Professional Documents

Culture Documents

Intermediate Accounting 2 - Liabilities

Uploaded by

Kathlene Balico100%(1)100% found this document useful (1 vote)

3K views3 pagesIntermediate Accounting

Original Title

CH 1 LIAB REVIEWER

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIntermediate Accounting

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

3K views3 pagesIntermediate Accounting 2 - Liabilities

Uploaded by

Kathlene BalicoIntermediate Accounting

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

INTERMEDIATE ACCOUNTING 2 – LIABILITIES

Liability – a present obligation of an enterprise arising from past event, CONTINGENT

PROVISION

the settlement of which is expected to result in an outflow from the LIABILITIES

enterprise of resources embodying economic benefits, (IASB’s DEFINITION

Conceptual Framework for Financial Reporting). Liabilities which are uncertain as Either:

to timing or amounts a) a possible obligation that

NOTE!!! Liabilities arise only from past events or transactions. arises from past events and

whose existence will be

Essential Characteristics: confirmed only by the occurence

or non-occurence of one or more

1. Present Obligation future events not wholly within

the control of the enterprise

2. Past Event

b) a present obligation that

3. Probable outflow of resources embodying economic benefits arises from past events but is not

recognized because:

Obligation – is a duty or responsibility to act or perform in a certain way Probable only, not

which may be legally enforceable as a consequence of a binding measurable

contract or statutory requirement; Measurable only not

probable

Obligating event – is one that results in an enterprise because having

no realistic alternative to settling that obligation. RECOGNITION

Recognized as a liability on the Not recognized as a liability on

Classification of Obligating Event: face of the statement of financial the face of the statement of

position. financial position.

1. Legal Obligation – is one derives from a contract. FINANCIAL STATEMENT PRESENTATION

(Ex: Accounts payable, withholding taxes payable and VAT Presented separately in the Unless remote, disclosed in the

payable) statement of financial position notes to financial statements

2. Constructive Obligation – is one derives from an enterprise’s under liabilities

actions whereby an established pattern of past practice,

published policies of a sufficiently specific current statement, Obligations involving uncertainties:

the enterprise has indicated to other parties that it will accept

certain resposibilities, and as a result, the enterprise has STATUS RECORDED AS:

Probable (more than 50%)

created a valid expectation on the part of those parties that it

Reliably measurable Expense/Loss xx

will discharge those responsibilities. Liability xx

(Ex: Provision for clean up costs) Not reliably

measurable Disclosure

Settlement of a Present Obligation: Reasonably Possible (50%) Disclosure

a) Payment of cash Remote (less than 50%) Ignore

b) Transfer of other assets

c) Provision of services

d) Replacement of an obligation with another obligation Liabilities are initially measured:

e) Conversion of the obligation to equity

1. At amount established in exchanges (amount tobe paid or

f) Condonation by creditor (in some exceptional cases

amount discounted).

Recognition of Liabilities: 2. By estimates of a definitive character when the amount of the

liability cannot be measured more precisely (provisions).

1. It is probable that an outflow of resources embodying o General Liability

economic benefits will result from the settlement of a present Probable (there is probability of outflow)

obligation Measurable – realiably measurable (sure amount)

2. The amount at which settlement will take place can be – reasonably estimated (estimation)

measured reliably. o Specific Liability

o General Liability

o Specific Liability

Chapter 1 – Current Liabilities, Provision and Contingencies

INTERMEDIATE ACCOUNTING 2 – LIABILITIES

SPECIFIC LIABILITY DATE OF RECOGNITION CURRENT LIABILITIES DEFINITION

Trade Payables Payable within the entity’s

Loans Upon approval normal operating cycle; even

Dividends if they are not due for

Cash Upon declaration settlement within 12 mos.

Property Upon declaration Non-trade Payables Due for settlement within 12

Scrip Upon declaration mos. From the end of

Share (Not a liability) accounting period.

Liquidating Upon declaration Accounts Payable Liabilities arising from the

Accrued Liability End of reporting period purchase of goods,

(Rent, utilities, interest, wages) (recognize expenses only materials, supplies, services

when incurred on an open charge-account

Agency Obligation (SSS, Pag-Ibig, basis (credit term, generally

Philhealth) 30-120 days, no interest)

Share of employer End of reporting period Short-term Notes Payable

Share of employee Upon withholding Acceptances Payable

Income tax payable End of reporting period Liabilities under Trust Receipts

Purchase of Merchandise Upon passing of title by the Deposits and Advances Advances are normally

seller contract to render

Estimated liability goods/services.

Premiums End of reporting period Current Portion of Long-term Debt

Warranties Upon sale of merchandise Accrued Liabilities Obligations for expenses

Gift certificates incurred on or before the end

Income Method End of reporting period of the reporting period but

Liability Method Upon issuance payable at a later date.

Tickets Similar to Gift Certificate Income Tax Payable

Bonus(Compensation) End of reporting period Dividends Payable

Deposits on returnable Credit Balances in Customers

containers End of reporting period Accounts

Advances from Deferred Revenue Are amounts collected in

Income Method End of reporting period advance that have not yet

Liability Method Upon receipt of cash been earned and recorded

Asset restoration as revenues pending

satisfaction of performance

Classification of Liabilities: obligations

Provisions expected to be settled

1. Current Liabilities within 12 mos.

2. Noncurrent Liabilities

ACCOUNTS PAYABLE

Recognition of Current liabilities:

Two methods of recording purchase

a) It expects to settle the liability in its normal operating cycle; transaction:

b) It holds the liability primarily for the purpose of trading;

Gross method Net method

c) The liability is due to be settled within 12 months after the

To record purchases

reporting period;

Purchases Puchases

d) It does not have an unconditional right to defer settlement of Freight-in Freight-in

the liability for atleast 12 months after the reporting period; Accounts Payable Accounts Payable

To record payment within discount period

Recognition of Noncurrent liabilities: Accounts Payable Accounts Payable

Purchase Discount Cash

a) Agreement to refinance is completed on or before the Cash

reporting date To record payment beyond discount period

b) The entity has the discretion to refinance or roll over an Accounts Payable Accounts Payable

obligation for more than 12 months after the reporting date Cash Purchase Discounts Lost

under an existing loan facility Cash

Chapter 1 – Current Liabilities, Provision and Contingencies

INTERMEDIATE ACCOUNTING 2 – LIABILITIES

FORMULAS: PROFORMA ENTRIES:

Cash paid x Cash collected x GIFT CERTIFICATES

Prepaid expense, beg x Unearned income, beg x Income method Liability Method

Accrued expense, end x Accrued income, end x To record issuance

Prepaid expense, end (x) Unearned income, end (x) Cash Cash

Accrued expense, beg (x) Accrued income, beg (x) Gift Certficate Payable Sales

EXPENSE x INCOME x To record redemption

Gift Certificate Payable

NO ENTRY

Sales

Advances from Gift Certificate Payable, beg x To record year-end adjustments

customers, beg x Gift Cert. Payable Sales

Cash receipts GC Issued during the period x Gift Cert. Forfeited Gift Cert. Payable

during the period x Gift Cert. Forfeited

Advances earned (x) GC Redeemed (x)

Cancelled (x) GC Forfeited (x) BONUS

ADVANCES FROM GIFT CERTIFICATE If paid: If unpaid:

CUSTOMERS, END x PAYABLE, END x Bonus Bonus

Cash Bonus Payable

BONUS (EXAMPLE ONLY) PREMIUMS

Given: NIBBBT = $ 5,000,000 Asset method Expense Method

Bonus = 5% of Net Income Income tax rate = 30% To record purchase of premiums

NIBBBT ( Net Income Before NIBBAT (Net Income Before Premiums Inventory Premium Expense

Bonus Before Tax) Bonus After Tax) Cash/AP Cash

B = 5% x 5,000,000 B = 5% (5,000,000 – T) To record redemption of proof of purchase

= 250,0000 B = 5% [5,000,000 – 30% Premiums Expense Premiums Expense

(5,000,000 – B)] Cash Cash

T = 30% (5,000,000 – 250,000) T = 30% (5,000,000 – B) distribution cost distribution cost

NIABBT (Net Income after Bonus NIABAT (Net Income after Bonus Cash Cash

before Tax) after Tax) Premium Expense Premium Expense

B = 5% (5,000,000 – B) B = 5%[5,000,000 – B – 30% Premium inventory cash remittance

(5,000,000 – B)] To record year-end adjustments

T = 30% (5,000,000 –B) T = 30% (5,000,000 –B) Premium Expense Sales

Premium Payable Gift Cert. Payable

FOR CHECKING: Gift Cert. Forfeited

NIBBAT NIABBT NIABAT

NIBBBT NIBBBT NIBBBT WARRANTIES

Less: Tax Less: Bonus Less: Bonus Warranties expense Warranties payable

NIBBAT NIABBT Tax Warranties payable Cash

Multiply by Multiply by Multiply by To record adjustment of estimate

Bonus rate Bonus rate Bonus rate Actual > Estimate Actual < Estimate

BONUS BONUS BONUS Warranties expense Warranties payable

Warranties payable Warranties expense

Warranties Payable, beg

Warranties during the period

Actual expenditure

WARRANTIES PAYABLE, END

Chapter 1 – Current Liabilities, Provision and Contingencies

You might also like

- Chapter 4 Intermediate AccountingDocument41 pagesChapter 4 Intermediate AccountingMae Ann Raquin100% (1)

- VALIX IA2 Chapter 1Document5 pagesVALIX IA2 Chapter 1M100% (1)

- Intermediate Accounting 2 Chapter on Notes PayableDocument13 pagesIntermediate Accounting 2 Chapter on Notes PayableRolando Verano TanNo ratings yet

- A4 Chapter 5 - Bonds PayableDocument8 pagesA4 Chapter 5 - Bonds PayableMa Jhenelle De Leon100% (1)

- Chapter 3 - Warranty LiabilityDocument3 pagesChapter 3 - Warranty LiabilityMarx Yuri Jayme100% (2)

- Right of Use Asset AccountingDocument22 pagesRight of Use Asset AccountingQueen ValleNo ratings yet

- Inventory Estimation MethodsDocument13 pagesInventory Estimation MethodsAna Leah DelfinNo ratings yet

- Loans Receivable ReviewerDocument3 pagesLoans Receivable ReviewerWilliam TabuenaNo ratings yet

- Module 1 - Bonds Payable: Dalubhasaan NG Lungsod NG Lucena Intercompany Accounting Part 3 Faye Margaret P. Rocero, CPADocument3 pagesModule 1 - Bonds Payable: Dalubhasaan NG Lungsod NG Lucena Intercompany Accounting Part 3 Faye Margaret P. Rocero, CPABrein Symon DialaNo ratings yet

- Chapter 1 - Current LiabilitiesDocument17 pagesChapter 1 - Current LiabilitiesJEFFERSON CUTENo ratings yet

- Chapter 9 InvestmentsDocument21 pagesChapter 9 InvestmentsAna Leah Delfin100% (1)

- Toa 38 40Document17 pagesToa 38 40Mary Joy AlbandiaNo ratings yet

- Chapter 13 Direct Finance LeaseDocument6 pagesChapter 13 Direct Finance LeaseLady Pila0% (1)

- LEASES 2 - Lessor AccountingDocument7 pagesLEASES 2 - Lessor AccountingMia CasasNo ratings yet

- SUMMARY For INTERMEDIATE ACCOUNTING 2 PDFDocument20 pagesSUMMARY For INTERMEDIATE ACCOUNTING 2 PDFArtisan100% (1)

- Chapter 2 - Premium Liabilities PDFDocument3 pagesChapter 2 - Premium Liabilities PDFMarx Yuri JaymeNo ratings yet

- Ch01 Liabilities ProblemsDocument6 pagesCh01 Liabilities ProblemsJessica AllyNo ratings yet

- Notes Payable Measurement and ClassificationDocument35 pagesNotes Payable Measurement and Classificationwala akong pake sayoNo ratings yet

- Final Exam - FA2 (Shareholders Equity) With QuestionsDocument10 pagesFinal Exam - FA2 (Shareholders Equity) With Questionsjanus lopezNo ratings yet

- Chapter 9 Investments QuizDocument5 pagesChapter 9 Investments QuizMs Vampire100% (1)

- Chapter 3 - Bonds Payable Other ConceptsDocument29 pagesChapter 3 - Bonds Payable Other ConceptsJEFFERSON CUTENo ratings yet

- Premium & Warranty LiabilitiesDocument16 pagesPremium & Warranty LiabilitiesKring Zel0% (1)

- Test Bank 1 - Ia 2Document18 pagesTest Bank 1 - Ia 2Xiena100% (2)

- Intermediate Accounting 2 - Notes Payable - Problems October 10, 2020Document11 pagesIntermediate Accounting 2 - Notes Payable - Problems October 10, 2020Sarah GNo ratings yet

- Adamson University Intermediate Accounting 1 Property, Plant, & Equipment Quiz - Answer KeyDocument4 pagesAdamson University Intermediate Accounting 1 Property, Plant, & Equipment Quiz - Answer KeyKhai Supleo PabelicoNo ratings yet

- MILLAN SOL. MAN. Chapter 21 Investment Property IA PART 1BDocument4 pagesMILLAN SOL. MAN. Chapter 21 Investment Property IA PART 1BZhaira Kim CantosNo ratings yet

- Reviewer For Mid Term ExamDocument12 pagesReviewer For Mid Term ExamJannelle SalacNo ratings yet

- Chapter 9 InvestmentsDocument19 pagesChapter 9 Investmentsjuennagueco100% (2)

- Chapter-4 ProvisionsDocument18 pagesChapter-4 ProvisionsJEFFERSON CUTENo ratings yet

- Requirement Solution: Employee Benefits (Part 1)Document6 pagesRequirement Solution: Employee Benefits (Part 1)Regina De LunaNo ratings yet

- Notes Payable and Bonds Payable - Quiz - With Answers - For PostingDocument8 pagesNotes Payable and Bonds Payable - Quiz - With Answers - For PostingWinny PoeNo ratings yet

- Chapter 5-Notes ReceivableDocument13 pagesChapter 5-Notes ReceivableStarilazation KDNo ratings yet

- Premium Liability AccountingDocument2 pagesPremium Liability AccountingAngelica MadsonNo ratings yet

- Premium Liability: Estimated LiabilitiesDocument50 pagesPremium Liability: Estimated Liabilities11 Lamen100% (1)

- Module 7 - PAS 16 PPEDocument6 pagesModule 7 - PAS 16 PPEbladdor DG.No ratings yet

- Accounting For PPE - PAS 16Document39 pagesAccounting For PPE - PAS 16Marriel Fate Cullano100% (1)

- Bonds PayableDocument5 pagesBonds PayableSky SoronoiNo ratings yet

- Chapter 1-Current LiabilitiesDocument15 pagesChapter 1-Current LiabilitiesMonique AlarcaNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument16 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy Perante100% (1)

- Calculating Premium Liabilities for Sales PromotionsDocument25 pagesCalculating Premium Liabilities for Sales PromotionskianamarieNo ratings yet

- Chapter 15 Financial Asset at Fair ValueDocument7 pagesChapter 15 Financial Asset at Fair ValueRujean Salar Altejar100% (1)

- Pas 1 - Presentation of Financial Statements - RecordingDocument41 pagesPas 1 - Presentation of Financial Statements - Recordingwendy alcosebaNo ratings yet

- Direct Financing Lease with Residual ValueDocument2 pagesDirect Financing Lease with Residual ValueQueen ValleNo ratings yet

- Provisions, Contingent Liabilities and Contingent Assets: Problem 1: True or FalseDocument6 pagesProvisions, Contingent Liabilities and Contingent Assets: Problem 1: True or FalseKim HanbinNo ratings yet

- Chapter 29 - Leases Part 1Document18 pagesChapter 29 - Leases Part 1lyra21No ratings yet

- Chapter 3 Introduction To Income TaxDocument20 pagesChapter 3 Introduction To Income TaxDANICKA JANE ENERONo ratings yet

- Accounting 2: Liabilities and Financial ClassificationsDocument37 pagesAccounting 2: Liabilities and Financial ClassificationsAndrei GoNo ratings yet

- Intermediate Accounting 1 Review MaterialsDocument24 pagesIntermediate Accounting 1 Review MaterialsGIRLNo ratings yet

- Intermediate Accounting 2020 Volume 2 - Conrado T. Valix - PDFDocument220 pagesIntermediate Accounting 2020 Volume 2 - Conrado T. Valix - PDFAira ArabitNo ratings yet

- Chapter 2 4 For Law On Sales by Domingo Rex Bookstore Summarized VersionDocument15 pagesChapter 2 4 For Law On Sales by Domingo Rex Bookstore Summarized Versionsoyoung kim100% (1)

- Intermediate Accounting 2 Topic: Unearned RevenuesDocument5 pagesIntermediate Accounting 2 Topic: Unearned RevenuesJhazreel BiasuraNo ratings yet

- Law On Sales Chapter 8Document4 pagesLaw On Sales Chapter 8Edith DalidaNo ratings yet

- FARAP 4406A Investment in Equity SecuritiesDocument8 pagesFARAP 4406A Investment in Equity SecuritiesLei PangilinanNo ratings yet

- Activity Chapter 5: Effect On December 31, 20X1: Using Straight Line MethodDocument2 pagesActivity Chapter 5: Effect On December 31, 20X1: Using Straight Line MethodRandelle James FiestaNo ratings yet

- Chapter 12 Dealings in PropertiesDocument6 pagesChapter 12 Dealings in PropertiesAlyssa BerangberangNo ratings yet

- PAS 20 Government Grant GuideDocument3 pagesPAS 20 Government Grant Guidepanda 1100% (1)

- CPA Review Center on Liabilities, Provisions and ContingenciesDocument12 pagesCPA Review Center on Liabilities, Provisions and ContingenciesMaeNo ratings yet

- Liabilities: Ransfer of An Economic ResourcesDocument19 pagesLiabilities: Ransfer of An Economic ResourcesSisiw WasyerNo ratings yet

- Intro To LiabilitiesDocument11 pagesIntro To LiabilitiesCreshayne Angelique MangobaNo ratings yet

- Contingent Assets and Contingent LiabilitiesDocument5 pagesContingent Assets and Contingent LiabilitiesRonan Ferrer100% (1)

- Answer-Internal ControlDocument5 pagesAnswer-Internal ControlKathlene BalicoNo ratings yet

- Part 10 Foreign TranslationDocument3 pagesPart 10 Foreign TranslationKathlene BalicoNo ratings yet

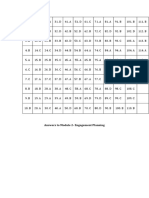

- Answers To Module 4: Responding Risk Assessment: Evidence Accumulation and EvaluationDocument1 pageAnswers To Module 4: Responding Risk Assessment: Evidence Accumulation and EvaluationKathlene BalicoNo ratings yet

- Answer-Internal ControlDocument5 pagesAnswer-Internal ControlKathlene BalicoNo ratings yet

- Audit Planning AnswersDocument3 pagesAudit Planning AnswersKathlene BalicoNo ratings yet

- Answers To Module 2 Engagement PlanningDocument1 pageAnswers To Module 2 Engagement PlanningKathlene BalicoNo ratings yet

- Understanding Internal Control and Assessing RiskDocument1 pageUnderstanding Internal Control and Assessing RiskKathlene BalicoNo ratings yet

- BSA 3105 - BBE - Balico, KathleneClaireDocument1 pageBSA 3105 - BBE - Balico, KathleneClaireKathlene BalicoNo ratings yet

- Sarawat My LoveDocument3 pagesSarawat My LoveKathlene BalicoNo ratings yet

- Steps in the accounting cycleDocument2 pagesSteps in the accounting cycleKathlene BalicoNo ratings yet

- VIP101Document1 pageVIP101Kathlene BalicoNo ratings yet

- Sarawat My LoveDocument3 pagesSarawat My LoveKathlene BalicoNo ratings yet

- Answer-Internal ControlDocument5 pagesAnswer-Internal ControlKathlene BalicoNo ratings yet

- Ecological community interactions and species relationshipsDocument2 pagesEcological community interactions and species relationshipsKathlene BalicoNo ratings yet

- Cloud Computing Title Nalang KulangDocument23 pagesCloud Computing Title Nalang KulangKathlene BalicoNo ratings yet

- A Reaction Paper On The Office: The Business Ethics EpisodeDocument2 pagesA Reaction Paper On The Office: The Business Ethics EpisodeKathlene BalicoNo ratings yet

- Foreign Finance, Investment, Aid, and Conflict: Controversies and OpportunitiesDocument54 pagesForeign Finance, Investment, Aid, and Conflict: Controversies and OpportunitiesKathlene BalicoNo ratings yet

- Astronomical Instruments MeaningDocument4 pagesAstronomical Instruments MeaningKathlene BalicoNo ratings yet

- Quality ControlDocument4 pagesQuality ControlKathlene BalicoNo ratings yet

- Cloud ComputingDocument23 pagesCloud ComputingKathlene BalicoNo ratings yet

- Difference between integrity, objectivity and independenceDocument1 pageDifference between integrity, objectivity and independenceKathlene BalicoNo ratings yet

- Cloud Computing IntroductionDocument2 pagesCloud Computing IntroductionKathlene BalicoNo ratings yet

- Environmental ScienceDocument2 pagesEnvironmental ScienceKathlene BalicoNo ratings yet

- Chap 010Document69 pagesChap 010hihi427No ratings yet

- THE AND: Environme NT Developme NTDocument17 pagesTHE AND: Environme NT Developme NTKathlene BalicoNo ratings yet

- Group 3 - Topic 6 - Poverty Inequality and DevelopmentDocument11 pagesGroup 3 - Topic 6 - Poverty Inequality and DevelopmentKathlene BalicoNo ratings yet

- Exercise On Segregation of CostsDocument3 pagesExercise On Segregation of CostsKathlene BalicoNo ratings yet

- Population Growth and Economic Development: Topic 7Document21 pagesPopulation Growth and Economic Development: Topic 7Kathlene BalicoNo ratings yet

- COMMUNITY TAX LECTURE: CITIES' TAX ON INDIVIDUALS & BUSINESSESDocument1 pageCOMMUNITY TAX LECTURE: CITIES' TAX ON INDIVIDUALS & BUSINESSESVic FabeNo ratings yet

- Tax Glimpses 2012Document92 pagesTax Glimpses 2012CharuJagwaniNo ratings yet

- Chapter 13-BDocument4 pagesChapter 13-BCARINO, GILLE ANNE MAE P.No ratings yet

- ROBIN Hood ExamDocument5 pagesROBIN Hood Examjoke_jansen_dulkNo ratings yet

- Measuring Bank Performance & Risk with Key RatiosDocument45 pagesMeasuring Bank Performance & Risk with Key RatiospavithragowthamnsNo ratings yet

- OnlyIas Important Committee Their Recommendations Marks BoosterDocument42 pagesOnlyIas Important Committee Their Recommendations Marks Boosterprakash patelNo ratings yet

- Tutorial 1Document7 pagesTutorial 1Shan JeefNo ratings yet

- State Excise ManualDocument106 pagesState Excise Manualajeez86100% (1)

- Unique Questions on PGBP for IPCC StudentsDocument5 pagesUnique Questions on PGBP for IPCC StudentsRohit GargNo ratings yet

- Income Deemed To Accrue or Arise in IndiaDocument2 pagesIncome Deemed To Accrue or Arise in IndiaDhirendra SinghNo ratings yet

- CIR vs. United SalvageDocument14 pagesCIR vs. United Salvagenathalie velasquezNo ratings yet

- Sales CaseDocument20 pagesSales CaseIsabel HigginsNo ratings yet

- Part D - Focus CasesDocument22 pagesPart D - Focus CasesShalom MangalindanNo ratings yet

- CH 01 What Is EconomicsDocument52 pagesCH 01 What Is EconomicsTheDigital PondNo ratings yet

- Digital Service Tax Debate FinalDocument9 pagesDigital Service Tax Debate FinalShivi CholaNo ratings yet

- Working CapitalDocument16 pagesWorking Capitalsherlyn_anacion50% (4)

- JSW SteelsDocument41 pagesJSW SteelsAthiraNo ratings yet

- Calculation of GSTDocument13 pagesCalculation of GSTSukanta PalNo ratings yet

- The Doctrine of Operative FactDocument3 pagesThe Doctrine of Operative FactTrem GallenteNo ratings yet

- Income Taxation 2015 Edition Solman PDFDocument53 pagesIncome Taxation 2015 Edition Solman PDFPrincess AlqueroNo ratings yet

- Tax Law Guide to Indian Income TaxDocument133 pagesTax Law Guide to Indian Income TaxTahaNo ratings yet

- PWC QaDocument14 pagesPWC QaClyde RamosNo ratings yet

- Intercompany Inventory and Land Profits: Solutions Manual, Chapter 6Document40 pagesIntercompany Inventory and Land Profits: Solutions Manual, Chapter 6HelloWorldNowNo ratings yet

- Direct Tax Law and Practice BookDocument694 pagesDirect Tax Law and Practice BookPrem MahalaNo ratings yet

- SEC B1 Income Statement and Statement of Financial PositionDocument3 pagesSEC B1 Income Statement and Statement of Financial PositionKəmalə AslanzadəNo ratings yet

- G.R. No. 148187 April 16, 2008 Philex Mining Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Ynares-Santiago, J.Document6 pagesG.R. No. 148187 April 16, 2008 Philex Mining Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Ynares-Santiago, J.Jhoi MateoNo ratings yet

- Tax - Midterm NTC 2017Document12 pagesTax - Midterm NTC 2017Red YuNo ratings yet

- Tax MockboardDocument8 pagesTax MockboardJaneNo ratings yet

- 2281 w04 QP 1Document12 pages2281 w04 QP 1mstudy123456No ratings yet

- LU1 - Value-Added TaxDocument24 pagesLU1 - Value-Added Taxmandisanomzamo72No ratings yet

- PIS Report 2Document1 pagePIS Report 2Ravi MalikNo ratings yet