Professional Documents

Culture Documents

Revision Assignment On Economics

Revision Assignment On Economics

Uploaded by

Alviya Fatima0 ratings0% found this document useful (0 votes)

20 views2 pagesThe document contains a revision assignment covering various economic concepts. It includes 12 questions asking students to:

1) Define key terms related to taxation and government budgets.

2) List aims of taxation and identify the nature and amounts of taxes paid based on income levels.

3) Analyze the impact of factors on labor supply and demand curves.

4) Identify whether expenditures are revenue or capital in nature.

5) Identify the types of taxes applicable to different sources of income and activities.

6) Discuss the impact of interest rates on housing loans and factors influencing savings.

7) Calculate average propensity to consume and average propensity to save values.

8

Original Description:

Original Title

revision assignment on Economics

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains a revision assignment covering various economic concepts. It includes 12 questions asking students to:

1) Define key terms related to taxation and government budgets.

2) List aims of taxation and identify the nature and amounts of taxes paid based on income levels.

3) Analyze the impact of factors on labor supply and demand curves.

4) Identify whether expenditures are revenue or capital in nature.

5) Identify the types of taxes applicable to different sources of income and activities.

6) Discuss the impact of interest rates on housing loans and factors influencing savings.

7) Calculate average propensity to consume and average propensity to save values.

8

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views2 pagesRevision Assignment On Economics

Revision Assignment On Economics

Uploaded by

Alviya FatimaThe document contains a revision assignment covering various economic concepts. It includes 12 questions asking students to:

1) Define key terms related to taxation and government budgets.

2) List aims of taxation and identify the nature and amounts of taxes paid based on income levels.

3) Analyze the impact of factors on labor supply and demand curves.

4) Identify whether expenditures are revenue or capital in nature.

5) Identify the types of taxes applicable to different sources of income and activities.

6) Discuss the impact of interest rates on housing loans and factors influencing savings.

7) Calculate average propensity to consume and average propensity to save values.

8

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

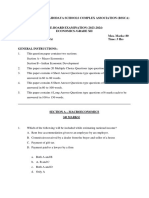

Revision Assignment

1. Define the terms: 3 marks

A.Tax evasion b.Budget Deficit c.Direct taxes

2. List 4 aims of taxation – 4marks

3. Calculate the tax percentage and identify the nature of taxation. 2 marks

Annual Income % Of Tax paid $ tax paid

5,000 ? 1500

15,000 ? 4500

25,000 ? 7500

4. Show the immediate impact of the following factors on labor demand or/and labor supply curve. 5 marks

a. Government announces reduced working hours for employees

b. A reduction in exports of footballs produced by labor

c. Government announces an increased rental allowance for workers

d. Government offers subsidy on purchase and installation of heavy machinery

e .Free Training program initiated to enhance the skills of workers

5. Identify whether each of the following are revenue or capital expenditure. 2 marks

a. Construction of Infrastructure for Metro bus

b. Cash distributed under Benazir income support program

6. Identify the type of taxes paid to each of the following: 4 marks

a. A footballer’s weekly wage _________________

b. Import of computers from USA__________________________

c. Tax on mineral products ______________________

d. Special permit for fishing ____________________

6. What would be the impact of increased Interest rate on demand for house loans? 2 marks

7. List any 3 factors that influence savings. 3 marks

8. Interpret an APC value of 0.85 and calculate the APS. 2 marks

9. Calculate the APS if the consumption is 200 and disposable income is 500. 2 marks

10. What advantage would a government have if it widens the tax net? 2 marks

11. Define the term remittance. State one advantage. 2 marks

12. What solutions were proposed in the article for improving the economic condition of Pakistan? 3 marks

You might also like

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- WE FNSACC517 Provide Management Accounting InformationDocument12 pagesWE FNSACC517 Provide Management Accounting InformationGurpreet KaurNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- ACCA F3 Financial Accounting INT Solved Past Papers 0107Document282 pagesACCA F3 Financial Accounting INT Solved Past Papers 0107Lai Andrew80% (10)

- Assignment On Demand, Supply and EquilibriumDocument1 pageAssignment On Demand, Supply and EquilibriumAlviya Fatima100% (1)

- Macro PDF Important QuestionsDocument2 pagesMacro PDF Important Questionsakhilsharmac1140No ratings yet

- Week 4 Practice Quiz: (AICPA Adapted)Document3 pagesWeek 4 Practice Quiz: (AICPA Adapted)Gwyneth ClarinNo ratings yet

- CMA Part 1 Sample Questions From ChinaIMADocument49 pagesCMA Part 1 Sample Questions From ChinaIMAnanchen1No ratings yet

- TEST-3 Topic-Government Budget MM-25 Date-26/05/2020Document2 pagesTEST-3 Topic-Government Budget MM-25 Date-26/05/2020harrycreNo ratings yet

- List A List BDocument6 pagesList A List BcherishletteNo ratings yet

- Answers Quiz Chapter 4Document4 pagesAnswers Quiz Chapter 4Anthony MartinezNo ratings yet

- Mock-2, Sec-ADocument19 pagesMock-2, Sec-AmmranaduNo ratings yet

- Fcomprehensiveexam FDocument16 pagesFcomprehensiveexam FDominic SociaNo ratings yet

- Level 4 ModelDocument7 pagesLevel 4 Modelsolomon asfawNo ratings yet

- Reading 23 Income TaxesDocument26 pagesReading 23 Income TaxessalmaNo ratings yet

- Class 12 Sahodaya Pre Board QP Economics Set ADocument23 pagesClass 12 Sahodaya Pre Board QP Economics Set AAnshika GangwarNo ratings yet

- Cash Flow StatementDocument5 pagesCash Flow StatementSai Phanindra Kumar MuddamNo ratings yet

- Payroll Fundamentals Practice TestDocument10 pagesPayroll Fundamentals Practice Testmohitkashap869No ratings yet

- Fcomprehensiveexam FDocument16 pagesFcomprehensiveexam FDominic SociaNo ratings yet

- DBA Macroeconomics Tutorial Questions 2017Document10 pagesDBA Macroeconomics Tutorial Questions 2017Limatono Nixon 7033RVXLNo ratings yet

- FINALDocument3 pagesFINALSherlene Antenor SolisNo ratings yet

- Auditing Hand OutDocument157 pagesAuditing Hand OutMOREGHNo ratings yet

- Exercises For Lesson 1Document95 pagesExercises For Lesson 1kirkthejerkNo ratings yet

- Barrett Hodgson University Departments of Management Science Midterm Semester Examination - Fall 2019Document4 pagesBarrett Hodgson University Departments of Management Science Midterm Semester Examination - Fall 2019Alishba KhanNo ratings yet

- CH 24Document76 pagesCH 24tafti_847122680No ratings yet

- Macro Economics-Sheeba Tahir. B.com 3 (A) - 4 (A) - Ev. Hyderi.. Paper A.Document4 pagesMacro Economics-Sheeba Tahir. B.com 3 (A) - 4 (A) - Ev. Hyderi.. Paper A.Abdul SammadNo ratings yet

- Intermediate 1Document11 pagesIntermediate 1Mary Anne ManaoisNo ratings yet

- 2 25 QuestionDocument3 pages2 25 Questionsharathk916No ratings yet

- Auditing Theory 1st PBDocument6 pagesAuditing Theory 1st PBRalph Adian TolentinoNo ratings yet

- Pre-Test 1 - ProblemsDocument3 pagesPre-Test 1 - ProblemsKenneth Bryan Tegerero TegioNo ratings yet

- Financial Statement Analysis 10Th Edition Subramanyam Test Bank Full Chapter PDFDocument57 pagesFinancial Statement Analysis 10Th Edition Subramanyam Test Bank Full Chapter PDFvanbernie75nn6100% (13)

- Financial Statement Analysis 10th Edition Subramanyam Test BankDocument36 pagesFinancial Statement Analysis 10th Edition Subramanyam Test Bankcleopatramabelrnnuqf100% (33)

- Taxation MalawiDocument15 pagesTaxation MalawiCean Mhango100% (1)

- MASDocument3 pagesMASjoenalynNo ratings yet

- May 2019 Professional Examinations Public Sector Accounting & Finance (Paper 2.5) Chief Examiner'S Report, Questions and Marking SchemeDocument24 pagesMay 2019 Professional Examinations Public Sector Accounting & Finance (Paper 2.5) Chief Examiner'S Report, Questions and Marking SchemeMahama JinaporNo ratings yet

- Multiple Choices and Exercises - AccountingDocument33 pagesMultiple Choices and Exercises - Accountinghuong phạmNo ratings yet

- ACC 577 Week 1 QuizDocument8 pagesACC 577 Week 1 QuizMaryNo ratings yet

- eco 文書Document19 pageseco 文書Cindy LamNo ratings yet

- Canadian Income Taxation 2016 2017 19th Edition Buckwold Test BankDocument25 pagesCanadian Income Taxation 2016 2017 19th Edition Buckwold Test BankMatthewWhitetwks100% (62)

- Payment of Bonus ActDocument13 pagesPayment of Bonus Act61Mansi Saraykar100% (3)

- MCQs of AccountingDocument29 pagesMCQs of AccountingImran Arshad33% (3)

- CBE Practice Exam Revised July 2015Document8 pagesCBE Practice Exam Revised July 2015Haymanot GirmaNo ratings yet

- tham khảo ECO kì 2Document49 pagestham khảo ECO kì 2Vũ Nhi AnNo ratings yet

- Far 6 Accounting For Income TaxDocument3 pagesFar 6 Accounting For Income TaxanndyNo ratings yet

- Economics Set BDocument10 pagesEconomics Set BdeepansinghranaNo ratings yet

- Reading 24 Income TaxesDocument43 pagesReading 24 Income TaxesNeerajNo ratings yet

- Itlp Question BankDocument4 pagesItlp Question BankHimanshu SethiNo ratings yet

- Homework 1 - Version BDocument3 pagesHomework 1 - Version BІлияс Махатбек0% (1)

- Part A / Bahagian A Short Questions / Soalan Pendek Instructions / ArahanDocument8 pagesPart A / Bahagian A Short Questions / Soalan Pendek Instructions / ArahanAdam KhaleelNo ratings yet

- De 2Document3 pagesDe 2Linh LinhNo ratings yet

- Macroeconomics (Mas.M-1403) Straight Problems: 1. Demand Elasticity. Mabuhay Corporation Has Recorded The Following Effects of ChangesDocument15 pagesMacroeconomics (Mas.M-1403) Straight Problems: 1. Demand Elasticity. Mabuhay Corporation Has Recorded The Following Effects of Changesharry severinoNo ratings yet

- Hird MacroDocument6 pagesHird MacroNguyễn Phước Định TườngNo ratings yet

- BSBFIM501 - Assessment 3 - Lukmanto Bong.Document14 pagesBSBFIM501 - Assessment 3 - Lukmanto Bong.ASTRI CAHYANINGSIHNo ratings yet

- Gov Acc Fin Reporting ComDocument7 pagesGov Acc Fin Reporting ComPia Angela ElemosNo ratings yet

- Solutions Chapter 24Document5 pagesSolutions Chapter 24Avi SeligNo ratings yet

- Chapter 4Document52 pagesChapter 4XI MIPA 1 BILLY SURYAJAYANo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Taxation Assignment 1Document2 pagesTaxation Assignment 1Alviya FatimaNo ratings yet

- Article On Effect of Covid On Trade With Q &ADocument5 pagesArticle On Effect of Covid On Trade With Q &AAlviya FatimaNo ratings yet

- Analyse Social Distancing Prevents Corona Virus But It Can Effect Social Interaction Too in Our SocietyDocument1 pageAnalyse Social Distancing Prevents Corona Virus But It Can Effect Social Interaction Too in Our SocietyAlviya FatimaNo ratings yet

- What If You're Missing An Opportunity To See The World Differently?Document1 pageWhat If You're Missing An Opportunity To See The World Differently?Alviya FatimaNo ratings yet

- Introduction To Micro Economcis-Topic 1Document25 pagesIntroduction To Micro Economcis-Topic 1Alviya FatimaNo ratings yet

- MCQs On Supply Curve ConceptDocument3 pagesMCQs On Supply Curve ConceptAlviya FatimaNo ratings yet

- Baroque1 (5 Files Merged)Document42 pagesBaroque1 (5 Files Merged)Alviya FatimaNo ratings yet

- MCQs On Demand Curve - AssignmentDocument6 pagesMCQs On Demand Curve - AssignmentAlviya FatimaNo ratings yet

- Managing Organizations: Section-BDocument20 pagesManaging Organizations: Section-BAlviya FatimaNo ratings yet