Professional Documents

Culture Documents

Instructions To Students: Annual Examinations For Schools 2019

Uploaded by

parapara11Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Instructions To Students: Annual Examinations For Schools 2019

Uploaded by

parapara11Copyright:

Available Formats

DEPARTMENT FOR CURRICULUM,

LIFELONG LEARNING AND EMPOLYABILITY

Directorate for Learning and Assessment Programmes

Educational Assessment Unit

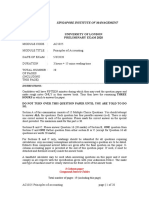

Annual Examinations for Schools 2019

YEAR 9 ACCOUNTING TIME: 2 hours

Name: _____________________________________ Class: _______________

FOR OFFICIAL USE ONLY

MARKS

SECTION A B C D E F1 F2 F3 TOTAL

MARKS 5 5 5 10 5 20 25 25 100

STUDENT’S

MARK

INSTRUCTIONS TO STUDENTS

ANSWER ALL QUESTIONS.

THE ORDERLY PRESENTATION OF YOUR WORK IS IMPORTANT.

ILLEGIBLE WORK WOULD BE WRITTEN OFF.

SECTIONS A, B, C, D AND E ARE TO BE ANSWERED ON THE PAPER.

SECTION F IS TO BE ANSWERED ON THE FOOLSCAPS PROVIDED.

YOU HAVE TO MAKE THE NECESSARY RULINGS.

Accounting – Year 9 – 2019 Page 1 of 8

SECTION A [5 marks]

Tick () the correct answer in the space provided. Each question carries 1

mark.

1. A business prepares the Statement of Financial Position to:

(a) check the accuracy of the double entry.

(b) summarize the business’ assets, liabilities and owners’ capital

at one point in time.

2

(c) calculate the gross profit.

(d) calculate the cost of goods sold.

2. A business bought machinery on credit from Mekanika Ltd. The double

entry to record this transaction is:

(a) Debit: Machinery a/c Credit: Mekanika Ltd. a/c

(b) Debit: Mekanika Ltd a/c Credit: Machinery a/c

(c) Debit: Machinery a/c Credit: Bank a/c

(d) Debit: Purchases a/c Credit: Mekanika Ltd. a/c

3. The business paid €630 to P. Galea (a trade payable) in full settlement of

his account of €680. This type of discount is called:

(a) Trade Discount.

(b) Discount Allowed.

(c) Discount Received.

(d) Employee Discount.

4. Which of the following is an example of capital expenditure?

(a) Carriage cost on purchases.

(b) Rent of the business.

(c) Carriage costs on sales.

(d) Cost of installing a new air conditioner in the business office.

5. An example of a non-current liability is:

(a) Bank Overdraft.

(b) Trade Receivable.

(c) Bank Loan.

(d) Cash Register.

Page 2 of 8 Accounting – Year 9 – 2019

SECTION B [5 marks]

Fill in the blanks below with the appropriate words from the list. Each word

can be used once only. There are two words which are not to be used.

wages government recording summarizing suppliers capital

assets transaction reporting lenders liabilities interpreting

Bookkeeping is the process of ____________________, in chronological order, the

daily transactions of a business entity. Bookkeeping forms part of accounting, but

accounting also include the process of classifying, ____________________,

_____________________, analysing and ____________________ the financial

condition and performance of a business. Accounting sets to satisfy the needs of a wide

range of users. The main users of accounting information include; investors,

___________________, managers, ____________________, employees and

____________________.

The accounting equation can be summarized by using the following equation:

____________________ = ____________________ + ____________________

SECTION C [5 marks]

Match the following to show which book of original entry is used to first record

the following transactions. The first one is done for you.

0. Payment by cheque to a supplier of a business. Sales Day Book

1. A. Borg bought goods on credit from the Sales Returns

business. Daybook.

2. The business bought goods on credit from 0 Cash Book.

T. Gauci.

3. A motor van is bought on credit by the business. Purchases Returns

Day Book

4. A. Borg returns damaged goods to the business. Purchases Day

Book.

5. The business returns unsuitable goods to Journal.

T. Gauci.

Accounting – Year 9 – 2019 Page 3 of 8

SECTION D [10 marks]

Explain the following terms.

1. Drawings. (1 mark)

2. Non-Current Assets. (1 mark)

3. Inventory. (1 mark)

4. Trial Balance. (1 mark)

5. Current Liabilities. (1 mark)

Page 4 of 8 Accounting – Year 9 – 2019

6. Business Entity Concept. (1 mark)

7. Real Accounts. (1 mark)

8. Nominal Accounts. (1 mark)

9. Imprest System. (1 mark)

10. Revenue Expenditure. (1 mark)

Accounting – Year 9 – 2019 Page 5 of 8

SECTION E [5 marks]

Show the effect of the following transactions on assets, liabilities or capital.

The first one is done for you.

Effect upon:

Assets Liabilities Capital

0. Bought furniture on credit. Increase (+) Increase (+)

1. Received cash from a bank

loan

2. The owner invested cash in

business

3. Bought inventory on credit.

4. Paid a trade payable by

cheque.

5. The owner paid a trade

payable from her private

money.

SECTION F [70 marks]

Answer all questions in this section on foolscaps provided.

Question 1

The following sales and purchases were made by the business of J. Grima during the

month of May 2019.

2019 Net after trade VAT (10%)

discount (€) (€)

May 1 Bought goods on credit from Nautica Ltd. 800 80

May 6 Sold goods on credit to J. Apap. 330 33

May 10 Sold goods on credit to P. Borg. 260 26

May 18 Credit purchases from Aqua Ltd. 760 76

May 28 Credit sales to P. Borg. 380 38

May 30 Bought goods on credit from Nautica Ltd. 690 69

a. You are required to enter the above information in the Sales Daybook and

Purchases Daybook.

b. Make the necessary postings from the daybooks to the personal accounts in the

Sales Ledger and Purchases Ledger.

c. Show the Sales Account and the Purchases Account as they will appear in the

General Ledger.

d. Balance off all Accounts at 31 May 2019.

[Total for Question 1: 20 marks]

Page 6 of 8 Accounting – Year 9 – 2019

Question 2

The following transactions relate to the month of March 2019.

2019

March 1 Balances brought forward from the previous month:

Cash €680, Bank Overdraft €183.

March 5 Cash purchases €400.

March 9 The following paid the business their accounts by cheque in each

case deducting 4% discount; T. Bartolo €850, C. Cole €900.

March 11 J. Borg lent the business €1,800 paying by cheque.

March 13 Business owner deposited €1,500 in the business bank account

from his personal savings.

March 15 Bought fixtures paying by cheque €3,000.

March 19 The business overpaid its telephone bill by €40 and received a

refund by cheque.

March 20 The business paid the account of A. Attard €680 by cheque and

received a discount of 5%.

March 22 Paid rent by cheque €480.

March 24 Cash withdrawn from the bank €350 for business use.

March 30 Paid electricity by cheque €185.

From the above transactions:

a. Write up a three-column Cashbook for the month of March 2019;

b. Balance off at the end of March 2019 and

c. Show the Discount Allowed Account and Discount Received Account as they

would appear in the general ledger.

[Total for Question 2: 25 marks]

Accounting – Year 9 – 2019 Page 7 of 8

Question 3

The following is a trial balance drawn from the books of Jessica Bugeja, a sole trader,

as at 31 March 2019.

Debit Credit

€ €

Bank Overdraft 6,800

Cash 2,000

Trade Payables 13,600

Trade Receivables 11,850

Sales Returns (Returns Inwards) 680

Purchases Returns (Returns Outwards) 535

Inventory as at 1 April 2018 8,630

Purchases 175,860

Sales 280,325

Discount Allowed 1,000

Discount Received 960

Water and Electricity 2,640

Rent 1,500

General Expenses 3,600

Carriage Inwards 1,583

Carriage Outwards 1,382

Motor Vehicles 45,000

Premises 150,000

Drawings 30,000

Capital as at 1 April 2018 149,158

Insurance 1,488

Communication Expenses 2,100

Commission Paid 582

Sundry Expenses 483

Wages 11,680

Commission Received 680

452,058 452,058

Inventory at 31 March 2019 was valued at €9,354.

Required:

a. Prepare the Statement of Profit or Loss for the year ended 31 March 2019.

(22 marks)

b. Calculate the Working Capital of the business as on 31 March 2019. (3 marks)

[Total for Question 3: 25 marks]

End of Paper

Page 8 of 8 Accounting – Year 9 – 2019

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Judo in Action: Facing The CompetitionDocument21 pagesJudo in Action: Facing The Competitionpollysivib100% (2)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- TI-84 Plus GuidebookDocument422 pagesTI-84 Plus GuidebookJava RobNo ratings yet

- Chase credit card statement blueprint paymentDocument3 pagesChase credit card statement blueprint paymentquannbui950% (1)

- Intermediate Accounting 1 Final Grading ExaminationDocument18 pagesIntermediate Accounting 1 Final Grading ExaminationRena Rose Malunes11% (9)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 12 20 C.A Knowledge Q ADocument108 pages12 20 C.A Knowledge Q Amichelo-kandamaNo ratings yet

- Advacc 1 Final Quiz JoyceDocument73 pagesAdvacc 1 Final Quiz Joycenena cabañesNo ratings yet

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersFrom EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersRating: 2 out of 5 stars2/5 (4)

- Seatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWDocument5 pagesSeatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWChristine Joy LanabanNo ratings yet

- Seatwork 01 Statement of Income Answer KeyDocument3 pagesSeatwork 01 Statement of Income Answer KeyTshina Jill BranzuelaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Review Program Third Quiz #AlagangWencyDocument12 pagesReview Program Third Quiz #AlagangWencyJazzy Mercado55% (11)

- Intermediate Accounting 1 Final Grading ExaminationDocument18 pagesIntermediate Accounting 1 Final Grading ExaminationKrissa Mae LongosNo ratings yet

- Return of InvestmentDocument5 pagesReturn of InvestmentPakar Kuda LautNo ratings yet

- Basic Accounting ExamDocument8 pagesBasic Accounting ExamJollibee JollibeeeNo ratings yet

- Philippine High School Exam on Accounting and FinanceDocument5 pagesPhilippine High School Exam on Accounting and FinanceRaul CabantingNo ratings yet

- Checklist For Lease of VenueDocument2 pagesChecklist For Lease of VenueJulius IgnacioNo ratings yet

- Acctg1 MidtermDocument6 pagesAcctg1 MidtermKevin Elrey Arce50% (4)

- Mock Examination Section B QuestionDocument23 pagesMock Examination Section B QuestionLuisito Quispe MarcosNo ratings yet

- Mock 2 QuestionsDocument10 pagesMock 2 QuestionsalibanaylaNo ratings yet

- Econ Past Exam PaperDocument7 pagesEcon Past Exam Paperagonza70No ratings yet

- Accounting MCQsDocument7 pagesAccounting MCQssaeedqk100% (7)

- Fundamentals of Accountancy, Business & Management 1 Third Grading ExaminationDocument6 pagesFundamentals of Accountancy, Business & Management 1 Third Grading ExaminationMc Clent CervantesNo ratings yet

- LUYONG - 3rd Periodical - FABM1Document4 pagesLUYONG - 3rd Periodical - FABM1Jonavi Luyong100% (2)

- SEO-Optimized Multiple Choice Exam QuestionsDocument3 pagesSEO-Optimized Multiple Choice Exam QuestionsChristian Joy ReyesNo ratings yet

- CH 05Document9 pagesCH 05Tien Thanh DangNo ratings yet

- PAKSHIKHA CENTRAL SCHOOL TRIAL EXAMINATION ACCOUNTANCYDocument16 pagesPAKSHIKHA CENTRAL SCHOOL TRIAL EXAMINATION ACCOUNTANCYSoNam ZaNgmoNo ratings yet

- B 2-1 ET - Financial Accounting - Quizzes - Winter2019 ISMNetDocument14 pagesB 2-1 ET - Financial Accounting - Quizzes - Winter2019 ISMNetKristi MaleNo ratings yet

- Quiz No. 1-AFAR-08 AFAR-09ADocument7 pagesQuiz No. 1-AFAR-08 AFAR-09Asharielles /No ratings yet

- AccountingDocument6 pagesAccountingaya walidNo ratings yet

- ACCOUNTANCYDocument6 pagesACCOUNTANCYdebangeesahooNo ratings yet

- PILOT TEST 2023Document6 pagesPILOT TEST 2023bapeboiz1510No ratings yet

- CCDC First Grading Examination MCQDocument9 pagesCCDC First Grading Examination MCQRoldan ManganipNo ratings yet

- (FINBUS2) (BUS-AC1) Financial Accounting 1 (Nov2013) v5Document6 pages(FINBUS2) (BUS-AC1) Financial Accounting 1 (Nov2013) v5mNo ratings yet

- Singapore Institute of Management: University of London Preliminary Exam 2020Document20 pagesSingapore Institute of Management: University of London Preliminary Exam 2020Kəmalə AslanzadəNo ratings yet

- The Bhawanipur Education Society College Department of CommerceDocument3 pagesThe Bhawanipur Education Society College Department of CommerceAyush PathakNo ratings yet

- HKABE 2014-15 Paper 1 QuestionDocument14 pagesHKABE 2014-15 Paper 1 QuestionChan Wai KuenNo ratings yet

- Basic Accounting Crash CourseDocument5 pagesBasic Accounting Crash CourseJolo RomanNo ratings yet

- ACCTG Plus Special Finals Quiz 2Document4 pagesACCTG Plus Special Finals Quiz 2irish romanNo ratings yet

- Diploma in Accountancy Examination June 2019 Q ADocument229 pagesDiploma in Accountancy Examination June 2019 Q ADixie CheeloNo ratings yet

- Vgu Obrw Halftime Mock ExamDocument9 pagesVgu Obrw Halftime Mock ExamSour CandyNo ratings yet

- Regina Mondi College Cost Accounting and Control Preliminary ExamDocument4 pagesRegina Mondi College Cost Accounting and Control Preliminary ExamJake Francis JarciaNo ratings yet

- Review Questions Financial Accounting 1 StudentsDocument5 pagesReview Questions Financial Accounting 1 StudentsNancy VõNo ratings yet

- Practice Questions Code 313, With AnswersDocument19 pagesPractice Questions Code 313, With AnswersChang QiNo ratings yet

- Exercises P Class2-2022Document9 pagesExercises P Class2-2022Angel MéndezNo ratings yet

- Third Quiz Accounting ProcessDocument6 pagesThird Quiz Accounting Processibrahim haniNo ratings yet

- Learnovate Ecommerce Financial Statement MCQsDocument5 pagesLearnovate Ecommerce Financial Statement MCQsNikita DakiNo ratings yet

- Mock Paper-3 (With Answer)Document19 pagesMock Paper-3 (With Answer)RNo ratings yet

- Level 4 Thoery-1Document25 pagesLevel 4 Thoery-1EdomNo ratings yet

- Institute of Business Management Final Assessment - Spring 2020Document6 pagesInstitute of Business Management Final Assessment - Spring 2020Shaheer KhurramNo ratings yet

- Level 4 ThoeryDocument25 pagesLevel 4 ThoeryEdomNo ratings yet

- Accounting FundamentalsDocument11 pagesAccounting FundamentalsAce Hulsey TevesNo ratings yet

- QUIZ 2. MC - Before Chap5Document9 pagesQUIZ 2. MC - Before Chap5minhhquyetNo ratings yet

- Pilot TestDocument4 pagesPilot TestTrang Nguyễn QuỳnhNo ratings yet

- BA3 Mock Exam 01 - PILOT PAPER Nov 2020Document8 pagesBA3 Mock Exam 01 - PILOT PAPER Nov 2020Sanjeev JayaratnaNo ratings yet

- Practice QA, 216, FDocument19 pagesPractice QA, 216, FChang QiNo ratings yet

- IIA Diploma: P2 Financial Risks and ControlsDocument19 pagesIIA Diploma: P2 Financial Risks and ControlskshitijsaxenaNo ratings yet

- Midterm I 2022 KEYDocument17 pagesMidterm I 2022 KEYkuo zoeNo ratings yet

- VIRAY, NHICOLE S. Midterm Exam in Acc417 - Acc412 - Refresher - For PostingDocument11 pagesVIRAY, NHICOLE S. Midterm Exam in Acc417 - Acc412 - Refresher - For PostingZeeNo ratings yet

- Comprehensive Exercise AjeDocument2 pagesComprehensive Exercise AjeCHRISTEA MAUSISANo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Mountain Man Brewing Bringing Brand To Light Marketing EssayDocument11 pagesMountain Man Brewing Bringing Brand To Light Marketing Essayparapara11No ratings yet

- Optimization-Modeling PDFDocument99 pagesOptimization-Modeling PDFparapara11No ratings yet

- CH 13 BDocument25 pagesCH 13 Bparapara11No ratings yet

- Linear Programing ModelsDocument165 pagesLinear Programing ModelsJDesconectado18No ratings yet

- Linear Programming Models:: Graphical and Computer MethodsDocument22 pagesLinear Programming Models:: Graphical and Computer Methodsakas84No ratings yet

- ConcavityDocument3 pagesConcavityparapara11No ratings yet

- Business ResearchDocument18 pagesBusiness ResearchMarsha Eflida DecenNo ratings yet

- Amarille, Estrellita Jane (Resume)Document3 pagesAmarille, Estrellita Jane (Resume)rennze dominic deveraNo ratings yet

- Consolidated ReportDocument86 pagesConsolidated ReportBalasubramanian M.BNo ratings yet

- UQA DS ISO 27001 2013 3pg A4 v3Document3 pagesUQA DS ISO 27001 2013 3pg A4 v3Mila FaradilahNo ratings yet

- Dream Job Placement ReceiptDocument1 pageDream Job Placement Receiptnaamm757No ratings yet

- ISO/DIS 45001:2017 OH&S Manual (Preview)Document16 pagesISO/DIS 45001:2017 OH&S Manual (Preview)info-390712No ratings yet

- Economic Development Goals and Objectives: Dubuque County Smart PlanDocument4 pagesEconomic Development Goals and Objectives: Dubuque County Smart Plankarthik MukuralaNo ratings yet

- Nifty 50 ratiosDocument6 pagesNifty 50 ratiosDeepak RahejaNo ratings yet

- Intermediate Macroeconomics ModuleDocument76 pagesIntermediate Macroeconomics ModuleKatunga MwiyaNo ratings yet

- Monson Jack ResumeDocument1 pageMonson Jack Resumeapi-488264962No ratings yet

- ManagementSpansandLayers - Booz and Co PDFDocument8 pagesManagementSpansandLayers - Booz and Co PDFMukul JainNo ratings yet

- RE Pre License CoursesDocument16 pagesRE Pre License Coursesalexbuch2010No ratings yet

- Analysis of Labour Codes - Revised 29.10.2020 17.50Document64 pagesAnalysis of Labour Codes - Revised 29.10.2020 17.50subirdutNo ratings yet

- Service-: Economic Activity Result Ownership Point of Sale Economics Goods Transfer Experience Person DoctorDocument3 pagesService-: Economic Activity Result Ownership Point of Sale Economics Goods Transfer Experience Person DoctorMunif KhanNo ratings yet

- NR ResumeDocument4 pagesNR ResumeNAMBIRAJAN GNo ratings yet

- Assignment The Big ShortDocument1 pageAssignment The Big ShortDaveNo ratings yet

- Assurance Services and The Integrity of Financial Reporting, 8 Edition William C. Boynton Raymond N. JohnsonDocument21 pagesAssurance Services and The Integrity of Financial Reporting, 8 Edition William C. Boynton Raymond N. JohnsonmerantidownloaderNo ratings yet

- Forms of Business OrganisationDocument6 pagesForms of Business OrganisationemonimtiazNo ratings yet

- FSC COC Application FormDocument11 pagesFSC COC Application FormC P TiwariNo ratings yet

- Chapter 27 Aggregate Supply and Aggregate DemandDocument44 pagesChapter 27 Aggregate Supply and Aggregate DemandastridNo ratings yet

- Chapter 2 Thinking Like An EconomistDocument29 pagesChapter 2 Thinking Like An EconomistVanna Chan Weng YeeNo ratings yet

- Labour union dispute over contract worker terminationDocument4 pagesLabour union dispute over contract worker terminationmouliNo ratings yet

- FEE STRUCTURE 2012 v1.0Document2 pagesFEE STRUCTURE 2012 v1.0HaslindaNo ratings yet

- Ayana Renewable Power Sr. Manager SCM EPC JobDocument3 pagesAyana Renewable Power Sr. Manager SCM EPC JobBala JiNo ratings yet

- Analyze Engineering Economy ProblemsDocument4 pagesAnalyze Engineering Economy ProblemsRenellejay PHNo ratings yet

- Company Profile: Business Consultant With A Global PerspectiveDocument20 pagesCompany Profile: Business Consultant With A Global PerspectiveSulistia WatiNo ratings yet