Professional Documents

Culture Documents

Bar Questions in Credit Transactions

Uploaded by

May Chan100%(1)100% found this document useful (1 vote)

343 views3 pagesBAR QUESTIONS IN CREDIT TRANSACTIONS

Original Title

BAR QUESTIONS IN CREDIT TRANSACTIONS

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBAR QUESTIONS IN CREDIT TRANSACTIONS

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

343 views3 pagesBar Questions in Credit Transactions

Uploaded by

May ChanBAR QUESTIONS IN CREDIT TRANSACTIONS

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

BAR QUESTIONS IN CREDIT TRANSACTIONS Sebastian and SSC to recover

Sebastian's unpaid taxes.

GUARANTY AND SURETYSHIP Simultaneously, BIR also initiated

action to foreclose on the bond.

1. What is the difference between

"guaranty" and "suretyship"? (BAR Even before paying the BIR, SSC

2010) sought indemnity from Sebastian on

the basis of the Indemnity Agreement.

2. Kevin signed a loan agreement with Sebastian refused to pay since SSC had

ABC Bank. To secure payment, Kevin not paid the BIR anything yet, and

requested his girlfriend Rosella to alleged that the provision in the

execute a document entitled Indemnity Agreement which allowed

“Continuing Guaranty Agreement” SSC to recover from him, by mere

whereby she expressly agreed to be demand, even if it (SSC) had not yet

solidarily liable for the obligation of paid the creditor, was void for being

Kevin. contrary to law and public policy. (BAR

2018)

Can ABC Bank proceed directly against

Rosella upon Kevin’s default even Can Sebastian legally refuse to pay

without proceeding against Kevin first? SSC?

Explain your answer. (BAR 2017)

Answer:

Answer:

No, Sebastian’s argument has no merit.

Yes, ABC Bank may proceed directly

against Rosella upon Kevin’s default even In the problem, SSC as guarantor who

without proceeding against Kevin first bound to be solidarity liable with

because Rosella is a surety after she Sebastian, its cause of action is based on

bound herself solidarily with the principal the surety bond that it posted to

debtor. accommodate Sebastian pending

assessment by the BIR. Sebastian’s

Notwithstanding the use of the word argument that SSC cannot recover from

“guaranty” circumstances may be shown him because SSC has not paid anything

which convert the contract into one of from BIR is wrong. Here, BIR’s foreclosure

suretyship. Under the Civil Code, when the of the bond served as payment by SSC so

guarantor binds himself solidarily with the as to allow him to recover indemnity from

principal debtor, the contract becomes one Sebastian based on the indemnity

of suretyship and not of guaranty proper. agreement.

In a contract of suretyship, the liability of

the surety is direct, primary and absolute. NOTE: Atty. Ferrer answered this problem

He is directly and equally bound with the saying “Parties may modify provisions of

principal debtor. Such being the case, a law because their contract is the law

creditor can go directly against the surety between them.”

although the principal debtor is solvent and

is able to pay or no prior demand is made MORTGAGE

on the principal debtor. [Basis: Article

2047, Civil Code; Ong v. PCIB, 448 SCRA 4. Eulalia was engaged in the business of

705; discussed in pp. 810-812, Vol. 2, buying and selling large cattle. In order

Rabuya’s Civil Law Reviewer] to secure the financial capital, she

advanced for her employees

3. Sebastian, who has a pending (biyaheros). She required them to

assessment from the Bureau of Internal surrender TCT of their properties and to

Revenue (BIR), was required to post a execute the corresponding Deeds of

bond. He entered into an agreement Sale in her favor. Domeng Bandong

with Solid Surety Company (SSC) for was not required to post any security

SSC to issue a bond in favor of the BIR but when Eulalia discovered that he

to secure payment of his taxes, if found incurred shortage in cattle procurement

to be due. operation, he was required to execute a

Deed of Sale over a parcel of land in

In consideration of the issuance of the favor of Eulalia. She sold the property

bond, he executed an Indemnity to her grandneice Jocelyn who

Agreement with SSC whereby he thereafter instituted an action for

agreed to indemnify the latter in the ejectment against the Spouses

event that he was found liable to pay Bandong.

the tax. The BIR eventually decided

against Sebastian, and judicially To assert their right, Spouses Bandong

commenced action against both filed an action for annulment of sale

against Eulalia and Jocelyn alleging requisites for their validity are present.

that there was no sale intended but only With regards to its enforceability, a contact

equitable mortgage for the purpose of of loan is not among those enumerated

securing the shortage incurred by under Art. 1403 (2) of the Civil Code,

Domeng in the amount of P 70, 000.00 which are covered by the Statute of

while employed as "biyahero" by Frauds.

Eulalia.

It is important to note that under Art. 1358

Was the Deed of Sale between Domeng and of the Civil Code, all the other contracts

Eulalia a contract of sale or an equitable where the amount involved exceeds Five

mortgage? Explain. (BAR 2012) Hundred pesos (P500.00) must appear in

writing, even in private one. However, the

Answer: requirement is not for validity of the

contract, but only for its greater efficacy.

The contract between Domeng Bandong and

Eulalia was an equitable mortgage rather than With regard to the chattel mortgage, Art.

a contract of sale. The purported deed of sale 1508, the Chattel Mortgage Law, requires

was actually intended to merely secure the an affidavit of good faith stating that the

payment of the shortage incurred by Domeng chattel mortgage is supposed to stand as

in the conduct of the cattlebuying operations. security of the loan; thus, for the validity of

the chattel mortgage, it must be in a public

Under Art 1602, Civil Code, the contract shall document and recorded in the Chattel

be presumed to be an equitable mortgage Mortgage Register in the Register of

when it may be fairly inferred that the real Deeds. A real estate mortgage, under the

intention of the parties is simply to secure the provisions of Art. 2125 of the Civil Code,

payment of a debt or the performance of any requires that in order that a mortgage may

other obligation. be validly constituted the document in

which it appears be recorded. If the

The present transaction was clearly intended to instrument is not recorded, the mortgage is

just secure the shortage incurred by Eulalia nevertheless valid and binding between

because Bandung remained in possession of the parties. Hence, for validity of both

the property inspite of the execution of the sale. chattel and real estate mortgages, they

must appear in a public instrument. But the

purpose of enforceability, it is submitted

5. Lito obtained a loan of P1,000,000 from that the form of the contract, whether in a

Ferdie, payable within one year. To public or private document, would be

secure payment, Lito executed a chattel immaterial (Mobil Oil v. Diocaresa, 29

mortgage on a Toyota Avanza and a SCRA 656, 1969).

real estatemortgage on a 200-square

meter piece of property. Also, under Art 1358, acts and contracts

which have for their object the creation or

(A) Would it be legally significant - transmission of real rights over immovable

from the point of view of validity property must be in a public document for

and enforceability - if the loan and greater efficacy and a real estate mortgage

the mortgages were in public or is a real right over immovable property.

private instruments?

6. Ellen entrusted her title over the lot

Answer: where she is residing to Patrick, her

nephew, for safekeeping because of

From the point of view of validity and her poor eyesight. Patrick, a gambler,

enforceability, there would be legal prepared a Special Power of Attorney

significance if the mortgage was in a public empowering him to mortgage the lot.

or private instrument. As for the loan, there

is no legal significance except of interest Ellen's signature was forged. With the

were charged on the loan, in which case, help of Julia who represented herself as

the charging of interest must be in writing. Ellen, Mega Bank granted a loan to

Patrick secured by a mortgage on

A contract of loan is a real contract and is Ellen's lot. Due to nonpayment, Mega

perfected upon delivery of the object of the Bank foreclosed the mortgage and was

obligation (Art 1934, Civil Code). Thus, a declared the highest bidder. Title was

contract of loan is valid and enforceable later registered in the name of the bank.

even if it is neither in a private nor in a When Ellen was notified that she

public document. should vacate the premises, she filed a

complaint to nullify the loan with

As a rule, contracts shall be obligatory in mortgage, the auction sale and the title

whatever form they may have been of Mega Bank on the ground that the

entered into provided all the essential bank is not a mortgagee in good faith.

b) No, Donna cannot redeem it from Juana

Decide the case with reasons. (BAR because the pledge contract is between

2016) her and Jane. Juana is not a party to the

pledge contract. (Article 1311, Civil Code)

Answer:

c) One example of a pledge created by

operation of law is the right of the

I will decide in favor of Ellen. Banks, their depositary to retain the thing deposited

business being impressed with public until the depositor shall have paid him

interest, are expected to exercise more whatever may be due to the depositary by

care and prudence than private individuals reason of the deposit. (1994)

in their dealings, even those involving

registered lands. The highest degree of Another is the right of the agent to retain

diligence is expected , and high standards the thing which is the object of the agency

of integrity and performance are even until the principal reimburses him the

required of it. expenses incurred in the execution of the

agency. (Article 1914, Civil Code)

A mortagee – usually can rely on what

appears on the certificate of title presented Also in the case of hotel keeper when the

by the mortgagor and an innocent guest surreptitiously left the hotel without

mortgagee is not expected to conduct an paying, his properties may be retained in

exhaustive investigation on the history of pledge.

the mortgagor’s title. This rule, is, however,

strictly applied against banking institutions. ANTICHRESIS

Mega Bank cannot be considered a 8. Distinguish antichresis from usufruct.

mortgagee in good faith as it failed to (BAR 2017)

inspect the disputed property when offered

to it as security for the loan, which could Answer:

have led it to discover the forged Special

Power of Attorney. Antichresis is always a contract while

usufruct need not arise from a contract

because it may also be constituted by law

PLEDGE or by other acts inter vivos, such as

donation, or in a last will and testament, or

7. Donna pledged a set of diamond ring by prescription.

and earrings to Jane for P200,000.00

She was made to sign an agreement The subject matter of antichresis is always

that if she cannot pay her debt within a real property while the subject matter of

six months, Jane could immediately usufruct may either be real property or

appropriate the jewelry for herself. After personal property.

six months, Donna failed to pay. Jane

then displayed the earrings and ring set Antichresis is an accessory contract or

in her jewelry shop located in a mall. A contract of security while usufruct is a real

buyer, Juana, bought the jewelry set for right.

P300,000.00.

While in both, the fruits do not pertain to

a) Was the agreement which Donna the owner, the usufructuary is entitled to

signed with Jane valid? Explain with enjoy the fruits while the antichretic

legal basis. creditor has the obligation to apply the

fruits to the payment of the interest, if

b) Can Donna redeem the jewelry set owing, and thereafter to the principal of the

from Juana by paying the amount she credit.

owed Jane to Juana? Explain with legal

basis.

c) Give an example of a pledge created

by operation of law. (BAR 2015)

Answer:

a) To appropriate the jewelry upon default

of Donna is considered pactum

commissorium and it is considered void by

law. ( Article 2088)

You might also like

- 4a - Bar Q and A - Credit Transactions and Torts and DamagesDocument76 pages4a - Bar Q and A - Credit Transactions and Torts and Damagesnbragas100% (3)

- Truth in Lending Act ViolationDocument4 pagesTruth in Lending Act ViolationMary Anne S. AlbaNo ratings yet

- Credit - Bar QuestionsDocument7 pagesCredit - Bar QuestionsbrendamanganaanNo ratings yet

- SAN BEDA COLLEGE OF LAW GUIDEDocument10 pagesSAN BEDA COLLEGE OF LAW GUIDEPamela DeniseNo ratings yet

- Defenses Forgery (2004)Document24 pagesDefenses Forgery (2004)ivan anonuevoNo ratings yet

- Torts Bar Questions and Suggested AnswersDocument8 pagesTorts Bar Questions and Suggested AnswersFaithmae100% (6)

- Succession Bar Exam Questions With AnswersDocument77 pagesSuccession Bar Exam Questions With AnswersCarla January Ong75% (16)

- Bar Questions - CreditDocument8 pagesBar Questions - CreditCyrusNo ratings yet

- Torts Exams and Quiz Reviwe Bar Q and ADocument10 pagesTorts Exams and Quiz Reviwe Bar Q and Ame100% (1)

- Torts Cases IDocument13 pagesTorts Cases IRgenieDictadoNo ratings yet

- Credit Transactions Bar Exam QuestionsDocument5 pagesCredit Transactions Bar Exam QuestionsMoon Beams100% (4)

- Conflict of Laws in Succession & AdoptionDocument24 pagesConflict of Laws in Succession & AdoptionDoc McStuffinsNo ratings yet

- Bar Questions in Administrative LawDocument9 pagesBar Questions in Administrative LawMarie Bernadette Bartolome100% (1)

- Civil Law 2008 Bar Q&ADocument14 pagesCivil Law 2008 Bar Q&ABino PrietoNo ratings yet

- Commercial Law Suggested Answers To Bar ExamsDocument79 pagesCommercial Law Suggested Answers To Bar ExamsJfm A DazlacNo ratings yet

- Bar Exam Questions For PropertyDocument20 pagesBar Exam Questions For PropertyMoon Beams100% (8)

- Succession Bar QDocument12 pagesSuccession Bar Qronald100% (1)

- Property Bar QuestionsDocument40 pagesProperty Bar QuestionsAngel Arriesgado-Ponla Yap100% (11)

- CREDIT CARD DEBT AND BANK LOAN OBLIGATIONSDocument21 pagesCREDIT CARD DEBT AND BANK LOAN OBLIGATIONScris100% (3)

- Torts and Damages Bar Exam QuestionsDocument5 pagesTorts and Damages Bar Exam QuestionsHector Torres91% (11)

- LAND TRANSFER & DEEDSDocument24 pagesLAND TRANSFER & DEEDSRandy ZarateNo ratings yet

- Bar Q and A 2015-2017 (Property)Document7 pagesBar Q and A 2015-2017 (Property)MarkNo ratings yet

- Bar Questions On Public International Law PDFDocument17 pagesBar Questions On Public International Law PDFJorge ParkerNo ratings yet

- Teodoro v. Metropolitan Bank and CoDocument18 pagesTeodoro v. Metropolitan Bank and CoJamaika Ina CruzNo ratings yet

- Credit Transactions - Bar Q and ADocument66 pagesCredit Transactions - Bar Q and Amystery law man90% (10)

- Credit Transactions by Pineda PDFDocument12 pagesCredit Transactions by Pineda PDFNyl John Caesar GenobiagonNo ratings yet

- Torts NotesDocument84 pagesTorts NotesWhere Did Macky GallegoNo ratings yet

- Bar Questions For FinalsDocument9 pagesBar Questions For Finalsarielramada100% (1)

- Universidad de Manila: Negotiable Instruments Law First Trimester SY 2020-2021Document183 pagesUniversidad de Manila: Negotiable Instruments Law First Trimester SY 2020-2021Kyle JamiliNo ratings yet

- Notes & Reviewer On Election Laws (For Final Exam)Document15 pagesNotes & Reviewer On Election Laws (For Final Exam)Miguel Anas Jr.No ratings yet

- Credit Trans Sa Civil Law 2009-2017Document22 pagesCredit Trans Sa Civil Law 2009-2017Dianne AguinaldoNo ratings yet

- Property Final Exam Part 2 - 1Document3 pagesProperty Final Exam Part 2 - 1George PandaNo ratings yet

- Civ Pro Bar Qs 2014-2017Document13 pagesCiv Pro Bar Qs 2014-2017Lucas MenteNo ratings yet

- Credit Trans Q and ADocument4 pagesCredit Trans Q and ADeness Caoili-MarceloNo ratings yet

- Corpo Bar QsDocument15 pagesCorpo Bar Qschisel_159100% (2)

- Bar 2019 Exam Suggested Answers in Labor Law: by Prof. Benedict Guirey KatoDocument14 pagesBar 2019 Exam Suggested Answers in Labor Law: by Prof. Benedict Guirey KatoJANE MARIE DOROMAL100% (4)

- JD 217 - Updated NREL Reviewer For Midterms M5 PDFDocument59 pagesJD 217 - Updated NREL Reviewer For Midterms M5 PDFMichaela RetardoNo ratings yet

- Bar Questions From UP Law Complex-SUCCESSIONDocument55 pagesBar Questions From UP Law Complex-SUCCESSIONRhona Cacanindin70% (10)

- Property QuAMTODocument14 pagesProperty QuAMTOMoon Beams100% (1)

- Bar Exams QuestionsDocument43 pagesBar Exams QuestionsLeomar Despi LadongaNo ratings yet

- PDF Bar Questions On Public International Law - CompressDocument8 pagesPDF Bar Questions On Public International Law - CompressPrime Dacanay100% (1)

- Questions and Suggested Answers in Special ProceedingsDocument5 pagesQuestions and Suggested Answers in Special ProceedingsFrancis A. DacutNo ratings yet

- Bar Exam Questions For Trust and AgencyDocument8 pagesBar Exam Questions For Trust and AgencyMoon BeamsNo ratings yet

- Banco Filipino Savings and Mortgage Bank v. CA, GR 143896, July 8, 2005, 463 SCRA 64Document1 pageBanco Filipino Savings and Mortgage Bank v. CA, GR 143896, July 8, 2005, 463 SCRA 64Gia DimayugaNo ratings yet

- BAR QUESTIONS: Wills and SuccessionDocument13 pagesBAR QUESTIONS: Wills and SuccessionDenzhelle100% (1)

- ARCH. EUSEBIO B. BERNAL, DOING BUSINESS UNDER THE NAME AND STYLE CONTEMPORARY BUILDERS Vs DR. VIVENCIO VILLAFLOR and DRA. GREGORIA VILLAFLORDocument1 pageARCH. EUSEBIO B. BERNAL, DOING BUSINESS UNDER THE NAME AND STYLE CONTEMPORARY BUILDERS Vs DR. VIVENCIO VILLAFLOR and DRA. GREGORIA VILLAFLORLara Cacal50% (2)

- Moran v. CADocument13 pagesMoran v. CAJoanne CamacamNo ratings yet

- Bar Q CivilDocument30 pagesBar Q CivilFrancis Leo TianeroNo ratings yet

- Civil Law Bar Exam Answers: Torts and Damages Collapse of Structures Last Clear Chance (1990)Document16 pagesCivil Law Bar Exam Answers: Torts and Damages Collapse of Structures Last Clear Chance (1990)SGTNo ratings yet

- RTC jurisdiction over rescission caseDocument2 pagesRTC jurisdiction over rescission caseKenneth PenusNo ratings yet

- DARAB Decision on Cancellation of EPs and TCTs UpheldDocument3 pagesDARAB Decision on Cancellation of EPs and TCTs UpheldSORITA LAWNo ratings yet

- Administrative Law Bar Questions ExplainedDocument20 pagesAdministrative Law Bar Questions ExplainedAlfonso Miguel Lopez100% (2)

- Chapter 1 - Administrative Law-De LeonDocument2 pagesChapter 1 - Administrative Law-De LeonMark AngeloNo ratings yet

- Bar Examination - Taxation (2005)Document15 pagesBar Examination - Taxation (2005)Edwin Rueras SibugalNo ratings yet

- Duano Book NotesDocument6 pagesDuano Book NotesCherry Jean RomanoNo ratings yet

- Landti Bar QsDocument5 pagesLandti Bar QsMikkaEllaAnclaNo ratings yet

- Bar Questions LoanDocument20 pagesBar Questions LoanJr MateoNo ratings yet

- Credit Digests - GuarantyDocument21 pagesCredit Digests - Guarantyduanepo100% (1)

- Bar Qs Cred Trans PrelimDocument4 pagesBar Qs Cred Trans PrelimAlex RabanesNo ratings yet

- CASES SecurityDocument162 pagesCASES SecurityVic CajuraoNo ratings yet

- Inter-Orient v. NLRCDocument4 pagesInter-Orient v. NLRCMay ChanNo ratings yet

- Section 6. Disinheritance: Succession (Final Term Notes) - Ralph Erwin CardosoDocument28 pagesSection 6. Disinheritance: Succession (Final Term Notes) - Ralph Erwin CardosoMay ChanNo ratings yet

- Insurance - Finals CasesDocument8 pagesInsurance - Finals CasesMay ChanNo ratings yet

- Insurance Finals - v2Document9 pagesInsurance Finals - v2May ChanNo ratings yet

- Rule 63Document2 pagesRule 63May ChanNo ratings yet

- Yu Con v. IpilDocument4 pagesYu Con v. IpilMay ChanNo ratings yet

- TRIAL COURT - Ruled in Favor of FELMAN: Asilda" Was Seaworthy When It Left The Port of Zamboanga (B)Document3 pagesTRIAL COURT - Ruled in Favor of FELMAN: Asilda" Was Seaworthy When It Left The Port of Zamboanga (B)May ChanNo ratings yet

- Rule 70Document3 pagesRule 70May ChanNo ratings yet

- Cargo liability caseDocument3 pagesCargo liability caseMay ChanNo ratings yet

- Bascos v. CaDocument4 pagesBascos v. CaMay ChanNo ratings yet

- BLT Bus Company v. IacDocument3 pagesBLT Bus Company v. IacMay ChanNo ratings yet

- Plaintiff PH Bar AssociationDocument10 pagesPlaintiff PH Bar AssociationMay ChanNo ratings yet

- Servando v. PH Steam NavigationDocument2 pagesServando v. PH Steam NavigationMay ChanNo ratings yet

- Pagi v. MGGDocument3 pagesPagi v. MGGMay ChanNo ratings yet

- Southern Lines v. CA, IloiloDocument2 pagesSouthern Lines v. CA, IloiloMay ChanNo ratings yet

- Court upholds carrier's liability for dumped scrap ironDocument2 pagesCourt upholds carrier's liability for dumped scrap ironMay ChanNo ratings yet

- Pagi v. MGGDocument3 pagesPagi v. MGGMay ChanNo ratings yet

- Atp P48Document8 pagesAtp P48May ChanNo ratings yet

- Martin Badong, Jr. For Petitioner. Eufronio K. Maristela For Private RespondentDocument2 pagesMartin Badong, Jr. For Petitioner. Eufronio K. Maristela For Private RespondentMay ChanNo ratings yet

- Court ruling on shipping accident liabilityDocument4 pagesCourt ruling on shipping accident liabilityMay ChanNo ratings yet

- Passenger Rights in Cases of Voyage InterruptionDocument5 pagesPassenger Rights in Cases of Voyage InterruptionMay ChanNo ratings yet

- Balgos & Perez Law Offices For Petitioner. C.A.S. Sipin, Jr. For Private RespondentDocument4 pagesBalgos & Perez Law Offices For Petitioner. C.A.S. Sipin, Jr. For Private RespondentMay ChanNo ratings yet

- Atp P58Document13 pagesAtp P58May ChanNo ratings yet

- GATCHALIAN SEEKS DAMAGES FROM CAR CRASHDocument4 pagesGATCHALIAN SEEKS DAMAGES FROM CAR CRASHMay ChanNo ratings yet

- Classified As Confidential. Please Do Not Forward This To Unintended Users. Otherwise, Request Necessary PermissionDocument8 pagesClassified As Confidential. Please Do Not Forward This To Unintended Users. Otherwise, Request Necessary PermissionMay ChanNo ratings yet

- ATP Last BatchDocument17 pagesATP Last BatchMay ChanNo ratings yet

- COURT OF APPEALS - Reversed The Trial Court: MajeureDocument3 pagesCOURT OF APPEALS - Reversed The Trial Court: MajeureMay ChanNo ratings yet

- Classified As Confidential. Please Do Not Forward This To Unintended Users. Otherwise, Request Necessary PermissionDocument8 pagesClassified As Confidential. Please Do Not Forward This To Unintended Users. Otherwise, Request Necessary PermissionMay ChanNo ratings yet

- Atp P48Document8 pagesAtp P48May ChanNo ratings yet

- Atp P58Document13 pagesAtp P58May ChanNo ratings yet

- Civics EOC Study Guide-KEY: CitizenshipDocument16 pagesCivics EOC Study Guide-KEY: Citizenshipfabiola loboNo ratings yet

- Law436 Contracts Final AssessmentDocument6 pagesLaw436 Contracts Final AssessmentaurymNo ratings yet

- DepEd Rationalization Program ExplainedDocument43 pagesDepEd Rationalization Program ExplainedDarwin AbesNo ratings yet

- PHIL. POL. GOV. 2nd Sem q1 Week 3&4Document13 pagesPHIL. POL. GOV. 2nd Sem q1 Week 3&4ARIEL ANGELIONo ratings yet

- Central Bank of The Phils. vs. C.A, G.R. No. 7618, March 30, 1993, 220 SCRA 536Document5 pagesCentral Bank of The Phils. vs. C.A, G.R. No. 7618, March 30, 1993, 220 SCRA 536Carlos JamesNo ratings yet

- Oblicon Case List Batch 2Document3 pagesOblicon Case List Batch 2Ray Vincent Esposo ChanNo ratings yet

- Affidavit of Loss Due To Fire IsmaelDocument1 pageAffidavit of Loss Due To Fire IsmaelRay Legaspi67% (6)

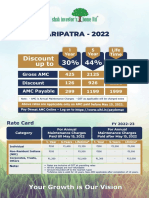

- Paripatra - 2022: Discount Up ToDocument2 pagesParipatra - 2022: Discount Up ToNafisur RahmanNo ratings yet

- Kahn 1Document18 pagesKahn 1Karina G BoiolaNo ratings yet

- Luyện dịchDocument5 pagesLuyện dịchBTC - Thái Thị Thảo HiềnNo ratings yet

- QuitclaimDocument2 pagesQuitclaimAlfred Hernandez CampañanoNo ratings yet

- Aguilar V Doj 197522Document6 pagesAguilar V Doj 197522Buen LibetarioNo ratings yet

- Alpha Group ConstitutionDocument2 pagesAlpha Group ConstitutionGeorgeNo ratings yet

- 2020 Sindon - v. - Alzate20210708 11 vt4xpvDocument8 pages2020 Sindon - v. - Alzate20210708 11 vt4xpvmaimagbalonNo ratings yet

- SZ - Case AnalysisDocument11 pagesSZ - Case AnalysisShayan ZafarNo ratings yet

- Heirs of Natividad v. Mauricio NatividadDocument8 pagesHeirs of Natividad v. Mauricio NatividadApa MendozaNo ratings yet

- The Ongoing Debate Over the "Feudal RevolutionDocument13 pagesThe Ongoing Debate Over the "Feudal Revolutioncarlos murciaNo ratings yet

- Memorandum of AssociationDocument3 pagesMemorandum of AssociationUtkarsh KhandelwalNo ratings yet

- Beware of Inventor ScamsDocument2 pagesBeware of Inventor ScamsSusanBaskoNo ratings yet

- Charles McGeever Termination Letter From City of ClevelandDocument7 pagesCharles McGeever Termination Letter From City of ClevelandWKYC.com100% (1)

- Maybank Scholarship - Parents Income Declaration Form v1Document1 pageMaybank Scholarship - Parents Income Declaration Form v1SENMI HUTASOIT100% (1)

- Tata AIG Motor Policy Schedule - 3189 - 6300185207-00-2Document6 pagesTata AIG Motor Policy Schedule - 3189 - 6300185207-00-2Pawan KanuNo ratings yet

- Law of AdulteryDocument15 pagesLaw of AdulteryPrince SingalNo ratings yet

- Helloworld CDocument4 pagesHelloworld Ckhin600No ratings yet

- LB3309 JurisprudenceDocument20 pagesLB3309 Jurisprudence20B0244 Massalwani Yussof.No ratings yet

- State Representative Kent V Ohio House Democratic Caucus 12.16.2020Document17 pagesState Representative Kent V Ohio House Democratic Caucus 12.16.2020Karen Kasler100% (1)

- MANCOL JR v. DBPDocument2 pagesMANCOL JR v. DBPAlia Arnz-Dragon100% (5)

- Case Digest - Tanada vs. TuveraDocument1 pageCase Digest - Tanada vs. TuveraSymon TubonNo ratings yet

- Information Sheet Tafe Institute Boards Directors DutiesDocument3 pagesInformation Sheet Tafe Institute Boards Directors DutiesMaja DakicNo ratings yet

- CPA ethics and principlesDocument2 pagesCPA ethics and principlesMichNo ratings yet