Professional Documents

Culture Documents

GHGH

Uploaded by

Tarannum khatriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GHGH

Uploaded by

Tarannum khatriCopyright:

Available Formats

A Commercial General Liability (CGL) insurance policy is designed to protect businesses against any

legal liability that involves paying compensation for damage or injuries incurred by a third party from

your routine business operations. This unique policy offers financial protection to the companies

against Public Liability and Product Liability claims. It is required for all the companies that involve

manufacturing and development of software and physical products for its clients and customers. CGL

also protects the policyholder against any monetary loss resulting from legal matters in case of

death, bodily injuries, property damage, and personal injuries caused due to your business

operations within your premises. For instance, it includes Fell, Trip or Slip claim filed by a client who

sustained injuries in your business premises and by falling/ tripping/slipping. It is important to keep

your premises in good shape, manufacture good quality products that are safe to use and consume.

The major concerns are the security and safety of premises and product reliability. The laws are

nowadays stringent to maintain third-party interest and amendments are also being made in this

regard that companies need to adhere to. General liability insurance policy offers compensation for

claims arising due to bodily injuries, and property damages or for which your business is

accountable. This coverage is provided to the Owners of a company, or managing directors,

operations head etc. who are involved in the business operations. It also covers sellers,

manufacturers, and distributors. CGL policy is extendible to both industrial activities like

construction, manufacturing, and non-industrial activities like offices, multiplexes, and hotels.

any damage is caused to a third-party laptop, phone, or any other belongings ( apart from your

employees). It would also involve paying for renovation of other building that is damaged due to an

accidental fire in your

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Debenture NewDocument3 pagesDebenture NewTarannum khatriNo ratings yet

- K.E.S L C M C B H ' S C N D, BDocument4 pagesK.E.S L C M C B H ' S C N D, BTarannum khatriNo ratings yet

- Number of ArbitratorsDocument9 pagesNumber of ArbitratorsTarannum khatriNo ratings yet

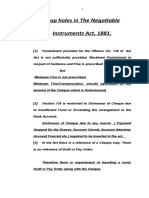

- Loop Holes in The Negotiable Instruments Act, 1881Document5 pagesLoop Holes in The Negotiable Instruments Act, 1881Tarannum khatriNo ratings yet

- Articles of Association Section 5Document9 pagesArticles of Association Section 5Tarannum khatriNo ratings yet

- Loop Holes in The Negotiable Instruments Act, 1881Document5 pagesLoop Holes in The Negotiable Instruments Act, 1881Tarannum khatriNo ratings yet

- Vaccine Beneficiary Status: Past Medical HistoryDocument1 pageVaccine Beneficiary Status: Past Medical HistoryTarannum khatriNo ratings yet

- Jashmir SPL PETITIONERDocument28 pagesJashmir SPL PETITIONERTarannum khatriNo ratings yet

- Loop Holes in The Negotiable Instruments Act, 1881Document5 pagesLoop Holes in The Negotiable Instruments Act, 1881Tarannum khatriNo ratings yet

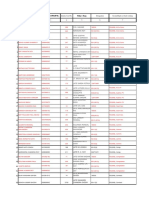

- BANDHANI SUITS-Inventory List 1Document1 pageBANDHANI SUITS-Inventory List 1Tarannum khatriNo ratings yet

- Jashmir - SPL RESPONDENTSDocument24 pagesJashmir - SPL RESPONDENTSTarannum khatriNo ratings yet

- MCA Port Overview Final PDFDocument10 pagesMCA Port Overview Final PDFTarannum khatriNo ratings yet

- A Commercial General LiabilityDocument2 pagesA Commercial General LiabilityTarannum khatri100% (1)

- Vakitlerin Aciklamalari ENDocument1 pageVakitlerin Aciklamalari ENTarannum khatriNo ratings yet

- Factories Act 1948Document46 pagesFactories Act 1948Tarannum khatriNo ratings yet

- Special Leave 2Document21 pagesSpecial Leave 2Tarannum khatriNo ratings yet

- Law of Meds Organ Transplant PDFDocument9 pagesLaw of Meds Organ Transplant PDFTarannum khatriNo ratings yet

- WB Voter List As On 01.05.2014Document56 pagesWB Voter List As On 01.05.2014Tarannum khatriNo ratings yet

- Order Details Contact Details: Air IndiaDocument2 pagesOrder Details Contact Details: Air IndiaTarannum khatriNo ratings yet

- WB Voter List As On 01.05.2014 PDFDocument56 pagesWB Voter List As On 01.05.2014 PDFTarannum khatriNo ratings yet

- HHMDocument15 pagesHHMTarannum khatriNo ratings yet

- HHMDocument15 pagesHHMTarannum khatriNo ratings yet

- Scan 15 Feb 2020 PDFDocument6 pagesScan 15 Feb 2020 PDFTarannum khatriNo ratings yet

- PDF To Word SPLDocument42 pagesPDF To Word SPLTarannum khatriNo ratings yet

- Special Leave 2Document21 pagesSpecial Leave 2Tarannum khatriNo ratings yet

- Scan 9 Feb 2020Document1 pageScan 9 Feb 2020Tarannum khatriNo ratings yet

- DPC 2Document2 pagesDPC 2Tarannum khatriNo ratings yet

- Scan 15 Feb 2020 PDFDocument6 pagesScan 15 Feb 2020 PDFTarannum khatriNo ratings yet

- DPCDocument5 pagesDPCTarannum khatriNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)