Professional Documents

Culture Documents

Allottees 2020

Allottees 2020

Uploaded by

archish100 ratings0% found this document useful (0 votes)

12 views11 pagesOriginal Title

allottees 2020

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views11 pagesAllottees 2020

Allottees 2020

Uploaded by

archish10Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 11

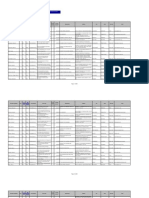

LIST OF ALLOTTEE(

Table A

Name of the Company CLASS 214 TECHNOLOGIES PRIVATE

LIMITED

Date of allotment 18" January, 2020

Type of securities allotted Series A Compulsorily Convertible Preference

Shares (Series A CCPS)

Nominal Amount per security (in RS.) | Series A CCPS:Rs. 1,000

Premium/ (Discount) amount per security (in RS.) | Series A CCPS: Rs. 1.40415,

Total number of allottees 06

Brief particulars in respect of terms and Series A CCPS shall have such terms and

condition, voting rights ete. conditions as annexed later in this document

CONSID) DN

ble-B

S. | Name & Address | Nationalit | Number Total amount | Total amount |

No. | occupation of y of Series A paid (including tobe |

of Allottee Allottee of the CCPs | premium) (in Rs.) | paid on calls |

Allottee allotted (Round OF) includin;

outstanding

| (in Rs)

3 4 5 6 7

Name: | Sth Floor, Mauritius 497 7.02.83.379.257- NIL

SURGE | Ebene

VENTURES | Esplanade. 24

Cybercity

Occupation: | Ebene.

_|__Business__|_ Mauritius

Name: SCT 3" Floor.) Mauritius 324 458,18, 5417- Nil

INVESTMEN | Ebene

TSVI | Esplanade. 24

Cybercity

Occupation: | Ebene.

Business| Mauritius

fester ea)

a

3 Name: | 902 Piramal Indian 06 Nit

REDWOOD Towers,

TRUST Peninsula

Corporate

Occupation: | Park.

Business | Ganpatrao

Kadam Marg

Lower Parel

Mumbai

400013,

Maharashtra,

India

5 Name: | 8F Oak Japan 15 Nil

AKATSUKI | Meguro, 2-13-

INC 30 Kamiosaki.

Shinagawa-ku.

Occupation: | Tokyo. Japan

Business 141-0021

5. | Name: ON IPS Court, Mauritius | 1,303 Ni

MAURITIUS | Bank Street,

Twenty Bight,

Occupation: | Cyber City

Business | Ebéne 72201,

Republic of

Mauritius

6 Name: | D-1205, St Indian NIL

ANKIT | JOHN’

NAGORI | WOOD,

‘Occupation:

Professional

€-1070 Basement

Sushant Lok 1, Gurgaon

Taverekere

Main Road,

Bangalore

360029

Total

eae

eer aon

CIN -U729

WT vlreaten

TABLE C

(LIST OF ALLOTTEES, APPLICABLE IN CASE OF ALLOTMENT OF SECURITIES FOR

CONSIDERATION OTHERWISE THAN IN CASH

Sk] Name of Address of Allottees | Nationality | No.of | W If partly paid

No, | Allottees of the Equity Securities up amount

Allottees Shares allotted are | outstan

allotted | fully or (in Rs.)

|

| partly paid

| | Up

Not Applicable

TABLE D

(LIST OF ALLOTTEES, APPLICABLE IN CASE OF ALLOTMENT OF BONUS SHARES)

S.No. | Name & Occupation of Address of Nationality of Number of Shares

Allottee Allottee Allotee allotted

Not Applicable

For, CLASS 214 TECHNOLOGIES PRIVATE LIMITED

For Class 21A Technologies Pvt. Ltd

CW MbALL NOt

TANUSHREE NAGORL

(Wirector)

DIN: 07031452

Address: H. No. 106 B,

Sanskriti Apartn

Sector -43, Gurgaon, 1

at,

002,

Haryana, India

Date: 18/01/2020

Place: Gurgaon, Haryana

CEeaaes Gk nae}

Ee ee Seer: OEE Macon)

aural te Limi

enero are ety)

ANNEXURE A

TERMS AND CONDITIONS OF SERIES 4 CCPS

The Series A CCPS shall be governed by the terms and conditions as set forth below

(i) Each Series A CCPS shall have a face value of INR 1,000/- (Rupees One Thousand

only),

(ii) Each Series A CCPS shall be entitled to a preferential (but pari passu with Seed

CCPS and Pre-Series A CCPS) non-cumulative dividend equal to zero point zero zero

bone percent (0.001%) per annum of the face value of such Series A CCPS (“Series A

Preferential Dividend”) and would also be entitled to participate on a puri passu

basis in any cash or non-cash dividends paid to the holders of Shares of any other

class or series on a pro rata as-converted basis to the fullest extent permissible under

Applicable Law. provided that no dividends shall be paid on any other class of Shares

during any financial year of the Company (other than Seed CCPS or Pre-Series A

CCPS) until the Series A Preferential Dividend shall have been paid or declared and

set apart during that financial year and any prior year in which dividends were

declared and accumulated but remain unpaid

( Each Series A CCPS shall automatically be converted into one (1) fully paid-up

Equity Share subject to Series A Anti-Dilution Adjustments (“Series A CCPS

Conversion Ratio 1 the first of the following ("Series A Conversion Event)

(a) the latest time permitted under Applicable Law in connection with the

consummation of a Qualified IPO:

(b) the written request of the holder of such Series A CCPS: or

(©) one (1) day prior to the twentieth (20") anniversary from the date of issuance of

the Series A CCPS.

(iv) Where a holder of the Series A CCPS elects to convert its one (1) or more Series A

CCPS under Clause 2.2.2(iiXb) above, the following shall apply

(a) Eacl

9 Sy Oeus ior nan tetn)

ushant Lok 1, Gurgaon meets

EReps Caveat]

aT

the registered office of the Company. and shall, at the time of such surrender

give written notice to the Company that such holder has elected to convert the

same and shall state in such notice the number of Series A CCPS being

converted

(b) Within five (5) days after receipt of such notice and the accompanying share

certificates, the Company shail issue and deliver to the holder of the converted

Series A CCPS. a share certificate or certificates for the ager umber of

Equity Shares issuable upon such conversion

(©) Where such aggregate number of Equity Shares includes any fractional share,

such fractional share shall be rounded off to the nearest whole number. Subject

to the requirements of Law, such conversion shall be deemed to have been

made immediately prior to the close of business on the date of such surrender

of the certificate or certificates representing the Series A CCPS, and the Person

entitled to receive the Equity Shares issuable upon such conversion shall be

treated for all purposes as the record holder of such Equity Shares on such date

(¥) Notwithstanding anything contained in Clause 2.2.2(iii) above. if Series A Anti-

Dilution Adjustments are needed, the Series A CCPS Conversion Ratio shall be

adjusted in a manner such that the number of Equity Shares issuable pursuant to the

conversion of each Series A CCPS shail be such number obtained by dividing the

Series A Subscription Price by the then current Series A CCPS Conversion Price.

Provided that no fractional shares shall be issued upon conversion of the Series A

CCPS and the total number of Equity Shares to be issued post conversion of the

Series A CPS shall. subject to Applicable Law. be rounded off to the nearest whole

number. The initial conversion price for the Series A CCPS shall be the Series A

Subscription Price as adjusted for Series A Anti-Dilution Adjustments ("Series A

CCPS Conversion Price”)

(i) The S

happening of any one or more of the following events (°S

Adjustment(s)")

ries A CCPS Conversion Price shall be subject to an adjustment on the

ies A Anti-Dilution

(a) Adjustment on a broad based weighted average basis, for issuance by the

Company of new equity linked Shares (“Series A Dilutive Issuance”) at a

purchase price (per Equity Share to be issued upon conversion, exchan,

exercise of such Shares) (Series A Dilutive Issuance Price”) less than the

then in effect Series A CCPS Conversion Price. in the following manner:

Series A CCPS

Conversion Price x _

(Adjusted)

C-1070 Basement

Sree eels Melero

0124 404993:

3)

Para aca

NEL ua versa renee re)

(by

wh

SOs’

Where:

X- is the Series A CCPS Conversion Price, as adjusted for any prior Series A

Anti-Difution Adjustment(s)

¥ is the sum of: (i) total number of outstanding Equity Shares, on a Fully

Diluted Basis, immediately prior to the Series A Dilutive Issuance; and (ii) the

number of Equity Shares which would have been issued if the Series A Dilutive

Issuance was made at the then Series A CCPS Conversion Price (and not the

Series A Dilutive Issuance Price): and

Z is the sum of: (i) total number of outstanding Equity Shares, on a Fully

Diluted Basis, immediately prior to the Series A Dilutive Issuance, and (ii)

number of Equity Shares actually issued through the Series A Dilutive Issuance

at the Series A Dilutive Issuance Price.

If, whilst any Series A CCPS remain capable of being converted into Equity

Shares of the Company, the Company splits, sub-divides (stock split) or

consolidates (reverse stock split) the Equity Shares into a different number of

securities of the same class, the number of Equity Shares issuable upon a

conversion of the Series A CCPS, shall be proportionately increased in the case

of a split or sub-division (stock split), and likewise, the number of Equity

Shares issuable upon a conversion of the Series A CPS, as the case may be,

shall be proportionately decreased in the ease of a consolidation (reverse stock

split).

If whilst any Series A CCPS remain capable of being converted into Equity

Shares. the Company makes or issues a dividend or other distribution of Equity

Shares to the holders of Equity Shares, the number of Equity Shares to be

issued on any subsequent conversion of Series A CCPS, as applicable, shall be

increased proportionately and without payment of additional consideration

therefore by the holder of Series A CCPS. as applicable. subject to any’ further

adjustment as provided in this paragraph (vi) but only to the extent

proportionate dividend has not been paid on the Series A CCPS

If the Company. by re-classification or conversion of securities or

changes any of the Equity Shares into the same or a different

securities of any other class or classes, the right to convert the Ser

into Equity Shares shall thereaiter represent the right to acquire

Ea Re eel}

7

Cestoroict

STE EI ae

o

Novwithstanding Clause 2.2.3(vi) above. the following

a

fener)

and kind of securities as would have been issuable as the result of such chan

with respect to the Equity Shares that were subject to the conversion rights of

the holder of Series A CCPS. immediately prior to the record date of such re-

classification or conversion, subject to further adjustment as provided in this

paragraph (vi).

IF, whilst any of the Series A CCPS remain capable of being converted inte

Equity Shares, there is a: (i) a reorganisation (other than a consolidation,

exchange or sub-division of shares or re-classification of shares as provided for

tunder sub-paragraphs (b). (c) or (d) of this paragraph (vi) respectively): (ii) a

merger or consolidation of the Company with or into another company in

which the Company is not the surviving entity, or a reverse triangular merger,

or similar transaction, in which the Company is the surviving entity but the

shares of the Company immediately prior to the merger are converted into other

property, whether in the form of securities, cash. or otherwise. which results in

change of Control: or (iii) a sale or Transfer of all or substantially all of the

Company’s Assets to any other person. then, as @ part of such change of

Control, the right to convert the Series A CPS. into Equity Shares shall

and shall automatically represent the right to receive the number of shares or

other securities or property offered to the Company’s holders of Equity Shares

in connection with such change of Control that @ holder of Series A CCPS

would have been entitled to re of Control if the right to

convert Series A CCPS into Equity Shares had been exercised in full

immediately before such change in Control, subject to further adjustment as

provided in this paragraph (vi).

eive in such change

If any Equity Shares are bought back or cancelled or otherwise cease to exist,

then the holder of Series A CCPS, upon the conversion of Series A CCPS at

any time after the record date on which the Equity Shares cease to exist shall

receive, in lieu of the number of Equity Shares that would have been issuable

upon such conversion immediately prior to the date of buy-back, cancellation

or cessation of Equity Shares, the securities or property that would have been

received ifthe right to convert the Series A CCPS into Equity Shares had been

exercised in full immediately before the date of buy-back. cancellation or

cessation of the Equity Shares, all subject to further adjustment as provided in

In the event the requisite number of employee stock options / advisor stock

options are not allocated, vested and / or exercised by the relevant individuals

in accordance with the provisions of the ESOP or ASOP (as relevant), or the

Company determines that these shall not continue as-is. prior to the occurrence

of 2 Liquidation Event, the benefit of the Share Capital representing such

employee stock options / advisor stock options. which have not been allocated,

vested, exercised and / or which have been determined by the Company to not

continue as-is, as the case may be. shall accrue to the Shareholders pro rata

(based on their percentage of the Company”s Share Capital)

issuances of S|

CSPLE Wy

Cate

9

(wii)

(ix)

a Series A Anti-Dilution Adjustment:

(a) the Equity Shares issuable upon conversion of any of the Series A CCPS, or as

bonus shares, dividend or other distribution on the Series A CCPS: or

(b) the Equity Shares issued or issuable pursuant to the ESOP: or

(©) Equity Shares actually issued upon the exercise of options or upon the

conversion or exchange of convertible securities or warrants, in each case

provided such issuance is pursuant to the terms of such option, convertible

security or warrant and has been approved by the Majority Investors: or

(4) any issuance of Shares in respect of which holders of Series A CCPS have

waived the requirement of Series A Anti-Dilution Adjustment in writing

The adjustment of the Series A CCPS Conversion Price pursuant to Clause 2.2.3(v)

and/or (vi) above shall not automatically trigger conversion of the Series A CCPS and

such conversion shall only be in accordance with the provisions of Clauses 2.2.3(ii)

and 2.2.3(iv) above. In the event that Applicable Law prevents or limits the

application of any adjustnents to the Series A CCPS Conversion Price as described

above, then the Company shall make all reasonable efforts to obtain any

authorizations necessary under Applicable Law to allow such adjustment, and in the

event that the holder of the Series A CCPS, on or prior to a Series A Conversion

Event agrees that such authorizations witi not be obtainable, the conversion shall be

carried out as follows: (a) the number of Equity Shares to be issued in exchange for

the Series A CCPS shall be the maximum number permitted by Applicable Law

(including. as applicable. in the event that Applicable Law prevents the full

adjustment of the Series A CCPS Conversion Price in accordance with Clause

2.2.3(9), the adjustment of such Series A CCPS Conversion Price to the lowest price

permitted under Applicable Law): and (b) the Company shall issue and offer to the

holder of the Series A CCPS at the lowest price permitted by Applicable Law, such

number of additional Equity Shares at such price so as to make up any shortfall in the

conversion to Equity Shares based on the intended application of the formula set forth

above

Upon the occurrence of each adjustment or readjustment of the Series A CCPS

Conversion Price pursuant to this Clause 2.2.3. the Company at its expense shall

Promptly compute such adjustment or readjustment in accordance with the terms

hereof and prepare and turnish t each holder of the Series A CCPS. a certificate

executed by an officer of the Company setting forth such adjustment or readjustment

and showing in detail the facts upon which such adjustment or readjustment is based

including as applicable. any authorizations obtained in connection wi

of any holder of the Series A CCPS. furnish or cause to be furnished to

(rere

aCe eal

ee aree ery

like certificate setting forth: (a) such adjustments and readjustments, and (b) the new

Series A CCPS Conversion Price resulting from the adjustments called for hei

d

he

very or acceptance of any such certifi

‘an acceptance by them of any statements or calculations set forth therein.

(x) The holders of Series A CCPS shall be entitled to such Liquidation Preference

Amount as set forth in Clause 2.4 of this Agreement.

(xi) The holders of Series A CCPS shall be entitled to such voting rights as set forth in

3 of this

(sii) Subject to Clause 2.4 below. the Equity Shares issued upon conversion of the Series

ACCCPS will in all respects rank pari passu with the Equity Shares already issued.

Voting Rights

L.L.1, Subject to Applicable Laws, the holders of the Seed CCPS, Pre-Series A CCPS and Series A

CCPS shalt be entitled to vote on as if converted basis, ie, the holders of the Seed CCPS,

Pre-Series A CCPS and Series A CCPS shall be entitled to such number of votes in the

general meetings of the Company which is equivalent fo the number of Equity Shares which

‘would be issuable at such point of time based on the then Seed CCPS Conversion Price and/or

Pre-Series A CCPS Conversion Price and/or Series A CCPS Conversion Price.

In the event that (a) the Company is converted from a private company to a public company:

or (b) the voting rights of the Seed CCPS. Pre-Series A CCPS or the Series A CCPS, as the

ease maybe, on as if converted basis. & able under Applicable Laws, until the

earlier of the conversion of Seed CPS, Pre-Series A CCPS or Series A CCPS, as the case

maybe. into Equity Shares, the Founders shail vote in accordance with the instructions of

Investors, Pre-Series A Investors or the Participating Investors, at a

provide proxies without instructions to Seed Investors, Pre-Series A Investors or the

neral meeting or

Participating Investors for the purposes of a general meeting, equal to the percentage of

Equity Shares in the Company that each of the Seed Investors. Pre-Series A Investors and the

Participating Investors would hold if they were to elect to convert the Seed CCPS, Pre-Series

A CCPS or the Series A CCPS, as the case maybe, held by them respectively, into Equity

Shares in accordance with the terms hereof. as set out in Clause 2.2 of this A

cement.

Liquidation Preference

Upon the occurrence of a Liquidity Event, the total proceeds of the Liquidity Event remaining

atter discharging or making provision for discharging the Company's statutory liablitig

("Proceeds") shall be distributed to each holder of Seed CCPS. Pre-Series A CCPSyaS 27)

Series A CCPS or any Equity Shares issued pursuant co conversion thereof shall (on 3a e

ss basis) to the extent that such holder patiipats inthe Liguidity Event by Tran :)

estrone’

Tee metic) Gece

Meares

NBUZ Ee ralcareioty

cone or more Seed CCPS andlor Pre-Series A CCPS andlor Series A CCPS and/or any Equity

Shares received pursuant to conversion of the respective Seed CCPS andior Pre-Series A

CCPS and/or Series A CPS. as the case may be (“LP Shares”), be entitled to receive. prior

to and in preference to any distribution of the Proceeds of the Liquidity Event (in any manner

including through declaration and payment of dividend) to any other Shareholders, the higher

of

(i) an amount equal to the Seed Subscription Price in respect of each Seed Shares

part of the LP Shares). the Pre-Series A Subscription Price in respect of

Series A Share (forming part of the LP Shares) and the Series A

Subscription Price in respect of each Series A Share (forming part of the LP Shares)

and any dividends or distributions declared but not paid in relation to such LP Shares

(hereinafier collectively referred to as the “Liquidation Preference Amount”), or

(ii) the amount that such holder of LP Shares would have received if the Proceeds were to

be distributed (in any manner including through declaration and payment of dividend)

amongst the holders of LP Shares and the holders of other Shares to the extent that

such holders participate in the Liquidity Event by transferring one or more of their

stich other Shares (“Non LP Shares”), on the basis of their pro-rata shareholding in

the Company (on as if converted basis) immediately prior to the occurrence of such

Liquidity Event (“Pro-Rata Amount”)

It is further clarified that in case of distribution of Proceeds of the Liquidity Event to each of

the holders of the LP Shares in terms of Clause 2.4.1 (i) above, the holders of the LP Shares

shall only be entitled (© their respective Liquidation Preference Amounts and they shall not

have any further participation in the balance amount of the Proceeds. which shall be

distributed amongst the other holders of the Non LP Sha

for clarity, excluding the holders

of the LP Shares) in accordance with the first sentence of Clause 2.4.3 below. Similarly, in

case of distribution of Proceeds to the holders of the LP Shares in terms of Clause 2.4.1 (ii)

above, the holders of such LP Shares shall not be entitled to any Liquation Preference

Amount and they sha

l receive only the Pro-Rata Amount.

It is further clarified that for calculating Liquidation Preference Amount, the subscription

price and number of LP Shares shall be appropriately adjusted on a proportionate basis For

stock / share splits and consolidations, stock dividends / bonus shares, recapitalizations and

other similar 0°;

other than cash, its value will be deemed its,

the Applicable Law then in force, be valued as follows:

estrous

Tee ee mcr oy

(the securities are traded on: (a) a stock exchange. the value of such securities shall

be determined in accordance with the relevant regulations issued by the Securities and

Exchange Board of India: and (b) any securities exchange of a foreign country. the

value of such securities shall be determined in accordance with the applicable law of

such country: provided. however, that in the event such foreign count

prescribed any regulations regarding the valuation of the securities. them the value of

the securities shall be deemed to be the average of the closing prices of the securities

over the twenty (20) trading-day period ending three (3) trading

of the Liquidity Event: and

has not

oon such exchai

days prior to the elosi

(ii) If the securities are of a nature not contemplated in paragraph (i) above, the value of

such securities shall, subject to Applicable Law, be such value as may be mutually

determined by the Company, the Founders and the Majority Investors.

2.2. Where the Proceeds of the Liquidity Event available for distribution are insufficient to pay in

full the Liquidation Preference Amounts payable to the holders of the LP Shares under Clause

2.4. above, the entire Proceeds of the Liquidity Event shall be distributed rateably among the

holders of the LP Shares. in proportion to the full Liquidation Preference Amount that each

such holder is otherwise entitled to receive under Clause 2.4.1 (i) above.

After the payment in full of the Liquidation Preference Amounts to the holders of the LP

Shares in accordance with Clause 2.4.1 (i) above, the remainder of the Proceeds of the

Liquidity Event, if any. shall be distributed (in any manner including through declaration and

payment of dividend) pro rata based on the shareholding, to the holders of the Non-LP Shares

(or clarity, excluding the holders of the LP Shares), provided that where the Proceeds are t0

be distributed in accordance with Clause 2.4.1 (ii) above, the entire Proceeds of the Liquidity

Event shall be distributed (in any manner including through declaration and payment of

dividend) pro rata based on the shareholding to all the hSlders of the LP Shares and Non-L.P

Shares on an as if converted basis,

1.2.4. Itishereby clarified and agreed that in case the Proceeds of a Liquidity Event are received by

the Company, the Proceeds of such Liquidity Event shall be distcibuted amongst the

Shareholders by the Company to give effect to the provisions of this Clause 24 in such

manner as may be reasonably required by Majority Investors

If for any reason whatsoever the Proceeds of a Liquidity Event cannot be distributed in the

manner set out above upon the occurrence of a Liquidity Event. the Parties hereto expressly

fee that they shall do all such aets and things as are legally permissible, to achieve the

commercial effect intended by above mentioned Clauses 2.4.1 to 24.4

estyereaa

STE eee ctl) 938

Seana

reverts

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- NSDC - An Overview and Opportunities in Skill FinancingDocument21 pagesNSDC - An Overview and Opportunities in Skill Financingarchish10No ratings yet

- Class 21A Technologies Private Limited: List of Shareholders As On 31st March 2019Document1 pageClass 21A Technologies Private Limited: List of Shareholders As On 31st March 2019archish10No ratings yet

- Money ManagerDocument17 pagesMoney Managerarchish10No ratings yet

- Josh Magazine RBI Grade B Officers Exam 2011 Reasoning Solved Question PaperDocument20 pagesJosh Magazine RBI Grade B Officers Exam 2011 Reasoning Solved Question Paperarchish10No ratings yet

- World Bank List of Economies (July 2014)Document37 pagesWorld Bank List of Economies (July 2014)archish10No ratings yet

- Table #121 Nih Research Career Development (K) Awards: Competing and Noncompeting Grant Listing Fiscal Year 2013Document203 pagesTable #121 Nih Research Career Development (K) Awards: Competing and Noncompeting Grant Listing Fiscal Year 2013archish10No ratings yet

- Table #121 Nih Research Career Development (K) Awards: Competing and Noncompeting Grant Listing Fiscal Year 2013Document203 pagesTable #121 Nih Research Career Development (K) Awards: Competing and Noncompeting Grant Listing Fiscal Year 2013archish10No ratings yet

- Amway Presentation - Introduction + Market CapDocument17 pagesAmway Presentation - Introduction + Market Caparchish10No ratings yet

- Hospital ListDocument218 pagesHospital Listarchish100% (1)

- Am Way 1Document3 pagesAm Way 1archish10No ratings yet