Professional Documents

Culture Documents

Paper Test 4

Uploaded by

jokoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paper Test 4

Uploaded by

jokoCopyright:

Available Formats

THE INFLUENCE OF PERFORMANCE, SIZE,

DEBT ON REPORT LAG IN FOOD AND

BEVERAGE SECTOR

*Bambang Leo Handoko1, Ang Swat Lin Lindawati2 Oki Saputra3

1,2,3

Accounting Department, Faculty of Economics and Communication, Bina Nusantara

University, Jakarta, Indonesia, 11480

1

bambang.handoko@binus.edu, 2lindawati@binus.edu, 3oki.scorpio@gmail.com

Abstract

Report lag is lag in finishing audit work. Report lags impact on loss to user of financial statements. The

more lag occur, it make more times to publish the financial report. It means that user will wait longer to

use it as tools for decision making. This study aims to analyze the effect of performance which is

measured by company level of ability to make profit, how big a company is, which is measured by

company size and level of debt on audit report lag or delay in food and beverage sub-sector manufactures

companies listed on the Indonesia Stock Exchange for the period time of 2016 - 2018. The total numbers

of sample observations were 30 company data. We choose the data using purposive sampling. Data

analysis method used to test the hypothesis is ordinary least square on multiple regression analysis using

SPSS Statistics version 22. The results of this study indicate that audit report lag affected by profit ability

and debt level, while company size has no effect on audit report lag.

Keywords: performance, size, debt, report lag, food, beverage, sector

1. Introduction down other companies (competitors). And

besides that, nowadays it is not uncommon

The rapid development of the business

to find companies that dare to manipulate

world in this era of globalization requires

their company's financial statements with

companies to compete with each other to

various objectives, such as attracting

maintain business continuity. The

investors, avoiding or reducing taxes to be

competition will determine whether the

paid or other things intended to benefit the

company can survive or not. Companies that

company.

do not have good management or even do

not have a planned competitive strategy will In Indonesia, the timely presentation of

enable the company to lose and be financial statements is an obligation for

eliminated from its business environment. In companies listed on the Indonesia Stock

addition, companies are also required to be Exchange (IDX) to submit financial reports

able to always develop and renew and have regularly. Since September 30, 2011, the

innovations in their business and products FSA has tightened the regulations with the

(both goods and services) in order to survive issuance of an attachment to the decision of

and develop their business. the head of the OJK Number: Kep36 / PM /

2011 stating that the annual financial

But now, competition that arises between

statements are accompanied by accountants'

companies is often negative and uses

reports with the usual opinion that must be

unhealthy methods. Many companies

submitted to the FSA no later than the end of

actually compete not by innovating with

the third month (90 days) after the date of

companies and products, but tend to bring

Published by: The Mattingley Publishing Co., Inc. 1

the annual financial statements. Audit delay accompanied by auditor's opinion to

that exceeds the time limit for OJK Bapepam. Based on Capital Market

regulations certainly results in delays in the regulations No. KEP 80 / PM / 1996

publication of financial statements. Delay in concerning the obligation to submit periodic

the publication of financial statements financial statements, which requires every

indicates there are problems in the issuer's company listed on the capital market to

financial statements so that it takes longer to submit the company's annual financial

complete the audit. In addition, delays in statements and independent auditor's reports

submitting the report will be subject to to BAPEPAM no later than one hundred and

administrative sanctions in the form of fines twenty days from the date of end date of the

based on the provisions of Article 63 letter e book year. The regulation was then updated

Government Regulation Number 45 of 1995 with the issuance of a BAPEPAM 38

which states, "Issuers whose Registration Chairperson Decree Number: Kep-36 / PM /

Statement has become effective are subject 2003 stating that the annual financial report

to a fine of Rp1,000,000.00 (one million is accompanied by an accountant's report

rupiah) on every day of late submission of with the usual opinion that must be

the report referred to in the condition that submitted to BAPEPAM no later than the

the total amount of the fine be no more than end of the third month (90 days) after the

Rp. 500,000,000.00 (five hundred million date of the annual financial statement. If the

rupiah) ". (Financial Services Authority) company goes public or the issuer is late in

submitting financial statements in

Delay in financial reporting will cause a

accordance with the Decree of the Chairman

negative reaction on the part of users,

of BAPEPAM Number: Kep-36 / PM /

because the information contained in

2003, then there are sanctions determined by

financial statements is very important

the stock exchange

considering the financial statements as an

instrument of communication between

2.2. Company Performance

management and external parties that

The first factor that can affect audit delay

contain important sources of information

is company performance. In this study,

about the company's performance and

company performance is proxies by

prospects which are then used as a basis

profitability. Profitability is the ability of a

consideration in decision making. Delays in

company to make a profit. Profitability

financial reporting will result in loss of

which is proxies by the Profit Margin ratio is

information in the financial statements

one indicator of management performance.

because they are not available when needed

The higher the PM it can be said that the

at the time of decision making. This can

better performance of management.

result in a decrease in investor confidence

Companies that suffer losses make auditors

and will then have an impact on the selling

be more careful in the audit process [3]. The

price of shares in the capital market [1].

results of the study [4] showed that

profitability significantly affected audit

2. Literature Review and Hypothesis

delay. This can be interpreted that

Development

companies that have a high level of

2.1. Audit Report Lag profitability need faster time in auditing

Audit delay or often also called audit financial statements. Based on this believe,

report lag is the length of time span of audit the hypothesis proposed is:

completion as measured from the closing

H1: Company performance influences

date of the financial year to the date the

audit report lag.

audit report is issued [2].

Companies that go public must submit

their annual financial statements 2.2. Company Size

Published by: The Mattingley Publishing Co., Inc. 2

The second factor that can affect audit The type of data used in this study is

delay is the size of the company the error quantitative data that is data in the form of

rate of the financial statements, then makes numbers and can be measured and tested by

it easier for auditors to audit the financial statistical methods. While the data source

statements. Companies that have better used is secondary data obtained from annual

internal control will facilitate the auditor so reports and financial statements of non-

that this can reduce the auditor's error in financial companies listed on the Indonesia

working on the audit report. The results of Stock Exchange in 2016 to 2018.

the study [5] said that the larger the size of The sample collection method in this

the company, the shorter the audit report study is included in the purposive sampling

lags. We write second hypothesis proposed because it has been determined beforehand

is: with the criteria to be taken, the criteria are:

H2: Company size influences audit report 1. Manufacturing companies listed on the

lag. Indonesia Stock Exchange in 2016-2018.

2.3. Level of Debt 2. The company which published the

The third factor that can affect audit delay independent auditor's report for the period

is the level of debt. The level of debt in our 31 December 2016-2018.

study is proxies by solvability. Solvability 3. Companies that do not have zero (0) or

according to [6] is the ability of a company negative earnings.

to fulfill all financial obligations when the

company is liquidated. The results of the 4. Financial statements present the rupiah

study [7] show that solvency affects audit in financial reporting.

delay. This is because the level of the size of 5. Food and beverage sub-sector

the debt owned by the company will cause manufacturing companies.

the examination and reporting of the

company's debt inspection take longer so 3.2. Data Analysis Method

that it can slow down the audit reporting This study uses multiple linear regression

process by the auditor. We write third to analyze the effect of each independent

hypothesis proposed is: and dependent variable. Hypothesis testing

H3: Level of debt influences audit report is done by SPSS version 22.

lag. 3.3. Measurement Variables

3. Material and Methodology The following is the measurements of the

variables used in this study:

3.1. Object and Sampling

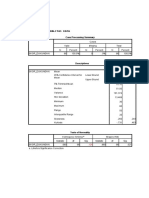

Table 1. Quantitative Measurement

Published by: The Mattingley Publishing Co., Inc. 3

4. Research Result aims to test whether in the regression model,

the dependent variable and the independent

4.1. Normality Test

variable both have normal distribution or

According to [11] in the Multivariate not. A good regression model is if both have

Analysis Application book with the IBM normal or near normal distribution

SPSS 23 Program that the normality test

Table 2. Normality Test Results

Figure 1. Normal Probability Plot

distributed. Thus, the data obtained from the

From the results of the normality test using

sample companies is feasible to be used in

Kolomogorov-smirnov which has been

this study. From Figure 1 it shows that the

processed in table 2 it is known that the

spread of data around the diagonal line and

Asymp. Value is below. Sig. (2-tailed) is

follows the direction of the diagonal line, it

0.738. The meaning of which is greater than

shows that the regression model has fulfilled

the real fixed tariff (α) which is 0.05. This

the normality assumption.

shows that the data used are normally

Published by: The Mattingley Publishing Co., Inc. 4

1,601. And the solvency variable (DAR) has

4.2. Multicollinearity Test

a tolerance value of 0.950 and a VIF value

According to [12] in the Multivariate of 1.052.

Analysis Application book with the IBM

Based on the results that have been

SPSS 23 Program that, the multicollinearity

processed in table 3, it can be concluded that

test aims to test whether in the regression

all independent variables, the profitability

found the presence or absence of

variable, company size and solvency have a

correlations between independent variables,

tolerance value greater than 0.10 and a VIF

a good regression model should not occur a

value smaller than 10. So it can be

correlation height among independent

concluded that there is no multicollinearity

variables.

between the independent variables in the

In table 3 it can be seen that the model regression so that this regression

profitability variable (ROA) has a tolerance equation is feasible to use for further

value of 0.620 and a VIF value of 1.614. analysis.

The company size variable (SIZE) has a

tolerance value of 0.625 and a VIF value of

Table 3. Multicollinearity Test

4.3. Autocorrelation Test From the results of the autocorrelation test

in table 4.10 it is known that the Durbin

According to [12] in the Multivariate

Watson value in this regression model is

Analysis Application book with the IBM

2,247 with n = 30, k = 3, the value of dᵤ =

SPSS 23 Program that the autocorrelation

1,213 is obtained so that 4-dᵤ = 2.78. The

test is aimed at testing whether in a linear

value of d meets the criteria dᵤ < d < 4-dᵤ,

regression model there is a correlation

i.e. 1,213 < 2,247 < 2.78. It can be

between the error in the t period and the

concluded that the regression model of this

residual period t - 1 ( previous).

study is free from autocorrelation and can be

accepted.

Table 4. Autocorrelation Test

4.4. Heteroscedasticity Test

residuals of one observation to another. If

According to [11] in the Multivariate

the variance from one observation residual

Analysis Application book with the IBM

SPSS 23 Program that, heterokedasticity test to another observation is fixed, then it is

called homoscedasticity and if different is

aims to test whether in the regression model

called heteroscedasticity.

there is an inequality of variance from the

Published by: The Mattingley Publishing Co., Inc. 5

From the image that has been processed heteroscedasticity in the regression model,

in Figure 2, it appears that the points spread so that the regression model is feasible to

randomly and spread well above and below. use.

It can be concluded that there is no

Table 5. Heteroscedasticity Test

solvability that affect audit delay, while the

4.5. Determination of Coefficient

remaining 40, 8% is influenced by other

From the table above it can be seen that factors which prove that the independent

the value of R is 0.796, R Square 0.634 and variable on the dependent variable has a

Adjusted R2 is 0.592. R value of 0.796 weak influence. The closer to 0, which

proves that the independent variable on the means that shows the weak influence of

dependent variable has a strong influence independent variables (Profitability,

while the R Square value of 0.634 and the Company Size and Solvency) on the

adjusted R2 value of 0.592 or 59.2% is the dependent variable (Audit Delay).

result of profitability, company size and

Table 6. Determination of Coefficient

0.001. Also known is the value of table with

4.5. Partial Hypothesis

df = 26 of 2,055. This shows that the t-count

According to [11] the statistical test t is smaller than the table (3,956 > 2,055) so it

basically shows how far the influence of one can be concluded that profitability has a

explanatory / independent variable significant effect on audit delay.

individually in explaining the variation of

This can be interpreted that companies

the dependent variable.

that have a high level of profitability need

Based on table 7, it can be interpreted as faster time in auditing financial statements.

follows:

Companies that have a higher level of

1. Effect of Profitability on Audit Delay. profitability require time in auditing

From the table above it is known that the t financial statements more quickly because of

count is 3,956 and the significance value is the desire to deliver good news as soon as

Published by: The Mattingley Publishing Co., Inc. 6

possible to the public. They also give examination of the company's debt longer

reasons that auditors who face companies and thus slow down the audit reporting

that suffer losses tend to be more careful in process by the auditor.

conducting the auditing process. 3. Effect of Solvency on Audit Delay.

The results of this study are also From the table above it is known that the t

supported by [13] which shows that count is 4.081 and the significance value is

profitability significantly influences audit 0.000. Also known is the value of t table

delay. Profitability in investments and other with df = 26 of 2,055. This shows that t

financial actions is very important to obtain count is greater than table (4,081 > 2,055) so

the desired return even beyond the it can be concluded that solvency has a

expectations of users of financial statements. significant effect on audit delay. The high

Profitability in this study uses ROA, proportion of total liabilities to total assets

companies with high ROA means the may also make auditors need to increase

company has used its assets efficiently so caution and more careful audit in relation to

that it can generate high profits for the the survival of the company. According to

company and shareholders. [17] auditing a debt account will take a long

2. Effect of Company Size on Audit time because it has to find the source of the

Delay. high proportion of debt held by the company

From the table above it is known that the t and requires a lot of time in confirming

parties (debt holders) related to the

count is 0.452 and the significance value is

company.

0.655. Also known is the value of table with

df = 26 of 2,055. This shows that t count is Multiple linear regression equation for

greater than table (0.452 < 2.055) so it can this study, as follows:

be concluded that company size does not AD = 95.441 – 44.191 ROA – 0.110 SIZE

significantly influence audit delay. This is – 29.998 DAR + ℇ

because large companies are monitored by

investors, capital supervisors, and the The regression equation above can be

government so that there is a tendency to interpreted as follows:

reduce audit delay. In addition, the audit 1. Constants (α)

process becomes easy because large

companies have adequate internal control The coefficient value for the constant is

systems. 95.411. This constant value shows that if the

Profitability, Company Size and Solvency

The results of this study are in line with variables are 0, the Audit Delay dependent

[14], research conducted by [13] states that variable value is 95,411.

company size has no significant effect on

audit delay. But it is not in line with [15] 2. Profitability (ROA) of Audit Delay.

that company size has a significant effect on ROA coefficient value is -44,191. This

audit delay. This is because the larger the means that a 1% increase in the profitability

company, the company has a good internal variable then audit delay will decrease by -

control system so that it can reduce the error 44,191 assuming the other variables are

rate of financial statements, and then fixed.

facilitate the auditor in auditing the financial

statements. Although the results of this study 3. Company Size (SIZE) of Audit Delay.

are supported by [16] which shows that The coefficient value of SIZE is -0.110.

solvency has a significant effect on audit This means that an increase of 1% of the

delay. The level of the size of the debt company size variable then audit delay will

owned by the company will cause the decrease by -0.110 assuming the other

examination and reporting of the variables are fixed.

Published by: The Mattingley Publishing Co., Inc. 7

4. Solvency (DAR) of Audit Delay. variable then audit delay will decrease by -

29.998 assuming the other variables are

DAR coefficient value is -29,998. This

fixed.

means that an increase of 1% solvency

Table 6. T Test

Conclusion and Suggestion to explain more broadly which has

an influence on audit delay.

5.1. Conclusion

2. Companies

1. Profitability which is posited by ROA

has a significant effect on audit delay. This It is better to pay attention to the factors

is evidenced by the significance value in the that influence audit delay so that it can help

hypothesis test of 0.001 which is smaller the auditor's work by providing the data

than 0.05. needed to be on time.

2. Company size which is classified as 3. Auditor

SIZE has no significant effect on audit As input material to find out the factors

delay. This is evidenced by the significance that influence audit delays so that financial

value in the hypothesis test of 0.655 which is statements can be published as soon as

greater than 0.05. possible. In addition, help the public

3. Solvency which is posited by DAR has accounting profession in an effort to

a significant effect on audit delay. This is improve the efficiency and effectiveness of

evidenced by the significance value in the the audit process by controlling the

hypothesis test of 0,000 which is smaller dominant factors that cause audit delay.

than 0.05. 4. Investors

5.2. Suggestion Investors are advised to pay attention to

1. Academics the factors that influence audit delay in

making decisions to invest in a company

Based on the limitations stated above,

because companies with long audit delays

here are suggestions for future researchers:

tend to make dividend announcements more

a. Further research is suggested to be slowly than companies that have short audit

able to use other sector companies, delays.

such as manufacturing companies

listed on the IDX so that the research References

results can be generalized more.

b. Future studies, should extend the [1] M. A. Harjoto, I. Laksmana, and R. Lee,

research period, for example 5 years. “The impact of demographic

characteristics of CEOs and directors on

c. It is expected to be able to add or use audit fees and audit delay,” Manag.

other independent variables in order Audit. J., vol. 30, no. 8, pp. 963–997,

Published by: The Mattingley Publishing Co., Inc. 8

2015. accounting firms in Indonesia,” Eur. Res.

[2] J. L. Abernathy, M. Barnes, C. Stefaniak, Stud. J., vol. 20, no. 3, pp. 524–537,

and A. Weisbarth, “An International 2017.

Perspective on Audit Report Lag: A [12] I. Ghozali and L. Sulistyani, “Firm

Synthesis of the Literature and capabilities role as mediator of

Opportunities for Future Research,” Int. relationship between levers of control

J. Audit., vol. 21, no. 1, pp. 100–127, and firm performance (empirical study on

2017. financial institutions in Indonesia),” Inf.,

[3] I. Lawrence, A. Ph, and A. Elijah, 2016.

“Corporate Attributes and Audit Delay in [13] S. O. Super and N. C. Shil, “Effect of

Emerging Markets : Empirical Evidence Audit Delay on the Financial

from Nigeria,” Int. J. Bus. Soc. Res., vol. Statements,” Sumerianz J. Econ. Financ.,

05, no. 03, pp. 1–10, 2015. vol. 2, no. 4, pp. 37–43, 2019.

[4] M. M. Alfraih, “Corporate governance [14] T. A. Lambert, K. L. Jones, J. F. Brazel,

mechanisms and audit delay in a joint and D. S. Showalter, “Audit time

audit regulation,” J. Financ. Regul. pressure and earnings quality: An

Compliance, vol. 24, no. 3, pp. 292–316, examination of accelerated filings,”

2016. Accounting, Organ. Soc., vol. 58, pp. 50–

[5] Y. M. Hassan, “Determinants of audit 66, 2017.

report lag: evidence from Palestine,” J. [15] D. H. Caplan, S. K. Dutta, and D. J.

Account. Emerg. Econ., vol. 6, no. 1, pp. Marcinko, “Unmasking the fraud at

13–32, 2016. toshiba,” Issues Account. Educ., 2019.

[6] B. Sarita, G. Zandi, and A. Shahabi, [16] I. L. Ayemere and A. Elijah, “Corporate

“Determinants of Performance in Attributes and Audit Delay in Emerging

Indonesian Banking: a Cross-Sectional Markets : Empirical Evidence from

and Dynamic Panel Data Analysis,” Int. Nigeria,” Int. J. Bus. Soc. Res., 2015.

J. Econ. Financ. Stud. Int. J. Econ. [17] A. Zorn, M. Esteves, I. Baur, and M.

Financ. Stud., vol. 4, no. 2, pp. 1309– Lips, “Financial ratios as indicators of

8055, 2012. economic sustainability: A quantitative

[7] H. Wahba, “Debt and financial analysis for Swiss dairy farms,” Sustain.,

performance of smes: The missing role of vol. 10, no. 8, 2018.

debt maturity structure,” Corp. Ownersh.

Control, vol. 10, no. 3 D,CONT3, pp.

266–277, 2013.

[8] K. B. Prempeh, A. M. Sekyere, and E. N.

Asare, “The Effect of Debt Policy on

Firms ’ Performance : Empiri cal

Evidence from Listed Manufacturing

Companies on the Ghana Stock

Exchange,” vol. 7, no. 6, pp. 70–77,

2016.

[9] B. L. Handoko, H. H. Muljo, and A. S. L.

Lindawati, “The effect of company size,

liquidity, profitability, solvability, and

audit firm size on audit delay,” Int. J.

Recent Technol. Eng., 2019.

[10] Y.-C. Wang, H. W. Huang, J.-R. Chiou,

and Y. C. Huang, “The effects of

industry expertise on cost of debt : an

individual auditor-level analysis,” Asian

Rev. Account., 2017.

[11] Y. Sunyoto, I. Ghozali, and A. Purwanto,

“Analysis of auditor performance by

using covariance based structural

equation modeling: A study of public

Published by: The Mattingley Publishing Co., Inc. 9

You might also like

- ISO 22301: 2019 - An introduction to a business continuity management system (BCMS)From EverandISO 22301: 2019 - An introduction to a business continuity management system (BCMS)Rating: 4 out of 5 stars4/5 (1)

- Recent Trends in Finance Reporting The IndependentDocument26 pagesRecent Trends in Finance Reporting The Independentamolmarathe19860% (2)

- Introduction To Financial Statements 1Document22 pagesIntroduction To Financial Statements 1Sarbani Mishra100% (1)

- Quantitative Analysis of Market Data A PrimerDocument43 pagesQuantitative Analysis of Market Data A Primergato444100% (2)

- Artikel Internasional 2Document9 pagesArtikel Internasional 2Rachmat HDNo ratings yet

- The Effect of Earning Management, Profitability, and Firm Sizeon Audited Financial Statement TimelinessDocument11 pagesThe Effect of Earning Management, Profitability, and Firm Sizeon Audited Financial Statement TimelinessAnonymous izrFWiQNo ratings yet

- Running Head: ACCOUNTINGDocument5 pagesRunning Head: ACCOUNTINGKashémNo ratings yet

- The Effect of Book-Tax Diffferences, Cash Flow Volatility, and Corporate Governance On Earning QualityDocument10 pagesThe Effect of Book-Tax Diffferences, Cash Flow Volatility, and Corporate Governance On Earning QualityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- (Ferdayani Et Al., 2019 Bab 2Document6 pages(Ferdayani Et Al., 2019 Bab 2Larasati WahyudiputriNo ratings yet

- Financial Restatement Research Literature ReviewDocument12 pagesFinancial Restatement Research Literature ReviewdiahNo ratings yet

- The Five-Minute Read # 6 - Introduction To Financial Statements Sep 22Document3 pagesThe Five-Minute Read # 6 - Introduction To Financial Statements Sep 22navyaNo ratings yet

- Moderasi 7Document7 pagesModerasi 7afifahnurw05No ratings yet

- Does Ownership Characteristics Have Any Impact On Audit Report Lag? Evidence of Malaysian Listed CompaniesDocument13 pagesDoes Ownership Characteristics Have Any Impact On Audit Report Lag? Evidence of Malaysian Listed CompaniesahmadhidrNo ratings yet

- 6093 17799 1 PBDocument13 pages6093 17799 1 PBkiyutNo ratings yet

- Audit Assurance Assignment Going Concern HighlightedDocument15 pagesAudit Assurance Assignment Going Concern HighlightedAbdullah YousufNo ratings yet

- Vhurinosara Tapiwanashe A BS Assignment 1Document8 pagesVhurinosara Tapiwanashe A BS Assignment 1Victor HoveNo ratings yet

- Chapter 1 AccDocument6 pagesChapter 1 AccMarta Fdez-FournierNo ratings yet

- Faktor Determinan Audit Report Lag Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia Tahun 2017-2019Document10 pagesFaktor Determinan Audit Report Lag Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia Tahun 2017-2019DesyNo ratings yet

- Classification and Factors Influencing Accounting SystemsDocument7 pagesClassification and Factors Influencing Accounting SystemsAreebaNo ratings yet

- Working Capital at Zuari Cement: Working Capital Management Is One of The Key Areas of Financial DecisionDocument5 pagesWorking Capital at Zuari Cement: Working Capital Management Is One of The Key Areas of Financial DecisionVardhan BujjiNo ratings yet

- Bkar3033 A221 Assignment 5Document5 pagesBkar3033 A221 Assignment 5Patricia TangNo ratings yet

- CARO 2020 strengthens financial reportingDocument4 pagesCARO 2020 strengthens financial reportingakshali raneNo ratings yet

- The Effect of Auditor Reputation, Prior Audit Opinion, Company Growth, Leverage and Liquidity On The Going Concern Audit Opinion Acceptance With Audit Switching As Moderating VariableDocument9 pagesThe Effect of Auditor Reputation, Prior Audit Opinion, Company Growth, Leverage and Liquidity On The Going Concern Audit Opinion Acceptance With Audit Switching As Moderating VariableInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Burget Paints Financial Report Summary and InsightsDocument5 pagesBurget Paints Financial Report Summary and InsightscoolNo ratings yet

- Class NotesDocument3 pagesClass NotesLeslie TaperaNo ratings yet

- Determinant Factors Audit Delay: Evidence From IndonesiaDocument8 pagesDeterminant Factors Audit Delay: Evidence From IndonesiaAsty AstitiNo ratings yet

- Acc7102e Individual Assignment Lum Ja Son - PBS22105070Document9 pagesAcc7102e Individual Assignment Lum Ja Son - PBS22105070JasonNo ratings yet

- Jurnal Internasional Audit Delay5Document7 pagesJurnal Internasional Audit Delay5Ikhsan Uiandra Putra SitorusNo ratings yet

- 74928bos60524 cp15Document54 pages74928bos60524 cp15Kishan JainNo ratings yet

- Textual Learning Material - Module 2Document34 pagesTextual Learning Material - Module 2Jerry JohnNo ratings yet

- Denny Novi Satria, Syahril Ali, Denny Yohana: Faculty of Economics Andalas University Padang, West Sumatera, IndonesiaDocument8 pagesDenny Novi Satria, Syahril Ali, Denny Yohana: Faculty of Economics Andalas University Padang, West Sumatera, IndonesiaKarina AprilliaNo ratings yet

- Factors Influencing Auditor Switching and Timeliness of Audit CompletionDocument16 pagesFactors Influencing Auditor Switching and Timeliness of Audit CompletionAlifah KurniaNo ratings yet

- Analysis of Financial Statements: After Studying This Chapter, You Would Be Able ToDocument26 pagesAnalysis of Financial Statements: After Studying This Chapter, You Would Be Able ToKumar PoudelNo ratings yet

- The COVID-19 pandemic will have a significant impact on Financial Reporting for companies around the world. Discuss the validity of this statement with reference to specific areas of the financial statementsDocument6 pagesThe COVID-19 pandemic will have a significant impact on Financial Reporting for companies around the world. Discuss the validity of this statement with reference to specific areas of the financial statementsMaria GeorgiouNo ratings yet

- 2560 10567 1 PBDocument14 pages2560 10567 1 PBBumi TerbalikNo ratings yet

- Innovation and Entrepreneurship Competition DraftDocument28 pagesInnovation and Entrepreneurship Competition DraftIsfundiyerTaungaNo ratings yet

- Q1. The Following Information of A Company Is Given To YouDocument5 pagesQ1. The Following Information of A Company Is Given To YouAman RastogiNo ratings yet

- Finance Effectiveness Benchmark 2017Document72 pagesFinance Effectiveness Benchmark 2017aditya mishraNo ratings yet

- 1832 3299 1 SMDocument11 pages1832 3299 1 SMSone VipgdNo ratings yet

- Corporate Reporting Practices in IndiaDocument25 pagesCorporate Reporting Practices in IndiaClary Dsilva67% (3)

- Report Cycle. 3Document28 pagesReport Cycle. 3Akimanzi GloriaNo ratings yet

- Analysis of Financial Statements: After Studying This Chapter, You Would Be Able ToDocument52 pagesAnalysis of Financial Statements: After Studying This Chapter, You Would Be Able ToDheeraj Turpunati100% (1)

- FMPR 2 - Lesson 2Document12 pagesFMPR 2 - Lesson 2jannypagalanNo ratings yet

- Chapter 2 - Fabm 1 PDFDocument18 pagesChapter 2 - Fabm 1 PDFAmalthyuhNo ratings yet

- New Standards in Revenue RecognitionDocument5 pagesNew Standards in Revenue RecognitionSantosh NathanNo ratings yet

- 489 - Assignment 01 Front Sheet - Fall2020Document11 pages489 - Assignment 01 Front Sheet - Fall2020Bảo NhưNo ratings yet

- Understanding A Financial Statement AuditDocument16 pagesUnderstanding A Financial Statement AuditHarshvardhan Singh ThakurNo ratings yet

- Dragos Revnic Financial AccountingDocument17 pagesDragos Revnic Financial AccountingDragosNo ratings yet

- 2 PBDocument14 pages2 PBDiana Mega PratiwiNo ratings yet

- INTERNSHIP REPORT ManishDocument108 pagesINTERNSHIP REPORT ManishPiyush GehlotNo ratings yet

- Impact of Implementation of IFRS 15 On The Financial Statements of Telecommunication Company (Case Study of PT XYZ)Document8 pagesImpact of Implementation of IFRS 15 On The Financial Statements of Telecommunication Company (Case Study of PT XYZ)Roy MarquezNo ratings yet

- Company's Financial Performance Analysis at Pt. Ultrajaya Milk Industry, TBK Which Are Listed On The Indonesian Stock ExchangeDocument12 pagesCompany's Financial Performance Analysis at Pt. Ultrajaya Milk Industry, TBK Which Are Listed On The Indonesian Stock ExchangeInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Chapter 1Document11 pagesChapter 1ChangNo ratings yet

- The Effect of Conflict Agency, Leverage, and Political Cost On Creative AccountingDocument7 pagesThe Effect of Conflict Agency, Leverage, and Political Cost On Creative AccountingEditor IJTSRDNo ratings yet

- Financial Information For Business DecisionDocument9 pagesFinancial Information For Business DecisionMohamed FAVAZIL pulloorsangattilNo ratings yet

- Module 3 Topic 3 in Cooperative ManagementDocument34 pagesModule 3 Topic 3 in Cooperative Managementharon franciscoNo ratings yet

- Assessment Ii,,,,prince's GroupDocument14 pagesAssessment Ii,,,,prince's GroupTafadzwaNo ratings yet

- Sme Listing: BSE Publication, 2 Edition, Dec 2011Document4 pagesSme Listing: BSE Publication, 2 Edition, Dec 2011Ismael GrayNo ratings yet

- Branches of Accounting and Users of Accounting InformationDocument5 pagesBranches of Accounting and Users of Accounting InformationSirvie FersifaeNo ratings yet

- Sip Report AuditDocument23 pagesSip Report AuditDhiraj singhNo ratings yet

- Revised AccountingDocument46 pagesRevised AccountingAli NasarNo ratings yet

- IJIET - International Journal PaperDocument4 pagesIJIET - International Journal PaperjokoNo ratings yet

- Taxonomy BloomDocument1 pageTaxonomy BloomjokoNo ratings yet

- PawelDocument20 pagesPaweljokoNo ratings yet

- Internal Control System On Fraud Detection: Nigeria ExperienceDocument12 pagesInternal Control System On Fraud Detection: Nigeria ExperiencejokoNo ratings yet

- en Strategy and Management Control System IDocument12 pagesen Strategy and Management Control System IFerri FatraNo ratings yet

- (1734039X - Financial Internet Quarterly) The Role of A Company's Internal Control System in Fraud PreventionDocument11 pages(1734039X - Financial Internet Quarterly) The Role of A Company's Internal Control System in Fraud PreventionjokoNo ratings yet

- A Critique of Miller and Rohling's Statistical Interpretive Method For Neuropsychological Test DataDocument5 pagesA Critique of Miller and Rohling's Statistical Interpretive Method For Neuropsychological Test DatacutkilerNo ratings yet

- Brief Lecture Notes On Simple Linear Regression Regression AnalysisDocument8 pagesBrief Lecture Notes On Simple Linear Regression Regression AnalysisMaliha FarzanaNo ratings yet

- 10-701/15-781 Machine Learning - Midterm Exam, Fall 2010: Aarti Singh Carnegie Mellon UniversityDocument16 pages10-701/15-781 Machine Learning - Midterm Exam, Fall 2010: Aarti Singh Carnegie Mellon UniversityMahi SNo ratings yet

- Apa TablesDocument2 pagesApa TablesAlexandra ChisNo ratings yet

- PCM (8) Test For Significance (Dr. Tante)Document151 pagesPCM (8) Test For Significance (Dr. Tante)Kris TejereroNo ratings yet

- Lesson 2.3 Standard Normal Curve and Z ScoresDocument18 pagesLesson 2.3 Standard Normal Curve and Z ScoresKlarence Timothy Pineda BundangNo ratings yet

- TRIAL STPM Mathematics M Kepong BaruDocument14 pagesTRIAL STPM Mathematics M Kepong BaruSK100% (1)

- Six Sigma KPMGDocument36 pagesSix Sigma KPMGMSP 003No ratings yet

- Tech - Speed Strength Endurance in 400Document7 pagesTech - Speed Strength Endurance in 400jeyNo ratings yet

- Dissolution ProfileDocument14 pagesDissolution ProfileShazia ArshadNo ratings yet

- Predicting Article Retweets and Likes Based On The Title Using Machine LearningDocument10 pagesPredicting Article Retweets and Likes Based On The Title Using Machine LearningQiscusNewsNo ratings yet

- A Guide to Statistical Methods for Hydrology AnalysisDocument27 pagesA Guide to Statistical Methods for Hydrology AnalysisJohn E Cutipa LNo ratings yet

- 00 Malhotra Mr7e Im TocDocument3 pages00 Malhotra Mr7e Im TocFatima Abboud0% (1)

- Steps 1-10 Constructing a Frequency Distribution TableDocument7 pagesSteps 1-10 Constructing a Frequency Distribution Tabledreample1003No ratings yet

- Marger Pengetahuan (Kurang+Cukup Baik) PerilakuDocument5 pagesMarger Pengetahuan (Kurang+Cukup Baik) PerilakuSang Aji Widi AneswaraNo ratings yet

- Econ 491: Econometrics Stock and WatsonDocument63 pagesEcon 491: Econometrics Stock and WatsonEdith KuaNo ratings yet

- Normality Test Results for Support Score DataDocument2 pagesNormality Test Results for Support Score DataMaulia HindunNo ratings yet

- Bangalao, June Roden E. Machine Design 1 Bsmesep-T-4B-T JUNE 30, 2022Document3 pagesBangalao, June Roden E. Machine Design 1 Bsmesep-T-4B-T JUNE 30, 2022juneroden bangalaoNo ratings yet

- STK 310 Multicollinearity Class Test MEMODocument3 pagesSTK 310 Multicollinearity Class Test MEMOThane SnymanNo ratings yet

- Stimulation of Testosterone Production PMSG Injection OvineDocument12 pagesStimulation of Testosterone Production PMSG Injection OvineLuis PeiroNo ratings yet

- Descriptive statistics and correlation of rainfall and umbrella sales dataDocument4 pagesDescriptive statistics and correlation of rainfall and umbrella sales dataAbdul SamadNo ratings yet

- Measures of VariabilityDocument46 pagesMeasures of VariabilityMelqui MagcalingNo ratings yet

- S1 Regression Past Paper QuestionsDocument9 pagesS1 Regression Past Paper QuestionsDEVAK ANAND YAGNIK-02306No ratings yet

- Tests of Hypotheses on Population Mean and ProportionDocument1 pageTests of Hypotheses on Population Mean and Proportionedward john calub llNo ratings yet

- File 3Document7 pagesFile 3NIK ADNIN AIN BINTI NIK KAMAL KTNNo ratings yet

- Habyarimana Faustin 2016Document232 pagesHabyarimana Faustin 2016Tesfaye Teferi ShoneNo ratings yet

- Metric Tolerance ChartDocument6 pagesMetric Tolerance ChartVinoth Sang100% (1)

- Chapter 10: Multicollinearity Chapter 10: Multicollinearity: Iris WangDocument56 pagesChapter 10: Multicollinearity Chapter 10: Multicollinearity: Iris WangОлена БогданюкNo ratings yet

- TUGAS ARS 105 SESI 10 Statistic AnalysisDocument18 pagesTUGAS ARS 105 SESI 10 Statistic AnalysisTiara Widyastuti100% (1)