Professional Documents

Culture Documents

Balina-Digest-Comm Customs V AGFHA PDF

Balina-Digest-Comm Customs V AGFHA PDF

Uploaded by

Namiel Maverick D. BalinaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balina-Digest-Comm Customs V AGFHA PDF

Balina-Digest-Comm Customs V AGFHA PDF

Uploaded by

Namiel Maverick D. BalinaCopyright:

Available Formats

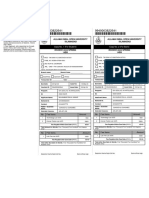

G.R. NO.

187425 March 28, 2011

Comm. Of Customs v. AGFHA Inc.

MAIN TOPIC – Modes of Extinguishment of Obligations (Special Rules on Monetary Obligations)

I. FACTS:

1. On December 12, 1993, a shipment containing bales of textile grey cloth arrived at the Manila International

Container Port (MICP).The Customs Commissioner, however, held the subject shipment because its owner/consignee

was allegedly fictitious.

2. AGFHA intervened and alleged that it was the owner and actual consignee of the subject shipment. Eventually, this

dispute reached the SC, which ended with a Writ of Execution ordering the immediate release of the subject shipment

to AGFHA. Asked to explain its consistent failure to execute the writ, the Commissioner explained, inter alia, that

despite diligent efforts to obtain the necessary information and considering the length of time that had elapsed since

the subject shipment arrived at the Bureau of Customs, the Chief of the Auction and Cargo Disposal Division of the

MICP could not determine the status, whereabouts and disposition of said shipment.

3. Acting on a complaint by AGFHA, the CTA-Second Division adjudged the Commissioner liable to AGFHA,

ordering the Bureau of Customs to pay AGFHA the value of the lost shipment in the amount of US$160,348.08),

subject to the payment of the prescribed taxes and duties, at the time of the importation, and that the Bureau of

Customs liability may be paid in Philippine Currency, computed at the exchange rate prevailing at the time of actual

payment.

4. The CTA En Banc and the CA affirmed the decision of the CTA Second Division.

5. The Commissioner basically argues that the exchange rate on the amount of payment should be computed not on the

time of payment, but on its acquisition cost at the time of importation; and that this case has been transformed into a

suit against the State because the satisfaction of AGFHAs claim will have to be taken from the national coffers.

II. ISSUE/s

1. Whether or not respondent AGFHA is entitled to recover the value of the lost shipment based only on its acquisition

cost at the time of importation

2. Whether or not the present action has been theoretically transformed into a suit against the State, thus BOC enjoys

immunity from suit since it is invested with an inherent power of sovereignty which is taxation.

III. HELD

1. No. the Petition lacks merit. The Court agrees with the ruling of the CTA that AGFHA is entitled to recover the value

of its lost shipment based on the acquisition cost at the time of payment. In the case of C.F. Sharp and Co., Inc. v.

Northwest Airlines, Inc. the Court ruled that the rate of exchange for the conversion in the peso equivalent should be

the prevailing rate at the time of payment. Likewise, in the case of Republic of the Philippines represented by the

Commissioner of Customs v. UNIMEX Micro-Electronics GmBH, which involved the seizure and detention of a

shipment of computer game items which disappeared while in the custody of the Bureau of Customs, the Court

upheld the decision of the CA holding that petitioner’s liability may be paid in Philippine currency, computed at the

exchange rate prevailing at the time of actual payment.

2. No. The Court held that circumstances of this case warrant its exclusion from the purview of the state immunity

doctrine. The Commissioner cannot escape liability for the lost shipment of goods. This was clearly discussed in the

UNIMEX Micro-Electronics GmBH decision, where the Court wrote: "the Court cannot turn a blind eye to BOC's

ineptitude and gross negligence in the safekeeping of respondent's goods. The situation does not allow us to reject

respondent's claim on the mere invocation of the doctrine of state immunity. Succinctly, the doctrine must be fairly

observed and the State should not avail itself of this prerogative to take undue advantage of parties that may have

legitimate claims against it.

Ponente: Mendoza, J.

Digest Maker: Balina, Namiel Maverick

G.R. NO. 187425 March 28, 2011

Comm. Of Customs v. AGFHA Inc.

IV. DISPOSITIVE PORTION

WHEREFORE, the February 25, 2009 Decision of the Court of Tax Appeals En Banc, in CTA EB Case No. 136,

is AFFIRMED. The Commissioner of Customs is hereby ordered to pay, in accordance with law, the value of the

subject lost shipment in the amount of US$160,348.08, computed at the exchange rate prevailing at the time of actual

payment after payment of the necessary customs duties.

V. DOCTRINE

In the case of C.F. Sharp and Co., Inc. v. Northwest Airlines, Inc. the Court ruled that the rate of exchange for the

conversion in the peso equivalent should be the prevailing rate at the time of payment.

Ponente: Mendoza, J.

Digest Maker: Balina, Namiel Maverick

You might also like

- Sworn Statement Gross SalesDocument1 pageSworn Statement Gross SalesERWINLAV200078% (9)

- Mexico Venture - MartinezDocument5 pagesMexico Venture - MartinezanafernandesbtsNo ratings yet

- Advanced News Lesson - Cashless SocietyDocument7 pagesAdvanced News Lesson - Cashless SocietyMari CarmenNo ratings yet

- 2019 Mock Exam A - Morning SessionDocument23 pages2019 Mock Exam A - Morning SessionDan ChanNo ratings yet

- Innocents Abroad: Currencies and International Stock ReturnsDocument24 pagesInnocents Abroad: Currencies and International Stock ReturnsGragnor PrideNo ratings yet

- Republic Vs Unimex (GR 166039-10)Document3 pagesRepublic Vs Unimex (GR 166039-10)erikha_araneta100% (2)

- 6 Customs Vs AGFHADocument1 page6 Customs Vs AGFHAAnonymous R3XcLE6No ratings yet

- CIR Vs AGFHADocument3 pagesCIR Vs AGFHACara Lucille Diaz RosNo ratings yet

- Customs - Cir Vs AgfhaDocument9 pagesCustoms - Cir Vs AgfhaKarla Marie TumulakNo ratings yet

- Republc vs. Unimex 518s19Document5 pagesRepublc vs. Unimex 518s19Marian's PreloveNo ratings yet

- The Commissioner of Customs vs. AGFHA 187425Document1 pageThe Commissioner of Customs vs. AGFHA 187425magenNo ratings yet

- 024 Villavicencio Republic v. UnimexDocument2 pages024 Villavicencio Republic v. UnimexSalve VillavicencioNo ratings yet

- 24 RP Vs UnimixDocument6 pages24 RP Vs UnimixMaria Jela MoranNo ratings yet

- Tax DigestDocument4 pagesTax DigestKristoffer Gabriel Laurio MadridNo ratings yet

- Thesis Cust 6Document26 pagesThesis Cust 6Jeselyn RequiomaNo ratings yet

- Rep Vs UnimexDocument3 pagesRep Vs UnimexAtty Ed Gibson BelarminoNo ratings yet

- Cir Vs TokyoDocument3 pagesCir Vs TokyoKimberly SendinNo ratings yet

- Republic vs. Unimex Summary: Doctrine: FactsDocument2 pagesRepublic vs. Unimex Summary: Doctrine: FactsNoelle SanidadNo ratings yet

- Republic v. UnimexDocument2 pagesRepublic v. UnimexAntonio Bartolome100% (1)

- Rule 41 45 CaseDocument86 pagesRule 41 45 CaseLeizel ZafraNo ratings yet

- CIR vs. Tokyo Shipping, 244 SCRA 332Document5 pagesCIR vs. Tokyo Shipping, 244 SCRA 332Machida AbrahamNo ratings yet

- Transglobe InternationalDocument7 pagesTransglobe InternationalMaggieNo ratings yet

- CIR vs. AGFHA, Inc., G.R. No. 187425, March 28, 2011Document6 pagesCIR vs. AGFHA, Inc., G.R. No. 187425, March 28, 2011Lou Ann AncaoNo ratings yet

- COC V CADocument17 pagesCOC V CAJust a researcherNo ratings yet

- Transportation Law Case DigestsDocument9 pagesTransportation Law Case DigestsScents GaloreNo ratings yet

- G.R. No. 136888 June 29, 2005 Philippine Charter Insurance Corporation, Petitioner, Chemoil Lighterage Corporation, RespondentDocument7 pagesG.R. No. 136888 June 29, 2005 Philippine Charter Insurance Corporation, Petitioner, Chemoil Lighterage Corporation, RespondentHelen Grace M. BautistaNo ratings yet

- Case StudyDocument50 pagesCase StudyJaypee BallesterosNo ratings yet

- CIR vs. Tokyo Shipping, GR#68252, May 26, 1995 224 SCRA 332Document5 pagesCIR vs. Tokyo Shipping, GR#68252, May 26, 1995 224 SCRA 332Khenlie VillaceranNo ratings yet

- Commissioner of Customs vs. Milwaukee Industries CorporationDocument14 pagesCommissioner of Customs vs. Milwaukee Industries CorporationAustine CamposNo ratings yet

- Eastern Shipping Lines vs. CADocument8 pagesEastern Shipping Lines vs. CAdonniefrancoNo ratings yet

- Nov.28.20 AssignmentDocument34 pagesNov.28.20 AssignmentAlexander DruceNo ratings yet

- Letter of CreditDocument7 pagesLetter of Creditmeiji15No ratings yet

- Eastern Shipping V CADocument12 pagesEastern Shipping V CAChristiane Marie BajadaNo ratings yet

- Upreme !court: L/epublic of Tbe TlbilippinesDocument9 pagesUpreme !court: L/epublic of Tbe TlbilippinesMonocrete Construction Philippines, Inc.No ratings yet

- Petitioner Vs Vs Respondent: Third DivisionDocument6 pagesPetitioner Vs Vs Respondent: Third DivisionLDCNo ratings yet

- Elite Shirt Factory Vs CornejoDocument2 pagesElite Shirt Factory Vs CornejoLiana AcubaNo ratings yet

- Customs DoctrinesDocument3 pagesCustoms DoctrinesBernadetteNo ratings yet

- Loadstar Shipping CoDocument11 pagesLoadstar Shipping CoAnonymous ubixYANo ratings yet

- G.R. No. 161759, July 02, 2014Document9 pagesG.R. No. 161759, July 02, 2014Elaine Villafuerte AchayNo ratings yet

- The Solicitor General For Petitioner. Jorge G. Macapagal Counsel For Respondent. Aurea Aragon-Casiano For Bagong Buhay TradingDocument4 pagesThe Solicitor General For Petitioner. Jorge G. Macapagal Counsel For Respondent. Aurea Aragon-Casiano For Bagong Buhay TradingTravis OpizNo ratings yet

- Taxation OnlyDocument6 pagesTaxation OnlyRmLyn MclnaoNo ratings yet

- 01-Commissioner of Customs v. AGFHA, Inc. GR No 187425Document7 pages01-Commissioner of Customs v. AGFHA, Inc. GR No 187425ryanmeinNo ratings yet

- Petitioner Vs Vs Respondents The Solicitor General Jorge G Macapagal Counsel Aurea Aragon-CasianoDocument8 pagesPetitioner Vs Vs Respondents The Solicitor General Jorge G Macapagal Counsel Aurea Aragon-CasianoKirby MalibiranNo ratings yet

- Philamgen vs. Sweet LinesDocument2 pagesPhilamgen vs. Sweet LinesJanlo FevidalNo ratings yet

- Loadstar Vs PioneerDocument5 pagesLoadstar Vs PioneerMavic MoralesNo ratings yet

- Eastern V CaDocument7 pagesEastern V CaJade AdangNo ratings yet

- Interprovincial Autobus Co., Inc. vs. Coll. of Internal Revenue and PerezDocument12 pagesInterprovincial Autobus Co., Inc. vs. Coll. of Internal Revenue and PerezYeu GihNo ratings yet

- 2 Asian Terminals, Inc. v. Malayan Insurance, Co., Inc. G.R. No. 171406, April 4, 2011Document11 pages2 Asian Terminals, Inc. v. Malayan Insurance, Co., Inc. G.R. No. 171406, April 4, 2011Ian Kenneth MangkitNo ratings yet

- Loadstar Shipping Co Vs Pioneer Asia Insurance - G.R. No. 157481. January 24, 2006Document5 pagesLoadstar Shipping Co Vs Pioneer Asia Insurance - G.R. No. 157481. January 24, 2006Ebbe DyNo ratings yet

- Maersk Line V CADocument15 pagesMaersk Line V CAJesha GCNo ratings yet

- Commissioner of Customs VDocument3 pagesCommissioner of Customs VAnonymous zizIYFrxtiNo ratings yet

- TL - Belgian Overseas Chartering and Shipping, Et - Al Vs Phil First Insurance, GR No. 143133 June 5, 2002Document9 pagesTL - Belgian Overseas Chartering and Shipping, Et - Al Vs Phil First Insurance, GR No. 143133 June 5, 2002Jec Luceriaga BiraquitNo ratings yet

- Transglobe International, Inc. vs. Court of AppealsDocument19 pagesTransglobe International, Inc. vs. Court of AppealsAustine CamposNo ratings yet

- 29) Phil First Ins Co., Inc. vs. Wallem Phils. Shipping, Inc., Et Al. G.R. No. 165647, March 26, 2009Document7 pages29) Phil First Ins Co., Inc. vs. Wallem Phils. Shipping, Inc., Et Al. G.R. No. 165647, March 26, 2009S.G.T.No ratings yet

- Case Brief - PPA Vs City of DavaoDocument2 pagesCase Brief - PPA Vs City of DavaoJeff Sarabusing100% (1)

- Mindanao Terminal and Brokerage Service, Inc. Petitioner, Phoenix Assurance Company of New York/Mcgee & Co., Inc., RespondentDocument5 pagesMindanao Terminal and Brokerage Service, Inc. Petitioner, Phoenix Assurance Company of New York/Mcgee & Co., Inc., RespondentAya BeltranNo ratings yet

- Farolan v. CTA (1993)Document5 pagesFarolan v. CTA (1993)Carlo MercadoNo ratings yet

- Alemar's Vs Court of Appeals GR No. 94996Document5 pagesAlemar's Vs Court of Appeals GR No. 94996Darrel John SombilonNo ratings yet

- Insurance CasesDocument288 pagesInsurance CasesLucifer MorningNo ratings yet

- AverageDocument2 pagesAverageChin MartinzNo ratings yet

- Transportation Law - DigestDocument41 pagesTransportation Law - DigestPJ SLSRNo ratings yet

- 8.) Delta Motors vs. Genuino G.R. No. 55665, February 8, 1989Document11 pages8.) Delta Motors vs. Genuino G.R. No. 55665, February 8, 1989reese93No ratings yet

- Jurisprudence Social Justice Calalang v. Williams Arrastre v. CaDocument25 pagesJurisprudence Social Justice Calalang v. Williams Arrastre v. CaAyet RamosNo ratings yet

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionFrom EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionNo ratings yet

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- ATP Notes 2Document9 pagesATP Notes 2Namiel Maverick D. BalinaNo ratings yet

- United BF Homeowners Association v. The Barangay ChairmanDocument2 pagesUnited BF Homeowners Association v. The Barangay ChairmanNamiel Maverick D. BalinaNo ratings yet

- Bernardo v. BataclanDocument1 pageBernardo v. BataclanNamiel Maverick D. BalinaNo ratings yet

- I. Rule/Law: Case Title: Midway Marine & Technological Foundation V. Castro (GR No. 189061)Document1 pageI. Rule/Law: Case Title: Midway Marine & Technological Foundation V. Castro (GR No. 189061)Namiel Maverick D. BalinaNo ratings yet

- de Roxas v. City of ManilaDocument1 pagede Roxas v. City of ManilaNamiel Maverick D. BalinaNo ratings yet

- The Conference of Maritime Manning Agencies v. POEADocument1 pageThe Conference of Maritime Manning Agencies v. POEANamiel Maverick D. BalinaNo ratings yet

- Balina - CONSTITUTIONAL LAW II Mid-Terms PDFDocument4 pagesBalina - CONSTITUTIONAL LAW II Mid-Terms PDFNamiel Maverick D. BalinaNo ratings yet

- Nacu v. CSC - BalinaDocument1 pageNacu v. CSC - BalinaNamiel Maverick D. BalinaNo ratings yet

- Bulletin Publishong Corp v. Noel - BalinaDocument1 pageBulletin Publishong Corp v. Noel - BalinaNamiel Maverick D. BalinaNo ratings yet

- The Rise of Crypto Laundries - How Criminals Cash Out of Bitcoin - Financial TimesDocument4 pagesThe Rise of Crypto Laundries - How Criminals Cash Out of Bitcoin - Financial TimesGonzalo Alonso LabragaNo ratings yet

- Coins and More - 14) Foreign Mints Which Have Minted Coins For India and Identification of Their Mint MarksDocument16 pagesCoins and More - 14) Foreign Mints Which Have Minted Coins For India and Identification of Their Mint MarksSamir JhabakNo ratings yet

- 1711110558 - Nguyễn Mai Phương - Bài tập Unit 1Document2 pages1711110558 - Nguyễn Mai Phương - Bài tập Unit 1Nguyễn Mai PhươngNo ratings yet

- Verbum Domini 5th LentDocument4 pagesVerbum Domini 5th LentRadiomaria IndiaNo ratings yet

- .S.3 Commerce - 1630400614000Document74 pages.S.3 Commerce - 1630400614000Ssonko EdrineNo ratings yet

- Foreign Currency - QuestionsDocument4 pagesForeign Currency - QuestionsMakita BatitaNo ratings yet

- RATES AND TARIFF - Emirates Shipping LineDocument2 pagesRATES AND TARIFF - Emirates Shipping LineCivicNo ratings yet

- 2020-03-06-February 2020 PMI Investor Information (FINAL)Document79 pages2020-03-06-February 2020 PMI Investor Information (FINAL)Alex espargoNo ratings yet

- Cancio V CtaDocument1 pageCancio V CtaAaron Gabriel SantosNo ratings yet

- Study Questions Exchange Rate + DerivativeDocument4 pagesStudy Questions Exchange Rate + DerivativeAlif SultanliNo ratings yet

- Coinify Inwallet Buy - SellDocument2 pagesCoinify Inwallet Buy - SellmehocayNo ratings yet

- SFM Forex Highlighted ModuleDocument26 pagesSFM Forex Highlighted ModuleGautam aroraNo ratings yet

- System of Public DebtDocument23 pagesSystem of Public DebtDILGR3MED MANILABAY100% (1)

- Charges: Applied Satellite Technology Asia Pte LTDDocument2 pagesCharges: Applied Satellite Technology Asia Pte LTDFirman JohariansyahNo ratings yet

- X SF STD InvDocument1 pageX SF STD InvIslamic BayanNo ratings yet

- ForwardInvoice ORD321555329Document2 pagesForwardInvoice ORD321555329Aman KapoorNo ratings yet

- Invoice 160490229Document1 pageInvoice 160490229Rakesh MahavarNo ratings yet

- Review Chapter 8-10 Session 2 With AnswerDocument5 pagesReview Chapter 8-10 Session 2 With AnswerJijisNo ratings yet

- FEG Token Litepaper v2.1Document15 pagesFEG Token Litepaper v2.1TelorNo ratings yet

- Chap 012Document80 pagesChap 012ALEXANDRANICOLE OCTAVIANO100% (1)

- CHAPTER 1 Revisison of Macroeconomics 1Document27 pagesCHAPTER 1 Revisison of Macroeconomics 1Nguyễn Khoa NamNo ratings yet

- Debt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair SiddiquiDocument38 pagesDebt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair Siddiquiumair_siddiqui89No ratings yet

- International FinanceDocument42 pagesInternational FinanceBilal AhmadNo ratings yet

- Currency Devaluation and Its Impact On The EconomyDocument4 pagesCurrency Devaluation and Its Impact On The Economytalha_ahmedNo ratings yet