Professional Documents

Culture Documents

Accident Guard: Proposal Form

Uploaded by

Take My CareOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accident Guard: Proposal Form

Uploaded by

Take My CareCopyright:

Available Formats

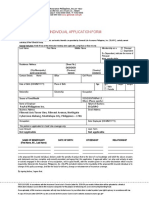

Accident Guard

Personal Accident Plan

Proposal Form

Proposal No.

Personal Details (In block letters)

Self

Name of the Insured

First Name Middle Name Surname

Address

City

State PIN

Phone (O) (R)

Fax Mobile

E-mail

Date of birth D D M M Y Y Y Y Marital Status

Sex Male Female

Occupation Service Self Employed

Nominee’s Name*

Relationship

* In case the nominee is a minor, please provide the name of the guardian also.

Family

Name of Spouse

Nominee Name*

Relationship Date of Birth D D M M Y Y Y Y

Name of First Child

Nominee Name*

Relationship Date of Birth D D M M Y Y Y Y

Name of Second Child

Nominee Name*

Relationship Date of Birth D D M M Y Y Y Y

Name of Third Child

Nominee Name*

Relationship Date of Birth D D M M Y Y Y Y

Name of Fourth Child

Nominee Name*

Relationship Date of Birth D D M M Y Y Y Y

* In case the nominee is a minor, please provide the name of the guardian also.

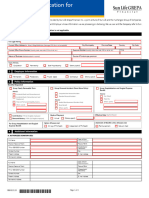

Policy Details (Please tick below)

Benefits Cost/Unit No. of Units Total Annual Premium

(Inclusive of applicable service tax)

Self Family

Core Benefit (up to 20)

Plan A 558 Or 890 X =

(up to 20) Or

Plan B 743 Or 1187 X =

Optional Benefit (up to 10) +

Accidental Weekly Benefit 76 X =

Grand Total

Policy Period : From D D M M Y Y Y Y To D D M M Y Y Y Y

Additional Details

1) Whether you are suffering/met with any illness/injury/disability in the last 2 years : Yes No

If Yes, provide details :

2) Whether you have taken any personal accident policy. Yes No

If yes whether from Tata AIG Other (Please Specify Name)

Policy No.

Other details:

3) I hereby declare that my Gross Annual Income is ( Rs '000): Rs. and understand that the Sum Insured opted

for will not be greater than 10 times / 20 times Gross Annual Income as applicable.* (see overleaf for details)

Payment Details

Premium Amount: Rs. Cheque Demand Draft

(Payable in favour of Tata AIG

Cheque/Demand Draft No.: General Insurance Company Ltd.)

Date: D D M M Y Y Y Y

Name of Bank: Branch:

Credit Card*

Credit Card No.: Expiry Date: M M Y Y Y Y

Transaction Code

**For credit card payment: 1) Only Visa/Master Card accepted. 2) Photocopy of front and back of the credit card has to be attached along with the application form.

PAN card Number : in the absence of PAN Card, please give details of any other authorized

photo identification card.

Card Type Number :

Sources of funds (please ü where applicable) : Salary Business Other (Please specify)

This Policy does not cover pre-existing medical conditions that are declared or undeclared. In the event of a claim, in order to determine eligibility for benefit payments under the Policy.

I/We authorize any hospital, medical care institution, physician, medical professional, pharmacy or insurers to furnish to Tata AIG General Insurance Company Limited or its representatives

any and all medical information or records with respect to any injury or sickness suffered by the person whose, death, injury, sickness or loss is the basis of a claim against the Policy.

I/We understand that this authorization is valid during the pendency of the claim until all issues with regard thereto have been definitively resolved, either extra-judicially or judicially.

I/We have read the Policy Prospectus and am/are willing to accept the insurance coverage, subject to all the terms, conditions and exceptions described in that Policy Prospectus.

I/We hereby declare and warrant that all of the statements in this and in the preceding paragraphs are true and complete. If it is found that the answers or particulars stated in this

Proposal Form and Medical Declaration are incorrect or untrue in any respect, I/We hereby acknowledge that the insurance company shall incur no liability for any insurance coverage.

I/We have understood the term & conditions of this insurance and agree that the insurance would be effective only on acceptance of this application by the Company and the payment

of premium by me/us in advance.

This Policy is valid subject to the realisation of the amount of premium by the Company. In the event of non-realisation of the Cheque or non-receipt of the amount of premium by

the Company where payment has been made by way of credit card for any reason whatsoever, the Policy shall be deemed cancelled ‘ab-initio’ and the Company shall not be

responsible for any liabilities of whatsoever nature.

* Max Sum Insured opted can be -

i) in case of Salaried Person - Max 10 times of Income (as appearing in Form 16 / Salary slip / IT acknowledgement)

ii) in case of Self-Employed Person - Max 20 times of Income (as appearing in IT acknowledgement / Audited P&L)

AML Guidelines

1. I/we herby confirm that all premiums have been/will be paid from bonafide sources and no premiums have been/will be paid out of proceeds of crime related to any of the offence

listed in Prevention of Money Laundering Act, 2002.

2. I understand that the Company has the right to call for documents to establish sources of funds.

3. The insurance company has right to cancel the insurance contract in case I am/ have been found guilty by any competent court of law under any of the statutes, directly or indirectly

governing the prevention of money laundering in India.

D D M M Y Y Y Y

Signature of Insured Person / Proposer Date

Producer’s Name Producer’s Code

Signature of the Producer Date D D M M Y Y Y Y

INSURANCE ACT 1938 Section 41 Prohibition of Rebates

No person shall allow or offer to alow, either directly or indirectly, as an inducement to any person to take out or renew or continue an insurance

in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the

premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may

be allowed in accordance with the published prospectus or tables of the Insurer. ANY PERSON MAKING DEFAULT IN COMPLYING WITH THE

PROVISIONS OF THIS SECTION SHALL BE PUNISHED WITH A FINE WHICH MAY EXTEND TO FIVE HUNDRED RUPEES.

Insurance is the subject matter of the solicitation.For more details on risk factors, terms and conditions,

please read sales brochure carefully, before concluding a sale.

Tata AIG General Insurance Company Limited

Registered Office : Peninsula Corporate Park, Piramal Tower, 9th Floor, G.K. Marg, Lower Parel, Mumbai – 400013.

Toll Free Nos. 1800 266 7780 /1800 11 99 66* (* From MTNL / BSNL Lines Only) Visit us at www.tataaiginsurance.in

You might also like

- BDO Life Employment Application Form With DPA FillableDocument6 pagesBDO Life Employment Application Form With DPA FillableVincent AndradeNo ratings yet

- Zitra Personal Account FormDocument2 pagesZitra Personal Account FormUgo BenNo ratings yet

- Application For Life InsuranceDocument8 pagesApplication For Life InsuranceCelmer Charles Q. VillarealNo ratings yet

- Serial Killers I. Subtypes, Patterns, and MotivesDocument11 pagesSerial Killers I. Subtypes, Patterns, and Motivescorina100% (1)

- Barrick Enrollment Form Apr 2022Document3 pagesBarrick Enrollment Form Apr 2022jorge ordinolaNo ratings yet

- Optima Restore Proposal Form OfflineDocument9 pagesOptima Restore Proposal Form OfflinemanohargudNo ratings yet

- Medicare Health Insurance Company LimitedDocument2 pagesMedicare Health Insurance Company LimitedVijay Singh ThakurNo ratings yet

- UBI Group Care 360 Application Form (UHS) Union Health SurakshaDocument4 pagesUBI Group Care 360 Application Form (UHS) Union Health Surakshanama nageswararao100% (2)

- Premier Proposal 5f2bd12e92Document5 pagesPremier Proposal 5f2bd12e92bajaj enterprisesNo ratings yet

- f1040 PDFDocument2 pagesf1040 PDFPio Rivas JrNo ratings yet

- Icici Insurance Mis 19-July 2022Document1 pageIcici Insurance Mis 19-July 2022Raj KumarNo ratings yet

- f1040 2018 PDFDocument3 pagesf1040 2018 PDFSara HeadrickNo ratings yet

- Enrolment Form: 1. Details of Account HolderDocument2 pagesEnrolment Form: 1. Details of Account Holderaditya_bb_sharmaNo ratings yet

- 1040 ArmstrongDocument2 pages1040 Armstrongapi-458373647No ratings yet

- Client Information Sheet: Policy Owner Policy InsuredDocument2 pagesClient Information Sheet: Policy Owner Policy InsuredMae Mark TorresNo ratings yet

- Gsis Lease With Option To Buy (Lwob) : Application InformationDocument2 pagesGsis Lease With Option To Buy (Lwob) : Application InformationOlivia Abac100% (1)

- Manulife Individual Application FormDocument1 pageManulife Individual Application FormRenz Christopher Tangca0% (1)

- Loan Applicant Details (To Be Filled by The Applicant) : Single SingleDocument6 pagesLoan Applicant Details (To Be Filled by The Applicant) : Single SingleVaibhav DafaleNo ratings yet

- FTF 2019-05-02 1556819863569 PDFDocument5 pagesFTF 2019-05-02 1556819863569 PDFWilliam Davis0% (1)

- Application Form - New Financial PlanDocument2 pagesApplication Form - New Financial PlanCamille FreoNo ratings yet

- Application Form - New Financial PlanDocument2 pagesApplication Form - New Financial PlanCamille FreoNo ratings yet

- Existing Investor'S Folio Number Unit Holding Options: Transaction Charges ORDocument4 pagesExisting Investor'S Folio Number Unit Holding Options: Transaction Charges ORraj tripathiNo ratings yet

- Dawn Income Tax 2019-07-21 - 1563756758720 PDFDocument6 pagesDawn Income Tax 2019-07-21 - 1563756758720 PDFDawn Smith100% (1)

- Common Application Form: For Holding Units in Demat ModeDocument6 pagesCommon Application Form: For Holding Units in Demat ModevasucristalNo ratings yet

- Candidate Form DependentNominationsInfoDocument13 pagesCandidate Form DependentNominationsInfoSrishty ChhabraNo ratings yet

- (Please Send This Back To Corporate Accounts Division) : Application For Group Insurance PlanDocument2 pages(Please Send This Back To Corporate Accounts Division) : Application For Group Insurance PlanKristian Romeo NapiñasNo ratings yet

- Elss Nfo JM Tax Gain FundDocument6 pagesElss Nfo JM Tax Gain FundDrashti InvestmentsNo ratings yet

- Health Guard Proposal Form PrintDocument4 pagesHealth Guard Proposal Form Printrock_on_rupz99No ratings yet

- FBL Personal Loan Auto Loan Forms AccountHolderDocument14 pagesFBL Personal Loan Auto Loan Forms AccountHolderCrentsil KwayieNo ratings yet

- 2018 FederalDocument19 pages2018 Federalnischal.khatri07No ratings yet

- Individual Income Tax Return: Confidential Year of AssessmentDocument3 pagesIndividual Income Tax Return: Confidential Year of AssessmentDamon HelthNo ratings yet

- Life Insurance Beneficiary Designation Form - GeneraliDocument2 pagesLife Insurance Beneficiary Designation Form - Generalijohn gerald reynoNo ratings yet

- IRDA Reimbursement Claim FormDocument2 pagesIRDA Reimbursement Claim FormVaibhav PawarNo ratings yet

- Manulife Form 2Document1 pageManulife Form 2xrfqpbxfmyNo ratings yet

- Assignment Form: InstructionsDocument2 pagesAssignment Form: InstructionsjahgfNo ratings yet

- Ap421fe 0216B NDDocument3 pagesAp421fe 0216B NDDen NisNo ratings yet

- BM Umbrella Retirement Scheme Member Application Form-EDocument3 pagesBM Umbrella Retirement Scheme Member Application Form-ExeniaNo ratings yet

- Friendly Tax Service 2016 Tax Return Preparation QuestionnaireDocument8 pagesFriendly Tax Service 2016 Tax Return Preparation QuestionnaireDeepti DasNo ratings yet

- Form For Nomination / Appointee Addition: General InformationDocument2 pagesForm For Nomination / Appointee Addition: General InformationSonu SinghNo ratings yet

- HDFC Ergo: General Insurance Company LimitedDocument2 pagesHDFC Ergo: General Insurance Company Limitedईश्वर हैNo ratings yet

- Manulife Application FormDocument4 pagesManulife Application FormSouthern Philippines Development AuthorityNo ratings yet

- Joy - Proposal FormDocument4 pagesJoy - Proposal FormSTARSRINo ratings yet

- Form For Withdrawal by Claimant Due To Death of SubscriberDocument6 pagesForm For Withdrawal by Claimant Due To Death of SubscriberAkash MalikNo ratings yet

- Proposal Form Arogya Sanjeevani HehiDocument6 pagesProposal Form Arogya Sanjeevani Hehihiteshmohakar15No ratings yet

- Form 2Document2 pagesForm 2api-383904539No ratings yet

- Policy Wording - FHP - Enrichments - 2023 - 115410Document51 pagesPolicy Wording - FHP - Enrichments - 2023 - 115410Nikunj SavaliyaNo ratings yet

- Customer Application Form August 2022Document6 pagesCustomer Application Form August 2022Chamika JayasingheNo ratings yet

- SLGFIEmployersApplicationForGroupInsurance Rev0Document3 pagesSLGFIEmployersApplicationForGroupInsurance Rev0cubelofrancis.scsNo ratings yet

- Affivadit For CDG v1.2Document1 pageAffivadit For CDG v1.2khwezishezi35No ratings yet

- LPG Distributorships Application Format UpDocument24 pagesLPG Distributorships Application Format UpSunil SparshNo ratings yet

- Rental Application Form For TenantDocument2 pagesRental Application Form For TenantDenisTitovNo ratings yet

- Nph1Liaafu : Application For BondDocument4 pagesNph1Liaafu : Application For BondAna SolitoNo ratings yet

- Kotak Health Super Top Up Proposal Form ClassicDocument4 pagesKotak Health Super Top Up Proposal Form ClassicRKNo ratings yet

- Nomination Form: (For Registering A Nominee or Cancelling An Existing Nomination)Document2 pagesNomination Form: (For Registering A Nominee or Cancelling An Existing Nomination)MailNo ratings yet

- Application For ServicesDocument4 pagesApplication For ServicesNermeen ElsayedNo ratings yet

- 2018 Federal Income Tax Return PDFDocument8 pages2018 Federal Income Tax Return PDFBrandon BachNo ratings yet

- Relationship Beyond Insurance: Health Guard: Proposal FormDocument2 pagesRelationship Beyond Insurance: Health Guard: Proposal FormAmardeep SinghNo ratings yet

- Federal Information Worksheet 2018: Jerry Pryde J JR 570-86-7356 DisabledDocument1 pageFederal Information Worksheet 2018: Jerry Pryde J JR 570-86-7356 Disabledsherrif douchebagNo ratings yet

- Disaster Dollars: Financial Preparation and Recovery for Towns, Businesses, Farms, and IndividualsFrom EverandDisaster Dollars: Financial Preparation and Recovery for Towns, Businesses, Farms, and IndividualsNo ratings yet

- 1st Batch CrimPro CasesDocument106 pages1st Batch CrimPro CasesIvan LuzuriagaNo ratings yet

- Rights of The Accused Under Custodial InvestigationDocument37 pagesRights of The Accused Under Custodial Investigationdot_rocksNo ratings yet

- Historical Perspective of PenologyDocument11 pagesHistorical Perspective of Penologyankit mishraNo ratings yet

- Nurhida Juhuri Ampatuan vs. Judge Virgilio v. MacaraigDocument2 pagesNurhida Juhuri Ampatuan vs. Judge Virgilio v. Macaraigyamaleihs100% (2)

- N Indecent Representation of Women Prohibition Act 1986 Rahuls Ias Rediffmailcom 20221015 153329 1 6Document6 pagesN Indecent Representation of Women Prohibition Act 1986 Rahuls Ias Rediffmailcom 20221015 153329 1 6Ved VyasNo ratings yet

- The Sanjay Dutt Cover PDFDocument13 pagesThe Sanjay Dutt Cover PDFTage NobinNo ratings yet

- M e M o R A N D U MDocument4 pagesM e M o R A N D U MRose Marie AriasNo ratings yet

- Title of CaseDocument5 pagesTitle of Casenica harina0% (1)

- G.R. No. 172116 October 30, 2006 People of The Philippines, Appellee, ROGER VILLANUEVA, AppellantDocument345 pagesG.R. No. 172116 October 30, 2006 People of The Philippines, Appellee, ROGER VILLANUEVA, AppellantLauraNo ratings yet

- Ambagan JR Vs PeopleDocument22 pagesAmbagan JR Vs PeopleNaif OmarNo ratings yet

- Protection of Human Rights of Women PrisonersDocument5 pagesProtection of Human Rights of Women PrisonersBrajakanta NameirakpamNo ratings yet

- Crime Information, Reporting and Analysis System (Ciras) : Pcsupt Francisco Don C. Montenegro, PH.DDocument68 pagesCrime Information, Reporting and Analysis System (Ciras) : Pcsupt Francisco Don C. Montenegro, PH.DAyesha LanuzaNo ratings yet

- Use of Force PolicyDocument5 pagesUse of Force PolicyGreenville NewsNo ratings yet

- Mona LisaDocument115 pagesMona LisaAngela Louise SabaoanNo ratings yet

- Crim Law 2 CasesDocument97 pagesCrim Law 2 CasesKaren Ampeloquio0% (1)

- People vs. OanisDocument4 pagesPeople vs. OanisSteven Vincent Flores PradoNo ratings yet

- Dimayacyac vs. CADocument11 pagesDimayacyac vs. CAAb CastilNo ratings yet

- Supreme Court Case Analysis-Team ProjectDocument5 pagesSupreme Court Case Analysis-Team ProjectJasmineA.RomeroNo ratings yet

- Harold V. Tamargo V. Romulo Awingan, LloydDocument4 pagesHarold V. Tamargo V. Romulo Awingan, LloydAnonymous EfPg6qLj7No ratings yet

- Plaintiff-Appellee Accused-Appellant: People of The Philippines, Glecerio Pitulan Y BrionesDocument16 pagesPlaintiff-Appellee Accused-Appellant: People of The Philippines, Glecerio Pitulan Y BrionesMark Christian TagapiaNo ratings yet

- Crim Pro Digest 6Document11 pagesCrim Pro Digest 6cmv mendozaNo ratings yet

- Josue vs. People GR 199579 December 10, 2012 Case DigestDocument2 pagesJosue vs. People GR 199579 December 10, 2012 Case Digestbeingme2No ratings yet

- A Critical Evaluation of Mobile Court Act 2009 HowDocument7 pagesA Critical Evaluation of Mobile Court Act 2009 Howhalima21gubNo ratings yet

- Republic Act No.9262 VAWC-Explainer Mary Joyce B. GarciaDocument33 pagesRepublic Act No.9262 VAWC-Explainer Mary Joyce B. GarciaMary Joyce Blancaflor GarciaNo ratings yet

- CO Code of Safe Practice For Shipboard Container Handling OnDocument64 pagesCO Code of Safe Practice For Shipboard Container Handling OnrigelNo ratings yet

- Custodial Investigation Cases 2Document1 pageCustodial Investigation Cases 2hiltonbraiseNo ratings yet

- Complaint PDFDocument2 pagesComplaint PDFAnonymous WHWJn0No ratings yet

- Display PDF PDFDocument17 pagesDisplay PDF PDFShahbaz MalbariNo ratings yet

- Binay vs. SandiganbayanDocument13 pagesBinay vs. SandiganbayannathNo ratings yet