Professional Documents

Culture Documents

Abstract Inggris

Abstract Inggris

Uploaded by

Kevin Ismael Manaf Putra0 ratings0% found this document useful (0 votes)

13 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageAbstract Inggris

Abstract Inggris

Uploaded by

Kevin Ismael Manaf PutraCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

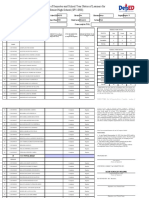

ABSTRACT

Kevin Ismael Manaf Putra / 33150221/2019 / Moderation of Reputation of Public Accountant

Firms on the Effect of Company Size, Profitability, Solvability and Audit Committee on

Audit Report Lag ( Empirical Study on Manufacturing Companies Listed in Indonesia Stock

Exchange Period 2015-2017 ) / Advisor: Rizka Indri Arfianti SE, Ak., MM, M.Ak.,

The company's performance can be assessed it has been good or not by looking at the

performance of the financial statements issued each year. If the financial statements produce

a positive value, then it can attract investors to invest their capital in the company. Every

public company is obliged to submit its financial statements periodically to Bapepam no later

than 120 days after the date of the annual financial report, this is based on the regulations of

the Capital Market Supervisory Agency (Bapepam) No.X.K.6, KEP-431 / BL / 2012. The

process of completing an audit by an auditor either in a Big Four or Non Big Four KAP

indicates an influence in the financial statements. The purpose of this study was to determine

the effect of company size, profitability, solvability and audit committee on audit report lag

with the reputation of KAP as a moderating variable.

Audit Report Lag is the difference in the number of days from the closing date of the

book to the date of signature in the independent auditor's report. The higher audit report lag

can endanger the quality of financial reporting by not providing timely information to

investors and can reduce the level of trust investors have to the market.

The sample for this study consisted of 47 manufacturing companies listed on the

Indonesia Stock Exchange in the 2015-2017 Period. Sampling is measured by non-probability

sampling techniques, using purposive sampling method. The analytical method used is

descriptive statistical test, pooling test, classic assumption test, and hypothesis test. Data is

processed using SPSS 20.

The results of the research from the F test show that all independent variables together

have an influence on audit report lag. The results of the t test show that the hypothesis 2 (two)

and 4 (four) are accepted because they have a sig / 2 value below α = 5% and have a direction

of influence according to the frame of mind. Whereas, hypothesis 1 (one), 3 (Three), 5 (Five),

7 (Seven), 8 (Eight) are rejected because they have a sig / 2 value above α = 5%. And

hypothesis 6 (six) is rejected because it has a sig / 2 value below α = 5% but has a direction of

influence that is not in accordance with the frame of mind.

Based on the results of data analysis, profitability and audit committees enough

evidence has a negative effect on audit report lag. And the reputation of KAP is able to

weaken the influence of profitability on audit report lag. While firm size, solvability and

moderation of KAP reputation on company size, solvability and audit committee there is

insufficient evidence to influence audit report lag.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Genetti, Carol (2014) - How Language Work. An Introduction To Language and LinguisticsDocument28 pagesGenetti, Carol (2014) - How Language Work. An Introduction To Language and LinguisticsMuh.Taufiq ShidqiNo ratings yet

- Comparison of Jis and Din StandardsDocument14 pagesComparison of Jis and Din StandardsRaja Sunder50% (2)

- Standard Operating Instruction: Turbine Lube Oil SystemDocument34 pagesStandard Operating Instruction: Turbine Lube Oil SystemSonrat100% (3)

- Bohr's Model of The AtomDocument7 pagesBohr's Model of The AtomsantiagoNo ratings yet

- Fire Safty in Public BuildingDocument40 pagesFire Safty in Public BuildingSamirsinh ParmarNo ratings yet

- Notes Methods of PhilosophizingDocument2 pagesNotes Methods of PhilosophizingChristy YcongNo ratings yet

- Newport Projects in Optics - Good For Literature ReviewDocument88 pagesNewport Projects in Optics - Good For Literature ReviewEngr SalimNo ratings yet

- The Mole and Gas Volumes 2Document4 pagesThe Mole and Gas Volumes 2Devonica PhoenixNo ratings yet

- Filipino Students Perceptions of Factors Affecting TheirDocument12 pagesFilipino Students Perceptions of Factors Affecting Theircharmela pabillonNo ratings yet

- Power Plant Engineering Notes UNIT 1Document33 pagesPower Plant Engineering Notes UNIT 1aakashNo ratings yet

- Discuss Acts Ofkindness AndhonestyDocument11 pagesDiscuss Acts Ofkindness AndhonestyMARIBEL CUSI RONCO100% (1)

- Tarea 2. Design - of - Machinery NortonDocument10 pagesTarea 2. Design - of - Machinery Nortonbisiosote100% (1)

- Q5. Teaching Styles (CAPEL's Book Excerpt)Document10 pagesQ5. Teaching Styles (CAPEL's Book Excerpt)Leonardo Borges MendonçaNo ratings yet

- 05 Ethos Pathos Logos Handout and Lesson Plan 2020Document4 pages05 Ethos Pathos Logos Handout and Lesson Plan 2020Andrea YangNo ratings yet

- LT3-00032-2-A - P24-P30S.pdf Parker Denison p24 PDFDocument67 pagesLT3-00032-2-A - P24-P30S.pdf Parker Denison p24 PDFAlex RamirezNo ratings yet

- Tank Sounding Manual (MANUAL-T - 4681251 - 1 - A) - 1Document143 pagesTank Sounding Manual (MANUAL-T - 4681251 - 1 - A) - 1Hung LeNo ratings yet

- Module 3 - CommunicationDocument58 pagesModule 3 - CommunicationMishal UbaidullahNo ratings yet

- Chi SquareDocument17 pagesChi SquareJazzmin Angel ComalingNo ratings yet

- Extended Enterprise Architecture Maturity Model Guide v2Document8 pagesExtended Enterprise Architecture Maturity Model Guide v2amunoz81No ratings yet

- ENGINEERING/2270 - GUG-S-17-7036 - Year - B.E. - Computer Science and Engineering Sem VIII Subject - CSE8051 - Elective-IV - Distributed SystemDocument1 pageENGINEERING/2270 - GUG-S-17-7036 - Year - B.E. - Computer Science and Engineering Sem VIII Subject - CSE8051 - Elective-IV - Distributed SystemDeepshikha SharmaNo ratings yet

- Ipa18 586 GDocument17 pagesIpa18 586 GMuhammad ThurisinaNo ratings yet

- School Form 5A (SF 5A) 3Document3 pagesSchool Form 5A (SF 5A) 3zettevasquez8No ratings yet

- WWW Ictlounge Com HTML Direct Input Devices HTMDocument3 pagesWWW Ictlounge Com HTML Direct Input Devices HTMahmadNo ratings yet

- C4.5 AlgorithmDocument33 pagesC4.5 AlgorithmVarun BalotiaNo ratings yet

- Z025679 Monic Operator's ManualDocument27 pagesZ025679 Monic Operator's ManualLarry MorganNo ratings yet

- Course Name: Dam Engineering Course Code:CENG 6032: Ethiopian Institute of Technology-MekelleDocument68 pagesCourse Name: Dam Engineering Course Code:CENG 6032: Ethiopian Institute of Technology-MekellezelalemniguseNo ratings yet

- 2009-Rational Coaching A Cognitive Behavioural Approach.Document8 pages2009-Rational Coaching A Cognitive Behavioural Approach.huerfanitovanidosoNo ratings yet

- Man Pack Jammer - PKI Electronic Intelligence GMBH GermanyDocument1 pageMan Pack Jammer - PKI Electronic Intelligence GMBH Germanyashwin tripathiNo ratings yet

- Diseño y Construcción de Vías MinerasDocument10 pagesDiseño y Construcción de Vías MinerasfbturaNo ratings yet

- Footing Ina MoDocument6 pagesFooting Ina MoHades HadesNo ratings yet