Professional Documents

Culture Documents

Phân Lo I Engagement PDF

Phân Lo I Engagement PDF

Uploaded by

Phạm Ngọc Ánh0 ratings0% found this document useful (0 votes)

18 views2 pagesOriginal Title

phân loại engagement.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views2 pagesPhân Lo I Engagement PDF

Phân Lo I Engagement PDF

Uploaded by

Phạm Ngọc ÁnhCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

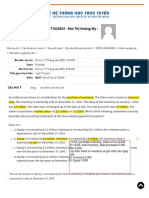

CPA SERVICES

ATTEST SERVICES

Crime

tea ieee

ASSURANCE SERVICES

In an assurance service, a CPA issues a report in which he or she expresses an opinion ora conclusion on the subject

‘matter (for example, financial statements) so that a user can make informed decisions.

Audit

fee ety a ee eee eee

‘assurance {which isa high level of assurance) about whether the financial statements are free from

‘material misstatement. The CPA selects procedures based on his or her judgment. Such

‘procedures may include inquiry, physical inspection, observation, third-party confirmation,

‘examination and other procedures. Audits of financial statements of nonissuers' are performed in

‘accordance with the the AICPA Statements on Auditing Standards (SASs) — which is referred to as

generally accepted auditing standards (GAAS) — while auclts of issuers" are performed in

‘accordance with the Public Company Accounting Oversight Board (PCAOB) Auciting Standards

Examination

Examinations are aucit-level engagements designed to provide a high level of assurance on

information other than historical financial statements. Examinations are performed in accordance

with the the AICPA Statements on Standards for Attestation Engagements (SSAES), and might be

performed on information related to security and privacy controls, sustainability, greenhouse

‘gases, extensible Business Reporting Language (XBRL) and other business matters

Review

In a review of financial statements, the CPA seeks to obtain limited assurance as basis for

‘eporting whether the CPA is aware of any material modifications that should be made to the

financial statements in order for them to be presented in accordance with an applicable financial

reporting framework. A review is substantially less in scope than an audit, and often is performed

‘or privately held companies that are required to provide financial statements to outside parties

such as banks, cieditors, or potential purchasers. Reviews of financial statements are conducted in

accordance withthe the AICPA Statements on Standards for Accounting and Review Services

(SSARS9, except for reviews of certain interim financial information that are conducted in

accordance withthe AICPA Statements on Auditing Standards (SAS), Reviews of subject matter

other than historical financial statements are performed in accordance with the AICPA Statements

‘on Standards for Attestation Engagements (SSAES}.

©-0—®

* Nonisuers are any entity not subject tothe Sarbanes-Oxley Act of 2002 or the rules ofthe SEC.

2 "gsuers" generally means those public ents that issue or propose secures such 2 stocks and bond.

Issuers ae subject tothe Sarbanes. Onley Act of2002 or the rules ofthe SEC.

Eee |

Innon-assurance services, CPAs issue reports that do not express an opinion or conclusion on the subject matter (for

‘example, financial statements).

Agreed-Upon Procedures Engagement

‘An agreed-upon procedures engagements one in which a CPAs engaged by a client tissue @

BKC) report of findings based on procedures agreed upon between the CPA and specified parties atthe

WW _cutset. in an agreed-upon procedures engagement, the CPA issues a report, but does not express

an opinion ora conclusion on the subject matter.

When 2 CPA undertakes this type of service, the CPA applies accounting and financial reporting

expertise to assist his or her client in the presentation of financial information, but the CPA does not

seek to obtain or provide any assurance that there are no material modifications that should be made

to the financial statements. Additionally, the CPA is required to determine ifhe or she is independent.

of the client, and the CPA will include this determination in @ report issued in accordance with the

AICPA Statements on Standards for Accounting and Review Services (SARS).

De eu SERVICES

‘and non: CPAs can piovide nonvattest services, Ci

Preperation Services

& in a preparation service,» CPA uses his or her knowledge ofthe client business to prepare financial

FEI) temercinvrrdoncs vith the AICPA Satemmnts on Standards for Accounting wd Rew

Service (SSARSe. Those standards do not require the CPA to determine ihe or shes independent

of the client, noris the CPA required to issue a report on his orher services

‘STANDARDS APPLICATION

+ Statements on Auditing Standard (SASs) — Audit repors for entities not included under the authority ofthe PCAOB

* PCAOB Auditing Standards (ASe)— Aualt reports for issuers as defined by the Sarbanat-Onley Act of 2002

* Statements on Standards for Attestation Engagements (SSAEs)— All other engagements, except those services covered by

SSASs oF SSARSs, in which a CPA is engaged to ietue or does issue an examination, review, or agreed-upon procedures report on

subject matter (eran assertion about subject matter) that i the responsibilty of ancther party

* Statements on Standords for Accounting and Review Services (SSARSs) — Engagements on unaudited financial statements or

‘other unaudited financial information for nonpublic entities

a atietcras resi erase _AICPA)

{©2015 American institute of CPAs. Aight reserve

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Auditing and Assurance Services in Australia 9th Edition Arens Test Bank 200102091047Document28 pagesAuditing and Assurance Services in Australia 9th Edition Arens Test Bank 200102091047Phạm Ngọc ÁnhNo ratings yet

- The Consolidated Statement of Financial PositionDocument14 pagesThe Consolidated Statement of Financial PositionPhạm Ngọc ÁnhNo ratings yet

- AFA 3e PPT Chap04Document24 pagesAFA 3e PPT Chap04Phạm Ngọc ÁnhNo ratings yet

- Chapter 3: Group Reporting II: Application of The Acquisition Method Under IFRS 3Document26 pagesChapter 3: Group Reporting II: Application of The Acquisition Method Under IFRS 3Phạm Ngọc ÁnhNo ratings yet

- Group Reporting I: Concepts and Context: acquisition: hợp nhất merger: sáp nhập associate: liên kếtDocument31 pagesGroup Reporting I: Concepts and Context: acquisition: hợp nhất merger: sáp nhập associate: liên kếtPhạm Ngọc ÁnhNo ratings yet

- Chapter 3: Group Reporting II: Application of The Acquisition Method Under IFRS 3Document26 pagesChapter 3: Group Reporting II: Application of The Acquisition Method Under IFRS 3Phạm Ngọc ÁnhNo ratings yet

- - Mai Thị Hoàng My: Câu HỏiDocument13 pages- Mai Thị Hoàng My: Câu HỏiPhạm Ngọc ÁnhNo ratings yet