Professional Documents

Culture Documents

01 General Principles and Concepts of Taxation PDF

Uploaded by

rogienelr0 ratings0% found this document useful (0 votes)

19 views16 pagesOriginal Title

01 General Principles and Concepts of Taxation.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views16 pages01 General Principles and Concepts of Taxation PDF

Uploaded by

rogienelrCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 16

the statement is correct, OF

* ess, oF as

¥ 1. Taxation could be eitbed as a power, 8 nae Maer

gr aan. Asa , taxation is a way of appo!

i nefits.

government among those who are privileged to enjoy its be

tizens in the form

authorizing it.

f 2. The State can enforce contributions upon its ci

/ of taxes even without a constitutional provision

ered valid if intended for the

particular

[ 3. Appropriation of taxes is consid

common good of the people without identifying @

person to be benefited from it

J 4, Taxation is inseparable in the existence of a nation

5. Taxation is considered as the lifeblood of the government and

must exercise this power, in nature

eee fire gers ner] ually only tor enoce eg em Ne

| 6 The amount of taxes may be increased to curve spending power

¢ and minimize inflation

f 7., The Constitution js-the source of the State's taxing. power

J 8 Taxation is the government's legitimate means of interfering with

z the private properties of its subjects.

9. The benefits from taxation heve-te-be-experienced-te-justify the

® legitimacy of collection of taxes from the people

£ 1 may Jiray rot be er perenced py th tekpuyer

10. Taxation is the primary source of government revenue. Hence, eH

¥ government funds come from taxes, A@* all funcli Come

1 11. Sovereign equality dictates that a nation cannot impose taxes on

the property of another country

Bane State can sull exercise its taxing powers over its citizen, even

é if he resides outside the taxing State’s territory,

ment entities 1egardless of their function

from taxes because it would be impractical eb EK

nt to be taxing itself. gou't agen en guged w>

bay functcat Cle tutyect fo fur UNLe Cheated

from taxes cannot be used for the exclusive

t. ¥

: asseasny . the President —

Beta nt aren Fred to

¥ Bee ae eer could be delesecretion. 7044

oS Paka ‘administral

“. covers both-legislative an : a

can- effectively be perfor

Paledne tbe

+ pxonen Mare avenue nt, oan

the power to tax ig delegated to the ial government, only

- ee Liane “branch of the local governme:

power. es

4, Eminent domain and police te

~ even without taxation. 7h

sour professor.

‘ear Se

page to

ot ation.

6.— All inherent powers presuppose equivalent compensatio

ne-imposition of amount in police power.

0s aig a I I amie ea

8. Police power and eminent domain may defeat the Constitutional

rights of person. ~

FE 9. Tex exemption applies-only to government entities that

iy ¥ proprietary functions. «Ay ced '

Cut here and submit this

xercise

stated ue,

predates is a process of taxation which involves the

oe apes ordinances through legislature

en thar ae peas by the Constitutional

“compensation. oniy ty,

Not be t, Ss

Ir emient lemon ‘aken without just

Problem 1-3 True or False ee

Write True if the statement is correct or False if the

Re ?

ly Taxes may be exercised to encourage economic growth

granting tax exemptions.

2., Taxes may be used as a tool and weapon in international :

relations and to protect trade relations.

3./ Protection is the basic consideration that justifies tax situs.

4. _The tax situs for occupation is the place where occupation is

pursued even if the criterion for nationality is given.

5.¥ There is-direct.double taxation by taxing corporate income and

corporate stockholders’ dividends from the same corporation.

4 Rae Ke KEpWiCHe «A diChncd pErCON fm

6.\.A nonresident Mien is liable to pay transfer taxes for properties

within and-outside- the Philippines. ony pepether win

the ‘phil pied

7) A tax may be levied for the support of religious-activities as long

asallehurches-benefitfrom it. «> public fund for religrous

Purpote

8.¥ In general, bills need not to be signed by the President to become

aia, It fad fo be crgned

9. y No law granting any tax exemption shall be passed without the

foneurrence of two-thirds of the members of the Congress.

mayo Only

10. The Constitution grant utonomous regions certain legislative

* powers which shall include legislative power over taxation,

11. Taxes collected by the BIR are iocettaxes. Vee ns | tenes

¥

12. Real estate tax and income tax collected on the same

bars F real estate

Property is not a form of double taxation,

ras

assets of non-stock, nonprofit educational —

or indirectly for educational pu e

and duties, oe

for the oe

j because

rade by oH by the courte cgurdes

iH

ct

net it me

conchrsive. ease

retroactive effect Decay

Rees tive jarposes. MC,

Tax laws are given ea ‘

" fers ay taxes which gives Tise

4._ In taxation, it is one’s civil liability to Pé

© to criminal liability. %

t of incorme-tax.

5.,-No person shall be imprisoned for nonPaYMent ©” py tay '

: ment, ane

the government,

4 strictly against a

6. ax ws must be conrad ay aginst the (axpayer

ally

7., As a rule, doubts as to imposition ee Pcie ly ix

y oF the payeromant emda aur oN

8. The Philippine tax laws are not political and penal in nature

9,-The doctrine of equitable recoupment is applicable to cases

% where the taxes involved are totally unrelated. (W' “p> 0?

10. When there is ambiguity of tax laws, the rules of statutory

7 construction may be used to search for the legislative intent.

However, when the meaning of the law is clear, the statute must

be enforced as written.

J. Tax exemption istfansferable and*@ssignable

with law have the

and reasonable,

i page to your Profesor

—

Cut here and submit tht

|

|

|

\

1

\

|

\

\

bmi this

z

oz

#

E

g

and iii only.

iand ii only

‘4. ionly

Which of the following is/are natural qualities of Taxation Power?

i, An inherent power ee ae

Essentially an executive function

An absolute power

iv. Territorial in operation |, .ateant

2+ legi¢fatwe

Choices: gate

a. i andivonly ey abe, eh

b. ii and iii only tech ote exemt

ci and ii only 4°

+” ptranqea €

d. TIonly Nubieet Atal penton

Taxation co-exist with the four clements of the state which includes

all, except r

Government

Property 2

Sovereignty 3+ cove rerg My

Territory. 4, qemrony

wer nent

Which of the following statements is not correct?

The government automatically po ses the power to collect

taxes from its inhabitants.

The government can enforce contribution upon its citizen only

wher the-Constitution grants it.

Taxation power exists inseparably with the State,

asthe State has the supreme power to command and enforce

tion from people within its jurisdiction.

its is not correct? 4

ent exercises the inherent power

2a ee a

axaTion : \ .

its \

= overnite un

jocal x 1

b es paar BE CS a es, \ "

"power eae ee go ate

: is

&._tnverpretaton e,

the government. - oa

i Y :

ee rea sae pat ney: ~" 4 of the people is

6 Which of the ce we? bi on “—_

© gern enn no popuon

. Construction of private Lege fran of great? porti 4

4. Allocation of taxes for the eee é

fi considered for public purposes:

xcept One:

7. Allof the following statements are correct ee ;

a. Taxation power is Wie strongest of al inherent powers of the

b. Taxation power is the stron} a

ees ea | restrictions. ~

¢. Tax laws must not violate Constit putional rationa iy

d. Exercise of Taxation power is subject to restr)

_ tite

this page t© YoUr

8. One of the following is not among the basic justification for taxation.

a. Taxation is based on necessity. # s

b. Taxation is the lifeblood of the government. v

¢, Taxation is the bread and butter of the government

d. Taxation is a ani tribution for the benefits received.

nad vecanrOAy

DP 9. Which of the following could be an object of taxation?

i. Person

ii, Tangible property

iii, Intangible property

iv. Rights

Choices:

a. iandii

b. i, iiand

c. iand iv.

da.

pere and submit

Cut

These refer to the rules or or

: ‘ders havi

executive branch of th: Wing force

ee 1 government to ensure fate a

: e ‘ z

problem 1-6 — Multiple Choice

Encircle the letter that contains the best answer.

This refers to the process of taxation to

based on existing tax |

a, Levying*~ceiwu oh ors

b, Impositior’) 6 6m) a

c. Assessment

d. Collection

os

i = ain ES Ee

All of the following are legislative aspect of taxation exce

a, selection of the object or subject of tax.

b, fixing of tax rates..~ z.

¢. valuation of property for taxation - adinin «webue feo

d. prescribing the general rules of taxation. ~~

Which of the following is/are elements of impact of taxation?

i, Levy ee

ii. Assessment “

iii, Collection »

Choices:

a. i, ii and iii

b. i and ii only.

¢. iiand iii only

d. iii only.

4. Allof the following are

a. selection of ot

b. valuation of property for tax

©. equalization of assessme

d. collection of taxes

ive functions of taxation except

The statement that “he who received more should give more” is based

on this basic tax principle

@. Fiscal adequacy (batexces buoge+

b. Theoretical justice (qua ty

c. Administrative feasibility ( juc+)

_ Due process of law

he burden of taxation, the corresponding estimated tax is

every payroll period so that at the end

t of tax withheld will be equal or

cation of

e 9 in gene!

Which of te following eh ot vision, taxe a

: hes ees ae lection is applicable to

. ai oe for assessment and co!

b. Prescriptive : i

etumable A769, 7 on being & remedie! ease s

Peet ieraly inorder sopratect tne “7

iptive peri :

Petia ting date and the actual date of filing,

i statements is carrect? i ;

oe . Retires: aoible taxation is legal as long as there is no vole of

equal protection and uniformity clauses of the Constitution.

Indigect double taxation violates the Constitutional provision of

uniformity and equal protection.

There is diregt double taxation

corporation andagain subject the portion

declared as dividend to final tax.

|. Direct double taxation is by the Constitutio:

Ga. Di Prohibited by onstitution

Which of the following remedies ag:

in taxing the income of the

of that income

treaty

i afould: be the shorter between the —

io

ainst double taxation requires tax

wage to your

ns here and submit this pé

Statement 2: Government owned or con

exercising proprietary functions are taxable unless

a. Only statement 1 is correct.

b. Only statement 2 is correct.

c. Both statements are correct.

d. Both statements are not correct.

3, Which of the following is an incorrect description of taxation?

a. Legislative and inherent for the existence of the government“

b. Necessary and for public purposes ~

c. Supreme and an absolute power of the State f

d. Restricted by Constitutional and inherent limitations 7

4. Which of the following is not true?

Police Eminent

Domain |

a. Inherent to the

Y Yes

b. N No

©. Superior to the non

impairment clause Yes ve Yes No

d. Restricted by just

compensation No No Yes

to exercise

Consututional Inherent

‘fol ions are inherent on the exercise of

E ,

'b. for public purposes. |

€. territorial jurisdiction. | v

_ d. international comity. J

Which of the following statements is not correct?

The national and local government units exercise

Power to tax. cerer *™

Local government units could exercise

though legislated delegation.“

National legislation is exercised by Ci ingress.

Interpretation of Tax Laws is done by the jud.

government.

‘ax affects the area or nation as a community

dduals. This is a specific explanation of

International comity.

~ Reciprocity.

d. International inhibition.

Which of the following statements is not correct?

a. Collections from taxes are public money.

b. Appropriation of taxes for the common good of the people is

valid.

¢. Construction of private road from taxes is a valid appropriation.

d. Allocation of taxes for the benefit of greater portion of population:

is considered for public purposes.

A taxpayer gives the following reasons in refusing to pay a tax. Which

of his reasons is not acceptable for legally refusing to pay the tax?

a. That he has been deprived of due proc of law.

b. That there is lack of territorial jurisdiction

¢. That he derives no bencfit from the tax.

d. That the prescriptive period for the tax has

elapsed

The following are the constitutional limitations on the power of

taxation, except

a, « taxes are not subject to set-off or compensation

b. only Congress can exercise the power of taxation

¢. non-impairment of the obligation of contracts.

d. the rule of taxation must be uniform.

Which of the following is/are taxable only for income earned within

the Philippines? a ae n th

i, Nonresident citizen ~

Nonresident alien

“Resident citizen (tru. Por income ovdcede[itarn POPS

alien —

es except

‘a value-added tax.

'b. other percentage tax.

-c. excise tax.

_d. custom duties. ~ Gr vmpyrt!

ee

e

“

o all of the following are National taxes as to collecting authority

icome tax.

real property tax. ~

All of the following are not taxes except

@, surcharge. % eae Aare

b. special assessment.x

© custom duties. ”

d. license fee. ¥

Which of the following could be an obje

i Person

ii, Tangible property~

iii, Intangible property ”

iv. Rights “

ct of taxation?

Choices:

a. iand ii

b. i, ii and iii

c. iand iv

d, i, ii, iii and iv.

Which of the following correctly describes the primary purpose of

taxation? ie ~ ae

Fiscal Regulatory

purpose —_ purpose

a, To raise revenue Yes Yes

b. To check inflation Yes No

¢. To discourage consumption of

harmful products No No

d. To limit influx of foreign products Yes.

esident Yes

a. Taxable income of MOREE

: Yes “

a eatate of resident aut 2

e Taxable castor ‘of resident citizeD a

c ree gident

d. Taxable sale

sans that it can impo

7. statement 1: The city of Baguio iS TT Code (in addi

~ Staterienpanks under the Local GOVCPEN Ey +

percentage tax on banks imPOSe ET double taxation

Se ttement 2: Such imposition is a Gu°2

a. Both statements are correct.

b. Only statement 1 is correct.

c. Only statement 2 is correct.

d. Both statements are incorrect.

ofessor

nit this page t0 Your PM

& One of the following is incorrect regarding tax exemption.

Express

Exempt

a:

13% month pay of P30,000 and

below Yes

Inter-corporate dividend Yes

No

Yes

b.

¢ Nontaxability of government units

ed.

Separation pay due to sickness

Cut here and subi

9. Which of the following statements is not correct?

a A tax bill must only be a per

ae plicable and operative after becoming a

The effectivity of the tax law comr

cette at fommences upon its approval. ~

stone. bean” Covers the present and future

Tax law i

Aw #8 €X post facto in application, x

i Up bn « are

sepa greet? pee

Bs

non, taxes in general

ctive in operation although the tax stat

“operate retrospectively provided it is cl

“Statement 1: When the primary consideration is the legislative

"intent, but doubts exist in determi

ing such intent, the dot bts must

be resolved strictly against the taxing authority. ~

Statement 2: Tax exemptions are strictly construed against the

a

‘Only statement 1 is true

Only statement

Both statements are true.

Both statements are tals

strictly ag:

strictly ag

and generally

A of tax returns,

a. GAAP shall prevail o ¥

b. Tax laws shall prevail over GAAP.

shall resolve the i:

er viola

_ d. Tax Code could vi

ss by court resolution

cerning barangay taXe-* hanged by.

BIR Rulings are i Ge gtitutional provisions *

rare ill:

witcher ee peodes" as Representative and on

. Must originate from the dmments.

* Jame bill the Senate may propose Te chich niane bill ie

b. May originate from the Senate and Dr acients

PCaER y se amen' s

of Representatives may propose @ ate! version al

id

©. May have a House version an F :

separately and then consolidated, with both houses appré

the consolidation version.

d. May be recommended by the President to Congress

Which of the following statements is cor ecy?

Revenue regulations have the force and effect

memorandum order of the Commissioner of Intern

approved by the Secretary of Finance, has the

effect as revenue regulation

b. The revenue regulations in conflict with law are null and void,

¢. The interpretations of the former Secretary of Fi t

necessarily bind their successors, wy nance San

d. All of the above. 7

Statement 1: The law on prescri :

should be interpreted liberally. senption being @ remedial

_ Statement 2: Doubts as to wi

imposed should be tesolved in ae ty a

correct, :

You might also like

- To Reduce System LossDocument1 pageTo Reduce System LossGwyneth Ü ElipanioNo ratings yet

- PHP BS EXCEL ABOITIZDocument4 pagesPHP BS EXCEL ABOITIZGwyneth Ü ElipanioNo ratings yet

- Answer Key in Applied Auditing by Cabrera 2006 EditionDocument271 pagesAnswer Key in Applied Auditing by Cabrera 2006 EditionGwyneth Ü Elipanio100% (14)

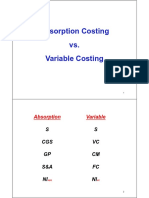

- Absorption Costing vs. Variable CostinggDocument11 pagesAbsorption Costing vs. Variable CostinggGwyneth Ü ElipanioNo ratings yet

- Economic Order QuantityDocument9 pagesEconomic Order QuantityGwyneth Ü ElipanioNo ratings yet

- Summary of Lecture 5 - ElasticityDocument5 pagesSummary of Lecture 5 - ElasticityGwyneth Ü ElipanioNo ratings yet

- Tax Administration PDFDocument19 pagesTax Administration PDFGwyneth Ü ElipanioNo ratings yet

- Case StudyDocument19 pagesCase StudyGwyneth Ü Elipanio100% (1)

- National Artists TheaterDocument5 pagesNational Artists TheaterGwyneth Ü ElipanioNo ratings yet

- Feasibility Analysis: The Beauty ClubDocument15 pagesFeasibility Analysis: The Beauty ClubGwyneth Ü ElipanioNo ratings yet

- BMC PersonalDocument2 pagesBMC PersonalGwyneth Ü ElipanioNo ratings yet

- 01 Review of The Auditing ProcessDocument34 pages01 Review of The Auditing ProcessGwyneth Ü ElipanioNo ratings yet

- 14 Capital Structure LeverageDocument35 pages14 Capital Structure LeverageMaria Ceth SerranoNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)