0% found this document useful (0 votes)

2K views11 pagesAccounting Cycle Week 2 Reviewer

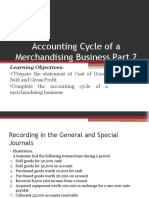

The accounting cycle is a series of steps performed to generate financial statements. It involves analyzing transactions, journalizing them, posting to ledgers, preparing an unadjusted trial balance, making adjustments, preparing a worksheet, and using the adjusted balances to prepare financial statements including the income statement, balance sheet, statement of cash flows, and statement of owner's equity. The purpose is to provide useful financial information to decision makers.

Uploaded by

Vinz Danzel BialaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views11 pagesAccounting Cycle Week 2 Reviewer

The accounting cycle is a series of steps performed to generate financial statements. It involves analyzing transactions, journalizing them, posting to ledgers, preparing an unadjusted trial balance, making adjustments, preparing a worksheet, and using the adjusted balances to prepare financial statements including the income statement, balance sheet, statement of cash flows, and statement of owner's equity. The purpose is to provide useful financial information to decision makers.

Uploaded by

Vinz Danzel BialaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd