Professional Documents

Culture Documents

Handout 2

Uploaded by

Vergel MartinezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Handout 2

Uploaded by

Vergel MartinezCopyright:

Available Formats

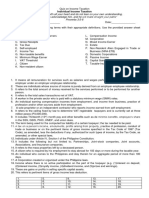

TAX REMEDIES

Tax Remedies of Government- These are courses of action provided by law to implement tax laws.

Tax Remedies of Taxpayer- These are legal actions which taxpayer can avail to seek relief from

undue burden or oppressive effect of tax laws.

TAX REMEDIES OF GOVERNMENT

(1) Administrative Remedies

a. Distraint- It is the seizure of the government of the personal property, tangible or intangible, to

enforce the payment of taxes.

b. Levy- It refers to the act of seizure of real property in order to enforce the payment of taxes.

(2) Judicial Actions

a. Civil Actions for government- It is the actions instituted by the government to collect internal

revenue taxes.

b. Criminal Actions for government- The CIR may file a criminal complaint about a delinquent

taxpayer.

TAX REMEDIES OF TAXPAYER

(1) Administrative Remedies

a. Protest- It is a challenge against an assessment.

b. Refund- It is a remedy in case of excessive or erroneous payment of a tax with the BIR.

(2) Judicial Actions

a. Civil Actions for taxpayer – Appeal to Court of Tax Appeals and action for damages.

b. Criminal Actions for taxpayer- Includes filing of the criminal complaint against BIR officials and

employees and injunction.

Penalties

a. Surcharge- 25% charge imposed if the taxpayer fails to file or pay a tax.

b. Interest- 20% cumulative per year of any unpaid tax liability running from the date of the

prescribed payment until the amount is fully paid.

c. Compromise Penalty- This is the amount of money which the taxpayer pays to compromise tax

violation. This is paid in lieu of criminal prosecution.

Assessment- This is a preliminary investigation and notice to the taxpayer of the tax liability based

on facts and evidence.

Collection- It is after the assessment and procedure, or when it becomes final and executory, the

BIR may avail the remedy of the collection.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

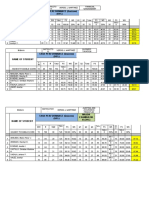

- Name of Student Task Performance (Quizzes) (50%)Document4 pagesName of Student Task Performance (Quizzes) (50%)Vergel MartinezNo ratings yet

- Review-Income TaxDocument9 pagesReview-Income TaxVergel MartinezNo ratings yet

- Time Value of MoneyDocument16 pagesTime Value of MoneyVergel MartinezNo ratings yet

- Seatwork On Income Taxation NameDocument2 pagesSeatwork On Income Taxation NameVergel MartinezNo ratings yet

- Final Midterm GradesDocument10 pagesFinal Midterm GradesVergel MartinezNo ratings yet

- Name of Student TASK PERFORMANCE (Quizzes) (50%) Class Participation (20%) Major Examination (30%)Document10 pagesName of Student TASK PERFORMANCE (Quizzes) (50%) Class Participation (20%) Major Examination (30%)Vergel MartinezNo ratings yet

- Tax GuideDocument1 pageTax GuideVergel MartinezNo ratings yet

- Quiz-FS AnalysisDocument3 pagesQuiz-FS AnalysisVergel MartinezNo ratings yet

- Income Tax Seatwork OnDocument8 pagesIncome Tax Seatwork OnVergel Martinez100% (1)

- Quiz On Income TaxationDocument2 pagesQuiz On Income TaxationVergel Martinez100% (1)

- Time Value of Money HandoutDocument4 pagesTime Value of Money HandoutVergel MartinezNo ratings yet

- Income Tax Seatwork OnDocument8 pagesIncome Tax Seatwork OnVergel Martinez100% (1)

- Quiz On Income TaxationDocument2 pagesQuiz On Income TaxationVergel Martinez100% (1)

- Quizzer-Donor's TaxDocument4 pagesQuizzer-Donor's TaxVergel Martinez33% (3)

- Gross Income Concept of Gross Income Gross Income Means The Total Income of A Taxpayer Subject To Tax. It Includes The Gains, Profits, and IncomeDocument7 pagesGross Income Concept of Gross Income Gross Income Means The Total Income of A Taxpayer Subject To Tax. It Includes The Gains, Profits, and IncomeVergel MartinezNo ratings yet

- Quiz-Pre Engagement & Audit PlanningDocument5 pagesQuiz-Pre Engagement & Audit PlanningVergel MartinezNo ratings yet

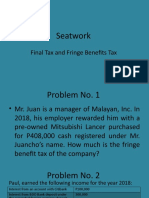

- Seatwork: Final Tax and Fringe Benefits TaxDocument6 pagesSeatwork: Final Tax and Fringe Benefits TaxVergel MartinezNo ratings yet

- Risk and Rates of ReturnDocument5 pagesRisk and Rates of ReturnVergel MartinezNo ratings yet

- Financial Statements AnalysisDocument9 pagesFinancial Statements AnalysisVergel MartinezNo ratings yet

- Quiz-Professional Standards-ARDocument4 pagesQuiz-Professional Standards-ARVergel MartinezNo ratings yet

- RR 12 QuizDocument2 pagesRR 12 QuizVergel MartinezNo ratings yet

- BondsDocument8 pagesBondsVergel MartinezNo ratings yet

- 2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsDocument2 pages2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsVergel MartinezNo ratings yet

- Marketable Securities + Receivable: Increase. IncreaseDocument4 pagesMarketable Securities + Receivable: Increase. IncreaseVergel MartinezNo ratings yet

- Seatwork: Final Tax and Fringe Benefits TaxDocument6 pagesSeatwork: Final Tax and Fringe Benefits TaxVergel MartinezNo ratings yet

- Quiz-Professional Standards-ARDocument4 pagesQuiz-Professional Standards-ARVergel MartinezNo ratings yet

- Quiz On Income TaxationDocument2 pagesQuiz On Income TaxationVergel Martinez100% (1)

- Income Tax Seatwork OnDocument8 pagesIncome Tax Seatwork OnVergel Martinez100% (1)

- Quiz-Pre Engagement & Audit PlanningDocument5 pagesQuiz-Pre Engagement & Audit PlanningVergel MartinezNo ratings yet