Professional Documents

Culture Documents

Evolution of Cartel Enforcement US

Uploaded by

Alija PandapatanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Evolution of Cartel Enforcement US

Uploaded by

Alija PandapatanCopyright:

Available Formats

The Booth School of Business, University of Chicago

The Evolution of U.S. Cartel Enforcement

Author(s): Vivek Ghosal and D. Daniel Sokol

Source: The Journal of Law & Economics , Vol. 57, No. S3, The Contributions of Robert

Bork to Antitrust Economics (August 2014), pp. S51-S65

Published by: The University of Chicago Press for The Booth School of Business,

University of Chicago and The University of Chicago Law School

Stable URL: https://www.jstor.org/stable/10.1086/676070

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide

range of content in a trusted digital archive. We use information technology and tools to increase productivity and

facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at

https://about.jstor.org/terms

The University of Chicago Press , The Booth School of Business, University of Chicago and The

University of Chicago Law School are collaborating with JSTOR to digitize, preserve and extend

access to The Journal of Law & Economics

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

The Evolution of U.S. Cartel Enforcement

Vivek Ghosal Georgia Institute of Technology

D. Daniel Sokol University of Florida

Abstract

Antitrust as a whole was transformed owing in large part to Robert Bork in The

Antitrust Paradox. This paper examines what Bork said and did not say about

cartel enforcement and offers an examination of how the actual structure of car-

tel enforcement played out relative to what Bork advocated. To provide some

perspective on Bork’s view of cartel enforcement, we compare his views with

those of the other major influential antitrust book of the time by Richard Pos-

ner. We identify three distinct stages of cartel enforcement. Stage 1 is character-

ized by a low number of cartels prosecuted along with low fines and jail terms.

Consistent with Bork’s vision, stage 2 demonstrates a significant increase in car-

tels prosecuted, although fines and jail terms remain low. Stage 3 (the current

stage) exemplifies a decline in the number of cartels prosecuted relative to stage

2 but with dramatic increases in monetary fines and jail terms.

1. Introduction

This paper traces the evolution of the design of the institutional setting of U.S.

cartel enforcement by examining its three major attributes: fines, criminal pen-

alties, and leniency over time. The transformation of cartel enforcement as part

of optimal antitrust institutional design occurred at the same time that much of

antitrust was being transformed. This general transformation was due in large

part to the influential writings of Robert Bork in The Antitrust Paradox (1978).

This paper examines what Bork said and did not say about cartel enforcement

and offers an empirical examination of how the actual structure of cartel enforce-

ment played out relative to what Bork advocated. To provide some perspective

on Bork’s view of cartel enforcement, we compare his views with those of the

other major influential antitrust book of the time, Posner’s Antitrust Law: An

Economic Analysis (1976).

Both Bork (1978) and Posner (1976) advocated a fundamental change in anti-

We thank participants at the 2014 New York University Law School conference Next Generation

of Antitrust Scholarship and the 2013 Yale Law School conference The Influence of Robert H. Bork

on Antitrust Law: A Retrospective and particularly Roger Blair, Dennis Carlton, Harry First, Doug-

las Ginsburg, Margaret Levenstein, George Priest, Eric Rasmussen, Larry White, and anonymous

referees for valuable suggestions.

[ Journal of Law and Economics, vol. 57 (August 2014)]

© 2014 by The University of Chicago. All rights reserved. 0022-2186/2014/5703-0027$10.00

S51

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

S52 The Journal of LAW & ECONOMICS

trust policy to one that comported with economic theory and empirics. The focus

of each of the books was to change antitrust doctrine in those areas most in need

of reform—primarily in the area of single-firm conduct. These books, particularly

Bork’s, transformed antitrust in practice (Priest 2014).

For each of these theorists, cartel enforcement was seen as the most import-

ant type of enforcement that the government should undertake (Bork 1978, p.

407; Posner 1976, pp. 507–8). Yet the specifics of how enforcement should work,

given developments in cases and mechanisms for increasing enforcement, were

not well developed in either book. To be sure, enforcement mechanisms were of

secondary concern to reforming antitrust policy to follow an economics-based

approach. However, both Bork and Posner wrote during a period when transfor-

mative changes were occurring in cartel enforcement mechanisms.

We identify three distinct stages of U.S. cartel enforcement in which the nature

of the institutional attributes changed, sometimes along the lines advocated by

Bork and Posner. Stage 1 is characterized by a low number of cartels prosecuted

along with low fines and jail terms as compared with the present. Stage 2 demon-

strates a significant increase in cartels prosecuted, although fines and jail terms

remain low (Bork). Stage 3 (the current stage) shows a decline in the number of

cartels prosecuted relative to stage 2 but with significant increases in monetary

fines (Posner) and jail terms (neither Bork nor Posner).

The paper is organized as follows. In Section 2, we examine Bork’s intellectual

contributions to cartel enforcement along with those of Posner. Bork’s Antitrust

Paradox (1978) is one of the most, if not the most, influential writings in antitrust

scholarship of all time in terms of its policy impact.1 Yet Bork’s brief discussion of

cartels did not focus on the institutional mechanisms of enforcement, even though

all three major attributes of the evolving structure of cartel enforcement were in

play during the 1970s. Next we describe the key cartel-enforcement and institu-

tional changes from 1890 to the present and place Bork’s and Posner’s contribu-

tions in context with these developments. We then examine the data to see how

closely developments in enforcement tracked Bork’s or Posner’s prescriptions.

In Section 3, we describe our historical U.S. cartel-enforcement data, along with

some quantification of the effects of the institutional changes. Section 4 concludes.

2. Bork and Posner on Hard-Core Cartels

Here we note Bork’s thoughts on cartels, compare his views with Posner’s, note

the key developments in U.S. cartel and antitrust enforcement, and conduct an ex

post assessment of Bork’s views against the fairly significant institutional changes

that altered the path of cartel enforcement.

2.1. Bork’s and Posner’s Contributions on Cartels

Although Becker’s (1968) optimal-deterrence framework was not applied for-

mally to antitrust until Landes (1983), implicitly the use of this framework per-

1

Priest (2014) explains why the book had such an important impact.

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

Evolution of Cartel Enforcement S53

vades the work of both Bork and Posner. Although this paper focuses on Bork’s

vision and potential impact, we find it useful to compare and contrast Bork with

Posner, as both were instrumental in altering the path of U.S. antitrust enforce-

ment. In the area of cartels, Bork and Posner had different visions for optimal

cartel enforcement.

Bork’s Antitrust Paradox offers a comprehensive view of antitrust law and pol-

icy. In this broader context of Bork’s argument on the proper role of antitrust, his

discussion on hard-core cartels is surprisingly brief. Bork (1978, p. 263) spends

less than a paragraph in a chapter titled “Horizontal Restraints” on the topic of

hard-core cartels. Instead, the chapter focuses on collusive behavior that has off-

setting efficiencies where the restraints to competition are merely ancillary.2 Fur-

ther, Bork’s solution to combat cartels is equally brief—to open more field offices

to prosecute local cartels (p. 406). This brief treatment of hard-core cartels per-

haps reflected a sense that hard-core cartels were both conceptually and doctrin-

ally easy situations. Consequently, the analytical structure of cartel enforcement

was not in need of repair relative to other parts of the antitrust system.

As a result of the brief treatment of naked cartels, Bork (1978) is silent with

regard to a number of critical features about how changes being institutionalized

in the area of cartel enforcement (leniency, increased fines, and increased incar-

ceration), which by the time of the publication of The Antitrust Paradox would

have a profound impact on enforcement. He is equally silent about international

cartel issues.

To be highly critical of Bork for the lack of specificity is excessive. The specific

mechanics of how cartel enforcement might work was a second-order question

for Bork relative to the repair of antitrust policy overall. To the extent that one

can be critical about Bork regarding cartels, it is that he fails to include in his

writing an institutional approach to cartel enforcement, particularly at a time in

which the institutional structure was shifting, which would subsequently have a

profound effect on cartel enforcement.

Posner was the other leading agent of change in antitrust law during the 1970s

and offered an alternative vision to that of Bork as to cartel enforcement. In his

book, Posner argues against criminal incarceration and instead advocates the use

of increased fines in both the first edition (1976) and second edition (2001) of An-

titrust Law. Advocacy for increased fines suggests a belief that cartel enforcement

was suboptimal in both periods because the punishment was too small, even after

a significant increase in the number of cartels detected during the 1980s and an

increase in the detection of international cartels during the 1990s.

On the three issues that Posner specifically raises—the doctrinal shift to a

broader view of tacit collusion, increased fines (Posner was in favor of increases

in fines—even after the 1974 Antitrust Procedures and Penalties Act), and the use

of incarceration (Posner opposed it)—Bork is silent on the last two. We interpret

2

Bork had concerns about misapplication of per se rules to cases such as United States v. Topco

Associates, Inc., 405 U.S. 596 (1972), and United States v. Sealy, Inc., 388 U.S. 350 (1967).

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

S54 The Journal of LAW & ECONOMICS

Bork’s silence on Posner’s ideas to mean that Bork found cartel enforcement sub-

optimal but for different reasons. If cartel enforcement was optimal or close to it,

there would have been no need to advocate more Department of Justice (DOJ)

field offices. By implication, Bork’s conceptualization of suboptimal enforcement

regarding cartels focused on the likelihood of detection rather than on the design

of penalties (incarceration and fines). Thus, Bork’s silence on increased penalties

suggests that he believed that the then-mix of low criminal penalties for individ-

uals and low fines was sufficient in terms of penalties but that the problem with

cartel enforcement was with detection.3

The present structure of cartel enforcement with high fines, significant incar-

ceration, an emphasis on large international cartels, and the use of leniency is

very different from what concerned Bork. In fairness to Bork, the goal of The

Antitrust Paradox was broader. Bork wanted to provide theoretical coherence to

what was rather poorly conceptualized antitrust case law.4 Operationalizing his

vision was of secondary concern. However, Bork’s silence on fines and incarcera-

tion in the face of the publication of Posner’s book just 2 years before the publica-

tion of The Antitrust Paradox is somewhat surprising.5 Moreover, increased fines

had just been introduced in 1974. On the incarceration side, at the end of 1976,

Donald Baker, the then-head of the Antitrust Division, gave a speech in which he

advocated for a significant increase in the use and severity of criminal antitrust

(Baker 1976). In 1977, guidelines were promulgated shortly thereafter that advo-

cated higher levels of criminalization (U.S. Department of Justice 1977).

In the area in which Bork was explicit, the emphasis on local cartel enforce-

ment was in some ways brilliant. He was able to focus on the low-hanging fruit

of cartel enforcement—significant cartel activity at the local level. In the context

of the time in which he wrote, the world was also less open to trade than at the

present, and international cartel activity may have been less significant than after

the Uruguay round of trade negotiations (Levenstein and Suslow 2014). Bork was

also silent on leniency. Given that international enforcement and leniency were

not significant in the late 1970s, it is difficult to fault Bork for not focusing on (or

perhaps anticipating) these changes.

Bork and Posner, when taken together, showed tremendous insight in identi-

fying most of the critical institutional questions with regard to cartels.6 Our em-

3

Bork’s policy prescription of increased cartel enforcement via additional Department of Justice

(DOJ) field offices suggests that Bork may have been less convinced than Stigler (1964) of the inher-

ent instability of cartels. That is, if cartels naturally fail, the case for increased cartel enforcement via

more staffing of regional field offices would be weak. Subsequent research into cartels suggests that

cartels are more successful than Stigler may have anticipated (Levenstein and Suslow 2004, 2011,

2014).

4

Whether Bork actually meant total welfare rather than consumer welfare is a different question.

See Blair and Sokol (2012) for a discussion.

5

Priest (2014) explains why it took so long for Bork to publish The Antitrust Paradox.

6

Neither Posner nor Bork discuss the leniency program or its implication in their initial or re-

vised editions. In Posner’s case, the lack of discussion in the initial edition is understandable—the

leniency program was first discussed in 1976. However, the lack of discussion in the second edition is

surprising since it was published well after new leniency policies had yielded impressive results. The

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC:56 UTC

All use subject to https://about.jstor.org/terms

Evolution of Cartel Enforcement S55

pirical results (Section 3) suggest that depending on the period in question, U.S.

cartel-enforcement policy has followed in part the policy prescriptions of Bork or

Posner since the late 1970s.

2.2. Key Developments in Domestic U.S. Cartel Enforcement

The 1960s and 1970s saw important shifts in institutional structures of car-

tel enforcement. The first iteration of the leniency program was also introduced

during this period.7 These three innovations (higher financial penalties, greater

criminal sanctions, and leniency) were all efforts to increase the punishments as-

sociated with cartel behavior and a higher probability of detection. Cartel fines,

which had been increased in the 1950s, were low by today’s standards, even when

adjusted for inflation. Cartel activity also was a misdemeanor rather than a fel-

ony. All of these changes (or, in the case of leniency, at least discussion of the pro-

posed change) occurred before the publication of The Antitrust Paradox.8

To motivate the empirical analysis in Section 3, we provide an overview of the

critical events in the timeline of cartel policy. These events provide a context for

what was known at the time of the publication of The Antitrust Paradox and for

subsequent events.

Table 1 presents the timeline of key U.S. cartel-enforcement events. In 1890,

the Congress passed the Sherman Act. The statute set the maximum fine at

$5,000. In 1955, Congress raised the maximum fine under the Sherman Act to

$50,000 per count. Shortly thereafter, an enforcement shift occurred regarding

incarceration. United States v. McDonough Co. (180 F. Supp. 511 [1959]) led to

the conviction of four executives.

The next major set of cartel cases occurred in the period 1958–61 as a result of

the electrical equipment price-fixing cases. These cases involved 30 corporations

and 45 defendants. The cartel received significant public scrutiny because of the

size of the overcharges, the prominence of the companies involved, the small fi-

nancial penalties, and the jail time for “respectable” people (Bane 1973; Sultan

1974).9 As Connor notes (2001, p. 43), “Corporate antitrust convictions were the

equivalent of corporate parking tickets.” Similarly, Denger (2003) notes eight ex-

other area of cartel dynamics in which neither acknowledged a fundamental enforcement issue was

in international cartel enforcement.

7

Although the original leniency program was introduced in 1978, DOJ Antitrust Division officials

had been discussing the leniency program since 1976, according to senior Antitrust Division offi-

cials at the time, with whom we conferred.

8

Whether the innovations brought antitrust closer to optimal deterrence is a separate question.

We cannot observe actual cartel behavior, and so we cannot be sure of the number of unidentified

cartels at any point in time or over time. However, scholarship estimates the detection rate in the

United States of between 13 and 17 percent from 1961 to 1988 (Bryant and Eckard 1991). More re-

cent scholarship (Detre, Golub, and Connor 2005) shows no change in detection rates. This perhaps

suggests that enforcement remains suboptimal. On theoretical grounds, cartel stability may have

increased postleniency by those cartels that have been able to harden as a result of being undetected

(Harrington 2004). On the empirics of cartels, see Levenstein and Suslow (2014).

9

The popular press covered the conspiracy closely (Herling 1962).

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

S56 The Journal of LAW & ECONOMICS

Table 1

Selected Developments in U.S. Enforcement Developments of Cartels

Year Development Citation

1890 Sherman Antitrust Act 15 U.S.C. secs. 1–7

1908 United States v. American Tobacco Co. 164 F. 700 (1908)

1930s Thurman Arnold prioritizes international cartel

enforcement

1945 United States v. Aluminum Company of America 148 F.2d 416 (1945)

1955 Maximum cartel fine increased

1959 United States v. McDonough Co. 180 F. Supp. 511 (1959)

1957–61 Electrical equipment cartel cases

1974 Antitrust Procedures and Penalties Act 15 U.S.C. sec. 16

1977–78 United States v. Continental Group et al. 456 F. Supp. 704

1977–79 U.S. uranium cartel litigation and international

responses

1978 Original U.S. leniency program

1979 Hart-Scott-Rodino Act of 1976, first full year of

implementation Pub. L. No. 94-435, 90 Stat. 1383

1981 Reagan inaugurated, subsequent changes in

enforcement

1982 Foreign Trade Antitrust Improvements Act Pub. L. No. 97-290, 96 Stat. 1246

1984 Criminal Fine Enforcement Act Pub. L. No. 98-596, 98 Stat. 3134

1987 U.S. Sentencing Guidelines (1984) applied to all

offenses

1990 Antitrust Amendments Act Pub. L. No. 101-588, 104 Stat. 2879

1993 Revised leniency program

1996 Lysine cartel

1996 First use of the alternative fine statute (based on gain

or loss) 18 U.S.C sec. 3571(d)

2004 Congress passes Antitrust Criminal Penalty

Enhancement and Reform Act Pub. L. No. 108-237, 118 Stat. 661

2006 Congress amends wiretapping statute to include

antitrust violations

2012 Department of Justice closes Atlanta, Philadelphia,

and Cleveland field offices

amples of domestic cases in the 1970s in which the settlement was 2–4 percent of

sales.

It was precisely because of low penalties—financial and jail time—that changes

were introduced during the 1970s to increase the severity of punishment via

higher jail time and increased fines. Moreover, it was because of perceived low

levels of detection that the DOJ created the leniency program.

In 1974, Congress enacted the Antitrust Procedures and Penalties Act (15

U.S.C. sec. 16). Cartel crimes were changed from misdemeanors to felonies, the

maximum fine for a cartel violation was increased to $1 million, and the maxi-

mum term of imprisonment for collusion was increased to 1 year. A few years

later, the United States v. Continental Group cases were decided (United States v.

Continental Group, Inc., 456 F. Supp. 704 [E.D. Pa. 1978]; United States v. Conti-

nental Group, Inc., 603 F. 2d 444 [1979]). These were the first sets of felony con-

victions at trial. During 1978, the enforcement structure changed, as the original

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

Evolution of Cartel Enforcement S57

U.S. leniency program was introduced. This leniency program proved to be inef-

fective.10

A significant change occurred with the election of Ronald Reagan. The govern-

ment’s civil enforcement of sections 1 and 2 of the Sherman Act significantly di-

minished (Baker 2002; Ghosal 2001, 2006, 2008, 2011b; Ghosal and Gallo 2001).

The creation of the Merger Guidelines in 1982, which were revised in 1984, also

changed patterns of antitrust enforcement (Ghosal 2011a). This shift in Antitrust

Division resources impacted cartel enforcement.11 Criminal enforcement in-

creased under Reagan in terms of the number of cases and marginally in terms of

penalties imposed (see Figures 1–4).12

In 1984, Congress passed the Criminal Fine Enforcement Act (Pub. L. No. 98-

596, 98 Stat. 3134), which increased individual fines to $250,000. Further pen-

alty enhancement came in 1987 when the U.S. Sentencing Guidelines (passed

in 1984) were applied to all cartel offenses.13 Further changes came about when

Congress passed the Antitrust Amendments Act of 1990 (Pub. L. No. 101-588,

104 Stat. 2879). The act increased maximum fines to $10 million for corporations

and $350,000 for individuals. Prison terms increased to up to 3 years. The 1990

act was a significant ratcheting up of sanctions compared to the previous penalty

structure.

The next significant transformative event in cartel enforcement occurred in

1993 when the DOJ revamped the leniency program. Under the revised leniency

program, the DOJ provided a leniency applicant automatic amnesty if there was

no preexisting cartel investigation and there was full cooperation. Further, am-

nesty was available even when cooperation began after an investigation. Finally,

in situations in which a corporation qualified for automatic amnesty, all direc-

tors, officers, and employees who cooperated fully also received automatic am-

nesty.

The first use of revised leniency occurred in 1995 for the lysine cartel. The

companies settled with the DOJ in 1996 for criminal fines of $105 million, a

then-record amount.14 The cartel members also incurred a total of $305 million

in private damages (Connor 2001). The majority of lysine cartel members were

international. Before 1995, fewer than 1 percent of all DOJ cartel indictments in-

10

Only one leniency application was received per year, and not a single leniency application was

for an international cartel (Hammond 2004). Another important issue is that the DOJ’s resource

allocation changed shortly after the introduction of the leniency program. In 1979, the Hart-Scott-

Rodino Antitrust Improvements Act of 1976 (Pub. L. No. 94-435, 90 Stat. 1383) went through its

first full year of implementation. The first year of merger-filing notifications totaled over 800 filings.

Increasingly, merger control became far more resource intensive, potentially distracting from other

areas of enforcement.

11

In 1982, Congress passed the Foreign Trade Antitrust Improvements Act (Pub. L. No. 97-290,

96 Stat. 1246) to clarify the extraterritorial application of the Sherman Act.

12

Much of the cartel enforcement in the 1980s and early 1990s appeared to focus on procurement

and infrastructure collusion (Kovacic 2011).

13

Until the implementation of the Sentencing Guidelines, judges were reluctant to impose signifi-

cant sentences on white-collar offenders.

14

The year 1996 also marked the first use of the alternative fine statute (18 U.S.C. 3571[d]).

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

S58 The Journal of LAW & ECONOMICS

volved non-U.S. conspirators. Other significant international cartel cases quickly

followed.15

Further changes occurred during the George W. Bush presidency. In 2004,

Congress passed the Antitrust Criminal Penalty Enhancement and Reform Act

(ACPERA) (Pub. L. No. 108-237, 118 Stat. 661). This increased the maximum

cartel fine to $100 million, provided for prison terms of up to 10 years and $1

million in individual fines, and awarded single damages for the leniency appli-

cant who cooperated with plaintiffs. Once again, relative to the previous penalty

structure (the 1990 amendment), ACPERA significantly increased the penalties

associated with collusion. In 2006, Congress amended the wiretapping statute to

include antitrust violations. More recently, in 2012 the DOJ closed its Atlanta,

Philadelphia, and Cleveland field offices, which historically participated and

aided in cartel enforcement.

3. Cartel-Enforcement Patterns

Our primary data are from the U.S. DOJ’s historical enforcement statistics. The

longest time series available is for total cartel cases, 1948–2012. The other data re-

lated to number of individuals and corporations prosecuted, fines, and incarcera-

tions, among others, were available only for the period 1969–2012. All monetary

data (fines) are measured in real 2005 dollars. The enforcement data are displayed

in Figures 1–6.

Figure 1 shows that prior to 1979–80, the mean number of cartel cases was

about 20 per year. It rises sharply starting in 1981 to about 60 cases per year.

Thereafter, it falls steadily, reaching a low of 25–30 cases per year, before showing

an uptick after 2009. While the pre-1980 period typically contains a uniformly

low number of prosecutions, the post-1980 period reveals a mixed picture, with

highs reaching almost 100 cases and lows of about 25. The active enforcement

during this period in terms of the number of cases suggests that Bork’s approach

to increasing the probability of detection likely became the cornerstone of cartel

enforcement. As Bork’s second edition of The Antitrust Paradox still advocated

for additional DOJ field offices and was silent as to penalties, we assume this to

mean that Bork continued to view cartel enforcement as a problem of inadequate

detection and prosecutions rather than of severity of punishment.

An interesting observation is that in the aftermath of 1993 leniency program

restructuring, the actual number of cartels prosecuted declines somewhat. Figure

2 displays the ratio of total cartel cases to total civil cases. It reveals a ratio of less

than 1.0 in the pre-1980 period and a mean ratio of about 6 during the 1980–1993

period and thereafter fluctuates around a mean of about 2.5.

A different pattern emerges in Figures 3 and 4, which show the total fines and

15

As International Competition Policy Advisory Committee (2000, ch. 4) notes, the change in in-

ternational priorities and the effect of the new leniency program were significant within a short time.

“From 1987 through 1990, the Antitrust Division did not file a single criminal cartel case against a

foreign-based corporation or individual. . . . By 1997, the figures had surged so that 32 percent of

corporate defendants and the same number of individual defendants were foreign-based.”

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

Evolution of Cartel Enforcement S59

Figure 1. Total cartel cases

Figure 2. Ratio of total cartel cases to total civil cases

total days in jail. Figure 3 indicates that the fines did not increase until after 1996

(the lysine fines in 1996 set new records). Figure 4 shows that the total number

of incarceration days increases gradually from the mid-1990s and shows a clear

jump starting in the mid-2000s. The clear message is that the severity of penalties

has increased dramatically only in the more recent years.

Figures 5 and 6 tell much the same story as Figures 3 and 4, but the contrast is

even sharper. In Figure 5, the number of individuals and corporations fined de-

clines steadily from their peaks in the mid-1970s. Figure 5 reveals that while the

number of cartel cases generally increased, the number of individuals and corpo-

rations prosecuted declined steadily from its peak in the late 1970s. The increase

in total fines (Figure 3) and the decreased number of corporations prosecuted

(Figure 5) reveals itself in much higher fines per corporation starting around the

mid-1990s (Figure 6). The mid-1990s also correspond to the period when the le-

niency program was restructured. The figures suggest that the introduction of the

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

S60 The Journal of LAW & ECONOMICS

Figure 3. Total fines, corporate plus individual (real 2005 $1,000s)

Figure 4. Total incarceration days ordered by court

revised leniency program, along with the Antitrust Amendments Act (1990) and

ACPERA (2004), impacted cartel enforcement. Overall, the story that emerges

for U.S. cartel enforcement is that the main changes in enforcement appear to be

less in the number of cartels prosecuted and more in the increasing harshness of

penalties in terms of incarceration time and fines.

Next we examine whether the institutional changes related to leniency and the

new penalty programs had measurable effects on the cartel-enforcement vari-

ables, in particular the number of cases prosecuted, fines, and jail terms. Our

objective is not to conduct a thorough econometric investigation but merely to

present some quantification.

In our regressions we alternatively include two sets of variables: a dummy

variable for the new leniency (1993) regime that takes a value of one for 1993–

2012 and zero otherwise or two dummy variables for institutional changes that

affected the severity of punishments (fines and jail terms): Punish1 (Antitrust

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

Evolution of Cartel Enforcement S61

Figure 5. Number of individuals and corporations fined

Figure 6. Fine per corporation (real 2005 $1,000s). A similar intertemporal pattern

holds for fines per individual.

Amendments Act of 1990) takes a value of one for the years 1990–2003 and zero

otherwise, and Punish2 (ACPERA) takes a value of one for the years 2004–2012

and zero otherwise. We do not use both the new leniency and Punish1 and Pun-

ish2 dummy variables in the same specification because of multiple overlapping

years.16

The estimates in Table 2 include the new leniency program (1993) dummy.

There appears to be no statistically significant effect on the total number of cartels

prosecuted. But there are strong positive effects on penalties: fines per individual,

fines per corporation, total fines per case, jail days per individual, and total jail

days per case. On the basis of the estimates in Table 2, the effects of the new leni-

16

Including multiple sets of dummy variables creates significant collinearity problems because of

overlapping periods and complicates drawing meaningful inferences.

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

S62 The Journal of LAW & ECONOMICS

Table 2

Leniency Effects

Total Fine per Fine per Total Fines Jail Days Total Jail

Cartel Individual Corporation per Case per Days per

Cases ($) ($) ($) Individual Case

Intercept 13.94+ 46.92+ 108.83+ 194.47 79.06+ 30.09+

(.01) (.01) (.03) (.19) (.01) (.01)

LDVt−1 .77+ −.03 .68+ .56+ .42+ .41+

(.01) (.80) (.01) (.01) (.01) (.01)

New leniency −5.15 107.97+ 8,153.41+ 5,238.62+ 217.02+ 169.85+

(.19) (.01) (.02) (.03) (.01) (.02)

R2 .66 .17 .68 .56 .60 .38

DW 2.00 2.04 2.25 1.98 2.45 2.41

ρ −.01 −.03 −.14 −.06 −.26 −.24

Note. LDVt−1 is the lagged dependent variable. Only one lag is reported, as the second lag was not

significant. New leniency refers to the revised leniency program starting in 1993–2012. The p-values

computed from two-tailed heteroskedasticity-consistent standard errors are in parentheses. A

p-value < .01 is reported as .01; DW and ρ denote the Durbin-Watson statistic and the first-order

autocorrelation, respectively.

+ p < .10.

ency period appear to manifest themselves primarily in the severity of the penal-

ties and not in the number of prosecutions. Next we present results for the two

punishment dummy variables: Punish1 (1990 act), and Punish2 (ACPERA). The

estimates in Table 3 reveal that the clearest effects of Punish1 and Punish2 man-

ifest themselves in the severity of the penalties and not in the number of cartels

prosecuted.17

4. Discussion and Concluding Remarks

In various stages, the Antitrust Amendments Act (1990), the revised leniency

program (1993), and ACPERA (2004) affected the financial penalties, increased

jail time, and developed sophisticated mechanisms to disrupt incentives to form

and sustain collusive agreements. These policy innovations transformed U.S. car-

tel enforcement to its current state.

On the basis of historical enforcement data, we are able to identify three broad

periods of U.S. cartel enforcement. The first period, roughly pre-1980, saw a rela-

tively limited number of cartels prosecuted, along with minimal penalties as mea-

sured by fines and jail time. The second period, roughly between 1980 and 1995,

saw a dramatically higher number of cartels prosecuted but only marginal in-

17

Our estimated clear effects of the Antitrust Criminal Penalty Enhancement and Reform Act

(ACPERA) contrast with findings by Miller (2009) and Sokol (2012). Most likely, there was a lag

from the passage of ACPERA to the time that results from ACPERA became clear that was not cap-

tured by the earlier studies. Miller’s data consist of all indictments and information reports filed for

violations of section 1 of the Sherman Act between January 1, 1985, and March 15, 2005. While this

time period is sufficient to explore the revised 1993 leniency program’s effects, the endpoint for the

data of March 2005 is clearly not enough time to examine the 2004 ACPERA effects. Sokol’s data

consist of both qualitative and quantitative survey data of cartel practitioners. The passage of more

time and a broader set of responses may explain divergence from that study.

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

Evolution of Cartel Enforcement S63

Table 3

Punishment Effects

Total Fine per Fine per Total Fines Jail Days Total Jail

Cartel Individual Corporation per Case per Days per

Cases ($) ($) ($) Individual Case

Intercept 12.47+ 42.26+ 148.03+ 350.20+ 116.18+ 53.81+

(.01) (.01) (.01) (.04) (.01) (.01)

LDVt−1 .81+ −.01 .45+ .31 −.01 −.06

(.01) (.92) (.01) (.12) (.95) (.78)

Punish1 −6.11 86.06+ 4,577.05+ 2,719.42+ 216.95+ 71.61+

(.27) (.02) (.08) (.07) (.01) (.05)

Punish2 −2.48 118.24+ 21,266.00+ 12,623.00+ 551.96+ 531.92+

(.56) (.02) (.01) (.01) (.01) (.01)

R2 .65 .12 .75 .65 .69 .56

DW 2.03 2.03 2.27 2.09 2.36 2.23

ρ −.02 −.03 −.14 −.07 −.19 −.12

Note. LDVt−1 is the lagged dependent variable. Only one lag is reported, as the second lag was not

significant. Punish1 refers to the Antitrust Amendments Act of 1990 and covers the period 1990–

2003, and Punish2 refers to the Antitrust Criminal Penalty Enhancement and Reform Act of 2004 and

covers the period 2004–2012. The p-values computed from two-tailed heteroskedasticity-consistent

standard errors are in parentheses. A p-value < .01 is reported as .01; DW and ρ denote the Durbin-

Watson statistic and the first-order autocorrelation, respectively.

+ p < .10.

creases in penalties. The third period, roughly starting in 1995 and continuing, is

characterized by a somewhat lower number of cartels prosecuted (relative to the

second period) but dramatically higher fines and jail terms.

The current stage, with dramatically higher penalties but a lower number of

prosecutions, is suggestive of a clear shift in objectives. The new enforcement net,

so to speak, is designed to catch bigger fish. This objective could be justified on

the grounds of proportionality to the degree of economic harm, as well as admin-

istrative efficiency. Such policy shifts, however, have pros and cons. While this

net is more likely to catch larger firms and multinational conspiracies, domestic

local and regional price-fixing conspiracies may suffer from a lack of detection

and deterrence. We attribute the recent closings of several DOJ regional offices to

this shift in emphasis.18

Some of these trends can be situated within the Chicago school antitrust ap-

proach, as Bork, among others, played an instrumental role in the adoption of

Chicago-based ideas by courts and agencies (Hovenkamp 2003). In the area of

cartel enforcement, Bork appears to have most directly impacted what we iden-

tify as the second stage of cartel enforcement (roughly 1980–95), primarily in

terms of the number of cartels prosecuted.

In other institutional developments of cartel enforcement, particularly the

current stage, Bork’s thinking played a much smaller role. Bork was silent as to

whether alternative enforcement penalties (incarceration and increased fines)

18

Interestingly enough, this is the exact opposite of what Bork (1978, p. 406) recommended in The

Antitrust Paradox.

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

S64 The Journal of LAW & ECONOMICS

other than opening field offices would be desirable. It is difficult to fault Bork spe-

cifically for the lack of focus on international enforcement. The global antitrust

community has been far more permissive to (and indeed facilitated) cartels in

their own jurisdictions.

References

Baker, Don. 1976. To Make the Penalty Fit the Crime: How to Sentence Antitrust Felons.

Speech presented at the 10th New England Antitrust conference, Boston, November 20.

Baker, Jonathan. 2002. A Preface to Post-Chicago Antitrust. Pp. 60–75 in Post-Chicago De-

velopments in Antitrust Analysis, edited by Antonio Cucinotta, Roberto Pardolesi, and

Roger van den Bergh. Cheltenham: Edward Elgar.

Bane, Charles. 1973. The Electrical Equipment Conspiracies: The Treble Damage Actions.

New York: Federal League Publications.

Becker, Gary S. 1968. Crime and Punishment: An Economic Approach. Journal of Political

Economy 76:169–217.

Blair, Roger D., and D. Daniel Sokol. 2012. The Rule of Reason and the Goals of Antitrust:

An Economic Approach. Antitrust Law Journal 78:471–504.

Bork, Robert. 1978. The Antitrust Paradox: A Policy at War with Itself. New York: Basic

Books.

Bryant, Peter G., and E. Woodrow Eckard, Jr. 1991. Price Fixing: The Probability of Get-

ting Caught. Review of Economics and Statistics 73:531–36.

Connor, John M. 2001. Global Price Fixing: Our Customers Are the Enemy. New York:

Springer.

Denger, Michael L. 2003. Too Much or Too Little, a Summary of Discussion. American

Bar Association, Antitrust Remedies Forum, Washington, D.C., April 2.

Detre, Joshua D., Alla Golub, and John M. Connor. 2005. The Profitability of Price Fixing:

Have Stronger Antitrust Sanctions Deterred? Paper presented at the International In-

dustrial Organization conference. Atlanta, April 8.

Ghosal, Vivek. 2006. Economics, Politics and Merger Control. Pp. 125–51 in Recent De-

velopments in Antitrust: Theory and Evidence, edited by Jay Pil Choi. Cambridge, Mass.:

MIT Press.

———. 2008. The Genesis of Cartel Investigations: Some Insights from Examining the

Dynamic Interrelationships between U.S. Civil and Criminal Antitrust Investigations.

Journal of Competition Law and Economics 4:61–88.

———. 2011a. The Law and Economics of Enhancing Cartel Enforcement: Using Infor-

mation from Non-cartel Investigations to Prosecute Cartels. Review of Law and Eco-

nomics 7:501–38.

———. 2011b. Regime Shift in Antitrust Laws, Economics and Enforcement. Journal of

Competition Law and Economics 7:733–74.

Ghosal, Vivek, and Joseph Gallo. 2001. The Cyclical Behavior of the Department of Jus-

tice’s Antitrust Enforcement. International Journal of Industrial Organization 19:27–54.

Hammond, Scott. 2004. Cornerstones of an Effective Leniency Program. Speech presented

at the International Competition Network Workshop on Leniency Programs, Sydney,

November 22. http://www.justice.gov/atr/public/speeches/206611.htm.

———. 2010. The Evolution of Criminal Antitrust Enforcement over the Last Two De-

cades. Speech presented at the 24th annual National Institute on White Collar Crime.

Miami, February 25. http://www.justice.gov/atr/public/speeches/255515.htm.

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

Evolution of Cartel Enforcement S65

Herling, John. 1962. The Great Price Conspiracy: The Story of the Antitrust Violations in the

Electrical Industry. Washington, D.C.: R. B. Luce.

Hovenkamp, Herbert. 2003. The Rationalization of Antitrust. Harvard Law Review

116:917–44.

International Competition Policy Advisory Committee. 2000. Final Report to the Attor-

ney General and Assistant Attorney General for Antitrust. http://www.justice.gov/atr/

icpac/finalreport.html.

Kovacic, William E. 2011. Norms in Competition Policy: Insights from US Experience. Pp.

45–73 in Criminalizing Cartels: Critical Studies of an International Regulatory Move-

ment, edited by Caron Beaton-Wells and Ariel Ezrachi. Oxford: Hart Publishing.

Landes, William M. 1983. Optimal Sanctions for Antitrust Violations. University of Chi-

cago Law Review 50:652–78.

Levenstein, Margaret, and Valerie Suslow. 2004. Studies of Cartel Stability. Pp. 9–52 in

How Cartels Endure and How They Fail, edited by Peter Grossman. Cheltenham: Ed-

ward Elgar.

———. 2011. Breaking up Is Hard to Do: Determinants of Cartel Duration. Journal of

Law and Economics 54:455–92.

———. 2014. Cartels and Collusion: Empirical Evidence. Ch. 18 in volume 2 of Oxford

Handbook of International Antitrust Economics, edited by Roger D. Blair and D. Daniel

Sokol. New York: Oxford University Press.

Miller, Nathan. 2009. Strategic Leniency and Cartel Enforcement. American Economic Re-

view 99:750–68.

Posner, Richard A. 1976. Antitrust Law: An Economic Analysis. Chicago: University of

Chicago Press.

Priest, George L. 2014. Bork’s Strategy and the Influence of the Chicago School on Modern

Antitrust Law. Journal of Law and Economics 57:S1–S17.

Sokol, D. Daniel. 2012. Cartels, Compliance and What Practitioners Really Think about

Enforcement. Antitrust Law Journal 78:201–40.

Stigler, George. 1964. A Theory of Oligopoly. Journal of Political Economy 72:44–61.

Sultan, Ralph G. M. 1974. Pricing in the Electrical Oligopoly. Boston: Harvard University

Press.

U.S. Department of Justice. Antitrust Division. 1977. Guidelines for Sentencing: Recom-

mendations in Felony Cases under the Sherman Act. Washington, D.C.: U.S. Depart-

ment of Justice.

This content downloaded from

112.206.207.244 on Mon, 27 Jul 2020 14:08:39 UTC

All use subject to https://about.jstor.org/terms

You might also like

- Case Laws List For Ca Foundation StudentsDocument34 pagesCase Laws List For Ca Foundation StudentsSrushti Agarwal100% (5)

- Business Law 2 NotesDocument34 pagesBusiness Law 2 NotesSenkatuuka Luke83% (6)

- Gift DeedDocument3 pagesGift DeedHamid Ali ArainNo ratings yet

- Legislative DraftingDocument14 pagesLegislative DraftingSwastik GroverNo ratings yet

- This Content Downloaded From 13.234.96.8 On Sun, 05 Sep 2021 17:42:36 UTCDocument12 pagesThis Content Downloaded From 13.234.96.8 On Sun, 05 Sep 2021 17:42:36 UTCsiddhant aryaNo ratings yet

- This Content Downloaded From 149.202.179.69 On Wed, 10 May 2023 08:12:23 +00:00Document35 pagesThis Content Downloaded From 149.202.179.69 On Wed, 10 May 2023 08:12:23 +00:00Khan BabaNo ratings yet

- Posner - An Economic Approach To Legal Procedure and Judicial AdministrationDocument61 pagesPosner - An Economic Approach To Legal Procedure and Judicial AdministrationFrancisco Soto CarreraNo ratings yet

- Boston Implementación EstadísitcaDocument43 pagesBoston Implementación Estadísitcax8ggggpzrrNo ratings yet

- Evolution of Mortgages in USDocument39 pagesEvolution of Mortgages in USrodrigoabreuroNo ratings yet

- DetectingDocument11 pagesDetectingalyn.gamquiNo ratings yet

- Bottomley A JC L ManuscriptDocument18 pagesBottomley A JC L Manuscriptsiska sembiringNo ratings yet

- The Procedural Foundation of Substantive LawDocument42 pagesThe Procedural Foundation of Substantive LawRANDAN SADIQNo ratings yet

- Contracting Out of Bankruptcy An Empirical Intervention. Harvard Law Review, 1197-1254.Document60 pagesContracting Out of Bankruptcy An Empirical Intervention. Harvard Law Review, 1197-1254.Paula MarquesNo ratings yet

- American Society of International Law: Info/about/policies/terms - JSPDocument6 pagesAmerican Society of International Law: Info/about/policies/terms - JSPrafiNo ratings yet

- Guzman InternationalSoftLaw 2009Document46 pagesGuzman InternationalSoftLaw 2009Fernando AmorimNo ratings yet

- Modern Law Review, Wiley The Modern Law ReviewDocument22 pagesModern Law Review, Wiley The Modern Law ReviewEunice YeohNo ratings yet

- Law & Borders The Rise of Law in CyberspaceDocument37 pagesLaw & Borders The Rise of Law in CyberspaceRizwana NourNo ratings yet

- Positive Constitutional Economics IIDocument53 pagesPositive Constitutional Economics IIfgdNo ratings yet

- Yale Law Journal Company, IncDocument36 pagesYale Law Journal Company, IncDiogo AugustoNo ratings yet

- Comment NarrativeDocument13 pagesComment NarrativePublius1776No ratings yet

- Enrons Legislative Aftermath - Some Reflections On The DeterrenceDocument29 pagesEnrons Legislative Aftermath - Some Reflections On The DeterrenceAhmad AbdullahNo ratings yet

- Accounting, Organizations and Society: Anna Alon, Peggy D. DwyerDocument16 pagesAccounting, Organizations and Society: Anna Alon, Peggy D. DwyerIk RamNo ratings yet

- Article: Ntroduction Omparative Ivil Rocedure EnerallyDocument32 pagesArticle: Ntroduction Omparative Ivil Rocedure EnerallyshakeelNo ratings yet

- AJCL - Public-Private PartnershipsDocument31 pagesAJCL - Public-Private PartnershipsJohn JohnsonNo ratings yet

- Theory and Practice of Supra-Constitutional Limits On Constitutional AmendmentsDocument42 pagesTheory and Practice of Supra-Constitutional Limits On Constitutional AmendmentsMuhammad JamilNo ratings yet

- Local Vacant Property Registration Ordinances in The U.S. An Analysis of Growth, Regional Trends, and Some Key CharacteristicsDocument44 pagesLocal Vacant Property Registration Ordinances in The U.S. An Analysis of Growth, Regional Trends, and Some Key Characteristicsapi-206590120No ratings yet

- In M Unities ImpliedDocument30 pagesIn M Unities ImpliedJose M TousNo ratings yet

- Handbook On The Rule of Law: The Invisible Constitution of Politics: Contested Norms and International EncountersDocument2 pagesHandbook On The Rule of Law: The Invisible Constitution of Politics: Contested Norms and International EncountersCthutqNo ratings yet

- Pao Law IrrDocument39 pagesPao Law IrrMelody May Omelan ArguellesNo ratings yet

- Journal of Law and Society - 2010 - WhitehouseDocument24 pagesJournal of Law and Society - 2010 - Whitehousea19990852No ratings yet

- Common Law and Economic EfficiencyDocument48 pagesCommon Law and Economic EfficiencyAnindya AnwarNo ratings yet

- Springer: Springer Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Law and PhilosophyDocument14 pagesSpringer: Springer Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Law and Philosophyfatty_mvNo ratings yet

- Hmab 009Document18 pagesHmab 009Camila Almeida PorfiroNo ratings yet

- The Impact of Ex Post Legislative Evaluations A Scoping ReviewDocument25 pagesThe Impact of Ex Post Legislative Evaluations A Scoping ReviewIara LopesNo ratings yet

- Scientific Method in The Application of LawDocument16 pagesScientific Method in The Application of LawVincent TanNo ratings yet

- 33 Hongkong LJ 639Document25 pages33 Hongkong LJ 639Doreen AaronNo ratings yet

- T-Death PenaltyDocument131 pagesT-Death PenaltyTruman ConnorNo ratings yet

- Business Law - Status of Law in The Context of The UK PDFDocument30 pagesBusiness Law - Status of Law in The Context of The UK PDFZamzam AbdelazimNo ratings yet

- Duke University School of LawDocument29 pagesDuke University School of LawTherese GonzagaNo ratings yet

- Statutory ForbearsDocument16 pagesStatutory ForbearsShabir AkbarNo ratings yet

- American Journal On Comparative LawDocument64 pagesAmerican Journal On Comparative LawMaryann MainaNo ratings yet

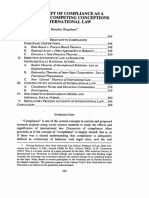

- 0013#BenedictKingsbury The Concept of Compliance As A Function of Competing ConceptionsDocument28 pages0013#BenedictKingsbury The Concept of Compliance As A Function of Competing ConceptionsJosé Alberto MartinsNo ratings yet

- System and Evolution in Corporate Governance: Simon DeakinDocument27 pagesSystem and Evolution in Corporate Governance: Simon DeakinnabiilahNo ratings yet

- SSRN Id2980337Document33 pagesSSRN Id2980337siwakotibishal1No ratings yet

- Cambridge University Press, British Institute of International and Comparative Law The International and Comparative Law QuarterlyDocument26 pagesCambridge University Press, British Institute of International and Comparative Law The International and Comparative Law QuarterlyGantulga EnkhgaramgaiNo ratings yet

- Judicial Amendment To The ConstitutionDocument31 pagesJudicial Amendment To The ConstitutionHardik TwitterNo ratings yet

- Article On Delegated Legislation in USA and UKDocument25 pagesArticle On Delegated Legislation in USA and UKDasharath YataNo ratings yet

- Ilippo OntanelliDocument38 pagesIlippo OntanelliMahmoud KhalifaNo ratings yet

- 07 Do Takeover Laws Matter Evidence From Five Decades of Hostile TakeoversDocument3 pages07 Do Takeover Laws Matter Evidence From Five Decades of Hostile TakeoversLina Correa AtehortuaNo ratings yet

- Tractman SSRN-id149348Document44 pagesTractman SSRN-id149348Jonah Mark AvilaNo ratings yet

- The Antitrust Paradox PDFDocument20 pagesThe Antitrust Paradox PDFBreno FragaNo ratings yet

- Bang and Esmark (2010) Governmentality and The Political (System)Document8 pagesBang and Esmark (2010) Governmentality and The Political (System)sashadam815812No ratings yet

- J. Account. Public Policy: Joseph C. Ugrin, Marcus D. OdomDocument20 pagesJ. Account. Public Policy: Joseph C. Ugrin, Marcus D. OdomrismaNo ratings yet

- Test No 2 - PLA 4191 NotesDocument2 pagesTest No 2 - PLA 4191 Notesaamariett17No ratings yet

- SSRN Id1911139Document39 pagesSSRN Id1911139Thanh LêNo ratings yet

- STATON - Judicial Policy Implementation in Mexico City and MéridaDocument21 pagesSTATON - Judicial Policy Implementation in Mexico City and MéridaDaniel GOMEZNo ratings yet

- PhilippMaume DisclosureandFiduciaryDutiesDocument30 pagesPhilippMaume DisclosureandFiduciaryDutiesthiviyani sivaguruNo ratings yet

- Integreon Ethics WhitepaperDocument16 pagesIntegreon Ethics WhitepaperNaveen KumarNo ratings yet

- M & A - HarvardDocument38 pagesM & A - HarvardMohammed Zubair BhatiNo ratings yet

- Transnational Legal Process and State ChangeDocument37 pagesTransnational Legal Process and State ChangeAnonymous b404mooQNo ratings yet

- Golden Parachutes PDFDocument44 pagesGolden Parachutes PDFsekfhksjfhNo ratings yet

- B Regulatorycapturereview 2006 2Document24 pagesB Regulatorycapturereview 2006 2Julius TariganNo ratings yet

- LL FLLT: African AfricaineDocument32 pagesLL FLLT: African AfricaineAlija PandapatanNo ratings yet

- The Rule of Reason PDFDocument89 pagesThe Rule of Reason PDFAlija PandapatanNo ratings yet

- Rise of Cultural RightsDocument23 pagesRise of Cultural RightsAlija PandapatanNo ratings yet

- Cartels and Other Horizontal Hardcore RestrictionsDocument33 pagesCartels and Other Horizontal Hardcore RestrictionsAlija PandapatanNo ratings yet

- 2011 Feb Crisis Cartels-2Document13 pages2011 Feb Crisis Cartels-2Alija PandapatanNo ratings yet

- EC Competition Law PDFDocument567 pagesEC Competition Law PDFAlija PandapatanNo ratings yet

- Cartels in ContextDocument15 pagesCartels in ContextAlija PandapatanNo ratings yet

- 25 Pastor v. CA (Panda) : The EstateDocument3 pages25 Pastor v. CA (Panda) : The EstateAlija PandapatanNo ratings yet

- Analysis of NRIADocument29 pagesAnalysis of NRIAAlija PandapatanNo ratings yet

- 01 Ypil V Salas SAN PEDRODocument4 pages01 Ypil V Salas SAN PEDROAlija PandapatanNo ratings yet

- Complaint For Ejectment of TenantDocument3 pagesComplaint For Ejectment of TenantCorpuz LawNo ratings yet

- Representation On Behalf of The Complainants in The Sexual Harassment Case Against Ramakant Gundecha and Akhilesh GundechaDocument2 pagesRepresentation On Behalf of The Complainants in The Sexual Harassment Case Against Ramakant Gundecha and Akhilesh GundechaFirstpostNo ratings yet

- H. E. Heacock Co. vs. Macondray & Co., 42 Phil., 205, No. 16598 October 3, 1921Document4 pagesH. E. Heacock Co. vs. Macondray & Co., 42 Phil., 205, No. 16598 October 3, 1921Sam WelbyNo ratings yet

- People vs. Mendoza, 59 Phil. 163, No. 39275 December 20, 1933Document9 pagesPeople vs. Mendoza, 59 Phil. 163, No. 39275 December 20, 1933gerlie22No ratings yet

- In The Court of The Addl Civil Judge and JMFC at Tumakuru PCR - No. / 2023Document6 pagesIn The Court of The Addl Civil Judge and JMFC at Tumakuru PCR - No. / 2023Govardhan GowdaNo ratings yet

- 2022-09-21 - Supreme Court Order & Opinion - PublishedDocument40 pages2022-09-21 - Supreme Court Order & Opinion - PublishedNBC MontanaNo ratings yet

- Lim Tong Lim vs. Philippine Fishing Gear Industries, Inc.Document3 pagesLim Tong Lim vs. Philippine Fishing Gear Industries, Inc.zealous9carrotNo ratings yet

- Tedesco DepositionDocument115 pagesTedesco Depositionjfranco17410No ratings yet

- Infinity Canopy v. Import Fencing - ComplaintDocument234 pagesInfinity Canopy v. Import Fencing - ComplaintSarah BursteinNo ratings yet

- Prudential Bank Vs Alviar DigestDocument2 pagesPrudential Bank Vs Alviar DigestRufino Gerard Moreno67% (3)

- Torts Digest Compilation Sbca PDFDocument121 pagesTorts Digest Compilation Sbca PDFElen CiaNo ratings yet

- University of Asia and The PacificDocument8 pagesUniversity of Asia and The Pacificroy rebosuraNo ratings yet

- Probationer in The Eyes of LawDocument7 pagesProbationer in The Eyes of LawRhea SharmaNo ratings yet

- Ethics in Psychological ResearchDocument31 pagesEthics in Psychological ResearchTinotendaNo ratings yet

- Subic Bay Metropolitan Authority v. Honorable of Court of AppealsDocument6 pagesSubic Bay Metropolitan Authority v. Honorable of Court of AppealsRimvan Le SufeorNo ratings yet

- Epicurean Justice: John M. ArmstrongDocument11 pagesEpicurean Justice: John M. Armstronganon_164052313No ratings yet

- Titan Ikeda Digest OwnDocument2 pagesTitan Ikeda Digest OwnErickson AgcoNo ratings yet

- Understanding DUI Laws in CaliforniaDocument6 pagesUnderstanding DUI Laws in CaliforniaSan Fernando Valley Bar AssociationNo ratings yet

- 2.7 United Airlines V CIRDocument6 pages2.7 United Airlines V CIRJayNo ratings yet

- Mambulao Lumber Company vs. RepublicDocument5 pagesMambulao Lumber Company vs. RepublicJoseLuisBunaganGuatelaraNo ratings yet

- People of The Philippines, Plaintiff-Appellee, vs. Albert Casimiro Y SERILLO, Accused-AppellantDocument7 pagesPeople of The Philippines, Plaintiff-Appellee, vs. Albert Casimiro Y SERILLO, Accused-AppellantJennyNo ratings yet

- Aditya Raj - CA 4 - HM-EE-401Document15 pagesAditya Raj - CA 4 - HM-EE-401sajid0khan-790945No ratings yet

- Second Division: DecisionDocument9 pagesSecond Division: DecisionJulius Carmona GregoNo ratings yet

- Villegas v. COMELECDocument2 pagesVillegas v. COMELECJay MoralesNo ratings yet

- Daniels enDocument38 pagesDaniels enGillian GraceNo ratings yet

- Property 2017 VLEDocument220 pagesProperty 2017 VLEN ShahNo ratings yet

- State of Punjab Vs Assocaited Hotels of IndiaDocument9 pagesState of Punjab Vs Assocaited Hotels of IndiasauravchopraNo ratings yet