Professional Documents

Culture Documents

Jharkhand List of Stamp Duty and Registration Fee PDF

Jharkhand List of Stamp Duty and Registration Fee PDF

Uploaded by

gurpreet06Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jharkhand List of Stamp Duty and Registration Fee PDF

Jharkhand List of Stamp Duty and Registration Fee PDF

Uploaded by

gurpreet06Copyright:

Available Formats

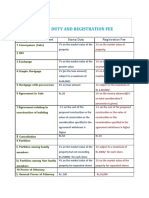

Govt.

of Jharkhand

Registration Department

Stamp Duty & Registration fee On Important Deeds

S. L Description of Instrument Stamp Duty Registration Fee

No.

1. Adoption Deed 42 1,000

2. Agreement. 3.50 1,000

3. Bond.

(i) Where exceed 1000 but 25.00

does not exceed 5000.

3% of the value of

the bond.

(ii) Where it exceed 5000 5.25% of the value of bond.

but does not exceed

50000.

(iii) Where it exceed 50000. 6.3% of the value of bond

4. Conveyance(Sale deed) 4% of the value of the 3% of the value of

document. the document.

5. Gift. 31.50

(i) Where the value of the

gift does not exceed

1000.

(ii) When it exceed 1000 but 31.50 for the first thousand

does not exceed 21 for every 500 or part 3% of the value of

10,000. there of by which the value the deed.

exceed 1,000.

The fee under clause (ii) in

(iii) Where it exceed 10000 addition 31.50 for every

500 or part there of by which

the value of the gift exceed

10,000

6. Mortgage. 4.2% of the value of the deed. 2% of the value of

the deed

7. Partition. Same duty as Bond. 3% of the value of

the deed

8. Partnership. 42 1,000

9. Power of Attorney 31.50 1,000

10. Trust (Declaration of) 47.25 1,000

11. Will. -Nil- 1200

NOTE :- On every document Rs. 30.00 will be charged on every page of the document as Service

Provider Fees, in addition to the Registration Fees.

Stamp_Duty_Fee.doc -1- Sonu

You might also like

- 6th Session (Cases)Document132 pages6th Session (Cases)DianahAlcazarNo ratings yet

- Deed of Extrajudicial Settlement of EstateDocument8 pagesDeed of Extrajudicial Settlement of EstatePrescila MagpiliNo ratings yet

- Albertelli Law's Wrongful "Foreclosure Action"Document13 pagesAlbertelli Law's Wrongful "Foreclosure Action"Albertelli_Law100% (3)

- Heirs of Felino M. Timbol Vs PDFDocument16 pagesHeirs of Felino M. Timbol Vs PDFRia Cua100% (1)

- Lim Tay vs. Court of AppealsDocument16 pagesLim Tay vs. Court of Appealscarl dianneNo ratings yet

- Corporate Law Case Digest DraftsDocument15 pagesCorporate Law Case Digest DraftsJona AddatuNo ratings yet

- Alberta Cabral Vs George Tunaya DigestDocument2 pagesAlberta Cabral Vs George Tunaya DigestJay Jasper LeeNo ratings yet

- Amendment To Real Estate MortgageDocument2 pagesAmendment To Real Estate MortgageRaihanah Sarah Tucaben Macarimpas100% (1)

- Land Titles. Land RegistrationDocument22 pagesLand Titles. Land RegistrationKaren GinaNo ratings yet

- Bachrach Motor Co., Inc. vs. IcarangalDocument7 pagesBachrach Motor Co., Inc. vs. IcarangalRomy Ian LimNo ratings yet

- Special Civil Actions Syllabus of CasesDocument15 pagesSpecial Civil Actions Syllabus of Casesandrew estimo100% (1)

- Saln Guide 2018Document120 pagesSaln Guide 2018Garsha HaleNo ratings yet

- Land Titles and Deeds NotesDocument8 pagesLand Titles and Deeds NotesBernadette QueniahanNo ratings yet

- Computation:: Freeway Company Requirement1: Books of Motorway Company Debit CreditDocument2 pagesComputation:: Freeway Company Requirement1: Books of Motorway Company Debit CreditAnonn100% (1)

- Credit Transactions TestbankDocument18 pagesCredit Transactions TestbankMaricris50% (2)

- Chandigarh - Stamp DutyDocument5 pagesChandigarh - Stamp DutyVirajNo ratings yet

- Taxation RegulationsDocument31 pagesTaxation RegulationsIsaacNo ratings yet

- Certificate of Insurance - B2CHKA800000898Document2 pagesCertificate of Insurance - B2CHKA800000898billyleemaxwayNo ratings yet

- Lecture 22 Working SheetDocument3 pagesLecture 22 Working Sheetsobian356No ratings yet

- Schedule of Rate Survey Works v4Document3 pagesSchedule of Rate Survey Works v4Catherine MartinezNo ratings yet

- Corporate Accounting 2023 - 240517 - 173809Document24 pagesCorporate Accounting 2023 - 240517 - 173809ananyajworkNo ratings yet

- Important McqsDocument23 pagesImportant McqsAmit ChaudhryNo ratings yet

- Solution:: The Following Are The Data Given in The Question For FactoringDocument1 pageSolution:: The Following Are The Data Given in The Question For FactoringCma Saurabh AroraNo ratings yet

- Accounting-Assignment - Sales Type & Sales and LeasebackDocument8 pagesAccounting-Assignment - Sales Type & Sales and Leasebackangelian bagadiongNo ratings yet

- National Commercial Arbitration Administrative FeesDocument4 pagesNational Commercial Arbitration Administrative FeesvishwaNo ratings yet

- Chapter 10 15Document89 pagesChapter 10 15Aira Mae P. VispoNo ratings yet

- Duty & Fees - Stamp Duty and Registration FeeDocument5 pagesDuty & Fees - Stamp Duty and Registration FeeBoopathy RangasamyNo ratings yet

- Haryana Stamp ActDocument4 pagesHaryana Stamp ActRupali SamuelNo ratings yet

- RAPHAEL RANDY 20220211161750 ACCT6133003 LH11 FIN ConfDocument8 pagesRAPHAEL RANDY 20220211161750 ACCT6133003 LH11 FIN ConfAnggur CapOTNo ratings yet

- 1 Banking CompaniesDocument15 pages1 Banking CompaniesNIKHIL MITTALNo ratings yet

- Tampoa Ae211 Unit 1 Assessment ProblemsDocument12 pagesTampoa Ae211 Unit 1 Assessment ProblemsJahna Kay TampoaNo ratings yet

- Depreciation MethodDocument3 pagesDepreciation MethoddreaammmNo ratings yet

- Ghi BaiDocument42 pagesGhi BaiPhạm Như HậuNo ratings yet

- Corporate Accounting Pervious Year Question 2022Document13 pagesCorporate Accounting Pervious Year Question 2022arpitgupta20050No ratings yet

- 23 Advanced Corporate Accounting Sep 2020 (CBCS F+R 2015 16 and Onwards)Document15 pages23 Advanced Corporate Accounting Sep 2020 (CBCS F+R 2015 16 and Onwards)Junaid AhmedNo ratings yet

- Quiz 4.1 Intangible AssetsDocument2 pagesQuiz 4.1 Intangible AssetsHunternotNo ratings yet

- Lobrigas Unit4 Topic2 AssessmentDocument7 pagesLobrigas Unit4 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Economics of The Projects AssumptionsDocument27 pagesEconomics of The Projects AssumptionsprakashNo ratings yet

- Problems On Sole PropritersDocument10 pagesProblems On Sole PropritersMouly ChopraNo ratings yet

- Retainers Proposal GuideDocument4 pagesRetainers Proposal GuideluckyNo ratings yet

- SS Practice Question 1 RPGT & RPC Oct 2022Document3 pagesSS Practice Question 1 RPGT & RPC Oct 2022FeahRafeah KikiNo ratings yet

- Practice Problems On FInal AccountsDocument30 pagesPractice Problems On FInal AccountsShreya TalujaNo ratings yet

- Chapter 9 - Debt Restructure (FAR6)Document3 pagesChapter 9 - Debt Restructure (FAR6)Honeylet SigesmundoNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsjaphethadadNo ratings yet

- Chapter 40 IFRIC InterpretationsDocument5 pagesChapter 40 IFRIC InterpretationsEllen MaskariñoNo ratings yet

- Stamp Duty and Registration FeeDocument3 pagesStamp Duty and Registration FeeJerard francis victorNo ratings yet

- List of Registrable ChargesDocument3 pagesList of Registrable Chargesadv_vinayakNo ratings yet

- Chapter 5Document19 pagesChapter 5Izzy BNo ratings yet

- Liquidation PQ SolDocument5 pagesLiquidation PQ SolKaran MokhaNo ratings yet

- Eje, Kaycie Lee D - Problem SolvingDocument2 pagesEje, Kaycie Lee D - Problem SolvingKaycie Lee Dinglasan EjeNo ratings yet

- Intermediate Accounting Chapter 23 To 35Document101 pagesIntermediate Accounting Chapter 23 To 35Blue SkyNo ratings yet

- DIAC Table of Fees and CostsDocument1 pageDIAC Table of Fees and CostsMohamed A.HanafyNo ratings yet

- SolutionsDocument10 pagesSolutionsBillah MagomaNo ratings yet

- Example 1: Classification of Leases: 1. Calculating Present Value of Minimum Lease PaymentsDocument9 pagesExample 1: Classification of Leases: 1. Calculating Present Value of Minimum Lease PaymentsJessa BasadreNo ratings yet

- Solutions Exercises Financial AccountingDocument11 pagesSolutions Exercises Financial Accountingddd huangNo ratings yet

- Corporate Accounts - Entire - IIDocument347 pagesCorporate Accounts - Entire - IIManjunath R IligerNo ratings yet

- Sole Proprietorship Final AccountDocument4 pagesSole Proprietorship Final Accountsujan BhandariNo ratings yet

- AC 121 - Corp Acc. - BalonesDocument4 pagesAC 121 - Corp Acc. - BalonessdluagueNo ratings yet

- Additional Questions AcctsDocument3 pagesAdditional Questions AcctsDEV NANKANINo ratings yet

- And Profit and Loss Account and Balance Sheet On 31st December, 2019Document2 pagesAnd Profit and Loss Account and Balance Sheet On 31st December, 2019Prabhleen KaurNo ratings yet

- Stamp Act, 1870 ScheduleDocument27 pagesStamp Act, 1870 ScheduleAbdullahel OwafeNo ratings yet

- Proposed Scheme For Trading of Computer & Mobile (Karma Sathi Prakalpa)Document2 pagesProposed Scheme For Trading of Computer & Mobile (Karma Sathi Prakalpa)ARJUN HALDARNo ratings yet

- Company Final AccountDocument2 pagesCompany Final AccountYashi710No ratings yet

- By-Kushagra Pratap B.com. H Corporate Accounting FonKOwtDocument32 pagesBy-Kushagra Pratap B.com. H Corporate Accounting FonKOwtanisharawat2007No ratings yet

- Chapter 1 Liabilities Practice SetsDocument5 pagesChapter 1 Liabilities Practice SetsAmberlynn PaduaNo ratings yet

- Balance SheetDocument6 pagesBalance SheetMahima SheromiNo ratings yet

- Account Set ADocument3 pagesAccount Set ANayan KcNo ratings yet

- Section 9 of The Transfer Duty ActDocument2 pagesSection 9 of The Transfer Duty ActMndebele NontokozoNo ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- Adobe Scan 26 Jul 2023Document12 pagesAdobe Scan 26 Jul 2023indukush8No ratings yet

- SS Add RPGTDocument5 pagesSS Add RPGTALIESYA FARHANA ALI HUSSAIN GHAZALINo ratings yet

- MF AssignmentDocument1 pageMF AssignmentAnkit KumarNo ratings yet

- Sale and LeasebackDocument10 pagesSale and LeasebackShinny Jewel VingnoNo ratings yet

- Course Guide in Remedial Law 1: RecapDocument10 pagesCourse Guide in Remedial Law 1: Recaptony ogbinarNo ratings yet

- FAR EAST BANK v. DIAZ REALTY INC., GR No. 138588, 2001-08-23Document2 pagesFAR EAST BANK v. DIAZ REALTY INC., GR No. 138588, 2001-08-23Michelle MatubisNo ratings yet

- Civil Law Bar Qs CompilationDocument47 pagesCivil Law Bar Qs CompilationMark TeaNo ratings yet

- General Milling Corporation, Petitioner, vs. Sps. LIBRADO RAMOS and REMEDIOS RAMOS, RespondentsDocument12 pagesGeneral Milling Corporation, Petitioner, vs. Sps. LIBRADO RAMOS and REMEDIOS RAMOS, RespondentsReyna RemultaNo ratings yet

- Couryards 2015 1321901Document37 pagesCouryards 2015 1321901api-322140170No ratings yet

- Chapter 1. General ProvisionsDocument9 pagesChapter 1. General ProvisionsRose Anne CaringalNo ratings yet

- Dy, Jr. Vs CADocument2 pagesDy, Jr. Vs CAHomer CervantesNo ratings yet

- 2012-315, Christina M. Deyeso v. Jules R. CavadiDocument6 pages2012-315, Christina M. Deyeso v. Jules R. CavadiChris BuckNo ratings yet

- Jefferson Bank v. Progressive Casualty Insurance Company, 965 F.2d 1274, 3rd Cir. (1992)Document21 pagesJefferson Bank v. Progressive Casualty Insurance Company, 965 F.2d 1274, 3rd Cir. (1992)Scribd Government DocsNo ratings yet

- Foundation - Primary PurposeDocument2 pagesFoundation - Primary Purposeaya5monteroNo ratings yet

- Quiz 1 CoverageDocument20 pagesQuiz 1 Coveragekristeen yumangNo ratings yet

- Dos With Assumption of MortgageDocument3 pagesDos With Assumption of MortgagejosefNo ratings yet

- Legal Writing Jurisprudence Auxilliary Verb MayDocument29 pagesLegal Writing Jurisprudence Auxilliary Verb Mayaj salazarNo ratings yet

- Complete Digests For PropertyDocument63 pagesComplete Digests For PropertyAllisonNo ratings yet

- Goquiolay vs. Sycip, G.R. No. L-11840, December 10, 1963Document7 pagesGoquiolay vs. Sycip, G.R. No. L-11840, December 10, 1963Lou Ann AncaoNo ratings yet

- Between Mr/Mrs .................. Son/daughter/wife .............. ResidingDocument12 pagesBetween Mr/Mrs .................. Son/daughter/wife .............. ResidingScottNo ratings yet