuel) that are refined in,

manufactured in, and/or imported into the Philippines, and that are subject to

the payment of taxes and duties, which include but is not limited to gasoline

and diesel, shall be marked with the official marking agent designated by the

Department of Finance (DOF). The marker shall be introduced at the refinery

or at the terminal, before the petroleum product is offloaded or transported to

the domestic market

► The person, entity, or taxpayer who owns or enters the petroleum

products into the country, or the person to whom the petroleum products

are consigned shall cause and accommodate the marking of petroleum

products with the official marking agent.

► A Customs/BIR official shall be on site to administer the declaration of the

tax and duties applied on the petroleum products.

Page 30 14 June 2017 Tax Reform Package (House Bill 5636)

Official Markers

Section 148-A (C)

► Official Markers.

► There shall be a list of chemical additives and corresponding quantitative

ratio for each type of fuel

► The official fuel markers shall be distinct and immune to imitation or

replication.

► Official fuel marker used in the Philippines must not be used in any part of

the world.

► Official markers’ chemical composition and quantitative ratio must persist

for at least three (3) years from their application or administration to the

unmarked fuel.

Page 31 14 June 2017 Tax Reform Package (House Bill 5636)

Absence of Marker; Presumptions

Section 148-A (D)

► Absence of Official Marker or Use of Fraudulent Marker;

Presumptions.

► If no official marker is found, it shall be presumed that the same

were refined, manufactured, and/or imported or withdrawn with the

intention to evade the payment of the taxes and duties due

thereon.

► The absence of the official marker or the use of fraudulent marker

on the petroleum products shall be considered prima facie

evidence that the same have been withdrawn or imported without

the payment of the excise tax.

Page 32 14 June 2017 Tax Reform Package (House Bill 5636)

Prosecution of Offense

Section 148-A (E)

► The failure of any person, entity or the taxpayer

responsible for the marking of the petroleum products as

required in this section shall be prosecuted under Section

265-A of this Code.

Page 33 14 June 2017 Tax Reform Package (House Bill 5636)

Offenses Relating to Fuel Marking

Sec. 265-A

Sec. 265-A. Offenses Relating to Fuel Marking. –

All offenses relating to fuel marking are hereby considered as economic

sabotage, and shall, in addition to the penalties imposed under Title X of this Act,

Section 1401 of Republic Act No. 10863, and other relevant laws, be punishable

as follows:

A. Any person convicted of selling, trading, delivering, distributing or

transporting unmarked fuel in commercial quantity held for domestic use or

merchandise shall suffer the penalties of:

1st offense - Fine P2,500,000.00

2nd offense - Fine of P5,000,000.00

3rd offense - Fine of P10,000,000.00 and revocation of license to

engage in any trade or business

Page 34 14 June 2017 Tax Reform Package (House Bill 5636)

Offenses Relating to Fuel Marking

Sec. 265-A (continued..)

B. The same penalty as above shall be imposed on any person who:

► Causes the removal of the official fuel marking agent from marked fuel

► Causes the adulteration or dilution of fuel intended for sale to domestic

market

► Has the knowing possession, storage, transfer or offer for sale of fuel

obtained as a result of such removal, adulteration or dilution

C. Any person convicted of the following acts:

► Making, importing, selling, using or possessing fuel markers without

express authority;

► Making, importing, selling, using or possessing counterfeit fuel markers; or

► Causing another person or entity to commit any of the two preceding acts

Fine - P1,000,000.00 - P5,000,000.00

Imprisonment - 4 years - 8 years

Page 35 14 June 2017 Tax Reform Package (House Bill 5636)

Offenses Relating to Fuel Marking

Sec. 265-A (continued..)

D. Any person convicted of willfully implicating, incriminating or imputing the

commission of any violation of this act by directly or indirectly, overtly or

covertly inserting, placing, adding or attaching whatever quantity of:

► Unmarked fuel

► Counterfeit additive

► Chemical

in the person, house, effects, inventory, or in the immediate vicinity of an

individual

Fine - P1,000,000.00 - P5,000,000.00

Imprisonment - 4 years - 8 years

Page 36 14 June 2017 Tax Reform Package (House Bill 5636)

Offenses Relating to Fuel Marking

Sec. 265-A (continued..)

E. Any person authorized, licensed or accredited to conduct fuel tests, who

knowingly, willfully or through gross negligence issues false or fraudulent fuel

test results

Additional penalty of imprisonment: 1 year and 1 day - 2 years and 6 months

The court may at its instance, impose the additional penalties of:

► Revocation of the license to practice his/her profession in case of a

practitioner

► Closure of the fuel testing facility

Page 37 14 June 2017 Tax Reform Package (House Bill 5636)

Random Field Tests

Section 148-A (F)

F. Random Field Tests –

► shall be conducted on fuels found in the warehouses, gas stations

and other retail outlets and in such other properties or equipment

► to be conducted in the presence of a representative from BIR or

BOC, third party marking provider, and authorized representative

of owner of the fuel to be tested.

► All field tests shall be properly filmed or video-taped, and

documented.

► BOC or BIR shall immediately obtain a sample of the tested fuel

upon discovering that the same is unmarked, adulterated or

diluted.”

Page 38 14 June 2017 Tax Reform Package (House Bill 5636)

Confirmatory Tests

Section 148-A (G)

G. Confirmatory Tests –

► to be conducted on the tested unmarked, adulterated, or diluted fuel

in an accredited ISO 170025 testing facility.

► Confirmatory fuel test certificates issued by fuel testing facilities shall:

► be valid for any legal purpose; and

► constitute admissible and conclusive evidence before any court.

Page 39 14 June 2017 Tax Reform Package (House Bill 5636)

Engagement of Third Party Marking Provider

Section 148-A (J)

Third Party Marking Provider:

► The Public Information Office (PIO) shall engage a third party marking

provider (not more than one), which:

► shall provide an end-to-end solution to the government, i.e.,

providing, monitoring and administering the fuel markers, provide

equipment and devices, conduct field and confirmatory tests and

perform other incidental or necessary acts.

► should not have any customer in the Philippines besides the

government.

Page 40 14 June 2017 Tax Reform Package (House Bill 5636)

Costs

Section 148-A (K)

All related costs in the implementation of the fuel marking

provisions - shall be borne by the refiner, importer or

manufacturer of petroleum products.

Page 41 14 June 2017 Tax Reform Package (House Bill 5636)

Excise Tax on Automobiles

(Section 149, Tax Code)

The ad valorem tax on automobiles based on the net

manufacturer’s or importer’s selling price net of excise and

value added tax is increased as follows:

► “Effective January 1, 2018:

Up to P600,000 Increased to 3%

Over P600,000 to Increased to P18k plus 30% in excess of P 600,000

P1.1 million

Over P1.1 million to Increased to P168k plus 50% in excess of P 1.1 million

P2.1 million

Over P2.1 million to Increased to P668k plus 80% in excess of P2.1 million

P3.1 million

Over P3.1 million P1.468 million plus 90% in excess of P3.1 million

Page 42 14 June 2017 Tax Reform Package (House Bill 5636)

Excise Tax on Automobiles

(Section 149, Tax Code)

(continued…)

► “Effective January 1, 2019:

Up to P600,000 In Increased to 4%

Over P600,000 to Increased to P24k plus 40% in excess of P 600,000

P1.1 million

Over P1.1 million to Increased to P224k plus 60% in excess of P 1.1 million

P2.1 million

Over P2.1 million to Increased to P824k plus 100% in excess of P2.1 million

P3.1 million

Over P3.1 million P1.824 million plus 120% in excess of P3.1 million

Page 43 14 June 2017 Tax Reform Package (House Bill 5636)

Excise Tax on Automobiles

(Section 149, Tax Code)

(continued…)

► (a) Automobile shall mean any four (4) or more wheeled motor

vehicle regardless of seating capacity propelled by gasoline, diesel or

any other motive power except purely powered by electricity or by

electricity in combination with gasoline, diesel or any other motive

power: Provided, that for purposes of this Act, buses, trucks, cargo

vans, jeeps/jeepneys/jeepney substitutes, single cab chassis, and

special-purpose vehicles shall not be considered automobiles.

► (b) Truck/cargo van shall mean a motor vehicle of any configuration

that is exclusively designed for the carriage of goods and with any

number of wheels and axles: provided, that pick-ups shall be

considered as trucks.

Page 44 14 June 2017 Tax Reform Package (House Bill 5636)

Excise Tax on Automobiles

(Section 149, Tax Code)

(continued..)

The definition below is added:

► (g) Hybrid vehicle shall mean a motor vehicle powered by electricity

in combination with gasoline, diesel or any other motive power. Its

drive system consists of an efficient combustion engine and a

powerful electric motor, which can run at least 30 kilometers under

one (1) full charge.”

Page 45 14 June 2017 Tax Reform Package (House Bill 5636)

Sugar- Sweetened Beverages

Section 150-A (A)

A new section on Sugar Sweetened Beverages is added.

Rates and Base of Tax

► On sugar sweetened beverages, excise tax per liter of

volume capacity effective January 1, 2018 shall be:

(1) Beverages containing purely locally produced sugar – P10.00

(2) Others – P20.00

The rates shall be adjusted once every 3 years through rules and

regulations issued by the Secretary of Finance after considering the

effect on the same of the three-year cumulative CPI inflation rate.”

Page 46 14 June 2017 Tax Reform Package (House Bill 5636)

Sugar- Sweetened Beverages

Section 150-A (B)

► Exclusions from the scope:

1. Plain milk and milk drink products without added sugar;

2. All milk products, infant formula and milk alternatives, such as soy milk

or almond milk, including flavored milk, such as chocolate milk;

3. 100% Natural Fruit Juices

4. 100% Natural Vegetable Juices

5. Meal replacement beverages and medically indicated beverages. Any

liquid or powder drink/product for oral nutritional therapy for persons

who cannot absorb or metabolize dietary nutrients from food or

beverages, or as a source of necessary nutrition used due to a

medical condition and an oral electrolyte solution for infants and

children formulated to prevent dehydration due to illness; and

6. Ground coffee; and

7. Unsweetened tea

Page 47 14 June 2017 Tax Reform Package (House Bill 5636)

Sugar- Sweetened Beverages

Section 150-A (B)

Sugar Sweetened Beverages: non-alcoholic beverages of any

constitution (liquid, powder, or concentrates) that are pre-packaged and

sealed in accordance with FDA standards, that contain sugar added by

manufacturers, and shall include the following:

A. Sweetened juice drinks;

B. Sweetened tea and coffee;

C. Other beverages:

C1. All carbonated beverages with added sugar, including those with caloric

and non-caloric sweeteners;

C2. Flavored water;

C3. Energy drinks;

C4. Sports drinks;

C5. Powdered drinks not classified as milk, juice, tea and coffee;

C6. Cereal and grain beverages; and

C7. Other non-alcoholic beverages that contain added sugar

Page 48 14 June 2017 Tax Reform Package (House Bill 5636)

Sugar- Sweetened Beverages

Section 150-A (B)

► Caloric Sweetener - a substance that is sweet and includes sucrose,

fructose, including high fructose corn sweetener, glucose or any

artificial sugar substitute that produces a desired sweetness.

► Artificial sweetener - a substance that is used in place of

sweeteners containing sugar or sugar alcohols, that is alternatively

called sugar substitute, non-nutritive sweetener and non-caloric

sweetener. It provides sweetness to foods and drinks but are non-

caloric. Artificial sweetener is a chemically processed substance

which can be directly added to food or during its preparation, such as,

aspartame, sucralose, saccharin, stevia, acesulfame k, neotame,

monk fruit and cyclamates.

Page 49 14 June 2017 Tax Reform Package (House Bill 5636)

Sugar- Sweetened Beverages

Section 150-A (D)

Penalties shall apply as follows:

► Misdeclaration or misrepresentation in the required sworn

statement - penalty of summary cancellation or withdrawal of

permit to engage in business as manufacturer or importer of SSBs.

► If act or omission is committed by a corporation, association or

partnership – fine of triple the amount of deficiency taxes,

surcharges and interest

► Criminal liability shall attach to any person liable for the prohibited

acts or omissions, and on any person who willfully aids or abets in

the commission of such act or omission.

► If not a citizen of the Philippines, the offender shall be deported

immediately after serving the sentence without further proceedings

for deportation.

Page 50 14 June 2017 Tax Reform Package (House Bill 5636)

Counting or Metering Devices

Section 155

Section 155 on Counting or Metering Devices is amended such that:

► Manufacturers and/or Importers shall provide themselves with Counting

or Metering Devices to determine Volume of Production and

Importation.

► Applies to:

► Manufacturers of cigarettes, alcoholic products, oil products and

other articles subject to excise tax that can be similarly measured

► importers of finished petroleum products

► This requirement shall be complied with before commencement of

operations.

Page 51 14 June 2017 Tax Reform Package (House Bill 5636)

Power of the Commissioner

Section 6

Section 6(A) of the Tax Code is amended to read as follows:

► “Sec. 6. Power of the Commissioner to Make Assessments and

Prescribe Additional Requirements for Tax Administration and

Enforcement. –

(A) Examination of Returns and Determination of Tax Due. — After a

return has been filed as required under the provisions of this

Code, the Commissioner or his duly authorized representative

may authorize the examination of any taxpayer and the

assessment of the correct amount of tax, notwithstanding any law

requiring the prior authorization of any government agency or

instrumentality:

Provided, however, That failure to file a return shall not prevent the

Commissioner from authorizing the examination of any taxpayer.”

Page 52 14 June 2017 Tax Reform Package (House Bill 5636)

Power of the Commissioner

Section 6 (continued..)

(F) Authority of the Commissioner to Inquire into and receive information on Bank

Deposit Accounts and Other Related data held by Financial Institutions. -

Notwithstanding any contrary provision of Republic Act No. 1405, otherwise known as

the “Bank Secrecy Law,” Republic Act No. 6426, otherwise known as the “Foreign

Currency Deposit Act,” and other general or special laws, the Commissioner is hereby

authorized to inquire into and receive information on the bank deposits and other

related data held by financial institutions of:

(3) A specific taxpayer or taxpayers upon an obligation to exchange tax information with

a foreign tax authority whether on request or automatic, pursuant to an international

convention or agreement on tax matters to which the Philippines is a signatory or a

party of: Provided, That the information obtained from the banks and other financial

institutions may be used by the Bureau of Internal Revenue for tax assessment,

verification, audit and enforcement purposes.

The exchange of information with a foreign tax authority, whether on request or

automatic, shall be done in a secure manner to ensure confidentiality thereof under

such rules and regulations as may be promulgated by the Secretary of Finance, upon

recommendation of the Commissioner.

Page 53 14 June 2017 Tax Reform Package (House Bill 5636)

Power of the Commissioner

Section 6 (continued..)

In case the exchange of information is upon request from a foreign tax authority, the

Commissioner shall provide the tax information obtained from banks and financial

institutions pursuant to a convention or agreement upon request of the foreign tax

authority when such requesting foreign tax authority has provided the following

information to demonstrate the foreseeable relevance of the information to the request:

(a) xxx

(g) xxx

If the Commissioner is unable to obtain and provide the information within ninety (90)

days from receipt of the request, due to obstacles encountered in furnishing the

information or when the bank or financial institution refuses to furnish the information,

he shall immediately inform the requesting tax authority of the same, explaining the

nature of the obstacles encountered or the reasons for refusal.

In case the exchange of information is automatic, the Commissioner shall provide tax

information obtained from banks and financial institutions in accordance with

international common reporting standards.

Page 54 14 June 2017 Tax Reform Package (House Bill 5636)

Power of the Commissioner

Section 6 (continued..)

(4) Any taxpayer upon order of any competent court in cases involving

offenses covered under Sections 254 of RA No. 8424, as amended, subject to

rules and regulations prescribed by the Secretary of Finance upon

recommendation of the Commissioner of Internal Revenue.”

Page 55 14 June 2017 Tax Reform Package (House Bill 5636)

Issuance of Receipts or Sales or Commercial

Invoices

► “Sec. 237. Electronic Receipts or Electronic Sales or Commercial

Invoices. -

► All persons subject to an internal revenue tax shall, at the point of each sale or

transfer of merchandise or for services rendered valued at P25.00 or more, issue

duly registered electronic receipts or electronic sales or commercial invoices,

showing the date of transaction, quantity, unit cost and description of merchandise

or nature of service

► In the case of sales, receipts or transfers in the amount of P100.00 or more, or

regardless of amount, where the sale or transfer is made by a person liable to

value-added tax to another person also liable to value-added tax; or where the

electronic receipt is issued to cover payment made as rentals, commissions,

compensations or fees, electronic receipts or electronic invoices shall be issued

which shall show the name, business style, if any, and address of the purchaser is

a VAT registered person, in addition to the information herein required, the

electronic invoice or electronic receipt shall further show the Tax Identification

Number (TIN) of the purchaser

Page 56 14 June 2017 Tax Reform Package (House Bill 5636)

Issuance of Receipts or Sales or Commercial

Invoices (continued..)

► Provided, further, that the electronic receipt or sales or commercial invoice

shall be issued either electronically or by tendering a printed copy thereof:

provided, finally, that the digital record or the printed copy of the electronic

receipt or sales or commercial invoice shall be kept by the issuer, purchaser,

customer or client in his place of business for a period of three (3) years from

the close of the taxable year in which such invoice or receipt was issued.

► The Commissioner may, in meritorious cases, exempt any person subject to

internal revenue tax from compliance with the provisions of this section.”

► Transmission. – The preceding paragraph notwithstanding, an electronic

receipt or electronic invoice, as the case maybe, shall be transmitted directly

to the Bureau of Internal Revenue (BIR) at the same time and date of each

sale transaction.”

Page 57 14 June 2017 Tax Reform Package (House Bill 5636)

Electronic Sales Reporting System

Section 237-A

► New section is added as follows:

► “Sec. 237-A. Electronic Sales Reporting System. - The Bureau shall require taxpayers

electronically report their sales data to the Bureau’s electronic system through the use

of CRM/POS machines, subject to rules and regulations to be issued by the Secretary

of Finance as recommended by the Commissioner of Internal Revenue: Provided, that

the machines and other ancillary devices shall be at the expense of the taxpayers:

Provided, further, that the establishment by the Bureau of the electronic sales reporting

system shall be done within three (3) years from the effectivity of this Act.

Confidentiality of Taxpayer Information and Compliance with the Data Privacy Act – The

provisions of Section 270 of the National Internal Revenue Code of 1997, as amended,

on unlawful divulgence of taxpayer information shall be strictly complied with.

The data processing of sales and purchase data shall also comply with the provisions

of Republic Act No. 10173 or the “Data Privacy Act”.

Page 58 14 June 2017 Tax Reform Package (House Bill 5636)

Attempt to Evade or Defeat Tax

Section 254

► Section 254 is amended to read as follows:

► From: "Sec. 254. Attempt to Evade or Defeat Tax. — Any person who willfully

attempts in any manner to evade or defeat any tax imposed under this Code or the

payment thereof shall, in addition to other penalties provided by law, upon conviction

thereof, be punished by a fine of not less than Thirty thousand pesos (P30,000) but not

more than One hundred thousand pesos (P100,000) and suffer imprisonment of not

less than two (2) years but not more than four (4) years:

Provided, That the conviction or acquittal obtained under this Section shall not be a bar

to the filing of a civil suit for the collection of taxes.”

► To: “Sec. 254. Attempt to Evade or Defeat Tax. - Any person who willfully attempts in

any manner to evade or defeat any tax imposed under this Code or the payment

thereof shall, in addition to other penalties provided by law, upon conviction thereof, be

punished with an administrative fine of not less than five hundred thousand pesos

(P500,000.00) but not more than ten million pesos (P10,000,000.00), and imprisonment

of not less than six (6) years but not more than ten (10) years: Provided, That the

conviction or acquittal obtained under this Section shall not be a bar to the filing of a

civil suit for the collection of taxes.”

Page 59 14 June 2017 Tax Reform Package (House Bill 5636)

Failure of Refusal to Issue Receipts or Sales

Commercial Invoices

► Section 264 is amended to read as follows:

► “(b) Any person who commits any of the acts enumerated hereunder shall

be penalized with a fine of not less than five hundred thousand pesos

(P500,000.00) but not more than ten million pesos (P10,000,000.00) and

imprisonment of not less than six (6) years but not more than ten (10)

years:

► A fourth item is added to Section 264(b) as follows:

“(4) Printing of other fraudulent receipts or sales or commercial invoices.”

Page 60 14 June 2017 Tax Reform Package (House Bill 5636)

Failure to Link CRM/POS to BIR’s Server

Section 264 - A

► Punishable act: Failure to transmit sales data to the Bureau’s

electronic sales reporting system

► Penalty: For each day of violation, pay a penalty amounting to one-

half of one percent (1/2 of 1%) of the annual gross sales as reflected

in the VAT-registered taxpayer’s audited financial statement for the

second year preceding the current taxable year, or P10,000,

whichever is higher.

► Provided, that payment of the penalty shall be made simultaneously with the

payment for VAT on a monthly basis as provided in Section 114(A) of the Tax Code;

► Provided, further, that should the aggregate number of the days of violation

exceeded one-hundred eighty (180) days within a taxable year, an additional

penalty of permanent closure of the VAT-registered taxpayer shall be imposed.”

Page 61 14 June 2017 Tax Reform Package (House Bill 5636)

Automated Sales Suppression Device

Section 264-B

► Punishable act: To purchase, use, possess, sell or offer to sell, install,

transfer, update, upgrade, keep or maintain any software or device designed

for, or is capable of:

► (A) Suppressing the creation of electronic records of sale transactions that a

taxpayer is required to keep under existing tax laws and/or regulations

► (B) Modifying, hiding, or deleting electronic records of sales transactions and

providing a ready means of access to them

► Penalty: Administrative fine of not less than Five Hundred Thousand Pesos

(P500,000.00) but not more than Ten Million Pesos (P10,000,000.00); and

suffer imprisonment of not less than two (2) years but not more than four (4)

years

► Provided, That a cumulative suppression of electronic sales record in excess of the

amount of Fifty Million Pesos (P50,000,000.00) shall be considered as economic

sabotage and shall be punished in the maximum penalty provided for under this

provision.”

Page 62 14 June 2017 Tax Reform Package (House Bill 5636)

Questions?

Atty. Luis Jose P. Ferrer

luis.jose.p.ferrer@ph.ey.com

Thank you.

Page 64 1 January 2014 Presentation title

You might also like

- Tax Updates Vs Tax Code OldDocument7 pagesTax Updates Vs Tax Code OldGianna Chloe S Victoria100% (1)

- PRTC - TAX-Final PB - May 2022Document16 pagesPRTC - TAX-Final PB - May 2022Luna VNo ratings yet

- Revenue District Office No. 38 - North Quezon CityDocument4 pagesRevenue District Office No. 38 - North Quezon CityDenise MarambaNo ratings yet

- Case North Country AutoDocument3 pagesCase North Country AutoAnanda Agustin Fitriana100% (2)

- TRAIN vs NIRC tax law guideDocument7 pagesTRAIN vs NIRC tax law guideBryant R. CanasaNo ratings yet

- Tax Reform for Acceleration and Inclusion (TRAIN) Act ExplainedDocument187 pagesTax Reform for Acceleration and Inclusion (TRAIN) Act ExplainedJanna GunioNo ratings yet

- Transpo CHAPTER 1Document7 pagesTranspo CHAPTER 1Denise MarambaNo ratings yet

- Chart of AccountsDocument8 pagesChart of AccountsMariaCarlaMañagoNo ratings yet

- Comparison Train Law and NircDocument37 pagesComparison Train Law and Nircczabina fatima delica89% (19)

- Income TAX: Prof. Jeanefer Reyes CPA, MPADocument37 pagesIncome TAX: Prof. Jeanefer Reyes CPA, MPAmark anthony espiritu75% (4)

- In Re Integration of The Philippine Bar, 49 SCRA 22 (1973)Document5 pagesIn Re Integration of The Philippine Bar, 49 SCRA 22 (1973)Casey DoyleNo ratings yet

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

- Transpo LawDocument664 pagesTranspo LawIsrael BandonillNo ratings yet

- Lesson 5 Income Tax On CorporationDocument20 pagesLesson 5 Income Tax On CorporationReino CabitacNo ratings yet

- Income Tax Book by CA Suraj Agrawal - May & Nov 2020 Exam - CompressedDocument590 pagesIncome Tax Book by CA Suraj Agrawal - May & Nov 2020 Exam - CompressedSonali Dixit100% (1)

- 3 - Bpi Vs CirDocument1 page3 - Bpi Vs CirClaribelle Dianne Rosales ManriqueNo ratings yet

- Iligan City - Seminar On TRAIn Law For Students - 05 03 18Document195 pagesIligan City - Seminar On TRAIn Law For Students - 05 03 18Lorainne AjocNo ratings yet

- Tax code changes lower individual rates and tighten rules for foreign workersDocument6 pagesTax code changes lower individual rates and tighten rules for foreign workersNatsu DragneelNo ratings yet

- TRAIN Law 2018Document27 pagesTRAIN Law 2018Solar PowerNo ratings yet

- M7 - P1 Individual Income Taxation - Students'Document66 pagesM7 - P1 Individual Income Taxation - Students'micaella pasionNo ratings yet

- Slide AKT 405 Teori Akuntansi 12 GodfreyDocument33 pagesSlide AKT 405 Teori Akuntansi 12 Godfreyadinugroho0% (1)

- CPA in Transit Reviewer: Tax Reform R.A. 10963 SummaryDocument8 pagesCPA in Transit Reviewer: Tax Reform R.A. 10963 SummaryZaaavnn VannnnnNo ratings yet

- Train Law 2018Document55 pagesTrain Law 2018Mira Mendoza100% (1)

- Income Tax Changes Under TRAIN LawDocument53 pagesIncome Tax Changes Under TRAIN LawGianna CantoriaNo ratings yet

- APT Not Liable for Workers' ClaimsDocument3 pagesAPT Not Liable for Workers' ClaimsDenise MarambaNo ratings yet

- (Train) : Taxchanges U Need To KnowDocument27 pages(Train) : Taxchanges U Need To KnowNoel DomingoNo ratings yet

- Tax Changes You Need To Know Under RA 10963Document20 pagesTax Changes You Need To Know Under RA 10963Rosanno DavidNo ratings yet

- Train Law PhilippinesDocument64 pagesTrain Law PhilippinesThe BeatlessNo ratings yet

- Essential guide to the Tax Reform for Acceleration and Inclusion Act (TRAINDocument28 pagesEssential guide to the Tax Reform for Acceleration and Inclusion Act (TRAINWilliam Alexander Matsuhara AlegreNo ratings yet

- Train by SGV ColorDocument32 pagesTrain by SGV ColorFlorenz AmbasNo ratings yet

- Tax Changes You Need To Know Under RA 10963Document25 pagesTax Changes You Need To Know Under RA 10963Charry BaximenNo ratings yet

- Train Final Ver A 1.25.2018Document89 pagesTrain Final Ver A 1.25.2018Careyssa MaeNo ratings yet

- Comprehensive+Tax+Reform+Package 121417+Document76 pagesComprehensive+Tax+Reform+Package 121417+mymyNo ratings yet

- Lesson 1 - 2 Tax On The Self Employed Andor Professional 2Document4 pagesLesson 1 - 2 Tax On The Self Employed Andor Professional 2Aaron HernandezNo ratings yet

- Individual Income Tax May 2020Document6 pagesIndividual Income Tax May 2020ziikerr99No ratings yet

- SGV Train LawDocument149 pagesSGV Train LawEm-em CantosNo ratings yet

- 2018-Tax Reform For Acceleration and Inclusion2Document14 pages2018-Tax Reform For Acceleration and Inclusion2Sinetch EteyNo ratings yet

- Income TaxationDocument2 pagesIncome TaxationPaulene PabloNo ratings yet

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDocument8 pagesNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNo ratings yet

- Amendments Introduced by TRAINDocument4 pagesAmendments Introduced by TRAINMarc Lester Hernandez-Sta AnaNo ratings yet

- P&A Briefing - Income Tax Rates 2080-2081 (2023-2024 A.D.) 20.07.23Document10 pagesP&A Briefing - Income Tax Rates 2080-2081 (2023-2024 A.D.) 20.07.23alpha NEPALNo ratings yet

- COMPARISON OF PHILIPPINE TAX RATESDocument3 pagesCOMPARISON OF PHILIPPINE TAX RATESKevin JugaoNo ratings yet

- TRAIN Law BriefingDocument30 pagesTRAIN Law BriefingJoselito PabatangNo ratings yet

- Philippine Income Tax Rates GuideDocument17 pagesPhilippine Income Tax Rates GuideCharie Mae YdNo ratings yet

- Changes to PH tax system under TRAIN LawDocument26 pagesChanges to PH tax system under TRAIN LawRalph Carlo SumaculubNo ratings yet

- Ernst & Young On How The Budget 2010 Will Affect Individuals and BusinessesDocument6 pagesErnst & Young On How The Budget 2010 Will Affect Individuals and Businessesrainaz07No ratings yet

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateDocument14 pagesLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudNo ratings yet

- Tax TablesDocument6 pagesTax TablesGeromil HernandezNo ratings yet

- Monthly Chargeable Income Rate of TaxDocument1 pageMonthly Chargeable Income Rate of TaxSam KNo ratings yet

- TRAIN LAW - Individual Income TaxationDocument25 pagesTRAIN LAW - Individual Income TaxationJennilyn SantosNo ratings yet

- Copy Individual Income TaxDocument10 pagesCopy Individual Income TaxMari Louis Noriell MejiaNo ratings yet

- Principles of Taxation M. Khalid Petiwala: Income Tax Rates, Rebates & DeductionsDocument15 pagesPrinciples of Taxation M. Khalid Petiwala: Income Tax Rates, Rebates & DeductionsosamaNo ratings yet

- Taxation (CHN) - Dec 2020 FinalDocument3 pagesTaxation (CHN) - Dec 2020 FinalALEX TRANNo ratings yet

- Income Tax Rates, Rebates & DeductionsDocument35 pagesIncome Tax Rates, Rebates & DeductionsMaryam IkhlaqeNo ratings yet

- Tabc - Train - Noel N. Cobangbang, CpaDocument117 pagesTabc - Train - Noel N. Cobangbang, CpaIsaac CursoNo ratings yet

- Income Tax ReturnDocument1 pageIncome Tax ReturnhitlersnipplesNo ratings yet

- Answer 1Document5 pagesAnswer 1mayetteNo ratings yet

- Erika Eunice Silva - Piecewise Function-1st PTDocument6 pagesErika Eunice Silva - Piecewise Function-1st PTerika eunice silvaNo ratings yet

- Income TaxationDocument41 pagesIncome TaxationErlindss Ilustrisimo GadainganNo ratings yet

- Old Tax Law Vs Train Law Tax PH Lessons - CompressDocument7 pagesOld Tax Law Vs Train Law Tax PH Lessons - CompressRonron De ChavezNo ratings yet

- Orca Share Media1613096356709 6765816501330676436Document9 pagesOrca Share Media1613096356709 6765816501330676436Mara Gianina QuejadaNo ratings yet

- Module 1 - Cherry Alfuerte - Train LawDocument41 pagesModule 1 - Cherry Alfuerte - Train Lawgerry dacerNo ratings yet

- Train Law WordDocument12 pagesTrain Law WordIsaac CursoNo ratings yet

- Philhealth and Pag-IBIG contribution tables explainedDocument5 pagesPhilhealth and Pag-IBIG contribution tables explainedMaraiah InciongNo ratings yet

- Income Tax SlabsDocument2 pagesIncome Tax SlabsGhulam AwaisNo ratings yet

- Q1.a) "Find Out The Taxes Paid by Both Mr. Sarthak and Mr. Bhavesh For The A.Y. 2021-22."Document11 pagesQ1.a) "Find Out The Taxes Paid by Both Mr. Sarthak and Mr. Bhavesh For The A.Y. 2021-22."kumar kartikeyaNo ratings yet

- Tax Planning Case StudiesDocument19 pagesTax Planning Case StudiesJayaNo ratings yet

- 4 5B Taxation of Individuals Graduated RatesDocument9 pages4 5B Taxation of Individuals Graduated RatesArgie DeguzmanNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- C J.L. Bernardo Construction v. CA, GR No. 105827, January 31, 2000Document4 pagesC J.L. Bernardo Construction v. CA, GR No. 105827, January 31, 2000Denise MarambaNo ratings yet

- A Metropolitan Bank and Trust Co. v. S.F. Naguiat Ent., GR No. 178407, March 8, 2015Document5 pagesA Metropolitan Bank and Trust Co. v. S.F. Naguiat Ent., GR No. 178407, March 8, 2015Denise MarambaNo ratings yet

- Transportation and Public Utilities LawDocument32 pagesTransportation and Public Utilities LawNovern Irish PascoNo ratings yet

- B DBP v. NLRC, GR No. 108031, March 1, 1995Document4 pagesB DBP v. NLRC, GR No. 108031, March 1, 1995Denise MarambaNo ratings yet

- D Philippine Deposit Insurance Corp. v. BIR, GR No. 172892, June 13, 2013Document3 pagesD Philippine Deposit Insurance Corp. v. BIR, GR No. 172892, June 13, 2013Denise MarambaNo ratings yet

- E Yngson, Jr. v. PNB, GR No. 171132, August 15, 2012Document3 pagesE Yngson, Jr. v. PNB, GR No. 171132, August 15, 2012Denise MarambaNo ratings yet

- Merry Christmas!Document1 pageMerry Christmas!Denise MarambaNo ratings yet

- Finacc1 FS1Document5 pagesFinacc1 FS1Denise MarambaNo ratings yet

- Wendy (Sales Accountant)Document2 pagesWendy (Sales Accountant)Denise MarambaNo ratings yet

- CASESDocument1 pageCASESDenise MarambaNo ratings yet

- Atty Gonzales accused of breaching client confidentialityDocument6 pagesAtty Gonzales accused of breaching client confidentialityDenise MarambaNo ratings yet

- Finacc1 Conceptual FrameworkDocument6 pagesFinacc1 Conceptual FrameworkDenise MarambaNo ratings yet

- Sta. Maria & Associates For Petitioner. Punzalan and Associates Law Office For RespondentsDocument66 pagesSta. Maria & Associates For Petitioner. Punzalan and Associates Law Office For RespondentsDenise MarambaNo ratings yet

- 10 - AC No 6166 October 2 2009Document6 pages10 - AC No 6166 October 2 2009Denise MarambaNo ratings yet

- 6 - 94 Phil 534 March 18 1954Document47 pages6 - 94 Phil 534 March 18 1954Denise MarambaNo ratings yet

- Finacc1 FSDocument1 pageFinacc1 FSDenise MarambaNo ratings yet

- 14 - AC No 5816 March 10 2015Document7 pages14 - AC No 5816 March 10 2015Denise MarambaNo ratings yet

- 1 - AC No 6708 August 25 2005Document5 pages1 - AC No 6708 August 25 2005Denise MarambaNo ratings yet

- Judge Reprimands Lawyer for Shouting at Judge in CourtDocument6 pagesJudge Reprimands Lawyer for Shouting at Judge in CourtDenise MarambaNo ratings yet

- A.C. No. 11316 PATRICK A. CARONAN, Complainant Richard A. Caronan A.K.A. "Atty. Patrick A. Caronan," Respondent DecisionDocument6 pagesA.C. No. 11316 PATRICK A. CARONAN, Complainant Richard A. Caronan A.K.A. "Atty. Patrick A. Caronan," Respondent DecisionDenise MarambaNo ratings yet

- Legal Ethics... Linsangan v. Atty. TolentinoDocument4 pagesLegal Ethics... Linsangan v. Atty. TolentinoIzza LoNo ratings yet

- Letter of Att. SorredaDocument4 pagesLetter of Att. SorredaChow Momville EstimoNo ratings yet

- 7 - AC NO 1303 AC No 1391 and AC 1542 June 30 2008Document8 pages7 - AC NO 1303 AC No 1391 and AC 1542 June 30 2008Denise MarambaNo ratings yet

- 9 - AC No 7815 July 23 2009Document7 pages9 - AC No 7815 July 23 2009Denise MarambaNo ratings yet

- A.M. No. 3360 January 30, 1990 People of The Philippines, Complainant ATTY. FE T. TUANDA, RespondentDocument3 pagesA.M. No. 3360 January 30, 1990 People of The Philippines, Complainant ATTY. FE T. TUANDA, RespondentDenise MarambaNo ratings yet

- The Industry Life CycleDocument6 pagesThe Industry Life CycleMaruf AhmedNo ratings yet

- Sales Forecasting and Capital Structure ModelsDocument4 pagesSales Forecasting and Capital Structure Modelsrachel prNo ratings yet

- Benefits of Customer Relationship ManagementDocument14 pagesBenefits of Customer Relationship Managementaaditya01No ratings yet

- Import of Vehicles Taxpayer's Facilitation Guide BrochureDocument14 pagesImport of Vehicles Taxpayer's Facilitation Guide BrochuremehrozaliNo ratings yet

- Chapter 5 Financial Decisions Capital Structure-1Document33 pagesChapter 5 Financial Decisions Capital Structure-1Aejaz MohamedNo ratings yet

- Determinants of FDIDocument11 pagesDeterminants of FDIAryan Shah100% (1)

- Aurobindo Pharma Annual Report 2015-16Document193 pagesAurobindo Pharma Annual Report 2015-16Jyotirmoy's Voice100% (1)

- FM Master Manufacturing Budgets April-June 2021Document8 pagesFM Master Manufacturing Budgets April-June 2021heyheyNo ratings yet

- Company Name Year 1 Year 2 Year 3 Year 4 Year 5Document4 pagesCompany Name Year 1 Year 2 Year 3 Year 4 Year 5Larasati LalatNo ratings yet

- Property Dealers and Consultants Regulation Act 2008Document67 pagesProperty Dealers and Consultants Regulation Act 2008Naveen ArichwalNo ratings yet

- Economic of Soil ErosionDocument30 pagesEconomic of Soil ErosionHehlangki TyngkanNo ratings yet

- ACCA Mock Financial Reporting Answer JJ2023Document16 pagesACCA Mock Financial Reporting Answer JJ2023vchandy22No ratings yet

- ABC Company Worksheet For The Year Ended December 31, 2019Document1 pageABC Company Worksheet For The Year Ended December 31, 2019Rosemarie VillanuevaNo ratings yet

- Income Tax Return Filing for Salary and House Property IncomeDocument7 pagesIncome Tax Return Filing for Salary and House Property Incomesachinsaboo3No ratings yet

- Partial - Solution - Module 2 - 6theditionDocument16 pagesPartial - Solution - Module 2 - 6theditionJenn AmaroNo ratings yet

- Hampden County Physician Associates Bankruptcy PapersDocument24 pagesHampden County Physician Associates Bankruptcy PapersJim KinneyNo ratings yet

- Bond Valuation and Risk Ch-8Document37 pagesBond Valuation and Risk Ch-8রোকন উদ্দিন সিকদারNo ratings yet

- Unit 3 Acct312-UnlockedDocument21 pagesUnit 3 Acct312-UnlockedTilahun GirmaNo ratings yet

- 1959 - Gordon Dividends, Earnings, and Stock Prices PDFDocument8 pages1959 - Gordon Dividends, Earnings, and Stock Prices PDFHop LuuNo ratings yet

- Life &personal Financial Management: Presentation To New Employees of Bank of GhanaDocument36 pagesLife &personal Financial Management: Presentation To New Employees of Bank of GhanaKwasi Osei-YeboahNo ratings yet

- PAW Fiction - Tired Old Man (Gary D Ott) - DestinyDocument127 pagesPAW Fiction - Tired Old Man (Gary D Ott) - DestinyBruce ArmstrongNo ratings yet

- Tar MRL Company PDFDocument18 pagesTar MRL Company PDFrishi Kr.No ratings yet

- Taxation Law Bar Questions & Answers: Submitted By: BALUYUT, Maria Corazon de Leon, Dino GADOR, Ken Reyes SUCGANG, JustinDocument8 pagesTaxation Law Bar Questions & Answers: Submitted By: BALUYUT, Maria Corazon de Leon, Dino GADOR, Ken Reyes SUCGANG, JustinKen Reyes GadorNo ratings yet

- Financial Management: I. Concept NotesDocument6 pagesFinancial Management: I. Concept NotesDanica Christele AlfaroNo ratings yet

- Marginal Costing Technique and Key ConceptsDocument3 pagesMarginal Costing Technique and Key ConceptsUdhaya SangariNo ratings yet