Professional Documents

Culture Documents

AF101 Exam

AF101 Exam

Uploaded by

Ayaan Ahaan Malik-Williams0 ratings0% found this document useful (0 votes)

25 views12 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views12 pagesAF101 Exam

AF101 Exam

Uploaded by

Ayaan Ahaan Malik-WilliamsCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 12

@USP

THE UNIVERSITY OF THE

AF101: INTRODUCTION TO ACCOUNTING AND

FINANCIAL MANAGEMENT PART 1

SCHOOL OF ACCOUNTING AND FINANCE

Final Examination

Semester 1 2016

FACE TO FACE & PRINT Mode

Duration of Exam: 3 hours + 10 minutes

Reading Tme: 10 minutes

Weng Time: 3 hours

Instructions:

This paper hot 2sections. All ques

‘Answer ol your questions in the

tions ce computor

wor bootlet provided.

This exam covers 50% of overcil mark

Total no. of pages: 12

This exam i closed book.

Materials slowed: Only a colcviatex

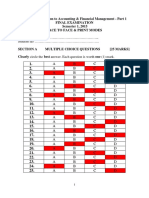

SECTION A MULTIPLE CHOICE QUESTIONS 10 Marks

1. Which of these are contingent libilites?

L.A oan rom financial insaton

1 Amunresoved lawsuit brought aginst a newspaper fr defamation

TUL Amagreemeat to act as guarantor for borrowings

a tka

% Lim

6 Li

aout

2. The classification of liabilities on the bass of timing of setement, i. cument and on

cament, is useful as it helps decision-makers assess the inns ability 10 meet all of the

following excep:

vides,

b profil

© commiments which are par of the operating cycle

4 capital payments

3. Which ofthese are sources of financial information about companies?

| Published financial statements (annual reports)

1, The Intemet

UL. The Stock Exchange

1V. Financial newspapers and journals

'V. Financial advisory services

IV, V

U,V, V

LV

HIV, V

1,

i

1

1

44. Lodoni Company Lid desided to issue 200000 onnary shares for $210 each, payable in

instalments 4c on application, Son allosment andthe balance payable at the discretion

ofthe company. Applications were recsved for 20.000 shares. The shes were alloted by

the directors ata meeting held a week afer the close of applications and refunds were made

{or 20 000 shares. The joural etry to record the all eet ofthe allotment insalment is

‘which ofthe following?

Debit bank asount $200 000; eet allotment $200 000,

Debit hank account $220 00; credit allotment $220 000

Debit alloment $220 000; credit share pital $220.0

Debit share capital $200 000; credit hank account S200 000

5. On January 2014 Hobbies Lu decided issue 40 000 shares to the publi, payable as

Fallows:

50 cents nil on appliction

20-cents payable within one month of allotment

530 cents payable in calls due 30 September 2015.

“Assuming the issue was fully subscribed and all rpouns due were received by 30 June

2014, The balance ofthe Share Capital acount on tha date was

$2000.

sin 00.

© 28000.

4 si2000.

6. Atyear-end, the Boar of Directors of Mega Motors Ld declared ial dividend of 4 per

shure on 80 000 ordinary shares. Early inthe next year, the dividend was paid. Which of

the following isthe general oumal entry to record the payment ofthe dividend?”

Debit tained earings $3200; credit Final dividend payable $3200

Debit retained earings $3200, credit bank $3200

Debit inal dividend payable $3200; credit bank $3200

Debit bank $3200; credit final dividend payable $3200

7. On what bass would the oss of several items of propery, plant and equipment, acquired

fora lump-sum payment, normally be allocated?

4. Netrealsable value at soquiston date

1b, Replacement cost st aoguisition date

& Independent valuation at cquison date

8 Fairvalu t acquisition date

8. Which statement concerning the iminishing-balance method of depreciation is true?

4 Itcharges the same smount of depreciation each perio.

b. Ieapplesa dectinng percentage factor to the asset's orignal cost

© Itisalso known asthe unto production method,

4 Ihisan appropriate method when proprionaely moe of the asset's benefits are

consumed inthe early years ofits its

49, When an asset is sold the gain or loss on disposi is the diffrence between the:

proceeds of sale and she original cost of the asset.

proceeds of sale and the carrying amount ofthe asset

Proceods of sale and the fit vale ofthe asst

‘original cost and the accumulated depreciation of the asset

10 In elation othe direct write-off method of acounting for bad debt, itis not te that

bad debts recharged as an expense athe time an account is determined tobe

uncollectable.

b. the enty o write off bad debts is debit bad debts expense, debit GST collected,

credit accounts receivable

there isn conta asset account fr estimated dou debs.

4d. debts expenses recorded in the sume period in which is related sles revenue is

included as income.

~ continue to Section 8~

SECTION B PROBLEM SOLVING QUESTIONS 90 Marks

Question 11 RECEIVABLES 20 MARKS

Prince King commenced business on | July 2015. On 30 June 2016, he found it necessary to

create an allowance for doubifl debs of $3 030, In addition, he fund that he had writen off

debts amounting 1o 1 875. During the year to 30 June 2017, debts toullng $2400 proved 1 be

bad and wore writen of, and $330 was recovered in respect of bad debs previously writen off

‘The total of accounts receivables balances at 30 June 2017 was $84 300 afer the bad debs had

been writen off) and it was decided to increase the allowance for doubifl debts to 6% ofthis

Sigur. Ignore GST.

REQUIRED (show a workings}

No nations ruired

4) Prepare the general jours] entes to create the allowance for doubful debs nd to write

off the had debts on 30 June, 2016 [6 marks}

1b) Prepare the general journal entries to write-off further bad debts and the bad debts that

‘were later recovered during the yea to 30 June, 2017 [6 marks}

©) Prepare the general journal entry to bring the allowance for dovbtful debts to the

appropriate amount t 30 Jun, 2017, [4 marks]

8) Show how accounts receivable and the allowance for doubtful debts would appear on the

balance sheet t 30 une, 2017 [4 marks}

QUESTION 12 NON-CURRENT ASSETS 28 MARKS,

Part

[Nomern Motors Limited purchased track fr cash for $2,000 plas 10% GST on Januar 1, 2008,

At the time of purchase it was estimated thatthe useful life of the vehicle would be 100,000,

[loners adit was expected tat it would tavel that distance over five yeas. At the end of four

‘yeas it was calculated tht te track could he sold fr $12,000.

‘The actual distance covered by the tucks a follows:

Year ending 30 June:

2008 10,000 kilometers

2009 25,000 klometers

2010 30,00 kilometers

2o1t 22,000 kilometers

2012 8000 kilometers,

REQUIRED [show ol workings]

1 Calculate depreciation forthe years ending 30" June 2008 to 30 June 2012 using the “Unite of

Prodstion” method (7 mks)

4i Prepare the appropriate gener jun entis forthe dates 1 January and 310 June 208,

(Narrtions are na required) [S marks}

Par

A130 June 2015, the financial statements of MeMastr Ld showed a building with a cost (net of

GST) of $300 000 and aeeumulated depeviation of $152 000, The business uses the straight-line

method to depreciate the building, When acquired, the building's useful life was estimated at 30

years ad is residual value at $60 000,

(On | January 2016, MeMaster Ltd made structural improvements to the building costing $94 000

(oet of GST). Although the capacity of the building was unchangod, i is estimated that the

improvements will extend the useful life of the building to 40 years, rather than the 30 years

‘riginally estimated. No change is expected inthe residual value.

REQUIRED [show al workings}

Prepare the appropriate general oumal entries on 1 January 2016 as indicated below.

[Round off to the nearest dollar}

i) Any unrecorded deprecation prior to the st

sural improvements {3 marks]

Ai) Write back accumulated depreciation on the existing building. [3 marks]

ii) Reco the cost ofthe structural improvements (7 marks]

QUESTION 13. ANALYSIS OF FINANCIAL STATEMENTS

20 MARKS

‘The fellowing information has Ben extracted fom the financial statements and nots thereto of Best and

Low Le

30 ami

= $580 0 $7500

25000 265007

00. 55000

[Profit (air) 52500 $6100

Preference dividends 2x0 2800

“Tosa arte a0 00 355 000

“Ti ab 300 00 330000

Preference sare api 162.00 62000

‘Ondnay share ea Tio woo cor

‘Resuned ea ‘65000 5000

REQUIRED [show oll workings]

8) Caleulate the following ratios for 2017 (use average figures where appropriate)

‘ret on assets

) stun on ordinary equity

1b) Calculate the following ratios for 2016 and 2017:

1 profit margin

ii) debt ratio

i times inerest eared

marks]

( marks]

[B marks}

(3 marks]

marks}

©) I one paragraph, comment on the company's profitability and financial stability

position. Include the results of the ratio analysis (rom (a) and (b) in your discussion

[sma]

QUESTION 14 CASH FLOW STATEMENT 22 MARKS

KYGO LIMITED.

INCOME STATEMENT

FOR THE YEAR ENDED 31 DECEMBER, 2017

s

Sales

Cost of Goods Sold

Gross Profit

‘Other income:

Gain on sle of land

Less: Operating Expenses

Salaries expenses

Other operating expenses (inc. insurance) 10000

Baa debt expense 2.000

Interest expense 2 500

Depreciation 11000

Loss onsale of Property, Plant & Equipment 4.000 56.500

Net operating profit before tax 21 500

Income ax expense 000

Net operating profit after tax 18500

KYGO LIMITED

(COMPARATIVE BALANCE SHEETS AS AT 31 DECEMBER 2016 & 2017

2017 2016

s s

CURRENT ASSETS

(Cash at bank 42000 15000

‘Accounts Receivable 37500 40,000

Allowance for doubtful debs (4500) 000)

Inventory 43000 25.000

Prepaid Insurance 6 000 3.000

Property, Plant & Equipment 236.000 215000

Less: Accumulated depreciation (32.000) (60.000)

‘TOTAL ASSETS 278.00 218000

LIABILITIES.

‘Accounts Payable 31.000 23.000

Salaries Payable 9.000 2.000

Interest Payable 1800 2.000

Income Taxes Payable 5500 1500

Dividends Payable 8000 °

Loans Payable 1s000 25.000

‘TOTAL LIABILITIES. 70.000 53 500

NET ASSETS 208 000 161500

SHAREHOLDER’S EQUITY

Iesuod Capital 145.000 100 000

Retained Earnings 63.000 61500

TOTAL SHARFHOLDER'S EQUITY 208 00 161 500

ADDITIONAL INFORMATION

{Wrote off 50 accounts receivable as uncollectiblc

Sold operational assets for $4,000 cash that had cost $17,000 and had a book value of

$8,000,

Declared a cash dividend of $13,000.

iv. Soi land for $30,000 that had been acquired fr $10,000,

Paid $10,000 towards long-term loan

vi. Purchase plan, propety & equipment for $48,000 cash

‘il, Issued shares for $45,000 cash

a0

REQUIRED [show oll workings]

Calculate the following

4. Cash receipts fom customers

Ji, Cash paid for inventory

ii, Cash pid to employees

iv. Cash pad for ather operating expenses

¥. Cash paid for interest

vis Cash paid for taxes.

Vii, Cash pad for dividends

mars)

marks)

Gimaris)

G mats)

G marks)

@ marks)

G marks)

‘Selected Ratio Formulae:

Profit

Average Toll ass

2) Return on total asset

soft Preference dividends

‘Average ondary equity

2) Return on ordinary eau

3) Profit Ma Profit

Revenue

4) Debt ratio = Total iailies

“Total assets

5) Times interest earned = Profit income tx + Finance cost

Finance costs

“THE END

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 3 NotesDocument10 pagesChapter 3 NotesAyaan Ahaan Malik-WilliamsNo ratings yet

- Chapter 4 Lecture NotesDocument8 pagesChapter 4 Lecture NotesAyaan Ahaan Malik-WilliamsNo ratings yet

- Chapter 2 NotesDocument8 pagesChapter 2 NotesAyaan Ahaan Malik-WilliamsNo ratings yet

- Chapter 10 NotesDocument10 pagesChapter 10 NotesAyaan Ahaan Malik-WilliamsNo ratings yet

- Chapter 1 NotesDocument5 pagesChapter 1 NotesAyaan Ahaan Malik-WilliamsNo ratings yet

- 2015 Final Exam SolutionsDocument8 pages2015 Final Exam SolutionsAyaan Ahaan Malik-WilliamsNo ratings yet

- 2014 Final Exam SolutionsDocument6 pages2014 Final Exam SolutionsAyaan Ahaan Malik-WilliamsNo ratings yet

- AF101 Major Assignment 2019Document7 pagesAF101 Major Assignment 2019Ayaan Ahaan Malik-WilliamsNo ratings yet

- Cover Page TemplateDocument1 pageCover Page TemplateAyaan Ahaan Malik-WilliamsNo ratings yet