Professional Documents

Culture Documents

Instructions: Record The Depreciation Expense For Year 2010

Instructions: Record The Depreciation Expense For Year 2010

Uploaded by

sara0 ratings0% found this document useful (0 votes)

18 views2 pagesDuPage Company purchased a factory machine for $18,000 that had a salvage value of $2,000 and useful life of 4 years or 160,000 hours of use. Actual annual hours of use were: 2010 - 40,000 hours, 2011 - 60,000 hours, 2012 - 35,000 hours, and 2013 - 25,000 hours. The summary asks to prepare depreciation schedules using the straight-line, units-of-activity, and declining-balance methods and record the 2010 depreciation expense.

Original Description:

Original Title

classwork 5.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDuPage Company purchased a factory machine for $18,000 that had a salvage value of $2,000 and useful life of 4 years or 160,000 hours of use. Actual annual hours of use were: 2010 - 40,000 hours, 2011 - 60,000 hours, 2012 - 35,000 hours, and 2013 - 25,000 hours. The summary asks to prepare depreciation schedules using the straight-line, units-of-activity, and declining-balance methods and record the 2010 depreciation expense.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views2 pagesInstructions: Record The Depreciation Expense For Year 2010

Instructions: Record The Depreciation Expense For Year 2010

Uploaded by

saraDuPage Company purchased a factory machine for $18,000 that had a salvage value of $2,000 and useful life of 4 years or 160,000 hours of use. Actual annual hours of use were: 2010 - 40,000 hours, 2011 - 60,000 hours, 2012 - 35,000 hours, and 2013 - 25,000 hours. The summary asks to prepare depreciation schedules using the straight-line, units-of-activity, and declining-balance methods and record the 2010 depreciation expense.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Financial accounting Classwork 3 plant asset and depreciation methods

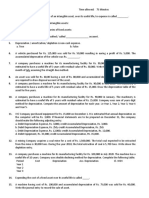

1- DuPage Company purchases a factory machine at a cost of $18,000 on January 1, 2010.

DuPage expects the machine to have a salvage value of $2,000 at the end of its 4-year

useful life. During its useful life, the machine is expected to be used 160,000 hours.

Actual annual hourly use was: 2010, 40,000; 2011, 60,000; 2012, 35,000; and 2013,

25,000.

Instructions: Prepare depreciation schedules for the following methods: (a) straight-line,

(b) units-of-activity, and (c) declining-balance using double the straight-line rate.

Record the depreciation expense for year 2010

You might also like

- Problem NO. 1: Pengantar Akuntansi 2 (S1) PR: Aset Tetap - PenyusutanDocument2 pagesProblem NO. 1: Pengantar Akuntansi 2 (S1) PR: Aset Tetap - PenyusutanEka NlyNo ratings yet

- Accounting 102 Intermediate Accounting Depreciation QuizDocument6 pagesAccounting 102 Intermediate Accounting Depreciation QuizApril Mae Intong TapdasanNo ratings yet

- Chapter 10: Plant Assets, Natural Resources and Intangibles Important TermsDocument2 pagesChapter 10: Plant Assets, Natural Resources and Intangibles Important TermsMarwan DawoodNo ratings yet

- (Drills - Ppe) Acc.107Document10 pages(Drills - Ppe) Acc.107Boys ShipperNo ratings yet

- Chapter 10 Noncurrent Assets: Discussion QuestionsDocument6 pagesChapter 10 Noncurrent Assets: Discussion QuestionskietNo ratings yet

- QUIZ - CHAPTER 16 - PPE PART 2 - 2020edDocument5 pagesQUIZ - CHAPTER 16 - PPE PART 2 - 2020edjanna napiliNo ratings yet

- Chapter 8Document2 pagesChapter 8Gio RobakidzeNo ratings yet

- Acct CH.7 H.W.Document8 pagesAcct CH.7 H.W.j8noelNo ratings yet

- Solved Problems and Exercises-DepreciationDocument7 pagesSolved Problems and Exercises-DepreciationKaranNo ratings yet

- Practice Problem Job CostingDocument4 pagesPractice Problem Job CostingDonna Zandueta-TumalaNo ratings yet

- Topic: Depreciation (Cost of Machine) Made by Sir Hyder AliDocument4 pagesTopic: Depreciation (Cost of Machine) Made by Sir Hyder AliHaroon KhatriNo ratings yet

- AIS16Exercises SCDocument6 pagesAIS16Exercises SCSarah GherdaouiNo ratings yet

- Test Bank 10Document9 pagesTest Bank 10mahmodsobhy121212No ratings yet

- University of London Preliminary Exam 2017Document11 pagesUniversity of London Preliminary Exam 2017Pei TingNo ratings yet

- Exercise Chap 11Document7 pagesExercise Chap 11JF FNo ratings yet

- Acc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long QuizDocument5 pagesAcc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long Quizemielyn lafortezaNo ratings yet

- Asistensi 8 - PPE (Revaluation Model)Document3 pagesAsistensi 8 - PPE (Revaluation Model)mirrmirmirNo ratings yet

- Test 06-07Document2 pagesTest 06-07goharmahmood203No ratings yet

- Chapter 10Document11 pagesChapter 10Saharin Islam ShakibNo ratings yet

- Capital Budgeting 2Document3 pagesCapital Budgeting 2mlexarNo ratings yet

- Latihan Chapter 9Document2 pagesLatihan Chapter 9LiliNo ratings yet

- Acc 308-Week3 - 3-2 Homework Chapter 11Document7 pagesAcc 308-Week3 - 3-2 Homework Chapter 11Lilian LNo ratings yet

- ABC Costing Question PackDocument9 pagesABC Costing Question Packsarahk3232No ratings yet

- Depreciation AssignmentDocument2 pagesDepreciation AssignmentAdil Khan LodhiNo ratings yet

- Programmazione e Controllo Esercizi Capitolo 9Document32 pagesProgrammazione e Controllo Esercizi Capitolo 9Azhar SeptariNo ratings yet

- Plates in Econ Direction: Copy and Solve The Following Problems in A Short/long/a4 Bond of Paper. Final Answer Must Be inDocument1 pagePlates in Econ Direction: Copy and Solve The Following Problems in A Short/long/a4 Bond of Paper. Final Answer Must Be inJamie MedallaNo ratings yet

- CH 11Document6 pagesCH 11Saleh RaoufNo ratings yet

- DepreciationDocument17 pagesDepreciationZAID BIN TAHIRNo ratings yet

- Singapore Institute of Management: University of London Preliminary Exam 2015Document10 pagesSingapore Institute of Management: University of London Preliminary Exam 2015Pei TingNo ratings yet

- Problems Theme 4 FIXED ASSETSDocument5 pagesProblems Theme 4 FIXED ASSETSMihaelaNo ratings yet

- Cga-Canada Management Accounting Fundamentals (Ma1) Examination March 2014 Marks Time: 3 HoursDocument18 pagesCga-Canada Management Accounting Fundamentals (Ma1) Examination March 2014 Marks Time: 3 HoursasNo ratings yet

- Tugas Depresiasi, Deplesi Dan Penurunan NilaiDocument4 pagesTugas Depresiasi, Deplesi Dan Penurunan NilaiAura Anggun Permatasari auraanggun.2021No ratings yet

- Answer ANY THREE Questions: Chandres Tejura BUS 239 Management Accounting For Decision MakingDocument9 pagesAnswer ANY THREE Questions: Chandres Tejura BUS 239 Management Accounting For Decision MakingrahimNo ratings yet

- Intermacc Depreciation, Depletion, Revaluation, and Impairment Prelec WaDocument1 pageIntermacc Depreciation, Depletion, Revaluation, and Impairment Prelec WaClarice Awa-aoNo ratings yet

- F2 MockDocument23 pagesF2 MockH Hafiz Muhammad AbdullahNo ratings yet

- Ias 16Document6 pagesIas 16Noman AnserNo ratings yet

- Assign MSDocument3 pagesAssign MSpritamwarudkarNo ratings yet

- May Exam 2021 Asb4007Document10 pagesMay Exam 2021 Asb4007Submission PortalNo ratings yet

- Revaluation and Impairment - Without AnswerDocument2 pagesRevaluation and Impairment - Without AnswerEra EllorimoNo ratings yet

- Tutorial Two-1Document9 pagesTutorial Two-1Gift MoyoNo ratings yet

- Acctg at Udm: DepreciationDocument32 pagesAcctg at Udm: DepreciationBunbun 221No ratings yet

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaNo ratings yet

- Cost Management PaperDocument8 pagesCost Management PaperHashan DasanayakaNo ratings yet

- Impairment of Assets - Assignment - For PostingDocument1 pageImpairment of Assets - Assignment - For Postingemman neriNo ratings yet

- ACC103 Assignment January 2019 IntakeDocument8 pagesACC103 Assignment January 2019 IntakeReina TrầnNo ratings yet

- SQB - Chapter 4 QuestionsDocument13 pagesSQB - Chapter 4 QuestionsracsoNo ratings yet

- Assignment On DepreciationDocument4 pagesAssignment On DepreciationNouman MujahidNo ratings yet

- DepreciationDocument3 pagesDepreciationAdnan ShabeerNo ratings yet

- EXERCISE 3.4 (1) Ass1Document1 pageEXERCISE 3.4 (1) Ass1Sonwabiso MatomelaNo ratings yet

- Tutorial Chpater 10-11 Part BDocument32 pagesTutorial Chpater 10-11 Part BKate BNo ratings yet

- Ias 20 QuestionsDocument6 pagesIas 20 QuestionsGonest Gone'stoëriaNo ratings yet

- Lesson 10 Exercises FormattedDocument7 pagesLesson 10 Exercises FormattedAnand RajNo ratings yet

- Problem 30-1 (IAA)Document7 pagesProblem 30-1 (IAA)Quinnie Apuli0% (1)

- MN20501 Lecture 9 Review ExerciseDocument3 pagesMN20501 Lecture 9 Review Exercisesamvrab1919No ratings yet

- AbdulSamad 12 15796 1 DepreciationDocument12 pagesAbdulSamad 12 15796 1 DepreciationSyed SumamaNo ratings yet

- Homework AssignmentDocument11 pagesHomework AssignmentHenny DeWillisNo ratings yet

- f2 - MGMT Accounting August 2014Document21 pagesf2 - MGMT Accounting August 2014aditya pandianNo ratings yet

- Questions AMADocument4 pagesQuestions AMAEnat EndawokeNo ratings yet

- DEPRECIATIONDocument5 pagesDEPRECIATIONjdjdbNo ratings yet

- Management Accounting 2Document3 pagesManagement Accounting 2ROB101512No ratings yet

- Control VariablesDocument3 pagesControl VariablessaraNo ratings yet

- What Is Human Resource? What Is Human Resource?Document51 pagesWhat Is Human Resource? What Is Human Resource?saraNo ratings yet

- 004 Profitability of Islamic BankDocument18 pages004 Profitability of Islamic BanksaraNo ratings yet

- Age of The BanksDocument26 pagesAge of The BankssaraNo ratings yet

- Lecture 2 Second Year Financial Accounting: Merchandising Operation 1Document40 pagesLecture 2 Second Year Financial Accounting: Merchandising Operation 1sara100% (1)

- Lecture (3) Accounting TheoryDocument35 pagesLecture (3) Accounting TheorysaraNo ratings yet

- Mutual Funds SummaryDocument13 pagesMutual Funds SummarysaraNo ratings yet

- Classwork 1Document2 pagesClasswork 1saraNo ratings yet

- Acc Theo Lecture 2Document45 pagesAcc Theo Lecture 2saraNo ratings yet

- To Record Estimate of Uncollectible AccountsDocument2 pagesTo Record Estimate of Uncollectible AccountssaraNo ratings yet

- Costing Systems (Job Costing System, Process Costing System and Activity Based Costing ABC)Document2 pagesCosting Systems (Job Costing System, Process Costing System and Activity Based Costing ABC)saraNo ratings yet

- Required: Compute Inventory On July 31, 2016 and Cost of Goods Sold For The MonthDocument1 pageRequired: Compute Inventory On July 31, 2016 and Cost of Goods Sold For The MonthsaraNo ratings yet