Professional Documents

Culture Documents

Stock Exchange

Uploaded by

Keerthi KeerzCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Exchange

Uploaded by

Keerthi KeerzCopyright:

Available Formats

Stock Exchange

Bombay Stock Exchange Limited offers trading in cash and

derivatives, and corporate and government securities, and is the

oldest stock exchange in Asia. The company was formerly known as

The Native Share & Stock Brokers Association. Around 4,800

Indian companies list on the stock exchange and it has a significant

trading volume. Bombay Stock Exchange Limited was founded in

1875 and is based in Mumbai, India.

A stock exchange, share market or bourse is a corporation or mutual

organization which provides facilities for stock brokers and traders,

to trade company stocks and other securities. Stock exchanges also

provide facilities for the issue and redemption of securities, as well

as, other financial instruments and capital events including the

payment of income and dividends.

The securities traded on a stock exchange include: shares issued by companies, unit trusts and

other pooled investment products and bonds. To be able to trade a security on a certain stock

exchange, it has to be listed there. Usually there is a central location at least for recordkeeping,

but trade is less and less linked to such a physical place, as modern markets are electronic

networks, which gives them advantages of speed and cost of transactions. Trade on an exchange

is by members only.

MUMBAI Stock Exchange:

The Stock Exchange, Mumbai

Address

Phiroze Jeejeebhoy Towers,

Dalal Street,

MUMBAI 400 023.

Tel. (+91-22) 2655581, 2655626, 2655860-61

Fax. (+91-22) 2658121

Tel. (+91-22) 2655665

...

History of Stock Exchanges

In 12th century France the courratiers de change were concerned with managing and regulating

the debts of agricultural communities on behalf of the banks. As these men also traded in debts,

they could be called the first brokers. Some stories suggest that the origins of the term "bourse"

come from the Latin bursa meaning a bag because, in 13th century Bruges, the sign of a purse (or

perhaps three purses), hung on the front of the house where merchants met.

New York Stock Exchange Market

The NYSE can trace its roots to 1792, however it did not become known

as the New York Stock Exchange until 1817 when the organization

drafted a constitution. In early times is composed of 5 rooms which were

used for trading but today the trading center has expanded to much

bigger. It is located in 18 Broad Street, New York City.

It is the biggest stock exchange in the world in the amount of dollars that

flows through it each day and has the second largest in terms of numbers

of company listing, exceeded only by NASDAQ.

The global capitalization of the exchange is $2.1 trillion with $1.7 trillion by companies not

based in the U.S.It works similar to that of an auction. Every company listed trades in one

location. A specialist broker designated by each of the listed companies has the duty of acting as

an auctioneer at the company post.

NYSY Today

When it comes to how much money is traded at any given day, the New York Stock Exchange is

categorized as the largest exchange market in the worldwide scope. It is also regarded as the

vanguard in the equities market in terms of technology and investments coming in from around

the globe. Each day, the New York Stock Exchange is where the largest companies buy and sell

billions of dollars amount of shares.

The New York Stock Exchange comprises of member-brokers who take on the trading of stocks

(buying and selling) for clients, which are financially huge companies based in different parts of

the world. Together with the value of companies that trade on the New York Stock Exchange, it

is estimated to have reach at nearly four trillion dollars. Members of the New York Stock

Exchange buy and sell millions of dollars worth of stock for their costumer every single day.

The New York Stock exchange has 1,366 members, who do all of the trading on behalf of their

clients. These members are actually some of the largest brokerages and companies in the world,

and have a net worth of their own that totals about 4 trillion dollars combined. Only members are

allowed to trade directly at the exchange, so each member handles stock orders for millions of

clients. This means that members are buying and selling billions of shares every day.

Singapore Stock Exchange

The SGX was inaugurated on 1 December 1999, following the merger of

two established and well-respected financial institutions - the Stock

Exchange of Singapore (SES) and the Singapore International Monetary

Exchange (SIMEX).

On 23 November 2000, SGX became the first exchange in Asia-Pacific to be listed via a public

offer and a private placement . Listed on our own bourse, the SGX stock is a component of

benchmark indices such as the MSCI Singapore Free Index and the Straits Times Index. Home to

Singapore's leading listed companies, SGX is also at the forefront of exchanges globally in

attracting international issuers and is rapidly emerging as Asia's offshore risk management centre

for international derivatives.

One Daylife for the Daytrader : Stock Exchange Market

Welcome in the strange world of Day trading. It's 9:30 in the morning. In the basement of the

Place of Canada, street of Gauchetière, Montreal, it is the routine. With signal of the opening of

the North-American stock exchange markets , a bunch of young adults are inclined feverishly

towards their keyboard of computer. And it left for another bogus day! From here until the

closure of the Stock Exchange, at 4PM, this heteroclite band will buy and sell tens of thousands

of actions of companies. Marjorie Landry, 23 years old, coed with the baccalaureat in finance at

the University of Quebec at Trois-Rivières (UQTR), takes seat behind his working station and

opens a meeting of computer.

At once its password accepted, the amount that it can speculate for the day on Stock Exchange

Market appears on one of the screens in front of it. It can then start to make its first transactions

on the title of Intel, on the Stock Exchange of Nasdaq. Its spirit and its must be sharp.

NSE ( National Stock Exchange)

The National stock exchange (NSE), located in Bombay, is

India's first debt market. It was set up in 1993 to encourage stock

exchange reform through system modernization and competition.

It opened for trading in mid-1994. It was recently accorded

recognition as a stock exchange by the Department of Company

Affairs. The instruments traded are, treasury bills, government

security and bonds issued by public sector companies. The

Organisation: The National Stock Exchange of India Limited has

genesis in the report of the High Powered Study Group on

Establishment of New Stock Exchanges, which recommended

promotion of a National Stock Exchange by financial institutions

(FIs) to provide access to investors from all across the country on

an equal footing. Based on the recommendations, NSE was

promoted by leading Financial Institutions at the behest of the

Government of India and was incorporated in November 1992 as

a tax-paying company unlike other stock exchanges in the country.

BSE ( Bombay Stock Exchange)

BSE is the first stock exchange in the country which obtained permanent recognition (in 1956)

from the Government of India under the Securities Contracts (Regulation) Act 1956. BSE's

pivotal and pre-eminent role in the development of the Indian capital market is widely

recognized. It migrated from the open outcry system to an online screen-based order driven

trading system in 1995. Earlier an Association Of Persons (AOP), BSE is now a corporatised and

demutualised entity incorporated under the provisions of the Companies Act, 1956, pursuant to

the BSE (Corporatisation and Demutualisation) Scheme, 2005 notified by the Securities and

Exchange Board of India (SEBI). With demutualisation, BSE has two of world's best exchanges,

Deutsche Börse and Singapore Exchange, as its strategic partners.

Stock Exchange under the symbol CMM

On May 22, 2009, a account absolution reported, "Century is currently in cancellation of a

US$65 actor costs underwriting commitment. Once a costs is bankrupt it is accepted that the

aboriginal gold will be caked aural 4 months of start-up."

After the Bre-X fraud, a 43-101 was instituted. It about puts to cardboard in a abundant address

what admeasurement of mineral abundance your acreage has. Bre-X had agrarian claims of 200

actor ounces of gold in a adopted country. Aback again there was appealing abundant no austere

accountability for these numbers. Investors bid Bre-X from pennies to as aerial as $280.00 an it

breach 10 to 1. People fabricated and absent fortunes trading Bre-X. This isn't a Bre-X flashback,

it's a little history as to why the 43-101 was started and it's accent today.

You might also like

- Economics For Everybody Scope and SequenceDocument19 pagesEconomics For Everybody Scope and SequencecompasscinemaNo ratings yet

- Seminar 3 N1591 - MCK Chap 8 QuestionsDocument4 pagesSeminar 3 N1591 - MCK Chap 8 QuestionsMandeep SNo ratings yet

- Indian Stock Market ProjectDocument10 pagesIndian Stock Market ProjectKirti ....0% (1)

- Green REIT PLC Annual Report 2016Document176 pagesGreen REIT PLC Annual Report 2016Mihir JoshiNo ratings yet

- Venture Capital in IndiaDocument84 pagesVenture Capital in IndiaAtul Parikh100% (1)

- 10 2004 Jun QDocument7 pages10 2004 Jun QFahad SajjadNo ratings yet

- Validate, Verify & Check Credit Card or Debit Card NumberDocument1 pageValidate, Verify & Check Credit Card or Debit Card NumberDaniel GrekinNo ratings yet

- ATM Claim FormDocument1 pageATM Claim FormJm VenkiNo ratings yet

- Chapter-1 1.1 Introduction To Industry: StocksDocument8 pagesChapter-1 1.1 Introduction To Industry: StocksAshutosh KumarNo ratings yet

- Introduction To Equity MarketDocument40 pagesIntroduction To Equity MarketGautam KhannaNo ratings yet

- Introduction To Equity MarketDocument40 pagesIntroduction To Equity MarketGautam KhannaNo ratings yet

- Stock Exchange: HistoryDocument5 pagesStock Exchange: HistoryjennynicholasNo ratings yet

- Motilal Oswal ProjectDocument54 pagesMotilal Oswal Projectmathibettu100% (2)

- Motilal Oswal ProjectDocument54 pagesMotilal Oswal ProjectAnkit GodreNo ratings yet

- Project VSLDocument61 pagesProject VSLajupulickalNo ratings yet

- History and Evolution of Stock Exchange in IndiaDocument6 pagesHistory and Evolution of Stock Exchange in IndiaAmudha Mony100% (1)

- Stock MarketDocument25 pagesStock Marketk lightNo ratings yet

- Stock MarketDocument19 pagesStock MarketNandhini EkambaramNo ratings yet

- Introduction to Indian Stock MarketDocument45 pagesIntroduction to Indian Stock MarketRavi SutharNo ratings yet

- Final Project of Caital MarketDocument42 pagesFinal Project of Caital MarketLaxmi YandoliNo ratings yet

- Internship ProjectDocument81 pagesInternship Projecthuneet SinghNo ratings yet

- SA Operations of Stock MarketDocument7 pagesSA Operations of Stock MarketPublik SecttorNo ratings yet

- Share Khan Summer ProjectDocument113 pagesShare Khan Summer Projectakash01190% (20)

- New Finance Stock Market ProjectDocument31 pagesNew Finance Stock Market ProjectHabiba IjazNo ratings yet

- Finance' Arose. Entrepreneurs Needed Money For Long Term Whereas Investors Demanded LiquidityDocument3 pagesFinance' Arose. Entrepreneurs Needed Money For Long Term Whereas Investors Demanded Liquidityakash08agarwal_18589No ratings yet

- Indian Stock Market Training PresentationDocument40 pagesIndian Stock Market Training PresentationShakti Shukla100% (1)

- Depoaitary ParticipantsDocument50 pagesDepoaitary Participantsseepi345No ratings yet

- Indian FinancialsystemDocument94 pagesIndian FinancialsystemKeleti SanthoshNo ratings yet

- Industry Profile 2Document5 pagesIndustry Profile 2piusadrien100% (2)

- BSMDocument13 pagesBSMA. NavinNo ratings yet

- Industry Overview: Chapter - 1Document36 pagesIndustry Overview: Chapter - 1Rahul VermaNo ratings yet

- Protfolio Managemen TDocument72 pagesProtfolio Managemen TNicholas CraigNo ratings yet

- Mba Project by FrajvalDocument28 pagesMba Project by FrajvalmorganNo ratings yet

- Industry Profile: History of Indian Brokerage MarketDocument75 pagesIndustry Profile: History of Indian Brokerage MarketManishh Venkateshwara RaoNo ratings yet

- 06 - History of StocksDocument4 pages06 - History of Stocks45satishNo ratings yet

- Stock MarketeDocument7 pagesStock MarketeMuhammad AsifNo ratings yet

- BST Project 1Document26 pagesBST Project 1Kashish AgrawalNo ratings yet

- Final ProjectDocument83 pagesFinal ProjectThulasiram ChowdaryNo ratings yet

- Stock Bse NseDocument10 pagesStock Bse NsePRIYANKNo ratings yet

- History and Evolution of Indian Stock ExchangesDocument45 pagesHistory and Evolution of Indian Stock ExchangesSangita070No ratings yet

- Project 2Document73 pagesProject 2ankitverma9716No ratings yet

- Motilal Oswal ProjectDocument58 pagesMotilal Oswal Projectshrikantk_karnewarNo ratings yet

- Capital Market at SPADocument103 pagesCapital Market at SPABinish ThomasNo ratings yet

- Harikrishna ProjectDocument72 pagesHarikrishna ProjectGopinath Basavaiah SiddaiahNo ratings yet

- MD anAS AHMEDDocument41 pagesMD anAS AHMEDanaskolkataNo ratings yet

- Indian Capital Markets OverviewDocument28 pagesIndian Capital Markets OverviewDhanraj BhardwajNo ratings yet

- 5.stock Anlaysis ProjectDocument113 pages5.stock Anlaysis ProjectPinky MulchandaniNo ratings yet

- What Is Stock MarketDocument47 pagesWhat Is Stock MarketSwadesh Kumar BhardwajNo ratings yet

- Capital Market in IndiaDocument12 pagesCapital Market in IndiaVinod DhoneNo ratings yet

- What Is A Stock Exchange N DefDocument18 pagesWhat Is A Stock Exchange N DefFaizan ChNo ratings yet

- Bombay Stock Exchange (BSE), (Bombay Śhare Bāzaār) Is A Stock ExchangeDocument2 pagesBombay Stock Exchange (BSE), (Bombay Śhare Bāzaār) Is A Stock ExchangesadathnooriNo ratings yet

- MCX Vs NseDocument170 pagesMCX Vs NsepbNo ratings yet

- Capital Market GuideDocument26 pagesCapital Market GuideNayana hyNo ratings yet

- STOCK EXCHANGE LOCATIONSDocument47 pagesSTOCK EXCHANGE LOCATIONSkinsthakkarNo ratings yet

- Stock Exchange PresentationDocument27 pagesStock Exchange PresentationAAMIR ALINo ratings yet

- Kartik Industry Report of HDFC BankDocument60 pagesKartik Industry Report of HDFC BankAnonymous jaO10lANo ratings yet

- History & Evolution of Stock Exchanges in India: 2.1 Introduction: Before We Study TheDocument5 pagesHistory & Evolution of Stock Exchanges in India: 2.1 Introduction: Before We Study TheSriranga G HNo ratings yet

- Angel BrokingDocument61 pagesAngel Brokingvyas_deepika100% (1)

- Developments in Stock Market OperationsDocument9 pagesDevelopments in Stock Market Operationschirag_puri_1No ratings yet

- Mastering the Stock Market: A Beginner's Guide to Financial SuccessFrom EverandMastering the Stock Market: A Beginner's Guide to Financial SuccessNo ratings yet

- Stock Market Investing For Beginners: Your Beginner's Guide To Making Successful Stock Market InvestmentsFrom EverandStock Market Investing For Beginners: Your Beginner's Guide To Making Successful Stock Market InvestmentsNo ratings yet

- Forex Trading Mastering the Global Foreign Exchange Market the Ultimate Guide with the Best Secrets, Strategies and Psychological Attitudes to Become a Successful Trader in the Forex Market: WARREN MEYERS, #5From EverandForex Trading Mastering the Global Foreign Exchange Market the Ultimate Guide with the Best Secrets, Strategies and Psychological Attitudes to Become a Successful Trader in the Forex Market: WARREN MEYERS, #5No ratings yet

- HDFC Bank Summer ReportDocument55 pagesHDFC Bank Summer Reportilover_140085% (20)

- Final Report - JM Financial by Sony Saju GeorgeDocument76 pagesFinal Report - JM Financial by Sony Saju GeorgeKeerthi KeerzNo ratings yet

- Merchant BankingDocument17 pagesMerchant BankinggauravchabukswarNo ratings yet

- Merchant BankingDocument17 pagesMerchant BankinggauravchabukswarNo ratings yet

- Hedge AccountingDocument8 pagesHedge AccountingDilip YadavNo ratings yet

- TOP 6 MONEY MARKET INSTRUMENTSDocument6 pagesTOP 6 MONEY MARKET INSTRUMENTSNur ShahiraNo ratings yet

- SBI Annual Report 10 11Document58 pagesSBI Annual Report 10 11AayushmaanDhirNo ratings yet

- Acct Statement - XX6419 - 08112022Document26 pagesAcct Statement - XX6419 - 08112022AartiNo ratings yet

- The Conduct of Monetary Policy: Strategy and TacticsDocument34 pagesThe Conduct of Monetary Policy: Strategy and TacticsAlejandroArnoldoFritzRuenesNo ratings yet

- IB Economics SL10/11 - Macroeconomic ObjectivesDocument7 pagesIB Economics SL10/11 - Macroeconomic ObjectivesTerran100% (2)

- SEC Form 10-Q FilingDocument39 pagesSEC Form 10-Q FilingalexandercuongNo ratings yet

- M&A ValuationDocument7 pagesM&A ValuationmithunsworldNo ratings yet

- Month End Closing-Foreign CurrencyRevaluation.Document5 pagesMonth End Closing-Foreign CurrencyRevaluation.Kancheti Bhanu PrasadNo ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- Stripe TransactionsDocument3 pagesStripe TransactionsJoshua havensNo ratings yet

- E-Banking Impact on Customer Satisfaction in PakistanDocument43 pagesE-Banking Impact on Customer Satisfaction in PakistanRameez AbbasiNo ratings yet

- Final ExamDocument3 pagesFinal ExamJaninelaraNo ratings yet

- National Bank of Ethiopia - WikipediaDocument16 pagesNational Bank of Ethiopia - WikipediaKal kidan100% (1)

- FM14e PPT Ch14 04012021 042014pmDocument44 pagesFM14e PPT Ch14 04012021 042014pmAli PuriNo ratings yet

- Unit 1Document15 pagesUnit 1tayyaba fatimaNo ratings yet

- Circular No. 102-2012-TT-BTC - Per-Diem For Overseas Business Trip - ENGDocument20 pagesCircular No. 102-2012-TT-BTC - Per-Diem For Overseas Business Trip - ENGLê Đình ChinhNo ratings yet

- 14 Private Company Case Study Kakao DaumDocument6 pages14 Private Company Case Study Kakao DaumasdfsadfsdfNo ratings yet

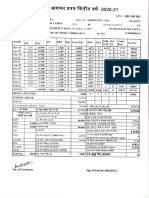

- Income Tax Agadan PrapatraDocument3 pagesIncome Tax Agadan Prapatraat.amitkumarbstNo ratings yet

- 04 Lease Financing ModelDocument26 pages04 Lease Financing Modeljanuar baharuliNo ratings yet

- Business ValuationDocument5 pagesBusiness ValuationPulkitAgrawalNo ratings yet

- Chapter 8 - GARDocument2 pagesChapter 8 - GARDibyendu DasNo ratings yet