Professional Documents

Culture Documents

IWT Unit-4 PDF

IWT Unit-4 PDF

Uploaded by

shivani0 ratings0% found this document useful (0 votes)

96 views27 pagesOriginal Title

IWT unit-4.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

96 views27 pagesIWT Unit-4 PDF

IWT Unit-4 PDF

Uploaded by

shivaniCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 27

‘There are different types of viruses which can be classified according to their origin, i

_ = types of files they infect, where they hide, the kind of damage they cause, the type of operating: 7

system, or platform they attack.

Let us have a look at few of them.

* “+” Memory Resident Virus

- ‘These viruses fix themselves in the ¢

‘and infeets all the files that are then opened.

Hideout: This type of virus hides in the RAM

executed, It gets control over the system memory and allocate memory blocks ‘through,

runs its own code, and executes the code when any function is executed.

Target: It can corrupt files and programs that are opened, closed, copied, renamed, ete.

Examples:Randex, — CMI, Meve, and ‘MrKlunky

Protection: Install an antivirus program.

Direet Action Viruses

The main purpose of this virus is to replicate and take action when it is executed. When_a

Specific condition is met, the virus will go into action and infect files in the directory or foldes

that are specified in the AUTOEXEC.BAT file path. This batch file is always located in the root

directory of the hard disk and carries out certain operations when the computer is booted.

FindFirst/FindNext technique is used where the code selects a few files as its victims. It also

infects the extemal devices like pen drives or hard disks by copying itself on them.

Hideout: The viruses keep changing their location into new files whenever the code is executed,

but are generally found in the hard disk’s root directory.

Target: [ean corrupt files. Basically, itis a file-infecter virus.

3 | chapter: Error! No text of specified style in document.

affects the boot sector of a hard disk. This is a crucial of the;

SE ato a

of the disk itself is stored along with a program that makes it possible to

af from the disk. This type of virus is also called Master Boot Sector Virus or Master

Ghicy oHect- Booting proces

‘It hides in the memory until DOS sses the floppy disk, and whichever boot data is

accessed, the virus infects it.

‘Examples:Polyboot.B, AntiEXE

Protection: The best way of avoiding boot sector viruses is to ensure that floppy disks are write-

protected. Also, never start your computer with an unknown floppy disk in the disk drive.

Macro Virus

Macro viruses infect files that are created using certain applications or programs that contain

doc, -xls, .pps, .mdb, etc. These mini-programs make it possible to automate series

of operations so that they are performed as a single action, thereby saving the user from having

to carry them out one by one. These viruses automatically infect the file that contains macros,

and also infects the templates and documents thatthe file contains. It is referred to as a type of

mail virus, a

Hideout: These hide in documents that are shared via e-mail or networks.

Examples: Relax, Melissa.A, Bablas, O97M/Y2K

Protection: The best protection technique is to avoid opening e-mails from unknown senders.

Also, disabling macros can help to protect your useful data.

~~ Directory Virus

Directory-viruses (also called Cluster Virus/File System Virus) infect the directory of your

Computer by changing the path that indicates the location of a file. When you execute a program

file with an extension .EXE or .COM that has been infected by a virus, you are unknowingly

running the virus program, while the original file and program is previously moved by the virus.

Once infected, it becomes impossible to locate the original files.

Hideout: It is usually located in only one location of the disk, but infects the entire program in

the directory. ot

Examples: Dir-2 virus

Protection: All you can do is, reinstall all the files from the backup that are infected after

5

i

i

:

a

2a

‘there another file

the new file. When the system calls the filename "Me", the ".

+ Paatigher priority than ".exe"), thus infecting the ut

# Stator, Asimov.1539. and Terrax.1069

tection: Install an antivirus

named "Me.com" and hides. in

-com" file gets executed (as "com"

scanner and also download Firewall, fie

*_ FAT Virus

© The file allocation table (FAT) is the part of a disk ‘used to store all the information about the

location of files, available space, unusable space, ers

Hideout: FAT virus attacks the FAT section and ‘may damage crucial information. It can be

especially dangerous as it prev

ai i pots '0 certain sections ofthe disk where empertaad

Stored. Damage caused can result in loss of information frors individual files or even entire

directories.

Examples: Link Virus

Protection: Before the virus attacks all the files on the computer, locate all the files that are

actually needed on the hard drive,

and then delete the ones that are not needed. They may be files

created by viruses.

—*Maltipartite Virus

These viruses spread in multiple ways possible. It may vary in its action depending upon the

‘Operating system installed and the presence of certain files i

Hideout: In the initial phase, these viruses tend to hide in the memory as the resident viruses do;

then they infect the hard disk

iples: Invader, Flip and Tequila

Protection: You need to clean the boot sector and also ihe disk to get rid of the virus, and then

reload all the data in it However, ensure that the data is clean.

* Web Scripting Virus

w | Chapter: Error! No text of specified style in document,

;

“

a

r ‘breed of malicious code are Trojans or Trojan horses, which.

not reproduce by infecting other files, nor do they self-replicate like worms In fact, itis a

‘Program which disguises itself as a useful program or application,

Bomb

They are not considered viruses because they do not replicate, They are not. ‘even programs in_

‘their own right, but rather camouflaged segments of other programs.cThey are only executed

when a certain predefined condition is met. Their objective is to destroy data on the

‘once certain conditions have been met. Logic bombs go undetected until launched, the reeults

‘can be destructive, and your entire data can be deleted! )

a // ‘ Client server Security Threats:

i

2

3

s

A security threat is defined as circumstance, condition, or event with the potential to cause

econoinic hardship to data or network resources in the form of destruction. «Disclosure,

~ modification of data, denial of service, andlor fraud, waist and abuse. Client/ Server security

issues deal with various authorization methods related to access control. Such mechanisms

include password protection, encrypted smart cards. Biometrics and firewalls. Client/Server

Security problems can be due to following:

* Physical security holes: These results when any individual gains unauthorizedaccess to a

computer by getting some user’s password,

* Software security holes: These result due to some bug in the software, due towhich the system

may be compromised into giving wrong performance, ~

+ Inconsistent usage holes: These may result when two different usages of asystems contradict

over a security point. Of the above three, software security holes and inconsistent usage h

ok: ‘external influence. Client threats mostly arise %

code. Malicious codes refer to viruses, worms (a self-replicating program that

tained and does not require a host program. The program creates a copy of itself and

it to execute without any user intervention, commonly utilizing network services to

to other host systems.e.g., Trojan horse, logic bomb, and other deviant software

‘Virus is a code segment that replicates by attaching copies of itself to existings:

cutables. The new copy of the virus is executed when a user executes the host programs. The

‘may get activated upon the fulfilment of somespecific conditions.

‘The protection method is to scan for malicious data and program fragments that

aretransferred from the server to the client, and filter out data and programs known to

Dedangerous.

‘ Data and Message Security

‘The lack of data and message security in the internet has become a high profile problem due to

the increasing number of merchants trying to spur commerce on the global network. For

instance, credit card numbers in their plain text form create a risk when transmitted across the

intemet where the possibility of the number falling into the wrong hands is relatively high,

* Data Security:

Electronic data security is of paramount importance at a time when people are considering

banking and other financial transaction by PCs. Data security is the means of ensuring that data

is kept safe from corruption and that access to is suitably controlled. Thus data security helps to

‘ensure Privacy. It also helps in protecting personal data. Data security is part of the larger

Practice of Information Technology.

: Error! No text of specified style in document.

Po ois os SONS ac cAaeiog ee arcr ae

6 authorized users can access these resources.

"7. Authorized users must be asked to change their passwords periodically.

+ Message Security:

‘The protocol specifies how integrity and confidentiality can be enforced on messages and allows

the communication of various security token formals. Messaging security is a program that

provides protection for companies messaging infrastructure. The programs includes IP reputation

‘anti-spam, pattem-based anti spam, administrator defined block/ allow lists, ‘mail antivirus,

zero-hour malware detection and email intrusion prevention. |

i

2

Threats to message security

They fall into three categories:

1. Message Confidentiality:Confidentiality is important for uses involving sensitive data such,

as credit card numbers. This requirement will be amplified when other kinds of data such as

employee records, government files and social security members begin traversing the network.

Confidentiality precludes access to, or release of, such information to unauthorized user.

2. Message and System Integrity: Business transactions require that their contents remain

unmodified during transport. In other words, information received must have the same content

The various factors that have lead the financial institutions to make use of electroni payments

are:

1, Decreasing technology cost. Ipfe of € Paymen—

2 *d operational and processing cost. CHedie: cond

3. online commerce. Debi) te

4. Reliability.

5. Security. E- mraney f oniot Cy

ad

‘Some example of EPS: Chea

1, Online reservation 4 nate

2. Online Bill Payment d |

3. Online order placing Wage

4. Online ticket booking(movie) nial cath

N | Chapter: Error! No text of specified style in document.

—

ddoes but in pure electronic form, with fewer manual steps.

‘businesses and consumers in the 21st century, using

‘orks like a paper check

is designed to meet the needs of|

‘of the art security techniques.

cen be used by all bank customers who have checking account, including small and mid

Zr businesses which currently have little access to electronic payment systems.

‘enhances existing bank accounts with new e-commerce features.

Let's examine how eCheck works for the banking industry and the clients it serve. There are

fndamental characteristics and differences between paper check, the eCheck and other

Electronic Funds Transfer (EFT) transactions. eCheck will be an important payments instrument

in transitioning businesses and consumers into the emerging world of electronic commerce,

First, what is the eCheck?

‘An eCheck is the electronic version or representation of a paper check,

— —

Terarity to conduct bank transactions, yet are safe enough to use on the Internet

ualimited, but controlled, information carrying capability

reduces fraud losses for all parties

automatic verification of content and validity

Saditional checking features such as stop payments and easy reconciliation

enhanced capabilities such as effective dating

‘The eCheck:

* can be used by all account holders, large and small, even where other electronic payment

Solutions are too risky, or not appropriate

‘+> is the most secure payment instrument available today

‘= Provides rapid and secure settlement of financial obligations

* can be used with existing checking accounts

* canbe initiated from a variety of hardware platforms and software applications

Whaat is eCheck technology?

@Check technology is software and hardware developed by FSTC members to:

* minimize start up expenses

* apply universal industry standards

wo | Chapter: Error! No text of specified style in document,

‘How secure are echecks?

‘eChecks are the most secure payments instrument or transaction ever designed or developed.

‘echecks are designed to utilize state of the art security techniques of :

authentication

public key eryptography

digital signatures

certificate authorities

duplicate detection

encryption

eChecks further enhance banking practices with added security so that even breaking the

‘eryptographic protections would not necessarily allow a fraudulent transaction to be paid.

Are echecks really checks?

Checks provide the best of both paper and electronic laws and regulations to bank customers:

. -ks are based on check law and have the same characteristics of paper checks but in

all-clectronic form. Account agreements include provisions for eCheck transactions.

+ theeCheck also provides consumers the protections and rights from Regulation B, which

limits liability and establishes dispute resolution timeframes.

* coupling the eCheck security technology with a sound legal structure reduces the

exposure and risk of loss to banks and their clients.

‘What do echecks provide that will permit banks to sustain their leadership position in the

payments system?

Checks:

# isa YN in Gi A Peon Cay sernnet my

tes 22D oy ounce via elecest Ly onal

é

artery Mvoling @ Honk +o medoare anlects

* A.system that allows a person to pay for goods or service by transmitting a number from

‘ne computer to another,

Like the serial no. on real currency notes the e-cash no. are unique,

* This is issued by a bank or represents a specified sum of real money

* Itis anonymous and reusable.

E cash security:

1. Complex cryptographic algorithm presents double spending,

2. Serial no. can allow tracing to prevent money laundering,

Chapter: Error! No text of specified style in document.

PR

scpnly a ee ane

hot for everyone. Low income segments without computer and

(AID) E- Wallet:

$ _Ewallet is an online prepaid account where one can stock mone

~ pre-loaded f facility, consumers can buy 2 range of products from airline tickets to grocery without: ‘

‘swipil wiping a debit ‘or credit card.

The e-wallet is another payment scheme that operates like a carries of e-cash and other

information.

‘The aim is to give shopper a single, simple and secure way of carrying currency

electronically.

© Trusts the basis of the e-wallet as a form of electronic payment.

Procedure for using an e-wallet:

ig ;

1. Becide on an online site where you would like to shop. -

© 2. Download a wallet from the merchants websites.

3. Fill out personal information such as credit card no., name, address, phone no. ete.

4. When you are ready to buy, click on the wallet button the buying process is fully executed.

Need of wallet:

For frequent online shopper, it becomes a hassle to fill out order forms with the same

information on them for every item you purchase. It will be nice if this information could be

handled automatically by the use of e-wallet.

Benefits:

The sites where e-wallet services are available generally have the following few easy steps to get

started,

1. Ease of use without having to enter your debit/credit card details for every online transaction,

3 For some sites there is no minimum amount and you can deposit an amerot ve low as Rs 10.

~ 3. You can pass on the benefits of your e-wallet to your friende and family as well,

4 There is no chance of a decline of payment since e-wallet is » prepaid account,

Risks:

1. Revealed passwords can lead to theft.

‘© The contact card have contact pads to interact with the reader, the contactless card have

‘antenna and hybrid card have both.

‘* The processor inside the smart card can be 8 bit or 32 bit processor.

«The OS reside in the ROM of the processor. It just like a mini computer embedded on a

chip.

Application:

1, Mobile Communication

2. Banking and Retail

3, Electronic Purse.

4, Health care

5.1D verification and access control.

6. Purchase and for record keeping in place of paper.

7. Consumer has been using chip cards for every thing from visiting libraries to buy

The EDI process looks like this — no paper, no people involved:

¢ =

Your partners’ internal systems Your intemal system

Electronic Data Interchange (EDI) is the computer-to-computer exchange of routine business

data between trading partners in standard data formats, This definition contains three key

concepts about EDI:

ss | Chapter: Error! No text of specified style in document,

€01 i6. a Communicatian Method or PMOVIAe! Standerds fos

Occhanging dare, \yia

ony

Te P

Vy Plechysnic means

Step 1: Prepare the documents to be sent

“The fist step is to collect and organize the data. For example, instead of printing a purchase

order, your system ereates an electronic file with the necessary information to build an EDI

document. The sources of data and the methods available to generate the electronic documents

Once your business documents are translated to the appropriate EDI format they are ready to be

transmitted to your business partner. You must decide how you will connect to each of your _

‘o perform that transmission. There are several ways, the most common of which’

1) to connect directly using AS2 or another secure internet protocol, 2) connect to an.

Network provider (also referred to as a VAN provider) using your preferred”

"Communications protocol and rely on the network provider to connect to your business partners

using whatever communications protocol your partners prefer, or 3) a combination of both,

‘depending on the particular partner and the volume of transactions you expect to exchange.

Benefits of EDI

‘Speed —Data can move directly from one computer to another with little to no delay

+ Accuracy:

Simplicity — EDI standards specify how data will be formatted and where it can found.

+ Security “EDI can be accessed only by authorized users and is accompanied by audit trails

and archiving of data.

Errors are reduced because data is not being re-keyed,

These four benefits produce the following results:

Faster buy-sell cycle time

+ Quicker cash flow

Reduced order lead time and inventories

Chapter: Error! No text of specified style in document.

Ability to conduct just-in-time manufacturing

ad bed

,

\

3

At log on time,

the server. Instead, it is used by the server to computes a token. The server the transmits an

ige containing the token which can be decoded with the user's key. :

encrypted messay

There are many variations on this theme. For example:- user can téll the authentication server 2

to which remote server they want to connect, It sends to the remote computer. This second token

is doubly encrypted and user passes it along after peeling off one layer of encryption, The remove

machine which has also authenticated itself with the server, supplies the second

decoding.

oF your request.

‘you first request authentication from the

tion Server creates a

it on your password (which it

that represents the requested service,

ticket.”

> ounext send your ticket-granting ticket ta ticket-granting server (TGS), The TGS may

be physically the same server as the Authentication Server, but i's now performing 4

g ‘ifferent service.The TGS retums the ticket that can be sent to the server for the ~

} requested service.

|. The service either rejects the ticket or accepts it and performs the service.

5. Because the ticket you received from the TGS is time-stamped, it allows you to make

additional requests using the same ticket within a certain time period (typically, eight

+hours) without having to be reauthenticated. Making the ticket valid for a limited time

period make it less likely that someone else will be able to use it later,

‘The user procedure may vary somewhat according to implementation.

+ Encrypted Documents And Emails é - .

Introduction to Eat!"

+ E-mail is one of the most popular Intemet applications

Asynchronous (> no session => no handshaking)

Fast >

Basy to distribute

Inexpensive

ail messages can include hyperlinks, HTML formatted text, images, sound,

and even video

+ _ Accessible from any host connected to the Internet,

A Typical E-mail Joumey

1. Starts its joumey in the sender's user agent

2. Travels to the sender’s mail server

or | Chapter: Error! No text of specified style in document.

0 log security relevant events.

/ to maintain system sage statistics and charge individual users.

of storing the message.

-e that an entire sequence of messages arrived in the order

tional) encryption of mess:

use of asymmetric crypt

oh OF the symmetic key)

* POP uses public key cryptograpliy.

© Anarchie certificate model:

* Bverybody issues certificates and forwards public keys,

Users decide on trust rules,

© Elaborate system’of generating public-private keys,

© Pata on public keys, certificates, and people is combined in a key ring,

* Key rings can be exchanged to build up trust databases.

* Transfer Encoding

© User specifies type of file for handling

"Binary

* Text file

Chapter: Error! No text of specified style in document.

Advantages:

1. They allow browser program to ignore the complex networking code necessary to support

every firewall protocol and concentrate on impotant client issues

no protocol functionality is lost as FTP,

E.g. By using HTTP between the client and proxy,

Gopher and other web protocols map into HTTP methods,

2. Proxy server mnmage network function including client IP address, date and time, byte count

and success code.

arisen peng bate

‘Short for Remote Authentication Dial In User Service, an authentication. ting

‘usage system used by many Internet Service Provider (ISPs). When you dial into the ISP you

‘must enter your user name and pass word. This information is passed to a radius server which

‘checks that the information is correct and then authorizes access ISP system.

‘Though not an official standard the RADIUS specification is maintained by a working

group of IETF.

> IDS:

Intrusion detection (ID) is a type of security management system for computers and networks.

‘An ID system gathers and analyzes information from various areas within a computer or a

network to identify possible security breaches, which include both intrusions (attacks from.

‘outside the organization) and misuse (attacks from within the organization). ID uses vulnerability

‘assessment (sometimes refered to as scanning), which is a technology developed to assess the

security of a computer system or network. ft

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (347)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Decisions: The Recognition-Primed Decision ModelDocument6 pagesDecisions: The Recognition-Primed Decision ModelshivaniNo ratings yet

- Question Bank of Decision Support System 8 Sem (CSE/IT)Document2 pagesQuestion Bank of Decision Support System 8 Sem (CSE/IT)shivaniNo ratings yet

- S.N o Decision Analysis Strategic Decision 1 Defination: Discipline Philosophy Methodology Professional DecisionsDocument2 pagesS.N o Decision Analysis Strategic Decision 1 Defination: Discipline Philosophy Methodology Professional DecisionsshivaniNo ratings yet

- Mis & EisDocument1 pageMis & EisshivaniNo ratings yet

- Unit-1 Overview of Different Types of Decision Making. SyllabusDocument22 pagesUnit-1 Overview of Different Types of Decision Making. SyllabusshivaniNo ratings yet

- Unit-2 1. What Are The Stages of Information Assimilation? (2) (Am-16) - AnsDocument12 pagesUnit-2 1. What Are The Stages of Information Assimilation? (2) (Am-16) - AnsshivaniNo ratings yet

- Unit - 5 1. Define Groupware (2) (Am-16) Ans-: Characteristics of GDSSDocument13 pagesUnit - 5 1. Define Groupware (2) (Am-16) Ans-: Characteristics of GDSSshivaniNo ratings yet

- DSS Unit - 5Document8 pagesDSS Unit - 5shivaniNo ratings yet

- E-Participation As A Process and Practice: What Metep Can Measure, Why and How?Document15 pagesE-Participation As A Process and Practice: What Metep Can Measure, Why and How?shivaniNo ratings yet

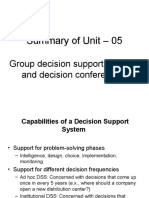

- Summary of Unit - 05: Group Decision Support Systems and Decision ConferencingDocument25 pagesSummary of Unit - 05: Group Decision Support Systems and Decision ConferencingshivaniNo ratings yet