Professional Documents

Culture Documents

Tutorial 3 Cost of Capital

Uploaded by

tai kianhongCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutorial 3 Cost of Capital

Uploaded by

tai kianhongCopyright:

Available Formats

BWFF2043

TUTORIAL 3

COST OF CAPITAL

1. The Down and Out Co. just issued a dividend of $2.40 per share on its common

stock. The company is expected to maintain a constant 5.5 percent growth rate in

its dividends indefinitely. If the stock sells for $52 a share, what is the company's

cost of equity?

2. The Up and Coming Corporation’s common stock has a beta of 1.05. If the risk

free rate is 5.3 percent and the expected return on the market is 12 percent, what

is the company’s cost of equity capital?

3. Holdup Bank has an issue of preferred stock with a $6 stated dividend that just

sold for $96 per share. What the bank’s cost of preferred stock?

4. Waller, Inc., is trying to determine its cost of debt. The firm has a debt issue

outstanding with 15 years to maturity that is quoted at 107 percent of face value.

The issue makes semiannual payments and has an embedded cost of 7 percent

annually. What is the company’s pretax cost of debt? If the tax rate is 35

percent, what is the aftertax cost of debt?

5. Mullineaux Corporation has a target capital structure of 60 percent common

stock, 5 percent preferred stock, and 35 percent debt. Its cost of equity is 14

percent, the cost of preferred stock is 6 percent, and the cost of debt is 8 percent.

The relevant tax rate is 35 percent. What is Mullineaux’s WACC?

6. Filer Manufacturing has 11 million shares of common stock outstanding. The

current share price is $68, and the book value per share is $6. Filer

Manufacturing also has two bond issues outstanding. The first bond issue has a

face value of $70 million, has a 7 percent coupon, and sells for 93 percent of par.

The second issue has a face value of $55 million, has an 8 percent coupon, and

sells for 104 percent of par. The first issue matures in 21 years, the second in 6

years. The most recent dividend was $4.10 and the dividend growth rate is 6

percent. Assume that the overall cost of debt is the weighted average of that

implied by the two outstanding debt issues. Both bonds make semiannual

payments. The tax rate is 35 percent. What is the company’s WACC?

You might also like

- MBA711 - Chapter 10 - Answers To All QuestionsDocument18 pagesMBA711 - Chapter 10 - Answers To All QuestionsWajiha Asad Kiyani100% (2)

- IFRS Functional Currency CaseDocument23 pagesIFRS Functional Currency CaseDan SimpsonNo ratings yet

- Fernandez Corporation Financial StatementsDocument20 pagesFernandez Corporation Financial StatementsKhánh Huyền0% (2)

- Discounted Cash Flow (DCF) Definition - InvestopediaDocument2 pagesDiscounted Cash Flow (DCF) Definition - Investopedianaviprasadthebond9532No ratings yet

- Solutions BD3 SM24 GEDocument4 pagesSolutions BD3 SM24 GEAgnes ChewNo ratings yet

- Forward Rate AgreementDocument8 pagesForward Rate AgreementNaveen BhatiaNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingMikz PolzzNo ratings yet

- CH 4 Classpack With SolutionsDocument24 pagesCH 4 Classpack With SolutionsjimenaNo ratings yet

- Financial Statement Ratio Analysis PresentationDocument27 pagesFinancial Statement Ratio Analysis Presentationkarimhisham100% (1)

- Fitch RatingsDocument7 pagesFitch RatingsTareqNo ratings yet

- IFRS 2 - Provisions, Contingent Liabilities and Contingent AssetsDocument10 pagesIFRS 2 - Provisions, Contingent Liabilities and Contingent AssetsUlanda20% (1)

- Cost of Capital ProblemsDocument5 pagesCost of Capital ProblemsYusairah Benito DomatoNo ratings yet

- WACC CALCULATIONSDocument4 pagesWACC CALCULATIONSshan50% (2)

- Cost Volume ProfitDocument4 pagesCost Volume ProfitProf_RamanaNo ratings yet

- 2 Risk&ReturnDocument23 pages2 Risk&ReturnFebson Lee MathewNo ratings yet

- Investment Analysis and Portfolio Management Christmas Worksheet 2009Document2 pagesInvestment Analysis and Portfolio Management Christmas Worksheet 2009farrukhazeemNo ratings yet

- Telecom Egypt Credit RatingDocument10 pagesTelecom Egypt Credit RatingHesham TabarNo ratings yet

- Case Study: Calculating CAPM Beta in ExcelDocument18 pagesCase Study: Calculating CAPM Beta in ExcelNumXL Pro100% (1)

- Financial Statement Analysis ControlDocument7 pagesFinancial Statement Analysis ControlTareq MahmoodNo ratings yet

- Corporate Finance PDFDocument185 pagesCorporate Finance PDFrodgington duneNo ratings yet

- Chapter 9Document33 pagesChapter 9Annalyn Molina0% (1)

- Assignment 5 - CH 10 - The Cost of Capital PDFDocument6 pagesAssignment 5 - CH 10 - The Cost of Capital PDFAhmedFawzy0% (1)

- Ch01 SMDocument33 pagesCh01 SMcalz_ccccssssdddd_550% (1)

- Expected Returns, Variance, and Portfolio DiversificationDocument7 pagesExpected Returns, Variance, and Portfolio DiversificationLavanya KosuriNo ratings yet

- Weighted Average Cost of Capital: Banikanta MishraDocument21 pagesWeighted Average Cost of Capital: Banikanta MishraManu ThomasNo ratings yet

- Balance Sheet Statement of Financial PositionDocument17 pagesBalance Sheet Statement of Financial PositionAhmed FawzyNo ratings yet

- Fauji Fertilizer Company (FFC) : Target Price StanceDocument17 pagesFauji Fertilizer Company (FFC) : Target Price StanceAli CheenahNo ratings yet

- 5.1 Questions: Chapter 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsDocument37 pages5.1 Questions: Chapter 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsLiyana ChuaNo ratings yet

- BD3 SM17Document3 pagesBD3 SM17Nguyễn Bành100% (1)

- Numericals On Stock Swap - SolutionDocument15 pagesNumericals On Stock Swap - SolutionAnimesh Singh GautamNo ratings yet

- Fertiliser Sector Report - PINC ResearchDocument72 pagesFertiliser Sector Report - PINC Researchsatish_xpNo ratings yet

- Wacc MisconceptionsDocument27 pagesWacc MisconceptionsstariccoNo ratings yet

- Test Bank For New Zealand Financial Accounting 6th Edition by CraigDocument67 pagesTest Bank For New Zealand Financial Accounting 6th Edition by CraigCarolparker100% (1)

- Nokia Analysis Report: András Csizmár, Quyen Vu, Stefanie WethDocument32 pagesNokia Analysis Report: András Csizmár, Quyen Vu, Stefanie Wethjason7sean-30030No ratings yet

- Camel Rating FrameworkDocument3 pagesCamel Rating FrameworkAmrita GhartiNo ratings yet

- Corporate Finance and Investment AnalysisDocument80 pagesCorporate Finance and Investment AnalysisCristina PopNo ratings yet

- Tutorial Cost of CapitalDocument3 pagesTutorial Cost of CapitalHoàng NguyễnNo ratings yet

- Definition of WACCDocument6 pagesDefinition of WACCMMNo ratings yet

- Risk N Return BasicsDocument47 pagesRisk N Return BasicsRosli OthmanNo ratings yet

- Capital StructureDocument59 pagesCapital StructureRajendra MeenaNo ratings yet

- Chapter 009 Test BankDocument13 pagesChapter 009 Test Banknadecho1No ratings yet

- Solution For Ca Final SFM Nov 15 Paper (Practical Questions) by Ca Praviin MahajanDocument18 pagesSolution For Ca Final SFM Nov 15 Paper (Practical Questions) by Ca Praviin MahajanPravinn_Mahajan50% (2)

- The Application of Ifrs Oil and Gas PDFDocument18 pagesThe Application of Ifrs Oil and Gas PDFSahilJainNo ratings yet

- Take Home QuizDocument8 pagesTake Home QuizJean CabigaoNo ratings yet

- Internship Report On: Financial Analysis of KDS Accessories LimitedDocument50 pagesInternship Report On: Financial Analysis of KDS Accessories Limitedshohagh kumar ghoshNo ratings yet

- 2.4 Earnings Per ShareDocument40 pages2.4 Earnings Per ShareMinal Bihani100% (1)

- Practice Test MidtermDocument6 pagesPractice Test Midtermrjhuff41No ratings yet

- What's A Bond?: What's A Bond? Types of Bonds Bond Valuation Techniques The Bangladeshi Bond Market Problem SetDocument30 pagesWhat's A Bond?: What's A Bond? Types of Bonds Bond Valuation Techniques The Bangladeshi Bond Market Problem SetpakhijuliNo ratings yet

- Value Added Metrics: A Group 3 PresentationDocument43 pagesValue Added Metrics: A Group 3 PresentationJeson MalinaoNo ratings yet

- Statement of Cash Flows Indirect MethodDocument3 pagesStatement of Cash Flows Indirect MethodheykmmyNo ratings yet

- Beta Value - Levered & UnleveredDocument2 pagesBeta Value - Levered & UnleveredVijayBhasker VeluryNo ratings yet

- ICAEW - Valuing A BusinessDocument4 pagesICAEW - Valuing A BusinessMyrefNo ratings yet

- PPT4-Consolidated Financial Statement After AcquisitionDocument57 pagesPPT4-Consolidated Financial Statement After AcquisitionRifdah SaphiraNo ratings yet

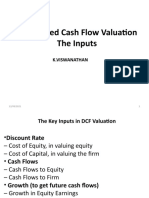

- Discounted Cash Flow Valuation The Inputs: K.ViswanathanDocument47 pagesDiscounted Cash Flow Valuation The Inputs: K.ViswanathanHardik VibhakarNo ratings yet

- Finance Zutter CH 1 4 REVIEWDocument112 pagesFinance Zutter CH 1 4 REVIEWMarjorie PalmaNo ratings yet

- NBS Non Performing LoansDocument28 pagesNBS Non Performing LoansGreg ZuccariniNo ratings yet

- CH 05Document48 pagesCH 05Ali SyedNo ratings yet

- Ba1727 Security Analysis and Portfolio ManagementDocument2 pagesBa1727 Security Analysis and Portfolio Managementbhuvanesh87No ratings yet

- Asset Conversion CycleDocument12 pagesAsset Conversion Cyclessimi137No ratings yet

- BKAL1013 (A172) - ppt-T4Document27 pagesBKAL1013 (A172) - ppt-T4tai kianhongNo ratings yet

- Outline Labour EcoDocument1 pageOutline Labour Ecotai kianhongNo ratings yet

- Basic Bond Valuation TutorialDocument2 pagesBasic Bond Valuation Tutorialtai kianhongNo ratings yet

- Time Value of Money ExercisesDocument2 pagesTime Value of Money Exercisestai kianhongNo ratings yet

- Lehman Brothers’ Story: Lessons of Ethics in BusinessDocument10 pagesLehman Brothers’ Story: Lessons of Ethics in Businesstai kianhongNo ratings yet