Professional Documents

Culture Documents

Consumer Trust in Bankings PDF

Uploaded by

Yitian LiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consumer Trust in Bankings PDF

Uploaded by

Yitian LiCopyright:

Available Formats

bs_bs_banner

International Journal of Consumer Studies ISSN 1470-6423

Consumer trust relations with payment cards and banks:

an exploratory study

Tuija Koivunen1 and Helena Tuorila2

1

School of Social Sciences and Humanities, University of Tampere, Tampere, Finland

2

Finnish Competition and Consumer Authority, Helsinki, Finland

Keywords Abstract

Banks, consumer complaints, payment cards,

qualitative study, trust. The article focuses on the ways in which consumer complaints reflect the trust relationship

between consumers, payment cards and banks from the consumers’ point of view. The

Correspondence empirical data consist of consumer complaints from Finland and are analysed with quali-

Tuija Koivunen, School of Social Sciences and tative method. The data show that consumers use payment cards in various places for

Humanities, University of Tampere, Linna different purposes at home and abroad at least until something unexpected and problematic

Building, Tampere FI-33014, Finland. happens. According to the consumer complaints, in problem situations, the banks blame

E-mail: tuija.koivunen@uta.fi the consumers and categorically deny their responsibility. Negligence on the part of the

consumers and questions concerning technology are the major reason for distrust concern-

doi: 10.1111/ijcs.12154 ing the reliability of payment cards. These findings provide bases for practical guidelines

to increase trust in payment cards and, finally, implications for consumer education are

discussed.

Iivarinen, 2011). The present article tackles this shortage by focus-

Introduction ing on consumer trust in payment cards.

In the modern world, payment cards are becoming the primary

payment method for in-person and online purchases. Due to the

popularity of payment cards, the market for credit and debit cards

Literature overview and

is continuously growing. Payment cards are considered to be the

research objective

most efficient and convenient way to pay in consumer-to-business During the last 25 years, the notion of trust has received a great

relations and they have replaced cash and cheques to a great extent deal of attention in research (Grayson et al., 2008; Kantsperger

(Erasmus and Lebani, 2008; Pulina, 2011; Sakharova and Khan, and Kunz, 2010). Consumer trust in payment cards has been

2011; Wickramasinghe and Gurugamage, 2012). However, studied from various perspectives. Technology-based perspective

payment cards were created in an era when the present risks were (Dimitriadis and Kyrezis, 2008; Kantsperger and Kunz, 2010)

unimaginable. The payment card has evolved from a paperboard to research reported findings from a retail bank customer survey,

metal and then to plastic with a magnetic stripe and now a chip which revealed two dimensions of trust, affective and cognitive

(Heikkinen and Iivarinen, 2011). While the actual payment card trust, and the significant role of three variables in forming trust in

has changed over time, the basic idea has not. It is supposed to be these channels: trust in the company, reputation of the company

an easy, quick and safe payment method instead of cash. and disposition to trust. According to Maroofi et al. (2012), both

As the payment card market has expanded rapidly in recent technical contribution and security declaration are significant

years, the number of crimes which involve payment cards has factors for improving consumers’ observed security. Consumers’

increased as well (Sakharova and Khan, 2011; Lamberger et al., observed security is positively related to consumers’ observed

2012). The criminal market of payment card fraud within the trust and use of e-payment systems. Consumers’ observed trust

European Union (EU) is dominated by well structured and glob- also has a positive impact on the use of e-payment systems.

ally active organized crime groups. Moreover, payment card fraud From an economic perspective, Merschen (2010) reviews the

is a low risk and highly profitable criminal activity which brings global status of card payment fraud against the backdrop of the

organized crime groups originating from the EU a yearly income progressing deployment of global EuroPay, MasterCard and Visa

of around €1.5 billion (Europol Review, 2012). Experienced or (EMV) chip cards. Merschen (2010) also compares the obvious

perceived insecurity in electronic payments, such as card pay- success stories of chip technology at points of sale in many coun-

ments, hampers trust in payment services in general and also tries with the global reality of inconsistent EMV penetration and

affects related industries such as e-commerce. Despite this, trust in its consequences for overall fraud reduction. Sullivan (2008) notes

payment cards is clearly an under-researched topic, although trust that smart cards have the potential to provide strong payment

is an elementary attribute of payment services (Heikkinen and authorization and thus put a substantial dent in the problem of

International Journal of Consumer Studies 39 (2015) 85–93 85

© 2014 John Wiley & Sons Ltd

Consumer trust relations T. Koivunen and H. Tuorila

identity theft and payment fraud. The falling costs of infrastructure in the broad social context in which a relationship might develop.

are tilting the cost-benefit calculation in favour of adopting Based on that, we argue that customers who own and use a

payment smart cards. payment card have broad-scope trust in such payment system in

Segal et al. (2011) have studied trust in payment cards from a general. However, we need more directional forms of trust for our

juridical perspective. They have examined how credit card com- analysis. Grayson et al. (2008) have also discussed narrow-scope

panies and banks have created a self-interested infrastructure that trust, which refers to customer trust in individual firms and their

insulates them from the liabilities and costs of credit card fraud. representatives. Our analysis is based on this notion of narrow-

Contrary to widespread belief, retailers, not card companies or scope trust, although we still find this conceptualization insuffi-

banks, absorb much of the loss caused by thieves who shop with cient for the purpose of our study. Consequently, we need to widen

stolen credit cards. the definition of narrow-scope trust for our analysis to involve

From the perspective of consumer complaining behaviour, consumers’ reliance on all parties involved with the card payment

Hogarth et al. (2001) have provided a picture of complaining processes, i.e. on organizations, on individuals and on technology.

behaviours, problem resolution and satisfaction with the complaint In addition, we regard distrust as consumers’ inability or unwill-

process. According to their results, consumers seem to have a ingness to trust.

cost-benefit approach to complaining; those with more at stake While trust in payment cards has been analysed from several

have taken more assertive actions and spent more time pursuing points of views, i.e. from economical, juridical, technology-based

their complaints. Consumers whose problems have been resolved and consumer complaining behaviour perspectives, trust in the

are obviously more satisfied with the complaint process and their various components of the card payment process has been widely

outcome. According to Stauss (2002), customers’ complaint sat- ignored. The gap in the literature is surprising because trust in

isfaction refers not only to the solution to the problem offered by organizations, individuals and technology is a fundamental

the company but also to the additional attributes of how the com- element in the use of payment cards. Another shortage in previous

plaints are handled. A factor analysis of complaint satisfaction data studies concerning trust is that too little attention has been paid to

leads to the identification of two factors: cold fact complaint the consumer’s perspective. The majority of the existing studies

satisfaction and warm act complaint satisfaction. Obviously, com- have emphasized the service providers’ perspective, instead of

plainants differentiate between those quality attributes that can be citizens’ experiences. This is although consumers’ experiences

evaluated on the basis of objective facts on the one hand, and those and attitudes provide valuable information about the strengths and

that lead to more emotional reactions. Cold fact satisfaction seems shortcomings of payment card systems and practices.

to have a stronger influence on overall complaint satisfaction and The principal objective of this article is to empirically analyse

relationship satisfaction than warm act complaint satisfaction. the ways in which consumers’ problems and complaints reflect the

However, the influence of warm act complaint satisfaction is trust relationship between consumers, payment cards and banks

stronger on relationship satisfaction than on overall complaint from the consumers’ point of view. Because trust is a substantial

satisfaction. part of the relationship between consumers and banks, it is impor-

To our knowledge, there is very limitedly academic research tant to gain more knowledge of the ways in which trust relations

that has addressed the complaining behaviour of consumers are created, altered and occasionally also terminated. The qualita-

encountering unauthorized use of their payment cards. What is tive study seeks to address two research questions: (1) what kind

even scarcer is the related research that utilizes qualitative research of trust relations there are between consumers, payment cards and

methods, despite the fact that trust has been a key aspect in numer- banks issued the cards and (2) what kinds of situations lead to

ous studies concerning Internet banking and other Internet-based transforming the trust relations to distrust.

services (e.g. Grabner-Kräuter and Faullant, 2008; Mukherjee and

Nath, 2003). Nevertheless, we still know very little about consum-

ers’ trust in banks and financial institutions in general (Shim et al.,

Cardholders’ complaints in Finland

2013), although trust is widely acknowledged as a central aspect of This study contains an analysis of consumers’ views on

the relationship between consumers and banks. For example, most unauthorized use of payment cards. Payment cards were selected

consumers have long-term relationships with banks (Kantsperger as the source of complaint data because they have a high level of

and Kunz, 2010), but to what extent this is indicative of consum- diffusion within the consumer marketplace and the broad-scope

ers’ trust in banks is not fully known. trust (Grayson et al., 2008) in payment cards is of utmost impor-

In the existing literature, consumer trust has been defined e.g. as tance for the whole of modern society.

the expectations held by the consumer that the service provider is Given that more than 70% of Finns use payment cards in their

dependable and can be relied upon to deliver on its promises daily shopping (Federation of Finnish Financial Services, 2013),

(Sirdeshmukh et al., 2002; Pizzutti dos Santos and Von der Heyde Finland offers an excellent context for examining trust in payment

Fernandes, 2008) or as consumers’ willingness to rely on an cards and banks. Finnish consumers need to take three steps to

exchange partner in whom they have confidence (Kantsperger and resolve problems related to unauthorized use of a payment card.

Kunz, 2010). This definition includes the idea that a consumer The steps are basically the same for the US consumers (Hogarth

may feel confident and secure when doing business with the et al., 2001). The first step is to contact the bank’s payment card

service provider (Kumara and Mittal, 2004). Moreover, a con- blocking service in order to stop the unauthorized use of a card.

sumer may maintain his or her beliefs about the service provider’s The second step, after the possible financial damage becomes clear

benevolence and honesty (Grayson et al., 2008). to the consumer, is to seek redress directly from the bank that

These definitions of trust are our starting points too. Grayson issued the payment card (Organisation for Economic Co-operation

et al.’s (2008) idea of broad-scope trust refers to customers’ trust and Development, 2010). More often than not, the bank’s response

86 International Journal of Consumer Studies 39 (2015) 85–93

© 2014 John Wiley & Sons Ltd

T. Koivunen and H. Tuorila Consumer trust relations

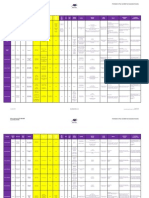

Table 1 The summaries of the complaints from the Consumer Disputes Board

Case Complaint Financial The recommended decision of the

number number The way payment card was misused loss Consumer Disputes Board

1 897/39/2010 Credit card was stolen from backpack 1.660 € Negative resolution. Backpack is not a safe place to

keep payment card.

2 1053/39/2010 Customer’s wallet and credit card were stolen at 1.007 € Negative resolution. Customer is in charge of the

night in central Helsinki. usage of his/her payment card.

3 1342/39/2010 According to the customer, the card was charged 4.395 € Negative resolution. Customer is in charge of the

with illegal purchases during a trip in Tallinn. usage of his/her payment card.

4 1892/39/2010 Customer’s wallet and credit card were stolen during 1.500 € Positive resolution. Customer is in charge of the

holiday trip to Athens. The customer thought that usage of his/her payment card. Payment recipient

the card was valid only in certain department store must, however, confirm the identity of cardholder.

chains.

5 2075/39/2010 According to the customer, the card was charged 2.268 € Negative resolution. Customer is in charge of the

with illegal purchases during a trip to Tallinn. usage of his/her payment card.

6 2348/39/2010 Fake police officers copied the card information in 3.278 € Negative resolution. Credit card information and PIN

Barcelona. should not be given to anyone.

7 2352/39/2010 Customer forgot his bag and credit card in a pub. He 1.037 € Negative resolution. Customer is in charge of the

contacted the payment card blocking service but usage of his/her payment card.

didn’t specifically request the service to shut down

the card.

8 2403/39/2010 Customer’s wallet and credit card were stolen during 1.617 € Negative resolution. Customer is in charge of the

ferry trip from Helsinki to Tallinn. usage of his/her payment card.

9 2659/39/2010 According to the customer, the card was in his 140 € Negative resolution. Customer is in charge of the

wallet at home while he was jogging. Card was usage of his/her payment card.

used to make an illegal withdrawal from cash

machine.

10 3198/39/2010 Customer’s wallet and credit card were stolen during 1.664 € Negative resolution. Customer is in charge of the

train journey. usage of his/her payment card.

11 3711/39/2010 Customer’s wallet and credit card were stolen in 1.560 € Positive resolution. Customer’s action by cash

shopping centre after he made a withdrawal from machine was meticulous. There was no

cash machine. negligence on customer’s part in safeguarding the

card.

to the consumer is unfavourable and redress is not granted. In that effectively offer information on consumers’ behaviour in situa-

event, the third step for the consumer is to contact a third-party tions of unauthorized use of payment cards, investigation of con-

organization dealing with consumer complaints. sequences, banks’ responses to financial demands made by

In Finland, there are two public organizations to which consum- consumers concerning the unauthorized use of payment cards and

ers may alternatively address a complaint: The Consumer Disputes the Boards’ resolutions. The resolution is positive when the Board

Board (CDB) and the Banking Complaints Board (BCB). It is the has decided it in favour of the complainant and negative when it is

consumers’ decision to choose between the Boards on where to decided in favour of the defendant. In accordance with the

address their complaint. The Boards handle consumers’ written exploratory nature of this study, we have applied a qualitative

complaints demanding redress from another party. A decision method to the analysis of the consumer complaints. A qualitative,

reached by the Boards is a recommendation for both parties of a exploratory research method was chosen because it allows the

dispute concerning the resolution. The handling of a matter by the discovery and identification of new ideas. The use of an explora-

Boards is free of charge for both parties. The opinions issued by tory descriptive research method is especially suitable when aca-

the Boards are public unless the Boards otherwise order (Fine.fi, demic research has looked very little into these areas (Grbich,

2013; Kuluttajariita.fi, 2013). 2013).

The research material consists of 11 complaints from the CDB

(Table 1) and 12 complaints from the BCB (Table 2). The com-

Methodology plaint documents were chosen from the Boards’ complaint data-

Qualitative complaint documents from the CDB and the BCB bases. The complaints were resolved in 2011 and they were filed in

were used because they are well documented and well suited to 2010 and 2011. During that time period, the Boards received more

collecting in-depth, qualitative data about the problems that result complaints than they resolved. From the CDB, all the complaints

in complaining behaviour and how consumers experience these were chosen and from the BCB 12 different kinds of complaint

problems. The complaints lend themselves well to obtaining an cases were chosen from the total of 46 complaint cases. The way

understanding of the phenomenon under study, which is trust in which the payment card was misused and the amount of finan-

relations, from the consumers’ point of view. The documents cial losses suffered by the complainant were the key grounds for

International Journal of Consumer Studies 39 (2015) 85–93 87

© 2014 John Wiley & Sons Ltd

Consumer trust relations T. Koivunen and H. Tuorila

Table 2 The summaries of the complaints from the Banking Complaints Board

Case Complaint The way payment Financial The recommended decision of

number number card was misused losses the Banking Complaints Board

1 17/10 Ex-husband stole credit card and PIN from home 620 € Negative resolution. Credit card and PIN should be

kept separately and in a safe place at home.

2 18/10 Credit card was stolen in Australia. Card was stolen 522 € Positive resolution. Customer kept the card in a safe

from locked hostel room while the customer is place.

asleep.

3 19/10 Credit card and PIN were stolen after customer left 22.540 € Negative resolution. Customer was drunk and

from pub with four unknown persons. showed gross negligence in his/her actions.

4 30/10 Credit card was stolen from locked cashbox at 1.989 € Positive resolution. Customer kept the card in a safe

home. Stolen PIN was kept in another place in place. PIN, however, should have been kept in a

apartment. safer form.

5 38/10 Customer left a restaurant and went home with 2.480 € Negative resolution. Customer showed gross

unknown men. During the ride, they stopped at negligence in his/her actions. Customer should

unmanned petrol station to fill up the tank. The have checked that the card was in his/her

next day, customer noticed that the card had possession as soon as he/she got home.

disappeared.

6 4/11 Card was charged with illegal purchases in a 5.322 € Negative resolution. Customer is in charge of the

restaurant in Portugal. usage of his/her payment card.

7 5/11 Customer spent night in a restaurant and the next 5.160 € Positive resolution. Customer showed no gross

day noticed that he didn’t have the card. Police negligence in his/her actions in the restaurant.

investigation revealed that professional criminals

had stolen the card in restaurant.

8 11/11 Customer forgot the payment card in an ATM at a 2.500 € Negative resolution. Customer showed gross

bank. Card was stolen. negligence in his/her actions.

9 13/11 Card was charged with illegal purchases in a 3.707 € Negative resolution. Customer is in charge of the

restaurant in Tallinn. usage of his/her payment card.

10 40/11 Card was charged with illegal purchases during 2.700 € Negative resolution. Customer is in charge of the

holiday trip to Gran Canaria. usage of his/her payment card.

11 41/11 Credit card was stolen right after customer made 1.980 € Negative resolution. Customer is in charge of the

withdrawal from cash machine. Customer was usage of his/her payment card. Customer showed

under the influence of alcohol. gross negligence is his/her actions.

12 64/11 Customer left a restaurant and went home with 1.600 € Positive resolution. Customer tried to ensure safe

unknown men. During the ride they stopped at usage of his/her card. Customer showed no

unmanned petrol station. In the car, the customer negligence in his/her actions.

noticed that the credit card had been stolen. He

contacted card blocking service as soon as he got

home.

selecting the complaints for detailed analysis in this exploratory The analysis was carried out by carefully reading and

study. A purposive sampling technique was applied to select com- re-reading the data (Lindebaum and Cassell, 2011) and relating

plaints. Purposive sampling allowed the identification of diverse the content of the complaints to the concepts of trust and dis-

complaints that complied with the inclusion criteria and ensured trust. The analysis was first performed by both the authors inde-

the collection of miscellaneous data in order to cut down the pendently and then their judgments were compared and

number of similar cases. The background information of the reconciled. The analysis began by classifying the research mate-

misuse situations is presented in Table 3. rial and identifying the observations that could be interpreted to

The complaints include facts, consumers’ experiences and illustrate the trust relationship between consumers and other

thoughts about the events connected to unauthorized use of actors. Then, the analysis was carried out by combining the

payment card. The complaints are related to trust and distrust in observations through seeking out common denominators or

various parties involved in the process when payment cards are themes (Hammersley and Atkinson, 1995; McAlister and

used (Atkinson and Coffey, 2004). These also include situations in Erffmeyer, 2003) and, thus, doing thematic analysis (Eriksson

which there has initially been trust but because of a fraud, the trust and Kovalainen, 2008). The themes were trust in technology,

has turned into distrust. The analysis in this article concentrates on trust in organizations and trust in individuals. Finally, these

the ways in which these trust relations appear in the texts. The themes were subjected to careful and detailed analysis, which

complaints provide information on how consumers, payment cards allowed making conclusions based on the complaints. Examples

and banks interrelate and what the significance of trust is in these of the complaint cases are referred to in the following sections

relations. outlining the results of the analysis.

88 International Journal of Consumer Studies 39 (2015) 85–93

© 2014 John Wiley & Sons Ltd

T. Koivunen and H. Tuorila Consumer trust relations

Table 3 The background information on misuse situations

The complaints from the The complaints from the

Consumer Disputes Board Banking Complaints

(case number) Board (case number) Total

The payment card was under the cardholder’s control when 3, 5, 6, 9 6, 9, 10 7

unauthorized use of payment card had occurred.

The payment card was stolen when unauthorized use of 1, 2, 4, 7, 8, 10, 11 1, 2, 3, 4, 5, 7, 8, 11, 12 16

payment card had occurred.

The unauthorized use on payment card took place in home 1,2, 7, 9, 10, 11 3, 4, 5, 7, 8, 11, 12 13

country.

The unauthorized use of payment card took place abroad. 3, 4, 5, 6, 8 1, 2, 6, 9, 10 10

Consumer noticed the disappearance of payment card 1, 2, 6, 8, 10, 11 2, 11, 12 9

immediately and contacted the card blocking service.

Consumer did not notice the disappearance of payment card 3, 4, 5, 7, 9 1,3, 4, 5, 6, 7, 8, 9, 10 14

immediately and contacted the card blocking service later.

case, the consumer claimed that the payment card had been under

Results his control when the alleged payment card fraud had happened

In our study, consumers’ trust in payment cards and banks is given (CDB 9).

various meanings with regard to the components of the

unauthorized use of the payment cards. According to the analysis,

these meanings can be grouped into three dimensions: trust in Trust in organizations

technology, trust in organizations and trust in individuals.

Trust in the payment recipient

According to the data, trust in the payment recipient’s honest

Trust in technology

action is the very starting point when payment cards are used by

consumers. Consumers apparently tend to believe in the payment

Trust in the payment terminal

recipient’s willingness to ensure that all the payment instruments

The data show that consumers use payment cards in various meet with the standards and recommendations set by the authori-

places for different purposes at home and abroad. They use cash ties. Consequently, the consumers expect payment terminals to be

dispensers, pay for their purchases in shops, buy tickets from authentic. Some cases of complaint on the unauthorized use of

ticket machines at railway stations, buy food and drinks in res- payment cards are based on allegations of dishonest action by the

taurants, for example. Consumers expect payment safety to be payment recipient. In some complaints, the consumers insist that

taken into account when payment terminals are placed at their the payment recipient has misused the payment card by charging

disposal because credit card information is more or less a direct a larger sum of money than the real price of the purchase inten-

link to a consumer’s funds. Based on the complaint documents, tionally or by saving card information for later unauthorized use

consumers commonly feel that in shops, restaurants, bars and (CDB 3, CDB 5, BCB 6, BCB 9, BCB 10).

other such places the payment recipients do not necessarily The complaint documents show that when consumers use their

create safe circumstances for typing in the personal identification payment cards, it is important that they receive a receipt so that

number (PIN). In other words, the keyboard of the payment ter- they can check the amount and validity of a payment. Especially in

minal is visible to every direction and there is no privacy to use those cases of unauthorized use of payment cards that have hap-

the terminal. pened abroad, consumers validate their complaints by stating that

Many shops, restaurants, etc., prefer to facilitate personnel they did not receive a receipt and therefore were not able to check

functions rather than focus on consumer safety. The complaint the validity of the related payment information. For example, in

documents indicate that consumers who feel that their payment one case, a consumer used his payment card abroad in a restaurant.

security is endangered do not always have the possibility to He bought beer several times but was not given a receipt. After-

request a secure place to use a payment terminal, especially during wards, he found out that expensive champagne had been charged

rush hours (BCB 7). Also, the technical features of payment ter- several times on the card (BCB 9, CDB 5).

minals cause distrust in payment technology. The design of

payment terminals endangers the safe typing of PINs (CDB 10,

Trust in the payment card blocking service

CDB 11). Especially, tall people standing close to the cash dis-

penser can get a view of the individual’s PIN. According to payment card contract terms, the cardholder must

The technology related to the use of payment cards and PIN contact a bank’s payment card blocking service immediately when

codes calls forth questions among consumers. Many complainants the payment card disappears. After doing this the cardholder is

suspect that it may be possible to ‘take the customer’s money’ released of liability concerning the use of the payment card. Con-

without using the original payment card and PIN. In one complaint sumers generally display a strong trust in blocking services

International Journal of Consumer Studies 39 (2015) 85–93 89

© 2014 John Wiley & Sons Ltd

Consumer trust relations T. Koivunen and H. Tuorila

because they are believed to act in the interest of the cardholder. they have noticed that their payment card is missing. In the com-

The blocking service has no financial incentives concerning the plaint documents, the consumers describe their behaviour as con-

unauthorized use of a payment card. However, the complaint vincingly as possible in order to obtain a positive resolution.

documents show that it is not enough to just contact the blocking The cases of unauthorized use of payment cards bring consum-

service, but the cardholder must specifically request that the ers’ trust in their own action under question, as it also appears as

service shut down the card. Distrust in blocking services is caused a reason for the problems or has contributed to the emergence of

in a situation in which the consumer hesitated on whether to shut problems. The conflict demonstrates that consumers do not nec-

down the card or whether it is just missing and could be found essarily act in accordance with the payment card contract terms.

later, which was the case in one of the complaints (CDB 7). The analysis of the complaints reveals that the consumers are not

Distrust can also be caused by a misconception that someone other always familiar with these terms. The data include, e.g. complaints

than the cardholder can shut down the card, e.g. a family member. in which the consumer states that she or he did not know that the

Due to bank secrecy, information about the use of a payment card daily limit for withdrawals is not in fact an obstacle to withdrawals

cannot be given to the cardholder’s family members, even if they with a due date (BCB 3) or that a store card can also be used as a

request the information with good and honest intentions, as in one payment card (CDB 2, CDB 4). In other words, the customers are

of the complaints. rather uninformed card users. On the basis of our data, we do not

know the reason for this lack of information.

The complaint documents also show that consumers apply

Trust in the bank

payment card terms in their own way. The terms emphasize the

In the analysed complaints, the consumers’ financial losses vary confidentiality of the PIN. It should not be told to anyone. Still, in

between 140 and 22 540 Euros. In Finland, a consumer’s own risk one case the customer revealed the code to a fake police officer

in the misuse of a card is 150 Euros and the cardholder is respon- upon request (CDB 6). In another case, a cardholder was aware

sible for financial damage caused by the unauthorized use of a card that her ex-spouse knew the place of her card and PIN, but she did

only if the card or PIN have been obtained by an outsider because not think that he would do anything with that knowledge (BCB 1).

of the cardholder’s negligence and the cardholder cannot show Eventually, he used the card and PIN under false pretences. Based

proof of his or her innocent action (Payment Services Act, 2010/ on the complaint documents, consumers tend to trust too much in

290). their own action concerning payment cards especially in those

The complaint documents indicate that consumers who have situations where alcohol is involved (BCB 11). Drunkenness

fallen victim to unauthorized use of their payment cards expect the weakens attention and exposes consumers to situations where

bank to fulfill the payment card contract terms. Consumers trust criminals find opportunities to misuse payment cards. The results

that the bank will compensate them for their losses. However, the of our analysis lead to the conclusion that consumers tend to trust

banks reject the consumers’ claims in all the complaint cases. largely in other people but are themselves unreliable cardholders.

Without exception, they consider that the consumer’s own negli-

gence is the reason for the financial loss. The banks’ negative

Trust in other people’s honesty

response to consumers’ financial losses create distrust towards

banks. The complaint documents also indicate that consumers who The more high-risk environment and situation the consumer uses

have fallen victim to unauthorized use of a payment card often his or her card in, the more carefully he or she should observe the

believe that banks promote businesses where customers are surroundings and make sure that the PIN and the card are not in

cheated (CDB 3, CDB 5, BCB 9). According to the consumers, danger of ending up in a criminal’s possession. In crowded places,

banks should take more responsibility to ensure the lawfulness of consumers do not pay sufficient attention to covering the keyboard

recipients of card payments. When banks decline to compensate with a hand when typing in the PIN. It is easy for criminals to find

financial damages to consumers, a consequent step for the con- out the number. Contract terms regarding keeping the payment

sumer is to seek reimbursement from third-party organizations card safe are not necessarily adhered to. According to the resolu-

dealing with consumer complaints. tions of the Boards, a backpack, e.g. is not a safe place to carry a

payment card because the cardholder cannot keep it in eye sight

(CDB 1). Nor do cardholders check often enough that the card is

Trust in individuals

safe. Especially in a throng, a push may mean that the payment

card has been stolen.

Cardholders’ trust in their own action

According to the event descriptions in the complaint docu-

Consumers have little control over technology or organizations, ments, cardholders easily trust in other people’s honesty and

but they are able to control their own actions. According to believe that they will not try to find out the PIN code in order to

payment card contract terms, the cardholder is obliged to keep the misuse it. Excessive trust in other people can be expensive. A good

card and the PIN safe and the PIN separately from the card so that example of this kind of excessive trust is a case where the card-

it is not possible for an outsider to find it. The complaint docu- holder was given a ride by strangers. As payment for the ride, the

ments indicate that consumers largely trust in their own ability to travellers stopped to fuel up and the PIN code ended up in wrong

comply with the regulations on payment card usage. In the com- hands (BCB 3, BCB 5, BCB 12). Later the cardholder noticed that

plaint documents, the consumers give full accounts of what has his payment card had disappeared.

happened and strive to prove that they have not been negligent Criminals who pretend to be authorities pose a threat to con-

when using their payment card. In their own opinion, they have sumers especially abroad, in a different cultural context. One

contacted the payment card blocking service without delay when complaint gives a poignant example of this kind of a problem

90 International Journal of Consumer Studies 39 (2015) 85–93

© 2014 John Wiley & Sons Ltd

T. Koivunen and H. Tuorila Consumer trust relations

situation that may occur abroad. Fake police officers claiming to The results presented in this article indicate that trust relations

represent the narcotics division copied the payment card infor- between consumers and payment cards involve the participation of

mation and made unauthorized withdrawals worth over 3000 technology, organizations and individuals. This array of relation-

Euros. According to the complainant, she did not have the capac- ships among technology, organizations and individuals is drawn

ity to question the demands of the fake police officers in such a from Grayson et al.’s (2008) definition of narrow-scope trust,

sudden, tensioned situation. The complainant thought that she which we found useful but widened it to meet the needs of our

had given the payment card information to authentic authorities analysis. Thus, the theoretical contribution of this study is to,

(CDB 6). following Grayson et al. (2008), understand broad-scope trust as a

broad social context in which the payment cards are used. This

social context includes cultural attitude towards payment cards

Summary of the empirical results usage, the national banking sector and the economy at large.

Furthermore, we understand narrow-scope trust as a directional

The data analysed here consist of 23 complaints of which 17 had

form of trust in firms and individuals. Furthermore, trust in

a negative resolution and only six had a positive resolution.

payment cards is an individual experience (Blomqvist, 1997; Shim

However, this ratio cannot be generalized to complaints at large,

et al., 2013) which is built as a multidimensional phenomenon. In

although the resolutions issued by the Boards are more often

the usage of payment cards, trust and distrust are related to tech-

negative than positive. We assume that the situations that prompt

nology, organizations and individuals.

the customers to file complaints and especially the negative

Our findings have important practical implications for eliminat-

responses received to the complaints both have an impact of

ing the factors that produce distrust in payment cards. We found

decreasing customers’ trust in banks. Although receiving a posi-

two essential keynotes concerning trust in cases of unauthorized

tive resolution does not necessarily change the trust relation, being

use of payment cards: consumer and technology. Negligence on

aware of the bank’s negative response to a complaint may change

the part of the consumers seems to be the major reason for distrust

it by decreasing trust.

concerning the reliability of payment cards. Consumers’ aware-

ness and preparedness need to be improved, as education is an

important determinant of consumer trust (Bell and Eisingerich,

Discussion and conclusions 2007; Sakharova and Khan, 2011). The Payment Services Act

This research investigates the ways in which consumer com- (2010/290) obliges banks to give general instructions to consum-

plaints reflect the relationship between consumers, payment cards ers, but they should be given more detailed directions and accurate

and banks from the consumers’ point of view. Third-party com- information on how to protect themselves when using payment

plaints are especially important and troublesome to service pro- cards. It would be convenient if the financial institutions also

viders because they represent a higher-order action than informed and reminded cardholders of their responsibilities and

complaints directly addressed to the company (Feick, 1987). The provide advice on how to protect their cards. In 2013, the Euro-

effort and involvement associated with third-party complaint pean Commission adopted a legislative package in the field of the

behaviour usually indicate a degree of consumer dissatisfaction EU payments framework. This package proposes a revised Pay-

that can threaten marketing relationships (McAlister and ments Services Directive (PSD2), which would offer better pro-

Erffmeyer, 2003). tection to consumers. In most cases, consumers would lose a

Finnish consumers use their payment cards extensively in vari- maximum of €50 if they had an unauthorized card payment instead

able situations. Our argument is that consumers would not use of current loss of €150 (Citizen’s summary, 2013).

their payment cards if they do not have broad-scope trust (Grayson Technology is another cause for distrust concerning the usage

et al., 2008) in the social context of payment cards. In other words, of payment cards. Some consumers use payment terminals care-

if consumers do not own cards, use them at home and abroad, there lessly giving criminals easy access to their card information. Our

would not be payment card fraud either. Thus, the data of this research indicates that problems related to trust in the usage of

study suggest that consumers have trust in the cards as a payment payment cards could be prevented by improving the identification

method at least until something unexpected and problematic methods of payment card users. Only the legitimate cardholder

happens, maybe also after that. In addition, consumers seem to should be able to use the payment card and at the same time the

have trust in banks as long as there are no problems with their identification methods should be easy and fast and not too expen-

payment card use. It has been suggested that some level of uncer- sive for the payment recipients. Perhaps, biometric passports will

tainty is required for trust to emerge. As long as there is no lead the way to the payment cards. In any case, identification

uncertainty or risk involved with a service, trust has no relevance. technology is developing rapidly (Duta, 2009; Adeoye, 2010;

Complete knowledge obviates the need for trust (Dasgupta, 2000; Clodfelter, 2010) but credit card companies have good reason to

Laeequddin and Sardana, 2010). avoid new technologies that could have an effect on their rev-

In our interpretation of the data, consumers’ trust in banks turns enues. The revenue generated from payment services can be sig-

into distrust when their payment card is misused and banks let nificant for some payment providers and a change in payment

down the consumers’ expectations by systematically stating that security standards could affect those revenue streams. Credit card

the consumers have caused the problems themselves by being companies and banks earn fees from every credit card transac-

negligent. Banks add insult to injury when they refuse to compen- tion, including those that are fraudulent (Sullivan, 2008;

sate the financial losses of the consumer who has fallen victim to Heikkinen and Iivarinen, 2011; Segal et al., 2011). The question

a crime. Consequently, a complaint to a third-party organization is is how long the consumers will pay the bill of the fraudulent

indicative of such distrust in banks. payment card use.

International Journal of Consumer Studies 39 (2015) 85–93 91

© 2014 John Wiley & Sons Ltd

Consumer trust relations T. Koivunen and H. Tuorila

Grabner-Kräuter, S. & Faullant, R. (2008) Consumer acceptance of

Limitations internet banking: the influence of internet trust. International Journal

We have utilized data which are limited to consumer complaints. of Bank Marketing, 26, 483–504.

The data are not representative and therefore the results cannot be Grayson, K., Johnson, D. & Chen, D.F.R. (2008) Is firm trust

essential in a trusted environment? How trust in the business

widely generalized. On the basis of the data, we do not know if

context influences customers. Journal of Marketing Research, 45,

most consumers came to a satisfactory resolution of their problems 241–256.

with their banks and only the unsatisfied consumers filed com- Grbich, C. (2013) Qualitative Data Analysis: An Introduction. Sage,

plaints with the two boards. It is not known how people who have London.

filed complaints react, especially after a negative resolution from Hammersley, M. & Atkinson, P. (1995) Ethnography. Principles in

the Boards, or in what way the negative resolutions influence how Practice. Routledge, London.

consumers use their payment cards and their relationship with the Heikkinen, P. & Iivarinen, T. (2011) Ensuring trust in electronic

bank. Moreover, the data do not provide information about the payment media. Journal of Payments Strategy & Systems, 5,

customers’ or the banks’ reactions to the resolutions or about 161–168.

the consequences the resolutions have. These questions are crucial Hogarth, J.M., Hilgert, M.A., Kolodinsky, J.M. & Lee, J. (2001) Prob-

lems with credit cards: an exploration of consumer complaining

in order to further explore the consumers’ experiences and their

behaviors. Journal of Consumer Satisfaction, Dissatisfaction and

relationship with banks. Complaining Behavior, 14, 88–107.

Kantsperger, R. & Kunz, W.H. (2010) Consumer trust in service compa-

nies: a multiple mediating analysis. Managing Service Quality, 20,

References

4–25.

Adeoye, O.S. (2010) A survey of emerging biometric technologies. Kuluttajariita.fi (2013) The Consumer Disputes Board. [WWW docu-

International Journal of Computer Applications, 9, 1–5. ment]. URL http://www.kuluttajariita.fi/index.php?language

Atkinson, P. & Coffey, A. (2004) Analysing documentary realities. In =en&linkID=0&subLinkID=0 (accessed on 3 December

Qualitative Research. Theory, Method and Practice (ed. by D. 2013).

Silverman), pp. 56–75. Sage, London. Kumara, R. & Mittal, R.K. (2004) Trust and its determinants in the

Bell, S.J. & Eisingerich, A.B. (2007) The paradox of customer: cus- internet banking: a study of private sector banks in India. Decision,

tomer expertise and loyalty in the financial services industry. Euro- 31, 73–96.

pean Journal of Marketing, 41, 466–486. Laeequddin, M. & Sardana, G.D. (2010) What breaks trust in

Blomqvist, K. (1997) The many faces of trust. Scandinavian Journal of customer supplier relationship? Management Decision, 48,

Management, 13, 271–286. 353–365.

Citizen’s summary (2013) Directive on Payment Services and Regula- Lamberger, I., Dobovšek, B. & Slak, B. (2012) Some dilemmas regard-

tion on interchange fees (MIFs). [WWW document]. URL http://ec ing payment card related crimes. Journal of Criminal Justice and

.europa.eu/internal_market/payments/docs/framework/130724 Security, 14, 191–204.

_citizens-summary_en.pdf (accessed on 15 May 2014). Lindebaum, D. & Cassell, C. (2011) A contradiction in terms? Making

Clodfelter, R. (2010) Biometric technology in retailing: will consumers sense of emotional intelligence in a construction management envi-

accept fingerprint authentication? Journal of Retailing and Consumer ronment. British Journal of Management, 23, 65–79.

Services, 17, 181–188. McAlister, D.T. & Erffmeyer, R.C. (2003) A content analysis of

Dasgupta, P. (2000) Trust as a commodity. In Trust: Making and Break- outcomes and responsibilities for consumer complaints to

ing Cooperative Relations (ed. by D. Gambetta), pp. 49–72. Depart- third-party organizations. Journal of Business Research, 56,

ment of Sociology, University of Oxford, Oxford. 341–351.

Dimitriadis, S. & Kyrezis, N. (2008) Does trust in the bank build trust Maroofi, F., Hashemi, R. & Nargesi, Z. (2012) Survey of customers’

in its technology-based channels? Journal of Financial Services Mar- conceptions of security and trust in e-payment system. Asian Journal

keting, 13, 28–38. of Business Management, 4, 275–285.

Duta, N. (2009) A survey of biometric technology based on hand shape. Merschen, T. (2010) Fraud dynamics in the card payments industry: a

Pattern Recognition, 42, 2797–2907. global review of the realities of EMV deployment. Journal of Pay-

Erasmus, A.C. & Lebani, K. (2008) Store cards: is it a matter of con- ments Strategy & Systems, 4, 156–169.

venience or is the facility used to sustain lavish consumption? Inter- Mukherjee, A. & Nath, P. (2003) A model of trust in online

national Journal of Consumer Studies, 32, 211–221. relationship banking. International Journal of Bank Marketing, 21,

Eriksson, P. & Kovalainen, A. (2008) Qualitative Methods in Business 5–15.

Research. Sage, Los Angeles. Organisation for Economic Co-operation and Development (2010)

Europol Review (2012) General report on Europol activities. [WWW Consumer policy toolkit. [WWW document]. URL http://books.google

document]. URL https://www.europol.europa.eu/sites/default/files/ .fi/books?id=ptP3hspOGjkC&lpg=PP1&ots=xtxiyqJgpK&dq=

publications/europolreview2012_0.pdf (accessed on 29 November CONSUMER%20POLICY%20TOOLKIT&pg=PP1#v=onepage

2013). &q=redress&f=false (accessed on 3 December 2013).

Federation of Finnish Financial Services (2013) Saving, borrowing and Payment Services Act (2010/290) Maksupalvelulaki [only in Finnish].

paying in Finland 2013. [WWW document]. URL http://www.fkl.fi/ [WWW document]. URL http://www.finlex.fi/fi/laki/ajantasa/2010/

en/material/publications/Pages/default.aspx (accessed on 3 December 20100290 (accessed on 22 April 2014).

2013). Pizzutti dos Santos, C. & Von der Heyde Fernandes, D. (2008) Anteced-

Feick, L.F. (1987) Latent class models for the analysis of behavioral ents and consequences of consumer trust in the context of service

hierarchies. Journal of Marketing Research, 24, 174–186. recovery. Brazilian Administration Review, 5, 225–244.

Fine.fi (2013) Regulations of the Finnish Financial Ombudsman Service Pulina, M. (2011) Consumer behavior in the credit card market: a

(FINE). [WWW document]. URL http://www.fine.fi/index.php? banking case study. International Journal of Consumer Studies, 35,

item=213 (accessed on 28 November 2013). 86–94.

92 International Journal of Consumer Studies 39 (2015) 85–93

© 2014 John Wiley & Sons Ltd

T. Koivunen and H. Tuorila Consumer trust relations

Sakharova, I. & Khan, L. (2011) Payment Card Fraud: Challenges and Stauss, B. (2002) The dimensions of complaint satisfaction: process and

Solutions. Selected Papers in Security Studies, Volume 5. The Univer- outcome complaint satisfaction versus cold fact and warm act com-

sity of Texas, Dallas. plaint satisfaction. Managing Service Quality, 12, 173–183.

Segal, L., Ngugi, B. & Mana, J. (2011) Credit card fraud: a new per- Sullivan, R.J. (2008) Can smart cards reduce payments fraud and iden-

spective on tackling an intransigent problem. Journal of Corporate & tity theft? Economic Review, 93, 35–62.

Financial Law, 16, 743–781. Wickramasinghe, V. & Gurugamage, A. (2012) Effects of social demo-

Shim, S., Serido, J. & Tang, C. (2013) After the global financial crash: graphic attributes, knowledge about credit cards and perceived life-

individual factors differentiating young adult consumers’ trust in style outcomes on credit card usage. International Journal of

banks and financial institutions. Journal of Retailing and Consumer Consumer Studies, 36, 80–89.

Services, 20, 26–33.

Sirdeshmukh, D., Singh, J. & Sabol, B. (2002) Consumer trust, value

and loyalty in relational exchanges. Journal of Marketing, 66, 15–37.

International Journal of Consumer Studies 39 (2015) 85–93 93

© 2014 John Wiley & Sons Ltd

Copyright of International Journal of Consumer Studies is the property of Wiley-Blackwell

and its content may not be copied or emailed to multiple sites or posted to a listserv without

the copyright holder's express written permission. However, users may print, download, or

email articles for individual use.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Residential Sales Contract (1101) 01 - 20Document7 pagesResidential Sales Contract (1101) 01 - 20Debbie MillerNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Mobile Banking QuestionnaireDocument3 pagesMobile Banking QuestionnaireMd Shohag Ali71% (38)

- A Monetary History of China Volumes One and Two (Zhongguo Huobi PDFDocument983 pagesA Monetary History of China Volumes One and Two (Zhongguo Huobi PDFYitian LiNo ratings yet

- E-Payments EvolutionDocument13 pagesE-Payments EvolutionYitian LiNo ratings yet

- Innovations in Payment Technologies and The Emergence of Digital CurrenciesDocument14 pagesInnovations in Payment Technologies and The Emergence of Digital CurrenciesYitian LiNo ratings yet

- Data Protection and The Legitimate Interest of Data PDFDocument26 pagesData Protection and The Legitimate Interest of Data PDFYitian LiNo ratings yet

- Internet Payment and BanksDocument21 pagesInternet Payment and BanksYitian LiNo ratings yet

- Factoring: Accounts ReceivableDocument3 pagesFactoring: Accounts ReceivableRia BhardwajNo ratings yet

- Limitations: Pillai's Institute of Management Studies and Research - New PanvelDocument4 pagesLimitations: Pillai's Institute of Management Studies and Research - New PanvelvishalbiNo ratings yet

- Report On Credit Appraisal in PNBDocument76 pagesReport On Credit Appraisal in PNBSanchit GoyalNo ratings yet

- Competitive Exams Accountancy: Bank Reconciliation StatementDocument3 pagesCompetitive Exams Accountancy: Bank Reconciliation StatementVikas ChoudharyNo ratings yet

- Indias Leading BFSI Companies 2017Document244 pagesIndias Leading BFSI Companies 2017rohit sharma100% (1)

- BANK OF AMERICA vs. PHILIPPINE RACING CLUB, INC. (PRCI)Document1 pageBANK OF AMERICA vs. PHILIPPINE RACING CLUB, INC. (PRCI)lucky javellanaNo ratings yet

- Excel FormatDocument38 pagesExcel FormatSaad QureshiNo ratings yet

- Principles of Accounting - CASE NO. 4 - PC DEPOTDocument24 pagesPrinciples of Accounting - CASE NO. 4 - PC DEPOTlouie florentine Sanchez100% (1)

- 2007 01 03 - DR3Document1 page2007 01 03 - DR3Zach EdwardsNo ratings yet

- Account Statements-MarDocument2 pagesAccount Statements-MarCAT ClusterNo ratings yet

- Tai Tong Chuache & Co. V Insurance Commission, G.R. No. L-55397, February 29, 1988Document2 pagesTai Tong Chuache & Co. V Insurance Commission, G.R. No. L-55397, February 29, 1988Lyle BucolNo ratings yet

- The Phygital Banking Transformation PDFDocument14 pagesThe Phygital Banking Transformation PDFbilloukos100% (2)

- Guide To Investment Management EmployersDocument449 pagesGuide To Investment Management EmployersYouness MouhyiNo ratings yet

- NEW 1 Colruyt Group Supplier SheetDocument3 pagesNEW 1 Colruyt Group Supplier SheetI M BrotoNo ratings yet

- Cross Currency Basis - RBS PDFDocument7 pagesCross Currency Basis - RBS PDFJaz MNo ratings yet

- Declaration For Consolidation of AccountsDocument2 pagesDeclaration For Consolidation of AccountsDhaneshNo ratings yet

- Rational Numbers (HIndi)Document32 pagesRational Numbers (HIndi)Bindu MenonNo ratings yet

- Chapter 10Document5 pagesChapter 10Shawon CorleoneNo ratings yet

- ShcilDocument58 pagesShcilDevika RaniNo ratings yet

- Test of Controls Procedure PDFDocument6 pagesTest of Controls Procedure PDFNatsu DragneelNo ratings yet

- RupayDocument3 pagesRupayItee Shree ChaudharyNo ratings yet

- Kotak SmartLife Plan BrochureDocument13 pagesKotak SmartLife Plan BrochureRobin VermaNo ratings yet

- Ethics QuestionsDocument4 pagesEthics QuestionsShwaibu Sella100% (1)

- Wallstreetjournaleurope 20170814 TheWallStreetJournal-EuropeDocument20 pagesWallstreetjournaleurope 20170814 TheWallStreetJournal-EuropestefanoNo ratings yet

- Anualidades ContinuasDocument3 pagesAnualidades ContinuasItzelRDNo ratings yet

- Top Banks in The PhilippinesDocument5 pagesTop Banks in The Philippinessummer mendozaNo ratings yet

- Reserve Bank of IndiaDocument8 pagesReserve Bank of IndiasachinoilNo ratings yet

- StatementDocument2 pagesStatementKaushal Tankaria100% (1)