Professional Documents

Culture Documents

Investment Opportunities in Somali Regional State Putting The Pastoralists Political Economy in Perspective

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Opportunities in Somali Regional State Putting The Pastoralists Political Economy in Perspective

Copyright:

Available Formats

Volume 5, Issue 9, September – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Investment Opportunities in Somali Regional State

Putting the Pastoralists Political Economy in Perspective

Miftah Mohammed Kemal

Department of political science and International Relations., Jigjiga University, Jigjiga Somali Region Ethiopia

Abstract:- Modern states and societies development can Keywords:- Investment, Macroeconomics, Capital

hardly be achieved without an appropriate policy and accumulation, Foreign Direct Investment, Somali Region,

action that delivers greater economic outcomes. To this Ethiopia, Economics, Pastoralism.

end, all states starting from the ancient times to the

modern era practiced economic policies that rely greatly I. INTRODUCTION

on the accumulation of wealth through different means

of the production process that leads to extraction hence Investment is, without doubt, one of the primary

accumulation of wealth based on which the state builds engines of growth in all economies (Anochiwa L. et al,

and maintains its internal as well as external 2018). The effectiveness of a lucrative investment heavily

sovereignty. It was in yesterday this motive for depends on the creation of strong complementarities with

achieving unlimited growth and accumulation of wealth technological progress, skills acquisition and the

that drives the first British East Indian company to development of innovative capability (World Bank 2018).

open its first overseas production plant in India in the These elements invest a natural point of departure for

18th century.Today the multiple economic social and governments seeking to formulate a robust development

technological imperative of investment and that of strategy. The presence of a well-developed link between

foreign direct investment have become clear. Foreign investment and these determinants of growth make

direct investment is the most important engine based on investment effective only when complemented by a

which sates economy gain income in terms of National favorable policy environment as well as institutions that

Gross Domestic Production, foreign exchange earnings encourage savings, attract and direct investment to key

and employment opportunity as well as technological sectors in the economy (Stephen Thomsen in OECD 2015).

and capital transfer. To this end, countries compete for Foreign direct investment thus became a key factor in

attracting capitals to flow to their economy in the form enhancing the contributions of investment to skills

of investment. This has greatly benefited countries of formation, technological innovation, competitiveness, and

South East Asia in the last couple of decades. Africa, economic growth. A clear understanding of how such a

though not benefited as much as the what the Asian synergy between investment policy on the one hand and

tigers and other eastern economies gained from foreign technological progress on the other hand can be created is

direct investment, many of African states are striving to an essential prerequisite for designing an effective national

use the advantage of investment in their national investment policy and investment promotion strategy

endeavor to achieve economic and socio-political (OECD 2015, UNCTAD, 2008).

development .Yet, the pattern of the distribution of this

gain from the foreign direct investment is limited in its In Ethiopia, the gap between domestic investment and

scope and not enabled states to benefiting the different savings has remained wide due to the low levels of income

sections of their population equally.This problem of and domestic savings however reinforcing the need for FDI

uneven distributions of gains from economic in the development of the country’s economy. Domestic

development has been common problem in many of the investment in Ethiopia as well has increased since the

emerging economies.Ethiopia is not peculiar.Despite the introduction of liberal economic policies in the EPRDF

progress made in atracting more investors to the regime since the year 1991 (Admasu Shiferaw 2017). For

national economy,the distribution of these has been instance, according to the report of UNCTAD 2008 in a

uneven.Most of the FDI gains are concentrated in few period between 1990 and 1997, gross domestic investment

clusters in the major regions of the country. One of the as a proportion of GDP rose from 11.9 percent to 19.1

least benefited livelihhod and economic areas has been percent, while gross domestic savings remained at the same

the pastoralist roaming areas. Comparatively rate.

speaking,thus far,the Somali regional state gained little

or no foreign direct investment since the new EPRDF In Ethiopia, there has been a major change over the

government came into power 30 years ago .This has past decades in the government's attitude towards private

been despite the region has a huge potential for making investment in general and foreign direct investment in

gain from FDI given that the required attention and particular (OECD 2015). This is expressed by the fact that

intervention is made.This article makes a description of the government recognizes the economic and or

the investment potentials in Somali regional state baed developmental imperative of the foreign investment, by

on the political economy framework. The review bringing capital, technology, and skill into the country

concludes that The review fininds out that the region economy and labor force and by strengthening linkages

has a huge potential for investment given the right which are vital for promoting regional development

attention by both policymakers and investors. endeavors. According to Erik Solheim in OECD 2015

IJISRT20SEP326 www.ijisrt.com 416

Volume 5, Issue 9, September – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

“Investments to Ethiopia have increased 15 times in just clearing land, putting oneself through college, etc .

seven years as a result of good policies and focus on Investment according to finance means buying of assets.

manufacturing, agriculture, and energy” For Examples, buying stocks and bonds, investing in real

estate, mortgages (Diego Rodriguez et al 2016). These

However, the distribution of this investment is uneven investments may then provide a future income and increase

and most of the major investment projects are concentrated in value (i.e., investing in real estate). Investment according

in Addis Ababa and its surrounding Oromia region to Oxford Dictionary means the investing of money.

followed by Amhara and Tigray and southern Regional Investment from an Individual Point of View refers to a

states . The situation with the less developed or emerging monetary commitment of some sort. For example, a

regions of the country is worst. In this peripheral area, the commitment of money to buy a new car is certainly an

level of socio-economic development is very poor “investment”.

compared even to the other regions of Ethiopia.

Determinants of Investment

This has partly to do with the historical neglect and There are a wide array of concepts and approaches in

lack of investment during the past regimes and the limited the literature of investment that identify determinants of

progress made in this regard even today as investment at the local national and global level. For

well(Kemal,2019). Somali region is not different. It is one instance, according to the 1998 World Investment Report,

of the less developed regions of Ethiopia which has the policy framework for FDI includes: economic, political

attracted little or no investment. Yet this does not entail that and social stability, rules regulating entry and operation of

investment in the region is zero and that there is no place FDI, standard of treatment of foreign affiliates, policies on

for investment. The region has tremendous wealth and functioning and structure of the markets, international

natural resource endowment if developed that suffice to agreement on FDI, privatization policy, trade policy and tax

change the nation into prosperity. What it lacked however policy (Yaw Asante, 2000). Business facilitation refers to

so far is the required attention in the past. the ease with which business can be conducted in the host

country. The most important business facilitations include

Since recent years, however, there is a light of hope investment promotions and incentives, hassle costs related

emerging into the region characterized by a quantum leap to corruption and administrative efficiency, development of

project launched in the capital city on the hotel and small financial institutions, the enforceability of contracts and

scale light industry sector. So in light of this background, protection of property rights, and quality of life (UNCTAD,

this paper tries to reveal the investment potential in Somali 2008).

regional state based on data obtained from regions

investment agency. Accordingly, the first part of the paper For others, the determinants are generally divided into

focuses on conceptualization of basic terms related to two places. The push and the pull factor of determinants for

investment, the second part presents the investment FDI and portfolio investment flows. The former represent

potential of the region based on data taken from Hodan external factors, the latter focuses on the internal factors

journal, the third part deals with the analysis of the data with in the country receiving the investment. These factors

while the last part provides a conclusion and some policy are classified in to pull and push factors. Push variables;

suggestions. refer to those that are external to the recipient country and

that take place in countries that are capital suppliers mostly

II. LITERATURE REVIEW the industrial countries (Saskia K.S et al 1998). Pull

variables, on the contrary, are those that take place in the

Conceptualizing of Investment host country.

The term ‘investing” could be associated with the

different activities, but the common target in these activities Further, these variables are classified into six broad

is to “employ” money during a given period planning to categories:- Market size, country conditions, openness

enhance the investor’s wealth. Capitals to be invested come variables, liquidity variables, government finance

from either asset already owned, borrowed money or indicators, and vulnerability indicators. In general, these are

savings. “By foregoing consumption today and investing variables that are commonly used in studies of FDI as

their savings, investors expect to enhance their future general determinants that affect the flow of investment.

consumption possibilities by increasing their wealth”

(Kristina, 2010:9). Definition of variables

Market Size: the market size hypothesis states that

Investment proclamation of Ethiopia published in the multinational firms are attracted to a larger market to utilize

year 2012 defined investment as: - “expenditure of capital resources efficiently and exploit economies of scale

in cash or in-kind or in both by an investor to establish a (Chakrabarti, 2001). The market size has been represented

new enterprise or to expand or upgrade one that already by real per capita GDP and growth rate of real GDP (as of

exists” (Investment Proclamation No. 769/2012). market growth potential). Real GDP per capita and real

According to theoretical economics, investment means the GDP growth rates are included in the regression as

production of capital goods - goods which are not measures of market attractiveness and FDI is expected to be

consumed but instead used in future production. Examples positively related to these two variables.

of such goods include building a railroad, a factory,

IJISRT20SEP326 www.ijisrt.com 417

Volume 5, Issue 9, September – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Macroeconomic Stability: there is a widespread Mining and quarrying of gold, marble and granite; and

perception that macroeconomic stability shows the strength Engineering and management consultancy.

of an economy and provides a degree of certainty of being

able to operate profitably (Balasubramanyam, 2001). III. RESEARCH METHODOLOGY

Inflation rates and exchange rates are used as proxy

variables for macroeconomic stability. Low inflation and The study has been completed through the use of

stable exchange rates are expected to have a positive impact secondary data. It relied heavily on a locally published

on FDI. Journal called Hodan published by the regions investment

promotion office in the year 2014.The analysis of the study

Infrastructure: infrastructure covers many is thus made by using secondary data sources.

dimensions ranging from roads, ports, railways and

telecommunication systems to the level of institutional IV. RESULTS AND DISCUSSION

development. The availability of well-developed

infrastructure will reduce the cost of doing business for Investment Opportunities in Somali Regional State

foreign investors and enable them to maximize the rate of The data presented in this section of the paper hugely

return on investment (Morriset, 2001). Therefore countries depended on the journal locally known as HODAN

with good infrastructures are expected to attract more FDI. published in Somali region by the regions investment

It is a standard practice to measure infrastructure by the agency as a data source. To this end, HOPDAN journal

number of telephone lines per 1000 people in a country. version publication in the year 2014 G.C included some

narrative on prospects, opportunities as well as policy-

Human Capital: human capital is considered to be an related issues of investment in the Somali Regional State.

important factor for location strategies of multinational

companies. When investing for the long term in another In this regard, the emphasis has been made on the fact

country, multinational companies have in mind the human that Somali region is endowed with natural resources that

resources in the host country. A large, efficient, educated are generally including farmland, varieties of natural

population is a requirement for an attractive investment. resources, rivers, livestock, water, forestry, minerals, and

The more educated the population is, the more likely it is energy sectors. In addition to this natural resources related

for a country to attract more FDI (Lewis, 1999). According endowment, the regions geographical location near to the

to Gereffi and Fernandez-Stark (2010), firms are attracted seaport namely ports of Berbera in Somali Land which is

to developing countries as offshore destinations for their located at 150 miles away from the regions capital Jigjiga

competitive advantages, such as low human resources has been presented as opportunity for rewarding investment

costs, technological skills, language proficiency, similar including investing in areas of education and health service

time zones, and geographic and cultural proximity to major provision related sectors to the sea harbours of the

markets. As more sophisticated work and knowledge- neighbouring countries of Djibouti, Somalia and Kenya.

intensive activities are performed abroad, the supply of The detailed scenarios figures and explanations of these

scientific, engineering and analytical talent offered by general areas and outline of investment potentials of the

developing countries also become key in attracting firms. region is summarised and discussed in the following

(WTO, 2012:4) section.

Determinants of Investment in Ethiopian Context The Potential of the Livestock Sector

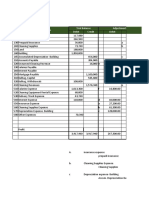

According to the study conducted by Getinet in The regions potential and its blessing with the huge

identifying the determinants of FDI in Ethiopia, livestock resource is emphasized to be one of the most

their findings show that economic growth, export important, promising and rewarding sectors for investment.

orientation (openness) and liberalization have a significant As it is discernible that the region represents the largest

positive impact on FDI, while macroeconomic instability total area and population of the pastoralist people living in

and low-level physical infrastructure have a negative Ethiopia as a whole and the livestock sector is the typical

impact on the same (Getinet et al 2005). mode of production and livestock is the main means of

production as well as capital for the pastoral communities.

Investment Opportunity in Ethiopia So the greater emphasis given to the sector by the agency is

The main business sectors which are open and in logically derived from this reality. Accordingly, the

which the country is currently seeking foreign investment discussion of this paper starts with the presentation of the

include: regions livestock endowment in terms of showing the latest

Manufacturing industries (including food, beverages, figures estimating the estimated total number of all types of

chemicals and pharmaceuticals, plastics, metallic and livestock resources of the region. This is important given

non-metallic products, paper products, leather and the presence of variation in the estimation of numbers

leather products, textiles and garments); livestock population in the pastoral areas resulted partly

Agriculture, including agribusiness and processing for from a lack of clear data. The following table displays the

exports; number and types of livestock resource in the region. The

Real-estate development; figures are taken from the regional livestock crop and rural

Education and health services; development bureau.

Grade 1 construction contract;

IJISRT20SEP326 www.ijisrt.com 418

Volume 5, Issue 9, September – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

The second potential and or priority area identified by context of the region. Some of the encouragements

the agency as an opportunity and rewarding investment mentioned are including:

area in the region is the feeding and forage sector. In this Duty-free customs examination for

regard, the journal mentioned that in the region six long machinery/equipment and supplementary materials

types of livestock forage and feed have been identified by intended for implementation of project works.

the regions research institute Somali Region Pastoral and Income tax exemption for investors for some specific

Agro Pastoral Research Institute (SORPARI). And these period

varieties are being used in some 25 woredas and or Encouragement in supplementary seed to project works

demonstration areas in the region and that investing in on the exploitation of natural resources

producing good livestock feed and forage is of rewarding The first factor of promoting duty-free customs service

and greater opportunity to use the advantage of. was allowed for some items categorized as follows:

Machinery for agricultural farmland works

Land and Water Sector Small industrial factory machinery

The third priority and potential area identified is

Machinery/equipment for construction projects

inland commensurate for water exploitation. In this part the

Equipment for tourism-related projects

potential of the region for farm production through the use

of rivers mentioned. The water resources described are two Equipment for education-related project works

types: Rivers and underground water. Equipment for health/healthcare-related service

Machinery equipment for water-related projects

Rivers: In the first category the rivers that could be used in And duty-free customs service on imported vehicles

the region are Wabi Shebele, Genale, Dawa and Weyb. Promoting land use as an incentive for investment

Ground Water: According to the journal in the region

there is huge underground water resource laying with In this regard, SRS investment law ref.no.96/2003.rev is

reachable underground and this can water 2000,000(two quoted in the document and stipulates that

million) hectares of farmlands and the current utilization is “An actively-involved investor has the right to obtain

only 1000 hectares. So using the rivers and groundwater’s and hold any certain land allotment deemed necessary for

many types of farm produces could be developed in the the implementation of projects-work with express

farmlands. The following are listed as some farm produces permission granting that said investor will be exempt from

that could be tended in the region: rental obligations for such land held in rural areas over a

Cereal Crops: wheat, barley, corn, sorghum and rice of five to ten years period (depending on the investment

different types can be produced as confirmed by the project type involved).”

research of SORPARI

Oil Seeds: peanut, custard oil, black bean, Lentils The reviews made in the beginning part of this paper

(misirka). sesem (Sisinka) are in tandem with the aim to help in the due analysis

Commercial Industrial Crops: cotton, sugar-seeds, processes of the issues of opportunities for investment in

tobacco the Somali region. The standard definitions of investment,

Green Vegetables and Fruits: Papaya, mango, lemon, the presence of an array of approaches and different way of

potato, onion, banana categorizing and conceptualizing the term investment does

not prevent the objective of this paper of shading light on

Mineral Resources the opportunity for investment in Somali region. Rather it

The fourth sector is the natural resource of minerals. provides it an ocean of knowledge from which it can select

In the mineral sector, the journal has emphasized on the the concepts that best fit to explain the reality in the

edible salt at Goolusbo. The estimated potential of the salt region's investment.

deposit is 774,681 tons per year. So the agency call for

investment in the production of iodinated salt since there is Accordingly in this analysis part of the paper

a gap in production and this gap could be covered by validation of data or testing of theory based on the standard

private sector investment. model of regression or other econometrics approaches will

not be used. Rather a qualitative analysis of the case in

Tourism, Energy, and Forestry point: investment opportunity is Somali region vis some of

The last sectors to mention are the tourism, energy the concepts used and determinants identified as well as

and forestry sector. The regions endowment in solar relevant practices underway at Ethiopian level will be

energy, wind tide and natural gas in one potential area for harmonized and analyzed. In doing so the first part of this

investment. From the forestry sectors trees with natural section starts by finding some commonalities between

gum, incense and Myrah are a potential resource that could Ethiopia’s investment priority/potential areas in light of

be developed. what has been the case for the same in SRS. This shows the

possibilities and complementarities of the two. The

The Policy Environment: Promoting Investment opportunities and prospects not witnessed by the journal

In this regard, mention has been made on the presence will be supplemented and reflected at if any. The third part

of encouraging an environment for private investment by concludes followed lastly by policy suggestions and

the government of Ethiopia and this could apply to the recommendations.

IJISRT20SEP326 www.ijisrt.com 419

Volume 5, Issue 9, September – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

In the context of dealing with very fragile and in investment in one of the most sustainable, profiting and

underdeveloped economies, the mainstream definition of productive manner. Their production and investment have

terms and measuring of development aspects based on been based on input such as land, the pasture, and water

standard tools gives mostly little or no result. This is which produces the livestock as capital, and the labor is the

especially true when one talks about the issue of measuring pastoral men and women undertaking the rearing of

development, poverty, employment or income of the livestock based on rational mobility. This is in line with the

pastoral communities which are highly detached from concept of production /investment which is the function of

mainstream economics that tries to quantify or measure land, labor, and capital.

development through crud measures common in

mainstream development literature. This challenge has been The pastoral enterprises’ productivity could be

witnessed by many development writers and researchers measured by the accumulation of wealth of livestock

working specifically in this sector (pastoralism). To this owned by the pastoral fellow. a large number of cattle

end, a lot has been said by notable writers on pastoralism concentration in the pastoral area is the result of a sustained

including Devereaux (2006) and little (2010) to mention act of saving and investment. The pastoralist accumulated

few. Who come-up with amazing realities about the huge herd of livestock also for prestige. The same is true of

economic and social development aspect of the pastoralist the modern businessman engaged in some prestigious

community in Ethiopia. A positive finding that questioned investment for fame. Both are the same. If saving livestock

the old fashion of seeing pastoralism as backward and in large quantity gives pleasure to a pastoral household then

irrational as well as unsustainable and unproductive way of the act of herding becomes leisure (which is consumption).

life. The increasing number of the flock of the herd is a profit.

But in their case, they developed a means that is sustainable

This challenge and confusion become clear as one as well. That they undertake to save, consumption, as well

tries to deal with the issue of saving, investment, spending as investment practices, long-lived. With this they had the

patterns, consumption and saving behavior of the pastoral corresponding institutions and behaviors such practices

communities of Ethiopia. There is a huge knowledge gap in entail as well.

this regard resulting in lack of secondary data. However,

this does not entail that there is no such thing as Devereux study of livelihoods in SRS unveiled that

consumption, saving or investment in this mode of the pastoral Somali communities are one of the highest

production and or pastoral way of life. Of course, there has calorie consuming groups of Ethiopia. And the region's

been saving, consumption as well as investment in pastoralist is the less poor groups compared to other groups

pastoralism a practice that evolved over thousands of years in the country. In a recent study by the UN entitled Ethiopia

but informal hence unnoticed. So this paper leaves the four it is unveiled that Ethiopia three, which refers to areas

question of consumption pattern and saving by the of the southeast lowland in Ethiopia including mainly

pastoralist aside since it is beyond its objective. However, Somali region, is of the highest potential for livestock as

the paper makes a brief comment on the question of saving well as irrigation agricultural development. According to

since it is highly related to the concept of investment which this and other related studies, the Somali region has the

is the topic of this paper. highest potential for development through the use of its

various natural resources endowment with a particular

The term saving is confused with investment as saving comparative advantage in the livestock sector. So in light of

and investment are related. And most works of literature this, the aforementioned priority area for investment

focus on the issues of financial saving and investment in identified by the region's agency is appropriate. The

their discussion and little attention seem to be given to the number of cattle per category presented above far exceeds

term of real investment. Despite this, there is a trend of the official statistical estimates given by agencies like CSA.

seeing real investment in light of financial investment and The actual number more likely exceeds even this large

its relation with saving and contend that saving and number.

investment are inseparable two faces of the same coin.

While financial savings and investment may indeed and In line with the GTP (2012) plan, the national

often do diverge from one another, the same is not at all investment agency bulletin (2013) identified investment

true of real saving and real investment. In the latter case, priority and focus area of the country. The manufacturing

real saving does not precede real investment; rather, it is sector with backward and forward linkage with agriculture

coincident with it. is put as number one priority area. The textile, garment,

leather, and leather products are the activities mentioned as

So leaving academic debate aside as professor Barnet part of this core area. This could be taken as a window of

maintained real investment as a phenomenon in which both opportunity for boosting Somali regional investment as the

saving and investment could occur at the same time. A regions potential is in areas of producing industrial crops

given person can either consumes or produces in a given such as cotton. Besides, the livestock dependent leather

time or place. Pastoralists have been in production of industry of Ethiopia rests much on the exploitations of

livestock. Where in pastoralism they consume part of this livestock-related resources in the pastoral areas.

livestock and save the remaining based on the plan for

future consumption which is an active investment. In the

real investment sense, the pastoralist community have been

IJISRT20SEP326 www.ijisrt.com 420

Volume 5, Issue 9, September – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

By the same token, this will create an opportunity to So attracting the investors and the foreign direct

realize an investment in the sector as planned by the region. investment has become a policy objective of many

The other priority areas also related to sugar cane and other developing and developed world. But the actual attainment

fruit sectors that are also priority areas of the region of the benefit of the act of FDI is determined by certain

identified as discussed above. So, in general, these sectors factors. Several determinants of FDI are available in the

and the priority areas identified by the region and listed in literature. And there is no sole couple of factors taken as

the above section is in line with the governmental focus standard determinants. The determinants vary across the

area for boosting investment in the coming years and place, time and condition. What could be said is the flow of

decades. And this can be seen as a golden opportunity for the FDI is affected by some general factors mentioned

realizing the investment promotion objective of the region above.

thereby solving the possible impediment that restrains its

actualization. Ethiopia, as a growing economy showing considerable

progress in its growth and development, has started the

V. CONCLUSION journey of using FDI and local investment to improve its

poor status in the area. The success recorded in some area

Investment is an important instrument for accelerating and the effort underway to become attractive to FDI should

economic growth and development of state and society at be kept upon in improved and expanded manner. In this

all level. And it has been an old practice that has lived with regard investment in improving the basic infrastructures in

the history of the world. It takes many forms. As people the less developed region should be emphasized. This is

live in the world in which hope, unlimited growth, and a important given the relatively poor performance of these

better future is the driving engine and have recurrent needs areas of the country in attracting and hosting local and

for today, human daily life condition is characterized by an foreign direct investment.

act of production, consumption and saving then investing

hoping to fulfill the future need to consume. So in this real The case in the Somali region is not exceptional. It has

sense of investment, an act of saving and investment has an array of endowment in natural resource wealth as noted

been a common practice of people. The same is thus in section three of this paper. But these resources could be

applicable to the pastoralists. used to change the condition of the community and benefit

the state and humanity when it is exploited in one of

However, the term investment mostly referred to in productive and sustainable manner. To do this additional

the economic and development discourse has a lot to do quantum measures namely investments on human, physical

with an activity through which wealth is accumulated and and policy areas infrastructures deem to be imperative. This

production is excelled and material prosperity is achieved. does not mean however that everything is zero. It is not and

In this regard, the investment is undertaken at a higher it can’t be. There is huge potential as well as startups and

level. In many countries investment undertaken by the positive developments in the health, education, banking and

governmental body on infrastructures has become one finance, and research areas together with the stimuli being

important aspect. Parallel to this, the investment made by observed in the booming of the construction

individuals and groups of individuals on a wide scale that sector (increase in number and size of buildings that are

can bring about change at a mass level in areas of instrumental to the service sector improvement as well) in

employment creation, income generation as well as poverty Jigjiga town. So building upon these strengths will have a

reduction has become another important development of positive distributive result on the whole regional investment

the modern world. In both cases, the total level of pattern thereby attractive lucrative investment to come to

household, corporate or governmental level saving and the region and benefit the community.

consumption pattern has become imperative. So in general

terms when one talks of investment today it is understood ACKNOWLEDGMENT

by default to be an act of flow of knowledge, technology

and capital from one place to another to achieve some gains The author would like to recognize the Somali

of economic or political depending on the nature of the Regions investment agency for its cooperation in providing

investment. valuable information for making this article produced.

In a world where states and societies are divided REFERENCES

between the developed/undeveloped, the poor the reach, the

north, and the south, the center-the periphery the ownership [1]. Admasu Shiferaw(2017) Productive Capacity and

of knowledge, technology, and capital is unevenly Economic Growth in Ethiopia UNITED

distributed. And the level of socio-economic development NATIONS(2017) Department of Economic and Social

of states and societies is different as well. While the variety Affairs CDP Background Papers CDP Background

and quantity of challenges are concentrated in the poor Paper No. 34 ST/ESA/2017/CDP/34

countries the skill knowledge and technology needed to [2]. http://www.un.org/en/development/desa/papers/

transform them resides with the economically developed [3]. African Development Bank. (2018) African Economic

world. So an act of foreign direct investment has become an Outlook 2018.African Development Bank

important aspect in a more and more globalizing world. Group. ISBN 978-9938-882-46-9 (electronic)

IJISRT20SEP326 www.ijisrt.com 421

Volume 5, Issue 9, September – 2020 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[4]. Abdul Khaliq And Ilan Noy(2007) “ Foreign Direct

Investment And Economic Growth: Empirical

Evidence From Sectoral Data In Indonesia” March

2007

[5]. Admasu Shiferaw Sioum “Private Investment And

Public Policy In Sub-Saharan Africa: An Empirical

Analysis” January 2002, Working Paper 356

[6]. Anochiwa Lasbrey, Michael Enyoghasim, Agbanike

Tobechi, Nkechi Uwajumogu, Basil Chukwu5, Ololo

Kennedy (2018).International Journal of Economics

and Financial Issues, 2018, 8(5), 309-318. ISSN:

2146-4138 available at http: www.econjournals.com

[7]. Balasubramanyam, Vihjay Mahjan ( 2001).The

Economic leverage of the virtual community.

[8]. Brimble, Peter. 2002 “ Foreign Direct Investment,

Technology And Competitiveness In Thailand,”

Chapter In A World Bank Institute Volume

Forthcoming In 2002.

[9]. Diego Rodriguez Palenzuela, Stéphane Dees

(eds)(2016). Savings and investment behavior in the

euro area. Occasional Paper Series.No 167/January

2016

[10]. GTP (2012) Growth and Transformation Plan

(2010/11-2014/15) Annual Progress Report for F.Y.

2010/11 Federal Democratic. Ministry of Finance and

Economic Development March 2012 Addis Ababa

[11]. Getinet Astatike & Hirut Assefa

(2005) “Determinants Of Foreign Direct Investment

In Ethiopia: A Time-Series Analysis” Paper Prepared

For The 4th International Conference On The

Ethiopian Economy, June 2005.

[12]. Hodan Journal (2014). Hodan Journal printed by

Somali Region Investment Agency.

[13]. Little, P. D., R. Behnke, J. McPeak, and G. Gebru.

(2010a). Future Scenarios for Pastoral Development

in Ethiopia, ----------2010–2025. Pastoral Economic

Growth and Development Policy Assessment,

Ethiopia, Report Number 2. London: Department for

International Development.

[14]. OECD (2015) how international investment is shaping

the global economy Social, economic, and policy

perspectives

[15]. Saskia K.S. Wilhelms and Morgan Stanley Dean

Witter (1998 ) “ Foreign Direct Investment And Its

Determinants In Emerging Economies” African

Economic Policy Paper Discussion Paper Number 9

July 1998

[16]. UNCTAD (2008). Globalization For Development:

The International Trade Perspective.

UNCTAD/DITC/2007/1 UNITED NATIONS

PUBLICATION

[17]. Yaw Asante (2000) “Determinants Of Private

Investment Behavior” Department Of Economics

University Of Ghana Legon March 2000

[18]. World Bank. (2018). Global Investment

Competitiveness Report 2017/2018: Foreign Investor

Perspectives and Policy Implications. Washington,

DC: World Bank. DOI:10.1596/978-1-4648-1175-3.

License: Creative Commons Attribution CC BY 3.0

IGO

IJISRT20SEP326 www.ijisrt.com 422

You might also like

- Martin Pring On Market Momentum - IndicadoresDocument357 pagesMartin Pring On Market Momentum - IndicadoresÉdipo Henrique83% (6)

- Final Project of IFMDocument9 pagesFinal Project of IFMOmer MirzaNo ratings yet

- Comprehensive Exam Case Analysis Lester Limheya FinalDocument36 pagesComprehensive Exam Case Analysis Lester Limheya FinalXXXXXXXXXXXXXXXXXXNo ratings yet

- MINIMALPLAN Project Launch Workbook ENG V3Document21 pagesMINIMALPLAN Project Launch Workbook ENG V30177986100% (2)

- Department of Labor checklist for construction safety evaluationDocument1 pageDepartment of Labor checklist for construction safety evaluationKevin BasaNo ratings yet

- Analysis of Foreign Direct Investment Environment in MalaysiaDocument15 pagesAnalysis of Foreign Direct Investment Environment in MalaysiaThe IjbmtNo ratings yet

- Parfums Cacharel de L'Oréal 1997-2007:: Decoding and Revitalizing A Classic BrandDocument21 pagesParfums Cacharel de L'Oréal 1997-2007:: Decoding and Revitalizing A Classic BrandrheaNo ratings yet

- #34 Naranjo V Biomedica Health Care (Magsino)Document2 pages#34 Naranjo V Biomedica Health Care (Magsino)Trxc MagsinoNo ratings yet

- Talent Management ProjectDocument6 pagesTalent Management ProjectAmbreen AnsariNo ratings yet

- Harsh Vardhan - Project Submission - Change ManagementDocument14 pagesHarsh Vardhan - Project Submission - Change ManagementHarsh Vardhan33% (3)

- Edexcel IGCSE Accounting Student S Book Answers PDFDocument92 pagesEdexcel IGCSE Accounting Student S Book Answers PDFArshad Bashir100% (1)

- Effect of FDI Inflows On Real Sector Economy of NigeriaDocument17 pagesEffect of FDI Inflows On Real Sector Economy of NigeriaEditor IJTSRDNo ratings yet

- Foreign Direct InvestmentDocument11 pagesForeign Direct InvestmentRachmat FhatuerNo ratings yet

- TL 9000 Quality Management System Measurements Handbook: Release 3.0Document168 pagesTL 9000 Quality Management System Measurements Handbook: Release 3.0kumarNo ratings yet

- An Empirical Analysis of The Determinants of Private Investment in ZimbabweDocument17 pagesAn Empirical Analysis of The Determinants of Private Investment in ZimbabweAnonymous traMmHJtV100% (1)

- Makati Haberdashery, Inc. vs. NLRCDocument3 pagesMakati Haberdashery, Inc. vs. NLRCXryn MortelNo ratings yet

- Doles Vs AngelesDocument2 pagesDoles Vs Angelesfermo ii ramosNo ratings yet

- 36 Ijrg18 A10 1777Document18 pages36 Ijrg18 A10 1777terefe kassaNo ratings yet

- The Contribution of Foreign Direct Investment ForDocument13 pagesThe Contribution of Foreign Direct Investment ForshulukaNo ratings yet

- Impact of Investment Activities On Economic Growth of PakistanDocument9 pagesImpact of Investment Activities On Economic Growth of PakistanMuhammad ImranNo ratings yet

- Determinants of FDIDocument11 pagesDeterminants of FDIshulukaNo ratings yet

- Foreign Direct Investment Bharth Cohesion To EmploymentDocument24 pagesForeign Direct Investment Bharth Cohesion To EmploymentBharath GudiNo ratings yet

- China'S Outward Foreign Direct Investment: March 2008, Issue 6Document8 pagesChina'S Outward Foreign Direct Investment: March 2008, Issue 6aniketbadraNo ratings yet

- Foreign Direct Investment Cohesion To EmploymentDocument25 pagesForeign Direct Investment Cohesion To EmploymentChandan SrivastavaNo ratings yet

- Montes & Cruz - The Political Economy of Foreign Investment and Industrial DevelopmentDocument25 pagesMontes & Cruz - The Political Economy of Foreign Investment and Industrial DevelopmentJoson AlyannaNo ratings yet

- Afghanistan's Investment Opportunities and ChallengesDocument42 pagesAfghanistan's Investment Opportunities and ChallengesSudeep ChinnabathiniNo ratings yet

- Foreign Portfolio Investment and Economic Growth in NigeriaDocument9 pagesForeign Portfolio Investment and Economic Growth in NigeriaADAMS UVEIDANo ratings yet

- 1.accelerating Economic Growth in Nigeria The Role oDocument6 pages1.accelerating Economic Growth in Nigeria The Role oAzan RasheedNo ratings yet

- Foreign Direct Investment (Fdi) : Nature and ScopeDocument4 pagesForeign Direct Investment (Fdi) : Nature and ScopeMaithili DicholkarNo ratings yet

- Impact of Fdi On Economic Growth in Pakistan ThesisDocument8 pagesImpact of Fdi On Economic Growth in Pakistan ThesisWriteMyPaperReviewsOverlandPark100% (2)

- Why Some African Economies Receive Less Inward FDIDocument9 pagesWhy Some African Economies Receive Less Inward FDIBisma FhNo ratings yet

- FDI Socio EconomyDocument84 pagesFDI Socio EconomyTemola VictorNo ratings yet

- A Granger-Causal Examination of The Relationship Between Foreign Direct Investment and Economic Growth IN NIGERIA (1981 - 2007)Document19 pagesA Granger-Causal Examination of The Relationship Between Foreign Direct Investment and Economic Growth IN NIGERIA (1981 - 2007)Mustapha MuktarNo ratings yet

- Final Essay - U7596796 - JoeDocument5 pagesFinal Essay - U7596796 - JoeRobert JoeNo ratings yet

- Annual Economic Report 2018Document309 pagesAnnual Economic Report 2018Ali HassenNo ratings yet

- Abala KenyaDocument22 pagesAbala KenyaevaNo ratings yet

- Edited ResearchDocument37 pagesEdited ResearchtemesgenNo ratings yet

- The Determinants and Impacts of Foreign Direct Investment in NigeriaDocument11 pagesThe Determinants and Impacts of Foreign Direct Investment in NigeriaKushagra KumarNo ratings yet

- Investment PolDocument24 pagesInvestment Polchernet kebedeNo ratings yet

- Report On FDI in BDDocument28 pagesReport On FDI in BDSazzad Hossain Tamim100% (2)

- Enhancing FDI Flows to Nepal during Global RecessionDocument21 pagesEnhancing FDI Flows to Nepal during Global RecessionIsmith PokhrelNo ratings yet

- FDI Impact StudyDocument25 pagesFDI Impact StudyBhumika ShrivastavaNo ratings yet

- 1 PBDocument9 pages1 PBTariku KolchaNo ratings yet

- CHAPTER 1 Determinants of Private InvestmentDocument6 pagesCHAPTER 1 Determinants of Private InvestmentAUGUSTINE SANDINO MBANo ratings yet

- Nurfatin Najiha Fazal MohamedDocument9 pagesNurfatin Najiha Fazal MohamedFatin Najiha FazalNo ratings yet

- Foreign Investment Drives Nigerian Economic GrowthDocument23 pagesForeign Investment Drives Nigerian Economic Growthatif ali qureshiNo ratings yet

- Trends and Patterns of Fdi in IndiaDocument10 pagesTrends and Patterns of Fdi in IndiaSakshi GuptaNo ratings yet

- Historical Trends of Savings and Investment in Pak-PepDocument33 pagesHistorical Trends of Savings and Investment in Pak-Pepbecks7trNo ratings yet

- Foreign Direct Investment, Economic Growth and Financial Sector Development in AfricaDocument21 pagesForeign Direct Investment, Economic Growth and Financial Sector Development in AfricaMuhammad BilalNo ratings yet

- Foreign Direct Investment and Its Effect On The Manufacturing Sector in NigeriaDocument9 pagesForeign Direct Investment and Its Effect On The Manufacturing Sector in NigeriaJASH MATHEW100% (1)

- Guide to FDI (Foreign Direct InvestmentDocument73 pagesGuide to FDI (Foreign Direct InvestmentArvind Sanu MisraNo ratings yet

- 16-219-237 A Study On The Effects of FDI On Cambodia's Economic Growth by HUON Sophanara-FinalDocument19 pages16-219-237 A Study On The Effects of FDI On Cambodia's Economic Growth by HUON Sophanara-Finalphang brostouchNo ratings yet

- Impact of Foreign Direct Investment On Sectoral Performance in The Nigerian Economy: A Study of Telecommunications SectorDocument19 pagesImpact of Foreign Direct Investment On Sectoral Performance in The Nigerian Economy: A Study of Telecommunications SectorDr. Ezeanyeji ClementNo ratings yet

- Foreign Land Ownership-Survey of Regulatory Approaches-LibreDocument23 pagesForeign Land Ownership-Survey of Regulatory Approaches-LibrebjosiahlanceNo ratings yet

- FDI in India by Sector and CountryDocument11 pagesFDI in India by Sector and CountryMohd sakib hasan qadriNo ratings yet

- CHAPTERDocument4 pagesCHAPTERabhaybittuNo ratings yet

- C UrveDocument10 pagesC Urvehuat huatNo ratings yet

- FDI & Its Impact On Home CountryDocument14 pagesFDI & Its Impact On Home CountryRajat RastogiNo ratings yet

- Foreign Direct Investment and Economic Growth: BVIMSR's Journal of Management Research 4Document31 pagesForeign Direct Investment and Economic Growth: BVIMSR's Journal of Management Research 4Azan RasheedNo ratings yet

- Final Essay U7596796 JoeDocument5 pagesFinal Essay U7596796 JoeRobert JoeNo ratings yet

- Determinants of Foreign Direct Investment in Nigeria "Evidence From Co-Integration and Error Correction Modeling"Document10 pagesDeterminants of Foreign Direct Investment in Nigeria "Evidence From Co-Integration and Error Correction Modeling"Mintu PaulNo ratings yet

- Ocrif261012 SN1 PDFDocument29 pagesOcrif261012 SN1 PDFYash MehraNo ratings yet

- Determinants of Private Investment in EthiopiaDocument9 pagesDeterminants of Private Investment in EthiopiaSemira Ali BezabhNo ratings yet

- Full Paper 1Document20 pagesFull Paper 1Inara JayasooriyaNo ratings yet

- 07 - Kadek Sri Mirah Yusita Putri - MICROECONOMICS-1Document10 pages07 - Kadek Sri Mirah Yusita Putri - MICROECONOMICS-115Kadek Sri Mirah Yusita PutriNo ratings yet

- Determinants of Private InvestmentDocument11 pagesDeterminants of Private InvestmentSolomonNo ratings yet

- Impacts of Foreign Direct Investment On Local Communities in Oromia RegionDocument12 pagesImpacts of Foreign Direct Investment On Local Communities in Oromia RegionInternational Journal of Business Marketing and ManagementNo ratings yet

- The Impact of FDI On Economic Growth Under Foreign Trade Regimes: A Case Study of PakistanDocument10 pagesThe Impact of FDI On Economic Growth Under Foreign Trade Regimes: A Case Study of PakistanAmnaMalikNo ratings yet

- IBON- Cha-cha and FDI 2301-26_finalDocument9 pagesIBON- Cha-cha and FDI 2301-26_finalSonny AfricaNo ratings yet

- EIB Group Survey on Investment and Investment Finance 2019: EU overviewFrom EverandEIB Group Survey on Investment and Investment Finance 2019: EU overviewNo ratings yet

- EIB Investment Report 2018/2019: Retooling Europe's economyFrom EverandEIB Investment Report 2018/2019: Retooling Europe's economyNo ratings yet

- Shaping Globalization: New Trends in Foreign Direct InvestmentFrom EverandShaping Globalization: New Trends in Foreign Direct InvestmentNo ratings yet

- Advancing Healthcare Predictions: Harnessing Machine Learning for Accurate Health Index PrognosisDocument8 pagesAdvancing Healthcare Predictions: Harnessing Machine Learning for Accurate Health Index PrognosisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Investigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatDocument16 pagesInvestigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Exploring the Molecular Docking Interactions between the Polyherbal Formulation Ibadhychooranam and Human Aldose Reductase Enzyme as a Novel Approach for Investigating its Potential Efficacy in Management of CataractDocument7 pagesExploring the Molecular Docking Interactions between the Polyherbal Formulation Ibadhychooranam and Human Aldose Reductase Enzyme as a Novel Approach for Investigating its Potential Efficacy in Management of CataractInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Analysis on Mental Health Issues among IndividualsDocument6 pagesAn Analysis on Mental Health Issues among IndividualsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Relationship between Teacher Reflective Practice and Students Engagement in the Public Elementary SchoolDocument31 pagesThe Relationship between Teacher Reflective Practice and Students Engagement in the Public Elementary SchoolInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Making of Object Recognition Eyeglasses for the Visually Impaired using Image AIDocument6 pagesThe Making of Object Recognition Eyeglasses for the Visually Impaired using Image AIInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Terracing as an Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains- CameroonDocument14 pagesTerracing as an Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains- CameroonInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Dense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)Document2 pagesDense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Harnessing Open Innovation for Translating Global Languages into Indian LanuagesDocument7 pagesHarnessing Open Innovation for Translating Global Languages into Indian LanuagesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Utilization of Date Palm (Phoenix dactylifera) Leaf Fiber as a Main Component in Making an Improvised Water FilterDocument11 pagesThe Utilization of Date Palm (Phoenix dactylifera) Leaf Fiber as a Main Component in Making an Improvised Water FilterInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Formulation and Evaluation of Poly Herbal Body ScrubDocument6 pagesFormulation and Evaluation of Poly Herbal Body ScrubInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Diabetic Retinopathy Stage Detection Using CNN and Inception V3Document9 pagesDiabetic Retinopathy Stage Detection Using CNN and Inception V3International Journal of Innovative Science and Research TechnologyNo ratings yet

- Auto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETDocument6 pagesAuto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Impact of Digital Marketing Dimensions on Customer SatisfactionDocument6 pagesThe Impact of Digital Marketing Dimensions on Customer SatisfactionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Electro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyDocument7 pagesElectro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Survey of the Plastic Waste used in Paving BlocksDocument4 pagesA Survey of the Plastic Waste used in Paving BlocksInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Automatic Power Factor ControllerDocument4 pagesAutomatic Power Factor ControllerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Comparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightDocument4 pagesComparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Cyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentDocument7 pagesCyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Explorning the Role of Machine Learning in Enhancing Cloud SecurityDocument5 pagesExplorning the Role of Machine Learning in Enhancing Cloud SecurityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Design, Development and Evaluation of Methi-Shikakai Herbal ShampooDocument8 pagesDesign, Development and Evaluation of Methi-Shikakai Herbal ShampooInternational Journal of Innovative Science and Research Technology100% (3)

- Review of Biomechanics in Footwear Design and Development: An Exploration of Key Concepts and InnovationsDocument5 pagesReview of Biomechanics in Footwear Design and Development: An Exploration of Key Concepts and InnovationsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Navigating Digitalization: AHP Insights for SMEs' Strategic TransformationDocument11 pagesNavigating Digitalization: AHP Insights for SMEs' Strategic TransformationInternational Journal of Innovative Science and Research Technology100% (1)

- Studying the Situation and Proposing Some Basic Solutions to Improve Psychological Harmony Between Managerial Staff and Students of Medical Universities in Hanoi AreaDocument5 pagesStudying the Situation and Proposing Some Basic Solutions to Improve Psychological Harmony Between Managerial Staff and Students of Medical Universities in Hanoi AreaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Formation of New Technology in Automated Highway System in Peripheral HighwayDocument6 pagesFormation of New Technology in Automated Highway System in Peripheral HighwayInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Review: Pink Eye Outbreak in IndiaDocument3 pagesA Review: Pink Eye Outbreak in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Hepatic Portovenous Gas in a Young MaleDocument2 pagesHepatic Portovenous Gas in a Young MaleInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Mobile Distractions among Adolescents: Impact on Learning in the Aftermath of COVID-19 in IndiaDocument2 pagesMobile Distractions among Adolescents: Impact on Learning in the Aftermath of COVID-19 in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Drug Dosage Control System Using Reinforcement LearningDocument8 pagesDrug Dosage Control System Using Reinforcement LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Effect of Time Variables as Predictors of Senior Secondary School Students' Mathematical Performance Department of Mathematics Education Freetown PolytechnicDocument7 pagesThe Effect of Time Variables as Predictors of Senior Secondary School Students' Mathematical Performance Department of Mathematics Education Freetown PolytechnicInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- PRC-Cebu CPA Exam Schedule October 2022Document26 pagesPRC-Cebu CPA Exam Schedule October 2022Marlon BaltarNo ratings yet

- Módulo 22: Pasivos y Patrimonio: Fundación IFRS: Material de Formación Sobre LaDocument64 pagesMódulo 22: Pasivos y Patrimonio: Fundación IFRS: Material de Formación Sobre LaDAYANA ANDREA DAMS MOLINANo ratings yet

- Global Eyewear Market InsightsDocument2 pagesGlobal Eyewear Market InsightsAnshul NataniNo ratings yet

- No. Account Title Trial Balance Adjustments Debit Credit DebitDocument7 pagesNo. Account Title Trial Balance Adjustments Debit Credit DebitJoanah Aquino100% (1)

- Annual Income Statement Report Name: Laporan Laba Rugi / Nama / Ery Abd Nasir PelupessyDocument2 pagesAnnual Income Statement Report Name: Laporan Laba Rugi / Nama / Ery Abd Nasir PelupessyErry Abdul Nasir PelupessyNo ratings yet

- Super Savings Account: Common Service ChargesDocument2 pagesSuper Savings Account: Common Service ChargesSantosh ThakurNo ratings yet

- Comparative Analysis of Advantages and Disadvantages of The Modes of Entrying The International MarketDocument9 pagesComparative Analysis of Advantages and Disadvantages of The Modes of Entrying The International MarketTròn QuayyNo ratings yet

- PR Week 5 CVPDocument3 pagesPR Week 5 CVPAyhuNo ratings yet

- Lorelle CarenderiaDocument22 pagesLorelle CarenderiaShiela may AdlawonNo ratings yet

- 5 Key Financial Ratios and How To Use ThemDocument10 pages5 Key Financial Ratios and How To Use ThemdiahNo ratings yet

- ARBURG Customer Service Contact List 2021Document2 pagesARBURG Customer Service Contact List 2021Moises GeberNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchDinesh ChoudharyNo ratings yet

- Chapter-5 A Comparative AnalysisDocument5 pagesChapter-5 A Comparative Analysisshoyeb1204No ratings yet

- Contract Law - Premium ChocolatesDocument9 pagesContract Law - Premium Chocolatesprathmesh agrawalNo ratings yet

- Strategic Management: Session 1: 05/12/2022Document38 pagesStrategic Management: Session 1: 05/12/2022TANISHA AGRAWALNo ratings yet

- Conceptual Framework and Accounting Standards OverviewDocument170 pagesConceptual Framework and Accounting Standards OverviewJ LagardeNo ratings yet

- Tcs Hitech Brochure Product-Training 110509ADocument2 pagesTcs Hitech Brochure Product-Training 110509AYogesh YogiNo ratings yet

- Standardizing Innovation Management: An Opportunity For Smes in The Aerospace IndustryDocument43 pagesStandardizing Innovation Management: An Opportunity For Smes in The Aerospace IndustryDr. Ammar YakanNo ratings yet