Professional Documents

Culture Documents

Challan MTR Form Number-6: Branch Teller: Use SCR 008765 Deposit Fee Collection State Bank Collect

Uploaded by

Gabbar SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Challan MTR Form Number-6: Branch Teller: Use SCR 008765 Deposit Fee Collection State Bank Collect

Uploaded by

Gabbar SinghCopyright:

Available Formats

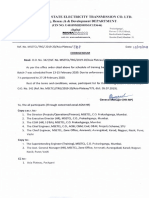

CHALLAN

MTR Form Number-6

(See Rule 11, 11C, 17, 20, 22(4) and 27B of the Professions Tax Rules, 1975)

Account Head 00280012

GRN MH0 11445451 201819M BARCODE Date 02/02/2019-17:42:08 Form ID IIIB

Department Commissioner of Sales Tax Payer Details

Profession Tax - PTRC TAX ID (If Any) 27525233685P

Type of Payment Maharashtra Profession Tax PTRC

PAN No.(If Applicable) NGPT01081D

Office Name Sales Tax Office NAGPUR Full Name EX ENG TESTING DIVISION MSETCL NAG

Location NAGPUR

Year 2018-2019 From 01/04/2018 To 31/03/2019 Flat/Block No.

Account Head Details Amount In Rs. Premises/Building

ADVANCE PAYMENT 7000.00 Road/Street

Area/Locality

Town/City/District

PIN

Remarks (If Any)

IIIB

Amount In Seven Thousand Rupees Only

Total 7,000.00 Words

Payment Details STATE BANK OF INDIA FOR USE IN RECEIVING BANK

Cheque-DD Details Bank CIN Ref. No. CPN0773584

Cheque/DD No. Bank Date RBI Date Not Verified with RBI

Name of Bank Bank-Branch STATE BANK OF INDIA

Name of Branch Scroll No. , Date

Department ID : URN10004348781TR Mobile No. : 7304157676

-------------Cut Here---------------------------------------------------------------------Cut Here---------------------------------------------------------------------Cut Here --------------

State Bank Collect Pre Acknowledgment Payment (PAP) Form for Payment through any SBI Branch Branch Copy

Branch Teller: Use SCR 008765 Deposit >Fee Collection>State Bank Collect

Beneficiary/Remittance Details Mode of Payment Cash Cheque/DD

State Bank MOPS Reference No. : CPN0773584 Cash Notes Amount Rs Paise

Beneficiary MAHARASHTRA GOVT (GRAS) 2000 x

GRN MH011445451201819M 500 x

Full Name EX ENG TESTING DIVISION MSETCL NAG 200 x

Amount 7,000 Seven Thousand Rupees Only 100 x

50 x

Cheque/DD No. 20 x

Cheque/DD Date 10 x

Drawee Bank

Drawee Branch Total Rs

Branch Stamp Signature of Depositor

Page 1/1 Print Date 02-02-2019 05:42:35

You might also like

- Screw The Note, Show Me The Loan! (The Nuclear Option)Document8 pagesScrew The Note, Show Me The Loan! (The Nuclear Option)Cairo Anubiss0% (1)

- Direct Deposit FormDocument2 pagesDirect Deposit FormCamiloNo ratings yet

- Mushtaq & IshfaqDocument1 pageMushtaq & IshfaqAʌĸʌsʜ AƴʌŋNo ratings yet

- Chapter 5 Core Banking SystemsDocument73 pagesChapter 5 Core Banking SystemsbiswajitNo ratings yet

- Albenson v. CADocument2 pagesAlbenson v. CAFrancis Xavier Sinon100% (3)

- Monirul, BangladeshDocument27 pagesMonirul, Bangladeshmoney_shallNo ratings yet

- Crim 2 - Title 10 DigestsDocument13 pagesCrim 2 - Title 10 Digestsscribdacct123No ratings yet

- IHRMDocument233 pagesIHRMAmit Khundia100% (1)

- 1617 1stS MX NBergonia RevDocument10 pages1617 1stS MX NBergonia RevLex Daquis100% (1)

- Challan MTR Form Number-6: Branch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectDocument1 pageChallan MTR Form Number-6: Branch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectMANOJNo ratings yet

- Ech All An MH 009741476202223 MDocument1 pageEch All An MH 009741476202223 MManish GaikwadNo ratings yet

- Echallan MH003486510202324 MDocument1 pageEchallan MH003486510202324 MDVET IndiaNo ratings yet

- FRM Epay Echallan PrintDocument1 pageFRM Epay Echallan PrintSanket PatelNo ratings yet

- Challan TR Form - 5 (A) : PAN No. (If Applicable)Document1 pageChallan TR Form - 5 (A) : PAN No. (If Applicable)26SarnokbeTeronNo ratings yet

- Index 2Document1 pageIndex 2ashishtambe40No ratings yet

- Challan ReceiptDocument1 pageChallan Receiptashishtambe40No ratings yet

- Echallan MH011121023202223 EDocument1 pageEchallan MH011121023202223 Erupesh jadhavNo ratings yet

- Gandhi PDFDocument1 pageGandhi PDFOmkar GuravNo ratings yet

- Echallan MH008155384202324 EDocument1 pageEchallan MH008155384202324 EA.S. ENTERPRISESNo ratings yet

- Challan MTR Form Number-6: PAN No. (If Applicable)Document1 pageChallan MTR Form Number-6: PAN No. (If Applicable)suttamanNo ratings yet

- Ech All An MH 009907744201819 PDocument1 pageEch All An MH 009907744201819 Pmd amin sameerNo ratings yet

- Challan MTR Form Number-6Document1 pageChallan MTR Form Number-6Shankey JAlanNo ratings yet

- Echallan MH010490649202223 EDocument1 pageEchallan MH010490649202223 EPramod PawarNo ratings yet

- MR Pravin WaghelaDocument1 pageMR Pravin WaghelaAtul KhadkeNo ratings yet

- Echallan MH010219447202223 EDocument1 pageEchallan MH010219447202223 EPramod PawarNo ratings yet

- E Challan MH014204013202021 PDocument1 pageE Challan MH014204013202021 PNikit ShahNo ratings yet

- Ech All An MH 007568993202223 PDocument1 pageEch All An MH 007568993202223 PIrshad KureshiNo ratings yet

- Ech All An MH 007075329201819 PDocument1 pageEch All An MH 007075329201819 PSharadBharatBagalNo ratings yet

- CHALANDocument1 pageCHALANkalpeshNo ratings yet

- Challan MTR Form Number-6Document1 pageChallan MTR Form Number-6Shankey JAlanNo ratings yet

- Westin Spaces - Stamp Duty - 1-1Document1 pageWestin Spaces - Stamp Duty - 1-1Amit SinghNo ratings yet

- Echallan MH018269422202324 UDocument1 pageEchallan MH018269422202324 UKiranNo ratings yet

- Olccs 6Document1 pageOlccs 6Rahul ShahNo ratings yet

- Flat No - 1801 - EchallanMH012851127202324EDocument1 pageFlat No - 1801 - EchallanMH012851127202324EanobleinfraprojectNo ratings yet

- Echallan MH000503223202324 EDocument1 pageEchallan MH000503223202324 Eankit trivediNo ratings yet

- 2010 0 0 0 46700 SGST (0006)Document2 pages2010 0 0 0 46700 SGST (0006)mohammad TabishNo ratings yet

- Challan 900 (08-03-2018)Document1 pageChallan 900 (08-03-2018)Shankey JAlanNo ratings yet

- EchallanMH005137814202324E Khetaram SutarDocument1 pageEchallanMH005137814202324E Khetaram SutarE SEVA KENDRA VISHRANTWADINo ratings yet

- Echallan MH007019260202021 EDocument1 pageEchallan MH007019260202021 EKasturi XeroxNo ratings yet

- Ech All An MH 000677700201920 eDocument1 pageEch All An MH 000677700201920 eHARSHAL MITTALNo ratings yet

- Sai GST ChallanDocument2 pagesSai GST ChallanAditya SinhaNo ratings yet

- Ech All An MH 004527253201920 eDocument1 pageEch All An MH 004527253201920 eHARSHAL MITTALNo ratings yet

- Ech All An MH 007620673202223 eDocument1 pageEch All An MH 007620673202223 ePramod PawarNo ratings yet

- Pay ChalanDocument1 pagePay ChalanSDO BUxar50% (2)

- 0 0 0 0 19834 SGST (0006)Document2 pages0 0 0 0 19834 SGST (0006)Mukesh KumarNo ratings yet

- GST ChallanDocument2 pagesGST ChallanSaravanan DevasagayamNo ratings yet

- Income Tax Payment Challan: PSID #: 47684385Document1 pageIncome Tax Payment Challan: PSID #: 47684385gandapur khanNo ratings yet

- 0 0 0 0 0 0 SGST (0006)Document2 pages0 0 0 0 0 0 SGST (0006)Shrutisagar PaniNo ratings yet

- Amount: Hundred: FRWN@ EDocument1 pageAmount: Hundred: FRWN@ EKaushal king WriterNo ratings yet

- GST - Payment ChallanDocument2 pagesGST - Payment ChallanPatel SumitNo ratings yet

- Challan Description in MaharastraDocument1 pageChallan Description in MaharastraOmkar KhadilkarNo ratings yet

- Varale ChallanDocument1 pageVarale ChallanPramod PawarNo ratings yet

- It 000141614736 2022 00Document1 pageIt 000141614736 2022 00Shahbaz MuhammadNo ratings yet

- EchallanMH011053749202223M PDFDocument1 pageEchallanMH011053749202223M PDFAniket BhalekarNo ratings yet

- 0 0 500 0 23237 SGST (0006)Document2 pages0 0 500 0 23237 SGST (0006)RAm kumarNo ratings yet

- It 000096024377 2017 00Document1 pageIt 000096024377 2017 00Haroon ButtNo ratings yet

- Echallan MH011056668202223 MDocument1 pageEchallan MH011056668202223 MAniket BhalekarNo ratings yet

- 13 01 2022 Both 293800 Deepak Inamake Rtgs BobDocument1 page13 01 2022 Both 293800 Deepak Inamake Rtgs BobSmita BuchakeNo ratings yet

- GST-CHALLAN (13) KPDocument2 pagesGST-CHALLAN (13) KPacpandey.lawfirmNo ratings yet

- It 000016485106 2011 00Document1 pageIt 000016485106 2011 00AMMAR REHMANINo ratings yet

- GST Challan PDFDocument2 pagesGST Challan PDFAnkit SinghNo ratings yet

- Ech All An MH 008032533202223 eDocument1 pageEch All An MH 008032533202223 ePramod PawarNo ratings yet

- Gst-ChallanDocument2 pagesGst-Challandeepak kumarNo ratings yet

- GST ChallanDocument2 pagesGST Challanvk6541803No ratings yet

- GST Challan PDFDocument2 pagesGST Challan PDFNishi GuptaNo ratings yet

- 3879 0 0 0 0 3879 SGST (0006)Document2 pages3879 0 0 0 0 3879 SGST (0006)Nishi GuptaNo ratings yet

- Income Tax Payment Challan: PSID #: 146916470Document1 pageIncome Tax Payment Challan: PSID #: 146916470Madiah abcNo ratings yet

- BlkTrg-OFFICE ORDER NO. 342 Asia Plateau PDFDocument59 pagesBlkTrg-OFFICE ORDER NO. 342 Asia Plateau PDFGabbar SinghNo ratings yet

- Sport Selected ListDocument9 pagesSport Selected ListGabbar SinghNo ratings yet

- Guidelinespractexam 109atsaittDocument4 pagesGuidelinespractexam 109atsaittGabbar SinghNo ratings yet

- Minister Address and Contact NoDocument6 pagesMinister Address and Contact NoGabbar SinghNo ratings yet

- Billing History: Maharashtra State Electricity Distribution Co - LTDDocument2 pagesBilling History: Maharashtra State Electricity Distribution Co - LTDGabbar SinghNo ratings yet

- Ticket Printer - CleartripDocument1 pageTicket Printer - CleartripGabbar SinghNo ratings yet

- Lab CostDocument2 pagesLab CostGabbar SinghNo ratings yet

- And Mock Test Etc. For CTS, ATS and CITS Schemes of DGTDocument1 pageAnd Mock Test Etc. For CTS, ATS and CITS Schemes of DGTGabbar SinghNo ratings yet

- (See Rule 11, 11E) Electronic Return Under The Maharashtra State Tax On Professions, Trades, Callings and Employments Act, 1975Document3 pages(See Rule 11, 11E) Electronic Return Under The Maharashtra State Tax On Professions, Trades, Callings and Employments Act, 1975Gabbar SinghNo ratings yet

- Various GO & Its Pay ScalesDocument2 pagesVarious GO & Its Pay ScalesGabbar SinghNo ratings yet

- April PDFDocument1 pageApril PDFVallabh UtpatNo ratings yet

- ReambbmbdmeDocument1 pageReambbmbdmeNibedanPalNo ratings yet

- IncentiveDocument1 pageIncentiveGabbar SinghNo ratings yet

- Various GO & Its Pay ScalesDocument2 pagesVarious GO & Its Pay ScalesGabbar SinghNo ratings yet

- Hrmiv GHRP PDFDocument189 pagesHrmiv GHRP PDFVs SivaramanNo ratings yet

- Question and Syllabus Global HRDocument2 pagesQuestion and Syllabus Global HRGabbar SinghNo ratings yet

- Unit I PDFDocument8 pagesUnit I PDFSimpyNo ratings yet

- A Brief Notes On Contract Labour (R&A) ACT, 1970 & RULES: Composed byDocument12 pagesA Brief Notes On Contract Labour (R&A) ACT, 1970 & RULES: Composed byGabbar SinghNo ratings yet

- Chapter 14Document26 pagesChapter 14Baptist KastinNo ratings yet

- Case Query - Details - High Court of BombayDocument1 pageCase Query - Details - High Court of BombayGabbar SinghNo ratings yet

- New Text DocumentDocument1 pageNew Text DocumentGabbar SinghNo ratings yet

- Marathi LetterDocument1 pageMarathi LetterGabbar SinghNo ratings yet

- New Hampshire LLC Certificate of FormationDocument5 pagesNew Hampshire LLC Certificate of FormationRocketLawyerNo ratings yet

- 22111075Document5 pages22111075Archana SinghNo ratings yet

- NBP DataDocument62 pagesNBP DataIdrees IlyasNo ratings yet

- Establish and Maintain Cash Based Accounting SystemDocument31 pagesEstablish and Maintain Cash Based Accounting SystemTegene Tesfaye100% (1)

- CBI Net BankingDocument1 pageCBI Net BankingSkand SrivastavaNo ratings yet

- Current AccountsDocument21 pagesCurrent AccountsSupriyo SenNo ratings yet

- Software Architecture ATM ExampleDocument3 pagesSoftware Architecture ATM ExampleOswald_Alving100% (1)

- Part - A - Acedamic 125 CRDocument100 pagesPart - A - Acedamic 125 CRRanjan SinghNo ratings yet

- Internship Report of TuhinDocument75 pagesInternship Report of Tuhinratul JiaNo ratings yet

- I 8802Document13 pagesI 8802ccshanNo ratings yet

- Domestic Cotton Selling Terms & ConditionDocument2 pagesDomestic Cotton Selling Terms & Conditioncottontrade100% (1)

- Bank Credit Card Usage Behavior of Individuals Are Credit Cards Considered As Status Symbols or Are They Really Threats To Consumers Budgets? A Field Study From Eskisehir, TurkeyDocument23 pagesBank Credit Card Usage Behavior of Individuals Are Credit Cards Considered As Status Symbols or Are They Really Threats To Consumers Budgets? A Field Study From Eskisehir, TurkeyMd Sakawat HossainNo ratings yet

- Campos Vs PeopleDocument3 pagesCampos Vs PeoplePinky de GuiaNo ratings yet

- Control of Cash and Credit: Cash Control - Cash Control Involves All The Transactions Which The Guest Makes inDocument14 pagesControl of Cash and Credit: Cash Control - Cash Control Involves All The Transactions Which The Guest Makes inAryan BishtNo ratings yet

- A Study On Consumer Awareness and Adoption of Green Banking PractisesDocument67 pagesA Study On Consumer Awareness and Adoption of Green Banking PractisesArdra SabuNo ratings yet

- Banking Theory Law and Practice: Assistant Professor in Commerce, Pavendar Bharathidasan College of Arts and ScienceDocument34 pagesBanking Theory Law and Practice: Assistant Professor in Commerce, Pavendar Bharathidasan College of Arts and SciencePriyanka PrNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument28 pagesInstructions / Checklist For Filling KYC Formvishnu ksNo ratings yet

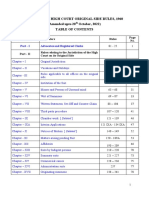

- BHC Original Side Rules, 1960Document661 pagesBHC Original Side Rules, 1960Hamza LakdawalaNo ratings yet

- Prepayment of Your Personal Loan Account:XXXXXXXXXXXX4785Document2 pagesPrepayment of Your Personal Loan Account:XXXXXXXXXXXX4785Daniel GnanaselvamNo ratings yet

- CBP Circular Letter 580-89Document4 pagesCBP Circular Letter 580-89Joben OdulioNo ratings yet

- School PoliciesDocument39 pagesSchool Policiesmaisie RameetseNo ratings yet

- Advance Premium Facility v09012014 PDFDocument42 pagesAdvance Premium Facility v09012014 PDFJeffrey Tan Jian ShengNo ratings yet